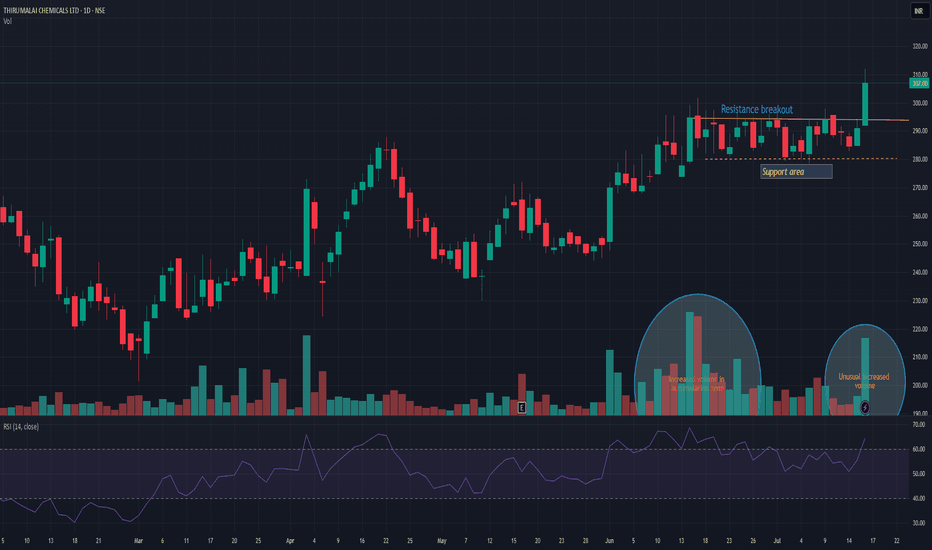

TIRUMALCHMTIRUMALCHM has given resistance breakout with decent volume. Another good thing is unusual volume increased in accumulation zone. Support can be seen near 280 levels. There is high probability that this time it may push the stock in to trend change and may take momentum to the next level. Keep it on radar.

TIRUMALCHM trade ideas

Thirumalai Chemicals Ltd16-April-2024 | Live Market Analysis

Thirumalai Chemicals Ltd

#buy range 280 ~ 282

Expected #targets - 335 / 525 ++

NSE : #tirumalchm

Disclaimer: This analysis is for educational purposes only and should not be considered as trading advice or recommendations. Always conduct your own research before making any investment decisions.

Thirumalai Chemicals on an upswing. Thirumalai Chemicals Ltd. is one of the largest producers of phthalic anhydride, malic acid, maleic anhydride & fumaric acid globally. The manufactured items have a broad use in plastic industry, agricultural fungicides, enhancement of sweetness of fruits and carbonated drinks, animal feeds, medicines etc. They have presence in more than 34 countries.

Thirumalai Chemicals CMP is 204.90. Negative aspect of the company is declining quarterly net profits. Positive aspects of the company are zero promotor pledge, improving annual net profit, improving cash from operations annual, promotors increasing stake. FIIs are also increasing stake & low debt.

Entry in Thirumalai Chemicals can be taken after closing above 207. Targets in the stock will be 216, 222 & 228. Long term target in the stock will be 237 & 250+. Stop loss in the stock should be maintained at closing below 188.

Tirumalai Chemicals This is only for academic interest and am not a certified analyst.

Tirumalai chemicals has formed a perfect cup & handle which is an indication for an upward potential

Also the MACD cross over happens, which confirms the upward potential.

A potential stock for a watch out

Regards

K.Chandrasekhar

TIRUMALCHM Breakout on Daily Timeframe, Best Buy 233/231 TIRUMALCHM Breakout on Daily Timeframe, Best Buy 233/231

TIRUMALCHM Breakout on Daily Timeframe, Best Buy 233/231

TIRUMALCHM Breakout on Daily Timeframe, Best Buy 233/231

TIRUMALCHM Breakout on Daily Timeframe, Best Buy 233/231

TIRUMALCHM Breakout on Daily Timeframe, Best Buy 233/231