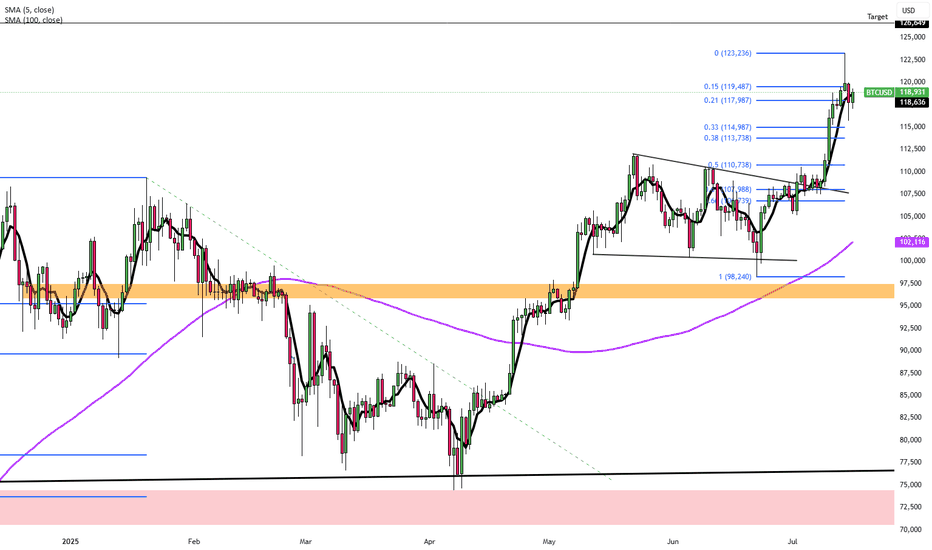

Clean BTC Trade – Bounce from Key Trendline SupportHi traders! , Analyzing BTC/USD on the 30-minute timeframe, we can observe that price is respecting the ascending channel and reacting to the dynamic trendline support (blue line). This bounce, aligned with prior structure, signals a potential bullish continuation.

🔹 Entry: 116,249

🔹 Take Profit (TP): 119,434

🔹 Stop Loss (SL): 113,105

Price remains above the 200 EMA while continuing to respect the ascending trendline, signaling sustained bullish structure. The RSI is showing a bullish divergence, which supports the idea of upward momentum. We also saw a strong reaction at the pivot point (115,373), and a bullish engulfing candle formed right near the trendline — adding further confirmation to this potential long setup.

This long setup presents a favorable risk/reward ratio within the context of the broader trend. Targeting a clean break above previous resistance and return to the R1 zone.

⚠️ DISCLAIMER: This is not financial advice. Trade at your own risk and always use proper risk management

BTCUSD trade ideas

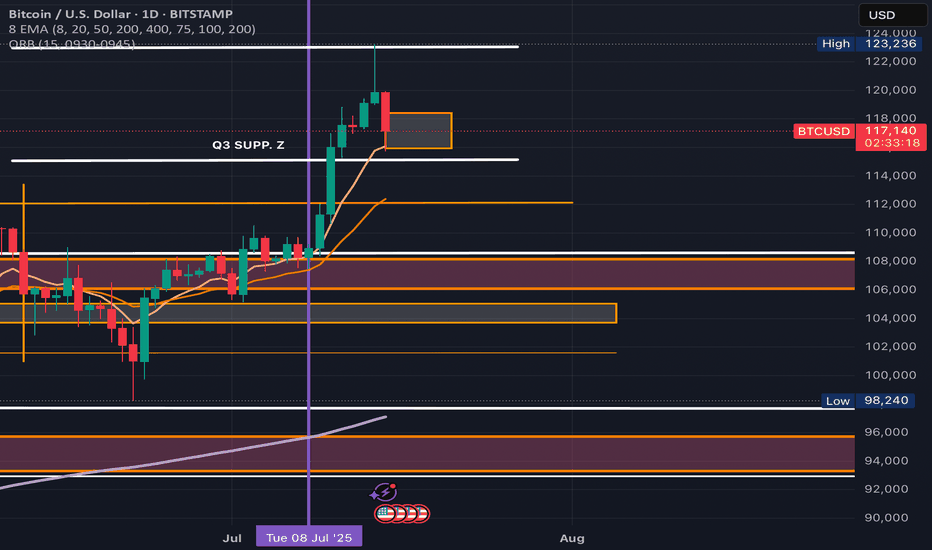

Global Market Overview | July 15President Trump’s latest statements made headlines again, but market reactions have become more measured. The Dow declined slightly, while Asian markets presented mixed performances; Japan remained flat, Korea and Australia posted losses, and Taiwan outperformed. The US dollar strengthened as the yen weakened. Bitcoin recovered near $118,000 after dropping from its $123,000 high. Silver held firm above $38.

