BTC/USD – 4H Technical and Fundamental AnalysisBTC/USD – 4H Technical and Fundamental Analysis

BTC/USD saw sharp downside pressure today, driven by a wave of long position liquidations—exceeding $800 million across the crypto market in the past 24 hours. The sudden shift triggered panic selling, dragging Bitcoin below its psychological and technical support near $116,000. Broader crypto market sentiment turned risk-off as large investors reduced exposure, accelerating the sell-off.

Fundamentally, the market remains cautious amid a lack of positive macroeconomic catalysts for risk assets. Speculation about stricter U.S. regulatory oversight and declining inflows into crypto ETFs also dampened sentiment. Combined with hawkish remarks from Fed officials, which keep interest rates elevated, appetite for high-risk assets like Bitcoin weakened further.

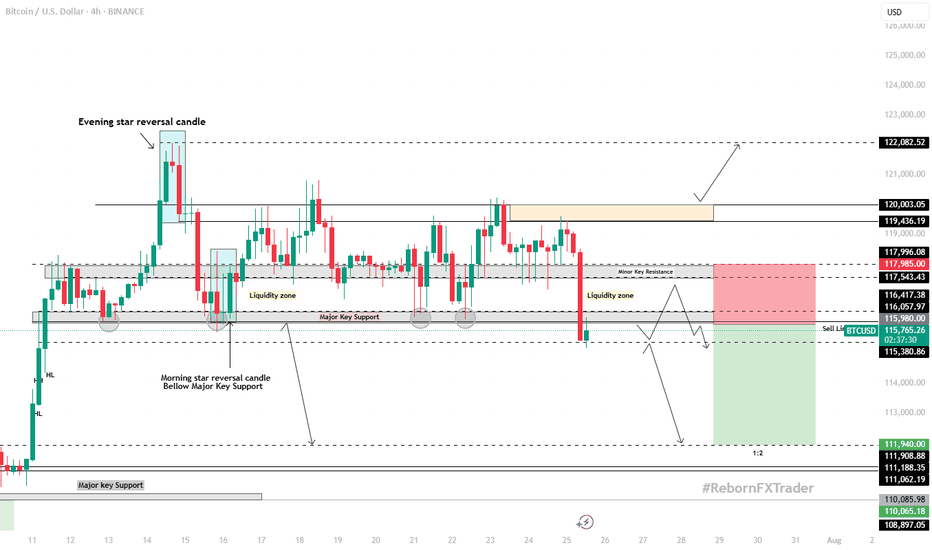

From a technical perspective, BTC/USD broke below the major support level of $116,000, confirming bearish pressure. This breakdown followed a period of consolidation, with price failing to maintain bullish momentum. A liquidity hunt appears to be underway, with price revisiting the zone to trap breakout traders before resuming its move.

We are now watching for a confirmed 4H candle close below the liquidity zone. Once confirmed, a short setup is validated, with targets aligned with the next key support zone.

📍 Sell Setup

Entry: Sell Limit at 115,980.00

Stop Loss: 117,985.00

Take Profit: 111,940.00

📌 Disclaimer:

This is not financial advice. Always wait for proper confirmation before executing trades. Manage risk wisely and trade what you see—not what you feel.

BTCUSD trade ideas

Bitcoin vs Global M2: Can Liquidity Predict the future?This chart compares Bitcoin’s price (daily) with a Global M2 indicator that includes the monetary supply of major economies like the U.S., Eurozone, China, and Japan.

It’s not a perfect global measure — but it gives us a reliable macro signal of what global liquidity is doing.

And when it comes to Bitcoin, liquidity is everything.

Why this matters:

Bitcoin is often seen as volatile or unpredictable. But when we zoom out and overlay it with liquidity flows (like M2), a powerful pattern emerges:

Bitcoin tends to follow global M2 with a ~10-week lag.

When M2 rises, Bitcoin often rallies weeks later. When M2 contracts, Bitcoin loses momentum.

This makes M2 a powerful leading indicator — not for predicting exact price levels, but for catching the direction of trend and regime shifts.

What this chart tells us:

M2 leads, Bitcoin follows.

The curves won’t align perfectly — but the macro structure is there.

Big expansions in M2 create a friendlier environment for risk assets like BTC.

This is the same logic used by macro strategists like Raoul Pal: liquidity drives everything.

Important disclaimer:

This doesn’t mean M2 tells you where price will be on a specific date. But it can help identify turning points — and confirm whether we’re in a reflationary vs contractionary environment.

Think of it as a weather forecast, not a GPS pin.

In other words:

This chart doesn't show the price. It shows the future.

