BTCUSD trade ideas

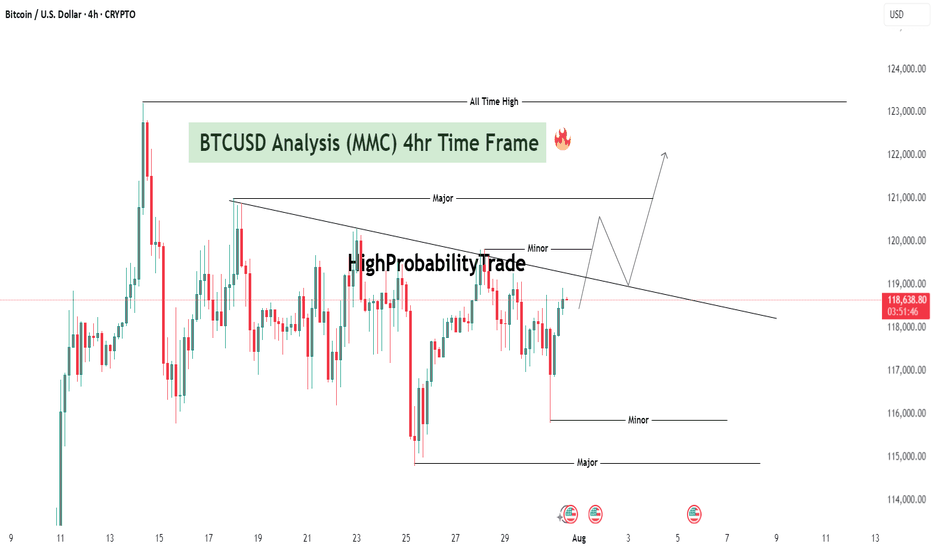

BTCUSD Analysis : Major Breakout Setup | Big Move Loading"Bitcoin Coiling Below Key Resistance – Breakout or Trap?"

🔍 Technical Overview:

Bitcoin is currently trading within a compressed range, sitting just below a key descending trendline that has capped upside movement for multiple sessions. Price is consolidating between minor highs and lows, hinting at a build-up of momentum for the next breakout move.

The setup presents a classic compression inside a bearish wedge, but with increasing bullish pressure evident from higher lows and wick rejections near minor supports.

🧱 Detailed Technical Breakdown:

🔸 1. Descending Trendline Structure

Price has formed a downward sloping resistance line from earlier highs.

This trendline has acted as a dynamic ceiling, rejecting multiple bullish attempts.

Each time price approaches it, the rejection gets weaker, indicating a possible breakout attempt soon.

🔸 2. Multiple Minor & Major Zones

Minor Resistance: Around $118,800–$119,200

A short-term ceiling that has paused bullish rallies.

Price needs a clean break and close above this to initiate momentum.

Major Resistance: ~$121,000–$121,200

This zone aligns with a previous significant swing high.

A break above here could result in strong bullish continuation toward ATH levels.

Minor Support: ~$117,000

Price has repeatedly bounced from this level.

A breakdown would indicate fading bullish strength and open the downside.

Major Support: ~$115,000

A historically strong demand zone.

If BTC fails all bullish attempts, this would be the final defense for buyers.

🧠 Market Psychology Insight:

Price is trapped between aggressive short-term sellers and accumulating buyers.

Buyers are placing confidence in this area by defending higher lows.

Sellers are still protecting the trendline, but with each retest, the defense weakens.

This is a classic equilibrium zone where liquidity is building—once imbalance hits, a strong impulsive breakout (either direction) is likely.

Volume and momentum should be watched closely as a breakout with confirmation may trap the opposite side, leading to a strong move (short squeeze or long liquidation).

🔮 Scenario Forecasts:

📈 Bullish Breakout Scenario:

Price breaks above $119,200 → minor resistance flips to support

Retest of the broken trendline confirms a bullish breakout

Price targets:

First Target: $121,000–$121,200 (major resistance)

Second Target: $122,500+

Third Target: $123,800–$124,000 (All-Time High)

Confirmation Needed: 4H candle close above descending trendline and $119,200 with rising volume.

