BTCDOWNUSDT trade ideas

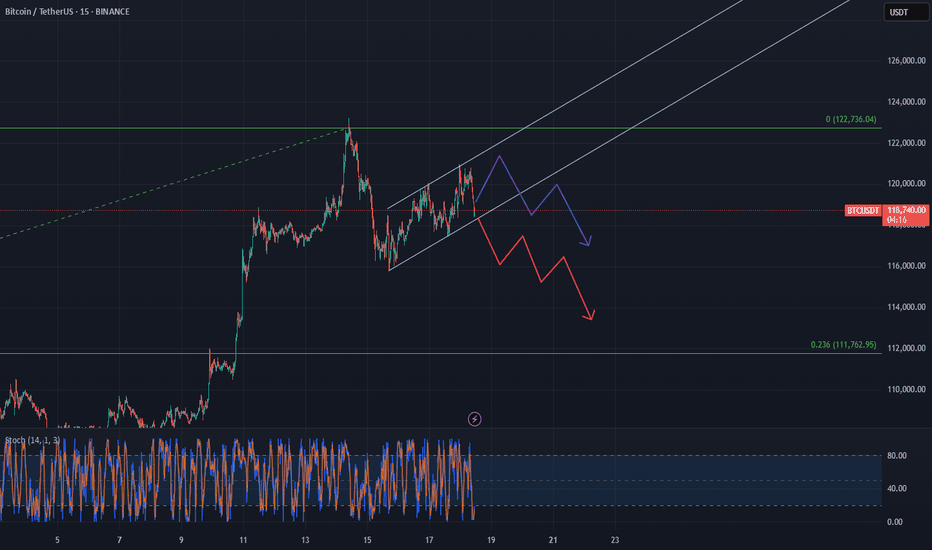

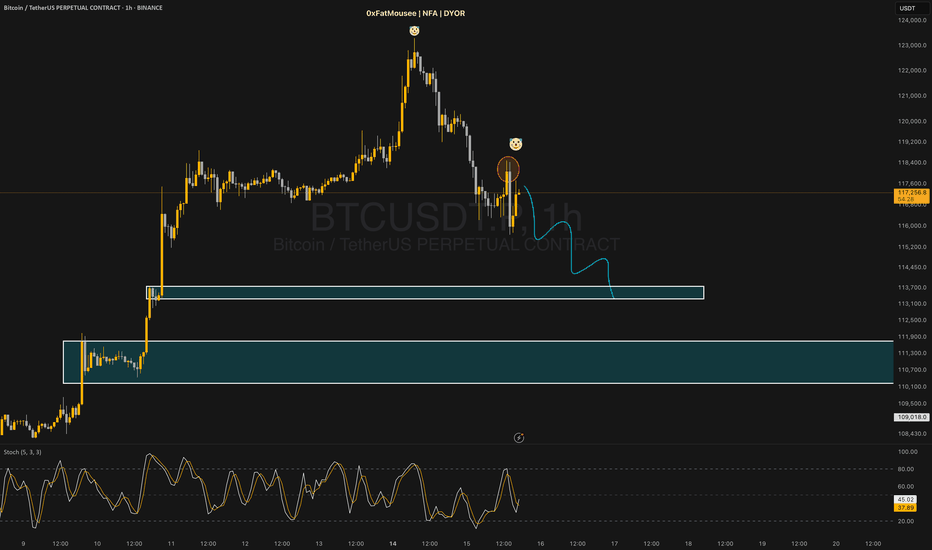

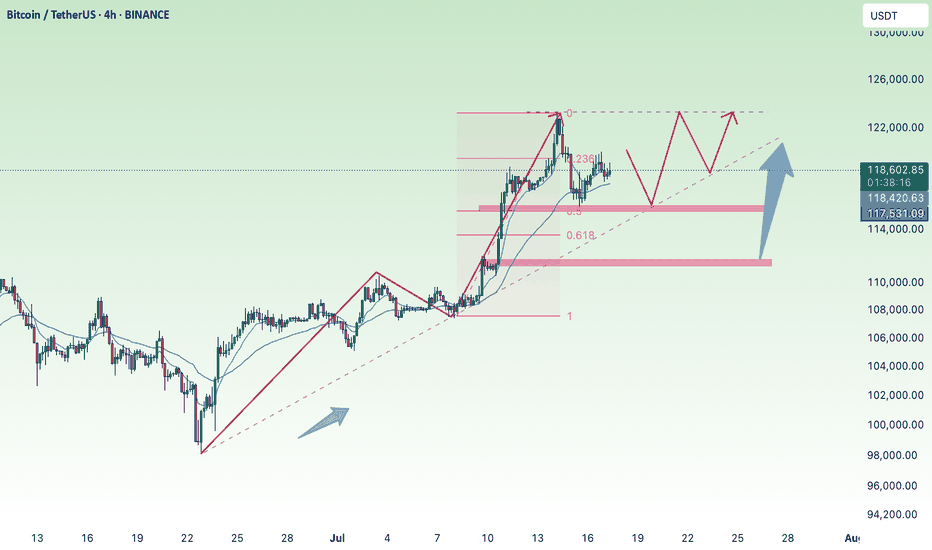

BTC consolidating a short term bearish channelBTC is moving inside a short-term bearish channel right now, even though the bigger trend is still upward. It looks like it's just consolidating for the time being, bouncing between the top and bottom of the channel.

But if it breaks below that lower trendline, we could see a pretty sharp move down—possibly all the way to around $112K , which lines up with the Fibonacci retracement from the last rally. That zone could act as a support.

