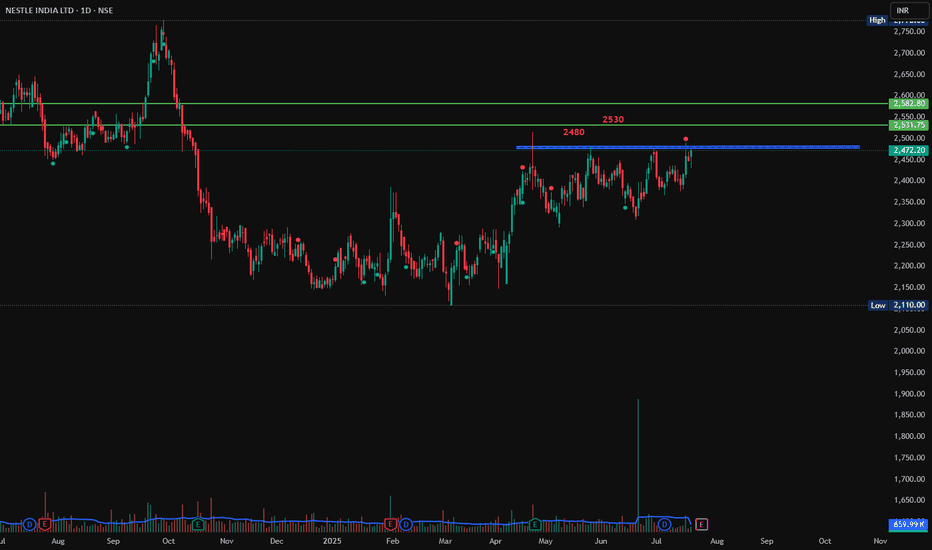

Nestle India, Breakout, 1D, LongNestle India tried to break the resistance at 2480 but failed multiple times. If it breaks this level of 2480 with Bullish candlestick patterns like Bullish Engulfing, Hammer & Inverted Hammer, Piercing Line, Morning Star, Three White Soldiers, Tweezer Bottoms or Bullish Harami, then a trade can be planned in it with target of 2530 and 2580.

Entry: 2480 (after Bullish Candlestick pattern)

Target1: 2530

Target2: 2580.

SL 2450

NESTLEIND trade ideas

#Nestle - Pivot Point is 2423.50 Date: 06-06-2025

#Nestle Current Price: 2415

Pivot Point: 2423.50 Support: 2378.05 Resistance: 2469.29

Upside Targets:

Target 1: 2513.39

Target 2: 2557.50

Target 3: 2607.75

Target 4: 2658.00

Downside Targets:

Target 1: 2333.78

Target 2: 2289.5

Target 3: 2239.25

Target 4: 2189.00

NESTLE INDIA SWING TRADE SETUP📊 Price Action & Trend Analysis

Analyzing market trends using price action, key support/resistance levels, and candlestick patterns to identify high-probability trade setups.

Always follow the trend and manage risk wisely!

Price Action Analysis Interprets Market Movements Using Patterns And Trends On Price Charts.

👉👉👉Follow us for Live Market Views/Trades/Analysis/News Updates.

NESTLE INDIA If the price bounces from this support, the next resistance level could be around 2,450–2,500.

If the price breaks this support, it would be a bearish breakdown, and the price could fall to 2,250 or even lower.

If you find this helpful and want more FREE forecasts in TradingView, Hit the 'BOOST' button

Drop some feedback in the comments below! (e.g., What did you find most useful?

How can we improve?)

Your support is appreciated!

Now, it's your turn!

Be sure to leave a comment; let us know how you see this opportunity and forecast.

