Bitcoin (BTC/USD) Weekly Analysis. Bull Market Top1️⃣ Key Market Structure - Elliott Wave Analysis

📉 Elliott Wave Progression:

BTC is in Wave 5️⃣, which historically marks the last bullish impulse before a potential correction.

Wave 3️⃣ was strong, confirming the trend continuation.

Now BTC is approaching the potential Bull Market Top 🚀.

🟢 Current Market Position:

BTC is forming Wave 5, targeting $117K - $139K as per Fibonacci extensions.

The final Wave 5 completion zone is projected within this range.

2️⃣ Fibonacci Retracement & Extension Levels

📊 Fibonacci Levels to Watch:

📍 0.236 Retracement: $93,845.34 ✅ (Minor pullback support)

📍 0.382 Retracement: $85,842.61 ✅ (Stronger correction zone)

📍 0.5 Retracement: $79,876.11 ⚠️ (Critical mid-level support)

🎯 0.382 Extension: $117,331.51 (Potential first target resistance)

🎯 0.618 Extension: $139,205.03 (Bull Market Top Projection)

📌 BTC Weekly High: $109,358.01

📈 BTC Current Price: ~$99,449.97

3️⃣ Technical Indicators - Confirmation Signals

📊 MACD (Momentum Indicator)

✅ MACD Histogram is still positive ➝ Confirming bullish momentum.

⚠️ Flattening MACD lines ➝ Indicates momentum might be slowing.

📊 RSI (Relative Strength Index):

🔼 RSI is near overbought zone (~69-70)

⚠️ Possible local top - BTC might need a correction before further upside

4️⃣ Key Support & Resistance Zones

🛑 Major Support Levels:

🟢 $93,800 (0.236 Fib - Short-term pullback zone)

🟢 $85,800 (0.382 Fib - Stronger correction zone)

🟢 $79,800 (0.5 Fib - Must hold support for long-term bullish trend)

🎯 Resistance Levels - Price Targets:

🔴 $109,000 (Current High - Short-term resistance)

🔴 $117,000 (First Major Resistance - 0.382 Fib Extension)

🚀 $131,000 - $139,000 (Bull Market Top Zone - 0.618 Fib Extension)

5️⃣ Trading Strategy & Market Outlook

💹 Bullish Bias Until BTC Breaks Below $93,800

🎯 Target Areas for TP (Take Profit):

✅ Conservative Traders: Exit near $109,000 - $117,000

✅ Higher Risk Targets: $131,000 - $139,000

⚠️ Risk Management:

🛑 Stop-loss: Below $93,000 to protect against a deeper correction.

📈 Scaling In: Consider adding positions if BTC retraces to the 0.382 ($85,800) or 0.5 ($79,800) Fibonacci level.

💡 Summary & Final Thoughts:

✅ BTC is in the final Elliott Wave 5 move, targeting a potential Bull Market Top of $131K - $139K based on Fibonacci extensions.

⚠️ However, RSI is overbought, and MACD momentum is slowing, meaning a pullback to $93K or $85K is possible before the next move higher.

🚀 Bullish until BTC breaks below key supports. Watch $109K and $117K for short-term resistance.

📊 Strategy: Hold long positions with profit-taking targets at $117K, $131K, and $139K. Use $93K as a support level for risk management.