📉 Bearish Rejection Scenario:

Price gets rejected from the trendline or minor resistance zone

Breaks below $117,000 minor support

Possible targets:

First Target: $116,000 (reaction zone)

Second Target: $115,000 (major support)

A fall below $115,000 could invalidate the bullish buildup and invite strong bearish continuation.

This would signal that bulls failed to reclaim control, and sellers maintain market structure dominance.

📌 Key Levels Summary:

Type Price Range Significance

🔺 All-Time High $123,800–124,000 Final upside target

🔸 Major Resistance $121,000–121,200 Key breakout level

🔹 Minor Resistance $118,800–119,200 Immediate trendline + local supply

🔹 Minor Support ~$117,000 Local demand base

🔻 Major Support $115,000 Last line of defense for bulls

🧭 Conclusion & Strategy:

Bitcoin is approaching a make-or-break zone under a significant descending trendline. Price compression is tightening, and a breakout looks imminent.

Traders should stay patient and wait for confirmation—either a breakout and successful retest for longs or a rejection and trendline defense for shorting opportunities.

Whether it’s a breakout toward $121K and ATH, or a drop toward $115K support, this setup offers a high-probability trade opportunity for both bulls and bears depending on the confirmation.

BITCOIN Will Move Higher! Long!

Take a look at our analysis for BITCOIN.

Time Frame: 2h

Current Trend: Bullish

Sentiment: Oversold (based on 7-period RSI)

Forecast: Bullish

The price is testing a key support 118,043.14.

Current market trend & oversold RSI makes me think that buyers will push the price. I will anticipate a bullish movement at least to 119,900.74 level.

P.S

The term oversold refers to a condition where an asset has traded lower in price and has the potential for a price bounce.

Overbought refers to market scenarios where the instrument is traded considerably higher than its fair value. Overvaluation is caused by market sentiments when there is positive news.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

Like and subscribe and comment my ideas if you enjoy them!

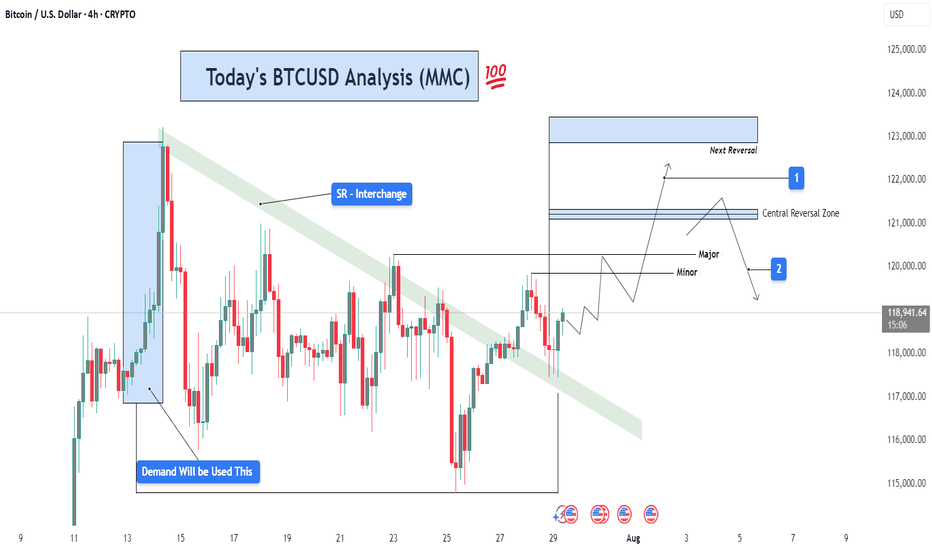

BTCUSD Analysis (MMC) – Breakout Confirmed + Target Next Zone⚙️ Chart Context (4H BTC/USD)

As part of our Mirror Market Concepts (MMC) strategy, today's BTCUSD 4H chart is a textbook representation of market structure shift, SR interchange, demand reaction, and target projection. After consolidating within a compressed range under a key descending structure, Bitcoin has successfully broken out of bearish control, signaling a fresh phase of bullish momentum.