Have a successful week

DISCLAIMER: I am NOT a SEBI registered advisor or a financial adviser. All the views are for educational purpose only

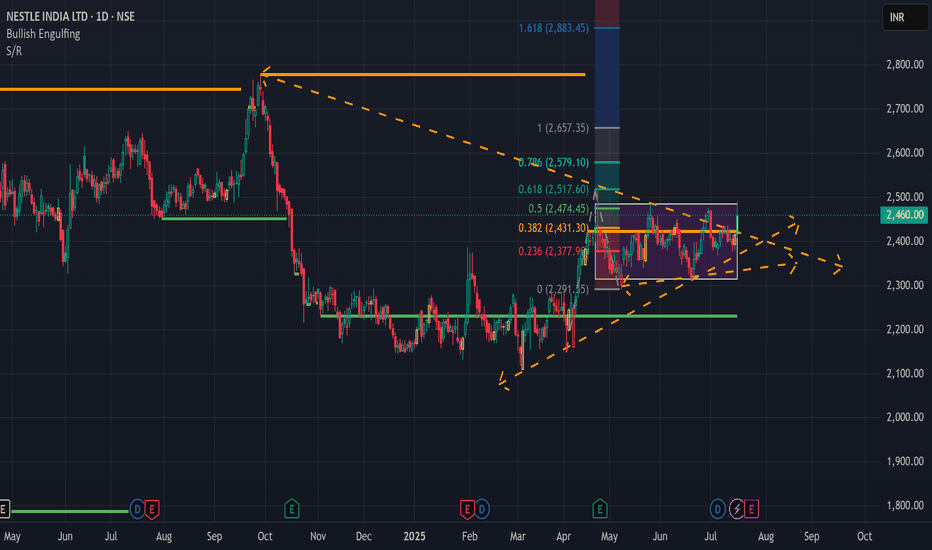

NESTLEIND - Range Bound -Box BreakOut -DailyThis is a technical analysis chart of **Nestle India Ltd. (NSE: NESTLEIND)** on a **daily timeframe**, and here's a breakdown of what it's showing:

---

### 📊 **Price Action and Pattern**

- **Range Bound (Accumulation)**: From around **November 2024 to mid-April 2025**, the price was consolidating between approx **₹2,135 (support)** and **₹2,342 (resistance)** — a classic **rectangle consolidation pattern**.

- **Breakout**: The stock has recently **broken out of this range** and is currently trading around **₹2,416.60**, suggesting a **bullish breakout**.

---

### 🔍 **Measured Move**

- The chart shows a **measured move target**:

- Rectangle height: ~**₹210.85**

- Breakout level: ~**₹2,342**

- **Target price** after breakout: ~**₹2,555.75** (highlighted in green)

This implies a potential **upside of 9%** from the breakout level.

---

### 🔊 **Volume Analysis**

- Noticeable **increase in volume during the breakout**, which confirms the **validity of the breakout**.

- Volume spikes have historically aligned with key price movements in this stock.

---

### 📌 **Key Levels**

- **Support**: ₹2,342 (previous resistance), and below that ₹2,135

- **Resistance**: ₹2,555, and further up at ₹2,765 – ₹2,778 (previous highs)

---

### 🧠 **Conclusion**

- **Bullish bias** post-breakout from the rectangular base.

- Potential for move towards **₹2,555**, with **volume support**.

- Traders might look for:

- Pullback to ₹2,342 for entry

- Tight stop-loss below support

- Target near ₹2,555 or partial booking en route

---

Nestle Crossing 200 EMASince FMCG Sector are defensive sector and moves aggresivly when market falls.

Nestle after a long consolidation near the support area broke out the 200 EMA and now ready to move for a uptrend.

Note: May not expected super rally if market moves rapidly because during bull markets, FMCG might underperform as investors chase higher-growth opportunities in other sectors.

But can easily capture 10% return from the current point for swing traders who do MTF trades.

Nestlé India – Strong Buy Opportunity After 25% Correction! 🔎 Market Overview & Technical Structure

Nestlé India has undergone a significant 25% correction from its all-time high, presenting a strategic investment opportunity. The stock has recently swiped a key monthly swing low and is now showing signs of potential upside movement.

📉 Stock Correction from High:

All-Time High: ₹2,789

Previous Monthly Swing Low: ₹2,144.95

Recent Low: ₹2,110

Correction from High: ~25% (Approx.)

