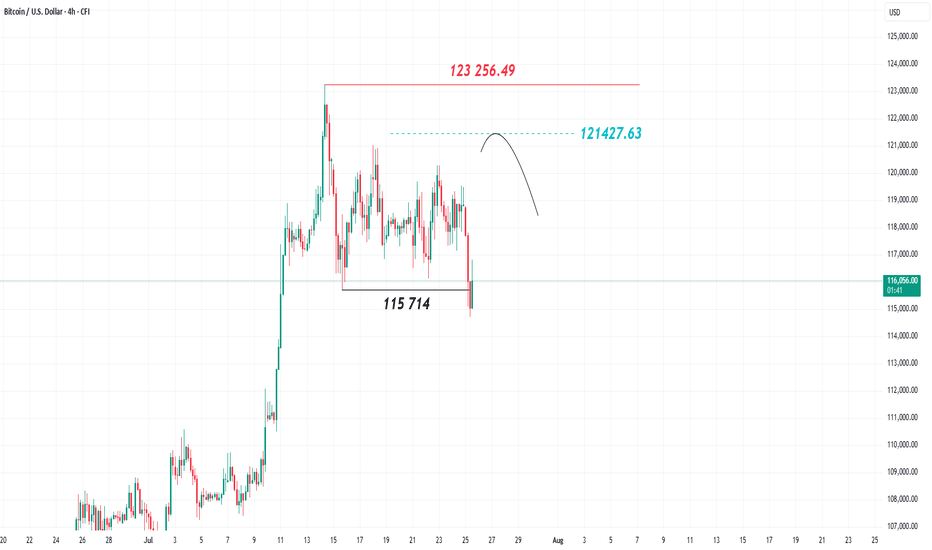

What's next for BITCOIN?After hitting a new all-time high at 123,256.49, Bitcoin, the world’s leading cryptocurrency, pulled back this week, closing on the 4-hour chart below the 115,714 level. This indicates a shift in trend from bullish to bearish and increases the likelihood of a short-to-medium-term decline.

The recent price rise appears to be corrective, and the 121,427 level is considered important and carries downside pressure, as it represents the 78% level of the Fibonacci retracement tool when measured from the recent high to the latest low. Holding below the 123,256 mark and failing to break above it would support the bearish scenario for Bitcoin.

BTCUSD.P trade ideas

Bitcoin Has Bearish DivergenceOverbought bearish divergence.

I pointed this out last week. In my mind, this is the most reliable signal for tops (bullish divergence for bottoms) that exists in technical analysis. We can see that this continues to play out, and know that it usually leads to RSI making the trip to oversold.

It looks like more correction is likely, standard fare in a bull market.

Bitcoin at $110,000?After reaching its last ATH, Bitcoin practically went into a coma. Now, with the strengthening of the dollar, it's undergoing a correction — and if that correction deepens, there's a possibility it could drop to \$110,000. We'll have to see whether it finds support around the \$112,000 level or not.

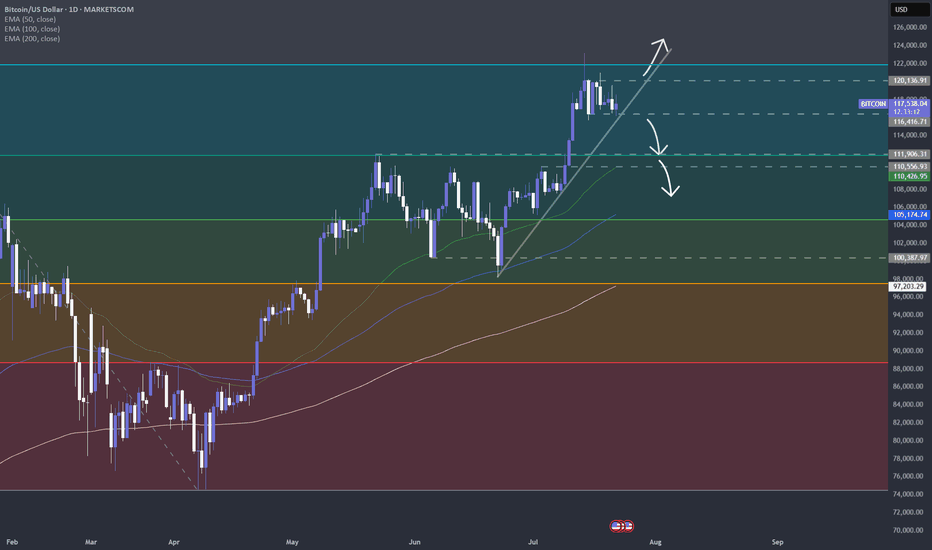

BTCUSD – Bullish Recovery Setup Forming Near Trendline Support🧠 Market Structure & Technical Breakdown

The BTCUSD 4H chart showcases a well-formed descending triangle or falling wedge structure with clearly respected major and minor descending trendlines. Currently, price action is testing a dynamic support zone, highlighted in green, which has been a strong reaction area in the past.

This area aligns with a bullish accumulation zone, from which buyers have previously stepped in to initiate impulsive moves. Given the confluence of diagonal support and horizontal price reactions, we may be on the verge of a bullish breakout opportunity.

📍 Key Zones & Trendlines

✅ Green Support Channel (Demand Zone): Acting as a key pivot for multiple recent rejections, this area (~114,000–113,000) is now being revisited again, offering potential buy interest.