BTCUSD.P trade ideas

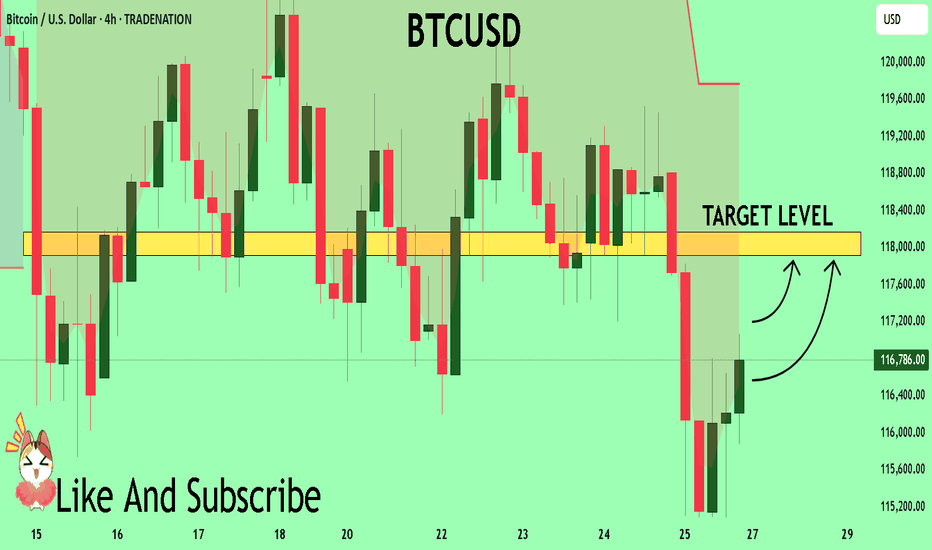

BTCUSD What Next? BUY!

My dear friends,

Please, find my technical outlook for BTCUSD below:

The price is coiling around a solid key level - 11678

Bias - Bullish

Technical Indicators: Pivot Points High anticipates a potential price reversal.

Super trend shows a clear buy, giving a perfect indicators' convergence.

Goal - 11791

About Used Indicators:

The pivot point itself is simply the average of the high, low and closing prices from the previous trading day.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

