SBIN🧠 Technical Logics Highlighted

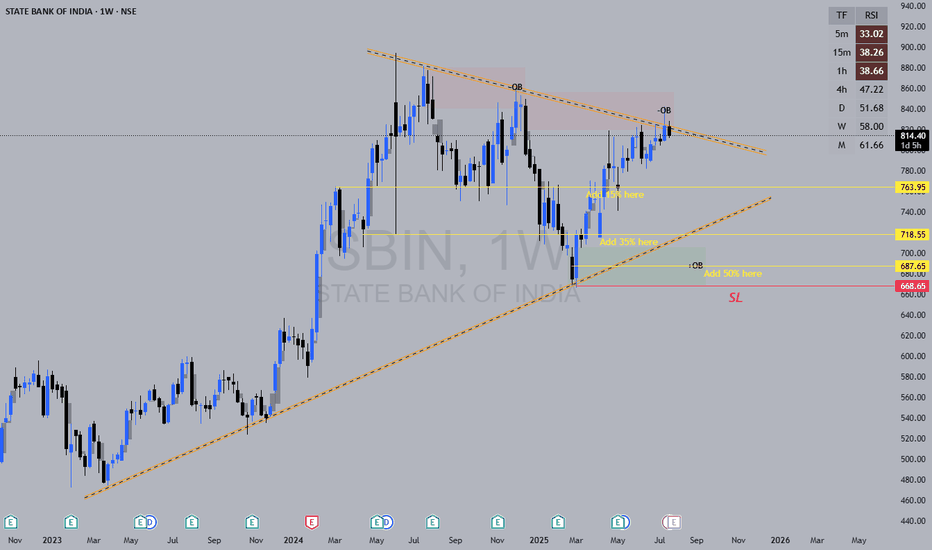

Qtrly BUFL Zone is respected – strong confirmation of demand at 765–705.

Weekly ASZ previously formed at 793, reinforcing buyer interest.

Engulfing Pattern with DMIP & SOE confirms buying strength.

Current price trades above Gann Level (766) – a technical sign of strength.

💼 Trade Plan – Long (BUY)

Parameter Value

Entry 817

Stop Loss (SL) 810

Risk 7 pts

Target 1045

Reward 228 pts

Risk:Reward Ratio (RR) 32.6 (Excellent!)

📊 Additional Technical Levels

Metric Value

Last High 894

Last Low 666

Point Var 228

✅ Final Commentary

Risk-Reward (RR) of 32.6 is outstanding – even a few successful trades of this kind can yield massive returns.

Entry point (817) sits perfectly within high-probability zones, aligned with strong daily/60M demand levels (814–821).

Stop-loss (810) is tight and efficiently placed just below the key proximal demand.

Target (1045) is ambitious but justifiable with the current bullish structure and price action.

🔔 Suggested Next Steps

Set alerts near 810 and 821 to monitor price reaction.

Watch for confirmation candles or volume spikes at 817.

Lock partial profits if price nears 894 (previous high), and trail SL to secure gains.

🔍 Trend & Demand Zone Summary

Timeframe Trend Proximal Distal Avg Demand Zone

HTF (High TF) UP 680 621 650

MTF (Mid TF) UP 795 761 778

ITF (Intraday TF) UP 807 803 805

✅ Conclusion: All timeframes indicate a strong bullish trend. Price is moving upward from demand zones across HTF, MTF, and ITF levels.

SBIN trade ideas

Importance of ATR(Average True Range)So idea here is to calculate risk.

understanding fear in the market ATR is an indication of volatility , not direction.

A smaller ATR range means low volatility.. tentatively market is consolidating.

A larger ATR range means the market is dealing with uncertainty so volatility has increased.

you can see the value of ATR on your chart.

the value of past ATR14period value is be greater than current ATR14 Period to take risk on a trades. it will help you reduce risk.