Today, market focus turns to U.S. PPI data and key bank earnings reports.

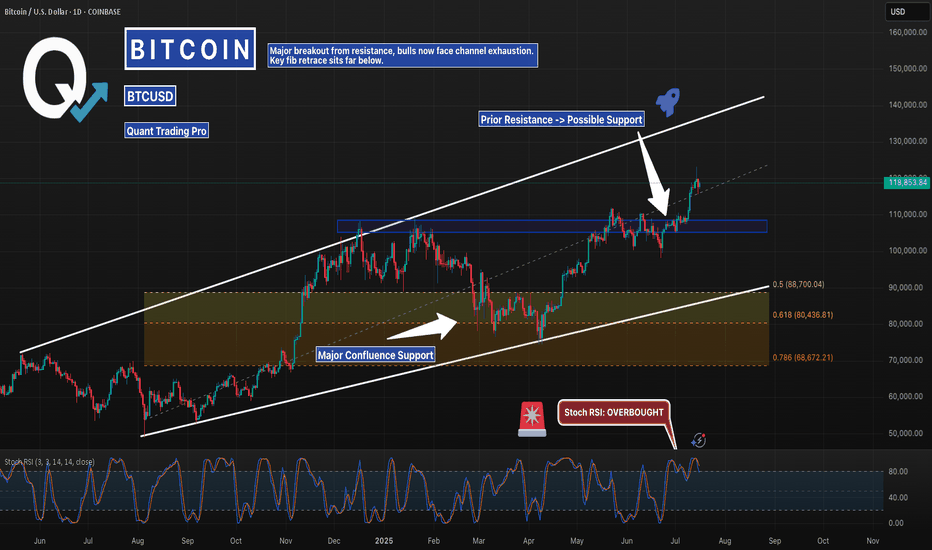

BTCUSD - Breakout Or Bull Trap? Watching the Fib Reload ZoneBitcoin just cleared the prior resistance zone near 114K–115K, breaking higher within the macro ascending channel. But with Stoch RSI overheated and price stretching toward the upper trendline, this move may exhaust soon.

I’m watching the Fib confluence zone between 88K–80K — which aligns with the mid-channel and prior breakout structure. If bulls lose steam, that’s where the real bid could return.

Set alerts. Let the algo hunters chase.

This is where smart traders prepare.

#BTCUSD #Bitcoin #Crypto #PriceAction #Fibonacci #SmartMoney #Backtesting #QuantTradingPro #TradingView

BITCOIN Will Go Higher! Long!

Here is our detailed technical review for BITCOIN.

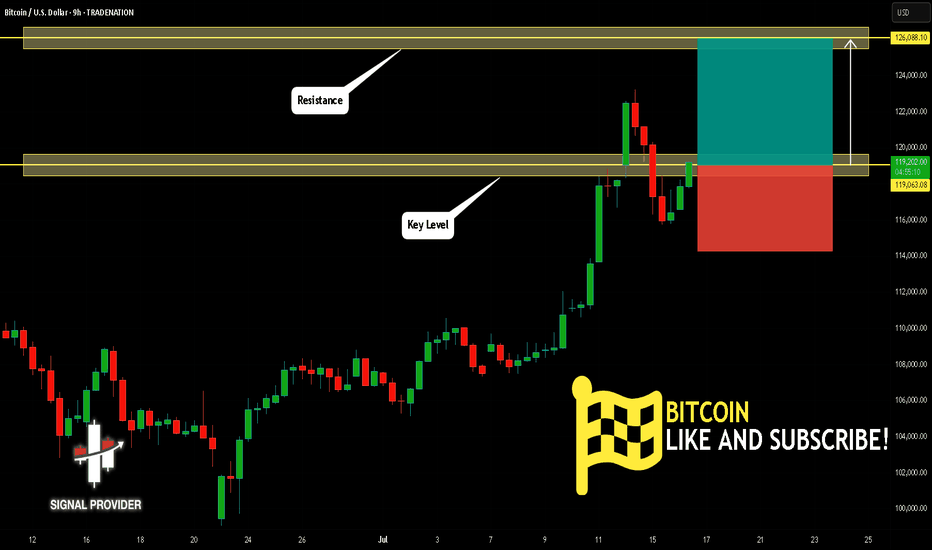

Time Frame: 9h

Current Trend: Bullish

Sentiment: Oversold (based on 7-period RSI)

Forecast: Bullish

The market is trading around a solid horizontal structure 119,063.08.