🧩 Breakdown of Technical Structure

🔹 1. Demand Zone Reaction (July 13–14)

The initial impulse move originated from a well-defined demand zone, marked by a strong accumulation and breakout. This zone—highlighted on the chart—acted as the institutional demand base, where buyers stepped in with volume and aggression. Price respected this zone precisely, confirming it as a valid MMC "Power Base."

Why this matters: Demand zones like these reflect institutional footprints. Once price reacts from such zones, they often become foundational for future bullish legs.

🔹 2. SR Interchange Zone – Structure Flip Confirmed

The descending green channel acted as dynamic resistance for several sessions. Every touch along this zone resulted in a lower high, confirming bearish order flow. However, BTC has now closed decisively above this structure, transforming this zone from supply to support—this is our classic SR Interchange concept in MMC.

Interpretation: This structure flip implies a strong change in sentiment. What was once a zone of rejection now becomes a potential support for continuation.

Expect retests of this zone before price resumes to higher reversal levels.

🔹 3. Minor and Major Resistance Zones

Above current price, two critical zones have been mapped:

Minor Resistance (~$120,000):

Acts as the first liquidity grab area. This is where early sellers may place stops or where short-term traders could book profits. MMC logic expects minor resistance to either cause a pause or a fakeout to lure in shorts.

Major Resistance / Central Reversal Zone (CRZ):

Spanning roughly $121,000 to $121,800, this is a key zone where price will likely meet decision-making. This CRZ is derived from previous structure congestion, imbalance fills, and projected Fibonacci confluence.

Next Reversal Zone (Final Target Area):

Located near $123,000, this is the outer reversal box where the bullish wave may either end, consolidate, or reverse entirely. This is the final target for swing traders or MMC practitioners looking for exhaustion.

🧭 Price Forecast Structure – Predictive Pathway

The forecast path shown on the chart illustrates a stair-step rally, with bullish impulses followed by shallow pullbacks:

First, price may pull back slightly to retest the breakout zone (green SR area).

Then a leg upward to minor resistance (~$120K).

A healthy rejection or small correction before breaking into the CRZ (~$121.2K).

Final move toward the outer reversal zone at ~$123K.

This fractal progression is a common MMC pattern seen during structure shifts—not impulsive straight-line rallies, but controlled, zone-to-zone movements.

🔍 Strategic Insights & Trade Plan

📌 Conservative Entry:

Wait for a retest of the breakout zone (SR Interchange) around $118,200–$118,500.

Look for bullish rejection candles or order flow confirmation on LTF (lower timeframes).

📌 Aggressive Entry:

Break and close above $120,000, confirming liquidity clearance and path toward CRZ.

🎯 Target Zones:

TP1: $121,200 – Central Reversal Zone

TP2: $123,000 – Outer Reversal Zone

❌ Stop-Loss Ideas:

Below $117,000 (structure invalidation)

Below recent bullish impulse candle low

🧠 MMC Concepts in Action:

SR Flip: Strong indication of market shift

Demand Rejection: Institutional footprint detected

Zone Mapping: Controlled zone-to-zone movement

Liquidity Logic: Price moves where orders rest – CRZ = likely reaction

Reversal Framing: Structure analysis ahead of time, not after the move

📊 Conclusion:

This BTCUSD 4H analysis showcases a strong MMC-style breakout scenario. The reaction from demand, shift in SR structure, and projected reversal zones give us a clean roadmap. As long as the structure remains valid and price respects the new SR zone, this bullish move remains high-probability.

Trade with structure. Trust the zones. Mirror the Market.

