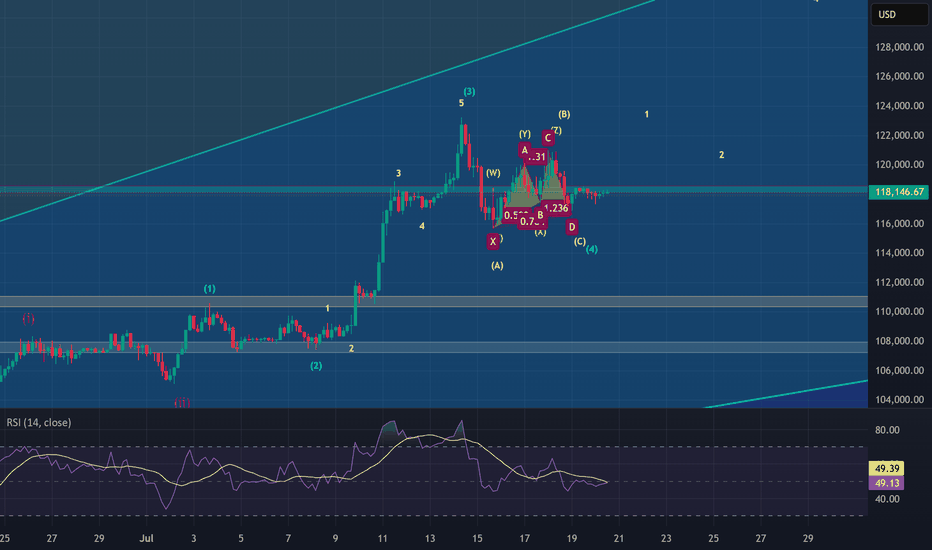

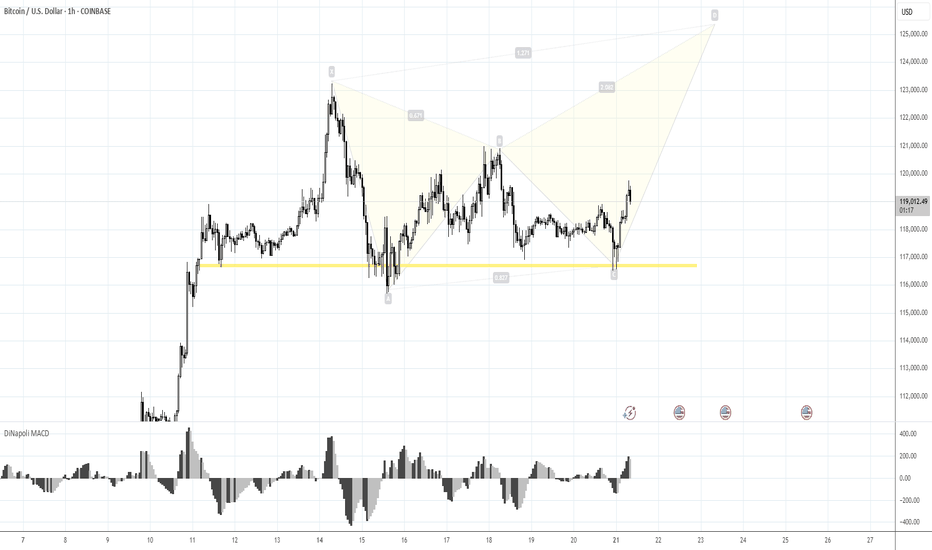

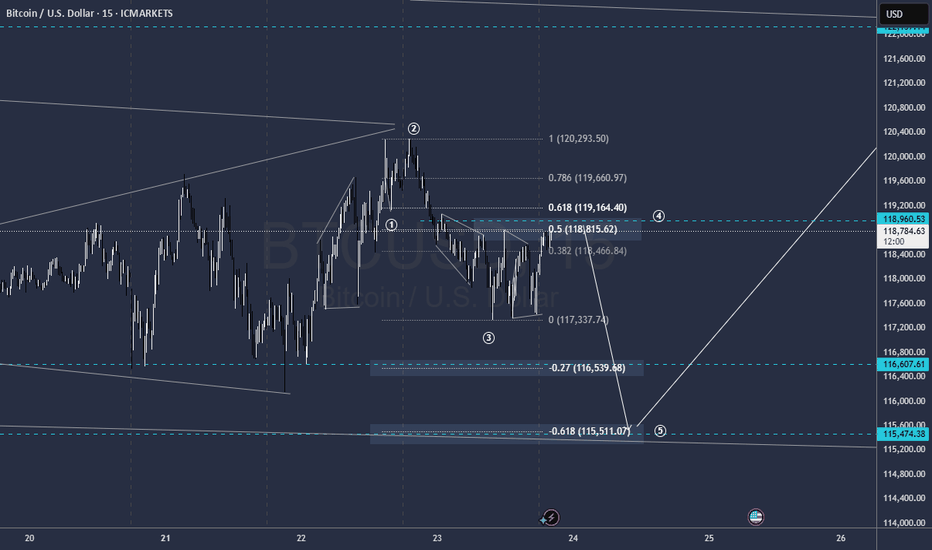

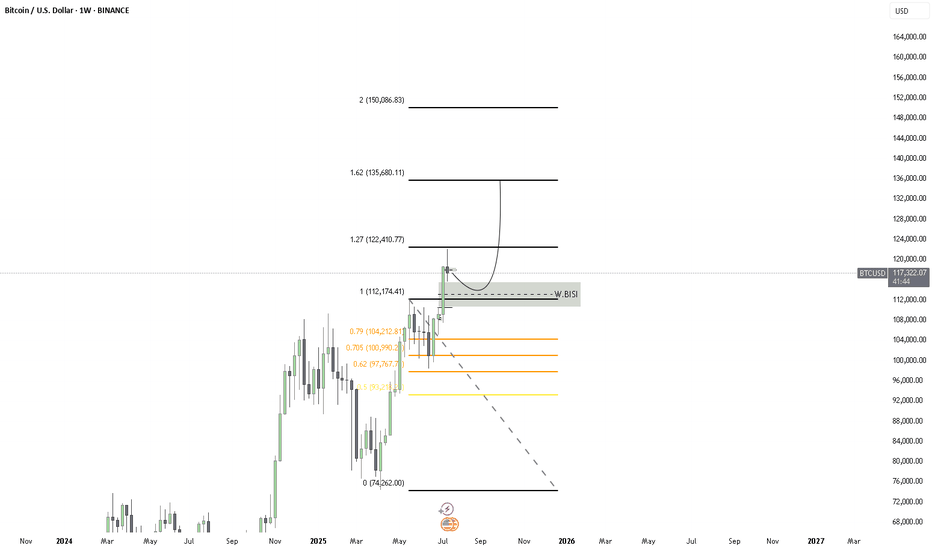

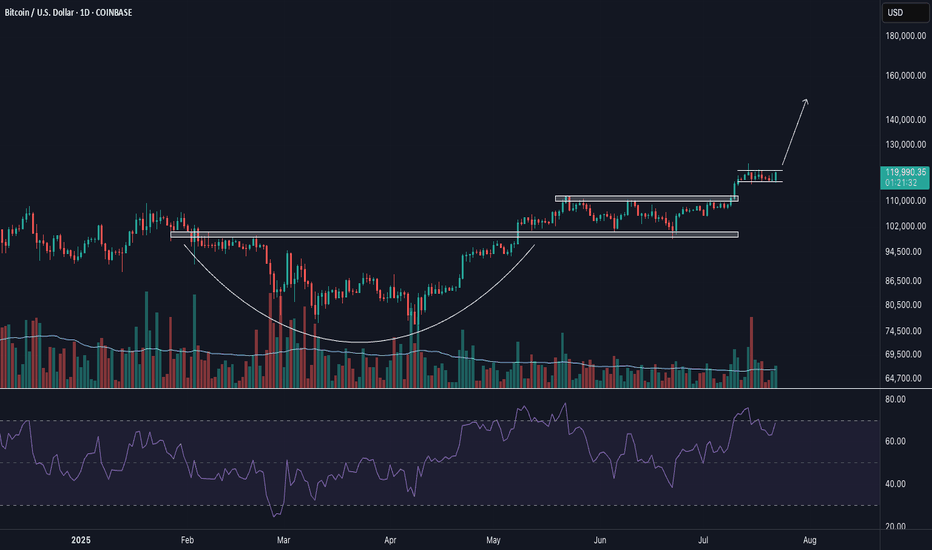

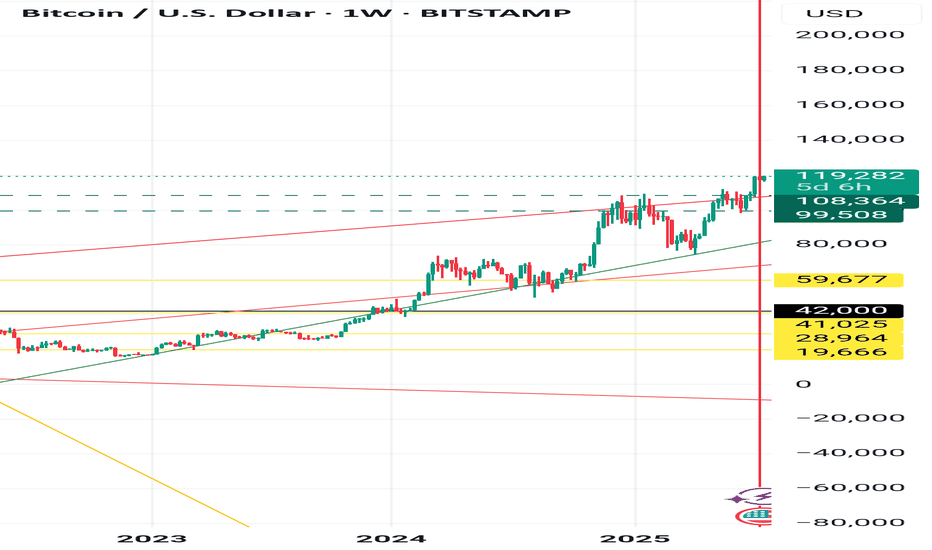

BTC Ready for the new impulse ? Elliott wave analysis 20/7/2025In my view, Bitcoin (BTC) has completed its micro correction and is now poised to move toward the $135,000–$139,000 target zone. This expectation is supported by the following factors:

1. Completion of the Sub-Waves in Wave (4)

My analysis of wave (4) indicates that it consists of an ABC correction, where wave B formed a WXYXZ pattern.

Additionally, I have counted the sub-waves within wave C of wave (4) and observed a complete 5-wave structure, suggesting that the fifth wave of wave C has ended, confirming the completion of wave (4).

2. Cypher Harmonic Pattern Pivot Point

I have identified a Cypher harmonic pattern with a pivot point around $116,600.

The termination of wave (4) occurred close to this pivot level, followed by a new impulsive move that made a higher high and formed a clear 5-wave structure—further confirming that wave (4) has likely ended.

3. Hidden Bullish Divergence on the 4-Hour Timeframe

A hidden bullish divergence can be observed on the 4-hour chart, particularly at the end of wave (a) and wave (c).

Historically, 4-hour hidden bullish divergences have often preceded strong bullish impulses. For instance, a similar setup occurred during the bullish rally from April 9, 2025, to May 22, 2025.

4. Failure to Make a New Low After Resistance Retest

The new impulse wave that emerged after the end of wave (4) has met resistance but failed to make a new low, suggesting that a fresh upward impulse is underway.

How Far Could Wave (5) Extend?

It is important to note that the wave (5) (blue) impulse is a sub-wave of wave (5) (purple).

The lengths of wave (3) (purple) and wave (5) (purple) are currently similar, which is unlikely because both are part of the major wave V (green), where typically only one wave should extend.

Since wave (3) has already completed, wave (5) is likely to be the extended wave, with a target length between 1.272 and 1.618 times the length of wave (3).

