BTC - Bulls vs Bears: who will win?Market Context

Bitcoin is trading in a tight consolidation just below its all-time high after a strong impulsive rally. This phase represents a balance of power between buyers and sellers, with neither side able to take control yet. Such a pause in momentum at this key level often builds pressure for a breakout move as liquidity pools accumulate above and below the range.

Consolidation Phase

The current range is clearly defined by a resistance area at the top and a support area at the bottom. Price has been oscillating within these boundaries without any sustained breakout attempts. This range-bound behavior is an essential part of the market cycle, as it allows larger players to build or distribute positions. The longer price stays in this box, the more significant the breakout that follows tends to be.

Bullish Breakout Scenario

If price breaks out decisively above resistance, it would indicate buyers have absorbed all the supply at these levels. Such a breakout opens the path to a new all-time high and could potentially extend far beyond as trapped shorts are forced to cover. For traders, a retest of the breakout level on lower timeframes could provide a low-risk entry point for continuation to the upside.

Bearish Breakout Scenario

On the flip side, if support fails, the market will likely gravitate toward the unfilled Fair Value Gap left behind during the previous rally. This inefficiency becomes a natural draw for price, offering a logical downside target for a corrective move. A clean break below the range followed by a retest from underneath could present shorting opportunities for those aiming to capture that move into the FVG.

Final Words

Patience and precision are key when dealing with setups like this. Let the market come to your level — and react with intent.

If you found this breakdown helpful, a like is much appreciated! Let me know in the comments what you think or if you’re watching the same zones.

BTCDOWNUSDT trade ideas

Bitcoin & The Altcoins —Name Your AltcoinBitcoin is sideways right now and is moving in a very tight and narrow range. All the action has been happening between $117,000 and $120,000 based on candle close since 11-July. This is bullish, think about it.

Bitcoin hits a new all-time high and next thing you know it turns sideways very close to resistance. The only drop was short-lived and everything sold was quickly bought. Why is Bitcoin consolidating so close to resistance? It is preparing to move ahead.

What happens when Bitcoin moves forward after so much recovery? Everything experiences a positive cycle. This is a very strong signal.

This chart allows for more whipsaw as you know nothing else is possible in a trading range. We predict the pattern to resolve bullish, but there can be swings to either side. A swing down just as it happened 25-July. A swing up just as it happened 14-July. This is always possible but the end result won't change. Bitcoin will continue sideways but when the sideways period is over, you will not see a move toward $110,000 or $100,000. The break of the trading range will confirm the advance toward $135,000 next month. Bitcoin is likely to continue in the same mode. While Bitcoin consolidates the new advance, the altcoins grow. In this way the entire market continues to recover and grow month after month after month.

Name Your Altcoin

Leave a comment with your favorite altcoin trading pair and I will do an analysis for you. I will reply in the comments section. Make sure to include any questions you might have beforehand.

If you see a comment with a pair you like, boost and reply so these can be done first.

Thanks a lot for your continued support.

Namaste.

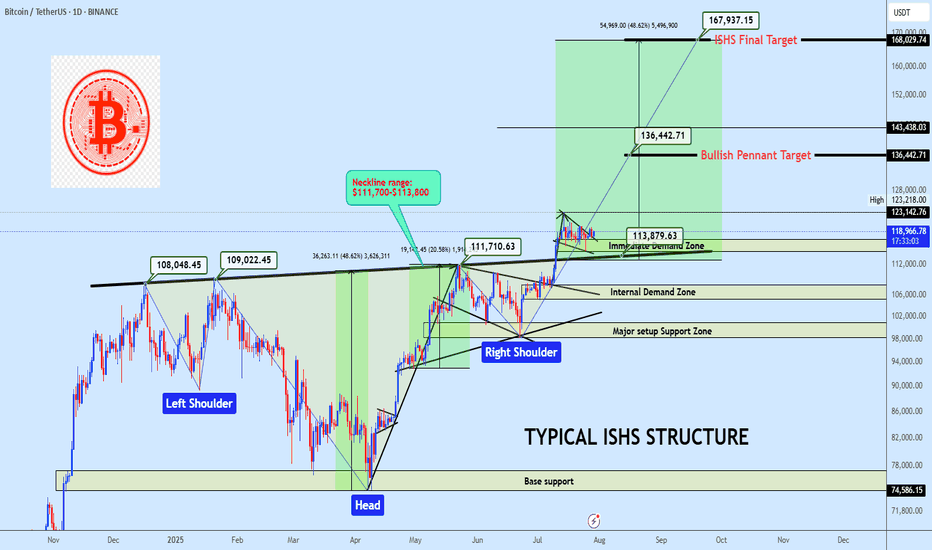

BTCUSDT ISHS Breakout with Bullish Pennant ContinuationBTC is holding above a clean neckline breakout from a inverse head and shoulders formation, currently consolidating inside a bullish pennant. A breakout from this range offers continuation potential to $136K and possibly to $168K. Bias remains bullish while price holds above the $114K region.

Market Structure

• Trend: Bullish continuation

• Pattern: Inverse Head & Shoulders + Bullish Pennant

• Price Action: Clean breakout and retest of neckline support, followed by tightening consolidation

Key Zones

• Immediate Demand Zone: $114,000 – $117,000

• Internal Demand Zone: $105,000 – $108,000

• Major Setup Support Zone: $98,000 – $101,000

• Base Support (ISHS Origin): $74,500 – $77,000

• Neckline: $111,700-$113,800 (Confirmed pivot level)

Technical Confluence

• Volume: Strong candle breakout through neckline, followed by low-volume bullish flag

• Price Geometry: ISHS measured move aligns with the final target at $168K

• Momentum: Bullish structure maintained with higher lows and reactive demand

Entry Plan

• Zone: $117,500 – $119,000

• Method: Limit buy on demand retest or breakout retest of $123K

• Execution: Swing entry with invalidation below demand base

Targets

• 🎯 TP1: $136,442 — Pennant measured move

• 🎯 TP2: $168,029 — Final ISHS target

Invalidation

• ❌ SL: Below $110,000

• Reason: Break below ISHS Neckline invalidates bullish thesis in the short term

• RRR: Estimated 1:4 depending on execution

If this structure aligns with your outlook, feel free to share your thoughts in the comments.

You’re also welcome to drop your preferred altcoins for a quick technical review.

