BTCETH trade ideas

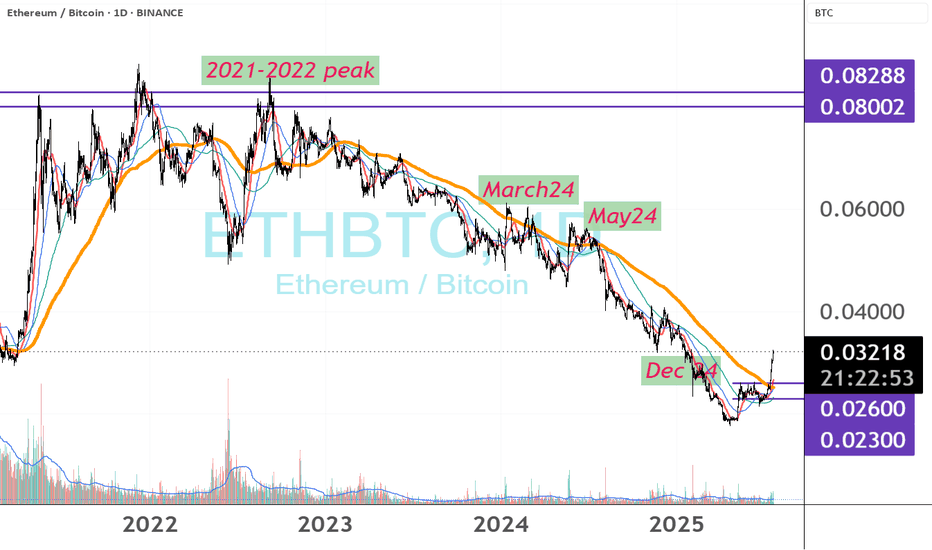

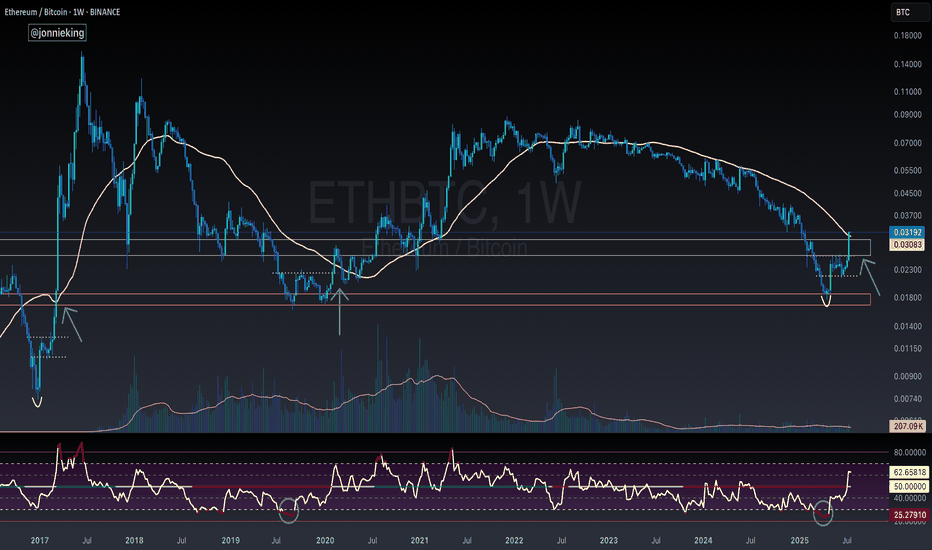

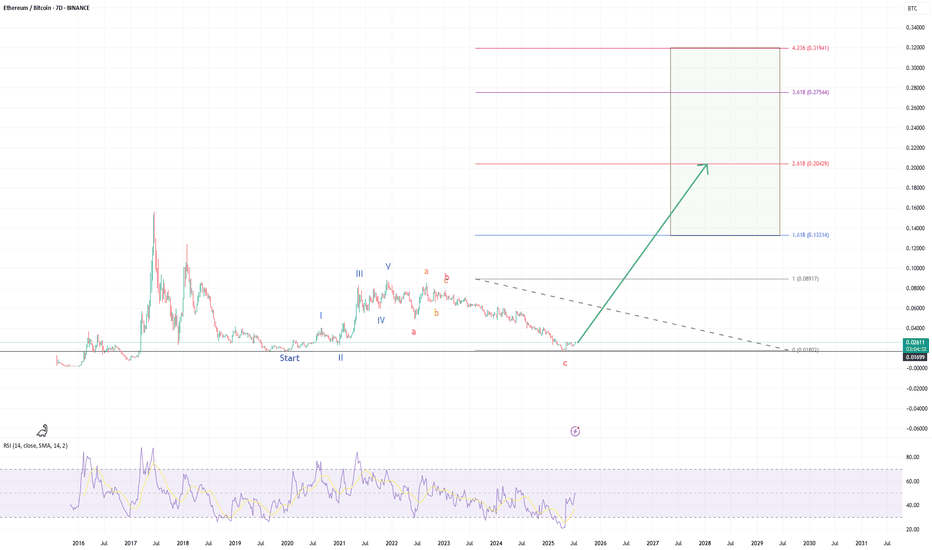

ETHBTC , what if?ETH/BTC has just pushed above 0.026 on the 200‑day MA, indicating ETH’s relative strength against BTC, despite ETH still trading under $4,000.