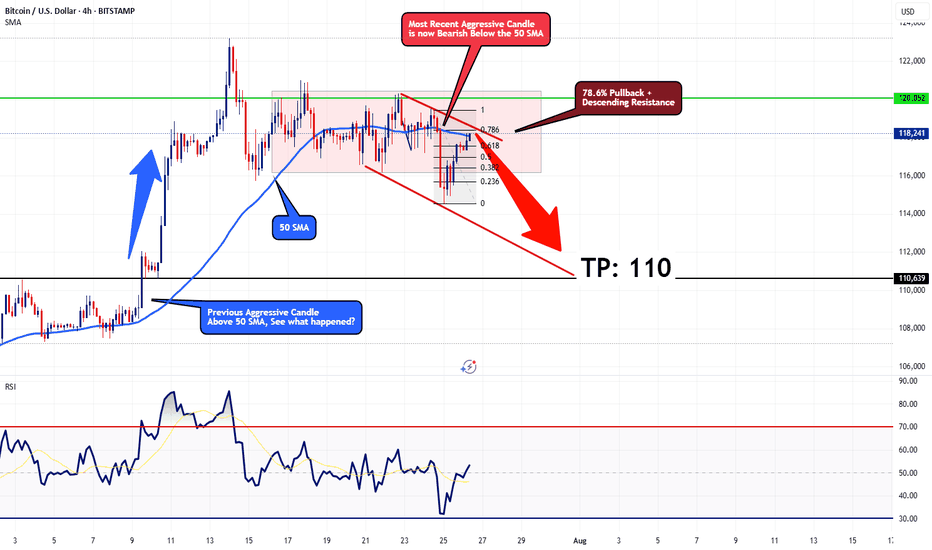

Bearish Outlook for BTCUSDOn the 4-hour timeframe, Bitcoin seems to be starting a corrective phase, likely moving toward the $110 mark. Current price action is facing resistance at a descending trendline, aligned with the 78.6% Fibonacci retracement level, which should limit any short-term upward moves. The price is also trading below the 50-period SMA, with a strong bearish candle from a few sessions back supporting the downward trend.

For a bullish outlook to take hold, Bitcoin would need to decisively break above the 78.6% Fibonacci level with a robust bullish candle closing above the 50 SMA. Until that happens, I remain bearish, with a target of $110.

This technical perspective aligns with the scenario where the Federal Reserve opts to maintain interest rates at 4.50% at this Wednesday's FOMC meeting

Stay cautious and trade wisely!

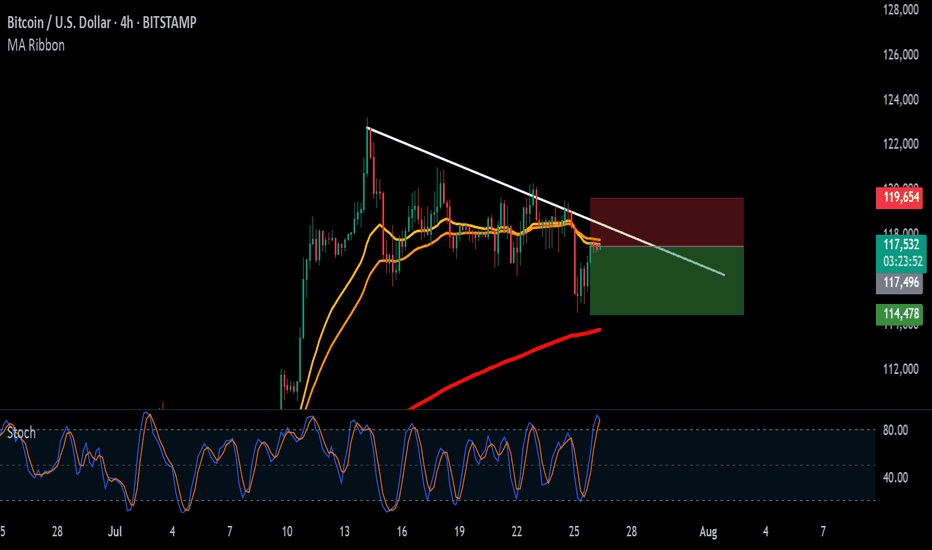

Bitcoin on the edge – Is a sharp drop coming?Bitcoin is keeping investors on edge as price action remains volatile and primed for an explosive move once news or capital flows ignite the market.

🌍 Latest market updates:

– Whales are back in accumulation mode, with on-chain data showing large wallets growing rapidly.

– The U.S. government has just transferred a significant amount of BTC to exchanges — is a dump coming?

– U.S. spot Bitcoin ETFs are witnessing record inflows after CPI came in lower than expected, fueling hopes that the Fed will pause further rate hikes this year.