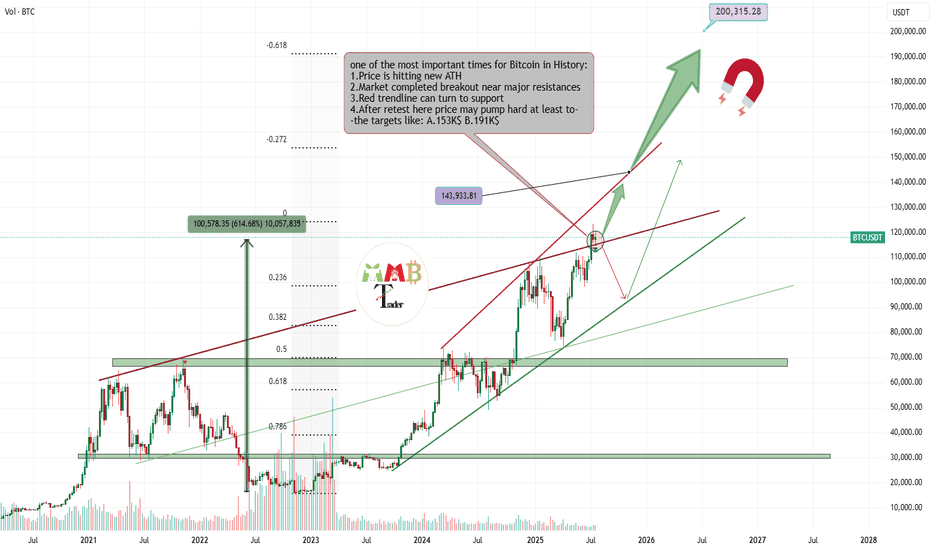

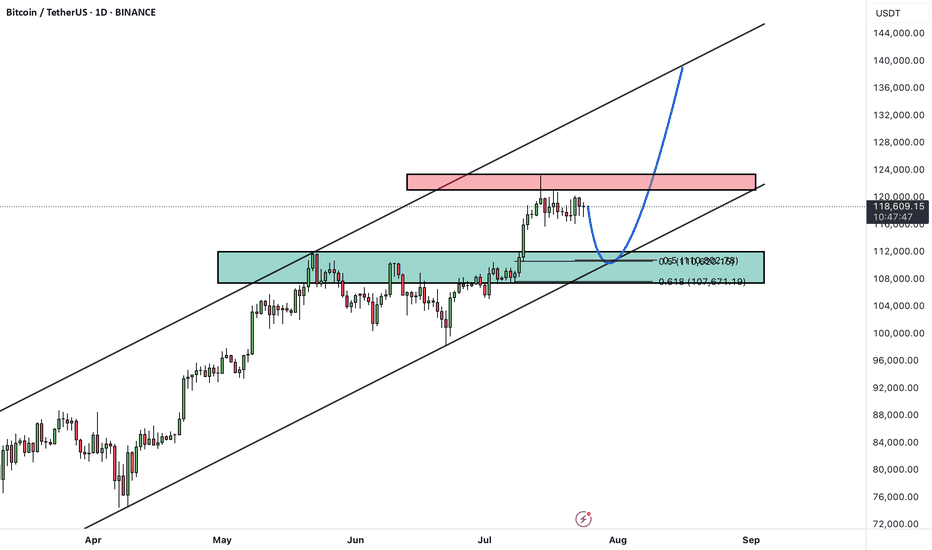

Bitcoin is getting Ready for 143K$ nowMajor red resistance trendline is now broken also last week the retest is completed now price is range for a while for new week to start and fresh volume and buys that make path easier to reach above 140K$.

Get ready and take a look at important zones at chart and possible scenarios which are all mentioned.

DISCLAIMER: ((trade based on your own decision))

<<press like👍 if you enjoy💚

Chart Patterns - How to read them like a ProChart patterns are visual formations on price charts that help traders anticipate potential market movements.

These patterns fall into three main categories: bullish , bearish , and indecisive .

---

1. Bullish Chart Patterns

Bullish patterns often signal that price is likely to move upward.

1.1 Bull Flag

* What it looks like: A sharp upward move followed by a small downward-sloping rectangle (the flag).

* Meaning: After a strong rally, the price consolidates briefly before continuing higher.

* Key insight: A breakout above the flag typically signals a continuation of the trend.

1.2 Pennant (Bullish)

* What it looks like: A strong upward move followed by a small symmetrical triangle.

* Meaning: Similar to the bull flag, but the consolidation takes a triangular form.

* Key insight: Once price breaks above the pennant, the uptrend often resumes.

1.3 Cup & Handle

* What it looks like: A “U”-shaped curve (the cup) followed by a small downward drift (the handle).

* Meaning: This pattern suggests a period of accumulation before price breaks higher.

* Key insight: A breakout above the handle signals the beginning of a new bullish leg.

1.4 Inverse Head & Shoulders

* What it looks like: Three low points, with the middle low being the deepest.

* Meaning: This reversal pattern appears after a downtrend and signals a potential change to an uptrend.

* Key insight: A breakout above the “neckline” confirms the reversal.

---

2. Indecisive Chart Patterns

These patterns show market hesitation, where neither bulls nor bears are clearly in control.

2.1 Consolidation Channel

* What it looks like: Price moves within a horizontal channel.

* Meaning: Market is moving sideways with no strong trend.

* Key insight: A breakout in either direction often leads to a significant move.

2.2 Symmetrical Triangle

* What it looks like: Two converging trend lines forming a triangle.

* Meaning: This is a neutral pattern that can break out in either direction.

* Key insight: Traders wait for a breakout before taking a position.

---

3. Bearish Chart Patterns

Bearish patterns signal a high probability of downward price movement.

3.1 Bear Flag

* What it looks like: A sharp decline followed by a small upward-sloping rectangle.

* Meaning: After a strong drop, price consolidates before continuing lower.

* Key insight: A breakout below the flag suggests a continuation of the downtrend.

3.2 Pennant (Bearish)

* What it looks like: A sharp downward move followed by a small symmetrical triangle.

* Meaning: Similar to the bear flag, but the consolidation takes a triangular form.

* Key insight: A breakout downward typically resumes the bearish trend.

3.3 Inverse Cup & Handle

* What it looks like: An upside-down cup with a small upward drift forming the handle.

* Meaning: Indicates weakness after an uptrend, often followed by a drop.

* Key insight: A break below the handle usually signals a strong bearish move.

3.4 Head & Shoulders

* What it looks like: Three peaks, with the middle one being the highest.

* Meaning: A classic reversal pattern that indicates a potential shift from an uptrend to a downtrend.

* Key insight: A break below the “neckline” confirms the bearish reversal.

---

How to Use These Patterns

* Combine pattern recognition with support/resistance, volume, and indicators for stronger confirmation.

* Always wait for breakouts and avoid acting too early.

* Manage risk with stop-loss orders.

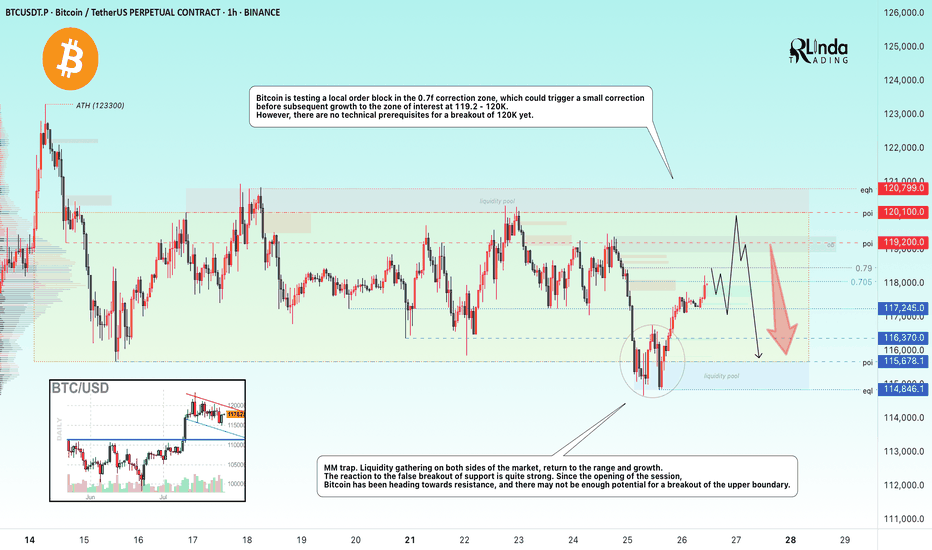

BITCOIN → Correction within a downward channel. 112K or 125K?BINANCE:BTCUSDT is consolidating. However, a local downward trading range is forming relative to the current setup. What is the probability of a correction continuing to 112K or growth to 125K?

