BTC to $1,000,000 by End of 2025? 📈 BTC to $1,000,000 by End of 2025? Here's a Macro View No One’s Charting Yet

While most are targeting $100K–$250K, this model suggests $1M BTC is possible — briefly — before global markets adjust.

🔎 Why?

Post-halving supply crunch is just starting to kick in

Sovereign wealth funds may rotate out of gold quietly

AI-run financial systems could hard-code BTC as a digital reserve

Institutional ETF demand hasn’t peaked — it’s still forming a base

🧠 The Twist:

If Bitcoin hits $1M, it won’t be because of retail.

It’ll be because the global financial system is silently being rewritten.

At that level, BTC becomes the benchmark, not the outlier.

Not advice. Just the next layer deeper.

📊 Agree? Disagree? Let’s chart it.

#BTCUSD #Bitcoin #Crypto #LongTermView #MacroTrading #HalvingCycle #TradingView

L1NK 0N BI0

BTCUSD.P trade ideas

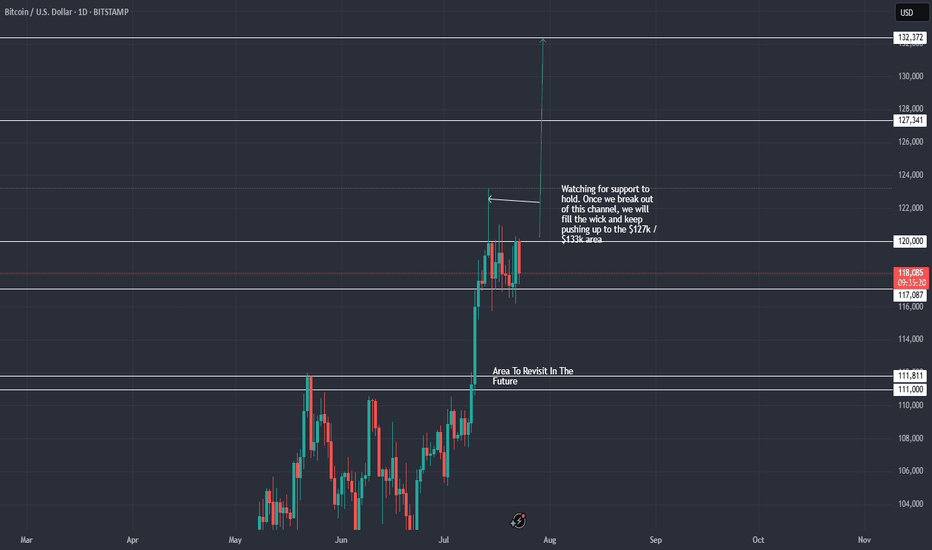

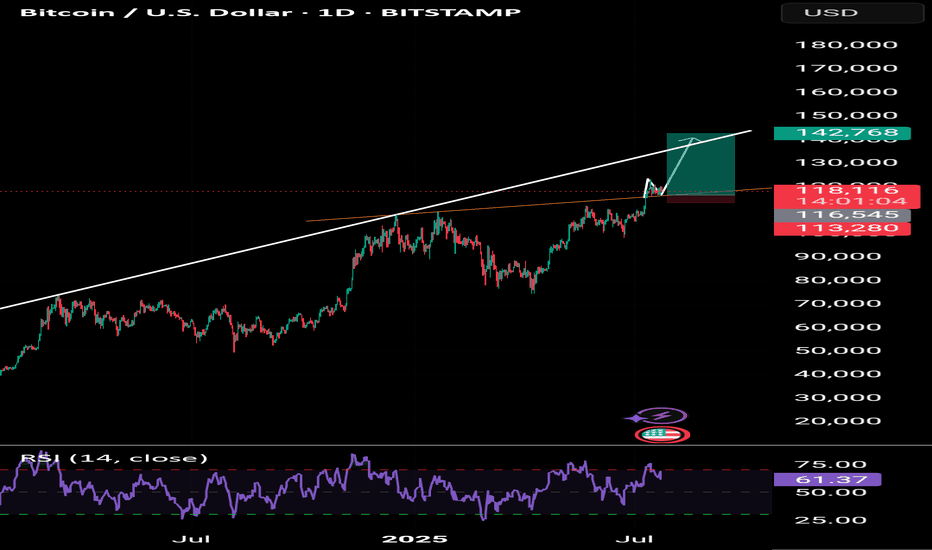

BTC / USD Daily ChartHello traders. Taking a look at the Daily on Bitcoin, I am watching for support to hold and for a break out above the $120k area. Leveraged traders need to be careful to not get smoked during any dips. Eventually we will need to retest that $111k area. Patience is key. We are just days / weeks away from Bitcoin going parabolic. Buckle up. All my thanks goes to Big G. Be well and trade the trend. Shout out to my crypto bro Josh. Happy Wednesday!!

