BTC #This is a 15-minute Bitcoin (BTC/USD) chart showingThis is a 15-minute Bitcoin (BTC/USD) chart showing a potential bullish breakout scenario. Price has broken above a key resistance zone (gray shaded area) and is forming a possible bullish continuation pattern (ABCD structure). The red projection indicates a bullish price target towards the 119,750–120,000 USD resistance area (blue line). Confirmation of breakout and sustained momentum above the gray zone would validate the bullish outlook.

thanking you

BTCUSD.P trade ideas

Confluence Timing: How Precise Geometry & Magnet Zones Forecast 🌀 Confluence Timing: How Precise Geometry & Magnet Zones Forecast Flushes & Breakouts

📅 Date: July 31, 2025

🔎 Symbol: BTCUSD

📈 Timeframes: 4h, 1D, 1W

🧠 Concept Overview

What if we could predict high-impact moves not by guessing direction — but by timing structural convergence?

In this article, we present a geometric confluence model for BTC, where the intersection of diagonal structures and median zones has shown a recurring pattern of magnetism — leading to flushes, rebounds, or volatile breaks.

---

🔍 The Setup: Current Structure (as of 118.3k USD)

We are inside a compression structure, with:

Descending triangle resistance (upper yellow line, near 119k–120k)

Rising base support (lower yellow diagonal, anchored from ~114.5k)

Volatility median created from historical channels (parallel projection)

EMA Compression (8/13/21) on the Daily, showing dynamic tightness (~1.9 %)

→ Intersection timing of these structures projected a confluence window within 6h, confirmed by price clustering near apex.

---

🧪 Historical Backtest (Past 3 Years)

We analyzed similar confluence points using the same logic (RSI intact, EMAs tight, price near diagonal apex):

Event Date Timeframe Structure Result Movement

Oct 2023 1D Falling wedge & EMA cross Rebound +6.3% in 24h

Jan 2024 4h Triangle tip near POC Flush –4.5% in 6h

Mar 2025 1D Channel + RSI divergence Breakout +8.1% in 2 days

🧾 Average move from apex reaction zone:

Up: +6.8 %

Down: –4.2 %

Reaction window: within 6–12h of intersection

---

📊 Indicators in Play

EMA Cluster Contraction: 8/13/21 are within 1.9 % on Daily — historically leads to move within 12–24h

RSI(14) Stable + Fast RSI Rebound: Supports bullish continuation

Volume has dropped pre-break, classic behavior before resolution

Heatmap above shows major absorption at 119.0–119.4k

---

📌 Forecast Expectation

⏳ Timing: Apex cross within 6h

📈 If breakout: Target 122.8k → 124.4k → projected 127.6k

📉 If fakeout or flush: Bounce likely near 116.3k → watch for reclaim

📉 Short-term bear warning: Only if RSI breaks below 50 and EMAs get crossed to downside with volume spike.

---

📍 Actionable Notes

Long bias remains valid as long as structure holds and RSI remains above midline

A flush below 117.2k could trigger short-term breakdown, but buy-the-dip zones are active at 116.3k

Next major long opportunity: If price reclaims post-flush zone or breaks out above 119.8k with confirmation

Confluence model now active: future alerts will warn 4–6h before similar apex intersections

---

🧭 Conclusion

This is not just pattern trading. It’s time-sensitive geometry-based confluence tracking, with proven historical accuracy and structural logic.

$BTCUSD, rally into rate cuts?BITSTAMP:BTCUSD has been coiling for some time now in a right angled descending broadening wedge.

A measured move of this cone so far would place BTC at right around ~$100k.

This aligns well with historical performance of BTC heading into a cutting cycle. If we rally into September and have a selloff following the cuts (sell the news), I wouldn't be shocked. This is a pattern that has happened in multiple years of the previous QE/QT Cycle (2016/2017, 2019/2020).

The real fireworks will be in 2025 if things go according to the FED's schedule

Bitcoin - Structural Ascendancy under Silent Momentum.⊣

⟁ BTC/USD - BINANCE - (CHART: 1D) - (Jul 29, 2025).

◇ Analysis Price: $118,996.40.

⊣

⨀ I. Temporal Axis - Strategic Interval - (1D):

▦ EMA9 - (Exponential Moving Average 9) - ($118,352.22):

∴ This short-term exponential blade reflects immediate price sensitivity, showing reactive balance across recent closes;

∴ Price currently floats above this threshold, indicating micro-support for the bulls - a soft floor in the fog of uncertainty;

∴ The EMA9 line curves gently upward, though not sharply - signaling lingering momentum, but without fury.

✴️ Conclusion: EMA9 acts as a dynamic support amid deceleration; a watchful line between calm consolidation and renewed ascent.