BTCUSD 4HOUR TIME FRAME ANALYSISOverall Structure & Trend

Over the past several 4-hour candles, BTCUSD has carved out a series of higher lows around 116,500–117,000 and higher highs around 120,000–120,500, defining a gentle up-sloping channel.

The current price (118,758) sits just above the middle of that channel, suggesting there’s still room toward the upper trendline before meeting heavy supply.

Key Support & Entry Zone

Primary support lies at 117,200–117,500 (the former swing high from three bars ago), which also aligns with the 50% retracement of the move up from 114,500 to 120,500. That zone offers confluence for the 118,758 entry.

A secondary buffer sits at 116,849 (your stop-loss), just below the channel’s lower boundary—if price breaches here, the bullish structure would be invalidated.

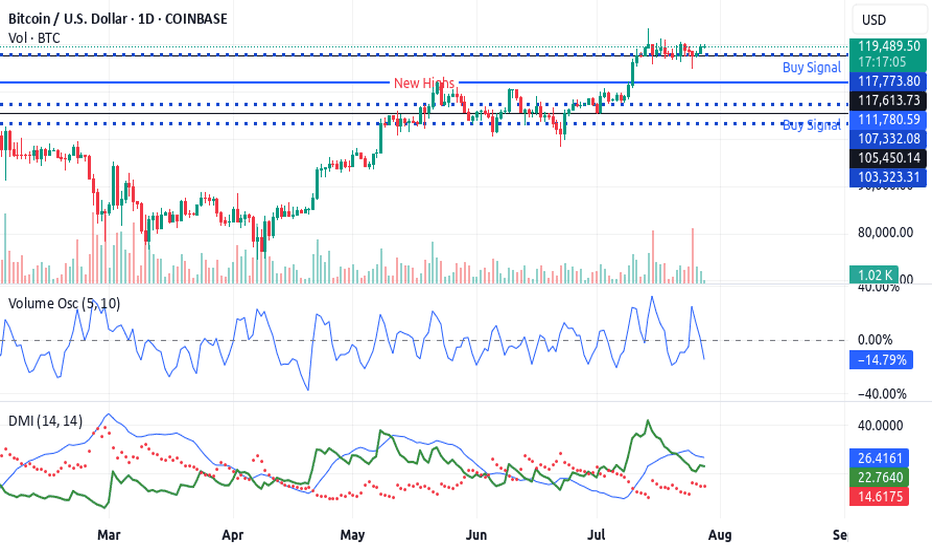

BTC - Weekly Warning SignsAfter seeing a 5% correction from our recent BTC ATH of $123k we are starting to see a few warning signs as momentum starts to decline.

Looking only at our RSI and price I have outline the last 3 time we have seen something similar since 2021. Without going into too much detail normally what we see is an RSI TOP followed by a retest + rejection right at the 70 level (overbought conditions).

We saw it at our market cycle high in 2021 that started the bear market (75% correction).

We saw it at our March 2024 high that started a mid cycle correction (33% correction).

And we are seeing it now after our recent 2025 ATH that has started a very mild correction so far (5%).

This does not mean it is the end of the world but absolutely something market participants need to be paying attention to as this is a make or break signal;.

If we see momentum continue to decline it could lead to our bull market structure being broken and lead us into a bear market that we have historically seen going into the new year.

However this correction can easily be negated to produce a strong bull market continuation move. All we need to see is bulls start to push our strength back above the 70 level (overbought conditions) and we can see the next leg of the bull market really kick off (WITH A CLOSE ABOVE).

For now pay attention to the weekly RSI as of the time of this post our strength has been declining from where we have seen previous tops align with.

August 2025 Monthly ScenariosChartingMyLosses | Monthly Analysis | 1M TF

Speculative structure meets macro zones

🔵 Scenario 1: Direct continuation to the highs (Blue Path)

Price holds above PH June and pushes toward the 0.78 retracement of July, targeting 121,399 USD. This would be a classic bullish continuation fueled by residual momentum and liquidity above recent highs.