Interestingly, two Gann fan projections point to resistance levels in the $135,000–$139,000 range, which perfectly aligns with this 1.272–1.618 extension zone.

Invalidation Point

The invalidation level is around $117,000, as the micro correction within the new impulse should not drop this low.

If BTC falls below $117,000, it could imply that wave (4) has not yet completed and may be taking another corrective form.

For example, the wave (c) we currently see might only be wave 1 of a larger wave (c), or the correction in wave (b) may still be ongoing.

However, this scenario seems unlikely given the weight of evidence suggesting that wave (4) has already ended.

BTCUSD.P trade ideas

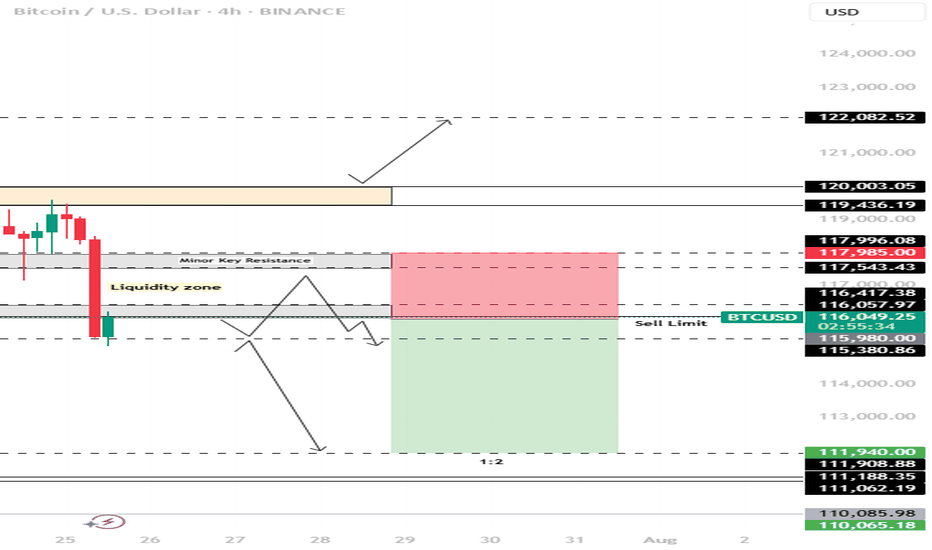

BTC/USD – 4H Technical and Fundamental AnalysisBTC/USD – 4H Technical and Fundamental Analysis

BTC/USD saw sharp downside pressure today, driven by a wave of long position liquidations—exceeding $800 million across the crypto market in the past 24 hours. The sudden shift triggered panic selling, dragging Bitcoin below its psychological and technical support near $116,000. Broader crypto market sentiment turned risk-off as large investors reduced exposure, accelerating the sell-off.

Fundamentally, the market remains cautious amid a lack of positive macroeconomic catalysts for risk assets. Speculation about stricter U.S. regulatory oversight and declining inflows into crypto ETFs also dampened sentiment. Combined with hawkish remarks from Fed officials, which keep interest rates elevated, appetite for high-risk assets like Bitcoin weakened further.

From a technical perspective, BTC/USD broke below the major support level of $116,000, confirming bearish pressure. This breakdown followed a period of consolidation, with price failing to maintain bullish momentum. A liquidity hunt appears to be underway, with price revisiting the zone to trap breakout traders before resuming its move.

We are now watching for a confirmed 4H candle close below the liquidity zone. Once confirmed, a short setup is validated, with targets aligned with the next key support zone.

📍 Sell Setup

Entry: Sell Limit at 115,980.00

Stop Loss: 117,985.00

Take Profit: 111,940.00

📌 Disclaimer:

This is not financial advice. Always wait for proper confirmation before executing trades. Manage risk wisely and trade what you see—not what you feel.

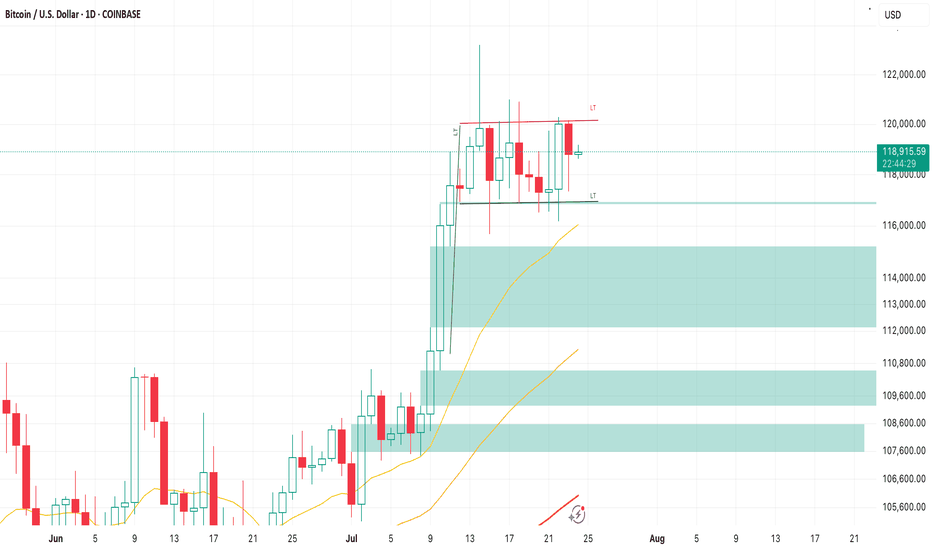

BITCOIN BTC/USD PULLBACK STARTED BACK TO BUYZONE?Hey Traders so today looking at Bitcoin showing a strong Uptrend since April this year. Now showing more bullish momentum after a break above the narrow sideways channel at 112,000. Breakouts normally get retested. Also the best place to buy imo is right at the trend line.

The way I like to trade it is don't chase the market let it come to you. It takes patience but you will always get the best price for your trade if you are willing to wait. However some might disagree with this strategy and say you may miss the move because the market doesn't come back.