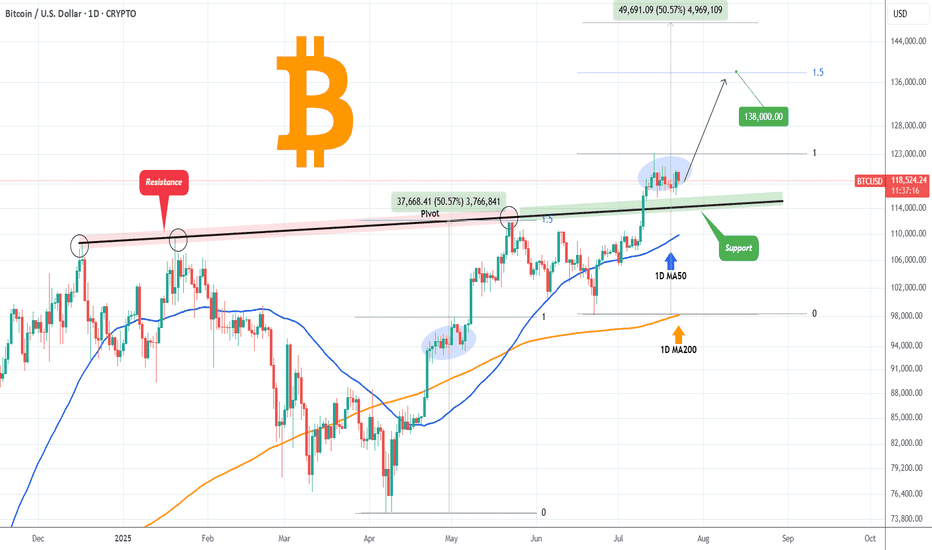

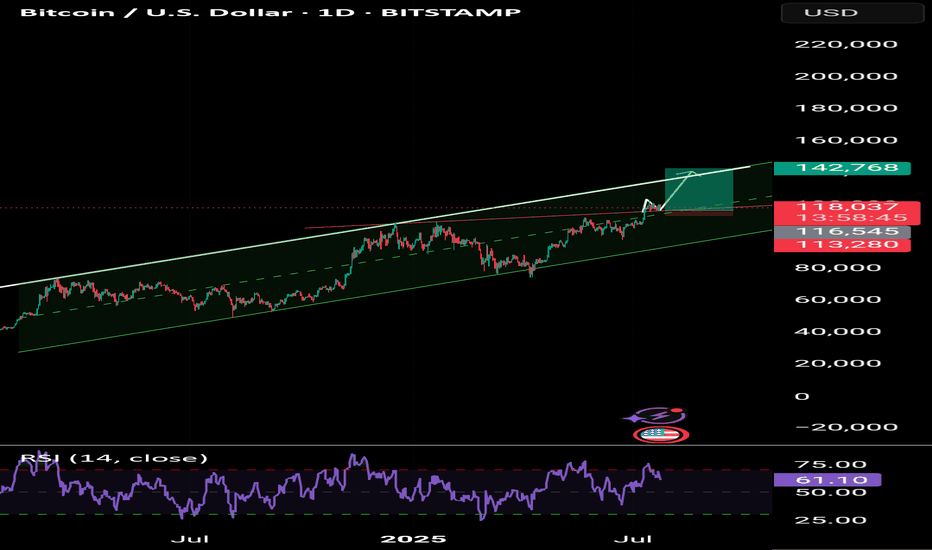

BITCOIN Former Resistance turned Support!Bitcoin (BTCUSD) is consolidating right above the December 17 2024 Pivot trend-line, a level that started off as a massive Resistance delivering two strong rejections but has now been turned into Support, holding this consolidation.

The 1D MA50 (blue trend-line) will soon cross this Pivot trend-line and will confirm it as a Support with the price technically looking for a new Bullish Leg towards the 1.5 Fibonacci extension at least ($138000), similar to the April - May uptrend, which also consisted of an Accumulation Phase much like the current.

Can the Pivot trend-line provide the necessary support for such a rebound? Feel free to let us know in the comments section below!

-------------------------------------------------------------------------------

** Please LIKE 👍, FOLLOW ✅, SHARE 🙌 and COMMENT ✍ if you enjoy this idea! Also share your ideas and charts in the comments section below! This is best way to keep it relevant, support us, keep the content here free and allow the idea to reach as many people as possible. **