🟢 Scenario 2: Support retest before continuation (Green Path)

A sweep of the 109,893–103,009 USD zone (June’s fib cluster and previous breakout range) leads to a rebound. This would validate the zone as a new macro support and could signal institutional reaccumulation before an end-of-month push to the highs.

🔴 Scenario 3: Deep retracement into OB + FVG (Red Path)

Bears attack, dragging price down to the 98,459–96,000 USD range, tapping into a Daily Order Block + FVG inefficiency. A full liquidity sweep in this zone could set up a powerful reversal toward the new max, but would require market-wide risk-on behavior to confirm.

🧠 Speculative Note

In just one month, BTC can traverse thousands of dollars. The real question isn’t "will it drop or pump?" but rather "where is price most efficient to move next?". Keep an eye on volume, reactions at fib levels, and especially how the market behaves near the prior June low (PL).

#Bitcoin Sunday Update $BTC bounced from the $112,398 support #Bitcoin Sunday Update

CRYPTOCAP:BTC bounced from the $112,398 support and is now trading above $113,700. If it holds above this level, a push toward $120K is likely. However, if downside continues, next key support sits near $110K — both supports could trigger a rebound toward $120K. Stay alert for range play before breakout.

Bitcoin(BTC/USD) Daily Chart Analysis For Week of August 1, 2025Technical Analysis and Outlook:

In this week's trading session, the Bitcoin market experienced a notable pullback. The primary reason for this movement was the Key Resistance level, which led to a decline that reached our Mean Support level of 113000. This anticipated pullback is prompting the completion of the Outer Coin Dip target of 111000, with a strong likelihood of moving towards the Mean Support level of 108000.

Bitcoin – Time to Book Profits?📉 Bitcoin – Time to Book Profits? 📈

Bitcoin (BTCUSD) has had a phenomenal run! On Nov 22, 2022, it bottomed out at around $15,500 — and then, on July 14, 2025, it smashed records by hitting an all-time high of $123,000! 💥

That’s a jaw-dropping gain of approximately 693% in just under 3 years! 🤑📊

🚨 But all that glitters isn't gold...

📉 Technical outlook based on Elliott Wave Theory suggests we might be in either:

An extended Wave 4 correction, or

A fizzling Wave 5 move that’s losing steam.

🔍 Adding to this concern:

Volume is below average – a classic warning sign 🚨

Price action shows weakening momentum

No strong buying confirmation near the highs

👉 The pattern now resembles a potential distribution phase, not a fresh breakout. That means: The smart money might already be booking profits.

💡 What should investors do?

If you’ve ridden the wave up — consider taking some money off the table. This could be a good time to lock in gains and wait for a better re-entry opportunity. Remember, discipline beats excitement in trading.

📛 Caution is advised — especially for late entrants who might get caught in a correction or a prolonged sideways phase.

BTCUSD CONSOLIDATES BELOW RESISTANCE OF 120,000.00BTCUSD CONSOLIDATES BELOW RESISTANCE OF 120,000.00

Today the price rebounded from the SMA50 on 4-h chart and continues to consolidate below the resistance level of 120,000.00. Yesterday there was a minor pullback from this level, still the price is pretty much at the same levels as yesterday. The recommendation is still the same: would be safer for long trade to wait for a breakout of the resistance (120,000.00) with first target of 123,190.30 (ATH). However, the asset shows nice bullish set up: RSI started to show some strength with price consolidation below resistance.