I say Who Cares if the market comes back or if it keeps rallying! 🤣

There is always another train at the station (anotherwords there are always other trading opportunities so if we miss one big deal we will another one. Most importantly we will find another one with the best price!

Anyway enough of my rant so if your bullish watch for that pullack to around 112,00-113,000 and put a stop loss below support at 107,500. It looks like a safe level not to get stopped out at.

However if Bearish wait for close below support at 107,500 before considering to sell a rally imo.

Good Luck & Always use Risk Management!

(Just in we are wrong in our analysis most experts recommend never to risk more than 2% of your account equity on any given trade.)

Hope This Helps Your Trading 😃

Clifford

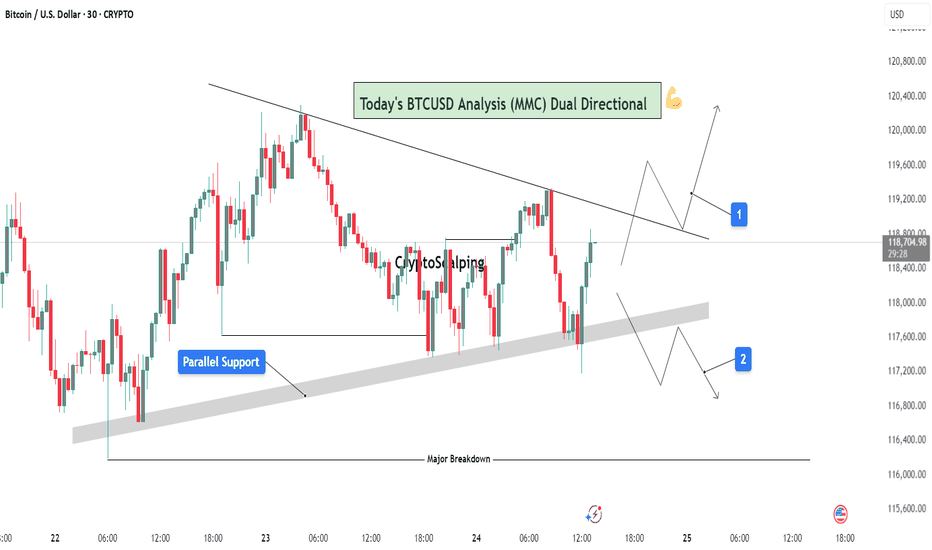

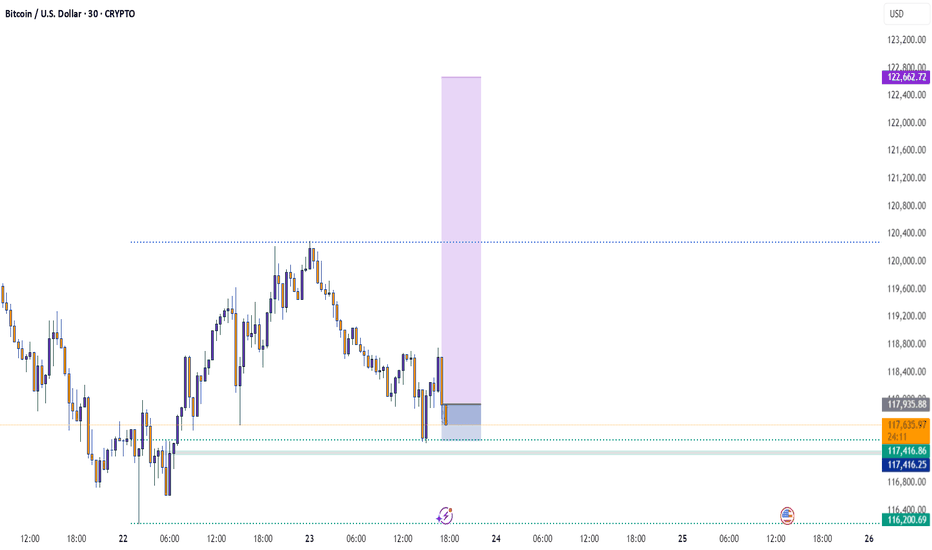

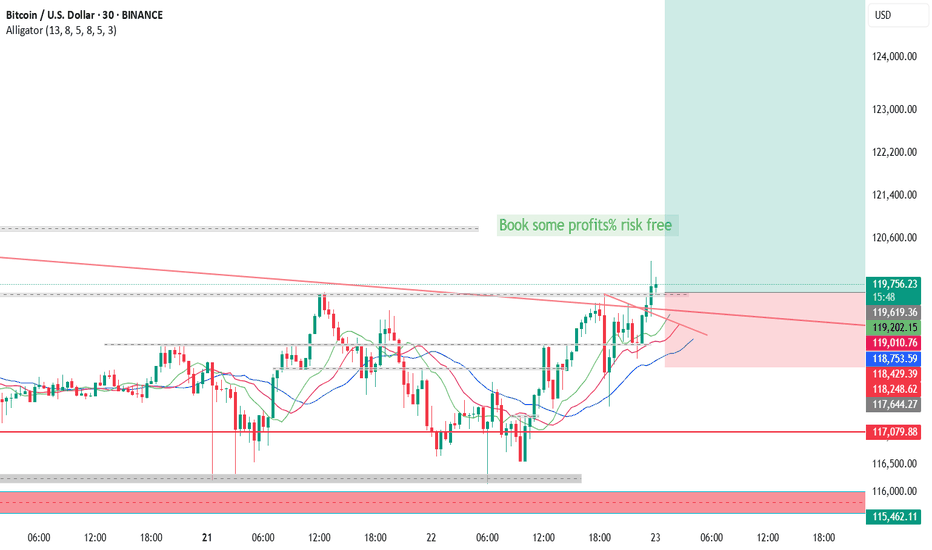

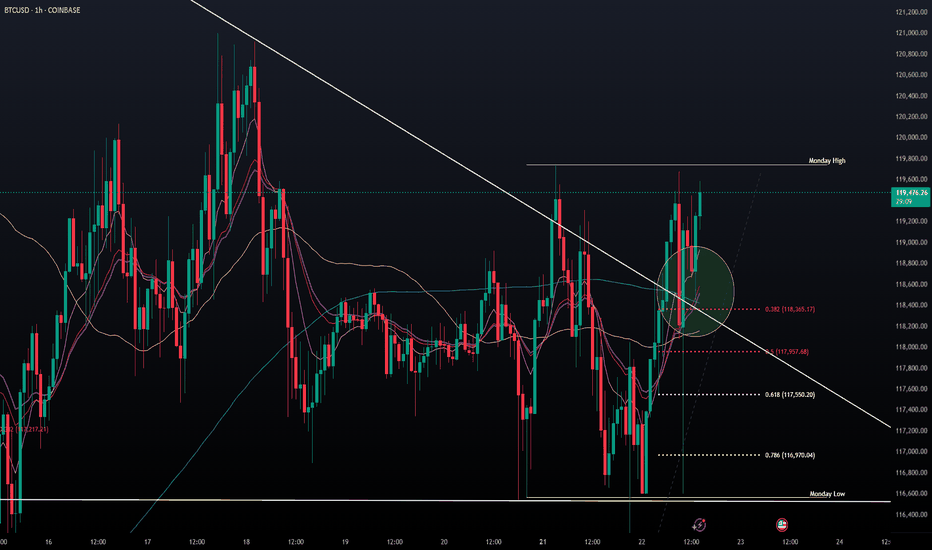

BTCUSD Analysis (MMC) : Dual Directional Outlook let's See🔍 1. Overview of Structure & Context:

On the 30-minute timeframe, BTCUSD is consolidating between two strong technical zones:

A descending trendline acting as resistance

A parallel rising support forming a compression zone

This wedge-like formation signals a potential high-impact move in either direction — a dual-directional outlook. Price is currently testing the midpoint between resistance and support, offering two reactive trade scenarios.

🟦 2. Key Zones Highlighted on Chart:

🔹 A. Parallel Support Zone (Dynamic Support):

A grey-shaded rising support has been tested multiple times.

Each bounce suggests buying strength near this diagonal zone.

This zone represents smart money accumulation potential under MMC concepts.

As price approaches this zone again, bulls are expected to step in if momentum aligns.

🔹 B. Descending Resistance Line (Supply Line):

The market is facing lower highs, a sign of bearish control at higher levels.

Each retest of this line has led to a rejection.

This line also acts as a liquidity magnet — price may spike above it to trap buyers before dropping (false breakout potential).

