BTCDOWNUSDT trade ideas

[SeoVereign] BITCOIN BULLISH Outlook – July 24, 2025We are the SeoVereign Trading Team.

With sharp insight and precise analysis, we regularly share trading ideas on Bitcoin and other major assets—always guided by structure, sentiment, and momentum.

🔔 Follow us to never miss a market update.

🚀 Boosts provide strong motivation and drive to the SeoVereign team.

--------------------------------------------------------------------------------------------------------

Hello.

This is SeoVereign.

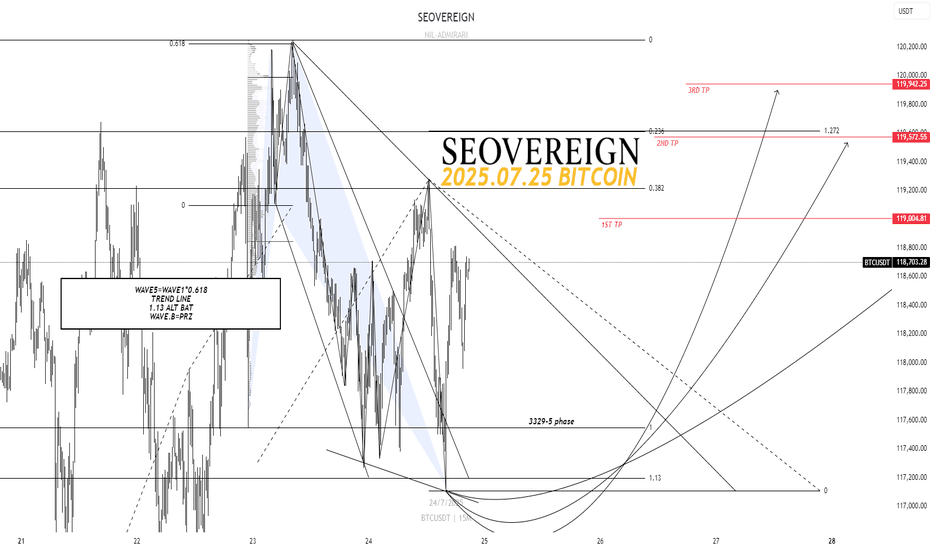

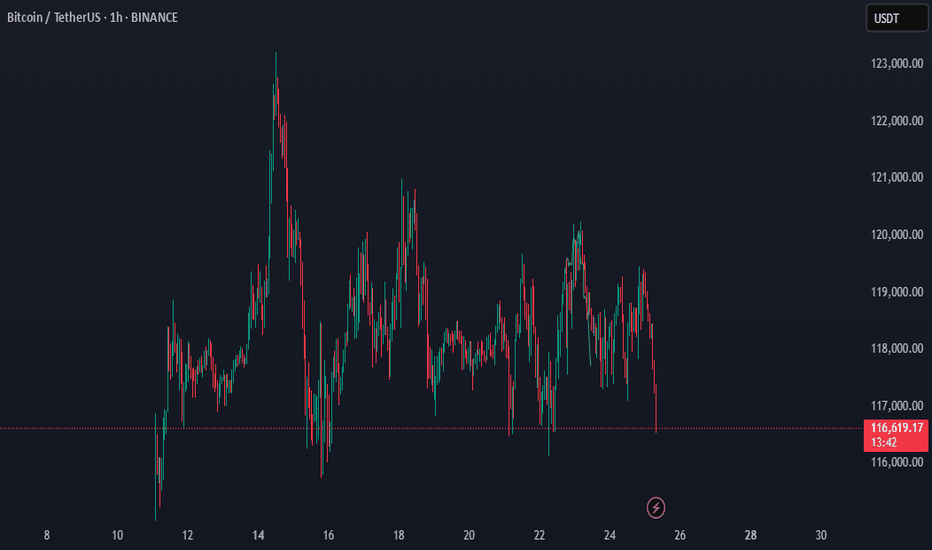

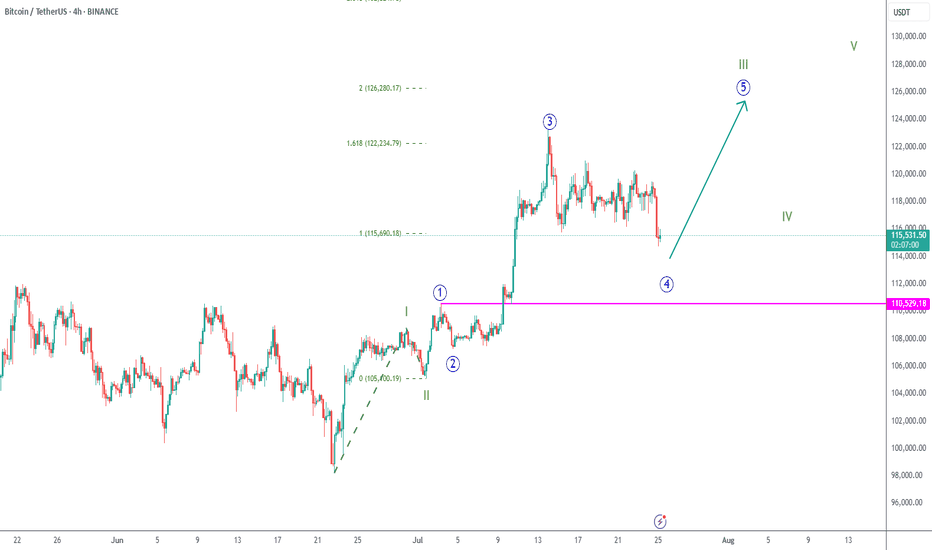

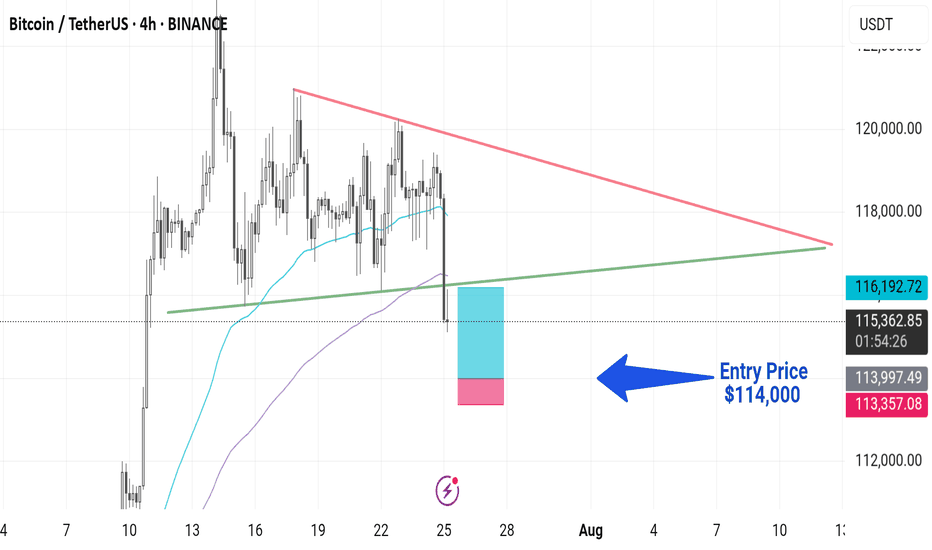

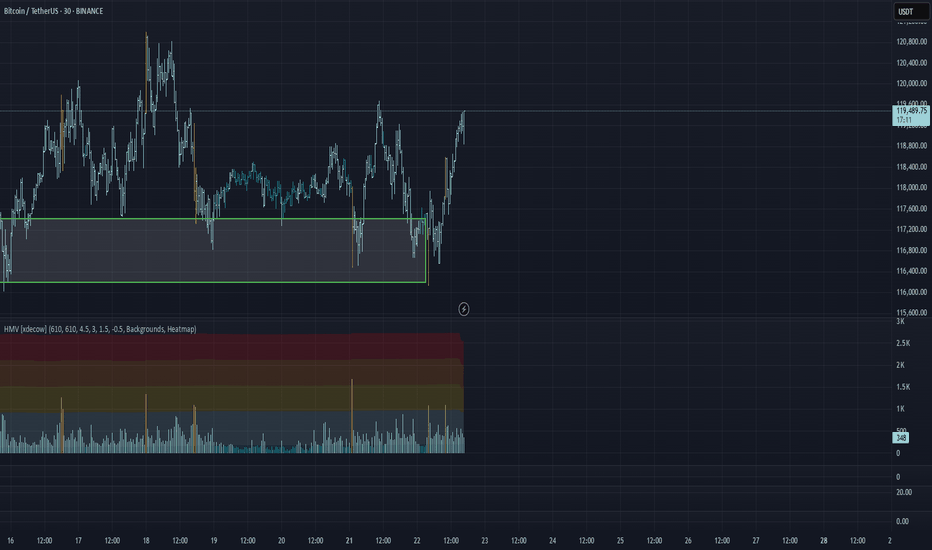

I am still holding the long position that I suggested in the idea posted on July 9th.

Regarding the upward trend that started around 107,200 USDT, I have consistently maintained my position without much doubt until just before posting this idea, as there were no clear signs indicating a decline.

However, at the time of writing this idea, some elements suggesting downward pressure are gradually being detected. Nevertheless, this idea is constructed around the upward scenario. The reason is that, as mentioned in this idea, a ‘single upward move’ is expected to occur with relatively high probability. Whether this rise leads to a trend reversal or serves as a precursor to a downturn will likely depend on how the chart unfolds.

The average TP (target price) is set around 119,300 USDT.

As always, I will carefully observe how the chart develops over time and will update with further explanations that organically integrate the detailed interpretations and grounds of this idea accordingly.

Thank you.

Bitcoin is OverheatedI’m observing the current situation in the BTC market and want to share a brief reflection. The latest upward impulse doesn’t just look confident—it’s starting to resemble overheating.

The price has detached from its averages, and the movement is accompanied by local euphoria. I see the community piling in “at the highs,” hoping for continuation. But it’s crucial to understand: markets don’t grow forever. Especially when the growth lacks proportional volume and fundamental support.

