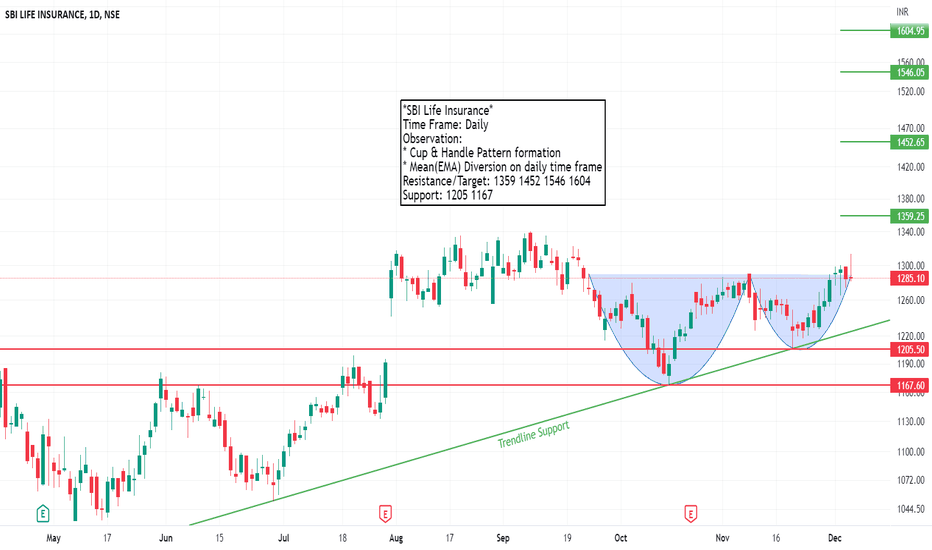

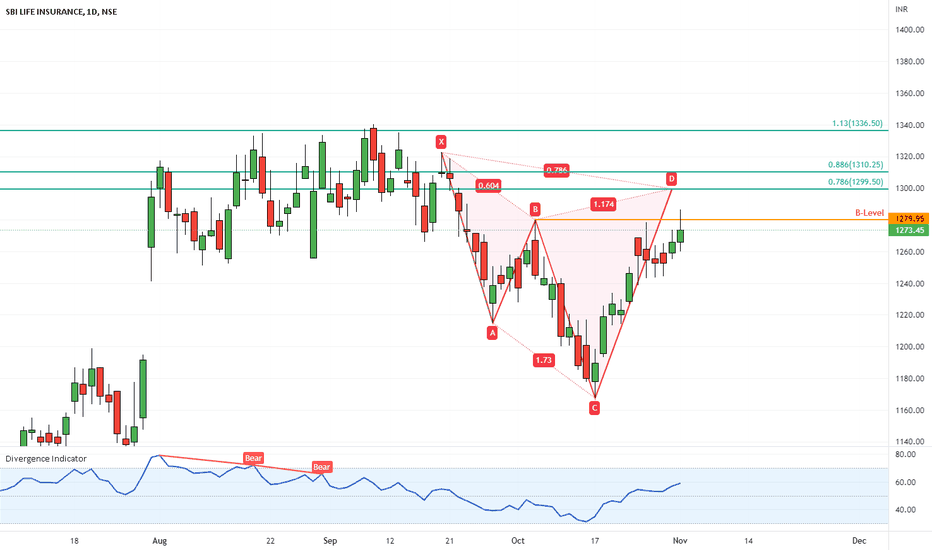

SBILIFEwe are looking SBILIFE Bullish move rapidly

Disclaimer:

Kind regards to all friends and members ,

Stock market investment is subject to 100% market risks. Our company is not a SEBI registered company. Please consult your financial advisor before investing. This is for learning and training purposes only. Market Traps administrators are not responsible for any financial gains or losses resulting from your decisions. You acknowledge that stock market investments are highly risky and that you understand the market risks involved. Hence any legal action is void.

SBILIFE trade ideas

#SBILIFE... Looking good 16.05.23#sbilife.. ✅▶️

Intraday as well as swing trade

All levels given in charts ...

IF good potential seen then we work in options also

if activate then possible a huge movement Keep eye on this ...

We take trade only when it activates...

Possible to give good target

TRADING FACTS

SBI LIFE KHARIDO 40% TAK BADH SKTA HAI ISH LEVEL SE APNA TGT1700SBI Life Insurance Company Ltd is engaged in the business of life insurance and annuity. It was started as a Joint-venture between State Bank of India and BNP Paribas Cardif S.A.

Market Cap

₹ 123,448 Cr.

Current Price

₹ 1,233

High / Low

₹ 1,340 / 1,004

Stock P/E

76.4

Book Value

₹ 126

Dividend Yield

0.16 %

ROCE

15.3 %

ROE

13.7 %

Face Value

₹ 10.0

Debt

₹ 0.00 Cr.

EPS

₹ 16.2

PEG Ratio

8.00

Promoter holding

55.4 %

Intrinsic Value

₹ 291

Pledged percentage

0.00 %

EVEBITDA

65.9

kharido target achieve jarur hoga jo maine dia hai

like and follow krna mat bhula kro bhai log

thankyou

SBILIFENSE:SBILIFE

Has Consolidated very well.

Note :

1.One Can Go long with a Strict SL below the Trendline or Swing Low of Daily Candle.

2. Close, should be good and Clean.

3. R:R ratio should be 1 :2 minimum

4. Plan as per your RISK appetite

Disclaimer : You are responsible for your Profits and loss, Shared for Educational purpose!

SBILIFENSE:SBILIFE

One Can Enter Now ! Or Wait for Retest of the Trendline (BO).

Note :

1.One Can Go long with a Strict SL below the Trendline or Swing Low of Daily Candle.

2. Close, should be good and Clean.

3. R:R ratio should be 1 :2 minimum

4. Plan as per your RISK appetite

Disclaimer : You are responsible for your Profits and loss, Shared for Educational purpose!