Next report date

—

Report period

—

EPS estimate

—

Revenue estimate

—

142.20 INR

1.66 B INR

16.82 B INR

5.13 M

About SWARAJ ENGINES LTD

Sector

Industry

CEO

Devjit Sarkar

Website

Headquarters

Mohali

Founded

1985

ISIN

INE277A01016

FIGI

BBG000D0SGK6

Swaraj Engines Ltd. engages in the manufacture of diesel engines, diesel engine components, and spare parts. The company was founded on September 24, 1985 and is headquartered in Mohali, India.

Related stocks

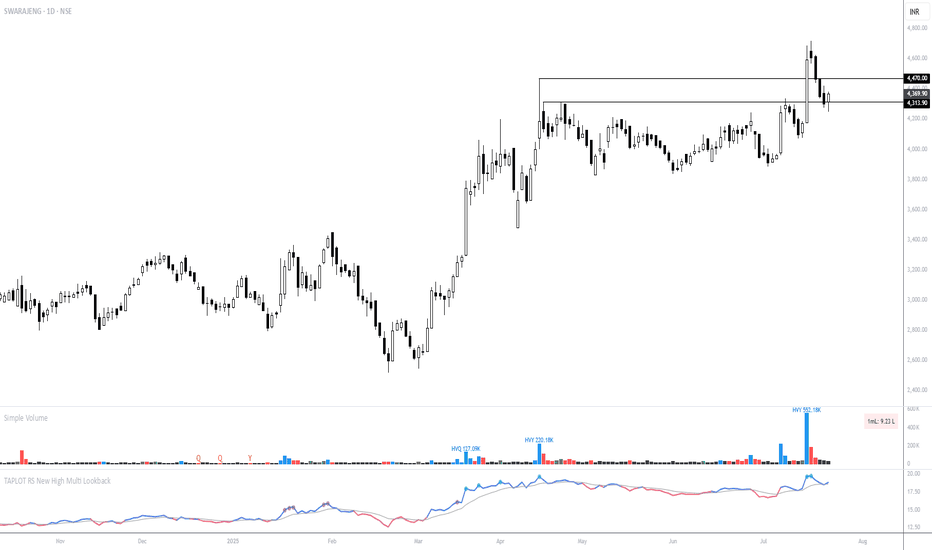

SWARAJENG - Earnings-Driven Breakout & RetestTechnical Overview

Trend: The chart shows a clear upward trend since early 2025. The price consolidated in a tight range for several months before breaking out convincingly.

Breakout: The breakout coincided with a notable spike in volume, indicating strong participation, likely due to robust earni

SWARAJ ENGINESBetween June 5th and June 24th, Swaraj Engines' stock price increased from 2400 to 3100, accompanied by high trading volumes. Since then, the stock has been consolidating, with 3100 acting as resistance and 2850 as support. On July 30, 2024, the stock attempted to break out of this resistance level

Swaraj Engines Boy , 🚜 and daddy - what next? NSE:SWARAJENG

~ Stock has stuck in a range for the last two years, line in a box

~ exactly playing from the last analysis horizontal line drawn

~ stock when below oblique support line and now trying to come back to its rails

~ check out below analysis from Sept 21 2022

~ Getting 120% in slig

SWARAJENGNSE:SWARAJENG

[ b]One Can Enter Now ! Or Wait for Retest of the Trendline (BO) Or wait For better R:R ratio

Note :

1.One Can Go long with a Strict SL below the Trendline or Swing Low of Daily Candle.

2. Close, should be good and Clean.

3. R:R ratio should be 1 :2 minimum

4. Plan as per your RI

near supply zone1) Weekly chart analysis

2) header and shoulder patterns completed in chart

3) decent volume in chart

4) volume meeting chart header shoulder pattern

5) stock at supply zone breakout not done

6) supply zone 2200

7) demanda zone 1900

8) The demand zone is major support for the stock

9) no recomanda

See all ideas

Summarizing what the indicators are suggesting.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

An aggregate view of professional's ratings.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Displays a symbol's price movements over previous years to identify recurring trends.

