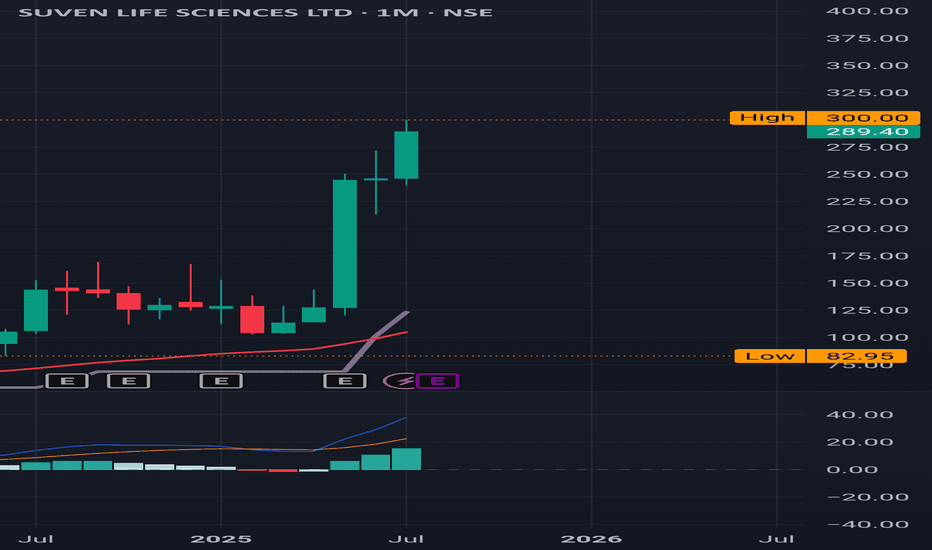

Suven Life Sciences: More than doubled in less than 3 months Suven Life Sciences:

More than doubled in less than 3 months from around 125 in May 2025 to ATH of 300 in July

( Monthly Time Frame )

( Not a Buy / Sell Recommendation

Do your own due diligence ,Market is subject to risks, This is my own view and for learning only .)

SUVEN trade ideas

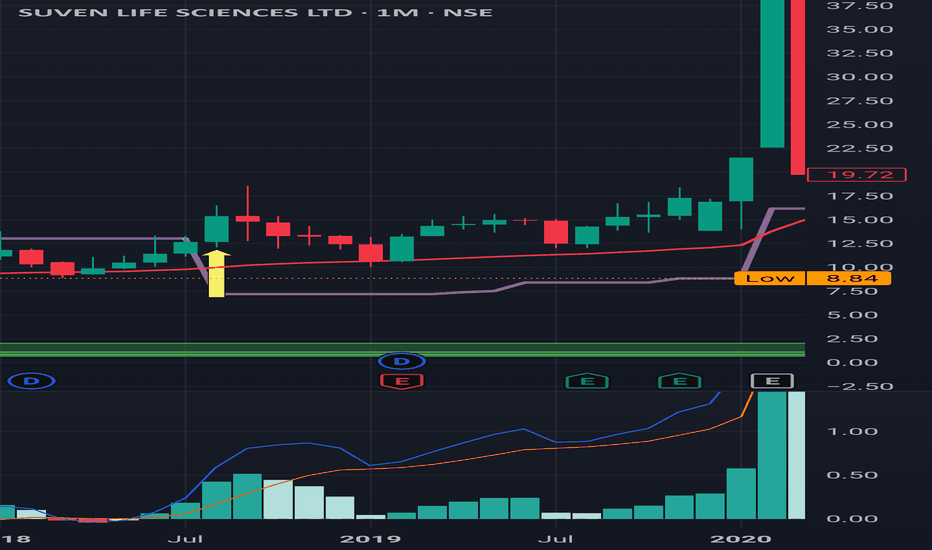

Suven Life Sciences: Monthly Time Frame Suven Life Sciences: Monthly Time Frame

What a Journey!!!

Last time Buy was triggered on August 2018 at around 15 . It's almost 7 years now in August 2025 and it never became a Sell and it has touched 300 .

( Not a Buy / Sell Recommendation

Do your own due diligence ,Market is subject to risks, This is my own view and for learning only .)

Darvas Box Strategy - Breakout StockDisclaimer: I am Not SEBI Registered adviser, please take advise from your financial adviser before investing in any stocks. Idea here shared is for education purpose only.