It might hang out in this range a little longer, but once it breaks down, it’s probably heading toward that level.

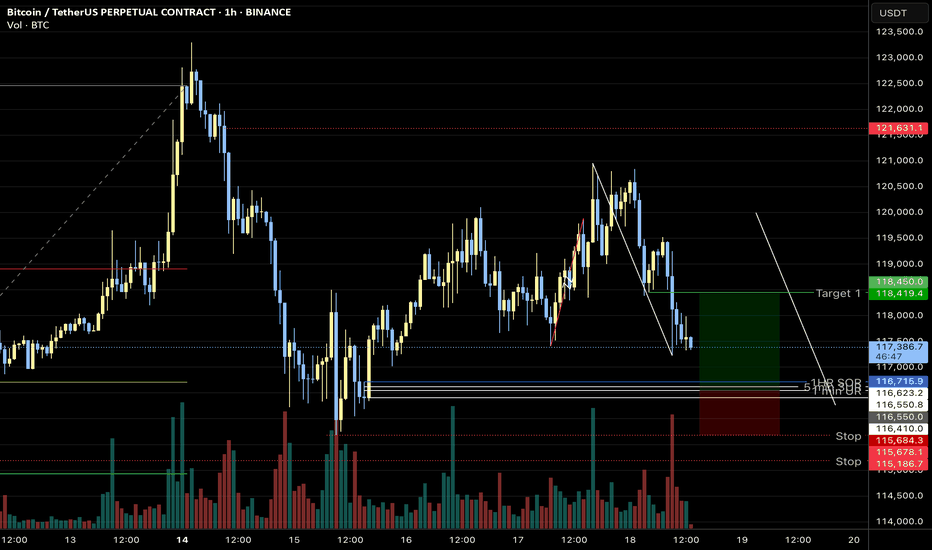

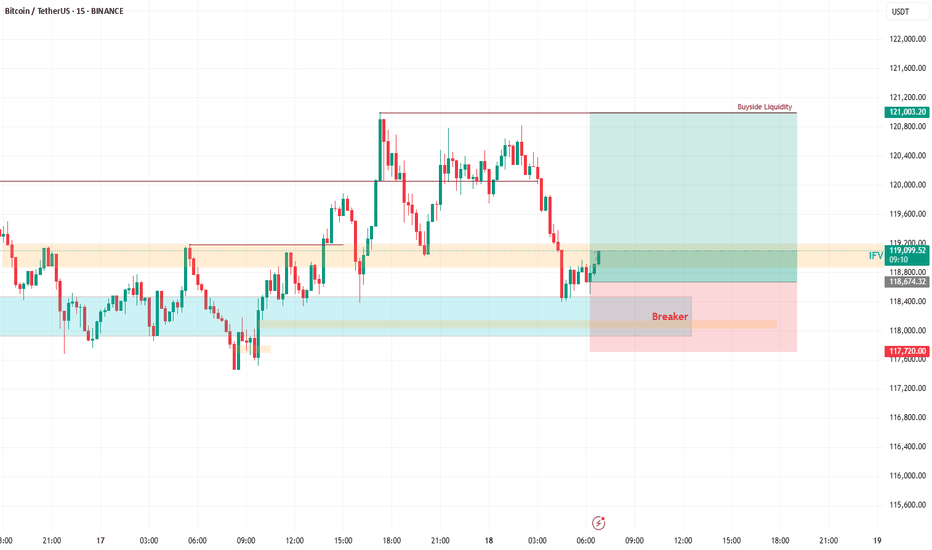

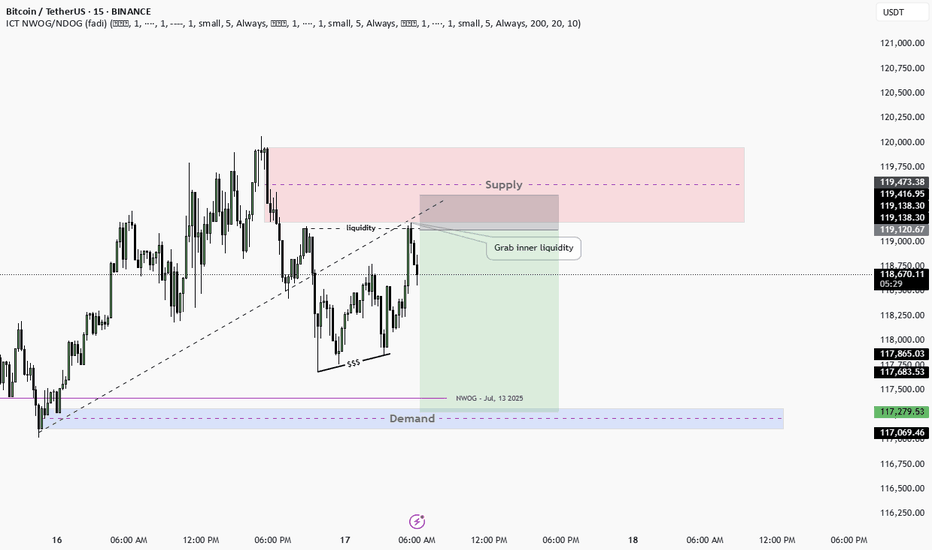

The Setup: Bullish Breaker in Play!Yesterday, BTC smashed into a strong bullish breaker and bounced like a champ. Today, it’s retracing back to this key level, setting up for what I expect to be another explosive buy reaction. Why? Because this breaker is rock-solid, and the price action is giving us all the right signals! Plus, it’s Friday—the last trading day of the week—and I’m betting BTC will stretch its legs to cover the weekly range. 🏃♂️

🎯 Trade Details: Where to Jump In

Buy Area: Right now, the price is teasing the breaker zone.