———————————

WISH YOU ALL LUCK

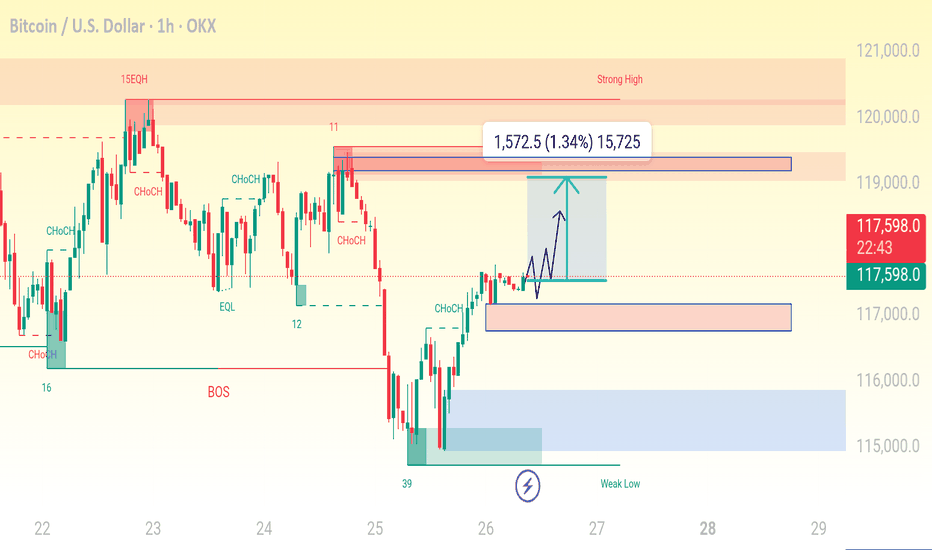

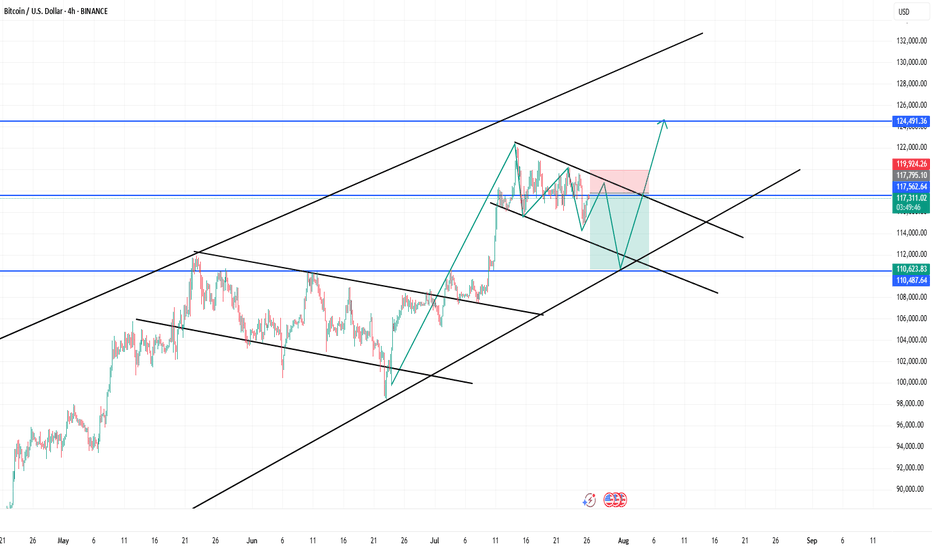

Reversal Zone: BTC Eyes $124.5K After Potential Liquidity SweepTechnical Analysis (4H Chart)

🔷 Pattern Overview:

Rising Channel: BTC is still respecting a long-term upward channel (black parallel trendlines).

Falling Wedge (Short-Term): Inside the channel, a falling wedge is forming—typically a bullish continuation signal.

The wedge is nearing completion, with a possible fakeout below support to the $110,500–$110,600 zone before a sharp rally.

✅ Price Expectation:

Bear Trap Likely: Price may dip to $110.5K support, triggering stop-losses.

Bullish Breakout Setup: If price rebounds strongly from $110K area, the wedge + channel pattern supports a move toward $124.5K–$125K.

Invalidation: Clean break below the channel and $110K could invalidate the bullish scenario.

key area for bullsif bulls cant hold this we're going to test previous range VAH which is 110k

holding this will need to reclaim VAL

if it rejects Range VAL as a bearish retest we may lose this area.

if VAH (which is a CME gapfill) wont hold (imo if we go this far down it will nuke) theres a likelyhood to 103k

Im bullish i think we reclaim here but thought is not edge.

for now we have decent oscilator data.

SP will be king here, if it will pump btc will pump also.

i longed here

BTCUSD Daily Analysis – Key Entry & DCA ZonesBitcoin is currently pulling back after a strong bullish move, now hovering near $115K. The correction opens a potential window for smart entries based on prior market structure and order block analysis.

🔍 Bullish Order Block (OB):

✅ Zone: $107,534 – $109,756

This area previously served as a breakout zone after consolidation. A retest of this region could act as strong support, making it a prime candidate for short- to mid-term bullish setups.

🟧 DCA Zone (Long-Term Accumulation):

✅ Zone: $98,543 – $103,297

Ideal for long-term investors looking to build exposure gradually. Dollar-cost averaging in this zone allows entry at historically undervalued levels in case of a deeper pullback.

🧠 Trading Insight:

Patience pays. Let price come to your levels rather than chasing. Use alerts and consider scaling into positions with proper risk management.

📌 Chart Context: 1D | COINBASE

📆 August 2025

📈 TA by: @NFX_Solutions

#BTC #Bitcoin #Crypto #BTCUSD #TechnicalAnalysis #OrderBlock #TradingView #CryptoStrategy #DCA #SwingTrade #SupportZone

Analysis BTC/USD Daily ChartAnalysis BTC/USD Daily Chart

**Chart Overview (Daily Timeframe)**

**Current Price**: \~\$114,937

**EMA 7**: \$116,896 (short-term)

**EMA 21**: \$116,561 (medium-term)

**Trendline**: Price is testing the long-term ascending trendline

**Key Zones:**

* **Support 1 (S1)**: \~\$110,000

* **Support 2 (S2)**: \~\$102,000

* **Immediate Resistance Zone**: \~\$116,000–\$120,000

**Bullish Scenario**

**Conditions**:

* Price **holds above the ascending trendline**

* A strong **bounce from current level (\~\$115K)** or a reclaim above **\$116K**

**Buy Setup**:

* **Entry**: \$115,000–\$116,000 (if bounce confirmed)

* **Stop-loss**: Below \$114,000 or the ascending trendline

* **Targets**:

* TP1: \$120,000

* TP2: \$125,000

* TP3: \$132,000+

**Confirmation**:

* Bullish candle formation near the trendline

* Reclaim of EMAs (especially EMA 7)

**Bearish Scenario**

**Conditions**:

* Price **breaks below the ascending trendline** and **closes below \$114K**

* Rejection from \$116K zone with a strong red candle

**Sell Setup**:

* **Entry**: Below \$114,000 (on confirmed breakdown)

* **Stop-loss**: Above \$116,000

* **Targets**:

* TP1: \$110,000 (S1)

* TP2: \$105,000

* TP3: \$102,000 (S2)

**Invalidation**:

* Quick recovery above \$114.5K and trendline reclaim = possible fakeout

**Bias**

**Neutral to Bullish**, as price is **at trendline support**.

Watch closely for **price reaction at current levels** for the next directional trade.

Bitcoin Intraday Analysis 31-Jul-25Quick analysis on bitcoin, the main area of interest i will be monitoring are 110,500, 115k, 120K. Keeping in mind that we still have important economic data tomorrow (US Employment Data).

Disclaimer: easyMarkets Account on TradingView allows you to combine easyMarkets industry leading conditions, regulated trading and tight fixed spreads with TradingView's powerful social network for traders, advanced charting and analytics. Access no slippage on limit orders, tight fixed spreads, negative balance protection, no hidden fees or commission, and seamless integration.

Any opinions, news, research, analyses, prices, other information, or links to third-party sites contained on this website are provided on an "as-is" basis, are intended only to be informative, is not an advice nor a recommendation, nor research, or a record of our trading prices, or an offer of, or solicitation for a transaction in any financial instrument and thus should not be treated as such. The information provided does not involve any specific investment objectives, financial situation and needs of any specific person who may receive it. Please be aware, that past performance is not a reliable indicator of future performance and/or results. Past Performance or Forward-looking scenarios based upon the reasonable beliefs of the third-party provider are not a guarantee of future performance. Actual results may differ materially from those anticipated in forward-looking or past performance statements. easyMarkets makes no representation or warranty and assumes no liability as to the accuracy or completeness of the information provided, nor any loss arising from any investment based on a recommendation, forecast or any information supplied by any third-party.

BTCUSD Analysis : Major Breakout Setup | Big Move Loading"Bitcoin Coiling Below Key Resistance – Breakout or Trap?"

🔍 Technical Overview:

Bitcoin is currently trading within a compressed range, sitting just below a key descending trendline that has capped upside movement for multiple sessions. Price is consolidating between minor highs and lows, hinting at a build-up of momentum for the next breakout move.

The setup presents a classic compression inside a bearish wedge, but with increasing bullish pressure evident from higher lows and wick rejections near minor supports.

🧱 Detailed Technical Breakdown:

🔸 1. Descending Trendline Structure

Price has formed a downward sloping resistance line from earlier highs.

This trendline has acted as a dynamic ceiling, rejecting multiple bullish attempts.

Each time price approaches it, the rejection gets weaker, indicating a possible breakout attempt soon.

🔸 2. Multiple Minor & Major Zones

Minor Resistance: Around $118,800–$119,200

A short-term ceiling that has paused bullish rallies.

Price needs a clean break and close above this to initiate momentum.

Major Resistance: ~$121,000–$121,200

This zone aligns with a previous significant swing high.

A break above here could result in strong bullish continuation toward ATH levels.

Minor Support: ~$117,000

Price has repeatedly bounced from this level.

A breakdown would indicate fading bullish strength and open the downside.

Major Support: ~$115,000

A historically strong demand zone.

If BTC fails all bullish attempts, this would be the final defense for buyers.

🧠 Market Psychology Insight:

Price is trapped between aggressive short-term sellers and accumulating buyers.

Buyers are placing confidence in this area by defending higher lows.

Sellers are still protecting the trendline, but with each retest, the defense weakens.

This is a classic equilibrium zone where liquidity is building—once imbalance hits, a strong impulsive breakout (either direction) is likely.