I use a comprehensive technical approach, and one of my indicators has given a clear signal—the market is overheated. We’re currently seeing a classic state of overbought conditions: the price is moving too far, too fast.

This doesn’t mean you should immediately short or panic. But as a trader, I understand that in such a phase, it’s wiser to:

– Partially take profits,

– Move stops closer to the market,

– And absolutely avoid entering new longs on emotions.

Typically, after such surges, the market either consolidates or corrects by 10–20% to shake off the overheating and provide an opportunity to enter at fairer levels. Personally, I’m waiting for a return to balance and a reset. I don’t rule out a final “explosive” move upward on news, but such breakouts usually end as quickly as they begin.

HIGH POWERED SHORT ZONE 2.0HIGH POWERED SHORT ZONE ⚡️

Usually, a 3% move doesn’t make anyone blink—but this one? It sent BTC into all-time high territory. I almost popped the champagne… until I remembered I’m in a short.

Not because I don’t believe in upside—but because my add zone in the HIGH POWERED SHORT ZONE hasn’t been tagged. Yet.

Here’s the breakdown 🧵👇

________________________________________

Before anyone goes bUCK wilD and cracks open that dusty bottle of Veuve, double-check something:

📅 The July 10th daily candle needs to close above the monthly swing high (orange line).

If BTC bulls lock that in, then a move deeper into the HIGH POWERED SHORT ZONE becomes real...

play-the-game real…

________________________________________

Where’s this HIGH POWERED SHORT ZONE coming from?

🔻 Solid red line – a trendline from Dec 2024 that has held strong through three separate tests — marking it as a key line on the sand.

🔻 Dashed red line – goes all the way back to Dec 2017. A seasoned veteran of resistance.

I also drew in a white ascending channel—not just for looks. If BTC breaks out, this channel will help us ask:

“How high is too high?”

________________________________________

Now enters Fibonacci — where nature maps out key alignments on the chart. 🌱

🟡 Gold lines = Fib golden ratios

🔵 Teal lines = Fib Degen Ratios

It’s wild how they just line up:

• 2.618? Right on the top of the channel.