🧭 3. Scenarios and Trade Possibilities (Dual Directional Path):

✅ Scenario 1: Bullish Breakout – (Marked as Path 1)

If BTC breaks above the descending trendline with strong bullish volume, this confirms a structural breakout.

This setup targets:

First level: $119,600

Second level: $120,200

Once broken, the trendline can flip into support.

Ideal confirmation:

Bullish engulfing candle on breakout

Retest of broken resistance turning into support

Volume surge or momentum indicators turning bullish

⚠️ Scenario 2: Bearish Rejection & Breakdown – (Marked as Path 2)

If BTC fails to break resistance and breaks below the parallel support zone, it opens a bearish scenario.

Price may fall back to:

First level: $117,200

Final key support: $116,400 (Major Breakdown Zone)

This is a typical MMC-style mirror move: a structure break leading to liquidity run toward a previous demand zone.

Bearish confirmation:

Close below grey zone

Lower high formation near resistance

Increasing bearish volume / weak bounce

📐 4. Strategy & Trading Tips (MMC Application):

Under the Mirror Market Concepts (MMC), these zones are not just technical levels — they represent emotional price memory of both institutional and retail players.

Wait for the reaction, not prediction.

Use confluence tools (RSI divergence, volume, candle patterns).

Avoid trading inside the wedge — it's a trap zone.

Ideal entries are at breakout with retest confirmation or rejection from major zones.

📊 Risk Management Plan:

Entry Type Trigger Level SL Suggestion TP Range

Long Trade Break & retest above $118.8K Below $118.2K $119.6K → $120.2K

Short Trade Breakdown below $117.8K Above $118.2K $117.2K → $116.4K

🧠 Conclusion:

BTC is in a decision-making zone between a downward pressure line and strong support. A breakout could lead to a clean trend continuation, while a breakdown would trigger bearish momentum. The chart reflects precision MMC logic, offering a tactical map for day traders and scalpers to follow the smart money — not the noise.

Let the market decide direction. We just need to be prepared, not predictive.

