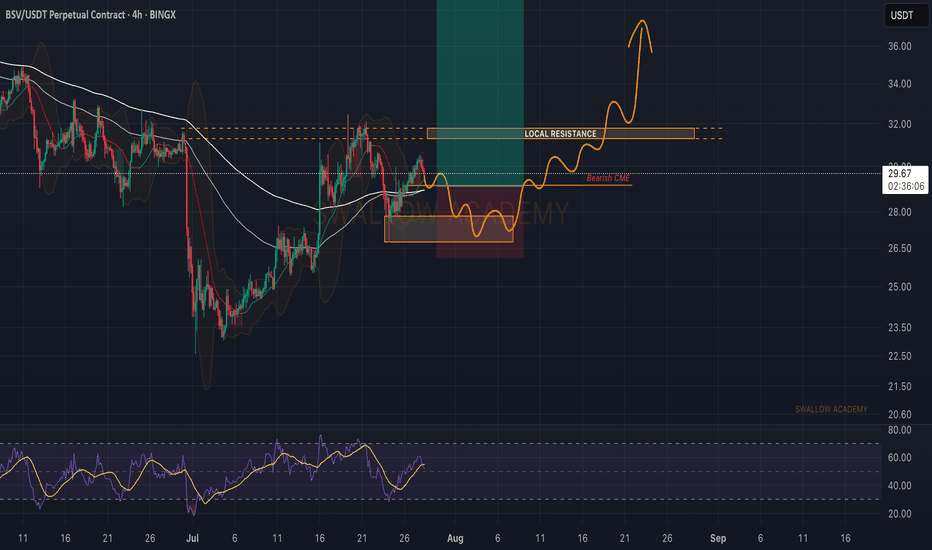

Bitcoin SV (BSV): Expecting Smaller Correction Before BreakoutBSV is going to have a smaller correction most likely which should fill the Bearish CME gap and give us a potential accumulation that we need to breakout from local resistance, which then would open us a potential 50% movement to upper zones.

Swallow Academy

BSVUSDT trade ideas

Bitcoin SV (BSV): Possible Bounce Are | Eyes on 200EMABSV has filled the huge FVG that was formed during the bullish candle that we formed on the 25th of April.

As price has now cooled itself down, we are expecting another rally toward the 200EMA, where once we see the proper buyside dominance near $35, we will be going for the long position here!

Swallow Academy

Bitcoin SV (BSV): Looking For Full Recovery | Might Be Good BuyBSV is still undervalued, and after a recent drop, we had a price that still has not filled the FVGs that are sitting in upper zones. We are looking for full recovery from here so let's wait patiently.

For entry, wait for proper BOS on smaller timeframes.

Swallow Academy

BSVUSDT Forming Bullish BreakoutBSVUSDT is currently showing a promising setup that could attract a lot of attention from crypto traders in the coming weeks. The chart displays a clear descending channel, which often acts as a continuation or reversal pattern depending on the breakout direction. The recent price action near the lower trendline, combined with strong volume, suggests that BSVUSDT might be preparing for a bullish breakout that could see significant upside momentum.

With an expected gain projection of 90% to 100%+, this pair offers an attractive risk-to-reward ratio for swing traders and position holders alike. The buying interest around these levels indicates that investors are accumulating, betting on a strong reversal as the broader market sentiment stabilizes. If the price can break and close above the channel’s resistance trendline, it would confirm the pattern and potentially trigger a wave of buying pressure.

This setup is further supported by the overall improvement in market conditions, where traders are increasingly looking for altcoins with technical breakouts and solid fundamentals. BSV’s community and network upgrades continue to spark discussions, which could help sustain momentum after the breakout. Keeping an eye on volume spikes and key support levels will be essential to manage the trade effectively.

✅ Show your support by hitting the like button and

✅ Leaving a comment below! (What is You opinion about this Coin)

Your feedback and engagement keep me inspired to share more insightful market analysis with you!

Bitcoin SV (BSV): Could Be Good Buying OpportunityBSV is still recovering from that huge dip we had recently, which dumped the coin by 26%, leading the price towards the major support area.