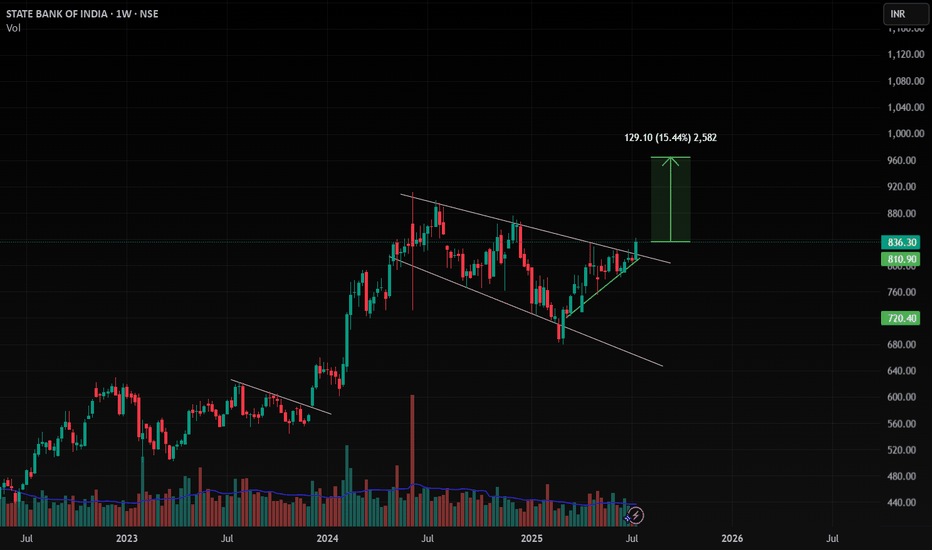

SBI - My Pick - No Financial Advice - VCP PatternAfter a recent upside rally SBI has retraced approx 8.5% from the resistance zone of 825-830, theafter second compression of 5% occurred. Thus I see sucessive Volatility contraction. Recent Golden Cross over clubbed with VCP is indication of good buying opportunity. Short to mid-term momentum is bullish, underpinned by strong moving averages and recent bullish crossover. My entry depends upon good bullish close with good volumes.

SBIN📝 Trade Plan

Position: Long (Buy)

Entry: 800

Stop Loss: 757

Risk: 43 points

Target: 1256

Reward: 456 points

Risk-Reward (RR): 10.6 – Excellent

✅ Multi-Timeframe Trend & Demand Zone Alignment

Zone Trend Demand Logic Avg Demand Zone

HTF UP RBR, BUFL 650

MTF UP RBR, DMIP, SOE, BUFL 762

ITF UP DMIP, BUFL 785

Trade Point Avg 732

This shows full timeframe alignment (HTF, MTF, ITF) in UP trend, strengthening the case for a long trade.

✅ Key Trade Logics – Highlights

Quarterly Demand (BUFL) is being respected.

Weekly ASZ previously formed at 793 – now engulfed with DMIP + SOE at 799 → Strong Demand.

Price trading above Gann Level of 766 → Bullish confirmation.

Entry at 800 is just above all critical demand structures (DMIP, BUFL, ASZ).

✅ Technical Observations

Last High = 894 → Short-term resistance.

Target = 1256 → Ambitious but possible if structure breakout confirms.

Last Low = 666 → Strong swing low. SL at 780 protects this level.

⚠️ Considerations / Watch Points

Immediate Resistance: ₹894 (last high); could act as short-term hurdle.

Gap Risk: Entry very close to Weekly demand zone (780–800) – be cautious of volatile retests.

Target Realism: ₹1256 may require a multi-week/month hold; consider scaling out partially at swing levels (e.g., ₹894, ₹975, ₹1050).

Reconfirm with Volume: Check for breakout with rising volumes above 800 and around 894 zone.