-------------------------------------------------------------------------------

💸💸💸💸💸💸

👇 👇 👇 👇 👇 👇

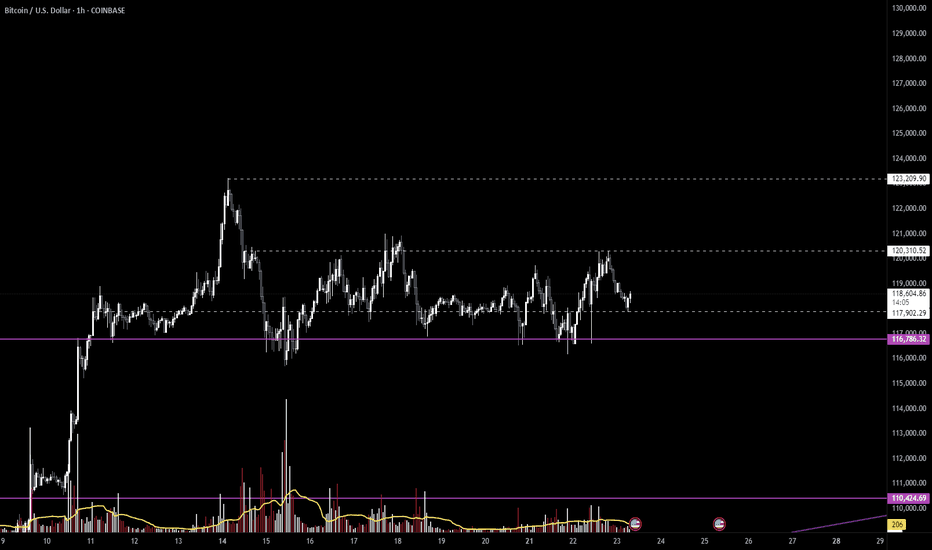

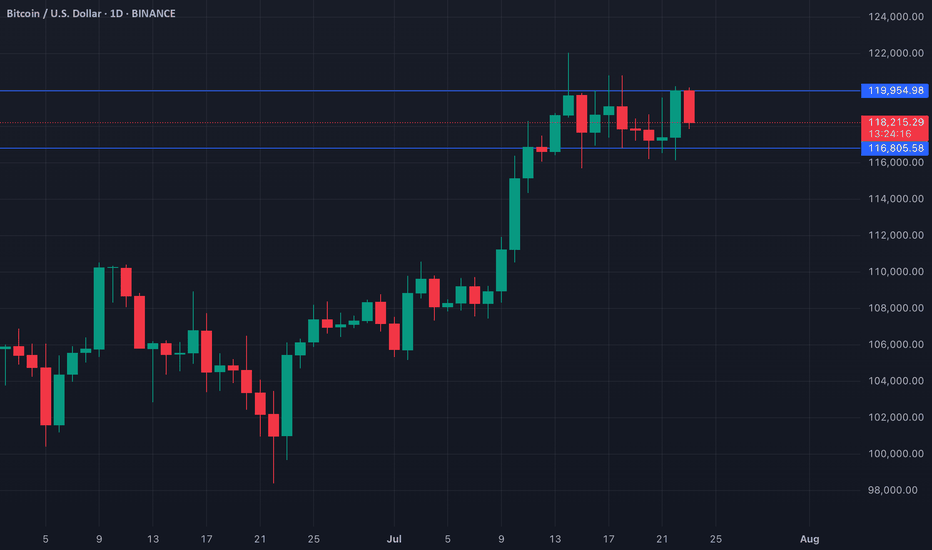

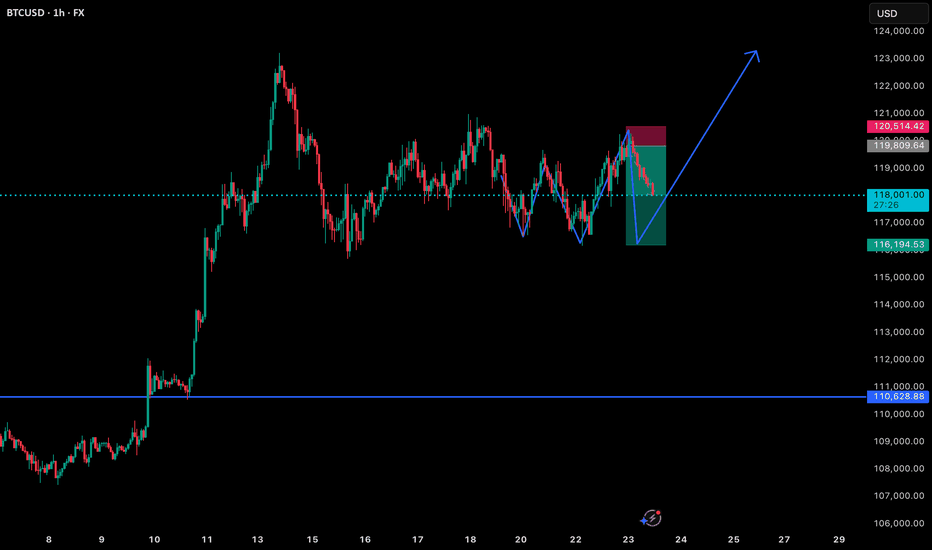

BTC Makes New Daily HighBitcoin is consolidating near its highs, and yesterday’s candle marked the **highest daily close in BTC’s history**, settling just below \$120,000. That’s a major technical milestone and a clear sign of strength in the ongoing trend.

While today’s price action has pulled back slightly – down about 1.19% at the time of writing – BTC remains firmly above the key support zone at \$112,000. This level, once resistance, has now flipped to support after a sharp breakout in mid-July. As long as BTC holds above it, the bullish structure remains intact.

Volume has cooled slightly since the breakout, but the recent candles show healthy consolidation rather than weakness. The 50-day moving average continues to trend upward, currently sitting just above \$108K – offering dynamic support for any deeper retracements.

The next key level to watch is the all-time high wick around **\$123,231**. A breakout above that zone would likely trigger another leg higher, possibly into price discovery. But even without immediate upside, the market appears to be digesting gains in a constructive way.

In short: **highest daily close ever**, bullish structure intact, consolidation healthy. Momentum is cooling, but the setup still favors the bulls.

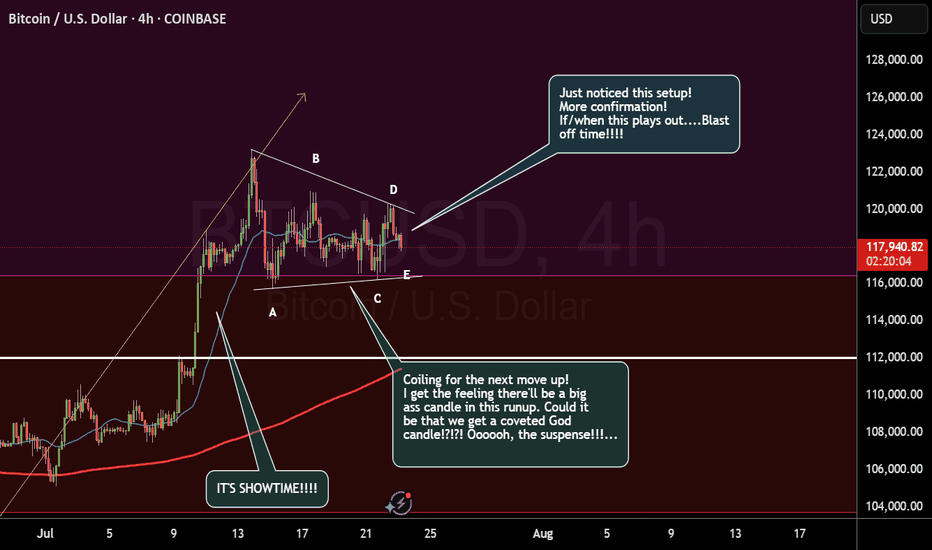

$BTC / Bitcoin Update - The Bitcoin Awakes? 7/23Hello fellow gamblers,

BTC price action has probably pissed off a lot of you, but I believe we are getting close to a breakout.

If my theory is correct, we are forming a wyckoff re-accumulation pattern that will give us an explosive move towards ATH.

- Right now will be a great buying opportunity for those with those that have nothing to lose(super risky entry), but I am suspecting that we formed a spring and the breakout happens next.

- The pattern is still valid as long as we stay above 116k.

- If we lose 116k, we will go towards 110k.

