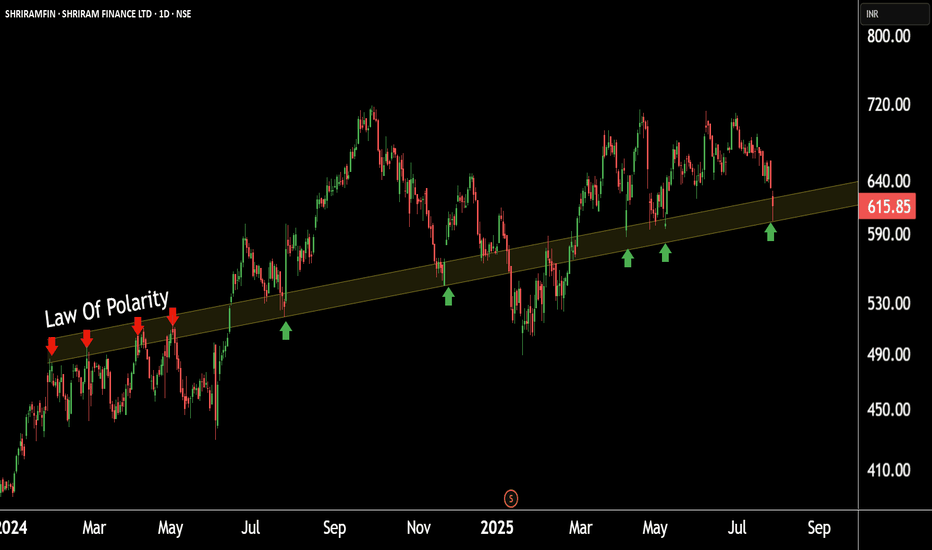

SHRIRAM FINANCE MID-TERM VIEWShriram Finance is looking positive for the next 4-6 months. We can expect a short-term low of around 570, and from there on, the charts are indicating a chance for a potential upside momentum up to 800-830, with it facing resistance in the range of 670-700.

THIS IS MY PERSONAL VIEW , NOT A BUY/SEL

Next report date

—

Report period

—

EPS estimate

—

Revenue estimate

—

51.55 INR

95.54 B INR

411.24 B INR

1.40 B

About SHRIRAM FINANCE LTD

Sector

Industry

Website

Headquarters

Mumbai

Founded

1979

ISIN

INE721A01047

FIGI

BBG000CZS2Q5

Shriram Finance Ltd. engages in the provision of financial services. It offers commercial vehicle finance, consumer finance, life and general insurance, stock broking, chit funds, and distribution of financial products such as life and general insurance products, and units of mutual funds. The company was founded on June 30, 1979 and is headquartered in Mumbai, India.

Related stocks

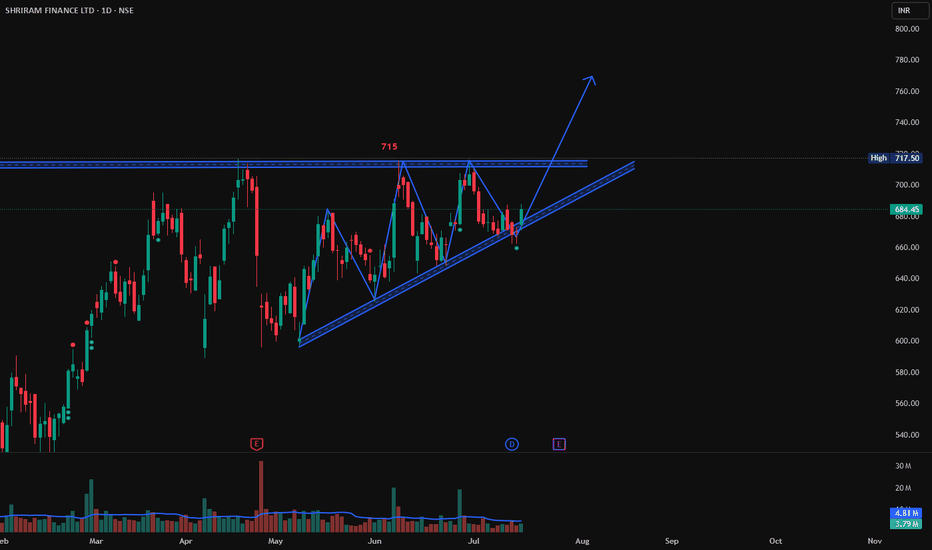

SHRIRAM FINANCE LIMITED in a channelThe stock experienced a strong bullish move (5-wave uptrend), currently consolidating inside an upward channel.