✅ Verdict

This is a strong, high-conviction trade setup with:

Perfect MTF Trend Alignment

Tightly defined risk

Excellent R:R ratio

Strong structural demand support

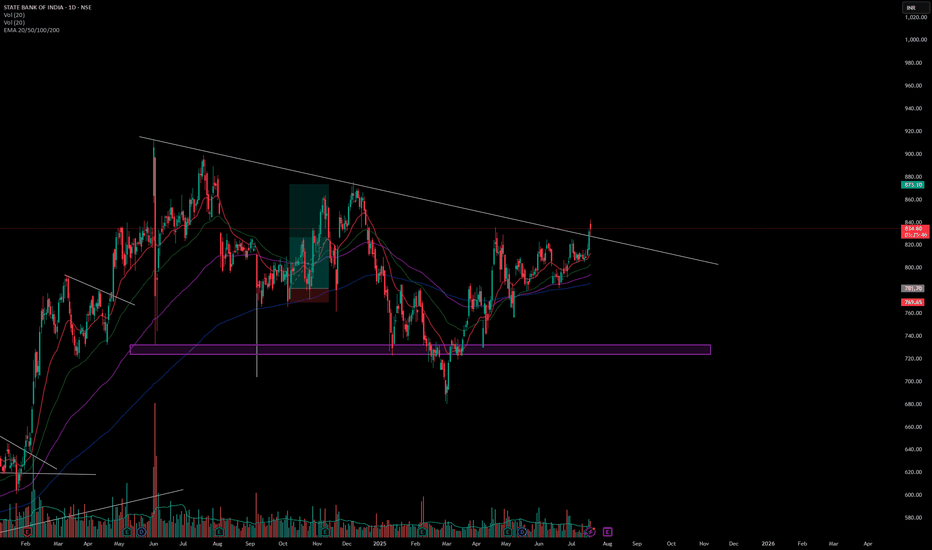

SBIN Weekly Levels and reportLook at the Weekly Chart:

This will show you how SBIN’s price has moved each week.

Identify Support and Resistance:

Support is where the price usually doesn’t fall below (like a floor).

Resistance is where the price often doesn’t go higher than (like a ceiling).

Example: If SBIN’s price bounced off ₹590 a few times, that’s support. If the price keeps struggling around ₹640-650, that’s resistance.

Check for Fibonacci Levels (Optional):

You can use a tool that shows you Fibonacci retracement levels. It helps find where prices might bounce or reverse.

Key levels to watch for are 38.2%, 50%, and 61.8% retracements from a big move (up or down).

Draw Trendlines:

If SBIN has been moving up, draw a line connecting the lows to see where it might find support in the future.

If it’s in a downtrend, connect the highs to see where resistance might be.

Check the Moving Averages:

The 50-week and 200-week moving averages can show if the stock is generally moving up or down.

If SBIN is above the 50-week average, it might be in a bullish (up) trend.

If it’s below the 200-week average, it might be in a bearish (down) trend.

Look for Round Numbers:

Prices like ₹600, ₹650, ₹700 are often seen as psychological levels. Traders often watch these prices because they’re easy to remember.

Example:

If SBIN recently bounced off ₹590 or ₹600 multiple times, that’s support.

If it keeps facing resistance around ₹640 or ₹650, those are resistance levels.

Final Thoughts:

If SBIN’s price breaks above resistance (say ₹650), it might go higher.

If it falls below support (say ₹590), it might drop further.

State Bank of India view for Intraday 20th May #SBIN State Bank of India view for Intraday 20th May #SBIN

Resistance 810 Watching above 811 for upside momentum.

Support area 780 Below 800 ignoring upside momentum for intraday

Watching below 778 for downside movement...

Above 800 ignoring downside move for intraday

Charts for Educational purposes only.

Please follow strict stop loss and risk reward if you follow the level.