Daily structure: a local correctional channel within a global bullish trend. We have cascading resistance at 119.2, 119.6, 120, and 120.8. It will be quite difficult to break through this zone on the first attempt, but MM can use it to form traps and collect liquidity.

At the bottom, everything is simpler — a breakdown of the local bullish structure, the formation of an intermediate minimum, below which there is a void down to 112K.

Yesterday, relative to 115-116K, mm staged a massacre (trap) on both sides of the market.

Liquidity collection, return to the range, and growth. The reaction to the false breakdown of support is quite strong. Since the opening of the session, Bitcoin has been heading towards resistance, but there may not be enough potential to break through the upper resistance conglomerate, so I expect to see a pullback or decline to 116-115-114.

Resistance levels: 119.2, 120.1, 120.85

Support levels: 116.37, 115.67, 112

Technically and fundamentally, I do not see any drivers that could support the market (I am talking about Bitcoin, since the driver for altcoins is the decline in Bitcoin's dominance). It is possible that this may appear later. In the current situation, I am considering a false breakout and correction, as the market has not yet finished consolidating or correcting, and the current downward trading range may be extended.

PS: As the price moves towards resistance, it is necessary to monitor the reaction. The market itself will show what it is preparing for...

Best regards, R. Linda!

Deep Dive Into Relative Strength Index (RSI)The Relative Strength Index (RSI) is a momentum oscillator developed by J. Welles Wilder Jr. that measures the speed and magnitude of price changes.

Introduction

In the world of trading, timing is everything — and few indicators have stood the test of time like the Relative Strength Index (RSI). Introduced by J. Welles Wilder in 1978, the RSI is a momentum oscillator that helps traders evaluate the strength and speed of price movements. Whether you're trading stocks, forex, or crypto, understanding how RSI is calculated and how to interpret its signals can give you a critical edge.

In this article, we’ll break down exactly how the RSI works, explore its formula, and dive into practical ways you can incorporate it into your trading strategies. From spotting potential reversals to identifying overbought and oversold conditions, the RSI remains a cornerstone of technical analysis — but only if you know how to use it properly.

Let’s explore the mechanics and the mindset behind this powerful indicator.

What Is RSI and How Is It Calculated?

The Relative Strength Index (RSI) is a momentum oscillator that measures the speed and change of price movements over a defined period. It outputs a value between 0 and 100, which helps traders determine whether an asset is overbought or oversold.

The default RSI setting uses a 14-period lookback window and is calculated with the following steps:

🔷Calculate the average gain and loss over the last 14 periods:

Average Gain = Sum of all gains over the past 14 periods / 14

Average Loss = Sum of all losses over the past 14 periods / 14

🔷Compute the Relative Strength (RS):

RS = Average Gain / Average Loss

🔷Apply the RSI formula:

RSI=100−(100/(1+RS))

The result is a single number between 0 and 100 that indicates the asset's momentum.

How to Use RSI in Trading Strategies

⚡️Overbought and Oversold Conditions Strategy

RSI > 70 typically signals that an asset may be overbought and due for a pullback.

RSI < 30 suggests the asset might be oversold, potentially primed for a bounce.

However, these levels aren’t absolute sell or buy signals. In strong trends, RSI can stay overbought or oversold for extended periods.

📈Long Trading Strategy Example:

1. Identify the major trend, to find the long trades it shall be uptrend. On the screen below you can see 1D time frame for BITMART:BTCUSDT.P .

2. Move to lower time frame (in our case 4h) and find the moment when RSI falls below 30. This is our oversold condition and we are going to look for long trade.

3. Find the local support zone and open long trade.

4. Take profit when price reaches resistance level next to the previous swing high

5. Don’t forget to put initial stop loss when enter position. The best stop loss which will give you 3:1 risk to reward ratio.

📉Short Trading Strategy Example

1. Identify the major trend, to find the short trades it shall be downtrend. On the screen below you can see 1D time frame for BITMART:ETHUSDT.P .

2. Move to lower time frame (in our case 4h) and find the moment when RSI grows above 70. This is our overbought condition and we are going to look for short trade.

3. Find the local resistance zone and open short trade.

4. Take profit when price reaches support level next to the previous swing low

5. Don’t forget to put initial stop loss when enter position. The best stop loss which will give you 3:1 risk to reward ratio.

⚡️RSI Breakout Strategy

RSI is breaking through 60 indicating bullish momentum shift if the long-term trend is bullish can be the potential long signal

RSI is breaking down 40 indicating bearish momentum shift if the long-term trend is bearish can be the potential short signal

This strategy works great only on the trending market, don’t use it on the range bounded market to avoid whiplashes.

📈Long trading strategy example:

1. Make sure that long-term trend is bullish. Use 200 period EMA as its approximation. If price remains above it we can look for potential long trade setup.

2. If RSI crossed above the level 60 open long trade.

3. Put the initial stop-loss under the signal candle’s low.

4. Take profit when price reached 3:1 risk-to-reward ratio.

📉Short trading strategy example

1. Make sure that long-term trend is bearish. Use 200 period EMA as it’s approximation. If price remains below it we can look for potential short trade setup.

2. If RSI crossed below the level 40 open short trade.

3. Put the initial stop-loss above the signal candle’s high.

4. Take profit when price reached 3:1 risk-to-reward ratio. In our case we received very fast and profitable trade

⚡️RSI Divergence Strategy

RSI can be used also as a trend reversal indicator if we are looking for divergences. This is very reliable sign of current trend weakness and great opportunity open trade against the trend. Usually it’s not recommended, but in case if divergence can be applicable.

Bullish divergence is the situation when price created the lower low, while RSI made the lower low. Usually, it indicates that current downtrend is weakening and we can look for long trades

Bearish divergence is the situation when price created the higher high, while RSI made the lower high. Usually, it indicates that current uptrend is weakening and we can look for short trades

😎Important hint: it’s rarely covered in textbooks about technical analysis, but in our opinion it’s better to used divergences when RSI was able to cross level 50 between two lows/highs.

📈Long trading strategy example

1. Find at the chart situation, when the price made the lower low

2. At the same time RSI shall set the higher low

3. RSI shall break level 50 between these lows indicating shift to the bullish momentum

4. If price failed to set the clean breakdown open long trade on the candle which set the lower low. Put stop loss under it’s low

5. Take profit at 3:1 RR. When you master this concept, you will be able to have much more RR trades, even 10:1. This is possible because when trend finish you have the highest potential upside

📉Short trading strategy example

1. Find at the chart situation, when the price made the higher high

2. At the same time RSI shall set the lower high

3. RSI shall break level 50 between these highs indicating shift to the bearish momentum

4. If price failed to set the clean breakout open short trade on the candle which set the higher high. Put stop loss above it’s high

5. Take profit at 3:1 RR. When you master this concept, you will be able to have much more RR trades, even 10:1. This is possible because when trend finish you have the highest potential upside

Conclusion

The Relative Strength Index (RSI) remains one of the most powerful and flexible tools in a trader’s technical arsenal — but its real value lies in how you use it.

We’ve explored three key RSI strategies:

✅ Overbought/Oversold setups offer simple entry signals in ranging markets, where price tends to revert to the mean.

✅ Breakout strategies unlock RSI’s momentum-tracking potential, helping you ride strong directional moves with confidence.