📉 Minor Trendline: A short-term descending resistance around 120,000—likely the first barrier in case of a bounce.

📉 Major Trendline: A more extended dynamic resistance line connecting swing highs, currently intersecting near the 124,000 region.

🔄 Potential Price Scenarios

Primary Bullish Setup (MMC Plan):

Price bounces off the green demand zone.

Breaks above the minor trendline (~120K).

Pullback retest to confirm breakout.

Continuation toward the major breakout level (~124K and beyond).

Invalidation / Bearish Case:

A clean breakdown below 113,000 with strong bearish momentum would negate this setup, likely targeting the psychological support near 110,000.

🧠 MMC Mindset: Trade with Patience & Confluence

This is a classic accumulation-to-breakout scenario. Smart traders wait for confirmation—especially as BTC often exhibits false breakdowns before a major move. Monitor candle behavior, volume, and reaction to the minor trendline.

Let the market show signs of strength (like bullish engulfing, pin bars, or a breakout-retest) before committing to the upside. Avoid FOMO; the key is discipline and precision entry at structural break points.

✅ Trade Plan Summary:

Watch zone: 113,000–114,500 for bullish price action

Breakout level: Minor trendline (~120,000)

Target zone: 123,500–124,000 (Major resistance)

Stop-loss idea: Below 112,800 (Invalidation of structure)

You've Already Lost: The Bitcoin Delusion of FOMO and False HopeLet’s get one thing straight: if you’re staring at Bitcoin, squinting past the red flags, and convincing yourself it’s not a Ponzi scheme because of that one shiny feature that screams “legit,” you’re not investing—you’re auditioning for the role of “next victim.” And if your motivation is the fear of missing out (FOMO) or the fantasy of getting rich quick, well... congratulations. You’ve already lost.

The 99%: Red Flags Waving Like It’s a Parade

Let’s talk about the indicators—the ones that make Bitcoin look suspiciously like a Ponzi scheme. No, it’s not technically one, but the resemblance is uncanny:

- No intrinsic value: Bitcoin isn’t backed by assets, cash flow, or a government. It’s worth what the next person is willing to pay. That’s not investing. That’s speculative hot potato.

- Early adopters profit from new entrants: The people who got in early? They’re cashing out while newcomers buy in at inflated prices. That’s the classic Ponzi dynamic: old money out, new money in.

- Hype over utility: Bitcoin’s actual use as a currency is minimal. It’s slow, expensive to transact, and volatile. But hey, who needs functionality when you’ve got memes and moon emojis?

- Opaque influencers: From anonymous creators (hello, Satoshi) to crypto bros promising Lambos, the ecosystem thrives on charisma, not accountability.

- Scam magnet: Bitcoin has been the currency of choice for over 1,700 Ponzi schemes and scams, according to a University of New Mexico study cs.unm.edu . That’s not a coincidence. That’s a pattern.

The 1%: The “But It’s Decentralized!” Defense

Ah yes, the one redeeming quality that Bitcoin evangelists cling to like a life raft: decentralization. No central authority! No government control! It’s the financial revolution!

Except… decentralization doesn’t magically make something a good investment. It just means no one’s in charge when things go wrong. And when the market crashes (again), you can’t call customer service. You can tweet into the void, though.

FOMO: The Real Engine Behind the Madness

Let’s be honest. Most people aren’t buying Bitcoin because they believe in the tech. They’re buying because they saw someone on TikTok turn $500 into a Tesla. FOMO is the fuel, and social media is the match.

Bitcoin’s meteoric rises are often driven by hype cycles, not fundamentals. Tesla buys in? Price spikes. El Salvador adopts it? Price spikes. Your cousin’s dog walker says it’s going to $1 million? Price spikes. Then it crashes. Rinse, repeat.

This isn’t investing. It’s gambling with a tech-savvy twist.

The Punchline: You’ve Already Lost

If you’re ignoring the overwhelming signs of speculative mania and clinging to the one feature that makes you feel better about your decision, you’re not ahead of the curve—you’re the mark. And if your motivation is “I don’t want to miss out,” you already have. You’ve missed out on rational thinking, due diligence, and the ability to distinguish between innovation and illusion.

Bitcoin might not be a Ponzi scheme in the legal sense. But if it walks like one, talks like one, and makes early adopters rich at the expense of latecomers… maybe it’s time to stop pretending it’s something else.

INDEX:BTCUSD NYSE:CRCL NASDAQ:HOOD TVC:DXY NASDAQ:MSTR TVC:SILVER TVC:GOLD NASDAQ:TSLA NASDAQ:COIN NASDAQ:MARA

BTCUSD CONSOLIDATES BELOW RESISTANCE OF 120,000.00BTCUSD CONSOLIDATES BELOW RESISTANCE OF 120,000.00

Today the price rebounded from the SMA50 on 4-h chart and continues to consolidate below the resistance level of 120,000.00. Yesterday there was a minor pullback from this level, still the price is pretty much at the same levels as yesterday. The recommendation is still the same: would be safer for long trade to wait for a breakout of the resistance (120,000.00) with first target of 123,190.30 (ATH). However, the asset shows nice bullish set up: RSI started to show some strength with price consolidation below resistance.