The above observations make me that the market will inevitably achieve 126,088.10 level.

P.S

Overbought describes a period of time where there has been a significant and consistent upward move in price over a period of time without much pullback.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

Like and subscribe and comment my ideas if you enjoy them!

BTC Bottom & New ATH..... when ?!!! Hello Guys

There are some notes of BTC weekly Chart:

1. We have a new ATH every 4 years ( 1428-1477 ) days..

2. After the ATH we take about ( 52-59 ) weeks to make a new bottom then we go up a little ...

3. Every time we reach a new ATH we drop down in a same angle (-55) before the new bull run starting .... look at my chart ( Red angles and curves ):

****** We dropped from ATH 2013 to Bottom 2015 by an angle ( -55 ) .

****** We dropped from ATH 2017 to Bottom 2018 by an angle ( -55 ) .

****** Same (24 July 2019) we dropped from local top to the local bottom by Angle ( -56 ) .

****** Will we drop from ATH 2021 to Bottom (2022 - 2023) by the same angle ( -55 or -56 )??

4. In my opinion , I expect we will reach the final bottom between ( 26 December 2022 : 6 march 2023 ).

5. I don't care what will be the price of BTC then , but I care only for when will be the possible bottom !!.

But if we can try to expect the price it will be in a range of ( 11900 : 9000$) ...

Note:( 10K - 10500$) is very very strong demand area for BTC .

-------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------

Finally , I think the new ATH will not be before Nov 2025 ( 150k $ ).

It is not a financial advice , I am only share my thoughts with u :)

Thank u and good luck.