Stop Loss: Protect your capital with a stop loss at around ~117,700.

Target: We’re aiming for the Buyside Liquidity sitting pretty around 121,000. That’s a juicy move with solid risk-reward potential! 💪

🧠 Why This Trade Makes Sense

Bullish Breaker Strength: This level has proven itself as a springboard for price action.

Weekly Range Play: Fridays often see BTC push to cover its weekly range, and we’re in prime position to catch it.

Liquidity Grab: The Buyside Liquidity at 121,000 is like a magnet for price—let’s ride it there!

⚠️ Risk Management Reminder

Always trade smart! Use proper position sizing, stick to your risk management rules, and don’t go all-in like it’s a casino. Keep those stops tight to avoid getting wrecked by any sudden volatility. 😎

💬 Join the Conversation!

What do you think of this setup? Are you jumping on this BTC train or waiting for more confirmation? Drop your thoughts in the comments below! 👇 Also, if you like this idea, smash that LIKE button ❤️ and follow for more trade ideas to keep your portfolio poppin’! 🚀

Happy trading, and let’s stack those pips! 💰

#BTC #CryptoTrading #BuyTrade #Bullish #TradingView

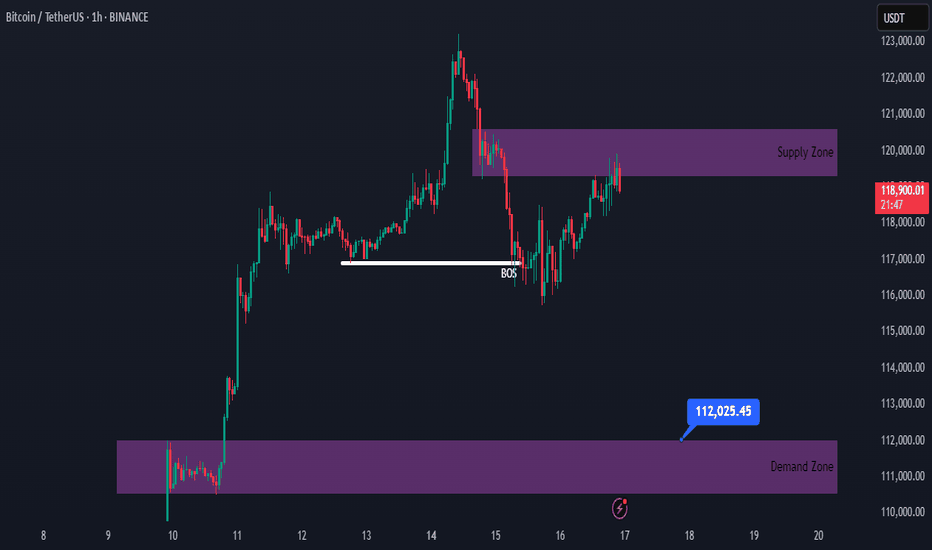

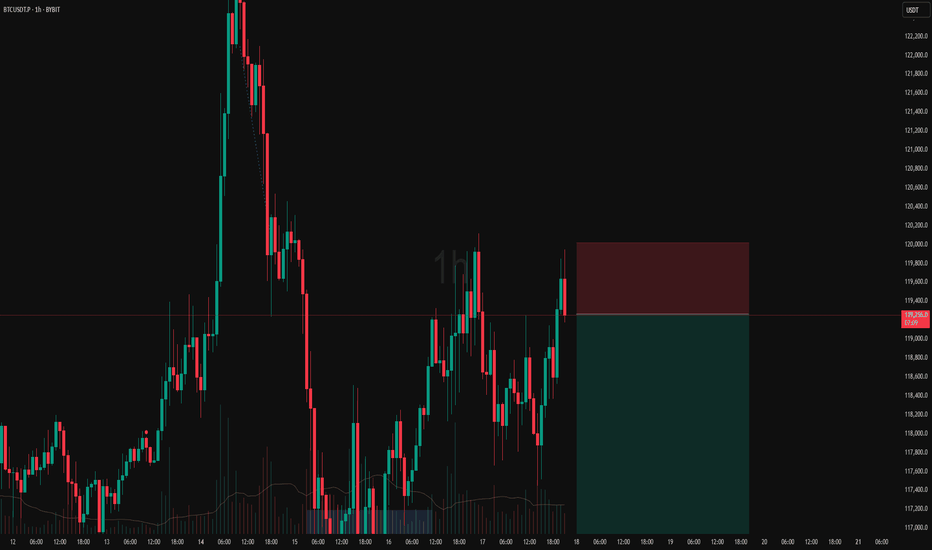

Bitcoin Bullish, but a Correction Might Be AheadHello traders!

Obviously, Bitcoin has a strong bullish momentum.

However, after noticing a minor shift in market structure, we may see a correction toward the 112,000 area.

If the supply area doesn’t break, we can look for a sell position here.