• 1.618? Sitting on the 2017 trendline.

• 0.618? Near current support + bottom of the channel.

Also had to draw that horizontal support white line to keep an eye on.

A Bounce or bust? Ask the bUCKmOON!

A bearish 12 Month candle could be in the cardsBitcoin made an yearly high of 20% after 6 months in on the yearly candle

This does not make me feel great about the rest of the year

a clear sell signal would be an higher timeframe close under 100k after an upthrust to new ath around 110k - 120k

around 50k-54k for me is an good buy level to build an longterm position:

0.382 fib retracement for an primary 1-2 wave

0.500 fib retracement from the 25k low

0.886 fib retracement from 49k low

50% pullback from current high to projected low

where will bitcoin go ? i don't know, but i do know where i want to buy and when i want to sell

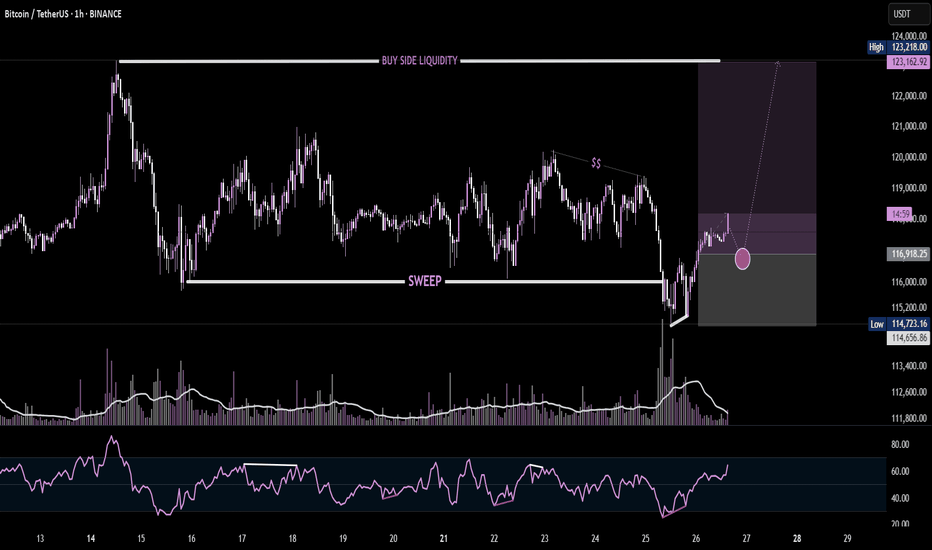

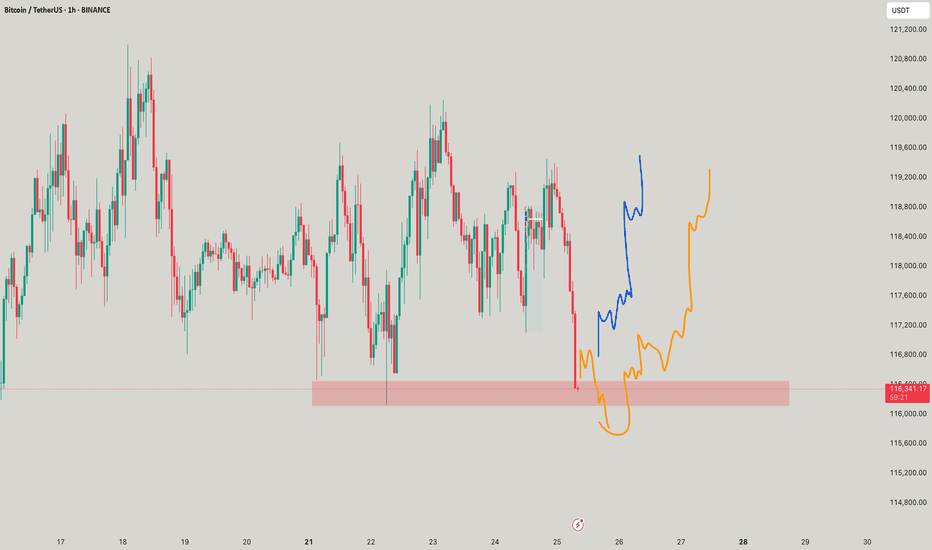

BTC Liquidity Grab + BounceBitcoin just completed a liquidity sweep below the recent low, grabbing stop-losses before reversing sharply. This move often signals smart money accumulation, as shown by the strong bullish reaction off the demand zone. Aiming for the Buy-Side Liquidity (BSL) above $123K. Volume spike and RSI divergence further validate the bullish narrative.

BITCOIN Indicates Consolidating Moves Before StronBitcoin (BTC) Market Analysis Report

Summary and Conclusion

Bitcoin (BTC) is currently trading around $117,000 to $118,000, showing a slight pullback from its recent all-time high near $123,000. The market sentiment is moderately bullish but cautious, with technical indicators signaling some overbought conditions and short-term consolidation. Institutional interest appears to be cooling off slightly, as evidenced by recent outflows from Bitcoin ETFs, while accumulation continues across various investor tiers, including whales and retail holders.

Key resistance is near $119,400-$120,000, and support lies around $117,200-$116,900. The market is in a "perfect accumulation" phase, with strong buying support despite some profit-taking. The Fear & Greed Index is at 70, indicating greed but not extreme euphoria.

Recent news highlights a mixed picture: Bitcoin remains dominant and stable, but altcoins are gaining some momentum. Institutional flows are shifting somewhat from Bitcoin to Ethereum and other altcoins. Experts predict potential for Bitcoin to reach $200,000 to $250,000 later this year, driven by macroeconomic factors like credit expansion and fiat inflation.

Detailed Analysis

1. Price and Market Data

Market Type Last Price (USD) 24h Change 24h High 24h Low 24h Volume (USD) Funding Rate (Contract)

Spot 116,959.8 -1.65% 119,498.4 116,946.6 1.43B N/A

Contract 116,962.7 -1.65% 119,492.9 116,935.5 8.91B 0.0001

Bitcoin is consolidating below $120,000 after reaching a peak of $123,218 on July 14.