✅ Divergence detection reveals hidden shifts in market sentiment, giving you an early warning of possible reversals or trend continuations.

Each approach has its strengths — and its risks — but together, they offer a complete framework for using RSI across different market conditions

🔑 Key Takeaways:

RSI is not just a “buy low, sell high” tool — it’s a multi-dimensional indicator that adapts to trends, momentum, and market structure.

The best RSI signals come from confluence: combining RSI with price action, support/resistance, volume, or trend filters like moving averages.

Patience and discipline are essential — RSI signals are only effective when paired with proper risk management and confirmation.

By mastering RSI beyond the basics, you'll be better equipped to make timely, confident, and informed trading decisions — whether you're entering a pullback, chasing a breakout, or spotting the early signs of reversal.

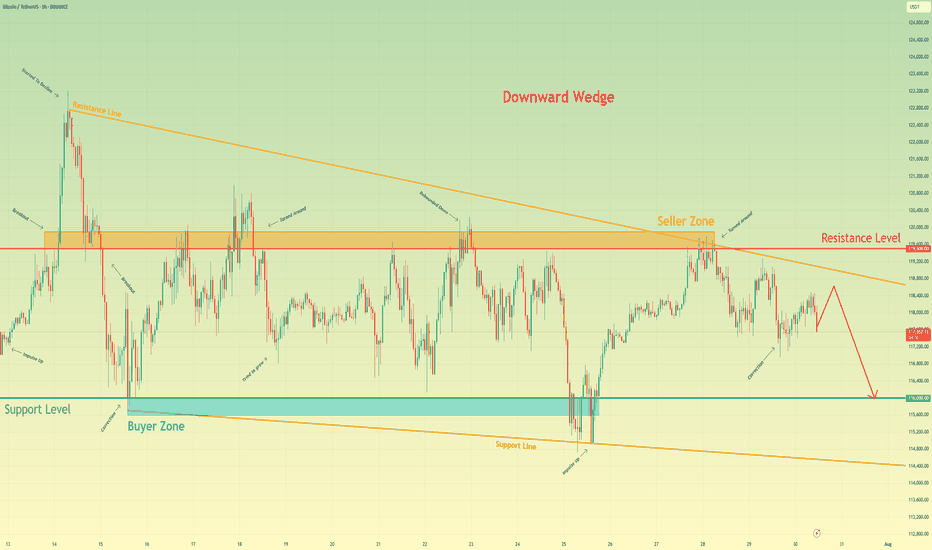

Bitcoin will continue to decline to support levelHello traders, I want share with you my opinion about Bitcoin. Following a period of a broad downward trend, bitcoin's price action has been channeled into a large downward wedge, a pattern that signifies converging volatility and a period of consolidation before an eventual decisive move. This market action is taking place between two critical, well-established zones: a major seller zone capping rallies around the 119500 resistance level and a significant buyer zone providing support near 116000. Recently, an upward rebound attempted to test the upper boundary of this wedge but was met with strong selling pressure from the seller zone, confirming its validity as a formidable barrier. The price is now correcting downwards after this rejection. The primary working hypothesis is a short scenario, anticipating that the bearish momentum from this recent failure will continue to drive the price lower. While a minor bounce or retest of local resistance is possible, the path of least resistance within the pattern's structure is now towards its lower boundary. Therefore, the TP is strategically set at the 116000 level. Please share this idea with your friends and click Boost 🚀

Disclaimer: As part of ThinkMarkets’ Influencer Program, I am sponsored to share and publish their charts in my analysis.

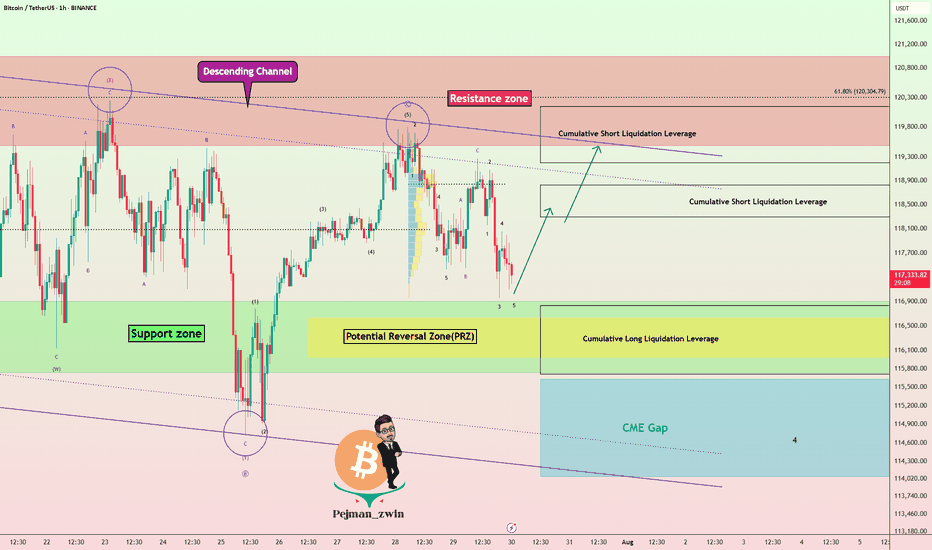

Bitcoin Rejected Near $120K – Bears Wake Up!First of all, I have to say that Bitcoin’s movements over the last 12 days have been a bit difficult to trade , generally, the hardest market to make a profit in is the range market with a swing movement .

Bitcoin( BINANCE:BTCUSDT ) is currently trading near the Resistance zone($121,000-$119,500) , Cumulative Short Liquidation Leverage($121,336-$120,000) , and the upper line of the descending channel .

Since Bitcoin has lost support lines , we can consider this increase in Bitcoin over the last two days as a pullback to the support lines(broken) . Do you agree with me!?

In terms of Elliott Wave theory , it appears that Bitcoin is still completing the main wave B. The main wave B is a Regular Flat(ABC/3-3-5) . The structure of the microwave B of the main wave B was a Double Three Correction(WXY) .

Additionally, the SPX 500 index ( SP:SPX ), which Bitcoin is correlated with , is poised for a correction in my opinion, which could also impact Bitcoin .

Also, unlike previous Mondays, MicroStrategy has NOT purchased Bitcoin , and the company currently holds 607,770 BTC .

Old Bitcoin wallets also seem to be waking up to the fact that they can create movements in the crypto market . " In recent days, 471,867.8 BTC worth $56.39 million have been transferred from old wallets from 2012 to 2017 . ".

I expect Bitcoin to decline to at least the Support zone($116,900-$115,730) and fill the CME Gaps in the coming hours .

New CME Gap: $119,500-$118,295

CME Gap: $115,060-$114,947

Cumulative Long Liquidation Leverage: $117,401-$116,615

Please respect each other's ideas and express them politely if you agree or disagree.

Bitcoin Analyze (BTCUSDT), 1-hour time frame.

Be sure to follow the updated ideas.

Do not forget to put a Stop loss for your positions (For every position you want to open).

Please follow your strategy and updates; this is just my Idea, and I will gladly see your ideas in this post.

Please do not forget the ✅' like '✅ button 🙏😊 & Share it with your friends; thanks, and Trade safe.