Since then we have been just consolidating and trading in a sideways smaller channel. What we are looking for now is a proper MSB, which will turn the trend and give us a proper recovery with a possible 1:4 RR trading setup!

Swallow Academy

Bitcoin SV (BSV): Expecting Sideways Movement + BreakoutBSV has formed a triangle pattern where the price has been bouncing in from one side to another, preparing itself for a breakout from this pattern.

We are looking for further movement in the sideways channel, where at one point we will be looking for a breakout from the triangle pattern, where then we will be looking for slight upward movement.

But keep in mind, if we see the price break the local support zone, then we might be seeing a steep movement to $30.50.

Swallow Academy

Bitcoin SV (BSV): Strong Upside Potential | Big Dump HappenedBSV had recently dumped hardly, where we are seeing a good potential for upward movement to follow the current movement.

The risk is big here but so is the reward, which might lead the price back to the full upper area and also go for the EMAs here.

Pure play of volatility here so let's see!

Swallow Academy

#BSVUSDT #1D (ByBit) Falling wedge breakoutBitcoin Satoshi Vision is pulling back to 100EMA daily support where it seems likely to bounce and resume bullish, mid-term.

⚡️⚡️ #BSV/USDT ⚡️⚡️

Exchanges: ByBit USDT

Signal Type: Regular (Long)

Leverage: Isolated (2.0X)

Amount: 4.5%

Entry Targets:

1) 38.05

Take-Profit Targets:

1) 63.54

Stop Targets:

1) 29.54

Published By: @Zblaba

AMEX:BSV BYBIT:BSVUSDT.P #BitcoinSatoshiVision #PoW

Risk/Reward= 1:3.0

Expected Profit= +134.0%

Possible Loss= -44.7%

Estimated Gain-time= 2 months

BSV/USDT Breakout and Potential RetraceHey Traders, in today's trading session we are monitoring BSV/USDT for a buying opportunity around 36.10 zone, BSV/USDT was trading in a downtrend and successfully managed to break it out. Currently is in a correction phase in which it is approaching the retrace area at 36.10 zone.

Trade safe, Joe.

BSV Rebuy Setup (12H)Since we placed the green arrow on the chart, it seems that the BSV correction has started. This correction was a butterfly diametric pattern that has now completed.

From the point where we placed the green arrow, the bullish phase of BSV appears to have begun, which should have at least 3 waves. It seems the first wave is complete, and we are currently in the second corrective wave.

We are looking for buy/long positions around the green zone to form wave C of the new bullish phase.

A daily candle closing below the invalidation level will invalidate this analysis.

For risk management, please don't forget stop loss and capital management

When we reach the first target, save some profit and then change the stop to entry

Comment if you have any questions

Thank You

BSV go to 38MBitcoin SV (BSV) has seen various price predictions, but reaching 38,000,000 seems highly unlikely based on current predictions. Analysts predict BSV could reach $168 by December 2024, $265 by 2028, and possibly $374 by 2030. Other sources suggest a more conservative outlook, with BSV potentially ranging between $36.73 and $38.30 in 2025.

Bsv usdtBsv just completed a corrective move after an impulsive move and could be a sign to another incoming impulsive move

Breaking: $BSV Spike 38% Today Amidst Breaking out of A Pennant The price of Bitcoin forked token called Bitcoin SV ticker name ( AMEX:BSV ), saw a notable uptick of about 38% today amidst breaking out of a falling wedge with current market metrics hinting at another leg up.

What Is BSV?

Bitcoin SV (BSV) emerged following a hard fork of the Bitcoin Cash (BCH) blockchain in 2018, which had in turn forked from the BTC blockchain a year earlier following the blocksize wars.

BSV claims to fulfill the original vision of the Bitcoin protocol and design as described in Satoshi Nakamoto’s white paper, early Bitcoin client software and known Satoshi writings. BSV aims to offer scalability and stability in line with the original description of Bitcoin as a peer-to-peer electronic cash system, as well as deliver a distributed data network that can support enterprise-level advanced blockchain applications.

