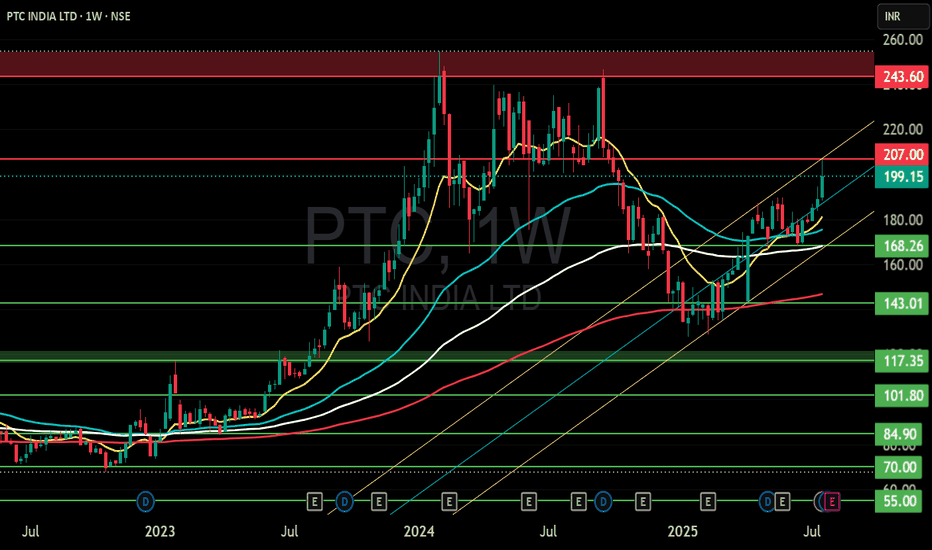

PTC INDIA LTD S/RSupport and Resistance Levels:

Support Levels: These are price points (green line/shade) where a downward trend may be halted due to a concentration of buying interest. Imagine them as a safety net where buyers step in, preventing further decline.

Resistance Levels: Conversely, resistance levels (red line/shade) are where upward trends might stall due to increased selling interest. They act like a ceiling where sellers come in to push prices down.

Breakouts:

Bullish Breakout: When the price moves above resistance, it often indicates strong buying interest and the potential for a continued uptrend. Traders may view this as a signal to buy or hold.

Bearish Breakout: When the price falls below support, it can signal strong selling interest and the potential for a continued downtrend. Traders might see this as a cue to sell or avoid buying.

MA Ribbon (EMA 20, EMA 50, EMA 100, EMA 200) :

Above EMA: If the stock price is above the EMA, it suggests a potential uptrend or bullish momentum.

Below EMA: If the stock price is below the EMA, it indicates a potential downtrend or bearish momentum.

Trendline: A trendline is a straight line drawn on a chart to represent the general direction of a data point set.

Uptrend Line: Drawn by connecting the lows in an upward trend. Indicates that the price is moving higher over time. Acts as a support level, where prices tend to bounce upward.

Downtrend Line: Drawn by connecting the highs in a downward trend. Indicates that the price is moving lower over time. It acts as a resistance level, where prices tend to drop.

Disclaimer:

I am not SEBI registered. The information provided here is for learning purposes only and should not be interpreted as financial advice. Consider the broader market context and consult with a qualified financial advisor before making investment decisions.

PTC trade ideas

PTC Elliott Wave Count | ₹337 in Sight if ₹200 Breaks ✅ Elliott Wave Count (Verified & Explained)

The chart presents a classic 5-wave impulsive Elliott Wave structure:

Wave 1: Initial rally, confirmed by a clear breakout.

Wave 2: Deep retracement to ~0.786 Fib (around ₹106.95) — valid corrective wave.

Wave 3: Strong rally to ₹318.15 — the longest wave, typical of Wave 3.

Wave 4: Corrective phase, consolidating sideways (drawn in a yellow box) — does not overlap Wave 1 top, which confirms its validity.

Wave 5 (projected): A potential rally to ₹337+, indicated by the orange trendline and Fibonacci projections.

🔍 Fibonacci Levels (Correctly Plotted)

0.618 Retracement from Wave 2 low to Wave 3 top aligns well at ₹137.69 (respected during pullback).

1.618 Extension of Wave 1 from Wave 2 gives ₹248.88, and 100% extension at ₹318.15 (already hit by Wave 3).

Final Wave 5 Target projected near ₹337.15.

📊 Technical Indicators (RSI + Volume)

RSI (14): Currently at 49.30, slightly bearish-neutral. The RSI-MA is at 53.99, suggesting minor divergence or consolidation.

Volume: Lower than peak Wave 3 volume, but not dried up — indicating consolidation or accumulation during current phase.

⚠️ Observations / Mistakes

✅ Elliott Wave Count is technically valid — follows rules (Wave 3 not the shortest, Wave 4 doesn't enter Wave 1 zone).