📉 Technical outlook:

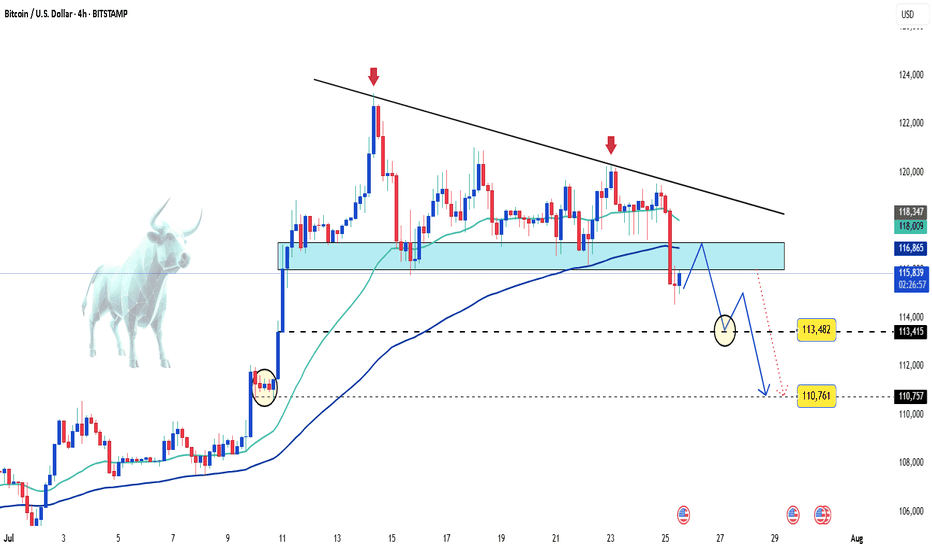

– On the H4 chart, BTC formed a tightening wedge pattern, which has now broken to the downside.

– A steep drop toward the 113,000 to 110,000 USD zone is entirely possible.

This looks like a classic break-retest setup — a golden window for strategic entries. If sell volume surges, it could be the perfect moment for bears to strike.

Stay sharp — and good luck!

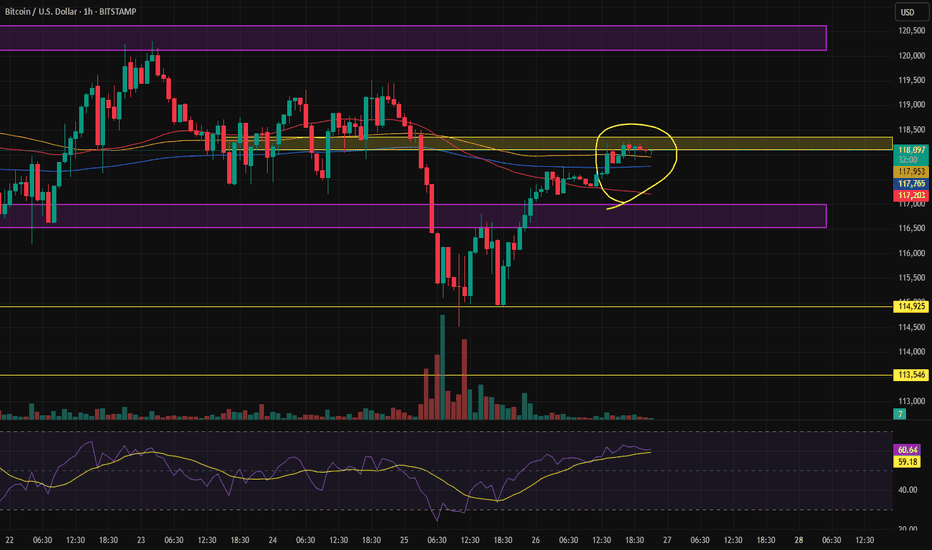

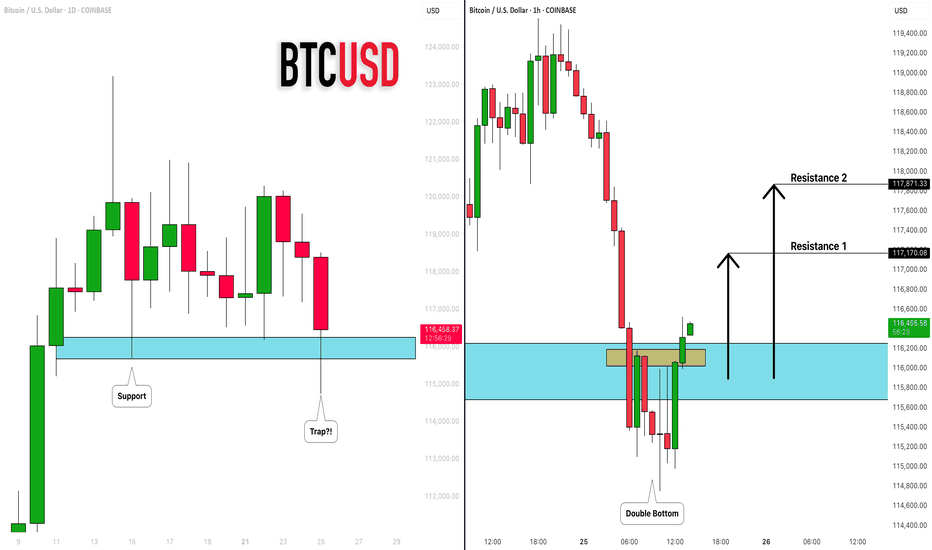

BITCOIN (BTCUSD): Recovery Starts

Bitcoin is going to rise from a key daily support.