Unlike the $4,000 rallies in March, May and December 2024—when ETH/BTC never truly broke out—this move shows genuine outperformance.

If Bitcoin holds at about $120K, revisiting the 2021–22 ETH/BTC high would put ETH near $9.6K.

Historical peaks for reference:

2018: ETH/BTC ≈ 0.12 → ETH ≈ $14,400

2017: ETH/BTC ≈ 0.15 → ETH ≈ $18,000

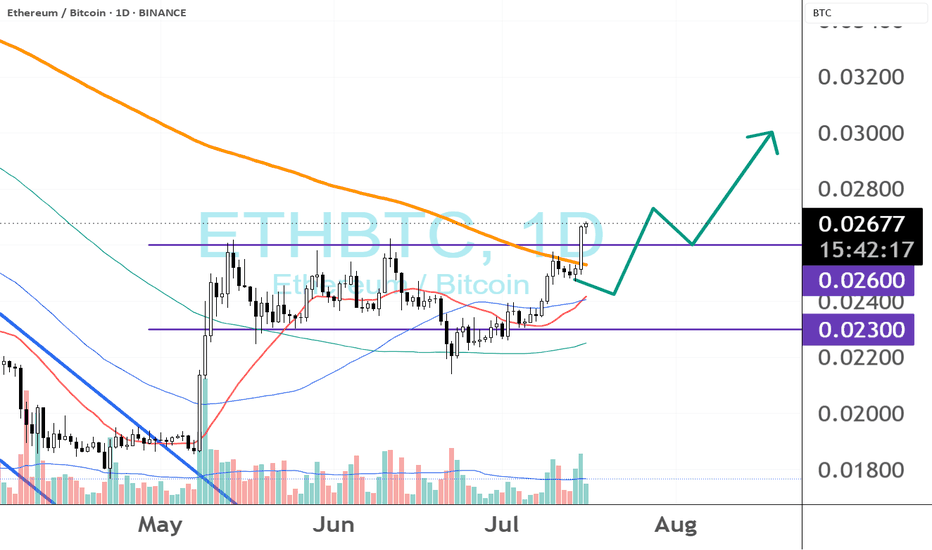

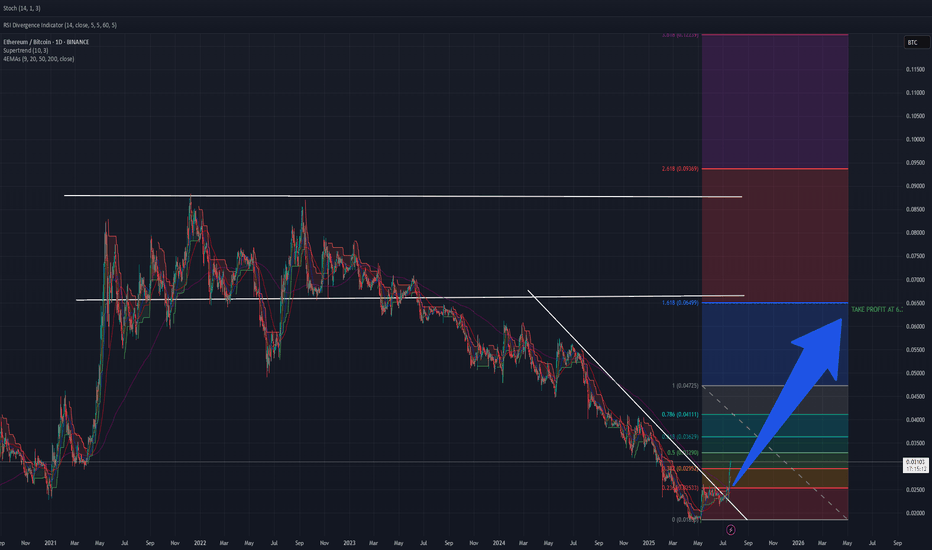

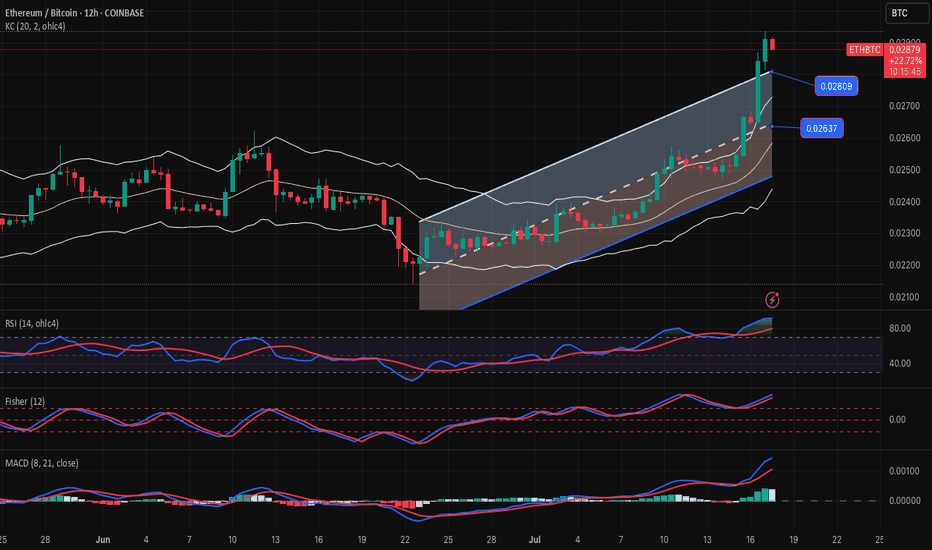

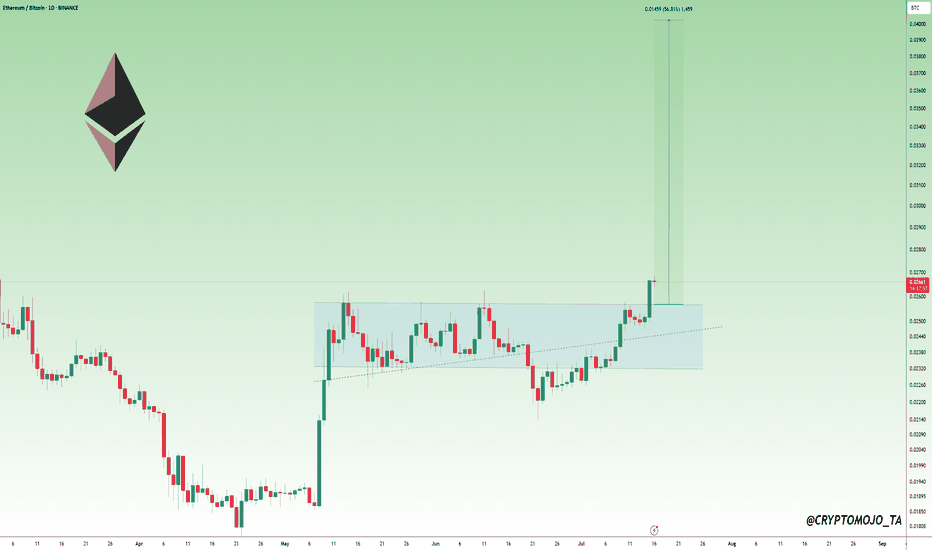

ETH against BTCETH/BTC has broken out of a bullish flag and cleared two key resistance levels. The first was at 0.02498, which held as resistance for a while. After a successful breakout and retest, price surged through the next key level at 0.02587.

We might see a retest of 0.02587—if it holds as support, the next major target to watch is around 0.03. This would mark a significant move and could set the stage for a broader rally.

The ultimate target for this bull cycle remains around 0.048, but let’s take it step by step and focus on the 0.03 level for now.

One thing to watch closely: the weekly RSI is showing signs of bearish divergence compared to price action. If this divergence plays out, we could see a correction. However, if RSI manages to break above 79.95, that bearish divergence would be invalidated—and we’d be in a stronger position to aim for higher levels.

Let’s see how things unfold. For now, 0.02587 is the key short-term level to hold.

$ETH Closes Above the 50WMA - Alt Season Signal ALT SEASON ALERT 🚨

CRYPTOCAP:ETH Closed the Week ABOVE the 50WMA

Historically this has signaled the start of ALT SEASON.

*NOTE* 2020 had the pandemic hiccup.

This bottoming pattern looks very similar to the 2017 explosion.

Also the RSI matches the 2019 bottom.