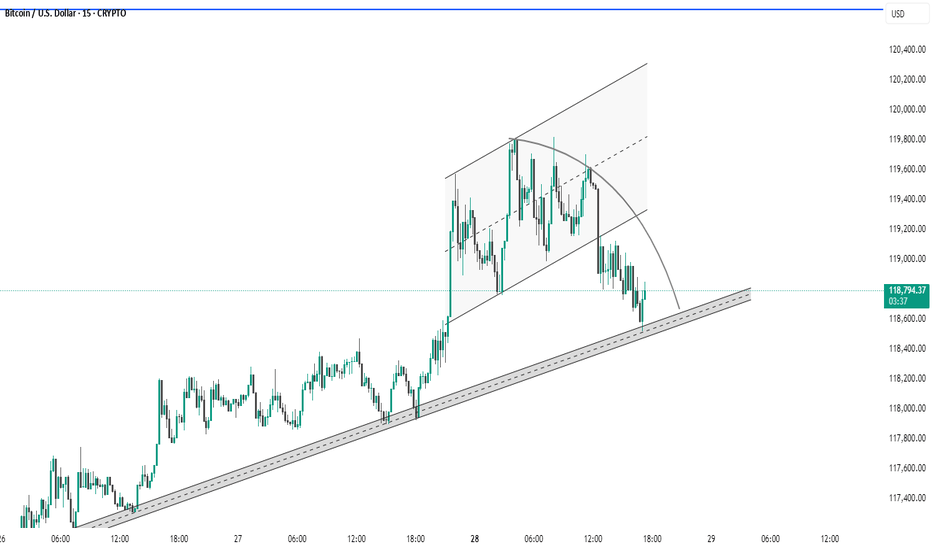

BTC #This 15-minute BTC/USD chart This 15-minute BTC/USD chart shows a rising channel formation that has recently been broken to the downside, indicating potential bearish momentum. The price is currently testing a long-term ascending trendline, acting as a critical support zone around $118,600–$118,800. A breakdown below this trendline could lead to further downside, while a bounce could suggest bullish continuation. The curved arc drawn also hints at a rounding top pattern, reinforcing possible short-term weakness.

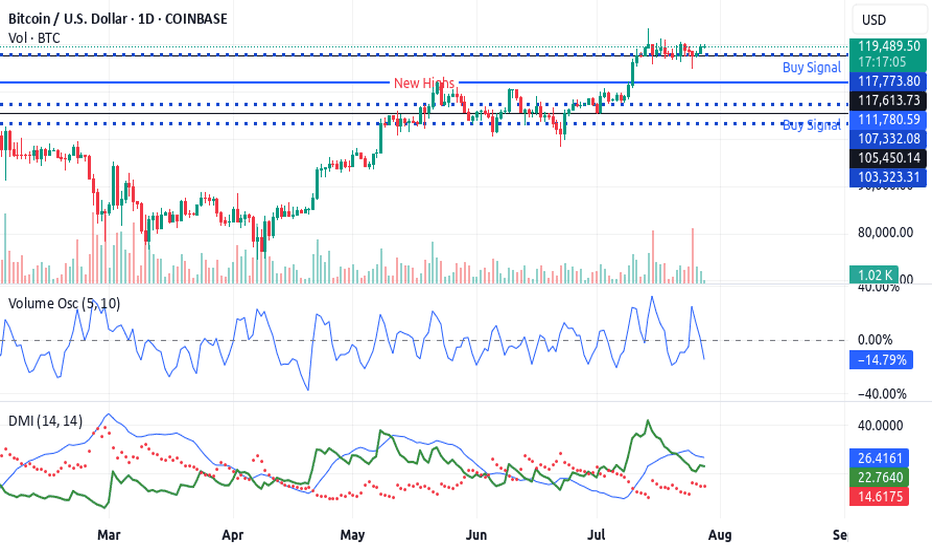

Bitcoin Set to Explode: 3 Powerful Buy Signals Active NowBitco🚀 Bitcoin is Flashing a Buy Signal — Rocket Booster Strategy in Play!

Bitcoin is currently in a strong buy zone, and the Rocket Booster Strategy confirms it’s go-time for traders and investors who know how to ride the wave.

✅ Top 3 Confirmations (Rocket Booster Strategy)

MACD Crossover – Bullish momentum is building. The MACD has crossed above the signal line, indicating a trend reversal.

Oscillator Rating: BUY – Leading oscillators such as the RSI and Stochastic show a bullish signal.

Candlestick Pattern: Rising Window / Bullish Engulfing – Clear bullish confirmation from price action.

This combination of technical signals is what we call the Rocket Booster Setup — a strategy that looks for lift-off moments just before a major upward thrust.

📈 Timeframe:

Daily timeframe only – This is a long-term investment setup, not a short-term scalp. Perfect for swing traders and HODLers.

⚠️ Disclaimer:

This is not financial advice. Always use a simulation/demo account before trading real money. Risk management is key.

BTC, zoom out!!!Based on your prediction that Bitcoin will change at a rate of 5% every year, the price of Bitcoin would be $124,709.55 in 2026, $151,585.24 in 2030, $193,465.44 in 2035, and $246,916.38 in 2040. Scroll down to view the complete table showing the predicted price of Bitcoin and the projected ROI for each year.

