SIEMENS LTD Long Term Trend OutlookSIEMENS has maintained a strong multi-year bullish trend since its 2009 low of ₹97.36, consistently respecting a well-anchored ascending channel. After a major rally peaking at ₹4,164.15, price is now reacting to a major supply zone, showing initial signs of distribution.

We should monitor a potent

Next report date

—

Report period

—

EPS estimate

—

Revenue estimate

—

73.15 INR

27.17 B INR

221.57 B INR

87.82 M

About SIEMENS LTD

Sector

Industry

CEO

Sunil Dass Mathur

Website

Headquarters

Mumbai

Founded

1957

ISIN

INE003A01024

FIGI

BBG000CZTKC9

Siemens Ltd. engages in the provision of technology enabled solutions operating in the energy, healthcare, and industry sectors. It operates through the following segments: Energy, Smart Infrastructure, Mobility, Digital Industries, Portfolio Companies, and Others. The Energy segment provides integrated products, solutions, and services across energy value chain of oil and gas production, power generation, and transmission. The Smart Infrastructure segment supplies products, systems, solutions and services for transmission and distribution of electrical energy for power utilities, industrial companies and infrastructure segments. The Mobility segment gives solutions for passenger and freight transportation- including rail vehicles, rail automation systems, rail electrification systems, road traffic technology and IT solutions. The Digital Industries segment includes technologies for the automation and digitalization of the discrete and process industries. The Portfolio Companies segment offers products, services and mining and minerals solutions to industry sector. The Others segment refers to other group companies and lease rentals. The company was founded on March 2, 1957 and is headquartered in Mumbai, India.

Related stocks

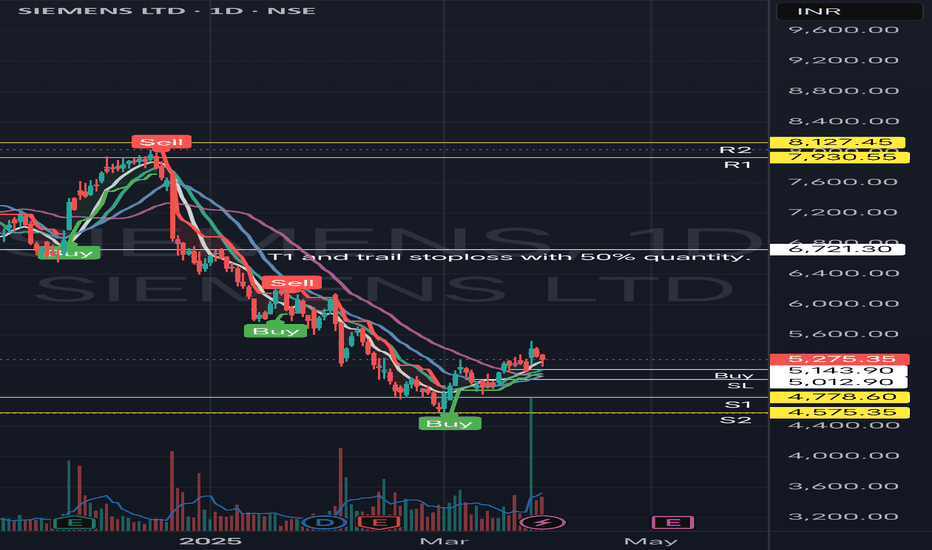

Equity Trade Setup – Siemens Ltd. (NSE: SIEMENS)Trade Type: Breakout + Channel Trend Continuation

🔹 Trade Details

Buy Zone (Entry): ₹2,982.00 – ₹2,987.00

Current LTP: ₹2,970.00

Stoploss (SL): ₹2,887.00 (below recent swing support)

Target (T1): ₹3,150.00

Target %: ~5.46%

Timeframe: 3–5 trading days

R:R Ratio: ~2:1

Confidence: Moderate to H

Review and plan for 27th March 2025Nifty future and banknifty future analysis and intraday plan.

This video is for information/education purpose only. you are 100% responsible for any actions you take by reading/viewing this post.

please consult your financial advisor before taking any action.

----Vinaykumar hiremath, CMT

SIEMENTS SET AND FORGETwe are currently in no-mans land with no significant demand levels that can push this stock up to the all time highs. We can expect this stock to keep dropping until it reacher the zone marked out, from there we can expect massive amounts of demand kick in and push this stock up.

Review and plan for 13th February 2025 Nifty future and banknifty future analysis and intraday plan.

Results.

This video is for information/education purpose only. you are 100% responsible for any actions you take by reading/viewing this post.

please consult your financial advisor before taking any action.