After a liquidity grab, the market shows a clear strength,

forming a double bottom on an hourly time frame.

I expect a bullish movement at least to 117100

❤️Please, support my work with like, thank you!❤️

I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

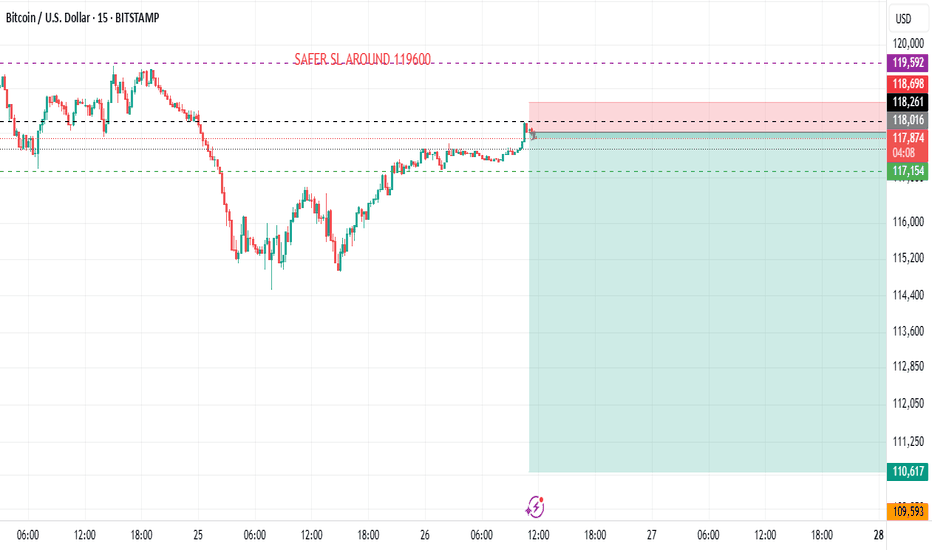

BTCUSD BUBBLE ABOUT TO BURST LOL ??? SELL SELL SELLLong term BTCUSD looks like BIG PLAYERS ARE TAKING PROFIT (about to dump this to retailers lol)

I see 15m signal sell with very good risk reward

BTCUSD its ready for correction i dont beleave we will see any NEW HIGHS from here

Let see how will pay out, only time will tell

Thanks

WHO WILL WIN BITCOIN'S RANGE BATTLE? In this weeks analysis, Bitcoin has been stack in a tight range for almost two weeks now. Trading range between $115k and $120k. Trend is still holding up for Bullish continuation but indicators strongly cautions loud Sirens. A decisive daily close above $120,200 could be the winning whistle for Bullish Continuation, while I see selling pressure to continue to the Support Block of about 113k. Also the selling Volumes are huge but prices are always quickly absorbed suggesting an accumulation is happening more than a distribution. So my thesis for Bitcoin is sideways range bound until there is a clear market winner. I will be paying much attention to the bearish alarm and a breakdown will be confirmed when daily price decisively close below $115k confirming the divergences on the chart. Trading between the range is high risk.

$BTCUSDT: Fictitious Fractal 136KSo. I see we are having a relatively difficult time.

My expectations are in this range for the next appx. 125 days - 365 days.

Downside: 68.6k-69.9k

Topside: 100k to 136k (round to 150k)

I drew this fractal by hand and I want to watch it closely.

I expect in the next few weeks we hit 100k and then do a nice rug to 69k range.

This is probably wrong.

I pretty much extrapolated the red brush circle into a weeks long fractal.

I am longing all the dips to 68k.

Enjoy.

Mr. Storm.