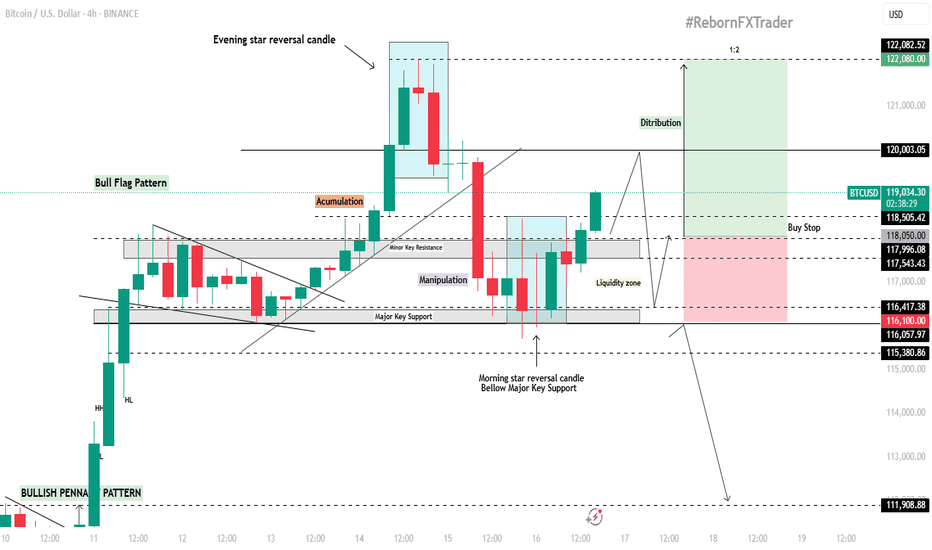

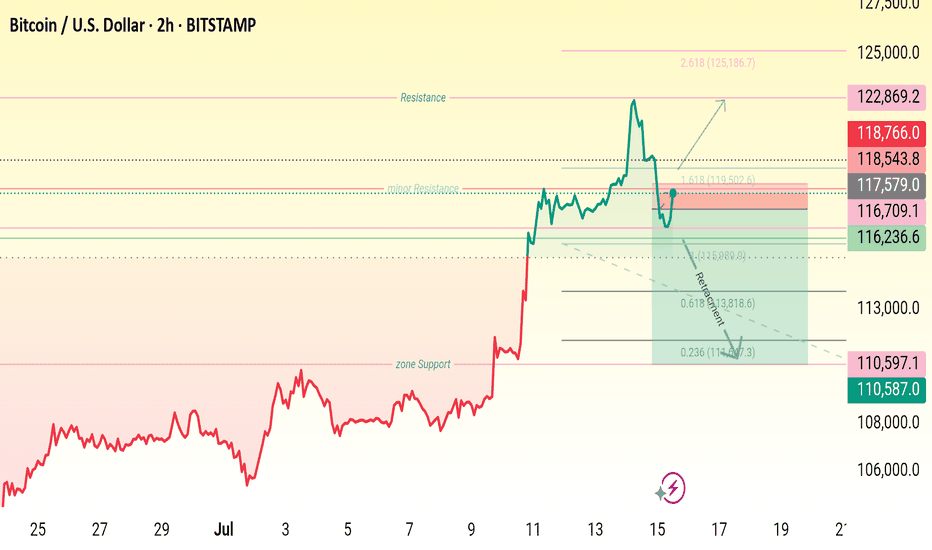

BTC/USD 4H Technical & Fundamental AnalysisBTC/USD 4H Technical & Fundamental Analysis

Bitcoin remains fundamentally bullish as institutional adoption continues to rise through Spot ETF inflows, while post-halving supply pressure tightens the available BTC in circulation. Additionally, the upcoming regulatory clarity such as the GENIUS Act could pave the way for major institutions like JPMorgan to issue their own stablecoins, further bridging the gap between crypto and traditional finance. On the technical side, BTC is currently consolidating around the 116,200 level, potentially forming a bull flag pattern on the 4H timeframe. This zone has acted as a major support level due to multiple historical touches.

Previously, price reached an all-time high around 122,000 before forming an Evening Star reversal pattern, leading to a pullback back to the 116,200 zone. A Morning Star reversal then formed on this key support, suggesting renewed bullish momentum.

Our current objective is to wait for price to climb toward the 120,000 level, where we anticipate a potential liquidity grab within the highlighted liquidity zone.

📍Buy Stop Setup:

Buy Stop Entry (AOI): Around 118,050

Stop Loss: 116,100 (below liquidity zone)

Take Profit: 122,080

📌 Disclaimer:

This is not financial advice. Always wait for proper confirmation before executing trades. Manage risk wisely and trade what you see—not what you feel.