Trading volume remains robust, indicating active market participation.

2. Technical Indicators

Bullish Signals: No strong bullish technical indicators currently detected.

Bearish Signals: RSI indicates overbought conditions, suggesting short-term caution.

Support and Resistance:

Resistance: ~$119,416.6

Support: ~$117,227.4

MACD and other momentum indicators show indecisiveness, implying possible sideways movement or minor corrections before the next major move.

3. Market Sentiment

Fear & Greed Index: 70 (Greed)

Investor sentiment is bullish but tempered by profit-taking and cautious positioning.

ETF flows show a recent reversal with $68 million outflows from Bitcoin ETFs, ending a 13-day inflow streak.

Ethereum and altcoins are attracting more inflows, signaling a rotation in institutional interest.

4. Recent News Highlights

Bitcoin remains dominant but has been mostly stagnant below $120K, while altcoins struggle for momentum.

Institutional investors are shifting some capital from Bitcoin to Ethereum and other altcoins.

Bitcoin is in a "perfect accumulation" phase, with all investor tiers building positions despite some whale transfers.

Experts like Arthur Hayes predict Bitcoin could reach $250,000 by year-end, driven by credit expansion and macroeconomic factors.

Network activity shows a slight dip in active addresses, indicating a short-term pause.

Support levels around $116,952 and $114,354 are critical to watch for downside risk.

Bitcoin's dominance remains strong at around 61%.

5. Outlook

Short-term: Bitcoin may continue to consolidate between $117,000 and $120,000, with potential minor pullbacks due to overbought RSI.

Medium to Long-term: Positive macro factors and accumulation trends suggest potential for new highs, possibly targeting $150,000 to $250,000.

Watch for a breakout above $120,000 to confirm bullish momentum continuation.

Monitor ETF flows and on-chain activity for signs of renewed institutional interest or caution.

Recommendations for Traders and Investors

Traders: Consider cautious trading around current levels, watching for RSI and MACD signals for entry/exit points. Be mindful of resistance near $120,000.

Investors: Accumulation phase suggests good opportunities for long-term holding, especially if Bitcoin holds above $117,000.

Risk Management: Keep stop-loss orders near support levels to mitigate downside risk in case of a correction.

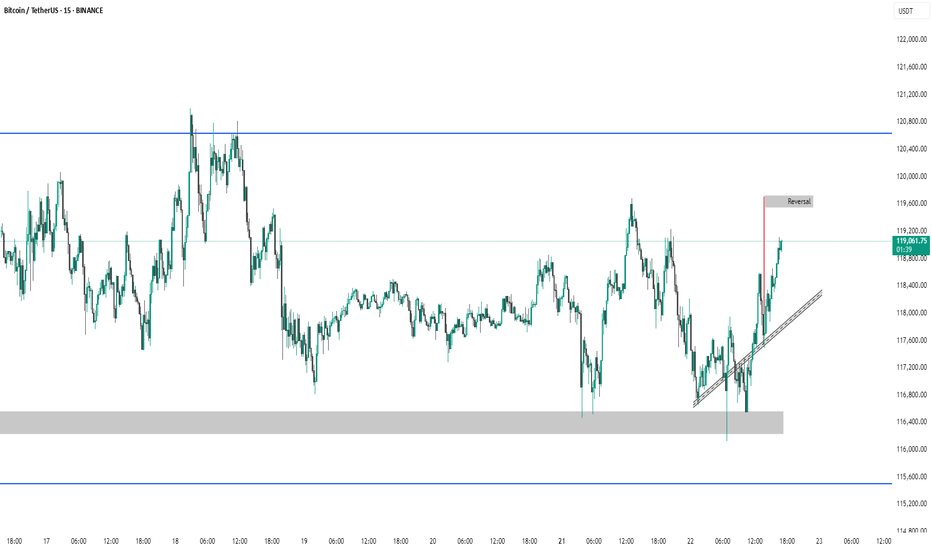

BTC #Bitcoin 15-minute BTC/USDT chart (Updated ChartThis 15-minute BTC/USDT chart (Binance) shows Bitcoin rebounding from a demand zone near 116,000–116,750 USDT and forming higher lows along a short-term ascending trendline. Price is currently around 118,446 USDT, aiming toward a marked supply zone near 119,500 USDT, suggesting a potential short-term bullish move. A rejection at this supply zone could signal a pullback, while a breakout may indicate continued upward momentum. Key support and resistance zones are clearly defined.

thanking you

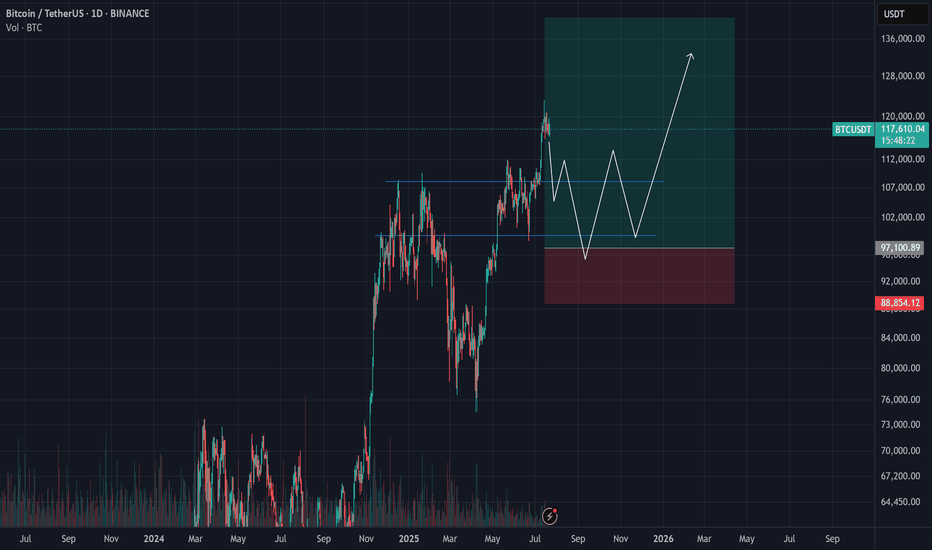

Bitcoin (BTC) Analysis – July 21, 2025We’ve previously discussed the significance of the $110,000 level — a zone where long-term holders typically take partial profits.