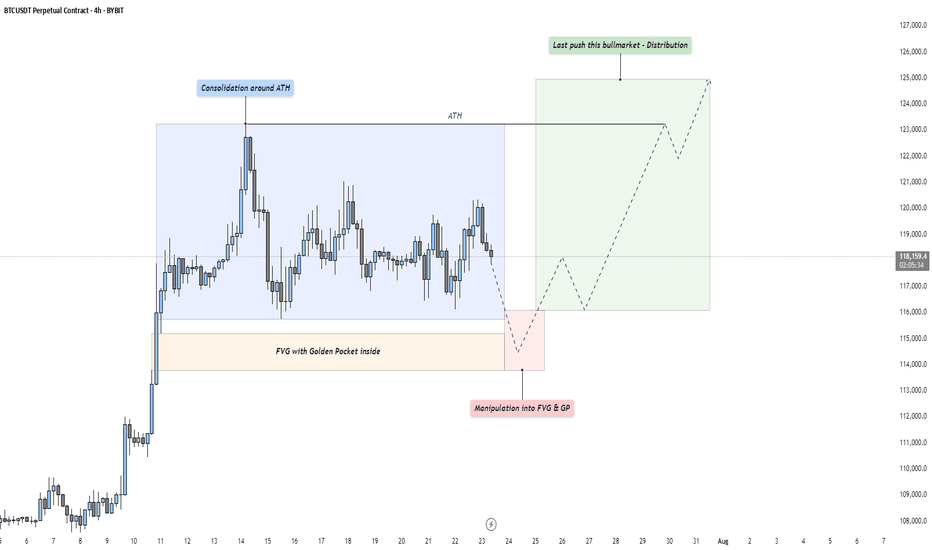

BTC - Last Push: Consolidation, Manipulation & DistributionMarket Context

After a strong upward impulse, Bitcoin has entered a mid-term consolidation phase just below its all-time high. This kind of price action is typical as the market digests recent gains and larger participants prepare for the next move. These pauses in momentum often precede either trend continuation or a reversal — and the structure here suggests we might be witnessing the former, but not without a final shakeout.

Phase 1: Consolidation Around the All-Time High

The first phase is defined by a tight range just beneath the all-time high, where price moves sideways in a balanced struggle between buyers and sellers. This is often where retail participants become overly bullish, anticipating a breakout. However, the lack of a sustained move higher indicates that smart money may be waiting for better entries — or preparing to engineer liquidity to fuel the next move.

Phase 2: Manipulation Into the Fair Value Gap and Golden Pocket

Directly below the range lies a clean Fair Value Gap, with a Golden Pocket retracement nestled inside it. This zone represents a strong area of interest. A sharp move into this area would likely sweep late long positions and trigger stop-losses from range traders — a classic manipulation pattern. This phase serves two purposes: collect liquidity and offer favorable pricing for larger players looking to position themselves before expansion. Watch for signs of absorption or reversal as price enters this zone.

Phase 3: Expansion – The Last Push of the Bull Market?

Following the liquidity sweep and reaction from the Fair Value Gap and Golden Pocket zone, we could see a renewed expansion toward higher highs. This is the phase where volume returns, sentiment shifts, and price accelerates. If this plays out, it could mark the final leg of this bull cycle — potentially driving Bitcoin to new all-time highs with strength.

Execution Thoughts

If you're looking to participate, it's wise to wait for a confirmation signal on a lower timeframe — like the 5-minute or 15-minute chart — once price enters the Fair Value Gap and Golden Pocket zone. Watch for a strong bullish reaction, break of structure, or shift in order flow to signal that buyers are stepping back in.

Final Thoughts

Let the market come to your level and don’t chase moves without context. These three phases — consolidation, manipulation, and expansion — are timeless patterns seen across all markets. Stay patient, stay objective, and react with clarity.

If this breakdown helped you see the setup more clearly, a like would mean a lot — and I’d love to hear your thoughts in the comments! Are you watching the same zone, or do you see something different?

Bitcoin - Will the liquidity at $122K be the next target?Bitcoin is currently trading within a defined corrective channel, which has been developing over the past few weeks. Price action within this structure has been characterized by a sequence of lower highs and lower lows, suggesting a mild downtrend. However, these movements lack strong momentum, indicating that the market is consolidating rather than entering a deeper correction. This kind of structure often precedes a significant breakout, and given the nature of the current price action, a retest of previous highs remains a realistic possibility.

Bullish Scenario

Looking at the overall structure of the channel, a bullish breakout seems increasingly likely. For this scenario to unfold, BTC needs to hold the midline of the channel as support. If this level is respected, it could pave the way for a push towards the upper boundary of the channel and a potential break above the lower high structure near $120,000. A successful breach of that level could trigger a move toward the $122,000 liquidity zone, with the potential to challenge the all-time high (ATH) in the near future. Holding the midline and breaking above key resistance would provide confirmation of strength and continuation to the upside.

Bearish Scenario

On the flip side, if BTC fails to hold the midline as support and starts closing below it on the 4H timeframe, we could see a renewed move toward the lower boundary of the corrective channel. This could lead to a test of the unfilled 4H fair value gap (FVG) highlighted in the chart, located around the $112,000 – $113,000 area. This zone also coincides with a strong historical support level, making it a logical area where buyers might step in and provide the momentum needed for a more sustainable bullish reversal.

Final Thoughts

While both scenarios remain valid, the price structure within the corrective channel currently leans slightly more toward a bullish outcome. The lack of aggressive selling and the potential for liquidity above the previous highs support this view. However, trading is never about certainty but about preparing for various possibilities. Being aware of both bullish and bearish setups allows traders to react with flexibility and discipline depending on how the market unfolds in the coming sessions.

-------------------------

Thanks for your support. If you enjoyed this analysis, make sure to follow me so you don't miss the next one. And if you found it helpful, feel free to drop a like 👍 and leave a comment 💬, I’d love to hear your thoughts!

Bitcoin Correction Maturing – Long Setup Brewing!Bitcoin ( BINANCE:BTCUSDT ) has fallen by more than -4% over the past day.

Let's take a look at the reasons for the decline.

One of the key reasons behind Bitcoin’s decline in the past 24 hours ( July 25 ) could be the reduced likelihood of Jerome Powell being replaced as Chair of the Federal Reserve.

In recent days, market participants were speculating that Donald Trump might replace Powell — a scenario that was considered bullish for risk assets like Bitcoin. However, recent reports of a meeting between Trump and Powell, and signs that Powell might not be dismissed, have weakened this fundamental narrative.

This meeting may signal a truce or reduced tension between Trump’s team and Powell , which could imply a continuation of current Fed policies. That’s bad news for Bitcoin, as it removes a potential psychological tailwind from the market and dampens speculative sentiment.

As a result:

Over $500 million in liquidations(Long Positions) occurred

Weak inflows into Bitcoin ETFs

A stronger U.S. Dollar Index ( TVC:DXY )

And declining Gold( OANDA:XAUUSD ) prices over the past two days

all added additional selling pressure on BTC. Now let's take a look at Bitcoin's conditions on the 4-hour time frame .

Bitcoin currently appears to have broken the Support zone($116,900-$115,730) , Support lines , 100_SMA(4-hour TF) , and the lower line of the Symmetrical Triangle Pattern with a bearish Marubozu candle .

Note : In general, trading was difficult when Bitcoin was inside a symmetrical triangle (about 10 days).

It also seems that the pullback to these zones has ended and Bitcoin is waiting for the next decline .

In terms of Elliott Wave theory , Bitcoin appears to be completing microwave 5 of microwave C of major wave 4 . There is a possibility that main wave 4 will create a descending channel and complete at the bottom of the descending channel (at Potential Reversal Zone(PRZ) ).