Price is facing resistance near ₹700–₹735.

The momentum indicator (RSI) suggests no extreme buying or selling; trend is neutral to cautiously bullish unless a clear breakout or breakdown

Shriram Finance following TrendLine, Long TradeShriram Finance is following the TrendLine. If it cross the high created today at 688 and shows a good Bullish candlestick patterns like Bullish Engulfing, Hammer & Inverted Hammer, Piercing Line, Morning Star, Three White Soldiers, Tweezer Bottoms or Bullish Harami. Then it may go till 715 which is

SHRIRAMFIN ANALYSIS The chart is a daily candlestick chart of Shriram Finance (SHRIRAMFIN) traded on the NSE, with the date shown as May 30, 2025.

Here’s a summary of the analysis presented in the chart:

---

Technical Highlights:

Current Price: ₹639.50

Trend: The price is currently in a downward correction phase.

Shriramfinance 691- breakout - trend directionShriramfinance 691- Has given breakout after successfully completing pull back test. As signals are positive with hidden divergence we expect shriramfin will test 791 in coming days with support 640 .

** HSBC identifies five Indian stocks

RELIANCE

ICICIBANK

TVSMOTOR

Shriram Finance

ADANIPORTS

—

SHRIRAMFIN CMP 580.SHRIRAMFIN With Strong Fundamentals.

Price to Earning--15,Price to Book Value--2,Dividend Yield--2%.

Strong Performer from YOY and QOQ.With heavy Institutional Holdings.

In this correction This stock trading at best and Affordable Price for Investors and Long term Players.We can add this to Our Port

See all ideas

Summarizing what the indicators are suggesting.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

An aggregate view of professional's ratings.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Displays a symbol's price movements over previous years to identify recurring trends.

830SFL25

SFL-8.30%-7-10-25-PVTYield to maturity

8.91%

Maturity date

Oct 7, 2025

930SFL28

SFL-9.30%-2-11-28-NCDYield to maturity

8.87%

Maturity date

Nov 2, 2028

872SFL32

SFL-8.72%-17-8-32-PVTYield to maturity

8.61%

Maturity date

Aug 17, 2032

9SFL28A

SFL-9%-28-3-28-PVTYield to maturity

8.39%

Maturity date

Mar 28, 2028

915SFL29A

SFL-9.15%-28-6-29-PVTYield to maturity

8.28%

Maturity date

Jun 28, 2029

875SFL26

SFL-8.75%-15-6-26-PVTYield to maturity

8.19%

Maturity date

Jun 15, 2026

920SFL29

SFL-9.20%-22-5-29-PVTYield to maturity

8.06%

Maturity date

May 22, 2029

94SFL28

SFL-9.40%-12-7-28-NCDYield to maturity

7.88%

Maturity date

Jul 12, 2028

931SFL26

SFL-9.31%-22-8-26-NCDYield to maturity

7.74%

Maturity date

Aug 22, 2026

850SFL26

SFL-8.50%-1-12-26-PVTYield to maturity

7.49%

Maturity date

Dec 1, 2026

903SFL28

SFL-9.03%-12-7-28-NCDYield to maturity

7.36%

Maturity date

Jul 12, 2028

See all SHRIRAMFIN bonds

Frequently Asked Questions

The current price of SHRIRAMFIN is 619.25 INR — it has decreased by −0.96% in the past 24 hours. Watch SHRIRAM FINANCE LIMITED stock price performance more closely on the chart.