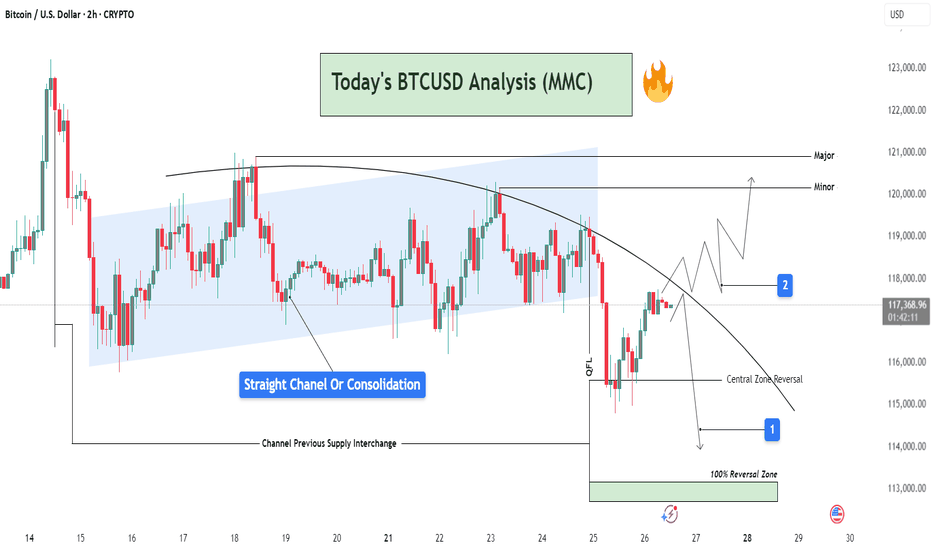

BTCUSD Analysis : Channel Break + QFL Setup | Structure Analysis📊 Chart Overview

This 2H BTCUSD chart reveals a comprehensive view of market behavior transitioning from a phase of consolidation into a potential breakout or further rejection. The price action is analyzed inside a parallel channel, transitioning into a curved resistance path, which is currently governing the market structure.

🔵 Phase 1: Consolidation Inside a Straight Channel

Price has respected a clear ascending channel (highlighted in blue) from July 16 to July 24.

This phase shows a range-bound movement with defined supply and demand zones.

Labelled as “Straight Channel or Consolidation”, this represents a potential accumulation/distribution zone.

The Channel Previous Supply Interchange marks an important S/R flip zone, now serving as a key reference for future reactions.

🔻 Phase 2: Break of Structure & Curved Resistance

Price broke down below the channel support and is now respecting a downward curved trendline.

This indicates a shift in momentum from neutral to bearish, forming lower highs.

A sharp drop occurred post-channel exit, marking a QFL (Quasimodo Failure Level) area—hinting at smart money involvement or liquidation hunt.

🔁 Reversal Scenarios & Key Levels

There are two possible future paths visualized:

🟥 Scenario 1: Bearish Continuation

Price respects the curved trendline, failing to break resistance.

A rejection near the current region (~117.5k) could lead price back toward:

Central Zone Reversal near 115,000 USD

Further into the 100% Reversal Zone (green zone) near 113,500–114,000 USD

Ideal for short entries after clear rejection confirmations.

🟩 Scenario 2: Bullish Breakout

Price breaks and sustains above the curved resistance.

Temporary resistance seen at Minor level (~120,000 USD), followed by Major resistance near 121,000 USD.

This scenario requires bullish volume and reclaim of structure, invalidating the short bias.

🧠 Strategic Viewpoint & Trade Mindset

Market is at a decision point—either confirming a bearish rejection from dynamic resistance or invalidating it for a bullish reversal.

Patience is key; wait for either:

A failed breakout attempt (short opportunity), or

A confirmed breakout and retest (long opportunity).

Use lower timeframes (15m–1h) for execution once direction is confirmed.

BTCUSD 7/27/2025Come Tap into the mind of SnipeGoat as he gives you a Full Top-Down Analysis of Bitcoins Price Action as we embark on another week of Quarter 3.

_SnipeGoat_

_TheeCandleReadingGURU_

#PriceAction #MarketStructure #TechnicalAnalysis #Bearish #Bullish #Bitcoin #Crypto #BTCUSD #Forex #NakedChartReader #ZEROindicators #PreciseLevels #ProperTiming #PerfectDirection #ScalpingTrader #IntradayTrader #DayTrader #SwingTrader #PositionalTrader #HighLevelTrader #MambaMentality #GodMode #UltraInstinct #TheeBibleStrategy

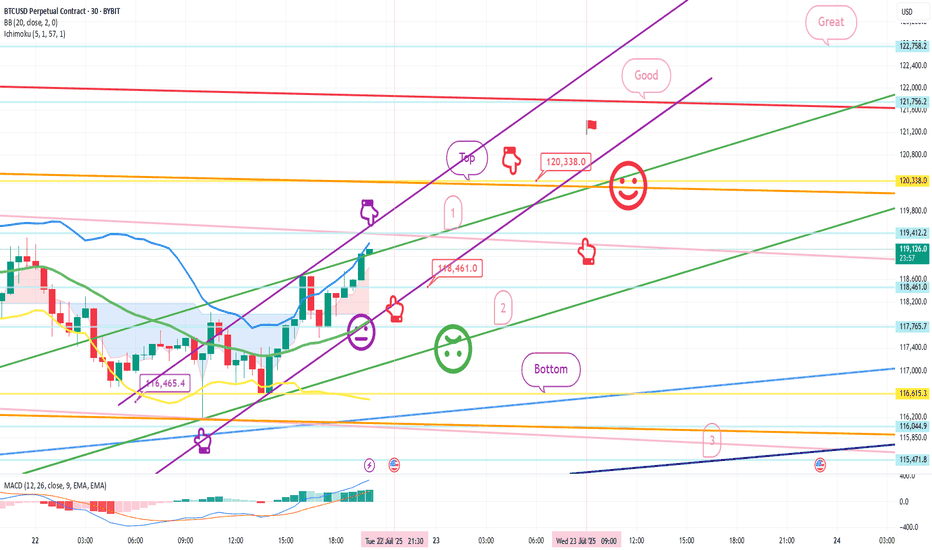

July 22 Bitcoin Bybit chart analysisHello

It's a Bitcoin Guide.