After multiple pullbacks from that region, a new wave of short-term investors stepped in around $97,000, managing to push the price as high as $123,000.

⚠️ I know many traders are tracking Bitcoin dominance and expecting a correction from this zone — and I partly agree.

However, issuing a sell signal here feels premature and potentially risky.

✅ Instead, I’d suggest looking for a re-entry opportunity around $95,000, where market structure and buyer activity may offer a much better risk-reward ratio.

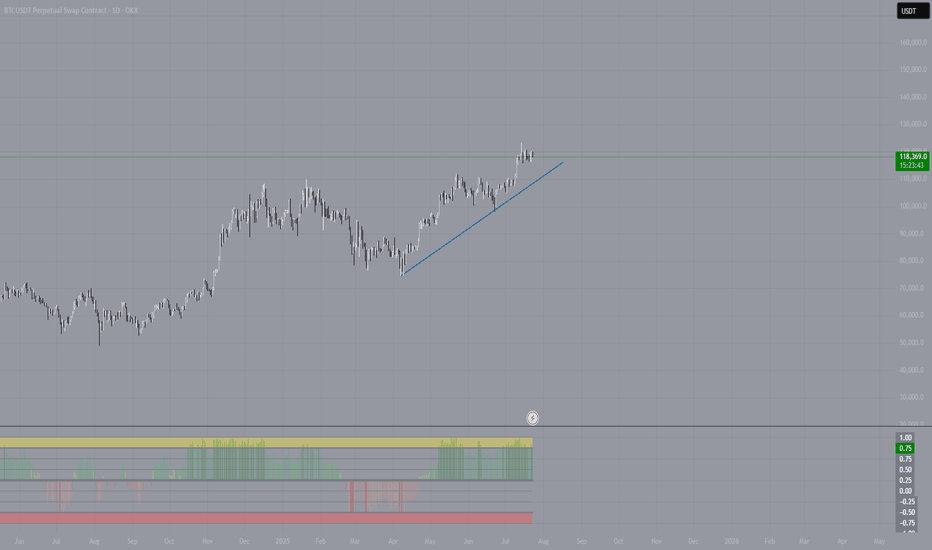

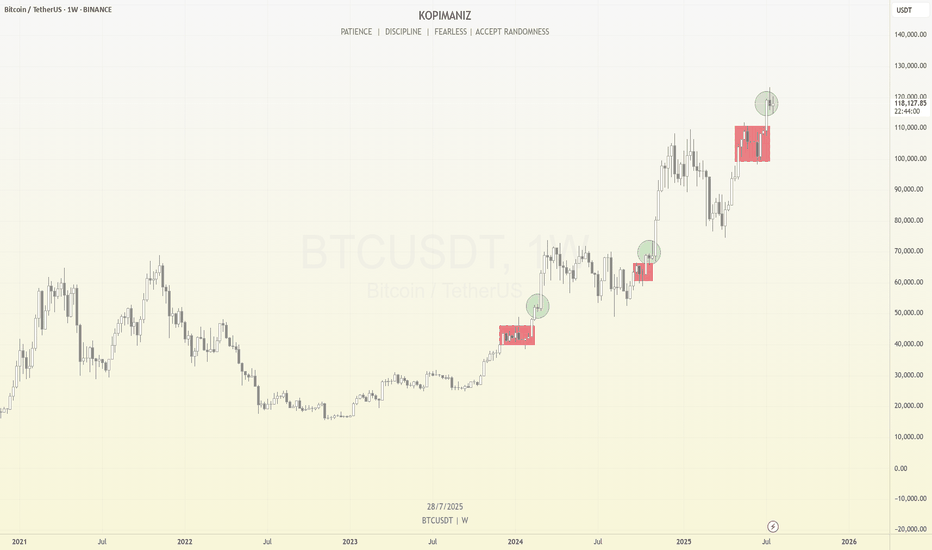

Bitcoin Weekly Structure: Repeating Rhythms and What’s Next

Bitcoin continues to follow a consistent structural rhythm on the weekly timeframe. We can observe that before every major breakout, price enters a multi-week consolidation phase, which I’ve marked using red boxes on the chart. These red box zones represent long periods of sideways movement, typically acting as reaccumulation phases. Once price breaks above these levels, it often results in a strong impulsive move, confirming that these areas serve as foundational support for trend continuation.

After each of these longer consolidations, Bitcoin tends to enter a brief 1–2 week consolidation right after the breakout, which I’ve marked with green circles. These short pauses are signs of healthy bullish momentum, often acting as flags or continuation patterns before the next leg up. What’s notable is that each of these green circle phases occurs after a clean breakout from a red box, and they consistently lead to further price appreciation.

Currently, Bitcoin has just broken out of another red box zone between ~$100k and ~$110k. Over the past two weeks, it has formed a small range near $118k, resembling the same green circle structures we’ve seen earlier in the trend. Given this recurring pattern, there’s a high probability that we are once again in the early stages of a bullish continuation. If the pattern plays out as it has in the past, the next move could be another strong weekly candle pushing toward new highs.

However, I’m paying close attention to the $125k–$126k level. This psychological zone may act as a major turning point. It could lead to either a prolonged consolidation phase that lasts for months, or potentially trigger a significant correction if the market faces strong resistance. This level marks a critical area where momentum may shift, so it deserves extra caution as we approach it.

This type of structural repetition helps me stay grounded in my analysis—focusing not just on price, but also on how long and where Bitcoin consolidates. So far, the rhythm has been clean and reliable.

Let’s see if Bitcoin respects the rhythm once again.