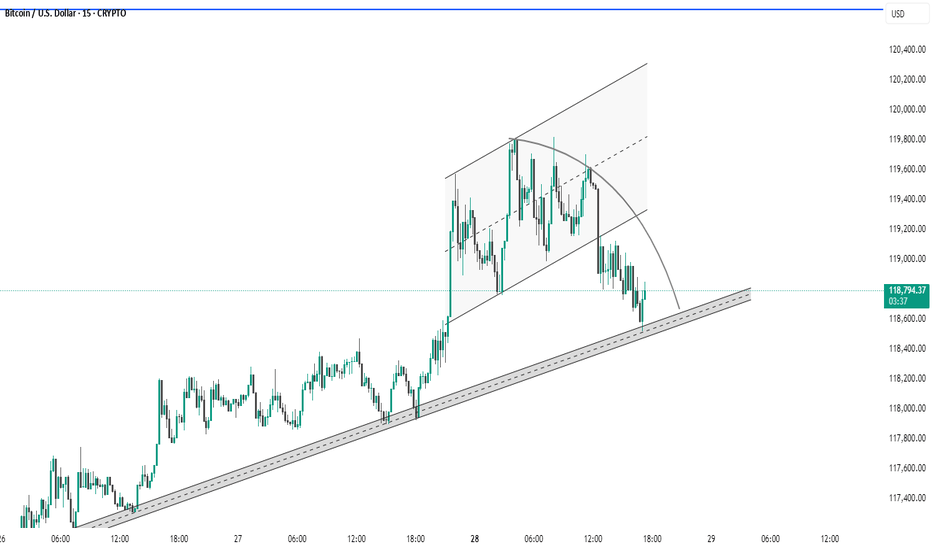

BTC #This 15-minute BTC/USD chart This 15-minute BTC/USD chart shows a rising channel formation that has recently been broken to the downside, indicating potential bearish momentum. The price is currently testing a long-term ascending trendline, acting as a critical support zone around $118,600–$118,800. A breakdown below this trendline could lead to further downside, while a bounce could suggest bullish continuation. The curved arc drawn also hints at a rounding top pattern, reinforcing possible short-term weakness.

Bitcoin Set to Explode: 3 Powerful Buy Signals Active NowBitco🚀 Bitcoin is Flashing a Buy Signal — Rocket Booster Strategy in Play!

Bitcoin is currently in a strong buy zone, and the Rocket Booster Strategy confirms it’s go-time for traders and investors who know how to ride the wave.

✅ Top 3 Confirmations (Rocket Booster Strategy)

MACD Crossover – Bullish momentum is building. The MACD has crossed above the signal line, indicating a trend reversal.

Oscillator Rating: BUY – Leading oscillators such as the RSI and Stochastic show a bullish signal.

Candlestick Pattern: Rising Window / Bullish Engulfing – Clear bullish confirmation from price action.

This combination of technical signals is what we call the Rocket Booster Setup — a strategy that looks for lift-off moments just before a major upward thrust.

📈 Timeframe:

Daily timeframe only – This is a long-term investment setup, not a short-term scalp. Perfect for swing traders and HODLers.

⚠️ Disclaimer:

This is not financial advice. Always use a simulation/demo account before trading real money. Risk management is key.

Beyond ICT & SMC: The Mathematical Revolution in Zone TradingIn the world of trading, there's a fundamental divide between traders who rely on subjective interpretation and those who trust mathematical precision. While concepts like ICT (Inner Circle Trader), SMC (Smart Money Concepts), and naked chart analysis have gained popularity, they all share one critical flaw: they're based entirely on personal interpretation.

The Subjectivity Problem

Ask ten ICT traders to mark their Order Blocks, Fair Value Gaps, or Breaker Blocks on the same chart, and you'll get ten different answers. Why? Because these concepts rely on:

Personal bias in identifying "significant" levels

Subjective interpretation of market structure

Discretionary decision-making on what constitutes a valid setup

Emotional influence on analysis

The same issue plagues SMC, CRT (Candle Range Theory), time-based analysis, and naked chart trading. One trader's "liquidity grab" is another trader's "breakout." One person's "strong support" is another's "weak bounce zone."