Stock has given break out. Buy above high. Keep this stock in watch list.

Buy above the High and do not forget to keep stop loss, best suitable for swing trading.

Target and Stop loss Shown on Chart. Risk to Reward Ratio/ Target Ratio 1:2.

Stop loss can be Trail when it make new box.

Be Discipline, because discipline is the key to Success in Stock Market.

Trade what you See Not what you Think.

go long - swing pick- this stock shows signficant delivery percentage value

- possible chances for accumulation

- may perform good in upcoming days

- this stock is picked after market close based on delivery qty data.

- follow this stock for next 5 days , if entry not triggered with in 5 days , ignore pick

- line marked in chart is the day it showed huge delivery percentage.i consider it as signal candle.i marked its high and low

entry

- go long with 1:1.5 RR

- take entry if 15min close crosses the line , ignore entry if it made gap ups

- i prefer entry with in 5 days , if not triggered ignore this pick

sl

- candle close below signal candle's low

target

- keep 1.5 times of sl.

suven high tight flagSuven lifesciences has been making a rounding bottom with a high tight flag at breakout

The breakout volume was good and the past week volume indicates a Pocket pivot.

RSI is in the bullish zone and our CPL indicator shows outperformance on the chart.

OBV is also elevated indicating buying interest.

Target as per fib extension is 153

whereas the target for the cup base is 200.

SL should be taken below the current week low on closing basis

breakoutstock breakout sentiment and its resistANCE LEVEL

STOCK AT LIFE TIME HIGH LEVEL

Industry Peers & Returns 1W 1M 1Y

SUVEN LIFE SCIENCES 24.1% 52.1% 88.2%

SUN PHARMACEUTICAL INDST 1.5% 7.5% 30.6%

DIVIS LABORATORIES -1.3% 6.1% 13.7%

CIPLA 2.9% 7.6% 23.1%

DR REDDYS LABORATORIES -1.2% 1.7% 33.4%

TORRENT PHARMACEUTICALS 6.3% 18.7% 59.3%

ABBOTT INDIA 8.7% 12.9% 13.4%

ZYDUS LIFESCIENCES -1% 9.6% 63.6%

ALKEM LABORATORIES -3% 3.3% 66.9%

SUVEN Stock Breakout analysisSUVEN is a performance based stock. and if we look at the chart we can see it has given the breakout after a nice consolidation of more than 1 year.

it’s expected to give a nice target of R:R :: 1:5.

Reason

Support at the VWAP.

RSI is in Bullish zone, Trendline break of trangle.

Successful breakout after 14 months

High Volume trade last 2 days.

successful breakout of the strong Resistance Zone. Now it will act as support

Price > EMAs

Verdict :

Stock is highly Bullish

R:R :: 1:5

Plan of Action :

Buy: 69.45

Stoploss: 65

Target: 90

Bouncing from here ! This looks like a good spot for this to bounce , most likely should break this pennant after 1 rejection at 53 .

On the weekly the MACD is looking sweet and all 3 Moving averages are offering support at present on the 4hr with the daily having 50 &99 as support.

33.85 would be an ideal SL since its a tad below the uptrend line.

Apparently after their demerger they have increased their profit margins by 25-30% ,also should be back on track after the fire in April.

Lets see how this opens maybe 35 is where i put my bid,worth having a bag.

Hint of accumulation , but lot depends on 502 trial outcomesoctober is here and suven definitely needs a track…

after the climactic stopping action last year in mid 300 levels, the price action has followed an extended fall , after which , key moving averages in the weekly chart has been tested, a selling climax at the 200weekly moving average, followed by a secondary test at the 100weekly moving avergae, leading to a good rally stopped at the high of the Automatic reaction , essentially showing a sign of strength and a uptrending channel has formed, presently face off with the 50 weekly moving average is coming, also at the channel demand line

it is difficult to say with conviction if this is an accumulation unless phase c unfolds and also the outcome of the suven 502 trial results this month, but the progress technically as mentioned so far, is definitely a positive build up…

the volumes remain low throughout the uptrending trading range…

any close above 275 and subsequent retest of that level, thereby formation of a last point of support , would be considered a positive outcome , technically for this scrip…

disclaimer... not an investing/trading recommendation