Volume and momentum should be watched closely as a breakout with confirmation may trap the opposite side, leading to a strong move (short squeeze or long liquidation).

🔮 Scenario Forecasts:

📈 Bullish Breakout Scenario:

Price breaks above $119,200 → minor resistance flips to support

Retest of the broken trendline confirms a bullish breakout

Price targets:

First Target: $121,000–$121,200 (major resistance)

Second Target: $122,500+

Third Target: $123,800–$124,000 (All-Time High)

Confirmation Needed: 4H candle close above descending trendline and $119,200 with rising volume.

📉 Bearish Rejection Scenario:

Price gets rejected from the trendline or minor resistance zone

Breaks below $117,000 minor support

Possible targets:

First Target: $116,000 (reaction zone)

Second Target: $115,000 (major support)

A fall below $115,000 could invalidate the bullish buildup and invite strong bearish continuation.

This would signal that bulls failed to reclaim control, and sellers maintain market structure dominance.

📌 Key Levels Summary:

Type Price Range Significance

🔺 All-Time High $123,800–124,000 Final upside target

🔸 Major Resistance $121,000–121,200 Key breakout level

🔹 Minor Resistance $118,800–119,200 Immediate trendline + local supply

🔹 Minor Support ~$117,000 Local demand base

🔻 Major Support $115,000 Last line of defense for bulls

🧭 Conclusion & Strategy:

Bitcoin is approaching a make-or-break zone under a significant descending trendline. Price compression is tightening, and a breakout looks imminent.

Traders should stay patient and wait for confirmation—either a breakout and successful retest for longs or a rejection and trendline defense for shorting opportunities.

Whether it’s a breakout toward $121K and ATH, or a drop toward $115K support, this setup offers a high-probability trade opportunity for both bulls and bears depending on the confirmation.

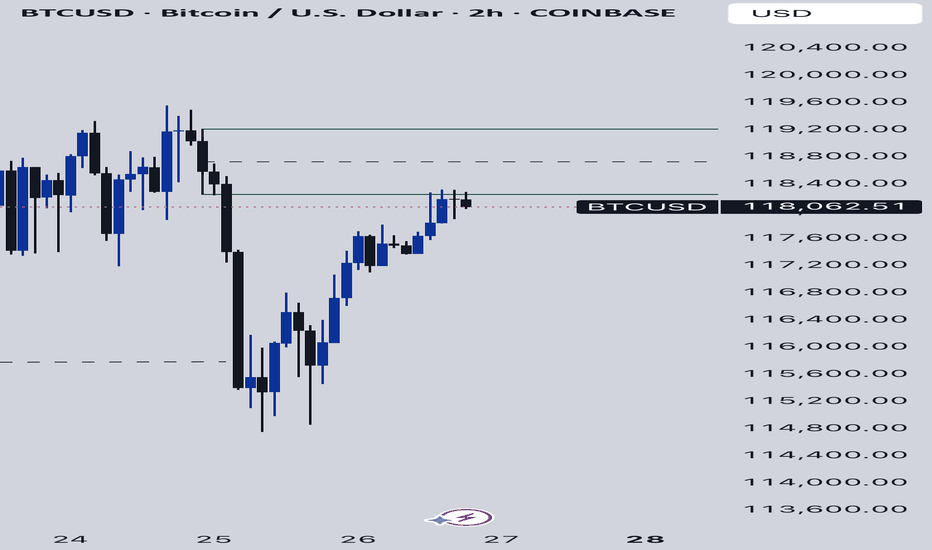

BITCOIN Will Move Higher! Long!

Take a look at our analysis for BITCOIN.

Time Frame: 2h

Current Trend: Bullish

Sentiment: Oversold (based on 7-period RSI)

Forecast: Bullish

The price is testing a key support 118,043.14.

Current market trend & oversold RSI makes me think that buyers will push the price. I will anticipate a bullish movement at least to 119,900.74 level.

P.S

The term oversold refers to a condition where an asset has traded lower in price and has the potential for a price bounce.