Dare I call it yet bros? 🤓

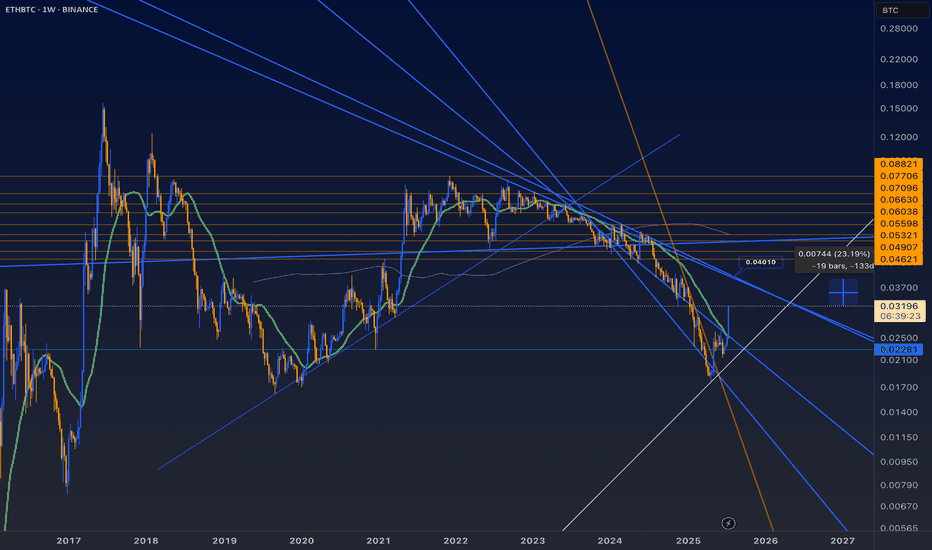

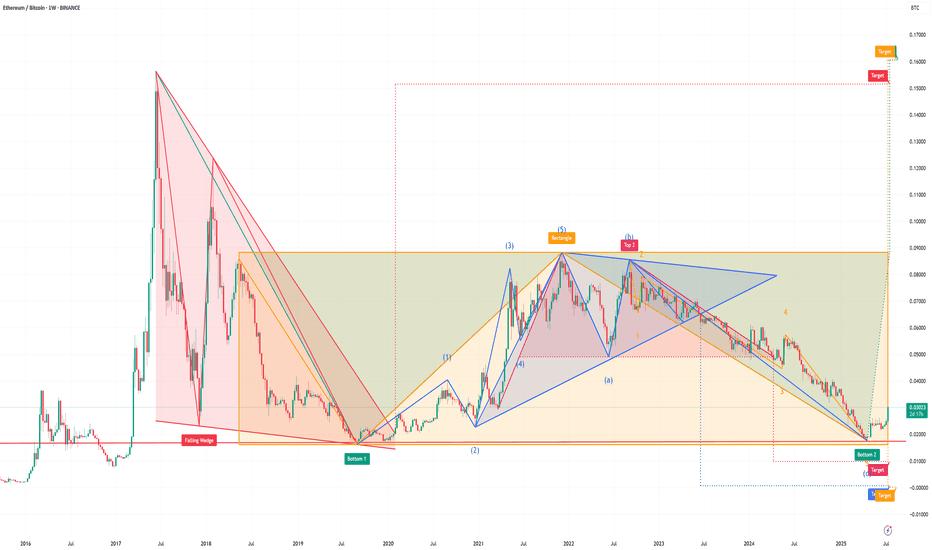

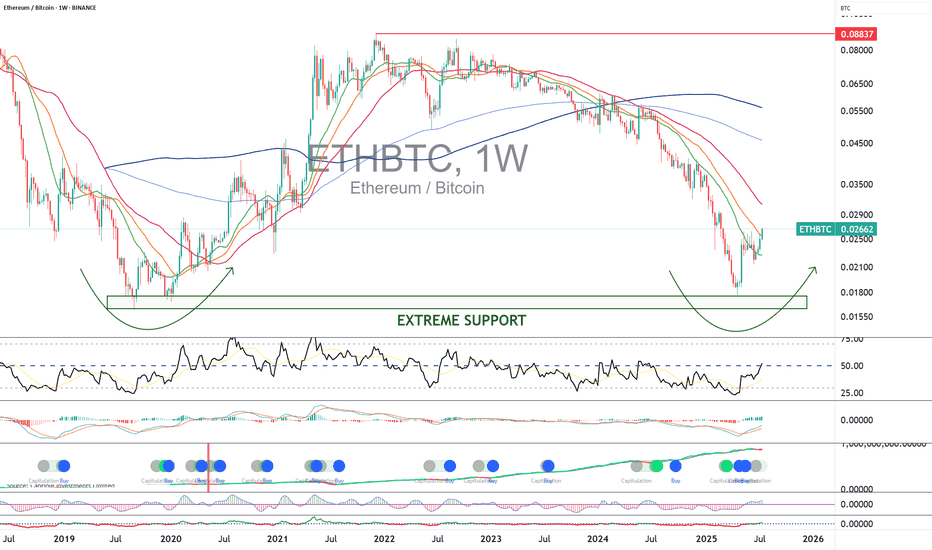

ETHBTC scenario for 2025-2027ETH/BTC is currently sitting at a historically strong support zone and is forming a bullish reversal pattern, which increases the likelihood of a new upward cycle against BTC.

The most probable scenario is a move towards the 0.05–0.07 BTC range, with potential to reach at least 0.09 BTC as a conservative scenario and 0.15–0.16 BTC as an optimistic scenario during 2025–2027.

ETH/BTC - Finally Trend is reversing - After a long time we are finally seeing a change in the trend of ETH/BTC pair.

- Compared to BTC, ETH was underperforming for last couple of years and we are seeing some strength in ETH