I expect Bitcoin to start rising again after completing the CME Gap($115,060-$114,947) from Cumulative Long Liquidation Leverage($114,480-$114,000) or Cumulative Long Liquidation Leverage($113,284-$112,603) near the PRZ and Heavy Support zone($111,980-$105,820) .

Cumulative Short Liquidation Leverage: $117,904-$116,665

Cumulative Short Liquidation Leverage: $121,046-$119,761

Do you think Bitcoin has entered a major correction, or does it still have a chance to create a new ATH?

Please respect each other's ideas and express them politely if you agree or disagree.

Bitcoin Analyze (BTCUSDT), 4-hour time frame.

Be sure to follow the updated ideas.

Do not forget to put a Stop loss for your positions (For every position you want to open).

Please follow your strategy and updates; this is just my Idea, and I will gladly see your ideas in this post.

Please do not forget the ✅' like '✅ button 🙏😊 & Share it with your friends; thanks, and Trade safe.

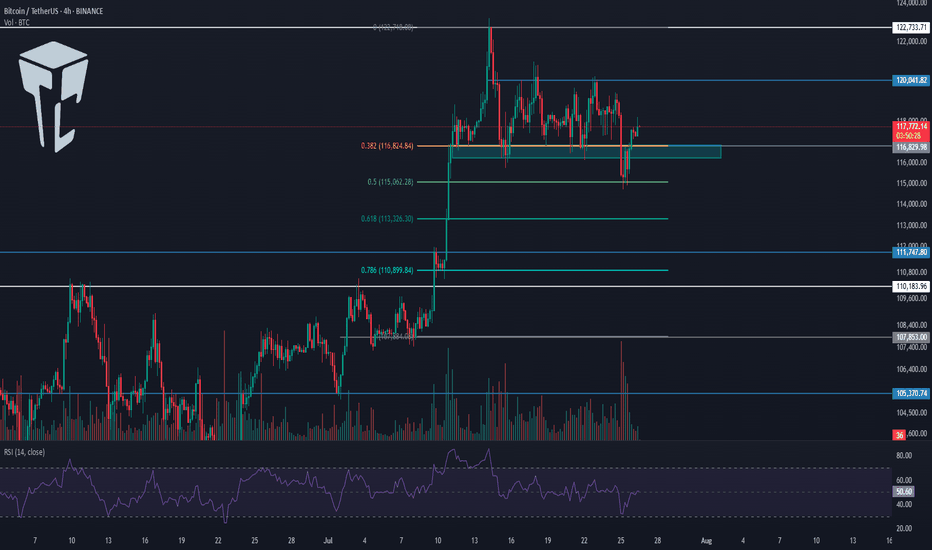

TradeCityPro | Bitcoin Daily Analysis #137👋 Welcome to TradeCity Pro!

Let’s go over the Bitcoin analysis. I’m making a change to how I analyze Bitcoin — I will no longer include indicators like dominance charts.

🔍 From now on, I’ll be analyzing Bitcoin in daily, 4-hour, and 1-hour timeframes only.

📅 Daily Timeframe

On the daily timeframe, Bitcoin is in a strong uptrend that started from the 78,397 level and in two bullish legs has reached the 122,733 zone.

✅ This level, along with the 0.618 Fibonacci Extension, has created a strong resistance zone. Although price has attempted multiple times to break into or above this area, it has not yet succeeded in closing a candle above or inside the range.

🎲 We also have a curved trendline from higher timeframes, which the price is reacting to even on the daily chart. Currently, the price is near this trendline. There is a possibility that price consolidates over time until it reaches this trendline and then begins its next bullish leg.

📊 If that happens, breaking 122,733 or 120,140 would be triggers for opening a long position on the daily timeframe.

I do not recommend buying Bitcoin on spot right now, because I believe we’re close to the top of this bullish cycle, and this current leg might be the last one.

⭐ A breakout of 76.50 on the RSI would be a strong confirmation of bullish momentum, and would mark the continuation of the uptrend.

🔑 If we get a pullback, the price could correct to dynamic zones like SMA25 or SMA99. Important static support levels are at 110,183 and 100,763.

⏳ 4-Hour Timeframe

In the 4-hour chart, we can see more details of the bullish leg. After the sharp move to 122,733, a correction phase began, forming a range box.

💥 The bottom of the box is around 116,829, which I’ve marked as a zone. It also overlaps with the 0.382 Fibonacci, making it a very important PRZ (Potential Reversal Zone).

The top of the range is at 120,041.

🧩 Yesterday, price made a fakeout to the downside. As you can see, it dumped hard with heavy selling volume and hit the 0.5 Fibonacci level, but couldn’t hold there and quickly bounced back above 116,829.

🧲 Today, I think it's better not to go below the 4-hour timeframe and avoid getting caught up in small market noise.

A break above 120,041 can trigger a long entry.

Another breakdown from the box might trigger a deeper correction.

❌ Disclaimer ❌

Trading futures is highly risky and dangerous. If you're not an expert, these triggers may not be suitable for you. You should first learn risk and capital management. You can also use the educational content from this channel.

Finally, these triggers reflect my personal opinions on price action, and the market may move completely against this analysis. So, do your own research before opening any position.

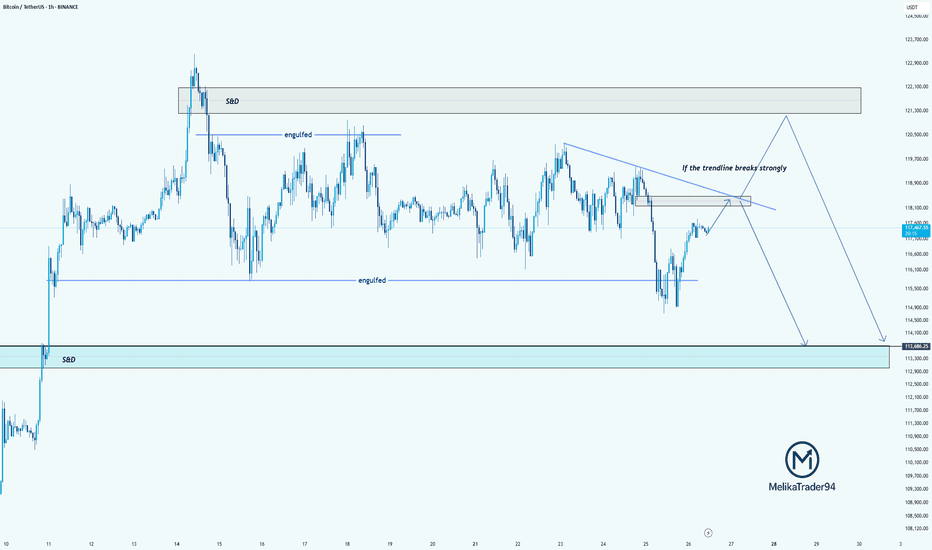

TC Analysis – Watching That Trendline Closely!Hello guys!

Bitcoin is currently approaching a key decision point. As highlighted on the chart, we’ve got a descending trendline acting as strong resistance. If this trendline breaks with strength, we may see price push up into the supply & demand zone around 121,000–122,000 before potentially reversing.

However, if the trendline holds, this current move could be a retest, setting up for another drop. The engulfed level at 114,000 has already been tested once, and if we break below that again, the price could slide down into the S&D demand zone around 113,000–112,000.

summry:

Trendline resistance is critical right now

Watch for a strong breakout or a fakeout & rejection

Possible bearish continuation if we fail to reclaim above 118,500

Let’s see how BTC reacts around this zone.