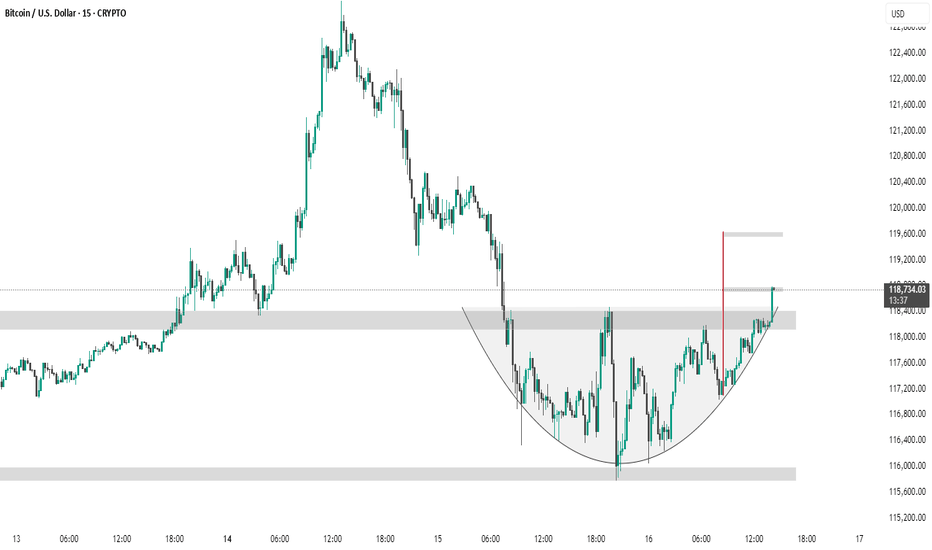

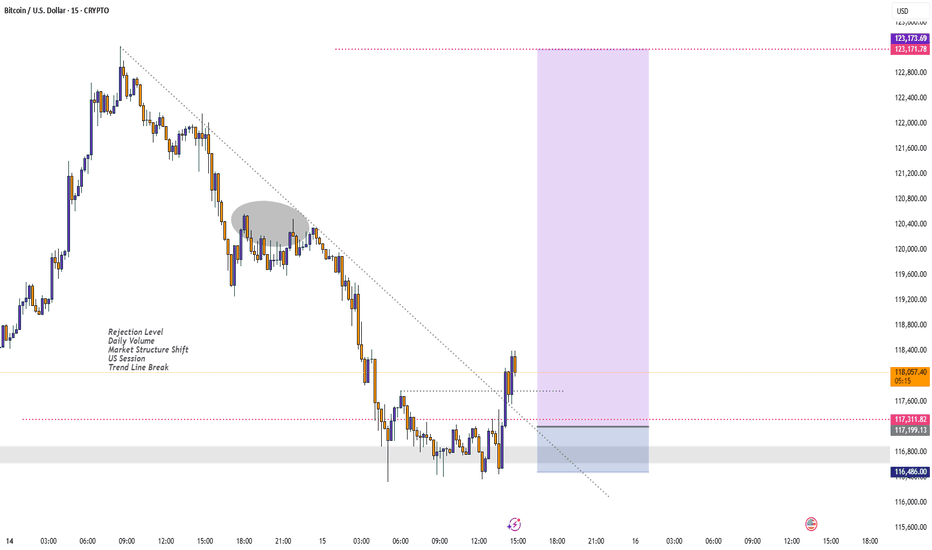

BTC #ARC Structure has breakout its levelThe chart shows a 15-minute BTC/USD timeframe forming a cup and handle pattern, a bullish continuation signal. Price has broken above the handle resistance zone (~$118,400), suggesting a potential breakout. The red vertical line marks the expected target, projecting a move toward the $119,600 level based on the pattern height.

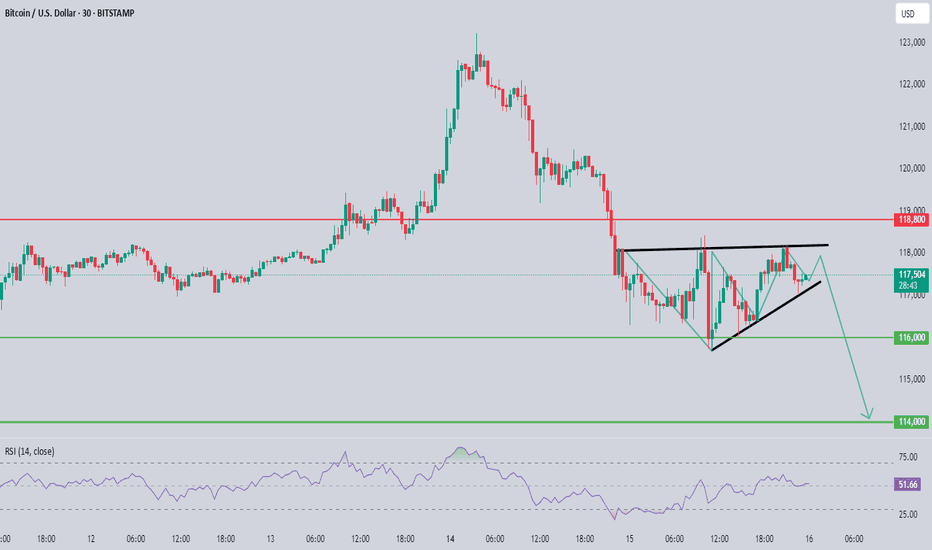

XAU/USD Chart Pattern ObservedBased on the image you've shared, this is a technical analysis chart for gold (XAU/USD), with a visible bearish setup in play. Here’s a detailed sell-side analysis:

Chart Pattern Observed

Bearish Pennant/Wedge Breakout:

The price appears to be breaking out downward from a rising wedge or bearish pennant pattern.

These patterns typically indicate a continuation to the downside after a short consolidation or pullback.

Key Levels Identified

Resistance Zone:

118.800 (Strong resistance level marked in red)

Price failed to break above this and reversed, confirming it as a solid supply zone.

Current Price: Around 117.500

Support Levels (Take Profit Targets):

116.000 – Minor support/first TP level

114.000 – Major support/final TP level (likely the full target of the move)

RSI Indicator

RSI at 50.71 – neutral but pointing slightly downward.

This gives room for further bearish momentum to unfold.

Sell Trade Setup

Entry: After confirmed break below the rising trendline (around 117.800 - 117.500)

Stop Loss: Above 118.800 (just above the resistance zone to avoid fakeouts)

Take Profits:

TP1: 116.000

TP2: 114.000

Trade Justification

Clear lower highs forming.

Rejection at strong resistance.

Breakdown of rising structure = bearish continuation.

Bearish projection arrows on chart suggest institutional outlook favors sell.

Risk Management

Use proper lot sizing based on your account balance and risk %.

Look for a retest of the trendline as a safer sell entry if missed the initial break.