- If this trend continue we can finally see some new ATH on ETH

Entry: 0.02633

StopLoss: 0.02125

TP1: 0.02825

TP2: 0.03168

TP3: 0.03592

Don't forget to keep stop loss. Stay tuned for more updates

Cheers

GreenCrypto

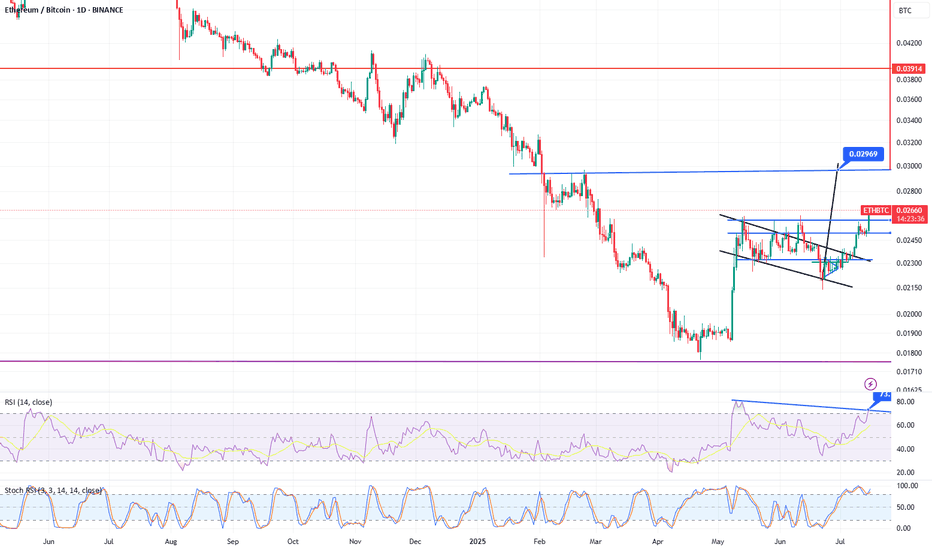

ETH/BTC Poised for a Breakout: A Technical and Fundamental ViewA confluence of technical signals on the weekly ETH/BTC chart, coupled with significant fundamental developments for both Ethereum and Bitcoin, suggests a potential upward move for the pairing in the coming weeks.

Technical Analysis (TA)

The weekly chart for ETH/BTC on Binance reveals a potential bottoming formation after a prolonged downtrend. The price has been consolidating in recent months, and the latest weekly candle shows a strong bullish engulfing pattern, indicating a possible shift in momentum.

Key levels to watch, as identified on the chart, are:

Immediate Resistance: 0.02546 BTC. A decisive close above this level on the weekly timeframe would be the first confirmation of a potential trend reversal.

Further Resistance: 0.02929 BTC and 0.03451 BTC. These represent subsequent hurdles for the bulls to overcome.

Take Profit Target: 0.038 BTC. This level is marked as the ultimate target for this potential upward move.

Timeframe: The analysis on the chart suggests a maximum timeframe of 5 weeks for this trade idea to play out.

Moving Averages: The price is currently trading below the MA Ribbon (SMA, 20, 50, 100, 200), which could act as dynamic resistance. A break above this ribbon would further strengthen the bullish case.

Fundamental Analysis (FA)

The current market environment in July 2025 provides several fundamental catalysts that could impact the ETH/BTC ratio.

For Ethereum (ETH):

Growing Institutional Interest: Ethereum ETFs have seen significant inflows, with over $890 million in July 2025 alone, driven by increasing confidence from institutional investors. Asset managers like BlackRock are accumulating substantial amounts of ETH, reducing the available supply on the market.

Network Upgrades: The upcoming "Pectra" upgrade, which includes Proto-Danksharding (EIP-4844), is anticipated in Q3 or early Q4 2025. This is expected to significantly reduce Layer-2 transaction costs and improve scalability, further enhancing the utility of the Ethereum network. The earlier Pectra upgrade in 2025 already introduced user-friendly features like smart accounts.

Ecosystem Growth: The Linea project, a prominent player in Ethereum's DeFi ecosystem, has a Token Generation Event (TGE) scheduled for July 2025, which is expected to drive market shifts. The overall DeFi ecosystem on Ethereum is showing signs of revitalization.

For Bitcoin (BTC):

Strong Institutional Demand: Similar to Ethereum, Bitcoin is experiencing a wave of institutional adoption, with significant inflows into spot Bitcoin ETFs. Public companies are now holding BTC in their treasuries, and major financial institutions view it as a strategic asset.

New All-Time Highs: Bitcoin has recently surged to new all-time highs, breaking key trendlines and signaling a new bullish era. This strong performance often has a spillover effect on the broader crypto market, including altcoins like Ethereum.

Favorable Macro Environment: Some analysts point to a looser monetary policy from global central banks and inflation concerns as factors boosting demand for hard assets like Bitcoin.

ETH vs. BTC Dynamics:

While Bitcoin's price has seen impressive gains, some analysts believe Ethereum has room to catch up. The ETH/BTC ratio is a key metric for gauging the relative strength of the two leading cryptocurrencies. An upward trend in the ETH/BTC chart, as suggested by the technical analysis, would indicate that Ethereum is outperforming Bitcoin. The performance of ETH relative to Bitcoin is often seen as a barometer for the broader altcoin market.

My point of view

The technical setup on the ETH/BTC weekly chart presents a compelling case for a potential bullish reversal in the short to medium term. This is supported by strong fundamental developments within the Ethereum ecosystem, including significant institutional inflows and major network upgrades. While Bitcoin's own bullish momentum is a factor to consider, the potential for Ethereum to outperform in the coming weeks, as indicated by the provided chart analysis, offers an interesting trading opportunity. Traders should closely monitor the identified resistance levels for confirmation of a breakout.