The Mathematical Solution

This indicator eliminates this guesswork entirely. Instead of relying on subjective interpretation, it:

Calculates exact entry levels using mathematical formulas based on session params

Identifies precise support/resistance zones

Standardises signals across all timeframes, ensuring consistency whether you're on 1m or 15m charts

Removes emotional bias by using algorithmic detection of significant price levels

Numbers Don't Lie

While an ICT trader might debate whether a level is "mitigation" or "inducement," our indicator simply states: "Entry at 1.0847, Stop at 1.0832." No interpretation needed. No second-guessing. Just mathematical precision derived from actual price action.

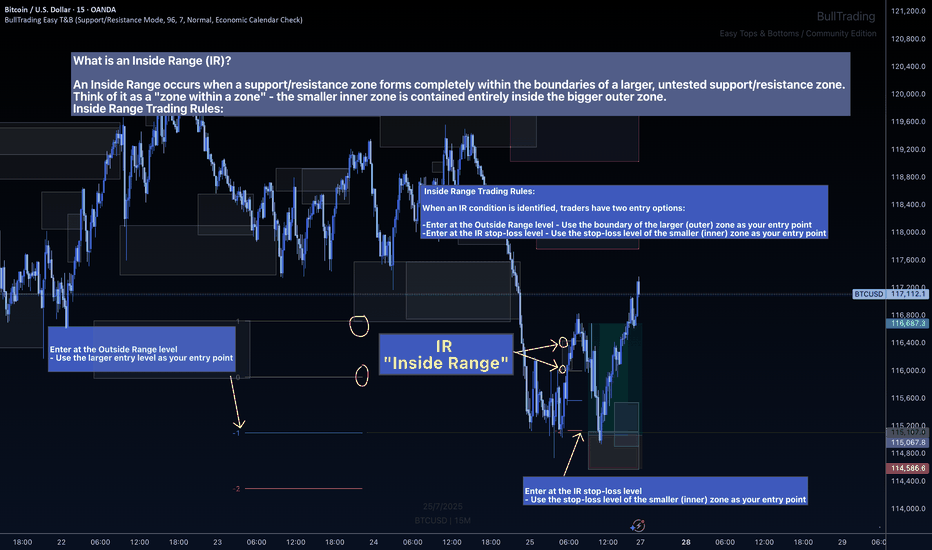

The Inside Range Advantage: When Zones Within Zones Create Superior Trading Opportunities

Most traders miss one of the most powerful setups in technical analysis: the Inside Range (IR). While ICT traders debate "nested order blocks" and SMC followers argue about "refined zones," you can easily identify Inside Ranges with this indicator and mathematically identify these high-probability setups with zero ambiguity.

What Makes Inside Ranges Special?

An Inside Range occurs when a new support/resistance zone forms completely within an untested larger zone. Think of it as the market revealing its hand twice – first showing you the broader area of interest, then pinpointing the precise level within it.

The Mathematical Edge

While discretionary traders struggle to identify these setups consistently, this indicator:

Automatically detects when a smaller zone forms within a larger untested zone

Calculates two precise entry options without any guesswork

Eliminates the confusion of nested levels that plague subjective analysis

Two Entries, Zero Confusion

Documentation and full trading system instructions can be found on the indicator's publication

When an IR forms, the indicator provides exactly two mathematically-derived entry options:

The Outside Range entry – Using the larger zone's entry level

The IR Stop-Loss entry – Converting the inner zone's stop level into an entry point

Compare this to SMC's "refined OB" or ICT's "nested FVG" concepts where traders endlessly debate which level is valid. With Inside Ranges, there's no debate – just two clear, calculated levels.

Inside Ranges represent areas where institutional interest overlaps. The larger zone shows initial interest, while the smaller zone within reveals refined positioning. By mathematically identifying these setups, you're trading where smart money has shown its hand twice.

Real Consistent Precision

Instead of squinting at charts trying to identify subjective "zones within zones," let mathematics do the heavy lifting.

In trading, consistency beats creativity. Stop drawing arbitrary lines and hoping for the best. Start trading with mathematical precision.

Documentation and full trading system instructions can be found on the indicator's publication →

Trade with confidence. Trust in mathematics. Trust in your Edge.