BTC – Strong Buy Signals, Sentiment Reversing, Final Push?BTC is clearly in a place of rising trust

- Fear & Greed Index improving: last week 24 (Extreme Fear), yesterday 31, now 38 (Fear), last month low was 3

- Several bullish divergences visible: RSI and MACD show higher lows vs. price, momentum indicators curling up, OBV ticking higher despite weak price action

- Price is sitting at the lower Bollinger Band and holding an ascending trendline

- Multi-indicator (mostly RSI-based) showing clustered buy signals, similar to previous rallies

- Simple Fibonacci retracement from the recent high (~73K) shows potential move toward 130K, assuming continuation and break above ~109K

- Last S-BUY signal was 14 bars ago, still active

- Structure is clean and holding

- If this is the final leg up, we could be entering danger or euphoria territory soon

BTC Heading DownThis is my first chart using TradingView. I'm 50/50 on how I feel about it's utility, but it does well enough until I learn it better. I use the D Timeframe too look for support/resistance. I focus in on the 4h, then 1h further. I have recently switched from lower timeframes to higher timeframes with some surprising success following my rules. Constructive Criticism/Dialogue welcomed.

It is time for a reversal. Why? Those ATHs were just hit after two bullish runs for 2025 (Jan and July). Granted it would be hopeful for all investors to keep seeing this beast rip for a 3rd time in 2025, that is a dream, I think. There has been two runs then consolidation/pullbacks, NORMALLY (see hollow boxes on chart). This does not mean this is the case, but this is what I am going with after researching. After the ATH, a lovely wick and an incredibly high volume on an engulfing candle formed. This along with a PSAR switch on the 4H is what I utilize. I have only researched down to $102k. Each TP (blue line), I will be looking for a sign of reversal on the 4h.

Key:

Blue lines:

- My TP

Boxes:

- Areas of Interest

Hollow Boxes only:

- Shows two runs before a consolidation to an official breakout

Highlights:

- What within that area of interest I'm using for justification

Orange lines:

- Where in the past BTC has had breakouts then a retest before the next breakout

Red line:

- My SL

Enjoy your BTC,

AtlasRising

BTC SHORT FOR NOW?An all time high was achieved recently at around 123k USD. A number of buyers should potentially be liquidating their profits around this region, reducing buy pressure and ultimately leading to a short term pull back maybe close to around the 110's? Price action will have to reveal more information in order to see what happens after this movement.

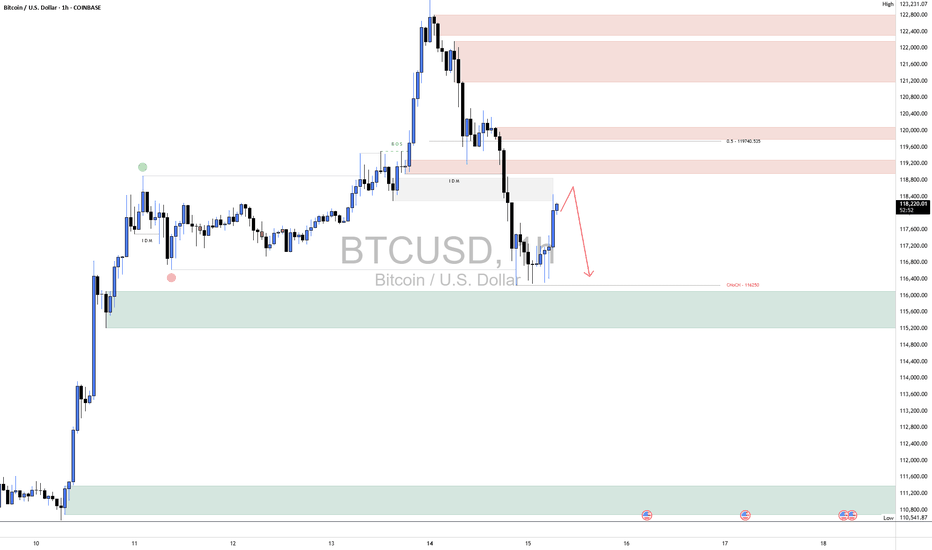

BTC ShortBTC has shown some short-term bullish signs, with a corrective bounce from the demand zone around 116,000–115,000, indicating a temporary reaction from buyers. However, this move appears to be a retracement rather than a full reversal, as the overall structure remains bearish.

Price is currently pushing into a previously broken intraday supply zone and approaching the 50% equilibrium level near 119,000, which aligns with a potential lower high forming. As long as BTC stays below this key level and fails to break market structure to the upside, the bias remains bearish.