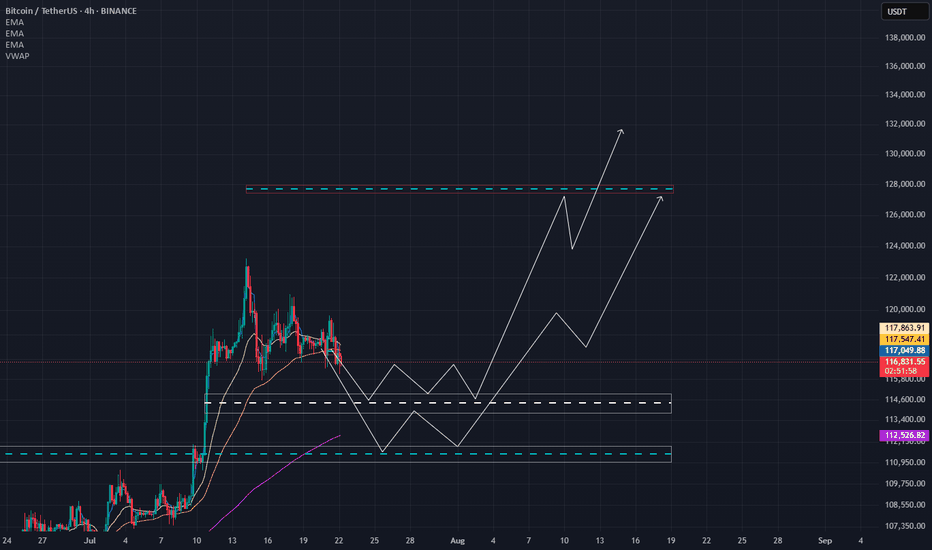

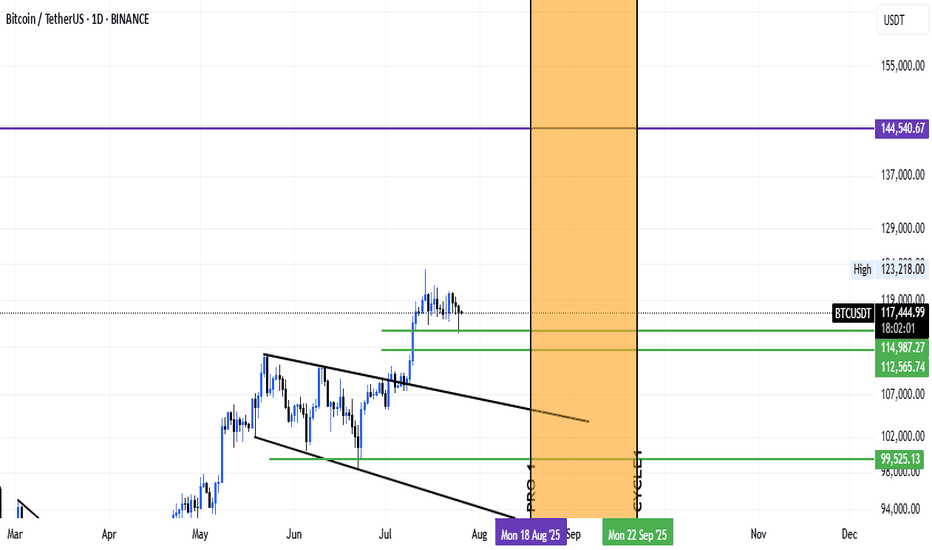

BTCUSDTAccording to previous analysis and its short-term target, Bitcoin has made a correction, and the correction areas, namely $114,000 and $112,000, were the important support areas it saw. However, considering the time, it can be said that the next Bitcoin ceiling will be reached in the period from August 18 to September 22, approximately 35 days.This is a medium-term timeframe on a weekly basis and Bitcoin is expected to reach $144,000 to $148,000 in price. Good luck and be victorious.

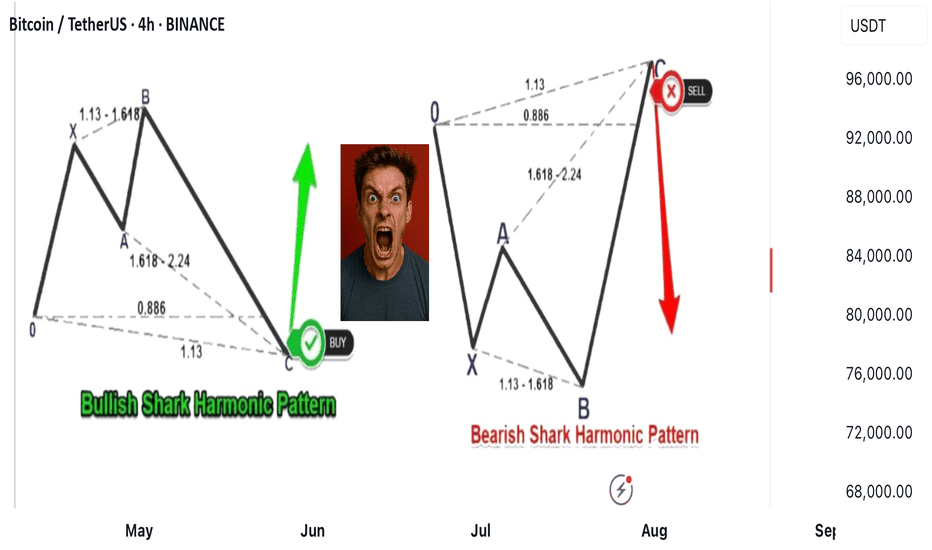

Shark harmonic pattern

---

### 🦈 What Is the Shark Harmonic Pattern?

- **Discovered by**: Scott Carney in 2011

- **Foundation**: Combines **Fibonacci ratios** with **Elliott Wave Theory**

- **Purpose**: Identifies potential **trend reversals** using precise geometric price structures

- **Structure**: Five points labeled **O, X, A, B, C** (not the usual XABCD)

- **Key Feature**: Relies heavily on the **88.6% Fibonacci retracement** and **113% extension**

---

### 📐 Pattern Geometry & Ratios

| Leg | Description | Fibonacci Ratio Range |

|------------|--------------------------------------------------|-------------------------------|

| XA | Initial impulse leg | No specific ratio |

| AB | Extension beyond X | 113% to 161.8% of XA |

| BC | Completion leg | 88.6% to 113% of OX |

| | | 161.8% to 224% of AB |

- **Point B** must **exceed point X**, forming an **Extreme Harmonic Impulse Wave**