Current Price: ₹2,250

💡 Why is This a Strong Investment Zone?

✅ Key Monthly Swing Low Taken – This indicates possible accumulation at lower levels.

✅ Six-Month Consolidation – Price has been trading in a range, signaling a potential breakout.

✅ Liquidity Sweep & Recovery – The stock recently hit stop-loss zones and rebounded sharply, suggesting selling pressure is reducing and buyers are stepping in.

✅ Range-Bound Structure – While it's not clear whether this consolidation is accumulation or distribution, as investors, we focus on potential upside.

📌 Trading & Investment Plan:

🔹 📍Entry Strategy:

Breakout Traders: Enter when the price crosses & closes above ₹2,261 for a confirmation of trend continuation.

Swing Investors: If the price retraces to ₹2,155, this would be an excellent long-term accumulation zone.

🔹 🎯 Target Projections:

✅ Target 1: ₹2,380 (Short-term)

✅ Target 2: ₹2,680 (Medium-term)

✅ Target 3: ₹2,880++ (Long-term Potential)

🔹 📉 Stop Loss:

🔺 Strict Stop-Loss: ₹2,110 (Recent Low) – Keeps risk under control while allowing room for volatility.

🔹 Risk Management & Position Sizing:

Use proper position sizing based on risk tolerance.

Avoid over-leveraging and maintain stop-loss discipline.

📢 Final Thoughts – Why This Trade Looks Promising?

📊 Nestlé India has corrected ~25% and is trading near key support zones.

📊 After a stop-loss hunt, the price has shown a sharp rebound, signaling bullish intent.

📊 A breakout above ₹2,261 could trigger further upside momentum.

🚀 Don’t Miss Out!

✅ Follow me for more expert stock insights!

👍 Like & comment if you found this analysis helpful!

💬 Let’s discuss in the comments – See you there! 📈

Nestle - Long term Bottom formation and Breakout for investmentSupport b/w 2100-2150 since Dec 24 has been holding

50 month SMA at 2106— very strong & rarely breaks

200 week SMA rarely breached & now at 2132

Moving averages: Crossed 20/50/100 day SMA

MACD: Daily +ve, Weekly +ve, Monthly -ve

Daily CCI > 100 (bullish)

Resistance Levels:

- 2280 (range)

- 2380-2400 : 2380 (100 week SMA), 2387 (parallel), 2394 (50 week SMA)—converging soon.

Break above 2280 likely coming week, but break above 2380-2400 with volume needed for long term breakout.

2100 support intact currently

At 2268-2280: Strong 2100 support. Buy on every dip for long term or on 2280 breakout.

Target - 2700 in 06 months

Long term Stop loss- below 2100

For short swing- Target 2380 if it breaks & closes above 2280, make 2270 as stop loss

Accumulate for Long TermNestle is trading at a little discount as compared to it's historic valuation for last 6-7 years. This is a growing stock, so it will be good to buy some shares now. Some details of it's strategies and products portfolio below - Happy Trading :)

Over the past six to seven years, Nestlé India has demonstrated consistent revenue growth, driven by a combination of strategic initiatives and a strong product portfolio. Key factors contributing to this sustained growth include:

1. Innovation and Product Diversification: Nestlé India has prioritized innovation, launching over 140 new products in the past eight years. These introductions span various categories, including science-led nutrition solutions, millet-based products, and plant-based protein options, catering to diverse consumer needs.

BUSINESS-STANDARD.COM

2. Strengthening Core Brands: The company has focused on reinforcing its flagship brands:

Maggi: Achieved the status of the largest market globally for Maggi, driven by balanced product mix, pricing strategies, and volume growth.

THE HINDU BUSINESS LINE

KitKat: India became the second-largest market for KitKat worldwide, reflecting robust performance in the confectionery segment.

THE HINDU BUSINESS LINE

Nescafé: The beverage segment, particularly Nescafé, has seen significant growth, introducing coffee to over 30 million households in the last seven years.