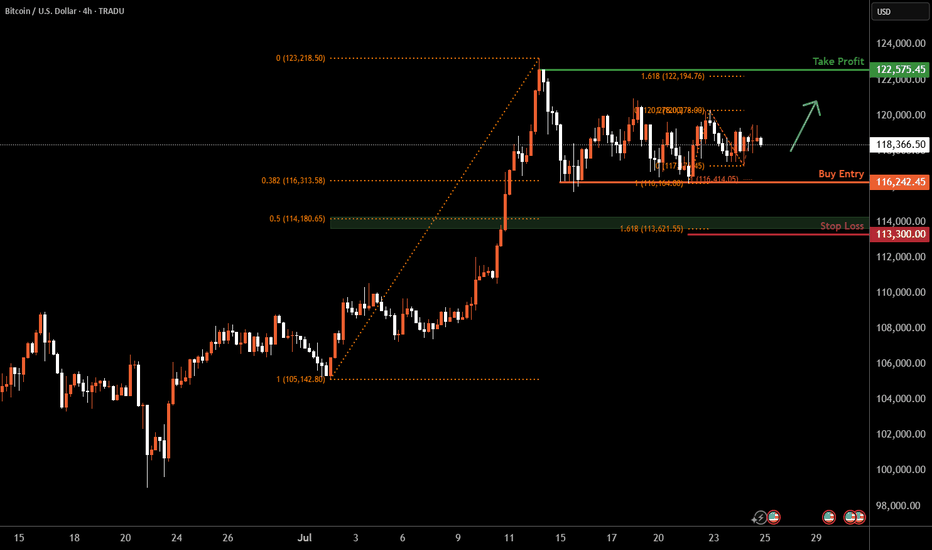

Bitcoin H4 | Falling toward a multi-swing-low supportBitcoin (BTC/USD) is falling towards a multi-swing-low support and could potentially bounce off this level to climb higher.

Buy entry is at 116,242.45 which is a multi-swing-low support that aligns with a confluence of Fibonacci levels i.e. the 38.2% retracement and the 100% projection.

Stop loss is at 113,300.00 which is a level that lies underneath a support zone that is identified by a confluence of Fibonacci levels i.e. the 50% retracement and the 161.8% extension.

Take profit is at 122,575.45 which is a swing-high resistance that aligns close to the all-time-high.

High Risk Investment Warning

Trading Forex/CFDs on margin carries a high level of risk and may not be suitable for all investors. Leverage can work against you.

Stratos Markets Limited (tradu.com ):

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 66% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Stratos Europe Ltd (tradu.com ):

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 66% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Stratos Global LLC (tradu.com ):

Losses can exceed deposits.

Please be advised that the information presented on TradingView is provided to Tradu (‘Company’, ‘we’) by a third-party provider (‘TFA Global Pte Ltd’). Please be reminded that you are solely responsible for the trading decisions on your account. There is a very high degree of risk involved in trading. Any information and/or content is intended entirely for research, educational and informational purposes only and does not constitute investment or consultation advice or investment strategy. The information is not tailored to the investment needs of any specific person and therefore does not involve a consideration of any of the investment objectives, financial situation or needs of any viewer that may receive it. Kindly also note that past performance is not a reliable indicator of future results. Actual results may differ materially from those anticipated in forward-looking or past performance statements. We assume no liability as to the accuracy or completeness of any of the information and/or content provided herein and the Company cannot be held responsible for any omission, mistake nor for any loss or damage including without limitation to any loss of profit which may arise from reliance on any information supplied by TFA Global Pte Ltd.

The speaker(s) is neither an employee, agent nor representative of Tradu and is therefore acting independently. The opinions given are their own, constitute general market commentary, and do not constitute the opinion or advice of Tradu or any form of personal or investment advice. Tradu neither endorses nor guarantees offerings of third-party speakers, nor is Tradu responsible for the content, veracity or opinions of third-party speakers, presenters or participants.

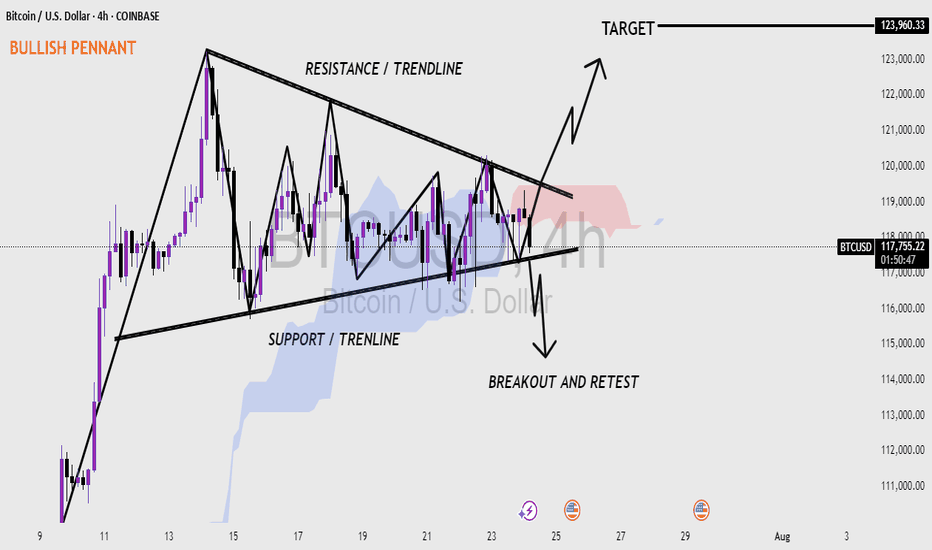

Bitcoin (BTC/USD) 4H CHART - BULLISH PENNANT PATTERN 📊 Bitcoin (BTC/USD) 4-Hour Chart – Bullish Pennant Formation

Bitcoin (BTC) forming a bullish pennant pattern on the 4-hour timeframe.