If you "follow"

You can receive real-time movement paths and comment notifications on major sections.

If my analysis was helpful,

Please click the booster button at the bottom.

This is Bitcoin's 30-minute chart.

Nasdaq indicators will be released at 9:30 in a little while.

Although Bitcoin's mid-term pattern is broken,

it looks like a strong upward trend based on signals and candlestick positions.

In the case of Nasdaq, the 6-hour and 12-hour charts MACD dead cross is in progress,

and even if there is no plunge and only a sideways movement,

it seems likely that today's strategy will be successful.

In the bottom left, from the analysis article on the 18th,

the final long position entry point of $116,465.4 Bottom

is connected as is.

*Red finger movement path

One-way long position strategy

1. $118,461.9 long position entry section / green support line breakout, stop loss price

2. $120,338 long position 1st target -> Good, Great in order of target price

See the 1st section at the top as a touch section for an upward wave rather than a short position entry,

and if this section breaks through right away, an upward trend can be connected.

If the purple parallel line support line is maintained without breaking away,

there is a possibility of a vertical rise.

If the top section is touched,

after the first liquidation,

it would be good to use the 1st section to re-enter a long position.

The 2nd section at the bottom is important,

and if it is pushed to this section according to the movement of Nasdaq today,

it can fall strongly.

Please check the real-time support line shape.

From the breakout, Bottom -> 3 sections are open.

If you touch the 3rd section after tomorrow, the mid-term pattern will be restored.

This is the 12+ day section.

Up to this point, I ask that you simply use my analysis for reference and use only.

I hope that you will operate safely with the principle of trading and stop loss.

Thank you.

Bitcoin – “topping-zone” update, grounded in the play-book 1️⃣ Big-picture wave count

We are deep inside cycle wave ⑤; sub-wave ③ delivered the textbook power surge, and price has now produced the final “pin” beyond the wedge roof – a move that often marks the last heartbeat of a fifth wave before the engine cools

.

The spike paused almost exactly at a 1-for-1 projection of wave ①, which is one of the three classic objectives for a non-extended wave ⑤ (0.618 ×, 1.0 × or 1.618 × wave ①)

.

Translation: price has reached the textbook exhaustion zone that the slide deck flags as “start thinking about profit-taking”.

2️⃣ What the internals are whispering

The manuals remind us that momentum should start to lag into a wave ⑤ – that’s exactly when bearish divergence appears and warns that the impulse is running out of stamina .

We now have that divergence across the three-day pane, lining up perfectly with the theory. In the past, that signal has kick-started either:

a shallow wave-four-type pullback (23.6 – 38.2 % of the entire leg) if the up-trend is still healthy, or

a full ABC retrace back to the 38 – 50 % pocket when the whole five-wave sequence is complete.

3️⃣ Fibonacci map – unchanged edges, new mid-points

Layer Why it matters (per slides)

117 k – 118 k 0.382 extension cluster and sub-wave ③ peak – first ceiling.

123 k wick 1.0 × wave ① – often the maximum for a regular wave ⑤

.

126 k – 131 k 1.618 overlay of the sub-waves – only reached if wave ⑤ “blows off”.

109 k 23.6 % retrace of the whole advance – first landing pad for a normal pullback

.

103 k – 99 k 38–50 % retrace – where a completed impulse usually rests before the next macro move.

4️⃣ Likely path from here (probabilities courtesy of the slide guidance)

Scenario Odds What you’d expect? How the slides back it up?

Truncated top – the wick was the high ~60 % Price rolls over swiftly; three-leg drop towards 109 k unfolds within weeks. Divergence in a ⑤ is a tired market; truncated fifths are common when wave ③ was extended

.

Mini blow-off to 126–131 k ~30 % Market reclaims the wedge roof quickly, squeezes short sellers, then stalls at 1.618 cluster. Slides label 1.618 × wave ① as the “stretch target” for an extending ⑤

.

Magazine-cover 139 k print <10 % Needs vertical follow-through and no weekly divergence – neither is present. Only seen when sentiment is euphoric and momentum refuses to fade (not the case now).