#BTC #Bitcoin

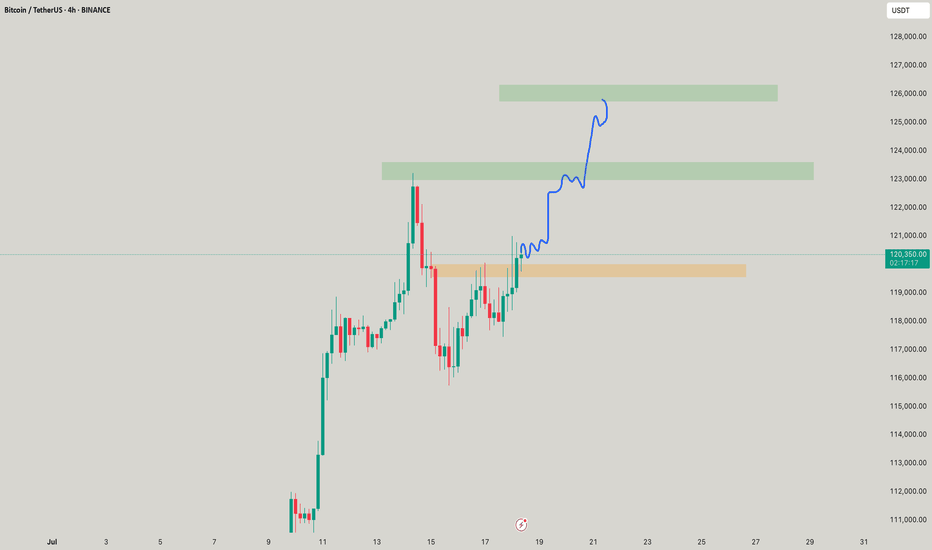

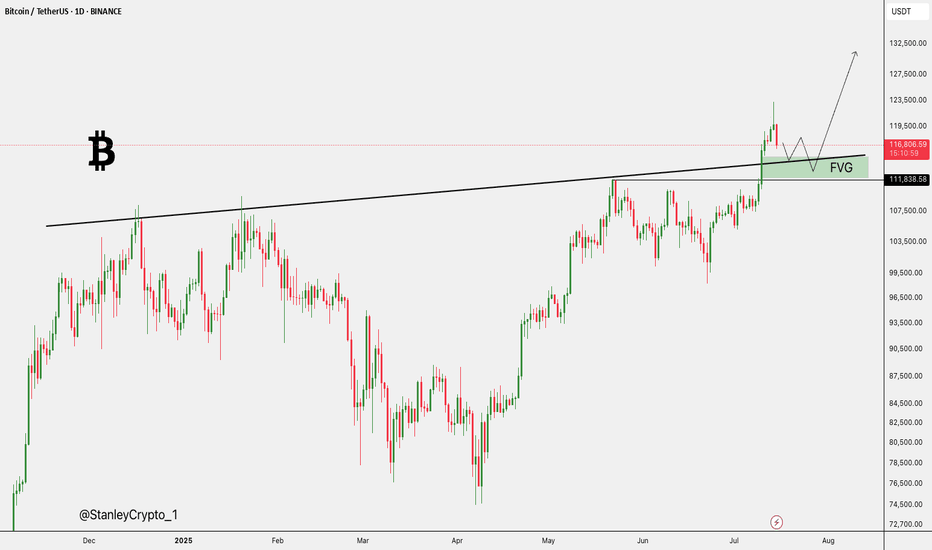

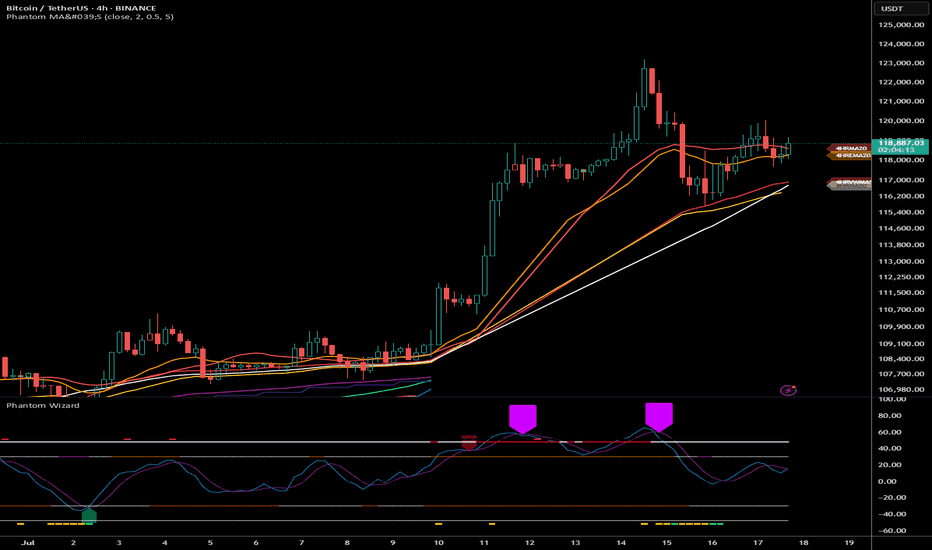

Lingrid | BTCUSDT strong Bullish Trend Continues The price perfectly fulfilled my last idea . BINANCE:BTCUSDT CRYPTOCAP:BTC broke out of a long consolidation range and confirmed a higher low at 98,200, initiating a new impulsive rally inside the upward channel. The price is now trading well above the 116,643 breakout level and holding near the mid-range of the next resistance zone. As long as the bullish structure holds, price is expected to target the upper resistance band near 130,000 in the coming sessions. Momentum and structure remain in favor of the bulls, supported by trendline and volume strength.