Thanks,

V Trade Point

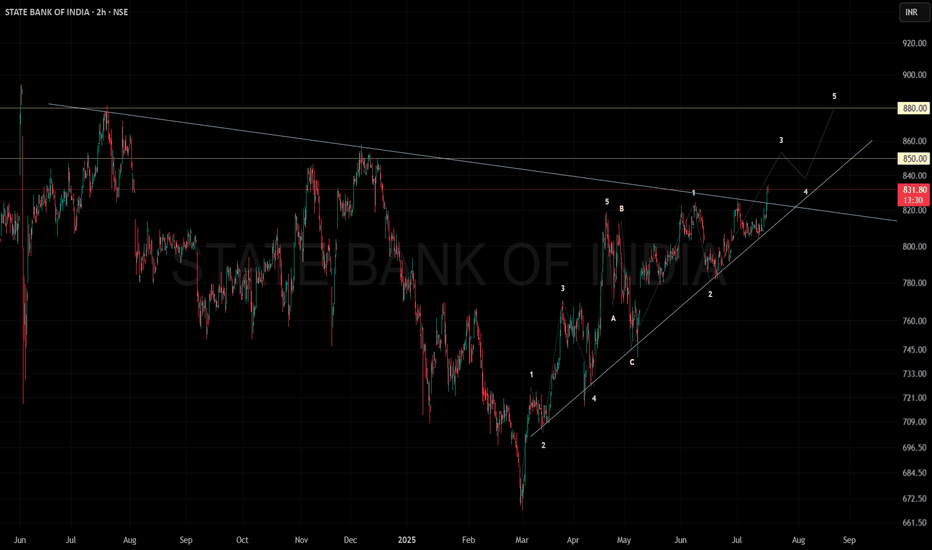

SBIN📈 Updated BUY Trade Plan – SBIN

Trade Component Value

Entry 775

Stop Loss (SL) 757

Risk 18

Target 995

Reward 220

Risk-Reward Ratio 12.2

Last High 900

Last Low 680

SBIN – Updated MTF Demand Zone Analysis

🔹 Higher Time Frame (HTF) Demand Zones

Timeframe Trend Proximal Distal Average

Yearly UP 660 500 580

Half-Yearly UP 660 600 630

Quarterly UP 660 600 630

HTF Average 660 567 613

🔹 Medium Time Frame (MTF) Demand Zones

Timeframe Trend Proximal Distal Average

Monthly UP 660 600 630

Weekly UP 738 719 729

Daily UP 775 757 766

MTF Average 724 692 708

🔹 Intraday Time Frame (ITF) Demand Zones

Timeframe Trend Proximal Distal Average

240 Min UP 775 757 766

180 Min UP 775 757 766

60 Min UP 775 757 766

ITF Average 775 757 766

✅ Consolidated Trade Points

Metric Value

Proximal Avg 720

Distal Avg 672

Combined Avg 696

✅ Strengths of the Setup:

All timeframes (HTF, MTF, ITF) show a strong UP trend, indicating alignment and directional strength.

Entry (775) is on a well-established Daily + Intraday demand zone → offering a solid support area.

Despite lowering the target from 1144 to 995, the RR remains high at 12.2, making this a still-attractive trade.

Target (995) is a reasonable swing move and sits well above the last high of 900, aiming for a new price discovery.

⚠️ Risks / Things to Monitor:

SL is tight (757); price could spike near it before moving higher—consider having a buffered SL or confirmation-based entry if volatility increases.

If the price retraces below 757, it would invalidate the current demand zone strength in the short term.

Conclusion:

This remains a high-conviction long trade, albeit with a slightly moderated target for a quicker reward realization. Strong confluence across all timeframes supports your trade thesis. Great RR, disciplined stop loss, and aligned demand zones offer a technically sound plan.

A dynamic exit strategy

Scaling plans (partial exit at 900)

Alternative SL strategies or re-entry if SL hits

State Bank of India view for Intraday 15th May #SBIN State Bank of India view for Intraday 15th May #SBIN

Resistance 810 Watching above 811 for upside momentum.

Support area 780 Below 800 ignoring upside momentum for intraday

Watching below 778 for downside movement...

Above 790 ignoring downside move for intraday

Charts for Educational purposes only.

Please follow strict stop loss and risk reward if you follow the level.

Thanks,

V Trade Point

State Bank of India view for Intraday 12th May #SBIN State Bank of India view for Intraday 12th May #SBIN

Resistance 810 Watching above 811 for upside movement...

Support area 780 Below 800 ignoring upside momentum for intraday

Watching below 778 for downside movement...

Above 800 ignoring downside move for intraday

Charts for Educational purposes only.

Please follow strict stop loss and risk reward if you follow the level.

Thanks,

V Trade Point