5️⃣ How to turn this into trades (slide-rule style)

Trail profits, don’t chase: the slide on “profit-taking in wave ⑤” recommends feeding the position back to the market once equality or 0.618 targets print, rather than waiting for a collapse

.

Watch the 23.6–38.2 % retrace band: that zone is the historic sweet spot for a healthy reset after a parabolic run; if price bounces there with improving momentum, the up-trend can restart

.

If— and only if—price vaults the wedge roof again, leave a runner for 126–131 k, but tighten stops using the 78.6 % trailing method highlighted in the slides.

In plain English

Bitcoin has done everything a late fifth wave is supposed to do: overshoot a channel, tag a textbook fib target, and lose its breath while momentum lags. That doesn’t guarantee an immediate plunge, but history – and the curriculum we’ve been working through – say a meaningful pullback is now the path of least resistance. Prepare for a cooling phase toward the low-100 k region; if we sprint instead, treat it as a bonus round, not the baseline.

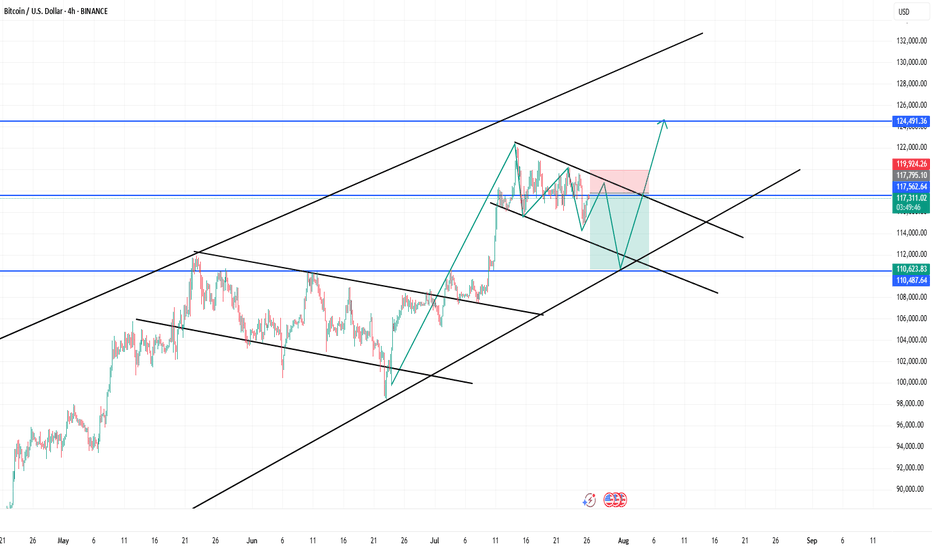

Reversal Zone: BTC Eyes $124.5K After Potential Liquidity SweepTechnical Analysis (4H Chart)

🔷 Pattern Overview:

Rising Channel: BTC is still respecting a long-term upward channel (black parallel trendlines).

Falling Wedge (Short-Term): Inside the channel, a falling wedge is forming—typically a bullish continuation signal.

The wedge is nearing completion, with a possible fakeout below support to the $110,500–$110,600 zone before a sharp rally.

✅ Price Expectation:

Bear Trap Likely: Price may dip to $110.5K support, triggering stop-losses.

Bullish Breakout Setup: If price rebounds strongly from $110K area, the wedge + channel pattern supports a move toward $124.5K–$125K.

Invalidation: Clean break below the channel and $110K could invalidate the bullish scenario.