- Levels to watch: 116.7k, 117.9k, 120.3k, 123.2k

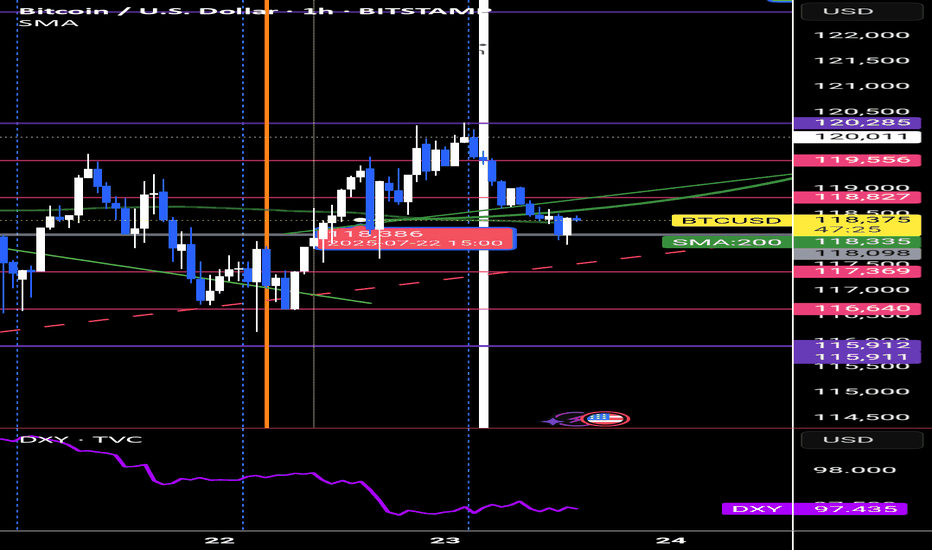

update : BTC/USD : WATCH TIME

Bitcoin

7 minutes ago

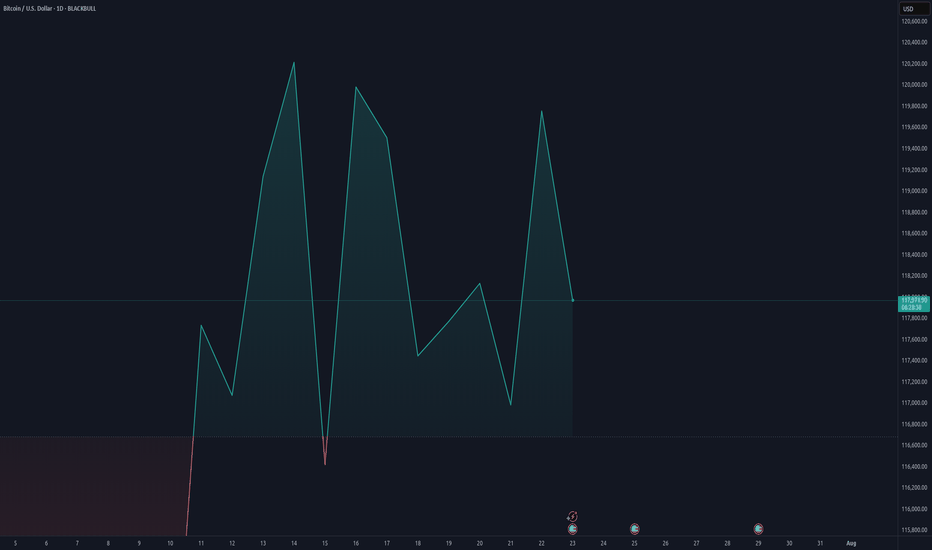

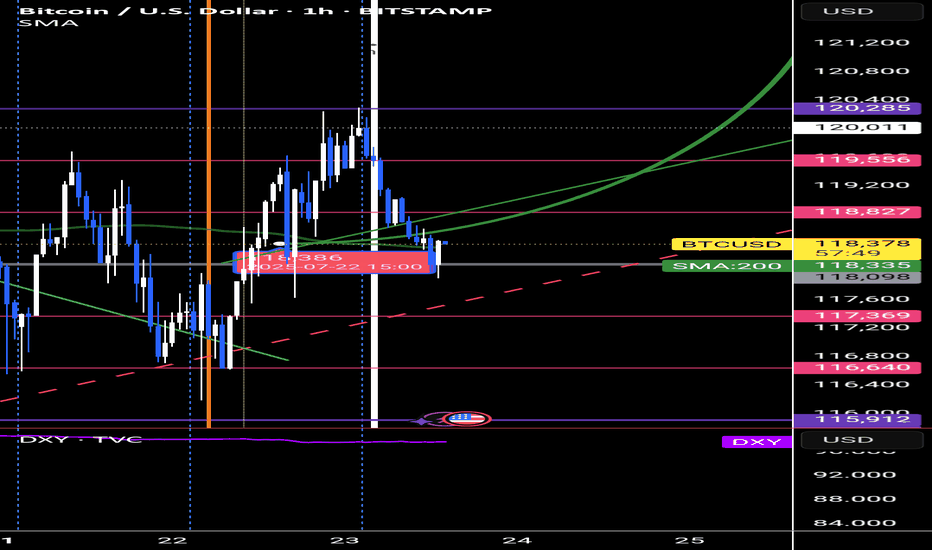

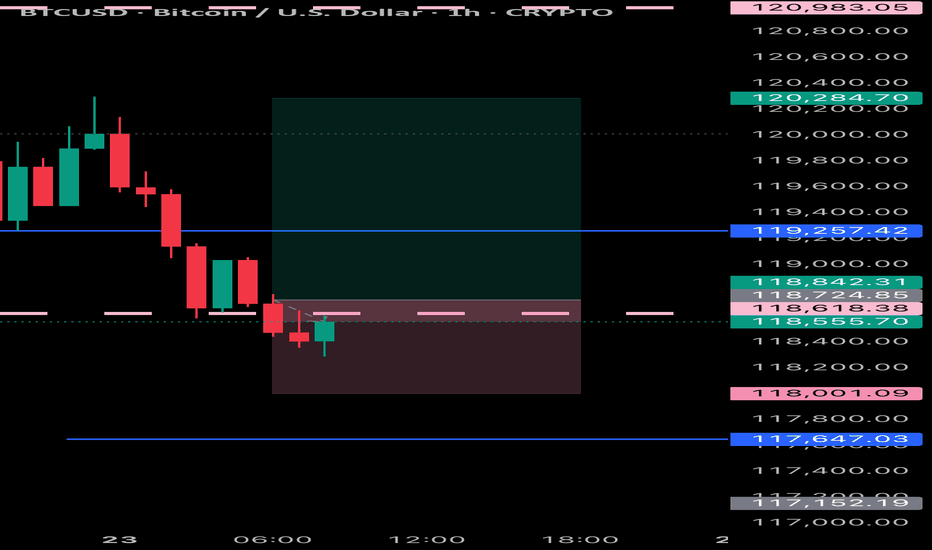

BTC/USD: Phase 9 In Progress – Watch Time

0

7 minutes ago

BTC has completed its impulsive and correction phases. Now it’s deep into Phase 9, the distribution phase ...