#BTCUSDT: Minor Correction In Price Then $150,000?Hi everyone,

Hope you are doing great we are witnessing some minor bearish correction in the price and think this might be a sellers trap. We think $110,000 can be a good area to buy. Our target is at $150,000 area which look possible after looking at how price recently behaved.

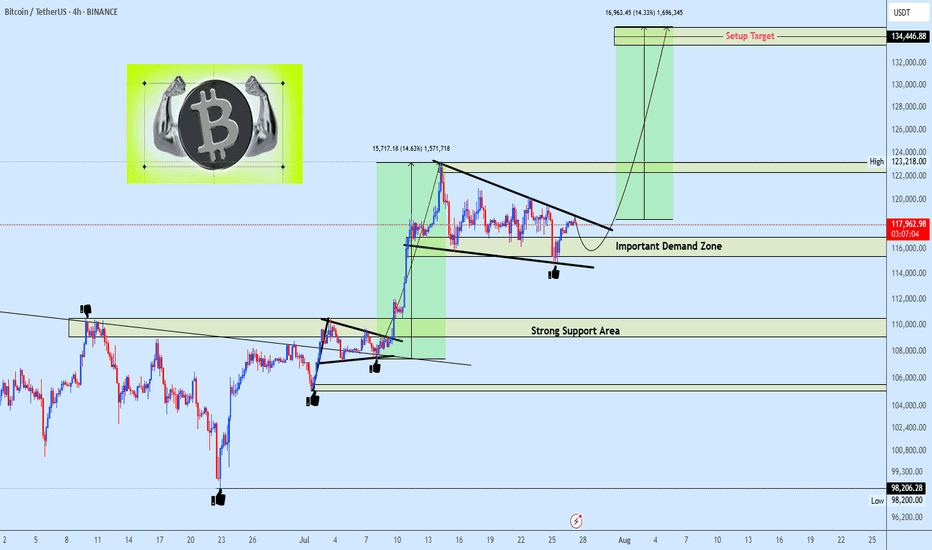

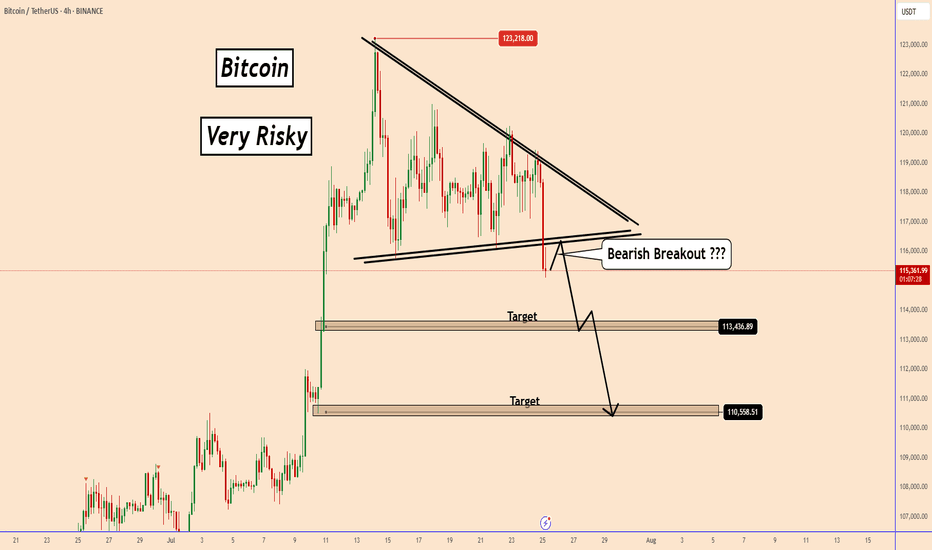

Bitcoin Next Leg Incoming? Targets $134K from Bullish WedgeBTCUSDT is consolidating within a descending wedge right above a critical demand zone, following a impulsive breakout from its prior range structure. This current setup suggests another potential bullish continuation, especially as price continues to respect both the wedge support and internal demand.

With the higher timeframe structure favoring bulls and previous demand zones holding firm, the projected breakout targets align with $123,218 and $134,446 respectively.

A clean invalidation would only be confirmed on a sustained break below the wedge and loss of the strong support area near $110K.

All eyes on the wedge apex as BTC prepares for its next major leg.

BTCUSDTHello Traders! 👋

What are your thoughts on BITCOIN?

After setting a new all-time high, Bitcoin remains in a corrective phase, marked by sideways price action and choppy movements.

There's a notable gap around the $114,000 level, which may act as a magnet for price during this correction.

The ongoing pullback is likely to extend toward the key support zone, which aligns with the previous breakout level and the bottom of the ascending channel.

Once this support holds, we could see a bullish reversal, targeting the upper boundary of the channel once again.

As long as Bitcoin remains above the marked support zone, the overall structure stays bullish and this correction may present a buy-the-dip opportunity.

Will Bitcoin fill the gap and bounce back toward new highs? Let us know your thoughts! 🤔👇

Don’t forget to like and share your thoughts in the comments! ❤️

White House Crypto Report Incoming: Will BTC Pump from Support? One of the important news for Bitcoin ( BINANCE:BTCUSDT ) that was released today was that " White House confirms first Bitcoin and crypto report will be released TOMORROW ". Bitcoin is likely to rise with the release of the White House report .

What do you think? At least a temporary pump may be in store for Bitcoin.

Bitcoin fell to the Support zone($116,900-$115,730) and filled the New CME Gap( $119,500-$118,295) as I expected in the previous idea .

Bitcoin is currently moving near the Support zone($116,900-$115,730) , Cumulative Long Liquidation Leverage($116,828-$115,710) and Potential Reversal Zone(PRZ) .

I expect Bitcoin to rise from the Support zone($116,900-$115,730) to at least $118,680(First Taregt) .

Second target: Upper line of the descending channel

Note: Stop Loss: $114,680 = Worst Stop Loss(SL)

CME Gap: $115,060-$114,947

Cumulative Short Liquidation Leverage: $118,827-$118,298

Cumulative Short Liquidation Leverage: $120,144-$119,200

Please respect each other's ideas and express them politely if you agree or disagree.

Bitcoin Analyze (BTCUSDT), 1-hour time frame.

Be sure to follow the updated ideas.

Do not forget to put a Stop loss for your positions (For every position you want to open).

Please follow your strategy and updates; this is just my Idea, and I will gladly see your ideas in this post.

Please do not forget the ✅' like '✅ button 🙏😊 & Share it with your friends; thanks, and Trade safe.

BTC Unfolds in Complex Way After Hitting 123KBTC Unfolds in Complex Way After Hitting 123K

Bitcoin recently reached a historic all-time high near 123,200, marking a strong bullish run. Over the past two weeks, BTC has been consolidating, showing signs of a potential upward movement.

However, today's price action disrupted that bullish setup and introduced bearish momentum.

At this moment, two scenarios are possible:

1️⃣ Continued Bullish Momentum: The prevailing trend remains strongly bullish. Selling BTC now is risky, as there's a high chance it could resume its aggressive rise again.

False Bearish Breakout: The recent bearish signal may be misleading. BTC may be forming a broader accumulation structure, paving the way for another upward move.

2️⃣ Profit-Taking Phase: This bearish shift might be valid, suggesting that Bitcoin is entering a profit-taking cycle after an extended rally. If this scenario unfolds, a deeper correction may follow, aligning with the current technical pattern.

You may find more details in the chart!