Depending on the exchange, the stock ticker may vary. For instance, on BSE exchange SHRIRAM FINANCE LIMITED stocks are traded under the ticker SHRIRAMFIN.

SHRIRAMFIN stock has fallen by −2.94% compared to the previous week, the month change is a −9.37% fall, over the last year SHRIRAM FINANCE LIMITED has showed a 3.87% increase.

We've gathered analysts' opinions on SHRIRAM FINANCE LIMITED future price: according to them, SHRIRAMFIN price has a max estimate of 850.00 INR and a min estimate of 578.00 INR. Watch SHRIRAMFIN chart and read a more detailed SHRIRAM FINANCE LIMITED stock forecast: see what analysts think of SHRIRAM FINANCE LIMITED and suggest that you do with its stocks.

SHRIRAMFIN reached its all-time high on Sep 27, 2024 with the price of 730.45 INR, and its all-time low was 3.20 INR and was reached on Oct 29, 2003. View more price dynamics on SHRIRAMFIN chart.

See other stocks reaching their highest and lowest prices.

See other stocks reaching their highest and lowest prices.

SHRIRAMFIN stock is 1.81% volatile and has beta coefficient of 1.69. Track SHRIRAM FINANCE LIMITED stock price on the chart and check out the list of the most volatile stocks — is SHRIRAM FINANCE LIMITED there?

Today SHRIRAM FINANCE LIMITED has the market capitalization of 1.15 T, it has increased by 2.07% over the last week.

Yes, you can track SHRIRAM FINANCE LIMITED financials in yearly and quarterly reports right on TradingView.

SHRIRAM FINANCE LIMITED is going to release the next earnings report on Oct 23, 2025. Keep track of upcoming events with our Earnings Calendar.

SHRIRAMFIN earnings for the last quarter are 11.46 INR per share, whereas the estimation was 11.47 INR resulting in a −0.11% surprise. The estimated earnings for the next quarter are 11.79 INR per share. See more details about SHRIRAM FINANCE LIMITED earnings.

SHRIRAM FINANCE LIMITED revenue for the last quarter amounts to 61.41 B INR, despite the estimated figure of 62.53 B INR. In the next quarter, revenue is expected to reach 64.91 B INR.

SHRIRAMFIN net income for the last quarter is 21.59 B INR, while the quarter before that showed 21.44 B INR of net income which accounts for 0.73% change. Track more SHRIRAM FINANCE LIMITED financial stats to get the full picture.

SHRIRAM FINANCE LIMITED dividend yield was 1.51% in 2024, and payout ratio reached 19.48%. The year before the numbers were 1.91% and 22.92% correspondingly. See high-dividend stocks and find more opportunities for your portfolio.

As of Aug 13, 2025, the company has 79.87 K employees. See our rating of the largest employees — is SHRIRAM FINANCE LIMITED on this list?

EBITDA measures a company's operating performance, its growth signifies an improvement in the efficiency of a company. SHRIRAM FINANCE LIMITED EBITDA is 188.17 B INR, and current EBITDA margin is 75.23%. See more stats in SHRIRAM FINANCE LIMITED financial statements.

Like other stocks, SHRIRAMFIN shares are traded on stock exchanges, e.g. Nasdaq, Nyse, Euronext, and the easiest way to buy them is through an online stock broker. To do this, you need to open an account and follow a broker's procedures, then start trading. You can trade SHRIRAM FINANCE LIMITED stock right from TradingView charts — choose your broker and connect to your account.

Investing in stocks requires a comprehensive research: you should carefully study all the available data, e.g. company's financials, related news, and its technical analysis. So SHRIRAM FINANCE LIMITED technincal analysis shows the sell today, and its 1 week rating is neutral. Since market conditions are prone to changes, it's worth looking a bit further into the future — according to the 1 month rating SHRIRAM FINANCE LIMITED stock shows the buy signal. See more of SHRIRAM FINANCE LIMITED technicals for a more comprehensive analysis.

If you're still not sure, try looking for inspiration in our curated watchlists.

If you're still not sure, try looking for inspiration in our curated watchlists.