Frequently Asked Questions

The current price of SWARAJENG is 4,206.65 INR — it has decreased by −3.66% in the past 24 hours. Watch SWARAJ ENGINES LTD. stock price performance more closely on the chart.

Depending on the exchange, the stock ticker may vary. For instance, on BSE exchange SWARAJ ENGINES LTD. stocks are traded under the ticker SWARAJENG.

SWARAJENG stock has fallen by −5.66% compared to the previous week, the month change is a 1.36% rise, over the last year SWARAJ ENGINES LTD. has showed a 35.97% increase.

We've gathered analysts' opinions on SWARAJ ENGINES LTD. future price: according to them, SWARAJENG price has a max estimate of 4,529.00 INR and a min estimate of 4,300.00 INR. Watch SWARAJENG chart and read a more detailed SWARAJ ENGINES LTD. stock forecast: see what analysts think of SWARAJ ENGINES LTD. and suggest that you do with its stocks.

SWARAJENG reached its all-time high on Jul 16, 2025 with the price of 4,725.95 INR, and its all-time low was 70.00 INR and was reached on Mar 25, 2004. View more price dynamics on SWARAJENG chart.

See other stocks reaching their highest and lowest prices.

See other stocks reaching their highest and lowest prices.

SWARAJENG stock is 4.33% volatile and has beta coefficient of 1.99. Track SWARAJ ENGINES LTD. stock price on the chart and check out the list of the most volatile stocks — is SWARAJ ENGINES LTD. there?

Today SWARAJ ENGINES LTD. has the market capitalization of 51.10 B, it has increased by 10.51% over the last week.

Yes, you can track SWARAJ ENGINES LTD. financials in yearly and quarterly reports right on TradingView.

SWARAJ ENGINES LTD. is going to release the next earnings report on Oct 27, 2025. Keep track of upcoming events with our Earnings Calendar.

SWARAJENG net income for the last quarter is 499.70 M INR, while the quarter before that showed 454.20 M INR of net income which accounts for 10.02% change. Track more SWARAJ ENGINES LTD. financial stats to get the full picture.

Yes, SWARAJENG dividends are paid annually. The last dividend per share was 104.50 INR. As of today, Dividend Yield (TTM)% is 2.48%. Tracking SWARAJ ENGINES LTD. dividends might help you take more informed decisions.

SWARAJ ENGINES LTD. dividend yield was 2.68% in 2024, and payout ratio reached 76.48%. The year before the numbers were 4.15% and 83.70% correspondingly. See high-dividend stocks and find more opportunities for your portfolio.

As of Jul 27, 2025, the company has 1.67 K employees. See our rating of the largest employees — is SWARAJ ENGINES LTD. on this list?

EBITDA measures a company's operating performance, its growth signifies an improvement in the efficiency of a company. SWARAJ ENGINES LTD. EBITDA is 2.36 B INR, and current EBITDA margin is 13.72%. See more stats in SWARAJ ENGINES LTD. financial statements.

Like other stocks, SWARAJENG shares are traded on stock exchanges, e.g. Nasdaq, Nyse, Euronext, and the easiest way to buy them is through an online stock broker. To do this, you need to open an account and follow a broker's procedures, then start trading. You can trade SWARAJ ENGINES LTD. stock right from TradingView charts — choose your broker and connect to your account.

Investing in stocks requires a comprehensive research: you should carefully study all the available data, e.g. company's financials, related news, and its technical analysis. So SWARAJ ENGINES LTD. technincal analysis shows the neutral today, and its 1 week rating is buy. Since market conditions are prone to changes, it's worth looking a bit further into the future — according to the 1 month rating SWARAJ ENGINES LTD. stock shows the strong buy signal. See more of SWARAJ ENGINES LTD. technicals for a more comprehensive analysis.

If you're still not sure, try looking for inspiration in our curated watchlists.

If you're still not sure, try looking for inspiration in our curated watchlists.