🧭 Bias: Long

📆 Daily Cycle:

Phase 3: Apr 5 – May 26 (40 bars)

Phase 6: May 26 – Jul 2 (12 bars)

Phase 9: Jul 2 → Expected until Aug 6

Now forming 3 internal sub-cycles (1H chart) = as explained on the chart by green trend info lines.

📍 Buy Zone: 118098 – 118827

🛡️ Stop Loss: 117369

🎯 Target: 120850

📅 Before Friday, July 25.

reason: this is the dip it shouldn't goback

The market doesn’t care what you “feel.”

It respects the clock.

BTC/USD: Phase 9 In Progress – Watch TimeBTC has completed its impulsive and correction phases. Now it’s deep into Phase 9, the distribution phase ...

🧭 Bias: Long

📆 Daily Cycle:

Phase 3: Apr 5 – May 26 (40 bars)

Phase 6: May 26 – Jul 2 (12 bars)

Phase 9: Jul 2 → Expected until Aug 6

Now forming 3 internal sub-cycles (1H chart) = as explained on the chart by green trend info lines.

📍 Buy Zone: 118098 – 118827

🛡️ Stop Loss: 117369

🎯 Target: 120850

📅 Before Friday, July 25.

reason: this is the dip it shouldn't goback

The market doesn’t care what you “feel.”

It respects the clock.

BTC Range-Bound Movement With Key Levels in SightBitcoin has largely traded sideways on the daily chart since reaching its all-time high of $122,054 on July 14. The current range is defined by a resistance level around $120,000 and a support floor around $116,000

With demand gradually weakening, BTC risks a breakdown below the current support. A close below $116,000 could open the path toward $114,000, marking a deeper short-term correction.

On the upside, renewed buying pressure could push BTC above the $120,000 resistance. A successful breakout may set the stage for another retest of the all-time high and potentially new highs if momentum follows through.

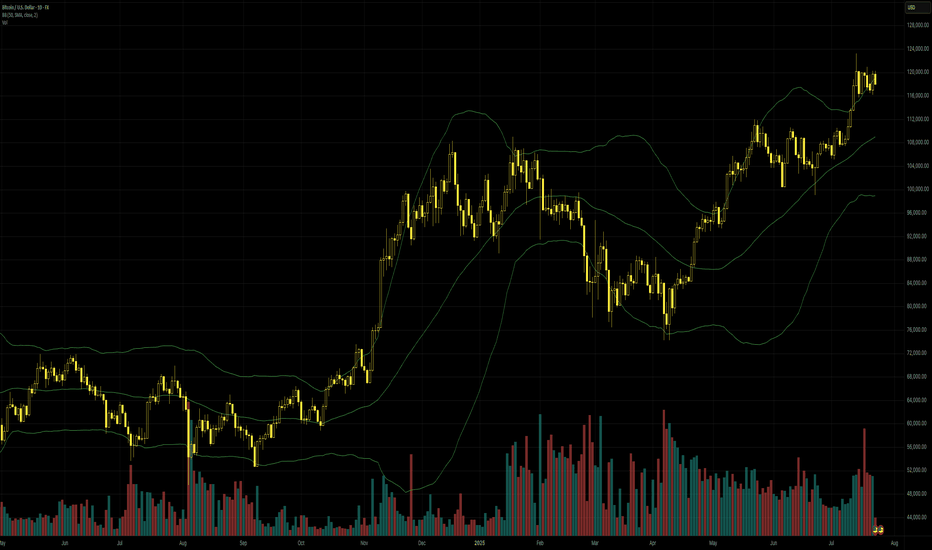

New highs for bitcoin but momentum lowerGenerally lower trade tension, ongoing expectations of two more cuts by the Fed this year and speculation about Jerome Powell’s possible replacement have been some of the main macro fundamental factors driving bitcoin recently. Sentiment in crypto markets generally is greedy but liquidity and volatility have been more limited. So far this movement starting in early July has been much more limited in scope compared to the frantic gains late in 2024.

The very obvious candidate for medium-term resistance would be the 161.8% weekly Fibonacci extension slightly below $140,000. It’s practically certain that the price will reach there sooner or later, but the challenge for traders of CFDs on bitcoin is how long that’s going to take and how far the price might retrace lower before then. Currently there’s no overbought signal from either Bollinger Bands (50) or the slow stochastic, but saturation generally isn’t a useful signal for cryptocurrencies anyway.

In the absence of any evidence of significant profit-taking after $120,000 was reached and amid seemingly high buying demand with an ongoing media frenzy, the price is likely to make a new high again soon unless fundamentals and sentiment shift dramatically. Timing the trade though is potentially very difficult.

This is my personal opinion, not the opinion of Exness. This is not a recommendation to trade.