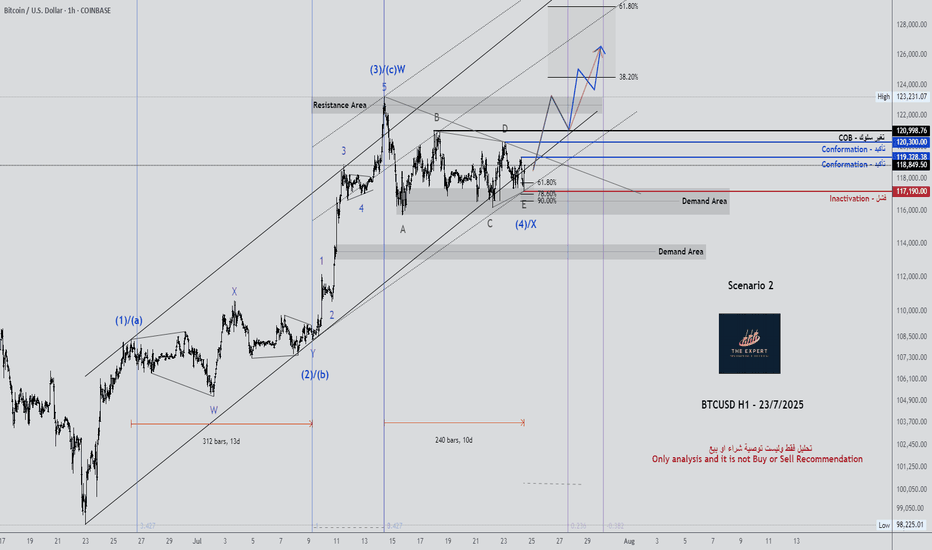

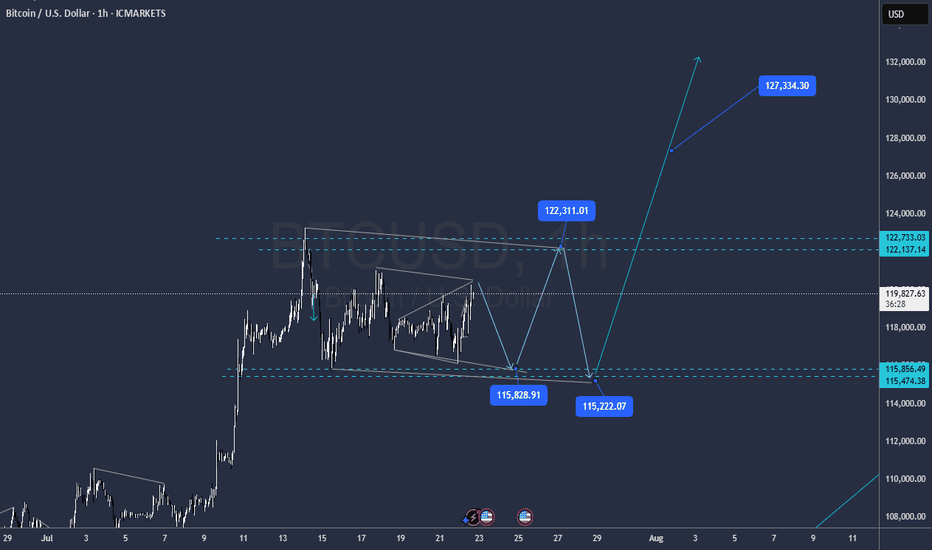

Risk 116. Target 123-125KMorning folks,

Prior 1H H&S was done, we were watching on 120K resistance area, as we said last time. Now, on 1H chart H&S is showing signs of failure - too extended right arm, no downside breakout. Price is taking the shape of triangle . All these signs are bullish. Because butterflies very often appear on a ruins of H&S, we suggest that this one could be formed here...

The risk level for this scenario is 116K lows - BTC has to stay above it to keep butterfly (and triangle) valid, otherwise, deeper retracement to 112K area could start.

Upside target starts from 123K top and up to 125K butterfly target.

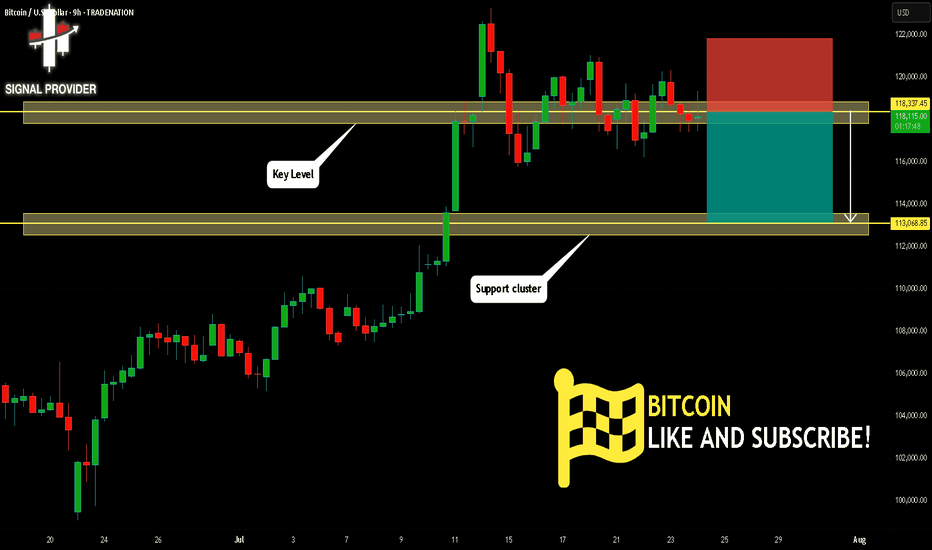

BITCOIN Will Fall! Short!

Take a look at our analysis for BITCOIN.

Time Frame: 9h

Current Trend: Bearish

Sentiment: Overbought (based on 7-period RSI)

Forecast: Bearish

The market is approaching a key horizontal level 118,337.45.

Considering the today's price action, probabilities will be high to see a movement to 113,068.85.

P.S

We determine oversold/overbought condition with RSI indicator.

When it drops below 30 - the market is considered to be oversold.

When it bounces above 70 - the market is considered to be overbought.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

Like and subscribe and comment my ideas if you enjoy them!

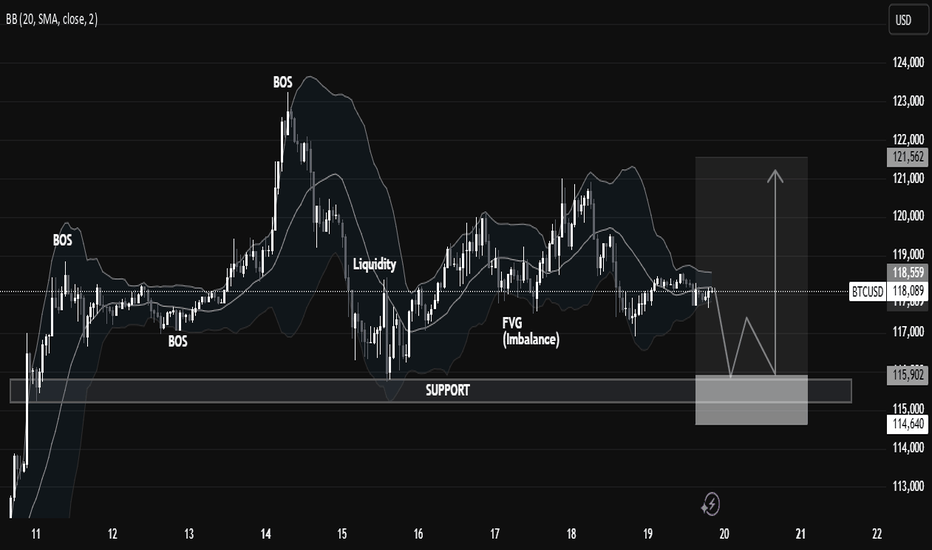

BTCUSD Technical Analysis | Smart Money Concept (SMC) BreakdownBTCUSD Technical Analysis | Smart Money Concept (SMC) Breakdown

🧠 Smart Money Market Structure Insight

📌 Key Elements Identified:

BOS (Break of Structure): Multiple BOS points indicate bullish intent early on. However, the latest BOS on July 14 followed by a significant drop signals a shift in momentum—possibly a distribution phase.