📉 Key Levels

Buy trigger: breakout and sustained move above 116,643

Buy zone: 116,643–120,000 (retest of structure and upper trendline)

Target: 130,000

Invalidation: drop below 116,000 breaks upward trend bias

💡 Risks

False breakouts around resistance zone may delay continuation

Macro uncertainty or ETF-related news can shift sentiment

Failure to hold above 116,643 would expose the trend to deeper correction

If this idea resonates with you or you have your own opinion, traders, hit the comments. I’m excited to read your thoughts!

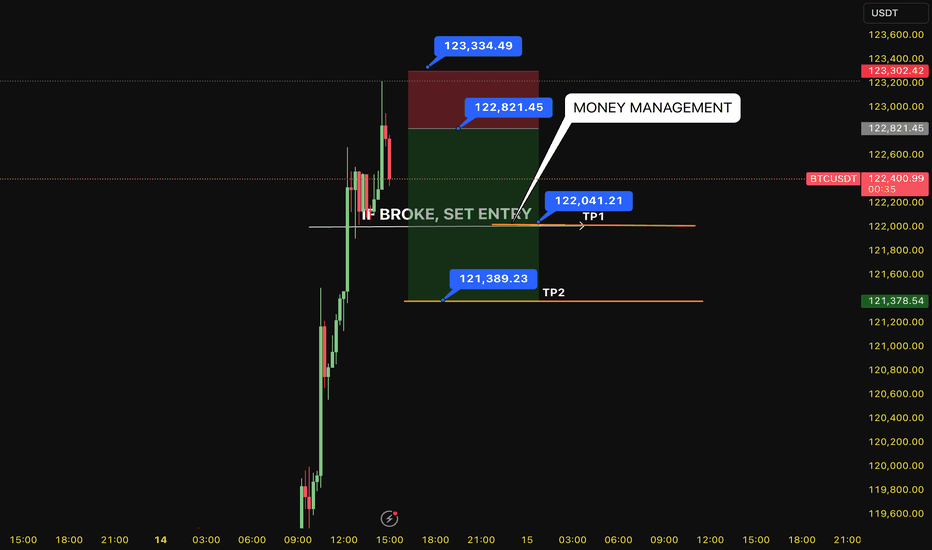

SELL BTC 13.7.2025 (scalping M15)Counter-trend trade order: SELL at THE TOP

Type of entry: Limit order

Condition:

- If the price break down at 122,041 confirming the down trend.

Note:

- Management of money carefully at the price of bottom (122,041)

Set up entry:

- Entry sell at 122,821

- SL at 123,334

- TP1: 123,041

- TP2: 121,389

Trading Method: Price action (No indicator, only trend and candles)

$BTC FLY TOWARDS 141K$ NEXT?CRYPTOCAP:BTC Bull Flag Target Hit – Eyes on 129K & 134.5K Next! 🔥

Bitcoin has overachieved its bull flag target and is now setting up a textbook Break & Retest of the previous All Time High (~$123K).

📌 Key Levels to Watch:

🔄 Retest Zone: $111K–$113K (previous ATH)

🎯 Next Targets:

$129K (0.12 Fib Extension)

$134.5K (Golden Extension Zone)

📉 Invalidation: Below $104K

Volume remains solid, and structure is bullish — expect a healthy dip & bounce before continuation.

This retest could be the final springboard toward $141K.

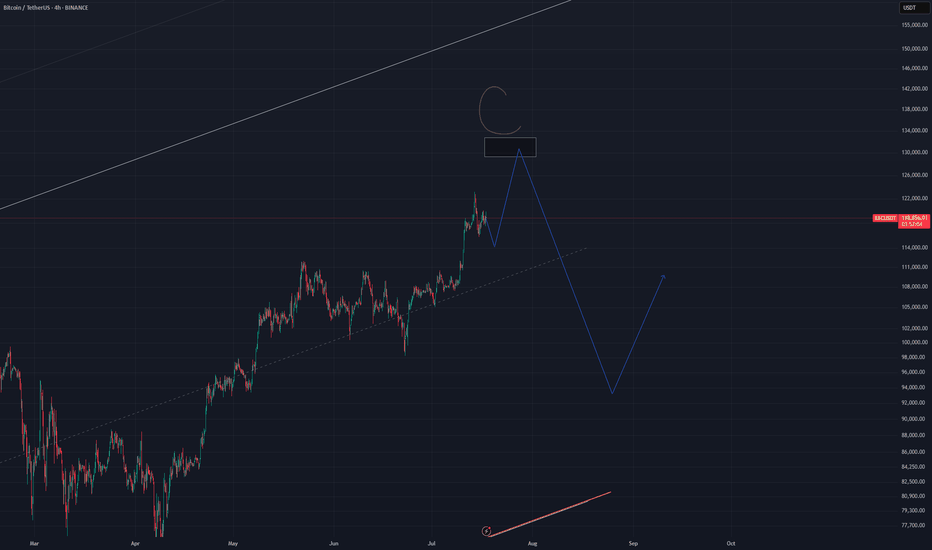

BTC third tap incoming? Recently, BTC has traded for a large amount of time in ranging environments. These ranges have started with a local range high and then an initial 3-tap accumulation (i.e., a local low and then two sweeps of that low) before making a solid attempt at the range highs. The sweeps of the lows are meant to shake people out and provide fuel to try to break higher. The previous two times, that initial attempt failed and the price was sent lower to put in a second 3-tap accumulation at lower prices.