Overbought refers to market scenarios where the instrument is traded considerably higher than its fair value. Overvaluation is caused by market sentiments when there is positive news.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

Like and subscribe and comment my ideas if you enjoy them!

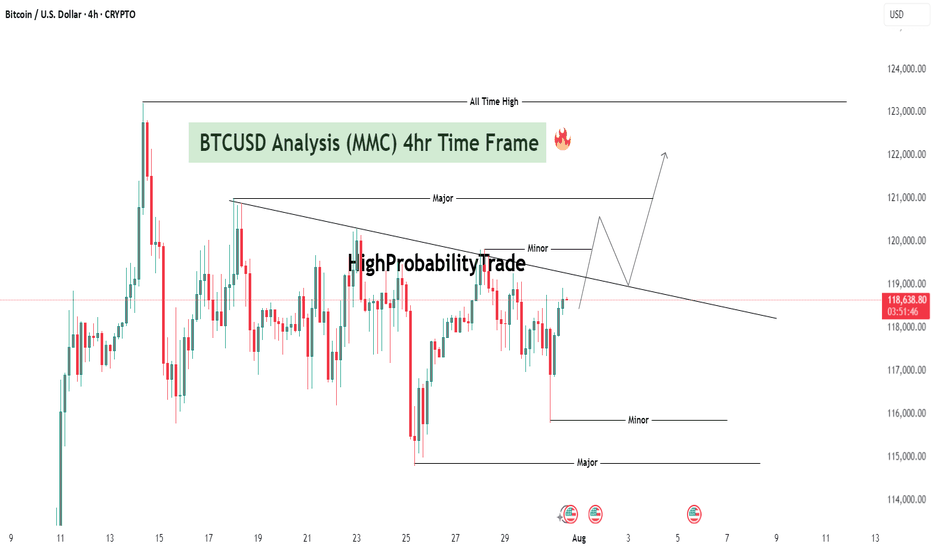

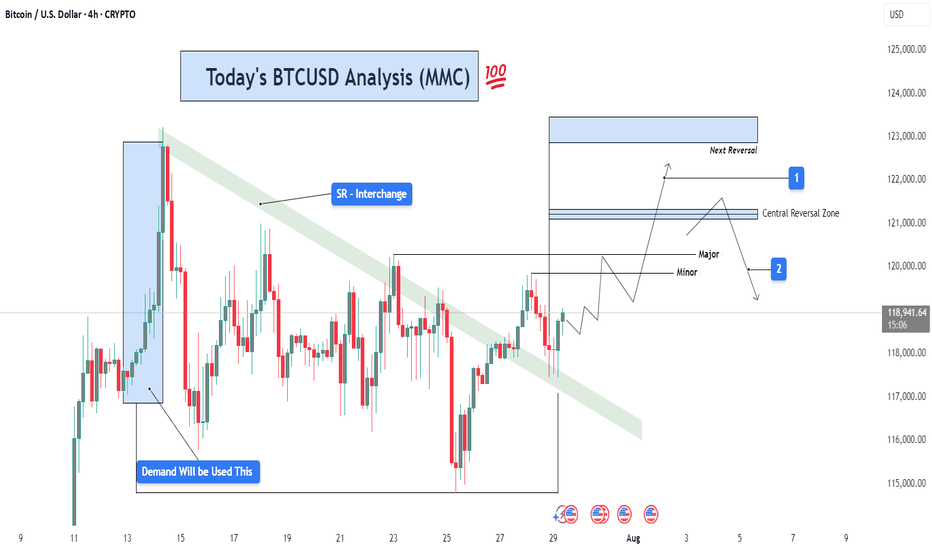

BTCUSD Analysis (MMC) – Breakout Confirmed + Target Next Zone⚙️ Chart Context (4H BTC/USD)

As part of our Mirror Market Concepts (MMC) strategy, today's BTCUSD 4H chart is a textbook representation of market structure shift, SR interchange, demand reaction, and target projection. After consolidating within a compressed range under a key descending structure, Bitcoin has successfully broken out of bearish control, signaling a fresh phase of bullish momentum.