A bullish pennant often appears after a strong upward move, followed by a period of consolidation, and usually signals a continuation to the upside.

🔍 Key Highlights:

Pattern: Bullish Pennant – a continuation pattern that forms after a strong rally (flagpole), followed by a tightening price range.

Resistance Trendline: The upper black line showing lower highs — where price has repeatedly faced selling pressure.

Support Trendline: The lower black line showing higher lows — where buyers have been stepping in.

Breakout Zone: Price is nearing the apex of the pennant. A breakout above the resistance line would likely confirm the bullish move.

Target Projection: If the breakout is successful, the target is around $123,960, based on the height of the flagpole.

Breakout and Retest: The chart also shows a possible retest of the trendline after breakout, which is common and can offer a second entry point for traders.

Volume Watch: A valid breakout usually comes with increased volume. Monitoring this can help confirm the move.

📉 Downside Possibility:

If the price fails to break out and falls below the support trendline, it could invalidate the pattern and lead to a bearish move — possibly retesting the $110,000 area.

---

The market is at a decision point. If BTC breaks above the resistance and retests successfully, it could push toward $123K. However, traders should watch for both breakout confirmation and false moves.

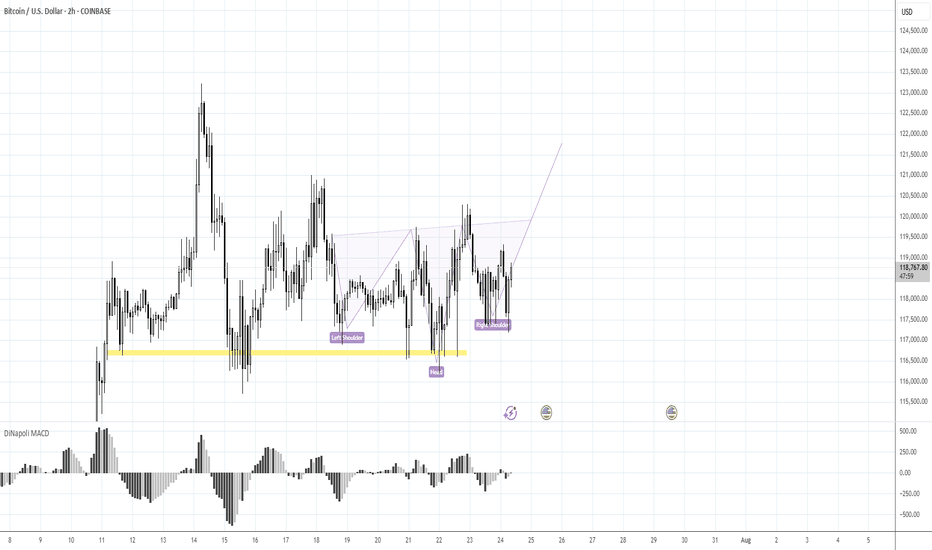

BTC Ready to Start to 125KMorning folks,

Better if you combine this update with previous idea. Now it seems that BTC stands in swamp action, flirting around 116K, which might be looking a bit bearish.

But by our view, this is not quite so. First is, triangle patterns as on daily chart as on 4H chart are look great and quite bullish. Pay attention that on 4H chart all sell-offs were bought out.

Our 1.16 lows that we set as vital ones for this scenario area still intact. So, it means that butterfly with 125K target that we discussed last time is also intact. I would say more. If you take a careful look at 1H chart - you could recognize reverse H&S pattern that could trigger all this stuff. It means that we're not in swamp, but at the point where the decision on long entry has to be made...

Take care

S.