Will the current price move back down to put in the 3rd tap of the current relatively small accumulation? That is my base case. I believe we will see some lower prices locally to put in the 3rd tap. I think the Bitcoin Swing Trade Indicator (BSTI) will fire off green one more time and then we will then make a run to try to break out of this current massive range (that started last year in November). This current range is fairly small, so it is not worth it to me to sell here to try to buy lower.

The bigger question is: Will we have enough fuel to durably break out of this range after the 3rd tap of the current accumulation (green line) or are we destined to repeat the pattern of the last two bigger ranges (red line), one of which we are still in? I personally believe we will break out after the smaller range 3rd tap (the green line) based on the larger context of cycle theory, how long we have been in this range, and how the current small range is part of the larger range starting back in November 2024.

It will be interesting to see what happens.

Da_Prof

Note that TV won't allow publication of a private/unpublished indicator anymore or I would have shown the BSTI, which is now published as invite only. It's implementation is too complicated to publish openly, so I don't feel comfortable doing that. If you want access, please DM me on TradingView. Thanks.

Bitcoin (BTC): Current Neckline Zone is Crucial | Bounce Coming?After a recent push to a new ATH area, the price has cooled down, which led the price back to the local neckline zone, which is our next important zone.

This correction cooled down the Bollinger Bands Channel and RSI, which would mean we are just one MSB (on smaller timeframes) away from another rally towards the upper zones.

Now if for any reason we fall more, then this might turn into a nasty movement, as our target would be then around $110K, where we would be looking for another buy entry (if we fail to get that MSB we are currently looking for).

Swallow Academy

BTC sideways above 115k💎 BTC PLAN UPDATE (July 17)

NOTABLE NEWS ABOUT BTC

Bitcoin Price Forecast: BTC Recovers as Trump Steps In to Revive Crypto Legislation Momentum

Bitcoin (BTC) saw a mild recovery, trading around $119,000 at the time of writing on Wednesday, after falling nearly 2% the previous day. This rebound followed an announcement by U.S. President Donald Trump on Wednesday morning, stating that the GENIUS Act is ready to be passed by the House during the legislative “Crypto Week”, sparking optimism in the crypto market. Furthermore, institutional demand continues to grow, with spot Bitcoin ETFs recording over $400 million in inflows on Tuesday, extending the growth streak since July 2.

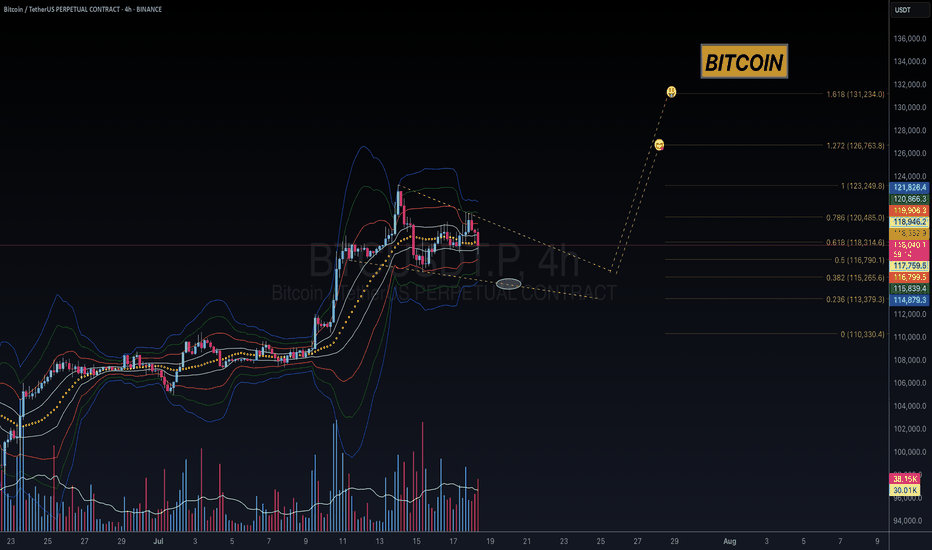

TECHNICAL ANALYSIS

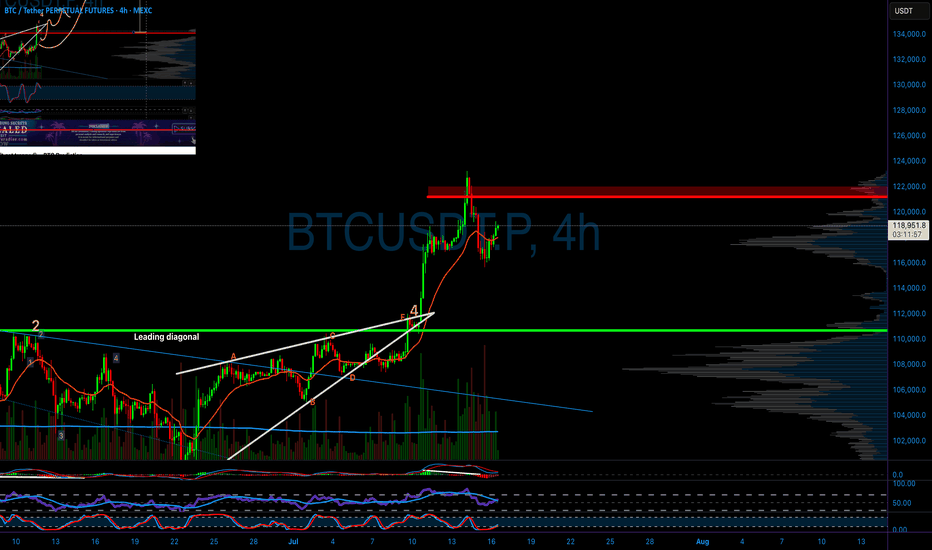

🧠 Pattern Overview:

The chart clearly displays an Elliott Wave pattern (1) → (2) → (3) → (4) → (5) along with Fibonacci Retracement and Extension levels, helping to identify potential support and resistance zones.