We still believe BTC is likely to come back down to retest the recent lows, possibly revisiting the 116,000 zone to sweep more liquidity before any meaningful reversal can occur.

As always, proper risk management is essential. Wait for confirmation before entering trades and protect your capital in these volatile conditions.

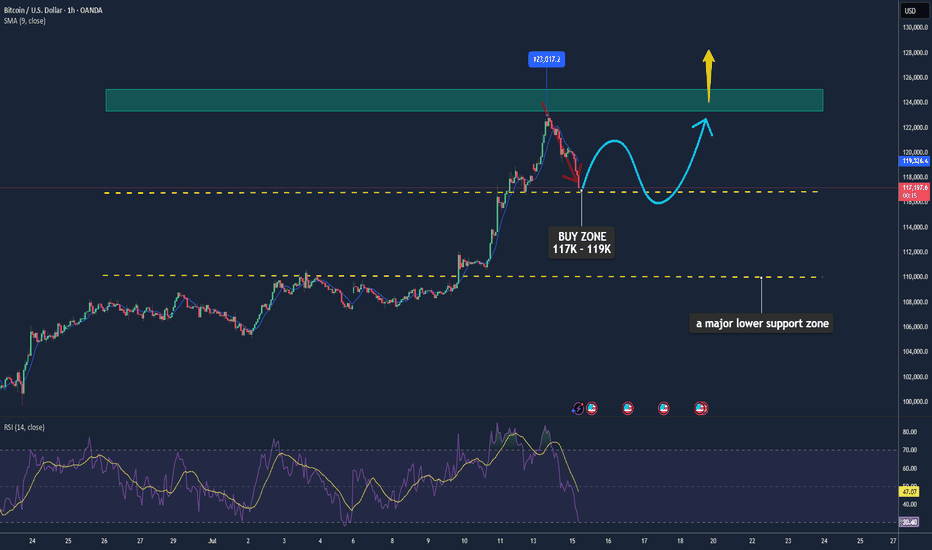

Bitcoin May Pause After Recent Highs📊 Market Move:

Bitcoin (BTC) recently touched an intraday high of ~$122.8K after hitting new all-time highs, supported by a weaker USD, strong institutional inflows, and favorable U.S. regulatory developments (e.g., GENIUS Stablecoin Act, CLARITY Act, and Trump’s executive orders). However, rising volatility (DVOL) and a rebounding USD are signaling a possible short-term correction.

📉 Technical Analysis:

• Key Resistance: ~$123K–$125K

• Nearest Support: ~$117K (with $110K as a major lower support zone)

• EMA: Price is currently above the 9-day EMA → short-term trend remains bullish.

• Candlestick / Volume / Momentum:

• A cup-and-handle formation has emerged, typically a bullish continuation pattern, suggesting a possible 14% rally to ~$134.5K.

• Momentum is still strong; RSI is elevated but not yet overbought (14-day stochastic RSI at ~79.4%).

📌 Outlook:

Bitcoin may consolidate or experience a mild pullback in the short term around the $123K level, especially if the USD continues to strengthen or volatility spikes. However, a clean breakout above $125K could trigger a further rally toward the $134K–$146K range.

💡 Suggested Trading Strategy: (Spot only – no leverage)

🔻 SELL Bitcoin/USD at: $123K–125K

🎯 TP: $117K

❌ SL: $126.5K

🔺 BUY Bitcoin/USD at: $117K–119K

🎯 TP: $123K–125K

❌ SL: $115K

BTCUSD overbought correction supported at 114,850The BTCUSD remains in a bullish trend, with recent price action showing signs of a corrective pullback within the broader uptrend.

Support Zone: 114,850 – a key level from previous consolidation. Price is currently testing or approaching this level.

A bullish rebound from 114,850 would confirm ongoing upside momentum, with potential targets at:

122,900 – initial resistance

124,420 – psychological and structural level

126,250 – extended resistance on the longer-term chart

Bearish Scenario:

A confirmed break and daily close below 114,850 would weaken the bullish outlook and suggest deeper downside risk toward:

112,860 – minor support

110,825 – stronger support and potential demand zone

Outlook:

Bullish bias remains intact while the BTCUSD holds above 114,850. A sustained break below this level could shift momentum to the downside in the short term.