Liquidity Sweep: Price swept prior equal lows/liquidity before reversing, a typical Smart Money trap setup.

FVG (Fair Value Gap) / Imbalance: Identified around the mid-section of the chart—price filled partially but failed to hold, suggesting internal weakness.

Strong Support Zone (Demand Area): Marked between 115,000 - 114,640; this zone is anticipated to act as a springboard for bullish reversal.

📉 Current Price Action Observation:

BTCUSD is hovering around 118,152 - 118,560, moving sideways with lower highs indicating compression.

Price is projected to form a "W" pattern or double bottom in the shaded region.

Expected liquidity grab beneath 115,902 followed by potential bullish reaction targeting 121,562, as indicated by the white arrow.

🧩 Strategic Outlook & Potential Play:

🔻 Bearish Sweep First:

Market likely to sweep the support one more time, tapping into deeper liquidity pools between 115,000–114,640.

This is aligned with the concept of Smart Money hunting for retail stop-losses before reversing.

🔼 Bullish Recovery After Sweep:

Strong probability of bounce due to presence of:

Fair Value Gap (already tested),

Fresh demand zone,

Liquidity grab setup.

Projected Bullish Target: 121,562

Confirmation Needed: A strong bullish engulfing or BOS on lower timeframes near support.

🏷️ Conclusion:

This BTCUSD setup is a textbook Smart Money scenario: BOS ➝ Liquidity Grab ➝ FVG ➝ Reversal from Demand. Traders should wait for confirmation from the support region before entering long positions.

TheKing Cycles- Nothing can be perfect in Life or in Trading, but you can always brighten up your day.

- Remember "Cycles are Cycles"

- Everything is in graph

- You can follow bears, predicting 10 years of recession, but we are in a big recession and for a long time already.

- You can fall in the deep and predict the darkness.

- i like to see the sunshine in the morning and i will always radiate warmth.

- Follow Hope, and always believe in your own judgement.

- Be Bold and do the opposite of what commons peoples think.

Happy Tr4Ding !

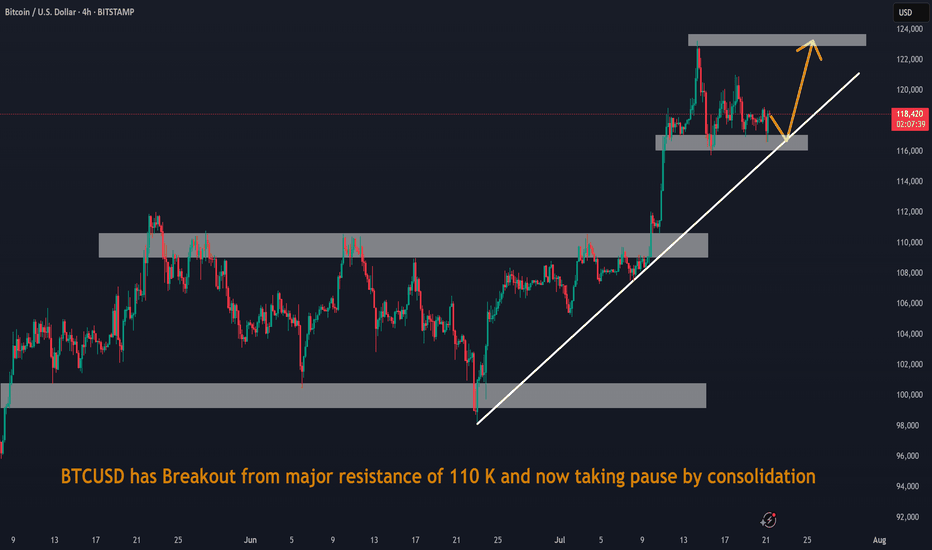

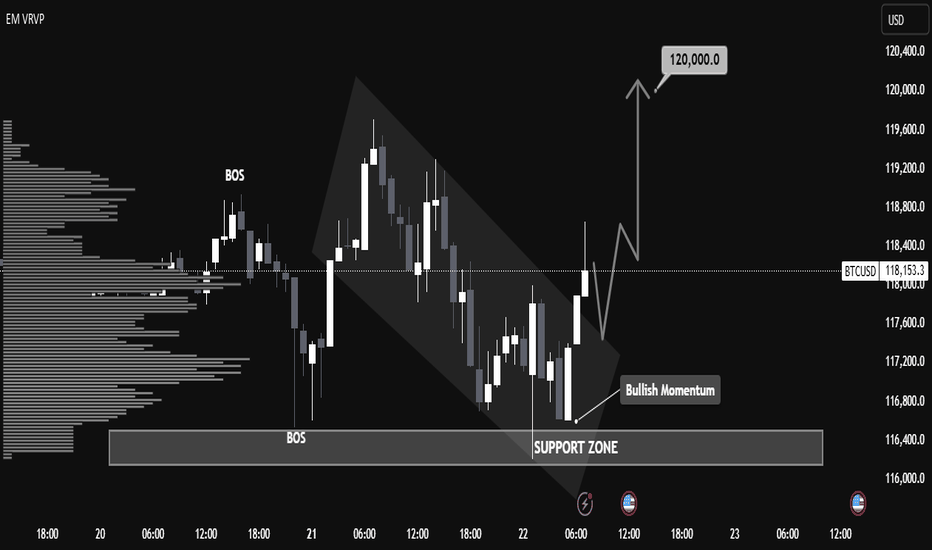

"BTC/USD Breakout Strategy: Identifying Bullish Momentum BTC/USD Technical Analysis – July 22, 2025

📈 Market Structure Overview:

The chart illustrates a recent Break of Structure (BOS) both to the upside and downside, indicating volatility and a shift in market sentiment. The price action formed a descending channel, followed by a breakout with strong bullish candles, suggesting a momentum reversal.