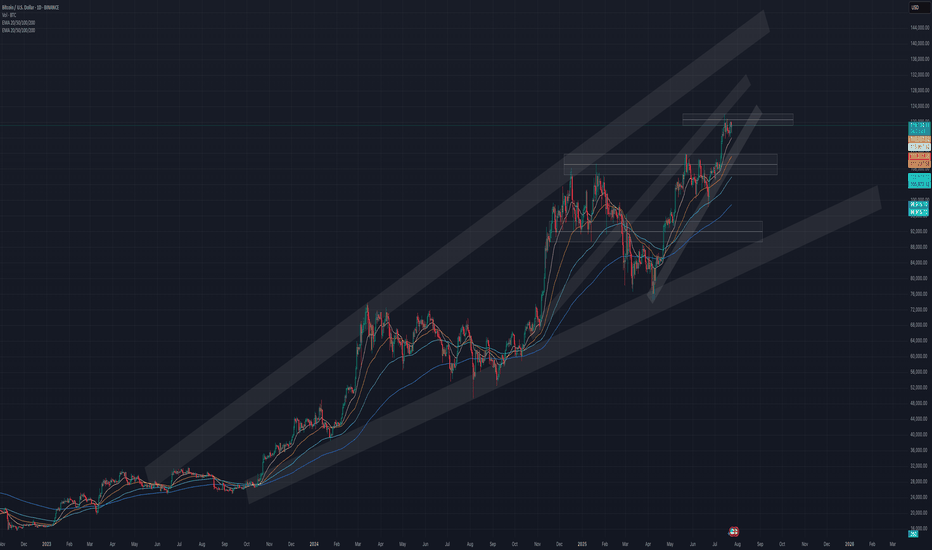

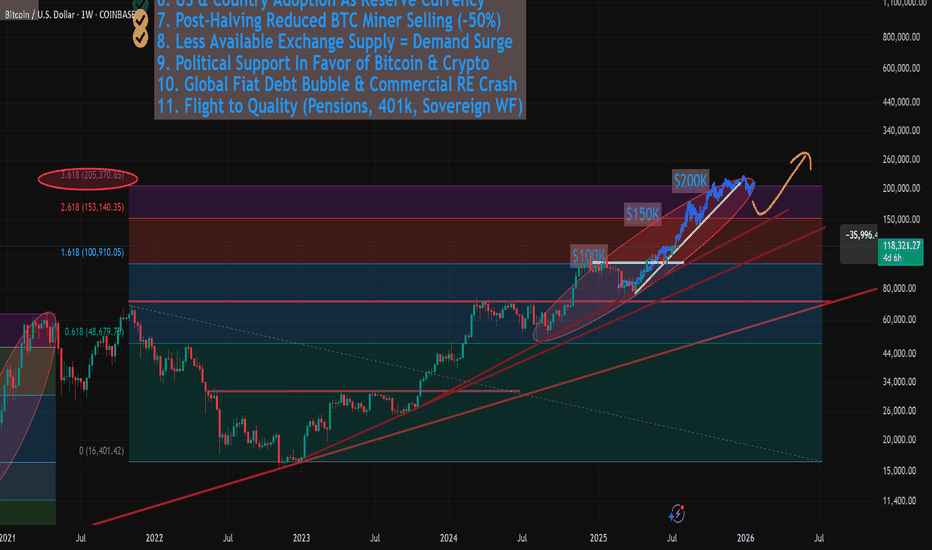

Revsiting $150k - $200k Bitcoin (AND Next Bear Market Bottom)In this video I revisit my 2-year old study showing the potential path for Bitcoin to $150k to $200k and not only how we might get there, but the 11 reasons WHY we can this cycle.

This is the same Fibonacci series that predicted the 2021 cycle high at the 3.618 (Log chart) and used the same way this cycle, with some interesting 2025 forecasts of:

1.618 - $100k

2.618 - $150k

3.618 - $200k

There are quite a few confluences that we get to $150k like the measured moves from both the recent mini bull flag, but also the larger one from earlier this year.

** Also I touch on revisiting my study from 2 years ago where I may have discovered the retracemebnt multiple that correctlty predicted and held the 2022 lowes around $16k. **

It's a VERY interesting number you all will recognize (buy may not agree with).

Let me know what you think.

Protect Capital First, Trade SecondIn the world of trading, mastering technical analysis or finding winning strategies is only part of the equation. One of the most overlooked but essential skills is money management. Even the best trading strategy can fail without a solid risk management plan.

Here’s a simple but powerful money management framework that helps you stay disciplined, protect your capital, and survive long enough to grow.

✅1. Risk Only 2% Per Trade

The 2% rule means you risk no more than 2% of your total capital on a single trade.

-Example: If your trading account has $10,000, your maximum loss per trade should not exceed $200.

-This protects you from large losses and gives you enough room to survive a losing streak without major damage.

A disciplined approach to risk keeps your emotions under control and prevents you from blowing your account.

✅2. Limit to 5 Trades at a Time

Keeping your number of open trades under control is essential to avoid overexposure and panic management.

-A maximum of 5 open trades allows you to monitor each position carefully.

-It also keeps your total account risk within acceptable limits (2% × 5 trades = 10% total exposure).

-This rule encourages you to be selective, focusing only on the highest quality setups.

Less is more. Focus on better trades, not more trades.

✅3. Use Minimum 1:2 or 1:3 Risk-Reward Ratio

Every trade must be worth the risk. The Risk-Reward Ratio (RRR) defines how much you stand to gain compared to how much you’re willing to lose.

-Minimum RRR: 1:2 or 1:3

Risk $100 to make $200 or $300

-This allows you to be profitable even with a win rate below 50%.

Example:

If you take 10 trades risking $100 per trade:

4 wins at $300 = $1,200

6 losses at $100 = $600

→ Net profit = $600, even with only 40% accuracy.

A poor RRR forces you to win frequently just to break even. A strong RRR gives you room for error and long-term consistency.

✅4. Stop and Review After 30% Drawdown

Drawdowns are a part of trading, but a 30% drawdown from your account's peak is a red alert.

When you hit this level:

-Stop trading immediately.

-Conduct a full review of your past trades:

-Were your losses due to poor strategy or poor execution?

-Did you follow your stop-loss and risk rules?

-Were there changes in the market that invalidated your setups?

You must identify the problem before you continue trading. Without review, you risk repeating the same mistakes and losing more.

This is not failure; it’s a checkpoint to reset and rebuild your edge.

Final Thoughts: Survive First, Thrive Later

In trading, capital protection is the first priority. Profits come after you've mastered control over risk. No trader wins all the time, but the ones who respect risk management survive the longest.

Here’s your survival framework:

📉 Risk max 2% per trade

🧠 Limit to 5 trades

⚖️ Maintain minimum 1:2 or 1:3 RRR

🛑 Pause and review after 30% drawdown

🧘 Avoid revenge trading and burnout

Follow these principles and you won't just trade, you'll trade with discipline, confidence, and longevity.

Cheers

Hexa

Will cryptos lose their appeal, as more regulation comes in?In this new world, where governments and financial institutions are getting more and more interested in cryptos, will those start losing their appeal?