- **Point C** is the **Potential Reversal Zone (PRZ)**

---

### 🛒 Buy Setup (Bullish Shark)

1. **No fixed retracement for A**

2. **B extends 113%–161.8% of XA**

3. **C completes at**:

- 88.6%–113% of OX

- 161.8%–224% of AB

📍 **Entry**: Near point C

📍 **Stop Loss**: Below point C

📍 **Target**: Retracement levels of BC (e.g., 50%, 61.8%), or back to point A/B

---

### 📉 Sell Setup (Bearish Shark)

1. **No fixed retracement for A**

2. **B extends 113%–161.8% of XA**

3. **C completes at**:

- 88.6%–113% of OX

- 161.8%–224% of AB

📍 **Entry**: Near point C

📍 **Stop Loss**: Above point C

📍 **Target**: Retracement levels of BC, or back to point A/B

---

### 📊 Real Trade Example & Educational Resources

In the comment

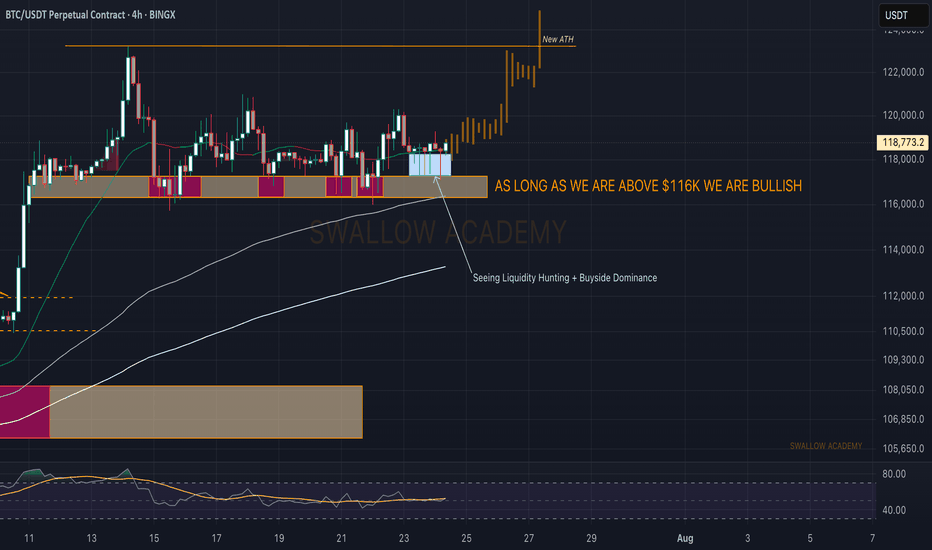

Bitcoin (BTC): Liquidity Hunting + Buyside Dominance | Bullish!What a week we have had so far; it has moved this whole week so far like one big rollercoaster, but nevertheless we are still above the $116K zone so we are bullish.

While we see slight buyside dominance,, we also see huge order limits sitting at $115K,, which means we might still see some kind of "last liquidity hunting."

That being said, we are keeping an eye on $116K and $115K zones.

Swallow Academy

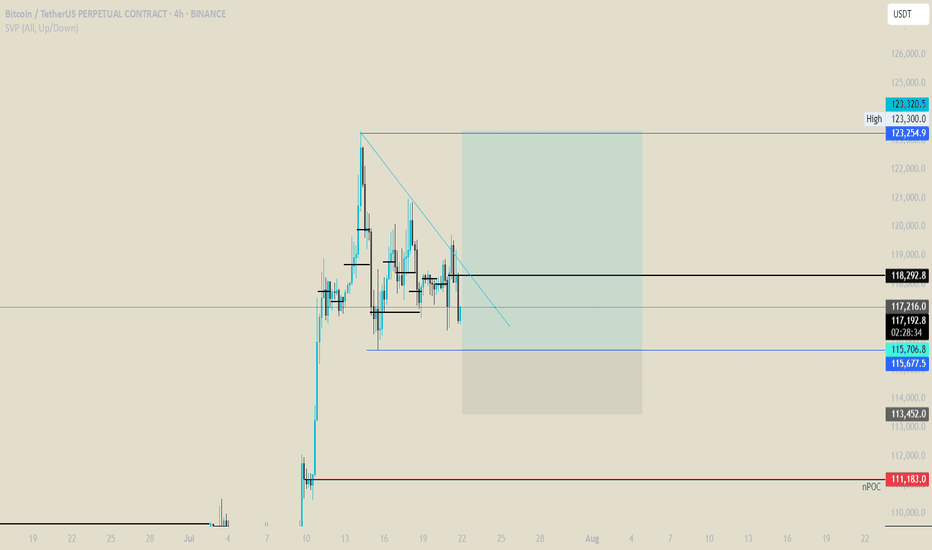

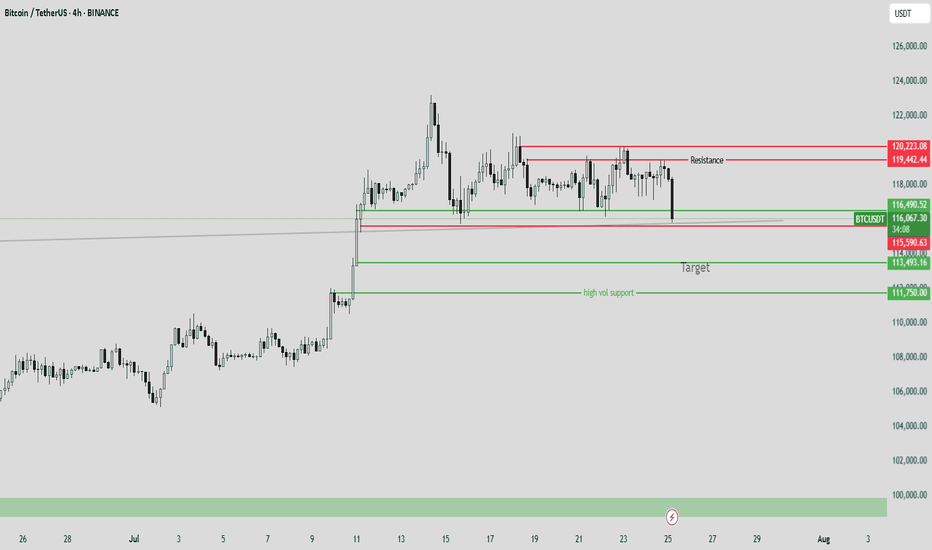

Trading plan for BitcoinLast week, Bitcoin established a new ATH at $123k before entering a corrective phase. The price action has since developed into a clear consolidation pattern and currently trades below the weekly pivot point.