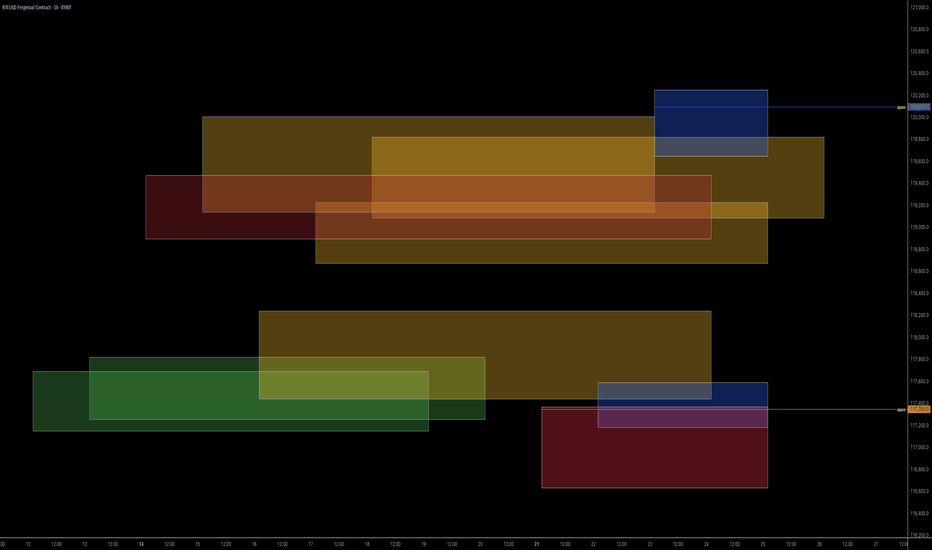

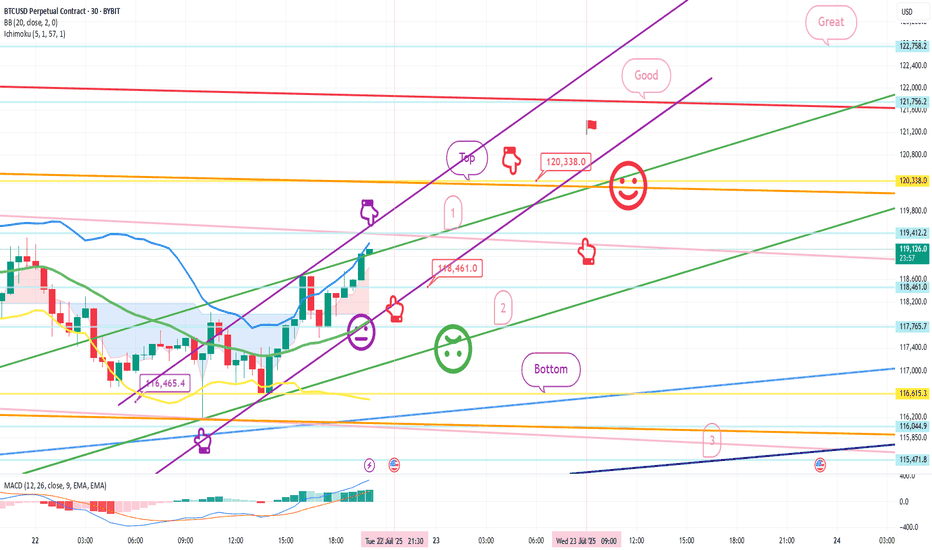

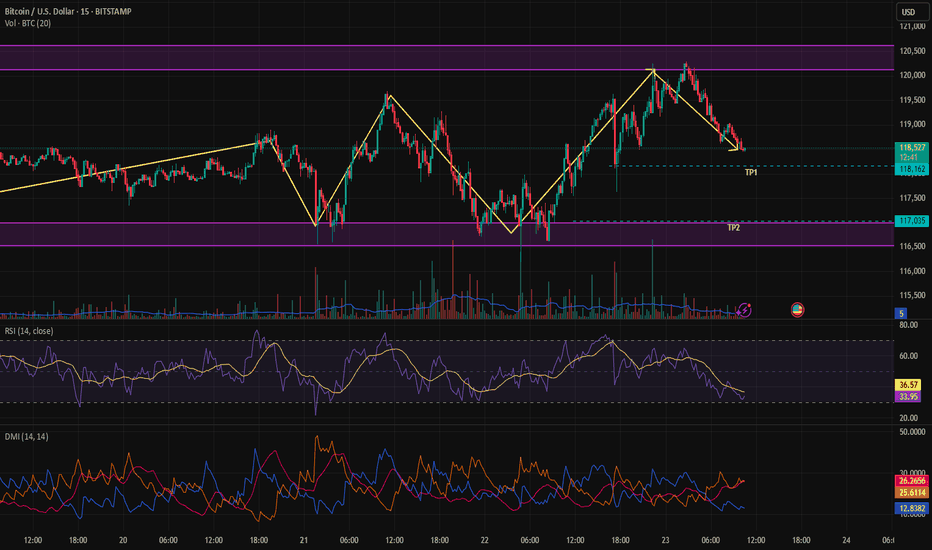

July 22 Bitcoin Bybit chart analysisHello

It's a Bitcoin Guide.

If you "follow"

You can receive real-time movement paths and comment notifications on major sections.

If my analysis was helpful,

Please click the booster button at the bottom.

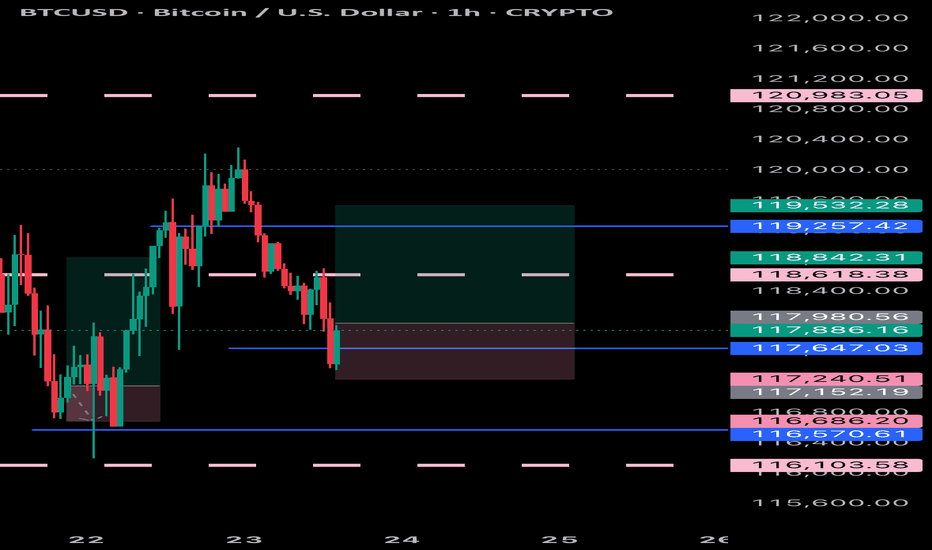

This is Bitcoin's 30-minute chart.