This communication is for informational purposes only and should not be viewed as any form of recommendation as to a particular course of action or as investment advice. It is not intended as an offer or solicitation for the purchase or sale of any financial instrument or as an official confirmation of any transaction. Opinions, estimates and assumptions expressed herein are made as of the date of this communication and are subject to change without notice. This communication has been prepared based upon information, including market prices, data and other information, believed to be reliable; however, Trade Nation does not warrant its completeness or accuracy. All market prices and market data contained in or attached to this communication are indicative and subject to change without notice.

BTC - LTF Retracement TargetsPlease refer to our previous post:

After identifying our first target right around $120.4k we are seeing the first signs of a cooloff. Until we get a daily candle close above this level price is likely to flush some leverage. The main move to $140k area is still likely to happen, but if we see a retracement in the short term here are the LTF levels to watch.

Support level #1 has been established with most of the candle bodies around $116.8k. If we lose that level then price is likely to test our previous ATH.

Support level #2 would be a test of our previous ATH around $112k or our teal trendline that connects the wick tops.

The final support level would be our macro old ATH right around $108-$110k. There is also a trendline there (which depending on what time it could be tested) would also be right in line with those price targets.

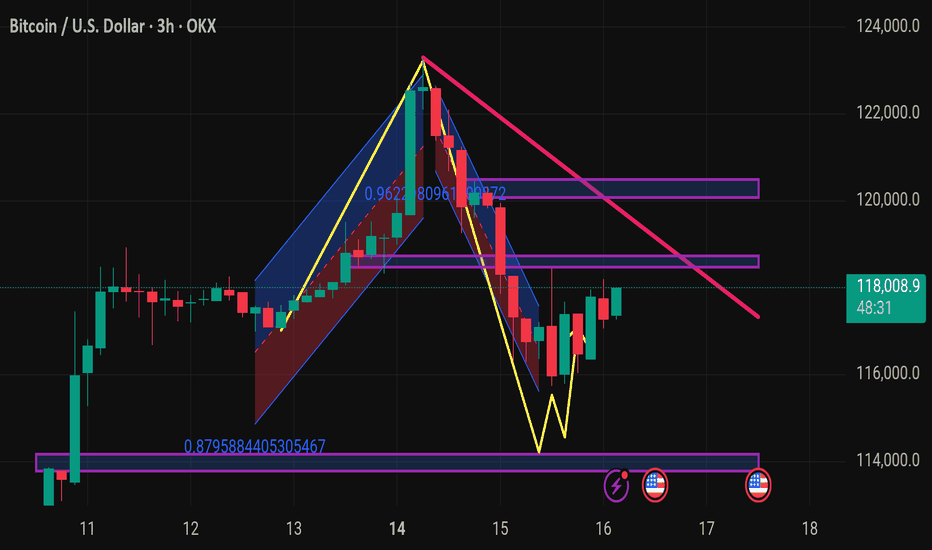

Btcusd techinical analysis.This chart displays the Bitcoin (BTC/USD) 3-hour price action with several technical indicators and patterns annotated. Here's a breakdown of what it shows:

Key Observations:

1. Price Action:

BTC is currently priced around $116,386, showing a -2.93% drop.

A strong downtrend has formed after a significant upward move, possibly forming a bearish ABCD pattern.

2. Harmonic Pattern:

The chart appears to reflect a completed harmonic retracement, with a deep retracement (near 0.88 Fibonacci level).

This suggests a potential reversal or bounce zone.

3. Support & Resistance Zones:

Several purple horizontal boxes indicate key support and resistance zones.

The current price is approaching a major support zone near $114,000–$115,000, which has been tested previously (visible on the left side).

4. Trend Lines:

A pink downward trend line suggests ongoing bearish momentum.

Price may need to break above this line to confirm a reversal.

5. Yellow Zig-Zag Path:

Indicates a possible bullish reversal scenario, predicting a bounce off the lower support zone followed by a move upward.

6. Event Markers:

Red circular icons (with flags) near the support zone hint at upcoming fundamental news/events that may influence price action.

---

Interpretation:

Short-term bias: Bearish until strong support holds (~$114,000–$115,000).

Possible trade setup: Watch for bullish reversal signals at support (candlestick patterns, RSI divergence, etc.) before entering long.

**Risk

Bitcoin Cooling Off… But the Bulls Aren’t Done YetAfter a sharp run-up, Bitcoin is pulling back into the first support zone just above prior resistance. If this level fails, the 0.5–0.618 Fib area aligned with structure (110K–107K) is the key zone to watch. Bullish momentum could reload from either zone if buyers step in.

This is the zone where smart entries form — not exits. Let price confirm, then strike with precision.