⊢

▦ EMA21 - (Exponential Moving Average 21) - ($116,729.10):

∴ This mid-range trend beacon provides clearer directional context - its upward slope holds the spell of continuity;

∴ Price rests safely above this median force, confirming bullish alignment;

∴ However, the arc begins to curve with less conviction, a signal that the current push is softening.

✴️ Conclusion: EMA21 maintains bullish structure but foretells potential slowing; if momentum dims further, this level may serve as magnet for retracement.

⊢

▦ EMA50 - (Exponential Moving Average 50) - ($112,511.79):

∴ The long-arm average projects the memory of the trend - the deep root under the recent canopy;

∴ Price is far above this line, a sign of strong prior conviction from bulls;

∴ Its firm inclination remains intact, yet price distance signals risk of gravitational return should upper momentum fracture.

✴️ Conclusion: EMA50 preserves bullish foundation, but may become a zone of rebalancing if the rally loses vitality.

⊢

▦ BB (21) - (Bollinger Bands + SMA21) - ($117,764.35):

∴ The Bands, ever sensitive to volatility’s breath, expand wide - a sign of elevated tension and price exploration;

∴ Price nears the upper band ($121,401.48), a common altar for speculative saturation and potential rejections;

∴ The median band (SMA) acts as equilibrium, now beneath the price - suggesting deviation from balance.

✴️ Conclusion: BB21 signals a volatile climax zone; price at the upper band often faces a verdict - continuation by force, or descent by default.

⊢

▦ Volume + MA21 - (Last - 148 vs Average - 363):

∴ Volume flows now with diminished voice - the current bar echoes only 148 units against a historical pulse of 363;

∴ Such silence beneath a rising price may betray a hollow rally - or a pause before engagement;

∴ Absence of participation often precedes reversal or sudden liquidity spikes.

✴️ Conclusion: Subdued volume undermines the bullish signal - lack of validation breeds caution in forward projection.

⊢

▦ RSI - (Relative Strength Index 21) - (61.41):

∴ RSI remains in neutral-high territory, not overbought, but clearly tilted toward bullish control;

∴ Momentum persists but shows signs of plateau - recent movement flattens after steady ascent;

∴ Without new strength, RSI may drift toward the median.

✴️ Conclusion: RSI shows bullish favor, but the fire beneath the trend cools; next candles will determine if it's pause or fade.

⊢

▦ MACD - (9, 21) - (Histogram: –455.70):

∴ MACD line at 2,078.82 vs Signal line at 1,623.12 suggests bullish dominance in structure;

∴ Yet the negative histogram tells a story of fading acceleration - as if the charge slows though direction holds;

∴ This divergence signals decay beneath strength, an omen of indecision.

✴️ Conclusion: MACD is structurally bullish, but its weakening impulse demands attention - the momentum candle dims.

⊢

▦ StochRSI - (3, 3, 21, 9) - (%K: 20.46 / %D: 23.93):

∴ The indicator rests near the lower bounds (sub-25) - a territory of emotional exhaustion and tactical reversion;

∴ A cross upward from these levels often ignites short-term rally pulses;

∴ No confirmed crossover yet - but proximity speaks of potential awakening.

✴️ Conclusion: StochRSI breathes in the lowlands, poised to reverse if kinetic force is summoned.

⊢

▦ OBV - (On Balance Volume) - (102.17M):

∴ The OBV remains elevated, suggesting previous bullish runs were volume-supported, not hollow;

∴ However, flatness in recent OBV progression warns that fresh volume is not accompanying the current price hold;

∴ It whispers of consolidation, or worse - divergence.

✴️ Conclusion: OBV confirms the history of strength, but offers no new blood to feed the advance.

⊢

🜎 Strategic Insight - Technical Oracle:

∴ The battlefield holds its shape - the banners of bullish trend still wave, upheld by structural support from EMA's and historical OBV flow. But the wind... it stills.

∴ Volume fades, momentum indicators lose their incline, and oscillators rest on edges. This is a moment of price levitation - elevated without lift. The form remains, but the force hesitates.

∴ The Arcane Pattern whispers:

Should volume return and MACD reignite, $121K may be pierced with clarity;

If silence deepens, however, the bands will contract, and price may descend toward EMA21 or even test EMA50.

∴ The Vortex of Pause has formed. From here, either ignition... or gravity.

⊢

𓂀 Stoic-Structural Interpretation:

▦ Structurally Bullish - Strategically Cautious:

∴ Price remains securely above all major (EMA's 9/21/50) on the daily chart, preserving directional integrity;

∴ Bollinger Bands expanded near upper thresholds, signaling climax zone - yet not rupture;

∴ Momentum indicators (MACD, RSI) maintain bullish structure, but histogram weakness and RSI flattening warn of interior softening;

∴ Stoch RSI in low-band suggests reversal potential, but has yet to trigger.