🧱 Support Zone (Demand Area):

Key Level: $116,400 – $116,900

This zone has acted as a strong demand level, with clear evidence of buying pressure pushing BTC higher after testing this area. The volume profile (VRVP) supports this, showing heightened trading activity at this price.

🔄 Bullish Breakout Confirmation:

A bullish breakout from the descending channel occurred just above the support zone, aligning with the label "Bullish Momentum".

The breakout candle has closed above minor resistance, which increases the probability of a trend reversal.

📍 Price Target:

The projection points toward $120,000, aligning with previous resistance and psychological round-number resistance.

This target is highlighted by an expected bullish leg after a possible retest of the breakout zone around $117,500 – $117,800.

🧭 Key Levels to Watch:

Support: $116,400 – $116,900

Retest Zone (Buy Opportunity): $117,500 – $117,800

Immediate Resistance: $118,400

Major Resistance / Target: $120,000

📊 Summary:

BTC/USD has shown a bullish reversal signal from a well-respected support zone after a descending correction phase. The current price structure, volume buildup, and breakout momentum suggest a high probability of continued upside movement toward the $120,000 mark. A successful retest of the breakout zone would provide a strategic entry for long positions with tight risk management.

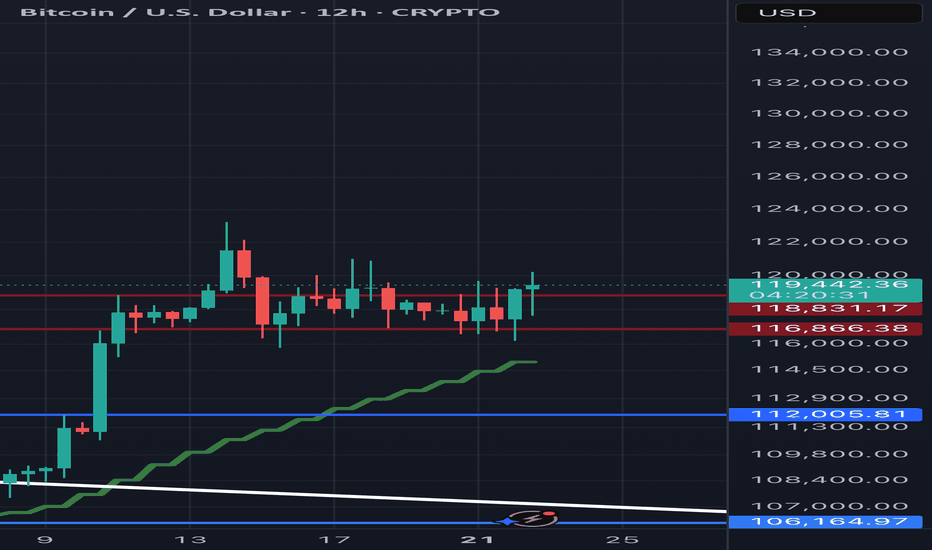

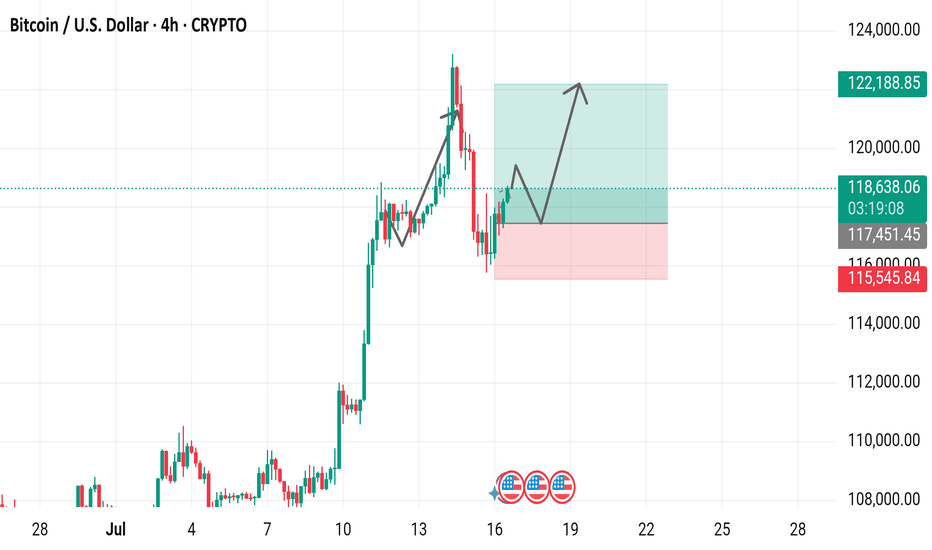

Btcusd:Huge trading opportunities and ideasBTCUSD's rebound after touching the position near 116180 this time is fast. From the trend observation. BTCUSD is still in a high consolidation stage. It has not broken the oscillation range for the time being. It can maintain selling near 120k. Buying near 11600 for range trading. It is expected that there will not be many trading opportunities in the London market. It will take until the New York market opens to see better trading opportunities.

Bitcoin / U.S. Dollar 4-Hour Chart (July 2025)4-hour price movement of Bitcoin (BTC) against the U.S. Dollar (USD). The price has risen from 118,714.64 to 118,714.64 (+937.9 or +0.80%) over the period. Key levels include a support zone around 115,451.45 to 117,451.45 and a resistance zone near 120,000.00 to 122,188.85,