1. Elliott Waves:

Wave (3) was completed around the $122,144 zone and the market is currently in the corrective wave (4).

Wave (5) is expected to move upward with targets at:

• 1.618 Fibonacci Extension: ~$127,404

• Or further: ~$130,747

2. Support Zone (grey area below):

Located around $115,000 – $116,000, which is:

• The 0.5 – 0.618 retracement of Wave (3)

• Aligned with the EMA200 and dotted black trendline support.

If the price falls into this area, it’s highly likely to bounce back and form Wave (5).

3. Danger Zone if Broken:

If this support fails, price may fall deeper to:

• $113,200 (0.786 retracement),

• Or even lower: $111,600 – $111,800

4. Potential Scenarios:

Two main outcomes:

• Continued Uptrend: Price bounces from the support zone and heads toward $127,000 – $130,000

• Breakdown: If the support breaks, a deeper decline may occur, breaking the wave structure.

Follow the channel for continuous and up-to-date analysis on XAUUSD, CURRENCIES, and BTC.

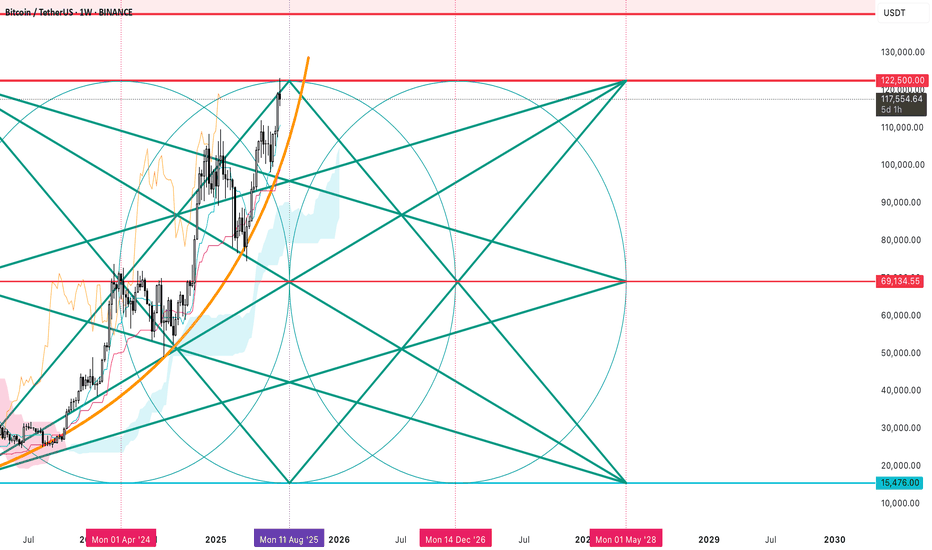

Bitcoin Forever Bitcoin's Technical Trajectory: Analysis for Q3-Q4 2025

Breaking New Records: Bitcoin's Path Beyond the July Peak

With Bitcoin currently trading near historical highs after reaching its all-time high of $123,218 in July 2025, we find ourselves in unprecedented territory. This comprehensive technical analysis examines Bitcoin's potential trajectory through the remainder of 2025, leveraging multiple analytical frameworks to identify probable price targets and key levels.

Current Market Context

Bitcoin has experienced a remarkable ascent in 2025, climbing from around $85,000 in January to establish a new all-time high of $123,218 in July. After this peak, we've seen a period of consolidation with price action forming a potential bull flag pattern between $117,000-$120,000. This consolidation phase represents a critical juncture for Bitcoin's next directional move.

The most recent data shows Bitcoin trading around $118,200 in late July, representing a modest pullback of approximately 4% from the all-time high. This shallow retracement suggests underlying strength rather than exhaustion in the primary trend.

RSI Analysis: Healthy Momentum Reset

Despite Bitcoin's extraordinary rise to $123,218 in July, the daily RSI has demonstrated remarkable resilience. After reaching overbought territory (70+) during the July peak, the indicator has now cooled to approximately 42-46, indicating a healthy reset of momentum conditions without surrendering the broader uptrend.

The weekly RSI reading of 46.4 is particularly significant—showing that despite the recent consolidation, Bitcoin maintains substantial momentum capacity before reaching the extreme readings (80+) that typically signal major cycle tops. This technical positioning creates an ideal scenario where momentum has reset while price structure remains intact.

Most notably, the absence of bearish divergences between price and RSI on higher timeframes suggests the current consolidation is likely a pause rather than a reversal in the primary trend.

Wyckoff Analysis: Re-accumulation Before Continuation

The price action following the $123,218 July peak displays classic characteristics of Wyckoff re-accumulation rather than distribution:

The initial decline from the peak represents a "Preliminary Support" (PS) phase

The subsequent trading range between $117,000-$120,000 shows tight price action with decreasing volatility

Volume characteristics show diminishing selling pressure rather than distribution

Recent price action suggests we're approaching the "Spring" phase that typically precedes markup

According to the data, Bitcoin's price action in late July shows decreasing volatility with narrowing price ranges, consistent with the "Cause Building" phase in Wyckoff methodology. This structure indicates institutional accumulation is still occurring at these elevated levels—a powerful sign that smart money anticipates further upside potential. The completion of this re-accumulation pattern projects a move toward the $135,000-$145,000 range in the coming months.