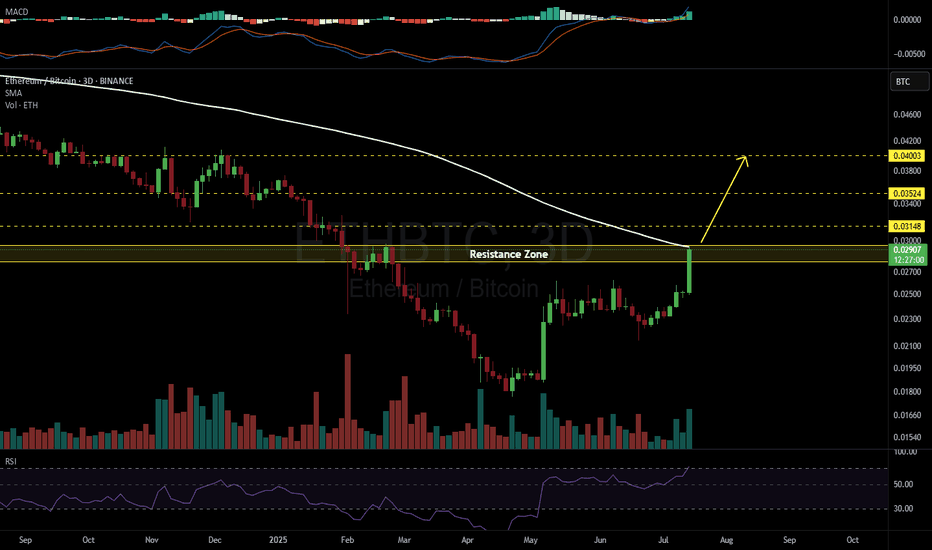

ETHBTC 3D#ETHBTC 3-day timeframe chart looks amazing!

All we need now is a breakout above the resistance zone and the 3-day SMA100.

The rise of ETH against BTC — combined with the decline in Bitcoin dominance — signals a potential rotation of capital into altcoins.

Are you ready for the altseason?

If the breakout occurs, the targets are:

🎯 0.03148 BTC

🎯 0.03524 BTC

🎯 0.04003 BTC

⚠️ Always use a tight stop-loss and apply proper risk management.

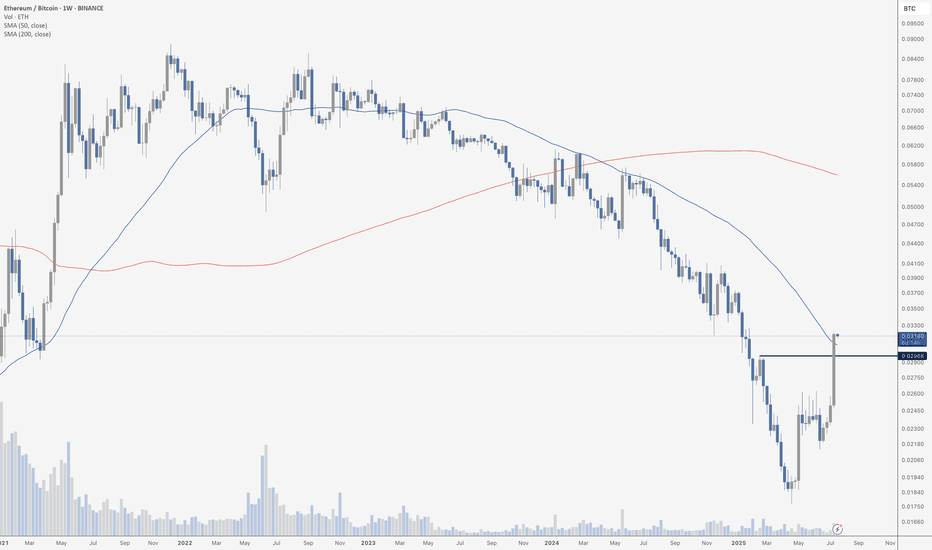

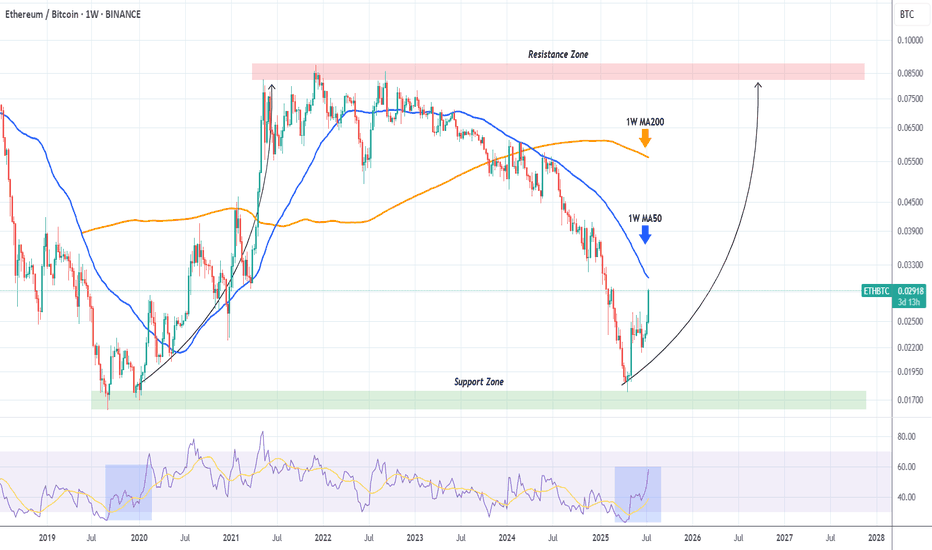

ETHBTC shows that Ethereum will outperform Bitcoin MASSIVELY!The ETHBTC pair has been rebounding hyper aggressively after the April 21 2025 Low on the 6-year Support Zone, and is now facing it's most important test, the 1W MA50 (blue trend-line).