Technical Outlook

Since April high of 2021, that saw the asset deliver a stunning 826% in gains, the asset quickly retraced losing about 94% of market value for over 4 years now. The rise in price today is integral for AMEX:BSV in order to bring back life to the project as the altcoin has been mute lately with no on chain development or ecosystem growth.

However, present market metrics shows we might experience a brief respite before another leg-up as the asset is oversold as hinted by the RSI at 92. Our next support is the $40- $37 zone.

BSV Channel ConvergenceFollowing up on the BSV/BTC chart channel, the BSV/USD chart is also at an interesting juncture. Although spikes down to the $17 area can't be ruled out, longterm this chart is suggesting buys as long as the trendline is respected.

Bitcoin SV's Path To A New All-Time High Starts NowBitcoin SV's previous bull-market lasted 721 days. The bottom low happened in April 2019.

We have an interesting chart here and we are seeing the start of the of a new bullish cycle that will end up, most likely, producing a new All-Time High for this trading pair and Cryptocurrency project.

BSV peaked early in 2021 —April. Naturally, after a bull-market comes a bear-market. Just as new ATHs are hit within a bull-market, new ATLs can be hit within a bear-market, and this was the case for BSVUSDT.

In May 2022, the market bottom low from April 2019, the start of the previous bull-market, was challenged. In October 2022, this long-term support level broke and BSVUSDT produced a new All-Time Low (June 2023).

Now, I am mentioning this only because of the bullish implications that arise when the action moves back above this level.

In December 2023, BSV managed to conquer this once support level turned resistance, and we entered the bullish zone. The initial breakout was corrected in early through mid-2024. The correction ended as a higher low compared to the ATL in 2023.

Present day. BSVUSDT is back in the bullish zone, right before massive bullish action. The action is happening above the April 2019 low, safely, the weekly session with a long lower wick and full green on the body. This simply means in candlestick reading terms that the market is ultra-bullish and ready to boom any day. We are talking about days, literally, before a major rise develops.

The rise can last several months, an entire year or more. Too early to say how the broader bull-market dynamic will develop for this pair.

This is a friendly reminder. The best ever possible entry timing.

A new ATH in 2025 can hit around $800.

This would give us around 12X total growth potential.

If the market becomes extremely bullish, then $1,290 opens up as a possibility for the next market peak. We are going with the conservative target though. This higher ATH projection yields 20X.

We are concerned here with great entry timing; great prices. Once the entry is done when prices are low, the market can take care of the rest.

Imagine holding this pair when it trades at $500 and you bought at $48, or $64... Wouldn't that be amazing? You can decide later down the road how to take profits. It is much more simple now, buy and hold. It is still early, but it won't be early for long. The market is about to go wild.

Thanks a lot for your support.

Namaste.

BSV Good support for bsv .

If it decides to break 66$ in the coming days . This is how i expect it to proceed.

Short term target of 127$

Bsv/usdt longYuppp friends

I think itis good chance for buy

First tp around fvg at 60$ zone

Post will update

BSV/USDT POSSIBLITY FOR $105Following the recent increase in BTC and based on the latest data, BSV has a good chance of entering a new trend. This suggests that BSV may gain enough momentum to break through to $107, with potential interim targets at $74, $85, and $105.

The reason for this update is that there is a high chance BSV can change a trend of break.

This depend on trend data.

Monitor BSV further to see if it can reach new levels in the coming periods.

Bitcoin SV Poised for a Breakout Amid Craig Wright's New LawsuitBitcoin SV ( AMEX:BSV ) has been making headlines once again, largely thanks to the latest controversial actions of its most vocal proponent, Craig Wright. The Australian scientist, who has long claimed to be Bitcoin’s pseudonymous creator, Satoshi Nakamoto, is back in the limelight with a new lawsuit. This time, Wright is suing Bitcoin Core developers, insisting that Bitcoin SV is the true embodiment of Bitcoin, and seeking a staggering £911 billion in damages.

As the legal battle unfolds, the market has taken notice, with BSV’s price seeing a modest 3% rise. But what does this mean for Bitcoin SV ( AMEX:BSV )?