----Vinaykumar hiremath

SIEMENS KEY LEVELS FOR 24/01/2025**Explanation:**

This trading system helps you avoid blind trades by providing confirmation for better entries and exits.

**Entry/Exit Points:**

- **Entry/Exit Lines:** Use the BLACK line for long trades and the RED line for short trades, based on confirmation from your trading plan.

- **Stop Los

See all ideas

Summarizing what the indicators are suggesting.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

An aggregate view of professional's ratings.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Displays a symbol's price movements over previous years to identify recurring trends.

Frequently Asked Questions

The current price of SIEMENS is 3,115.15 INR — it has decreased by −2.42% in the past 24 hours. Watch SIEMENS LTD. stock price performance more closely on the chart.

Depending on the exchange, the stock ticker may vary. For instance, on BSE exchange SIEMENS LTD. stocks are traded under the ticker SIEMENS.

SIEMENS stock has fallen by −6.22% compared to the previous week, the month change is a −8.24% fall, over the last year SIEMENS LTD. has showed a −24.78% decrease.

We've gathered analysts' opinions on SIEMENS LTD. future price: according to them, SIEMENS price has a max estimate of 4,300.00 INR and a min estimate of 2,564.00 INR. Watch SIEMENS chart and read a more detailed SIEMENS LTD. stock forecast: see what analysts think of SIEMENS LTD. and suggest that you do with its stocks.

SIEMENS reached its all-time high on Oct 16, 2024 with the price of 4,222.15 INR, and its all-time low was 28.10 INR and was reached on Oct 29, 2003. View more price dynamics on SIEMENS chart.

See other stocks reaching their highest and lowest prices.

See other stocks reaching their highest and lowest prices.

SIEMENS stock is 2.78% volatile and has beta coefficient of 1.62. Track SIEMENS LTD. stock price on the chart and check out the list of the most volatile stocks — is SIEMENS LTD. there?

Today SIEMENS LTD. has the market capitalization of 1.14 T, it has increased by 0.29% over the last week.

Yes, you can track SIEMENS LTD. financials in yearly and quarterly reports right on TradingView.

SIEMENS LTD. is going to release the next earnings report on Aug 8, 2025. Keep track of upcoming events with our Earnings Calendar.

SIEMENS earnings for the last quarter are 11.45 INR per share, whereas the estimation was 11.94 INR resulting in a −4.13% surprise. The estimated earnings for the next quarter are 13.77 INR per share. See more details about SIEMENS LTD. earnings.

SIEMENS LTD. revenue for the last quarter amounts to 42.59 B INR, despite the estimated figure of 46.39 B INR. In the next quarter, revenue is expected to reach 42.26 B INR.

SIEMENS net income for the last quarter is 5.82 B INR, while the quarter before that showed 6.14 B INR of net income which accounts for −5.26% change. Track more SIEMENS LTD. financial stats to get the full picture.

Yes, SIEMENS dividends are paid annually. The last dividend per share was 12.00 INR. As of today, Dividend Yield (TTM)% is 0.38%. Tracking SIEMENS LTD. dividends might help you take more informed decisions.

SIEMENS LTD. dividend yield was 0.17% in 2024, and payout ratio reached 15.73%. The year before the numbers were 0.27% and 18.16% correspondingly. See high-dividend stocks and find more opportunities for your portfolio.

As of Jul 11, 2025, the company has 11.71 K employees. See our rating of the largest employees — is SIEMENS LTD. on this list?

EBITDA measures a company's operating performance, its growth signifies an improvement in the efficiency of a company. SIEMENS LTD. EBITDA is 24.98 B INR, and current EBITDA margin is 13.93%. See more stats in SIEMENS LTD. financial statements.

Like other stocks, SIEMENS shares are traded on stock exchanges, e.g. Nasdaq, Nyse, Euronext, and the easiest way to buy them is through an online stock broker. To do this, you need to open an account and follow a broker's procedures, then start trading. You can trade SIEMENS LTD. stock right from TradingView charts — choose your broker and connect to your account.

Investing in stocks requires a comprehensive research: you should carefully study all the available data, e.g. company's financials, related news, and its technical analysis. So SIEMENS LTD. technincal analysis shows the sell today, and its 1 week rating is buy. Since market conditions are prone to changes, it's worth looking a bit further into the future — according to the 1 month rating SIEMENS LTD. stock shows the neutral signal. See more of SIEMENS LTD. technicals for a more comprehensive analysis.

If you're still not sure, try looking for inspiration in our curated watchlists.

If you're still not sure, try looking for inspiration in our curated watchlists.