This trend-line has been its Resistance since basically March 13 2023, so if broken, it will be a massive bullish break-out signal.

In fact during the 2020 - 2021 Bullish Leg, once the price broke above the 1W MA50, the market got the final confirmation of the upcoming long-term rally.

We expect Ethereum to outperform Bitcoin for the rest of the year at least.

-------------------------------------------------------------------------------

** Please LIKE 👍, FOLLOW ✅, SHARE 🙌 and COMMENT ✍ if you enjoy this idea! Also share your ideas and charts in the comments section below! This is best way to keep it relevant, support us, keep the content here free and allow the idea to reach as many people as possible. **

-------------------------------------------------------------------------------

💸💸💸💸💸💸

👇 👇 👇 👇 👇 👇

$ETH Breakout Alert!🚀 CRYPTOCAP:ETH Breakout Alert!

Ethereum has finally broken above $ 0.02583, a strong resistance level that had stopped it for months.

ETH is starting to look stronger than BTC.

Next targets:

🔹 0.02985 – near-term resistance

🔹 0.03281 – major targethad

🔹 0.0415 – full breakout target (around +56%)

If ETH retests 0.02583 and stays above, it confirms the breakout.

This could be the start of ETH outperforming BTC in the short term.

Keep an eye on it, this move could lead to a strong ETH rally!

DYOR, NFA

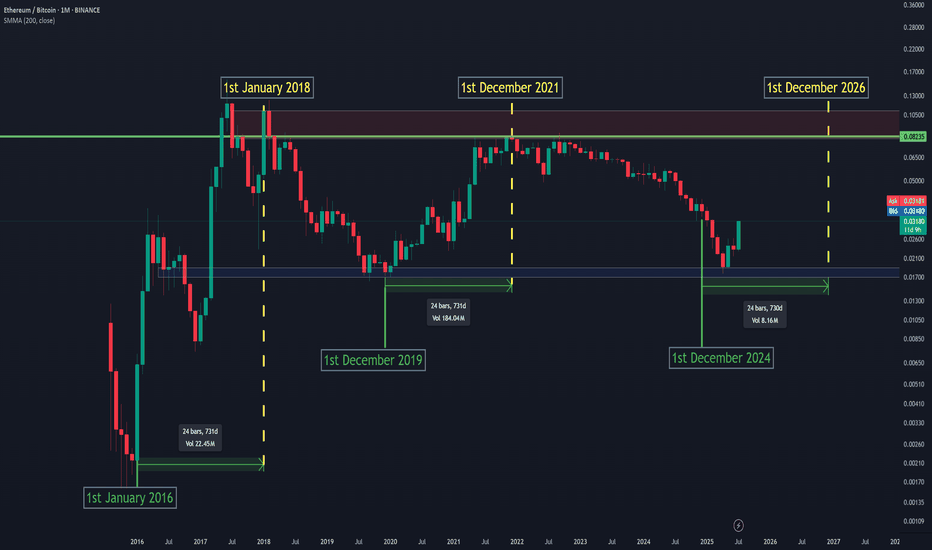

Alt season ?Ethereum has been underperforming Bitcoin since 2022.

However, in the short term, ETH is starting to show some relative strength.

If ETH/BTC can break above the 0.026 level, we could potentially see momentum shift towards altcoins.

Current Outlook:

* Short-term: Bullish

* Mid-to-long term: Neutral

* Long-term: Bearish

ETH VS BTC, Ethereum will outperform this summer!The bitcoin price set a new all-time high earlier this week at 123,000 US dollars, confirming that the bullish cycle linked to the spring 2024 halving is far from over. This current bullish cycle is set to end in autumn 2025, if the market continues to repeat past cycles - bitcoin's famous 4-year cycle. You can reread our bitcoin analysis on this subject by clicking on the link below.

1) The ETH/BTC ratio has validated a major bullish reversal, signalling Ether's outperformance of BTC until the end of the current cycle

Cycles of relative strength between the bitcoin price and the ether price are multi-year cycles, lasting 5 to 6 years. Technical analysis highlights the presence of a historically extreme graphical support, which in recent weeks has enabled the ETH/BTC rate to reverse its upward trend. In conclusion, it is now the Ether token that will outperform the bitcoin rate, and this should continue until the end of the current cycle, i.e. next October/November.

The chart below shows Japanese candlesticks in weekly data for the ETH/BTC rate

2) BTC dominance is validating a bearish divergence

This is a signal long-awaited by the crypto investment community, namely the day when bitcoin's dominance will recede to make way for better relative behavior by altcoins. It's a phenomenon known as “altcoin season”, and it will come about if, and only if, BTC's dominance gives a downward reversal signal. This is why we need to keep a close eye on this potential bearish divergence on BTC dominance.