🧩 Breakdown of Technical Structure

🔹 1. Demand Zone Reaction (July 13–14)

The initial impulse move originated from a well-defined demand zone, marked by a strong accumulation and breakout. This zone—highlighted on the chart—acted as the institutional demand base, where buyers stepped in with volume and aggression. Price respected this zone precisely, confirming it as a valid MMC "Power Base."

Why this matters: Demand zones like these reflect institutional footprints. Once price reacts from such zones, they often become foundational for future bullish legs.

🔹 2. SR Interchange Zone – Structure Flip Confirmed

The descending green channel acted as dynamic resistance for several sessions. Every touch along this zone resulted in a lower high, confirming bearish order flow. However, BTC has now closed decisively above this structure, transforming this zone from supply to support—this is our classic SR Interchange concept in MMC.

Interpretation: This structure flip implies a strong change in sentiment. What was once a zone of rejection now becomes a potential support for continuation.

Expect retests of this zone before price resumes to higher reversal levels.

🔹 3. Minor and Major Resistance Zones

Above current price, two critical zones have been mapped:

Minor Resistance (~$120,000):

Acts as the first liquidity grab area. This is where early sellers may place stops or where short-term traders could book profits. MMC logic expects minor resistance to either cause a pause or a fakeout to lure in shorts.

Major Resistance / Central Reversal Zone (CRZ):

Spanning roughly $121,000 to $121,800, this is a key zone where price will likely meet decision-making. This CRZ is derived from previous structure congestion, imbalance fills, and projected Fibonacci confluence.

Next Reversal Zone (Final Target Area):

Located near $123,000, this is the outer reversal box where the bullish wave may either end, consolidate, or reverse entirely. This is the final target for swing traders or MMC practitioners looking for exhaustion.

🧭 Price Forecast Structure – Predictive Pathway

The forecast path shown on the chart illustrates a stair-step rally, with bullish impulses followed by shallow pullbacks:

First, price may pull back slightly to retest the breakout zone (green SR area).

Then a leg upward to minor resistance (~$120K).

A healthy rejection or small correction before breaking into the CRZ (~$121.2K).

Final move toward the outer reversal zone at ~$123K.

This fractal progression is a common MMC pattern seen during structure shifts—not impulsive straight-line rallies, but controlled, zone-to-zone movements.

🔍 Strategic Insights & Trade Plan

📌 Conservative Entry:

Wait for a retest of the breakout zone (SR Interchange) around $118,200–$118,500.

Look for bullish rejection candles or order flow confirmation on LTF (lower timeframes).

📌 Aggressive Entry:

Break and close above $120,000, confirming liquidity clearance and path toward CRZ.

🎯 Target Zones:

TP1: $121,200 – Central Reversal Zone

TP2: $123,000 – Outer Reversal Zone

❌ Stop-Loss Ideas:

Below $117,000 (structure invalidation)

Below recent bullish impulse candle low

🧠 MMC Concepts in Action:

SR Flip: Strong indication of market shift

Demand Rejection: Institutional footprint detected

Zone Mapping: Controlled zone-to-zone movement

Liquidity Logic: Price moves where orders rest – CRZ = likely reaction

Reversal Framing: Structure analysis ahead of time, not after the move

📊 Conclusion:

This BTCUSD 4H analysis showcases a strong MMC-style breakout scenario. The reaction from demand, shift in SR structure, and projected reversal zones give us a clean roadmap. As long as the structure remains valid and price respects the new SR zone, this bullish move remains high-probability.

Trade with structure. Trust the zones. Mirror the Market.

BTCUSD 4HOUR TIME FRAME ANALYSISOverall Structure & Trend

Over the past several 4-hour candles, BTCUSD has carved out a series of higher lows around 116,500–117,000 and higher highs around 120,000–120,500, defining a gentle up-sloping channel.

The current price (118,758) sits just above the middle of that channel, suggesting there’s still room toward the upper trendline before meeting heavy supply.

Key Support & Entry Zone

Primary support lies at 117,200–117,500 (the former swing high from three bars ago), which also aligns with the 50% retracement of the move up from 114,500 to 120,500. That zone offers confluence for the 118,758 entry.