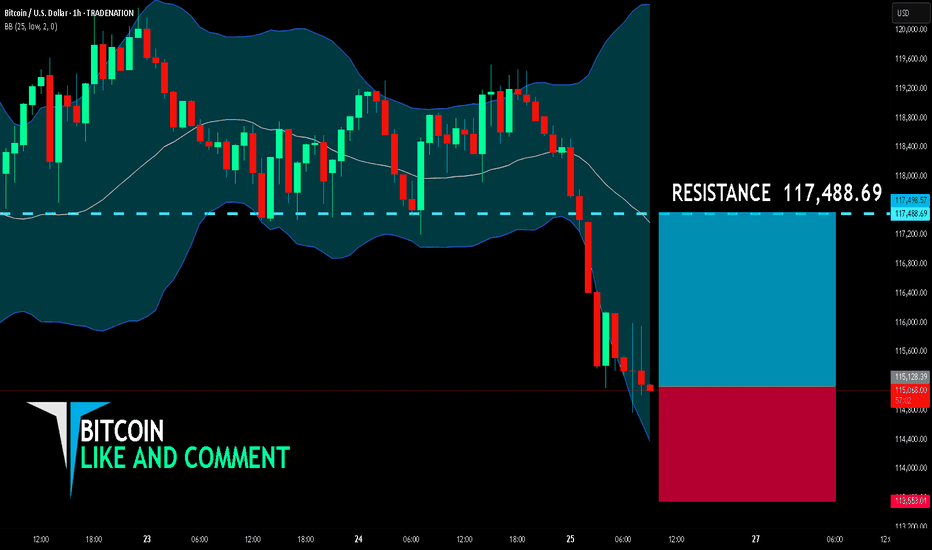

BITCOIN BULLS ARE GAINING STRENGTH|LONG

BITCOIN SIGNAL

Trade Direction: long

Entry Level: 115,128.39

Target Level: 117,488.69

Stop Loss: 113,553.01

RISK PROFILE

Risk level: medium

Suggested risk: 1%

Timeframe: 1h

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

✅LIKE AND COMMENT MY IDEAS✅

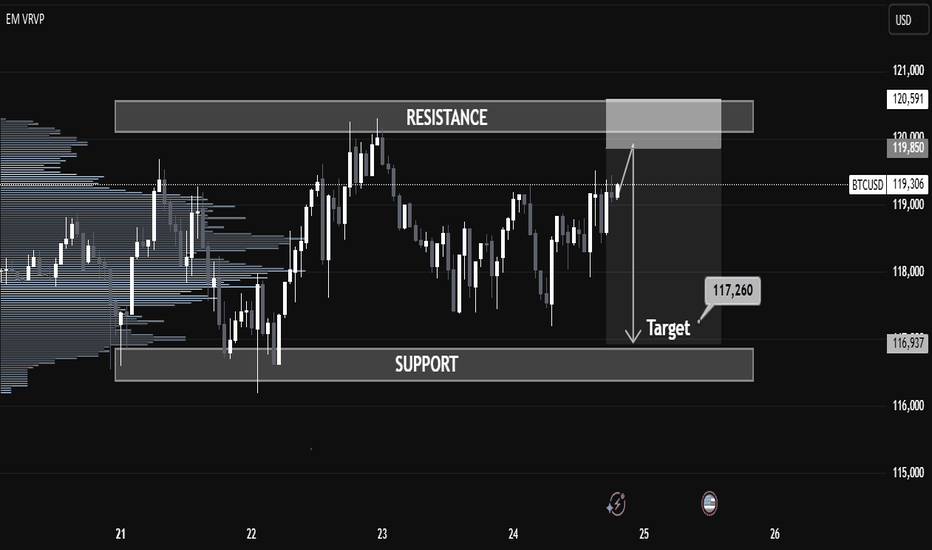

BTCUSD Key Supply Zone Rejection – Bearish Target Mapped BTCUSD Key Supply Zone Rejection – Bearish Target Mapped (Educational Breakdown)

⸻

🧠 Technical Analysis (1H Chart):

• Range Structure: BTCUSD is currently trading within a well-defined consolidation range between the Resistance Zone ($119,850–$120,591) and the Support Zone ($116,937).

• Volume Profile (VRVP): Volume is noticeably thick near the mid-range, suggesting accumulation/distribution behavior. Price is struggling to break above the value area high near $120K.

• Resistance Rejection: After testing the upper supply zone, price failed to sustain bullish momentum and is showing signs of exhaustion – a possible sign of institutional selling.

• Target Zone: If price rejects this resistance again, a strong move toward the target level of $117,260 is expected. This aligns with:

• Mid-range liquidity sweep

• Low-volume node (LVN) below current price

• Fair Value Gap fill near $117,200–$116,900

⸻

🧩 Key Concepts Highlighted:

• Support & Resistance Mapping

• Volume Profile Readings

• Institutional Order Flow Bias

• Target Projection using Smart Money Concepts

⸻

⚠ Educational Insight:

This setup is a perfect example of how to combine Volume Profile + Price Action to identify liquidity traps and smart entries. Always wait for confirmation near key zones — not every level breaks!

⸻

✅ Trade Plan (Not Financial Advice):

• Watch for bearish engulfing/rejection wick at resistance

• Short entry below $119,000 with SL above $120,600

• Target: $117,260 / Final TP: $116,937 zone

Healthy BTC Retrace in Trend Next Breakout Target 112K Then 122KBitcoin continues to respect the bullish market highlighted in our previous analysis, where the AB=CD structure pointed toward significant upside potential. The market has since retraced into a well defined re-accumulation zone, aligning precisely with prior expectations.

Price has held firmly above the round figure support ($100k), with the current structure confirming a healthy correction within trend.

As long as the re-accumulation zone between 104k–107k holds, momentum remains skewed to the upside. The projected 2.618 extension sits near the 122k mark, where the current setup aims to complete.

The broader structure still respects higher timeframe demand and ascending channel boundaries, keeping bullish continuation valid unless 100k decisively breaks. Watch for confirmation breakout above 112k to activate the next leg of the move.

If you found this analysis insightful, drop a like to support the work and leave a comment with your perspective whether you agree, disagree, or have an alternate scenario in mind. Let's grow together through collective insights.