Craig Wright Claims Bitcoin SV is the True Bitcoin

Craig Wright’s lawsuit targets Bitcoin Core developers, accusing them of altering Bitcoin’s original protocol with updates like SegWit and Taproot, which he claims have strayed from the original vision set out in the Bitcoin whitepaper. Wright argues that Bitcoin SV (BSV) remains faithful to the initial protocol, positioning it as the true representation of Bitcoin.

However, this lawsuit follows a series of legal losses for Wright, most notably a ruling by the UK High Court that discredited his claims of being Satoshi Nakamoto. Despite this, Wright presses on, asserting that Bitcoin SV’s undervalued market position is a result of these misrepresentations by Bitcoin Core developers, which he believes justifies his demand for £911 billion in damages.

Legal Controversy: Community Reaction

Wright’s lawsuit has been met with a mix of skepticism and criticism from the broader crypto community. Prominent figures, including Hodlonaut, who previously won a defamation case against Wright, have mocked the legal action. Hodlonaut sarcastically suggested that Wright might be using AI tools like ChatGPT to craft his claims, reflecting the broader sentiment that many in the community consider his actions to be legally and factually baseless.

Bitcoin SV Price Reaction: Small Gain Amid Legal Drama

Despite the controversy, Bitcoin SV’s price saw a 3% jump in the last 24 hours, trading around $51.23 with a 25% decrease in trading volume, signaling that while the market is reacting, the enthusiasm is not overwhelming. The price touched a daily high of $51.91, showing that some traders may be betting on a bullish outcome. However, with skepticism surrounding Wright’s claims, many are cautious about any long-term bullish sentiment based solely on the lawsuit.

Open interest in BSV ( AMEX:BSV ) futures has also risen by nearly 5%, indicating growing interest in the token despite—or perhaps because of—the legal drama. Whether this interest will translate into sustained gains remains to be seen, but the increase in futures activity suggests that traders are closely watching the situation.

Technical Outlook: Is BSV Poised for a Breakout?

From a technical perspective, Bitcoin SV ( AMEX:BSV ) appears to be on the verge of a potential breakout. Currently trading above key moving averages, BSV’s RSI (Relative Strength Index) stands at 60, signaling that it’s neither overbought nor oversold, leaving room for further gains.

Immediate resistance is pegged at $55, a critical pivot point that could determine the direction of the next major move. If BSV ( AMEX:BSV ) manages to surpass this level, it could trigger a rally toward its next target of $115—a level that aligns with the highs from March 2024. Such a move would mark a significant recovery for BSV ( AMEX:BSV ), which is still far below its all-time high of $423.

On the downside, support is currently set at $48, which could offer a favorable entry point for buyers looking to capitalize on a potential bullish run. If BSV ( AMEX:BSV ) dips to this level, a consolidation phase could occur before the token regains momentum.

What’s Next for BSV?

While the technical outlook for BSV ( AMEX:BSV ) is promising, the token’s future largely depends on the broader adoption and community sentiment surrounding Wright’s claims. As the crypto community continues to question Wright’s legal tactics and assertions, any further developments in his lawsuit could either boost or hinder BSV’s price action.

For now, traders seem cautiously optimistic, with the potential for gains in the near term. However, given the controversial nature of Craig Wright’s involvement, Bitcoin SV’s trajectory is far from guaranteed. The next major move could be heavily influenced by external factors, including the outcome of the lawsuit, market sentiment, and overall crypto market conditions.

Conclusion

Bitcoin SV ( AMEX:BSV ) is trading at a pivotal point, both in terms of price action and its place in the broader crypto narrative. Craig Wright’s continued legal battles have put the token in the spotlight, but whether this attention will translate into long-term gains remains uncertain. For now, the technical indicators suggest a possible breakout, but traders should proceed with caution, keeping an eye on both the charts and the unfolding legal drama.

If BSV ( AMEX:BSV ) can overcome its immediate resistance levels and break free from the shadow of controversy, it may see a resurgence, but it will need more than just legal headlines to reclaim its former glory.