✴️ Conclusion: Market structure supports continuation, but momentum exhaustion and low volume raise caution flags. Bulls hold the field - but must call the wind.

⊢

▦ Tactical Range Outlook:

∴ Upper Limit: $122,054 - Fibonacci 1.0 and previous cycle top;

∴ Short-Term Support: $118,352 - EMA9 + 0.618 Fib confluence;

∴ Median Guard: $116,729 - EMA21 + 0.382 Fib;

∴ Sacred Support: $112,511 - EMA50 base + structural floor;

∴ Final Bastion: $103,971 - 0.236 Fib retrace (macro turn pivot).

✴️ Conclusion: Bullish path remains sealed while price resides above EMA50 and above $103K. Breach of that zone could awaken deeper volatility structures.

⊢

◩ Codicillus Silentii - Strategic Note:

∴ Price stands at the edge of Fibonacci climax, just below the mythic $122K - a known threshold of reaction;

∴ Volume whispers, not commands - the force of momentum now rests on belief, not confirmation;

∴ The convergence of structure without influx invites caution. This is the realm not of action, but of observation.

✴️ Final Seal: Beware the illusion of calm. A structure may stand in silence, but silence precedes collapse as often as continuation. The Sacred Frame is intact - but shall remain sacred only through vigilance.

⊢

⧉

· Cryptorvm Dominvs · MAGISTER ARCANVM · Vox Primordialis ·

⚜️ ⌬ - Silence precedes the next force. Structure is sacred - ⌬ ⚜️

⧉

⊢

Bitcoin is in a coma.I see a larger range where Bitcoin is showing compression and indecision.

Whenever it breaks out of this compression, if it breaks to the upside, the first target would be the top of the channel, with hopes of a channel breakout.

If it breaks to the downside, the first target would be the bottom of the channel, with hopes of a breakdown.

In either case, we only enter with a confirmed trigger.

BTCUSDT BUYING AND SELLING SETUP !🔻 SELLING ZONE: 119,817 – 120,215

🔴 VERY STRONG SELLING ZONE: 120,700 – 121,122

🟢 BUYING ZONE: 115,823 – 116,392

✅ VERY STRONG BUYING ZONE (Buy Limit): 109,221

Watch these zones closely for potential entries. Wait for confirmation before executing trades and always follow proper risk management.

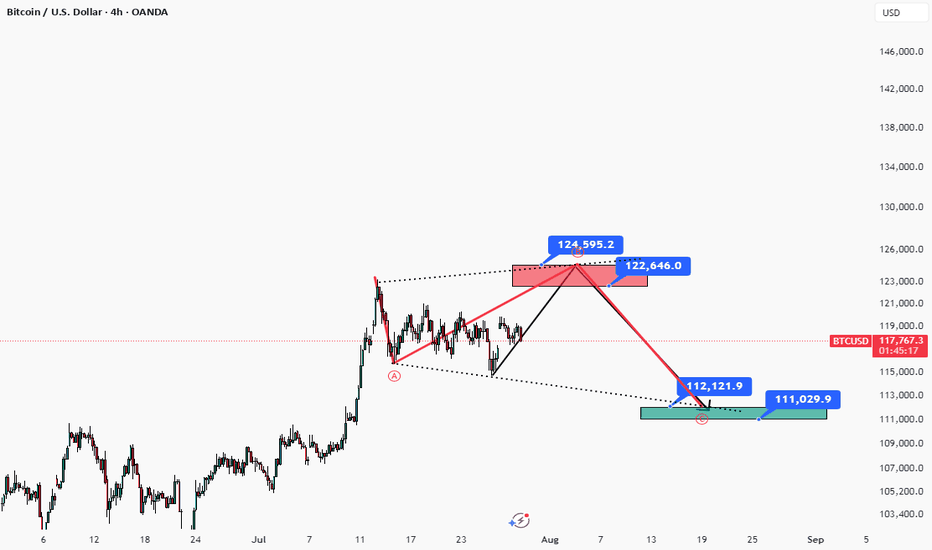

BTCUSD Analysis : Blue Ray + MMC Bullish Scenario + Target Zone🟢 Today’s BTCUSD Analysis (MMC) – Strategic Insight into Institutional Behavior 💪

📊 Chart Breakdown: Understanding Price Through MMC

This 4H BTCUSD chart highlights critical behavior using Mirror Market Concepts (MMC) — where smart money traps, fakes, and flips market participants to create directional moves. Let’s break down the scenario:

🔸 1. Fakeout Zone – Smart Money Trap

Price initially surged to a local high, triggering a bullish fakeout, as shown in the green rectangle.