Nasdaq indicators will be released at 9:30 in a little while.

Although Bitcoin's mid-term pattern is broken,

it looks like a strong upward trend based on signals and candlestick positions.

In the case of Nasdaq, the 6-hour and 12-hour charts MACD dead cross is in progress,

and even if there is no plunge and only a sideways movement,

it seems likely that today's strategy will be successful.

In the bottom left, from the analysis article on the 18th,

the final long position entry point of $116,465.4 Bottom

is connected as is.

*Red finger movement path

One-way long position strategy

1. $118,461.9 long position entry section / green support line breakout, stop loss price

2. $120,338 long position 1st target -> Good, Great in order of target price

See the 1st section at the top as a touch section for an upward wave rather than a short position entry,

and if this section breaks through right away, an upward trend can be connected.

If the purple parallel line support line is maintained without breaking away,

there is a possibility of a vertical rise.

If the top section is touched,

after the first liquidation,

it would be good to use the 1st section to re-enter a long position.

The 2nd section at the bottom is important,

and if it is pushed to this section according to the movement of Nasdaq today,

it can fall strongly.

Please check the real-time support line shape.

From the breakout, Bottom -> 3 sections are open.

If you touch the 3rd section after tomorrow, the mid-term pattern will be restored.

This is the 12+ day section.

Up to this point, I ask that you simply use my analysis for reference and use only.

I hope that you will operate safely with the principle of trading and stop loss.

Thank you.

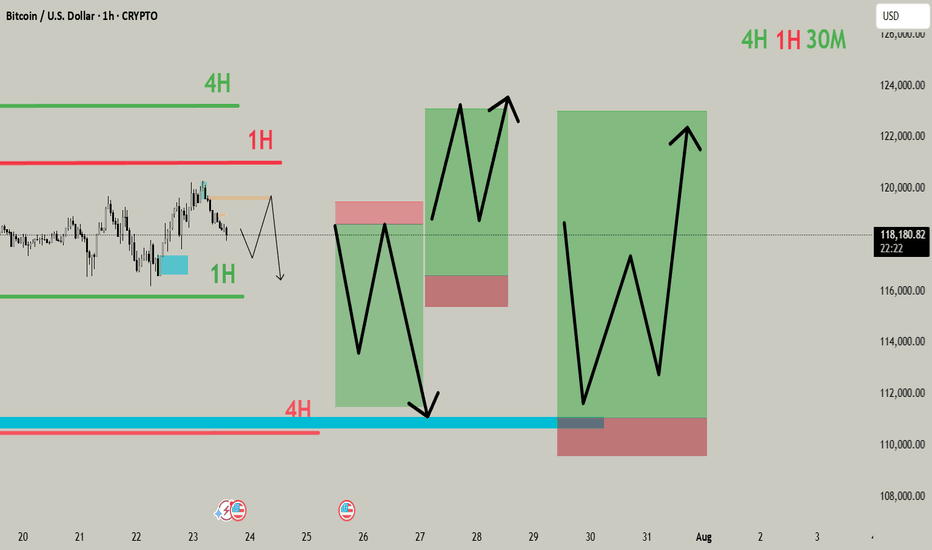

BITCOIN - Entry on basis of Internal CHOCH & (Demand/supply).1. Trade Prediction Breakdown

Current Price: ~117,967

Short-Term Bias (1H):

Expecting a minor pullback/retrace toward a small 1H supply (orange line), then a drop.

This internal structure sets up a CHOCH.

Mid-Term Setup:

Price is projected to dip into the 4H demand zone (~112,000–114,000), confirming a bullish mitigation zone.

After demand is tapped → Expect bullish BOS (Break of Structure) to resume higher timeframe uptrend.

Entry Logic:

Aggressive Entry: Sell from 1H supply (small RR setup).

Main Entry: Buy from 4H demand after price shows bullish internal structure (e.g., bullish CHOCH or BOS on LTF like 15M/30M).

🧠 Key Concepts Applied:

Concept How it's used in this chart

CHOCH Signals potential reversal in short-term structure

Supply Zone (1H) Short entry trigger area

Demand Zone (4H) Expected strong bounce area

Internal Structure Used to time entries and CHOCHs

External Structure Governs overall trend and swing direction

✅ Final Trade Idea Summary:

🔽 Short-Term Sell from 1H supply zone.

📉 Target = 4H Demand Zone (112k–114k).

🔼 Buy from 4H Demand after confirmation (expecting strong upward rally).

🎯 Final target = 122k+ area (based on external bullish structure).

Let me know if you want this turned into a trade journal

Protect Capital First, Trade SecondIn the world of trading, mastering technical analysis or finding winning strategies is only part of the equation. One of the most overlooked but essential skills is money management. Even the best trading strategy can fail without a solid risk management plan.

Here’s a simple but powerful money management framework that helps you stay disciplined, protect your capital, and survive long enough to grow.

✅1. Risk Only 2% Per Trade

The 2% rule means you risk no more than 2% of your total capital on a single trade.

-Example: If your trading account has $10,000, your maximum loss per trade should not exceed $200.

-This protects you from large losses and gives you enough room to survive a losing streak without major damage.

A disciplined approach to risk keeps your emotions under control and prevents you from blowing your account.

✅2. Limit to 5 Trades at a Time

Keeping your number of open trades under control is essential to avoid overexposure and panic management.

-A maximum of 5 open trades allows you to monitor each position carefully.

-It also keeps your total account risk within acceptable limits (2% × 5 trades = 10% total exposure).

-This rule encourages you to be selective, focusing only on the highest quality setups.

Less is more. Focus on better trades, not more trades.

✅3. Use Minimum 1:2 or 1:3 Risk-Reward Ratio

Every trade must be worth the risk. The Risk-Reward Ratio (RRR) defines how much you stand to gain compared to how much you’re willing to lose.

-Minimum RRR: 1:2 or 1:3

Risk $100 to make $200 or $300

-This allows you to be profitable even with a win rate below 50%.

Example:

If you take 10 trades risking $100 per trade:

4 wins at $300 = $1,200

6 losses at $100 = $600

→ Net profit = $600, even with only 40% accuracy.