THE HINDU BUSINESS LINE

3. Expansion into New Categories: Nestlé India is exploring opportunities in emerging sectors such as healthy aging products, plant-based nutrition, healthy snacking, and toddler nutrition. These initiatives aim to tap into evolving consumer preferences and health-conscious trends.

CFO.ECONOMICTIMES.INDIATIMES.COM

4. Focus on Premiumization: The company is enhancing its premium product offerings, including the introduction of Nespresso and health science products. This strategic move aims to have premium products contribute to 20% of sales in the long term, up from the current 12-13%.

GOODRETURNS.IN

5. Strategic Partnerships: A notable collaboration with Dr. Reddy's Laboratories to form a joint venture in the nutraceuticals space underscores Nestlé India's commitment to expanding its health science portfolio and leveraging synergies for growth.

THE HINDU BUSINESS LINE

Collectively, these strategies have enabled Nestlé India to maintain a consistent upward trajectory in revenue, effectively adapting to market dynamics and consumer demands.

Nestle Buy At This Level 22221. **Nestlé India Ltd.** is a leading food and beverage company, a subsidiary of the Swiss multinational Nestlé.

2. Established in 1961, the company is headquartered in Gurugram, Haryana.

3. It is known for popular brands like Maggi, Nescafé, KitKat, and Milkmaid.

4. Nestlé India focuses on nutrition, health, and wellness, offering a wide range of dairy, culinary, and beverage products.

5. The company has a strong presence across India with multiple manufacturing facilities and a vast distribution network.

Nestle swing tradingAll is well

Good day

Just my view and educational purposes only I'm not a SEBI registered advisory...trade on your own risk.

This is simple ORB Strategy with volume breakout..i will enter EOD 3.25pm if the price trade above the blue line and after entry I will wait for my target or stoploss (D candle should close below the red line) in valid if direct not triggered and closed below red line..

Just a view educational purposes only

NESTLEIND buying opportunityPrice is showing a positive reaction from the institutional buying zone, suggesting a potential buying opportunity at the levels indicated in the chart.

NESTLEIND presents a strong opportunity for both short-term and long-term gains.

Please note: I am NOT a SEBI-registered advisor or financial advisor. The investment or trade ideas I share are solely my personal viewpoint and should not be considered as financial advice.

Nestle at Crucial juncture on Weekly basisNestle India hefty down from its top.

FMCG Sector searching for its base formation.

Can take a trendline support on Weekly basis along with its peers and Sector.

On Weekly basis risk can be taken with a small Stop Loss.

Seems something is cookingsooking, please take advice from your financial advisor before investing.

NESTLE INDIA 60 DAYS BREAKOUT BEING READYHello,

Trend-Based Analysis. Buy the Dips, Sell The Rallies, Also Following the Trend. Let's see where the Price Action takes us, Riding the wave. Potential trade setups based on trend momentum.

Technical analysis based on trend identification and momentum, Looking for high-probability setups within the prevailing trend.

Analyzing the current market trend and potential future price movement. Focusing on risk management and reward-to-risk ratios.

Details is Mentioned in Chart, Read carefully.. .

Nestle-Bullish Swing- Will this be bullish swing? NSE:NESTLEIND

21.08.2024

Buy-2551

Target 01-2643, Target 02-2761

Stop Loss-2447

Risk Reward- 1:2

After the good uptrend from March 2023, price is

under consolidation from Beginning of January

2024. Hopefully it us under the formation of

Bullish Flag and trying to provide the big breakout.

1.Breakout- Inside Bar

2.Trend- Uptrend in higher TF & trying to break the downward range in shorter time frame.

3.KeyLevel- second time rejection from resistance converted to support zone.

4.Volume- Average volumes. Need more & above average volumes in next sessions for more rewards

5. EMA- Perfect rejection from 200 EMA. Price is above 21 EMA & 50 EMA

6. Chart Pattern- bullish flag in the border view

7.RSI- Strong bounce from 30 RSI. Still very good potential for more movement.