Let's take a look at CRYPTO:BTCUSD

MARKETSCOM:BITCOIN

CRYPTO:ETHUSD

MARKETSCOM:RIPPLE

Let us know what you think in the comments below.

Thank you.

75.2% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money. Past performance is not necessarily indicative of future results. The value of investments may fall as well as rise and the investor may not get back the amount initially invested. This content is not intended for nor applicable to residents of the UK. Cryptocurrency CFDs and spread bets are restricted in the UK for all retail clients.

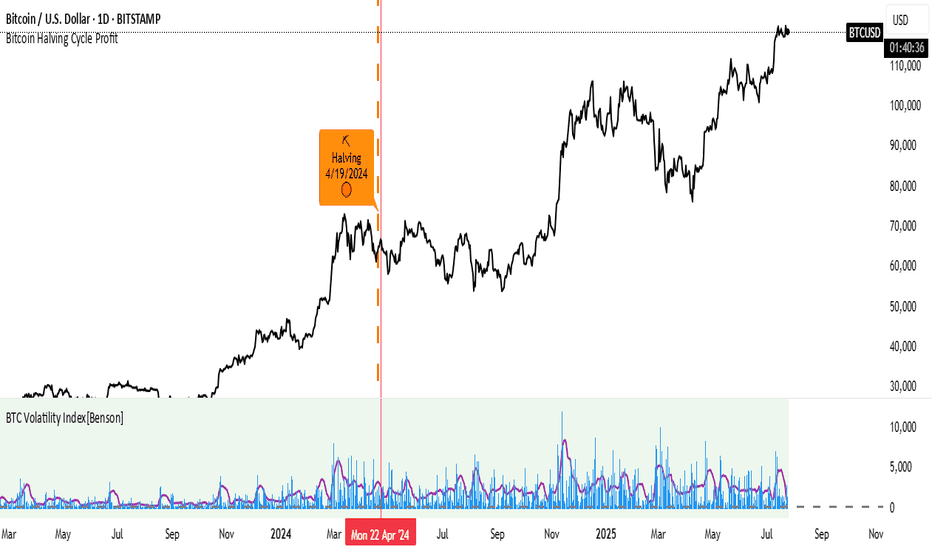

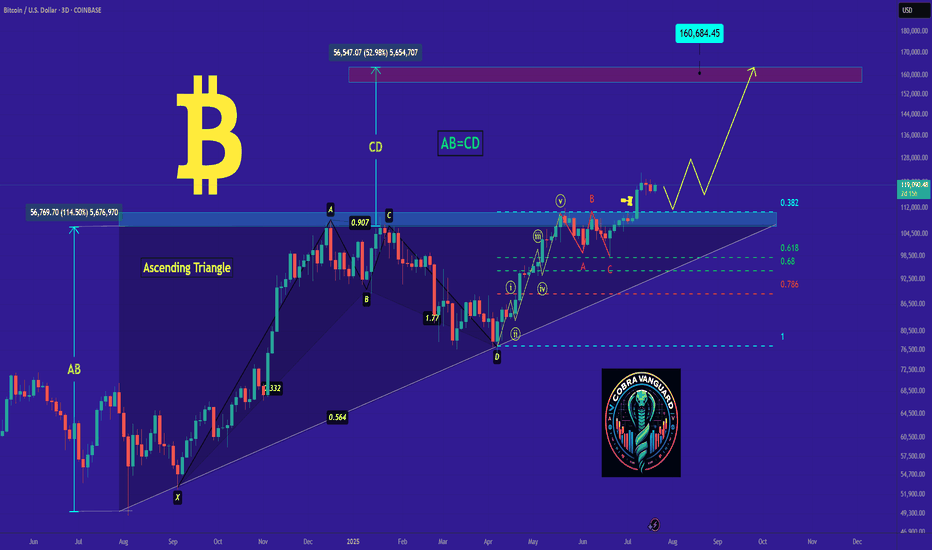

Bitcoin massive bullrun incoming!!!If historical patterns serve as a guide, we consistently observe the formation of a rounding bottom pattern on BTC preceding each bull run.

Presently, it appears we are on the brink of significant BTC movements this year. Notably, a critical support level indicated on the chart stands at 59k, extrapolated from historical data.

The target for the rounding bottom formation is distinctly delineated on the chart. This post will be continuously updated in a timely manner.

Do share your insights regarding this pattern.

BTC Bulls Defend Key Zone Eyes on $123K Breakout ExtensionBitcoin has successfully completed a breakout above the prior weekly high structure, followed by a healthy pullback which is currently unfolding into a bullish pennant formation. The key highlight is how price is retesting the neckline zone with precision, which now doubles as a strong immediate buyback zone.

The reaction from this level is already showing strong bullish momentum, with price gearing up to challenge the previous ATH. A breakout above that resistance should unlock the path toward the projected $116.5k and $123.4k targets as shown on the chart. Failure to hold the Immediate Buyback Zone opens the door toward the Strong Demand Zone, which remains a valid re-accumulation point within this bullish cycle.

Stay sharp. The structure remains intact unless the neckline fails decisively.