Supply/Demand Zone Analysis: Key Levels Identified

Supply and demand zone analysis reveals critical price levels that will influence Bitcoin's next directional move:

Major demand zone established between $115,000-$117,000 (recent consolidation floor)

Secondary support cluster at $108,000-$110,000 (previous resistance turned support)

Primary resistance at $123,200-$125,000 (all-time high region)

Limited historical supply overhead above $123,218 suggests minimal resistance once this level is breached

The formation of fresh demand zones during the recent consolidation indicates strategic accumulation before the anticipated upward expansion. The neutralization of previous supply zones during the advance to all-time highs has effectively cleared the technical pathway for Bitcoin's next significant move higher.

Volume Analysis: Confirming the Bullish Case

Examination of trading volume during the recent consolidation provides crucial validation for our bullish thesis:

Declining volume during pullbacks indicates diminishing selling pressure

Volume spikes on upward moves suggest accumulation on strength

The Volume-Weighted Average Price (VWAP) maintains a positive slope, confirming the underlying strength of the trend

The high-volume node has migrated upward in recent weeks, signalling comfort with accumulation at these unprecedented price levels—a powerful indication of market confidence in Bitcoin's valuation. The buying/selling volume differential maintains a positive bias, confirming underlying accumulation despite price consolidation.

Fibonacci Extension Framework: Projecting Targets

With Bitcoin having established a new all-time high at $123,218 in July, we can project potential targets using Fibonacci extensions from the most recent significant swing points:

The 127.2% extension from the June-July rally projects to approximately $132,000

The 161.8% extension suggests potential movement toward $145,000

The 200% extension indicates a possible target of $160,000

These projections align with psychological thresholds that could serve as natural targets in this new price discovery phase.

Elliott Wave Analysis: Extended Fifth Wave Scenario

The current price action suggests we're likely in an extended fifth wave scenario within a larger degree bull cycle:

Primary waves I through III appear complete with the move to $123,218 in July

The current consolidation represents wave IV

Wave V is projected to reach the $140,000-$160,000 range

This wave count suggests potential for continued appreciation toward the $145,000-$160,000 range before a more significant corrective phase begins. The internal structure of the current consolidation displays textbook proportional relationships, further validating our analysis.

Price Projection Timeline

August-September 2025:

Completion of the current consolidation phase with a potential final retest of support in the $115,000-$117,000 range. This would represent the "Last Point of Support" in Wyckoff terminology and provide a final opportunity for institutional accumulation before the next leg up. A decisive break above $125,000 would confirm the end of the consolidation phase.

October 2025:

Renewed momentum pushing Bitcoin toward the $132,000-$140,000 range, potentially coinciding with seasonal strength typically observed in Q4. This phase could see increased institutional participation as year-end positioning begins, with volume expansion confirming the strength of the move.

November-December 2025:

Final wave extension potentially reaching the $145,000-$160,000 range, representing a 20-30% appreciation from current all-time high levels. This phase may exhibit increased volatility and could be followed by a more substantial correction as the extended fifth wave completes.

Key Levels to Monitor

Support Zones:

Primary: $115,000-$117,000 (must hold for bullish scenario)

Secondary: $108,000-$110,000 (previous resistance turned support)

Tertiary: $100,000-$102,000 (psychological and technical support)

Resistance Zones:

Immediate: $123,200-$125,000 (all-time high region)

Target 1: $132,000-$135,000 (127.2% Fibonacci extension)

Target 2: $145,000-$150,000 (161.8% Fibonacci extension)

Target 3: $160,000+ (200% Fibonacci extension)

The Technical Case for New Highs

Despite Bitcoin already achieving unprecedented price levels in July, multiple technical frameworks suggest the potential for continued appreciation:

Historical Precedent: Previous bull cycles have shown Bitcoin capable of extending significantly beyond initial all-time highs before cycle completion

Institutional Adoption: On-chain metrics indicate continued accumulation by large holders despite elevated prices, with exchange outflows remaining positive

Technical Structure: The current consolidation pattern resembles re-accumulation rather than distribution, suggesting the market is preparing for another leg higher

Momentum Characteristics: Current momentum readings have reset from overbought conditions without breaking the underlying trend structure

Strategic Considerations

With Bitcoin having already achieved a new all-time high at $123,218 in July, strategic approaches might include:

Maintaining core positions while implementing trailing stop strategies

Adding to positions during retests of key support levels ($115,000-$117,000)

Considering partial profit-taking at key Fibonacci extension levels

Remaining vigilant for signs of distribution patterns that may emerge at higher levels

Conclusion: The Path to $160,000

The weight of technical evidence suggests Bitcoin has entered a new paradigm of price discovery following its break to all-time highs in July 2025. While the path may include periods of consolidation and volatility, the underlying trend remains firmly bullish with multiple technical frameworks projecting targets in the $145,000-$160,000 range by year-end 2025.

The current consolidation phase represents a healthy reset of momentum conditions rather than a trend reversal, creating an ideal technical foundation for Bitcoin's next major advance. With institutional adoption continuing to grow and technical indicators suggesting ample room for further appreciation, Bitcoin appears well-positioned to achieve new record highs in the coming months.