The chart below shows weekly Japanese candlesticks for Bitcoin dominance

3) What is the target price for ETH/USD, based on the findings of technical analysis of the financial markets?

The ETH/USD rate has proposed a firm rebound on its 200-week moving averages, which are reinforcing the lower part of a chartist support pattern at 1500/2000 US dollars. As a result, the ETH/USD rate should be able to trend towards the upper part of the technical configuration, supported by inflows into US spot ETH ETFs. This corresponds to resistance at US$4,000.

The chart below shows weekly Japanese candlesticks for ETH/USD, with a bullish trend above the 200-week simple and exponential moving averages

DISCLAIMER:

This content is intended for individuals who are familiar with financial markets and instruments and is for information purposes only. The presented idea (including market commentary, market data and observations) is not a work product of any research department of Swissquote or its affiliates. This material is intended to highlight market action and does not constitute investment, legal or tax advice. If you are a retail investor or lack experience in trading complex financial products, it is advisable to seek professional advice from licensed advisor before making any financial decisions.

This content is not intended to manipulate the market or encourage any specific financial behavior.

Swissquote makes no representation or warranty as to the quality, completeness, accuracy, comprehensiveness or non-infringement of such content. The views expressed are those of the consultant and are provided for educational purposes only. Any information provided relating to a product or market should not be construed as recommending an investment strategy or transaction. Past performance is not a guarantee of future results.

Swissquote and its employees and representatives shall in no event be held liable for any damages or losses arising directly or indirectly from decisions made on the basis of this content.

The use of any third-party brands or trademarks is for information only and does not imply endorsement by Swissquote, or that the trademark owner has authorised Swissquote to promote its products or services.

Swissquote is the marketing brand for the activities of Swissquote Bank Ltd (Switzerland) regulated by FINMA, Swissquote Capital Markets Limited regulated by CySEC (Cyprus), Swissquote Bank Europe SA (Luxembourg) regulated by the CSSF, Swissquote Ltd (UK) regulated by the FCA, Swissquote Financial Services (Malta) Ltd regulated by the Malta Financial Services Authority, Swissquote MEA Ltd. (UAE) regulated by the Dubai Financial Services Authority, Swissquote Pte Ltd (Singapore) regulated by the Monetary Authority of Singapore, Swissquote Asia Limited (Hong Kong) licensed by the Hong Kong Securities and Futures Commission (SFC) and Swissquote South Africa (Pty) Ltd supervised by the FSCA.

Products and services of Swissquote are only intended for those permitted to receive them under local law.

All investments carry a degree of risk. The risk of loss in trading or holding financial instruments can be substantial. The value of financial instruments, including but not limited to stocks, bonds, cryptocurrencies, and other assets, can fluctuate both upwards and downwards. There is a significant risk of financial loss when buying, selling, holding, staking, or investing in these instruments. SQBE makes no recommendations regarding any specific investment, transaction, or the use of any particular investment strategy.

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. The vast majority of retail client accounts suffer capital losses when trading in CFDs. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Digital Assets are unregulated in most countries and consumer protection rules may not apply. As highly volatile speculative investments, Digital Assets are not suitable for investors without a high-risk tolerance. Make sure you understand each Digital Asset before you trade.

Cryptocurrencies are not considered legal tender in some jurisdictions and are subject to regulatory uncertainties.

The use of Internet-based systems can involve high risks, including, but not limited to, fraud, cyber-attacks, network and communication failures, as well as identity theft and phishing attacks related to crypto-assets.

ETH/BTC Reclaiming Macro Bottom — Altcoin Momentum Incoming?ETH/BTC tagged its 2019 cycle low back in April 2025 — a key macro support level that’s held up for nearly six years. Since then, it’s printed a clean rebound followed by a textbook retest. Now it's threatening to break out of the pullback structure formed over the past few months. If this breakout plays out, ETH could lead the charge for altcoins, signaling the early stages of an altcoin rotation.

ETH/BTC AT 200 MA RESISTANCEQuick update on ETH/BTC. As discussed, ETH is finding strong resistance at the daily 200 MA, riding it down for 5 days. On the ETH/USD chart, the 50 and 200 MAs are in the rearview. A break above the 200 MA on the daily chart vs. BTC could signal a major move in altcoins.

Time to Eth BitcoinIn advance, Ethereum would like a second plate of Bitcoins this cycle please because despite what you may have heard, there is a new Sheriff in town equipped with "smart contracts" and Ethereum is the name. While Bitcoin was paving the way, Ethereum was at home building a vehicle for the pavement. Ethereum's "smart contracts" will be a big deal in the new world and so will many other crypto currencies. Stay Tuned!

Wajani Investments: ETHBTC Analysis

ETHBTC has formed a bullish flag (rectangle) which signifies trend continuation. Aside from that, there’s a bullish wedge still supporting a move to the upside. This analysis shows we would have a Leg2 move like Leg1 and even higher. This is a good trade with a 1:3 risk.

Remember, trading always carries risks, and this is for EDUCATIONAL PURPOSES only.

Let me know your views.