A poor RRR forces you to win frequently just to break even. A strong RRR gives you room for error and long-term consistency.

✅4. Stop and Review After 30% Drawdown

Drawdowns are a part of trading, but a 30% drawdown from your account's peak is a red alert.

When you hit this level:

-Stop trading immediately.

-Conduct a full review of your past trades:

-Were your losses due to poor strategy or poor execution?

-Did you follow your stop-loss and risk rules?

-Were there changes in the market that invalidated your setups?

You must identify the problem before you continue trading. Without review, you risk repeating the same mistakes and losing more.

This is not failure; it’s a checkpoint to reset and rebuild your edge.

Final Thoughts: Survive First, Thrive Later

In trading, capital protection is the first priority. Profits come after you've mastered control over risk. No trader wins all the time, but the ones who respect risk management survive the longest.

Here’s your survival framework:

📉 Risk max 2% per trade

🧠 Limit to 5 trades

⚖️ Maintain minimum 1:2 or 1:3 RRR

🛑 Pause and review after 30% drawdown

🧘 Avoid revenge trading and burnout

Follow these principles and you won't just trade, you'll trade with discipline, confidence, and longevity.

Cheers

Hexa

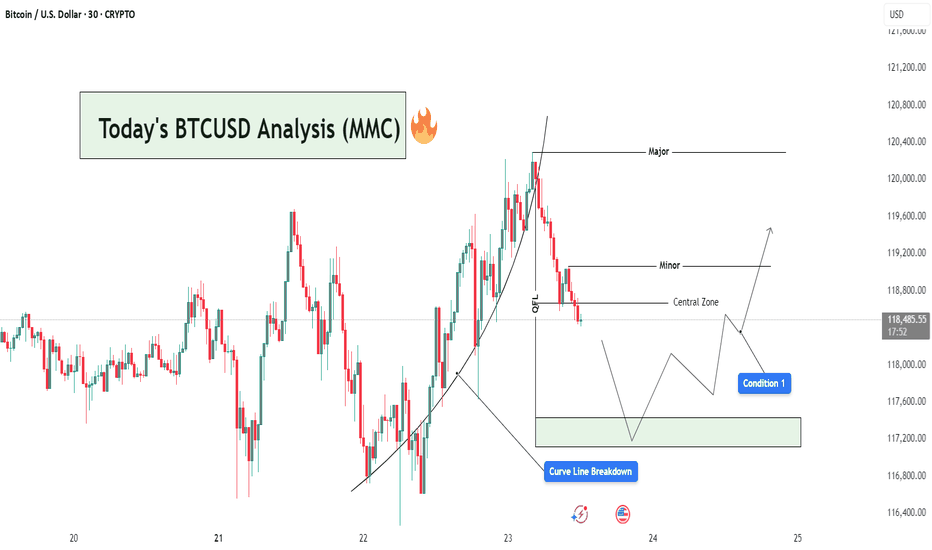

BTCUSD Analysis : Curve Line Breaked and Move Towards Target📊 Market Overview:

BTCUSD has recently completed a strong bullish leg, following a parabolic curve formation that led price into a Major Resistance Zone near the $120,400 level. This rally aligns with MMC principles where price forms momentum-driven structures before reaching high-liquidity zones (often ending in exhaustion).

📍 1. Curve Line Support & Breakdown – A Shift in Sentiment

Your chart shows a clear Curve Line that supported the bullish impulse. Price respected this dynamic support throughout the uptrend until a Curve Line Breakdown occurred—marking the first sign of bullish weakness.

In MMC strategy, this curve structure breakdown is critical:

It tells us the accumulation → expansion → exhaustion cycle is ending.

The market is likely entering retracement or distribution phase.

Price often seeks lower equilibrium, typically around the Central Zone.

🧠 2. QFL Zone (Quick Flip Level) – The Hidden Base

Immediately after the curve broke, price moved toward the QFL level, which represents a demand base from earlier structure. This zone acts as a short-term support and often produces a reactive bounce (but not always a reversal).

Watch closely:

If price respects this zone → temporary relief bounce

If it fails → we’ll likely see full test of Central Zone or lower demand levels

🟩 3. Central Zone – The MMC Decision Area

The Central Zone is a key horizontal level on your chart, defined between ~$117,300 and ~$118,200. This zone is marked based on:

Previous structure

Volume clusters

Demand imbalance

Why is this zone important?

It serves as the balance point between buyers and sellers.

A bullish reaction here could re-initiate a move toward Minor Resistance (~$119,200).

A failure to hold could open the door for deeper retracement toward the green demand box (~$117,200 or below).

🔄 4. Two Primary MMC-Based Conditions to Watch:

✅ Condition 1: Bounce from Central Zone

Price reacts from within the Central Zone

Forms bullish structure (double bottom, bullish engulfing, or reversal wick)

Short-term target becomes Minor Resistance (~$119,200)

If volume increases and price breaks above Minor, continuation toward Major is possible

❌ Condition 2: Breakdown & Bearish Continuation

Price fails to hold within Central Zone

Bearish structure forms (e.g. lower highs, breakdown candles)

Clean move expected toward next liquidity pocket at $117,200–$116,800

This would confirm market shifting into bearish control

📌 5. Minor vs Major Levels – Key Zones

Minor Resistance (~$119,200): Short-term target if bounce occurs

Major Resistance (~$120,400): Liquidity sweep zone, strong supply

Green Demand Box (~$117,200): If Central Zone fails, this becomes next bounce zone

📘 Final Thoughts:

This is a classic MMC setup in real-time:

Curve Formed → Broke

OFL + Central Zone → Now being tested

Next move depends on confirmation from buyers or sellers at Central Zone

Don’t trade emotionally — let price action give you confirmation before taking any positions. Watch the Central Zone behavior closely and manage risk based on scenario outcomes.

Price is approaching the bottom of the rangeAs mentioned in our previous analysis, the price had reached the top of the range. At that stage, we had two options: wait for a confirmed breakout to the upside, or take a reactive position anticipating a move toward the bottom. Now, we are seeing price action moving toward the lower boundary of the range.