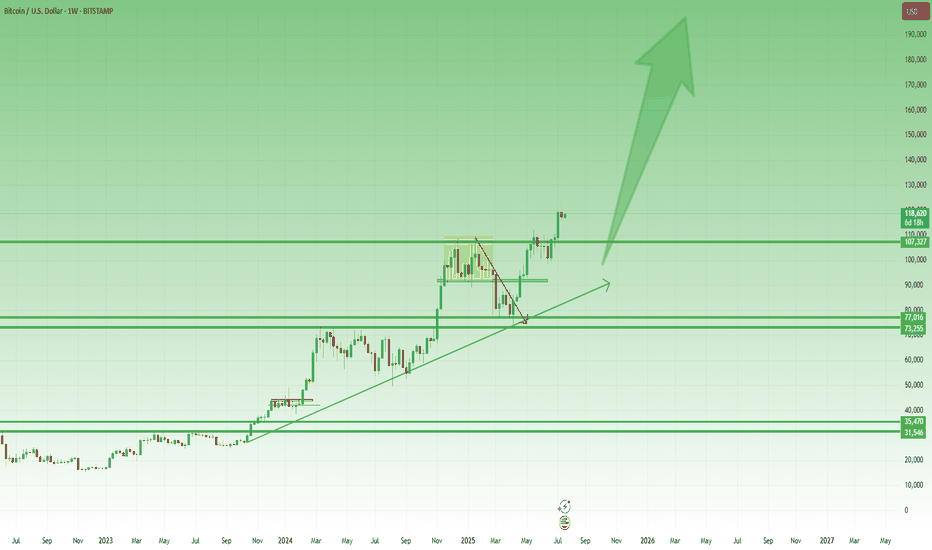

Bitcoin- 175-200k by year's endEvery major Bitcoin move over the last decade — whether a jaw-dropping bull run or a brutal crash — has shared one silent macro trigger.

It’s not the halving.

It’s not ETF hype.

It’s not Twitter sentiment or TikTok FOMO.

👉 It’s global liquidity.

And right now, this powerful force is expanding fast — the same setup that previously drove Bitcoin from $5K to $70K in under a year.

But here’s the twist: as of today, Bitcoin is already trading near $120,000, not $20K or 30k.

That means the engine is already roaring — and if this macro thesis holds, the next stop might just be $175,000-200.000 by year's end.

________________________________________

🧠 What Is Global Liquidity, Really?

Global liquidity = the total money sloshing around the financial system.

It’s often measured through M2 money supply, combining:

• Cash

• Checking/savings deposits

• Easily accessible liquid assets

The most comprehensive view comes from Global M2, which aggregates liquidity from 20 of the world’s largest central banks.

Right now, Global M2 is not just rising — it’s breaking to all-time highs.

And if history repeats itself, Bitcoin tends to follow this wave closely.

________________________________________

📅 Past Performance: Bitcoin and Liquidity Walk Hand in Hand

Let’s break it down:

• 2016–2017: Liquidity surges → BTC +5,000%

• 2020–2021: Post-COVID easing → BTC $5K to $69K

• 2018 & 2022: Liquidity dries up → BTC crashes ~70%

It’s a recurring pattern:

Liquidity drives the crypto cycle.

________________________________________

💡 Why Liquidity Moves: Interest Rates and Central Banks

Central banks control the tap.

• 🟢 Cut rates → Easier credit → More lending → More liquidity

• 🔴 Raise rates → Tighter credit → Less spending → Liquidity contraction

In 2022, the Fed tightened hard.

🧊 U.S. money supply shrank.

📉 Bitcoin fell from $70K to $15K.

But starting August 2023, the Fed paused, then pivoted.

Since then:

• 🟢 The U.S. M2 supply rebounded

• 🟢 Global M2 began expanding again

• 🟢 Over 64 global rate cuts were made in just six months — one of the fastest global easing cycles in history

The last time we saw this much cutting? 2020.

And we all know what happened to Bitcoin then.

U.S M2

________________________________________

🟢 Today’s Setup: The Engine Is Already Running

Fast forward to mid-July 2025:

Bitcoin is no longer at $30K — it’s already testing $120K.

Intraday highs have touched $123K, with a current consolidation zone between $117K–$120K.

This isn’t a "recovery rally" — we’re already in price discovery territory.

The question now becomes:

Is $150K and above next… or are we topping out?

________________________________________

📈 Charting the Path: Bitcoin vs Global M2

When we overlay Bitcoin price over global liquidity trends, one thing becomes crystal clear:

📊 Bitcoin tracks liquidity direction.

• When money supply expands, Bitcoin rallies.

• When money dries up, Bitcoin tanks.

Given that global M2 is at record highs, and liquidity conditions are easing globally, the chart suggests there’s still plenty of fuel in the tank.

And if we follow the same growth, Bitcoin could realistically reach $175,000 before 2026 kicks in.

________________________________________

Technically:

As we can clearly see from the posted weekly chart, you don’t need to be an expert to recognize the strength of the current uptrend.

While last week printed a small bearish Pin Bar, this alone shouldn’t raise major concerns — especially considering the presence of multiple key support levels, starting from the 110K zone.

In the context of a strong and well-established trend, such candles often reflect normal short-term profit-taking, not a reversal.

🎯 Conclusion – Don’t Fight the Tide

This isn’t about hopium.

It’s not moon talk.

It’s about macro flows and monetary velocity.

Ignore the noise.

Watch what the central banks are doing.

Because Bitcoin moves not on wishful thinking, but on waves of liquidity — and the tide right now is rising fast.

Whether $175K comes by year-end, one thing is clear:

We are in the middle of a liquidity-driven expansion phase, and Bitcoin is already responding.

Stay focused, manage your risk, and don’t chase — ride the wave. 🌊