Key Observations:

Proximity to last week's low increases probability of a full ABC correction targeting $113k

Break above noted resistance could invalidate bearish scenario and suggest ATH retest

Critical Levels:

Resistance: $119,500

Support: $113,000 (ABC target)

Trade the range until the market declares its next direction.

BTC/USDT Analysis: Rotation Continues

Hello everyone! This is a daily analysis from a trader-analyst at CryptoRobotics.

Yesterday, Bitcoin continued to rotate within a narrow sideways range, and so far, there has been no breakout. We retested the lower boundary of the range and once again saw absorption of market selling at that level.

At the moment, the scenario remains valid — we expect a breakout to the upside. Several factors support this outlook: strong defense at the lows, delta absorption across the entire range, and buyer control on the most recent local upward wave.

A less likely scenario is a dip into the lower buy zone, a liquidity grab, and another attempt to move higher.

Buy Zones:

~$115,000 (zone of initiating/pushing volumes)

$110,000–$107,000 (accumulated volumes)

This publication is not financial advice.

The 3-Step Rocket Booster Strategy Bitcoin Edition🚀 3 Key Features of Bitcoin

Decentralized Network – No central authority like a bank or government controls Bitcoin.

Limited Supply – Only 21 million bitcoins will ever exist, making it scarce and valuable.

Borderless Transactions – Send or receive money globally without needing permission or intermediaries.

✅ 3 Benefits of Using Bitcoin

Freedom from Inflation – Bitcoin resists inflation because of its fixed supply.

Fast & Low-Cost Transfers – Especially useful for international payments.

Financial Inclusion – You don’t need a bank to own or use Bitcoin—just a smartphone and internet.

⚠️ 3 Problems with Bitcoin

Price Volatility – The price can change rapidly in short timeframes.

Scams & Fraud – Many fake crypto projects use Bitcoin’s name to deceive people.

Technical Learning Curve – Beginners may find it hard to understand wallets, keys, and security.

🤔 3 Common Objections

“Bitcoin is too volatile—I might lose money!”

“It’s too complicated for me to use.”

“Governments will ban it eventually.”

💡 3 Ways to Overcome Objections

Use only what you can afford to lose. Start small and grow with knowledge and confidence.

Use beginner-friendly apps like Binance, Trust Wallet, or Paxful. These platforms make Bitcoin easier than ever.

Bitcoin is legal in most countries, and major companies are adopting it—its use is expanding, not shrinking.

🛒 Take Action Now!

Don’t wait for the price to explode again. Learn, test with small amounts, and start your Bitcoin journey today.

👉 Buy Bitcoin now and take control of your financial future!

🚀 The 3-Step Rocket Booster Strategy

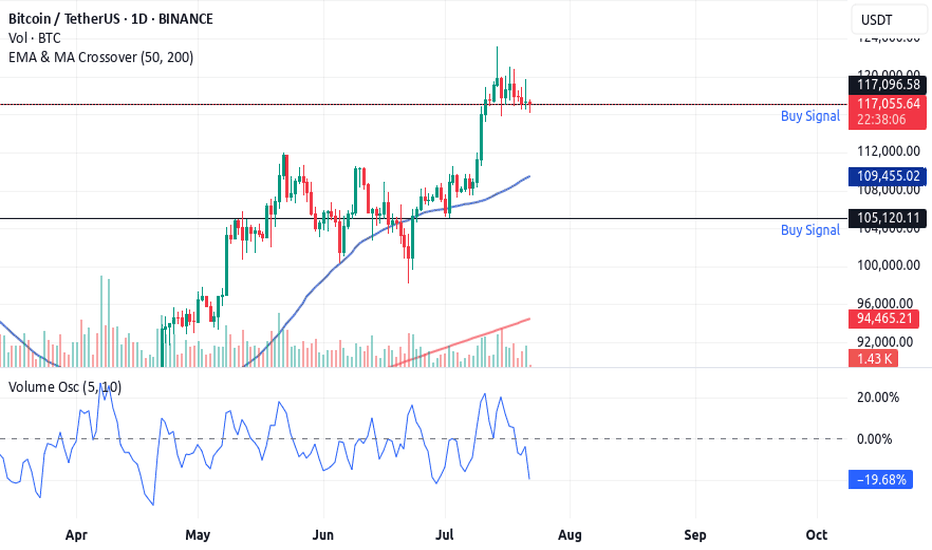

🔍 Step 1: Price Above the 50 EMA

What it means: The price is trending upward in the short-to-medium term.

Why it matters: This shows strength and upward momentum—price is above its recent average.

🔍 Step 2: Price Above the 200 EMA

What it means: The long-term trend is also bullish.

Why it matters: This confirms that the overall market direction is up, reducing the risk of fakeouts.

🔍 Step 3: Volume Oscillator Surge (Volume "Booster")

What it means: There is a spike in volume (measured using a volume oscillator).

Why it matters: Volume confirms that big players are involved. Price moves backed by high volume are more reliable and likely to continue.

✅ Optional Extra Filter: Check if the price has gapped up or if there's a bullish candlestick pattern (e.g. Marubozu, Engulfing, Morning Star) to increase confidence.

Rocket boost this content to learn more.

Disclaimer:Trading is risky please use a simulation trading account before you trade with real money.Also learn risk management and profit taking strategies.