✅ Fibonacci levels are accurate and meaningful.

⚠️ Wave 5 projection line is hypothetical; current price action still hasn’t broken above consolidation zone (~₹180–200). A confirmed breakout with volume is needed.

🧾 Summary (For TradingView Description)

PTC India Ltd – Weekly Elliott Wave + Fibonacci Analysis

A textbook 5-wave Elliott impulse is unfolding. Wave 4 appears completed after a long consolidation.

Wave 5 targets ₹337, with intermediate resistances near ₹248 and ₹318 based on Fibonacci projections.

RSI is neutral but showing signs of recovery; a break above ₹200 with volume can trigger Wave 5.

Investors can watch for breakout confirmation with stop-loss below Wave 4 low (~₹130).

🔸 Bias: Moderately Bullish (awaiting breakout confirmation)

🔸 Invalidation: Below ₹130 (Wave 4 low)

GO LONG ON - PTCOne is advised to Go long on PTC at current market price band of 155- 162. The Daily and Weekly charts have formed Lower Swing Lows. The RSI also indicated oversold condition on all Time Frame. Also the script has corrected almost 35% from the highs of 246.00. One is advised to go long PTC with SL - 140.00. Target Short term 182.00 & Long Term 200.00

PTC INDIA LONGPTC INDIA

MTF Analysis

PTC India Yearly Demand Breakout 203

PTC India 6 Month Demand Breakout 203

PTC India Qtrly Demand BUFL 158.8

PTC India Monthly Demand DMIP 208.5

PTC India Weekly BUFL 205

PTC India Daily DMIP 207

ENTRY 207

SL 204

RISK 3

Target 303

REWARD POINT 96

Last High 255

RR 32.00

RR 46%

PTC India ltd - Investment IdeaSymmetrical Triangle formation. Breakout or breakdown

will show us direction. Still the company is good fundamentally.

Currently trading at support level which created good RR to go long.

Results were good still reaction needs to come.

For me personally targets are big on upside, this may test our patience

before bullish trend gets started.

if you're patient enough this may give you decent returns in long run.

Disc - personally holding this in good numbers.

Just analyse before taking any trade.

PTC India (Swing):PTC India (Swing):

PTC is on a nice setup.

Here the present position offers a trade with RR of more than 1:5.

PTC is also well set for a significant up move by breaking the all time high.

Appropriate supply and demand zones are highlighted.

Check out my earlier views for a better understanding.

Note: Do your own due diligence before taking any action.

PTC INDIABreakout trading implementation:

1. **Identifying New Trends:** Breakout trading helps traders identify the beginning of new trends by focusing on price levels where an asset breaks out of its historical trading range.

2. **Volatility Indicator:** Breakouts often occur when there's increased volatility in the market. Monitoring breakouts can provide insights into shifts in market sentiment and potential price movements.

3. **Entry Points:** Breakout points serve as potential entry points for traders looking to ride the momentum of a newly established trend. Buying on a breakout can capture the early stages of a price movement.

4. **Confirmation of Strength:** Successful breakouts indicate the strength of a trend. If an asset breaks out with high volume and follows through with sustained price movement, it suggests a strong trend in that direction.

5. **Avoiding False Signals:** Breakout strategies often include using indicators or confirmation signals to avoid false breakouts. This can enhance the accuracy of trade decisions.

6. **Defined Risk and Reward:** Breakout trading allows for setting clear stop-loss levels below the breakout point, which helps manage risk. Traders can also calculate potential profits based on the distance between the breakout point and a projected target.

7. **Adaptable to Various Markets:** Breakout trading can be applied to various markets, including stocks, forex, commodities, and cryptocurrencies. The concept remains consistent across different assets.

8. **Flexibility:** Traders can adapt breakout strategies to their preferred timeframes, whether they are day traders, swing traders, or long-term investors.

9. **Liquidity Opportunities:** Breakout points are often associated with increased trading volume, which can provide better liquidity for executing trades.

10. **Risk vs. Reward Assessment:** Traders can evaluate the potential risk of a trade (stop-loss) against the potential reward (target price), aiding in decision-making and portfolio management.

11. **Psychological Advantage:** Successful breakout trades can boost a trader's confidence and discipline, reinforcing the effectiveness of their strategy.

12. **Market Events:** Breakouts can occur around significant market events such as earnings reports, economic data releases, or geopolitical developments, offering traders opportunities to capitalize on sudden price movements.

Remember, while breakout trading offers potential advantages, it also carries risks. False breakouts and market reversals can lead to losses. Successful implementation requires a solid understanding of technical analysis, risk management, and the ability to adapt to changing market conditions.

Resistance BreakoutPlease look into the chart for a detailed understanding.

Consider these for short-term & swing trades with 2% profit.

For BTST trades consider booking

target for 1% - 2%

For long-term trades look out for resistance drawn above closing.

Please consider these ideas for educational purpose