This move is designed to lure in breakout buyers above resistance, only to reverse sharply.

The sudden drop confirms smart money liquidation, catching retail longs off-guard.

A perfect example of a liquidity grab before shifting back into range.

📌 Fakeouts often mark the beginning of a new range or reversal setup in MMC methodology.

🔸 2. Blue Ray – Trend Continuation Structure

The consolidation after the fakeout forms the Blue Ray pattern, a recognizable trend continuation framework.

This structure signals smart money’s accumulation or re-accumulation phase.

Note how the price oscillates within the pattern, creating both lower highs and higher lows.

These compressions usually lead to explosive moves, either up or down, depending on liquidity build-up.

🔸 3. QFL – Quantity Following Line Event

Price briefly dips below the QFL level — another engineered stop-hunt to shake out premature longs and trap breakout sellers.

The reaction afterward shows strong buyer defense, confirming hidden demand.

MMC traders recognize this zone as a fake breakdown, setting up for the next trend wave.

🔸 4. Central Reversal Zone – The Decision Area

We’re currently hovering around the Central Reversal Zone, a key level of decision-making.

This is where liquidity from both buyers and sellers meets, making it a high-volatility zone.

Price could either:

(Scenario 1) Reject and fall lower to retest the trendline zone (marked with label 1).

(Scenario 2) Break above minor resistance and head toward the Next Reversal Zone (marked with label 2).

This structure aligns with MMC’s "Trap – Absorb – Break" cycle.

🔸 5. Major & Minor Resistance

Above the current price lies:

Minor Resistance (~$120,000): Immediate zone to clear for bullish continuation.

Major Resistance (~$121,000): Strong institutional supply, could act as the final hurdle before reversal.

If price clears these, BTC will likely target the Next Reversal Zone (~$122,500–123,500) for the next MMC reaction or short-term top.

🧠 Strategic Trade Outlook (MMC Logic)

✅ Bullish Playbook (Scenario 2):

Entry: Break and retest above $120,000 (Minor Resistance)

Confirmation: Hold above Central Reversal Zone with impulse

Target: $122,500–123,500 (Next Reversal Zone)

Risk: Close below $117,500 invalidates idea

🔻 Bearish Playbook (Scenario 1):

Entry: Rejection from $119,500–120,000

Target: Trendline support or prior QFL (~$116,000–115,500)

Invalidation: Clean 4H close above $120,500

📐 Key Concepts in This Analysis

Fakeout Trap: Retail euphoria liquidation

QFL Sweep: Smart money’s liquidity grab below structure

Blue Ray: Compression structure before continuation

Reversal Zones: Institutional interest areas where reactions occur

SR Flip Zones: Level conversion confirms trend maturity

📈 Summary

BTCUSD is currently in a smart money-controlled environment, compressing near key structural levels. The next move will be large, and by applying MMC, we’re prepared for both bullish breakout and bearish retest scenarios.

Be patient — traps come before trends.

BTC #The chart shows Bitcoin (BTC/USD) on the 15-minute timeframThe chart shows Bitcoin (BTC/USD) on the 15-minute timeframe. Price is currently trading within an ascending channel after rebounding from a support zone around $117,200. It's approaching a key resistance area near $118,200, which aligns with the mid-channel line. A breakout above this resistance could signal bullish continuation, while rejection might lead to a retest of the lower trendline or support zone.

BTC USDBITFINEX:BTCUSD

This current four hour Ichi cloud will likely fail and we see some decent downside but there is always that chance we respect the cloud and finish heading towards 131k.

Looking at the daily/weekly tf's I'm assuming one more move higher before we sell off relatively soon within the weekly time frames narrative so within some months.

BTC's latest trading strategy and analysis layout#BTCUSD

BTC's current technical signals show a bull-bear tug-of-war situation.If a golden cross is formed near the zero axis, it may indicate a new wave of rise; if it falls below the zero axis, we need to be wary of a deep correction.

There are certain opportunities for both bulls and bears in the current market, but global regulatory policies have not yet been unified. Policies such as the US "GENIUS Act" may affect BTC and require continued attention. BTC is currently facing significant buying support around 117,500, but the hourly chart shows that there is still potential for a continued pullback. The current trend has not yet finished. Pay attention to the support level of 116,000 below. If it falls below, it may fall into the consolidation range of 116,000-114,000. For aggressive traders, consider going long at 117,500-116,500, with a target of 118,500-119,500. A break above this level could lead to 120,000.

🚀 117500-116500

🚀 118500-119500