A secondary buffer sits at 116,849 (your stop-loss), just below the channel’s lower boundary—if price breaches here, the bullish structure would be invalidated.

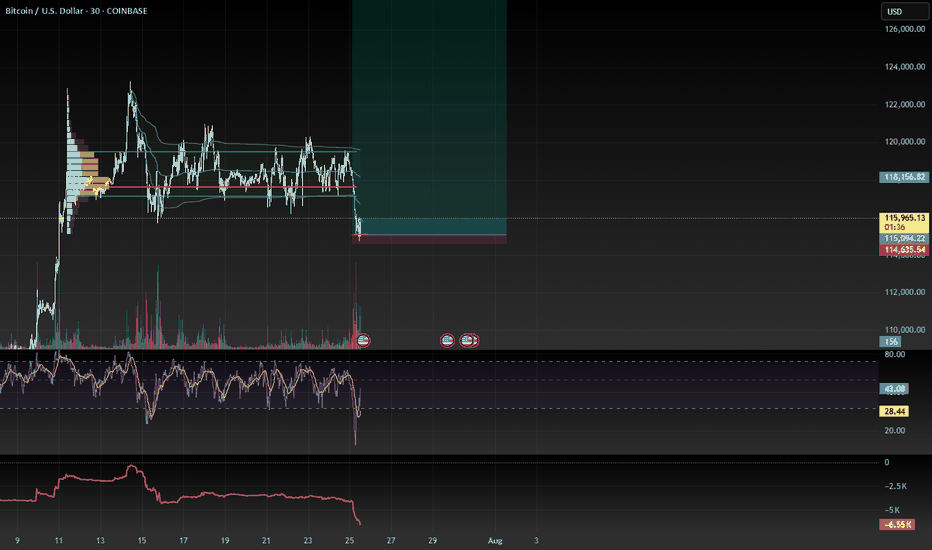

BTC - Weekly Warning SignsAfter seeing a 5% correction from our recent BTC ATH of $123k we are starting to see a few warning signs as momentum starts to decline.

Looking only at our RSI and price I have outline the last 3 time we have seen something similar since 2021. Without going into too much detail normally what we see is an RSI TOP followed by a retest + rejection right at the 70 level (overbought conditions).

We saw it at our market cycle high in 2021 that started the bear market (75% correction).

We saw it at our March 2024 high that started a mid cycle correction (33% correction).

And we are seeing it now after our recent 2025 ATH that has started a very mild correction so far (5%).

This does not mean it is the end of the world but absolutely something market participants need to be paying attention to as this is a make or break signal;.

If we see momentum continue to decline it could lead to our bull market structure being broken and lead us into a bear market that we have historically seen going into the new year.

However this correction can easily be negated to produce a strong bull market continuation move. All we need to see is bulls start to push our strength back above the 70 level (overbought conditions) and we can see the next leg of the bull market really kick off (WITH A CLOSE ABOVE).

For now pay attention to the weekly RSI as of the time of this post our strength has been declining from where we have seen previous tops align with.

BTCUSD 7/27/2025Come Tap into the mind of SnipeGoat as he gives you a Full Top-Down Analysis of Bitcoins Price Action as we embark on another week of Quarter 3.

_SnipeGoat_

_TheeCandleReadingGURU_

#PriceAction #MarketStructure #TechnicalAnalysis #Bearish #Bullish #Bitcoin #Crypto #BTCUSD #Forex #NakedChartReader #ZEROindicators #PreciseLevels #ProperTiming #PerfectDirection #ScalpingTrader #IntradayTrader #DayTrader #SwingTrader #PositionalTrader #HighLevelTrader #MambaMentality #GodMode #UltraInstinct #TheeBibleStrategy

BTCUSD As BTCUSD fell back to 118k, we’ve some good break of structure to the downside with some good momentum seen from the H4 timeframe. Could this be giving us some good bearish sentiment? Or it’s just one of the mini-fluctuations pullbacks as they accumulate enough orders to push the BTCUSD markets even higher.