Thank you and Good Luck!

PS: Please support with a like or comment if you find this analysis useful for your trading day

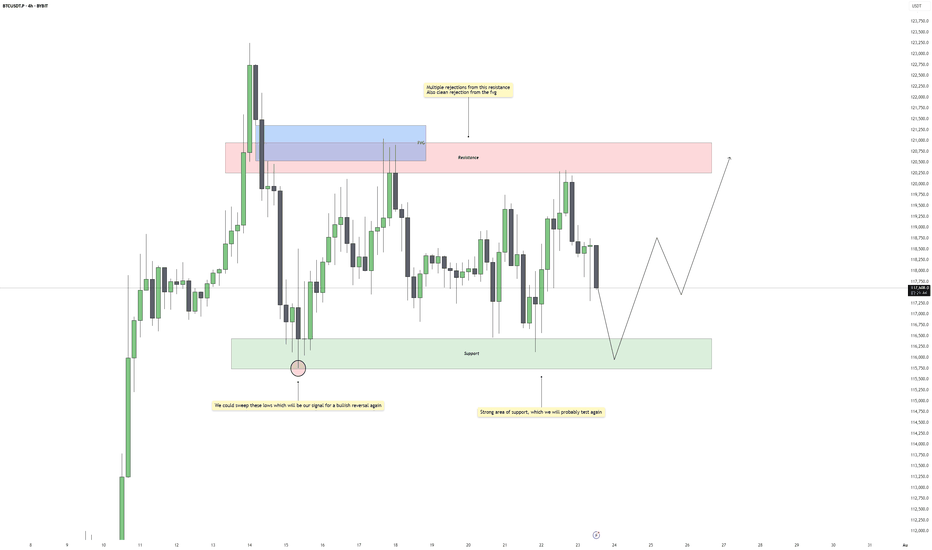

Bitcoin - Bullish Reversal PotentialBitcoin is currently consolidating within a well-defined range, with repeated rejections from the upper resistance zone and strong reactions from the support below. Price continues to respect both ends of the structure, suggesting that liquidity is being built up on both sides. Until a clear breakout occurs, we should expect more range-bound movement with sharp rejections near the boundaries.

Support Zone and Liquidity Engineering

The support zone beneath current price action has already held several times, showing clear buying interest. However, the lows around this area remain relatively clean. A sweep of those lows would not only engineer sell-side liquidity but also set the stage for a reversal if buyers step back in. This would align well with typical accumulation behavior seen during consolidation phases.

Rejections from Resistance and FVG Influence

Price has shown multiple rejections from the resistance zone, particularly inside the fair value gap that sits just above it. This confirms that the area is actively defended and will likely be the next upside target if price manages to bounce from support. The FVG itself acts as a magnet once price begins to trend again, especially if a strong displacement follows a sweep.

Expected Flow and Trade Opportunity

The anticipated scenario involves price dipping back into support, possibly sweeping the lows for inducement, and then bouncing with a shift in short-term structure. If that happens, we can expect a move back toward resistance, completing another rotation within the range. The sweep would offer an added layer of confirmation, giving a stronger reason to look for long setups.

Invalidation and Risk Perspective

If support fails to hold and price breaks beneath the range without immediate recovery, that would invalidate the bullish view and point to a potential shift in directional bias. As long as price stays inside the current consolidation, however, this remains a waiting game for either a clean reaction from support or a sweep followed by structure shift.

Conclusion

Bitcoin remains locked in a clear range, and until the breakout happens, the edges of that range offer the best trading opportunities. A sweep of the lows would act as a high-probability signal for a reversal back to the highs. Patience is key, wait for the sweep and confirmation before committing to the upside.

___________________________________

Thanks for your support!

If you found this idea helpful or learned something new, drop a like 👍 and leave a comment, I’d love to hear your thoughts! 🚀

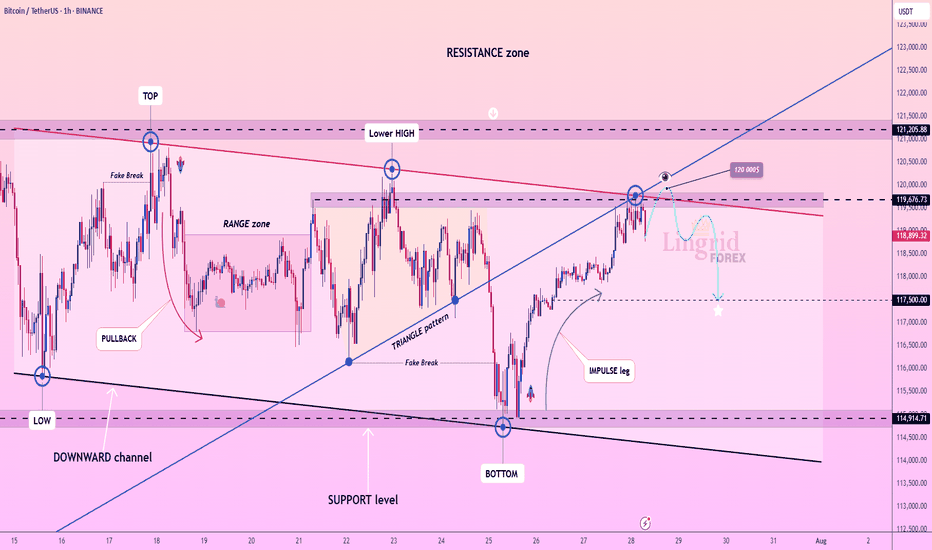

Lingrid | BTCUSDT Range-Bound Market: Short-Term Bearish MoveBINANCE:BTCUSDT has failed to break through the descending resistance near 120,000 and is now forming a lower high within the broader resistance zone. The price action follows an impulsive leg up and is currently tracing a potential reversal pattern under key structural resistance. As long as the market remains capped below 120,000, continuation toward 117,500 is likely. The downward bias is supported by weakening momentum after the bull trap and resistance rejection.

📉 Key Levels

Sell trigger: Breakdown below 119,000

Sell zone: 119,400 – 120,000

Target: 117,500

Invalidation: Break and close above 120,500

💡 Risks

Sudden bounce from the 119,000 handle could trap late sellers

Breakout above 120,000 would shift structure to bullish

Support near 117,500 may slow or reverse bearish pressure

If this idea resonates with you or you have your own opinion, traders, hit the comments. I’m excited to read your thoughts!

Bullish Channel Intact: BTC Poised for Next Leg Toward 152KBitcoin continues to coil within a bullish consolidation zone above the critical $114.5k–$117.5k Immediate Demand Zone, firmly riding the ascending channel structure that has guided price since the March swing low. The prior wave structure confirms a clean ABC correction, followed by a powerful breakout and a structured range indicative of accumulation, not exhaustion.

The RSI shows persistent bullish divergence, confirming hidden strength, with multiple support bounces confirming demand. The current tight consolidation above former resistance now flipped demand presents a launchpad scenario for a breakout towards major projected upside targets.

Targets to Watch:

🟢 $123,053 – Range breakout threshold, aligns with channel midline and prior local high.

🟢 $134,428 – Measured move from current range and top channel boundary intersection.

🟢 $152,174 – Final leg projection based on macro channel trajectory and bullish wave extension potential.

On the downside, failure to hold $114.5k opens the door to a test of the $105k Strong Support Zone, which aligns with prior structural demand and broader trendline confluence.

💬 Drop your favorite altcoins in the comments for quick analysis , let's catch the next movers before they fly!