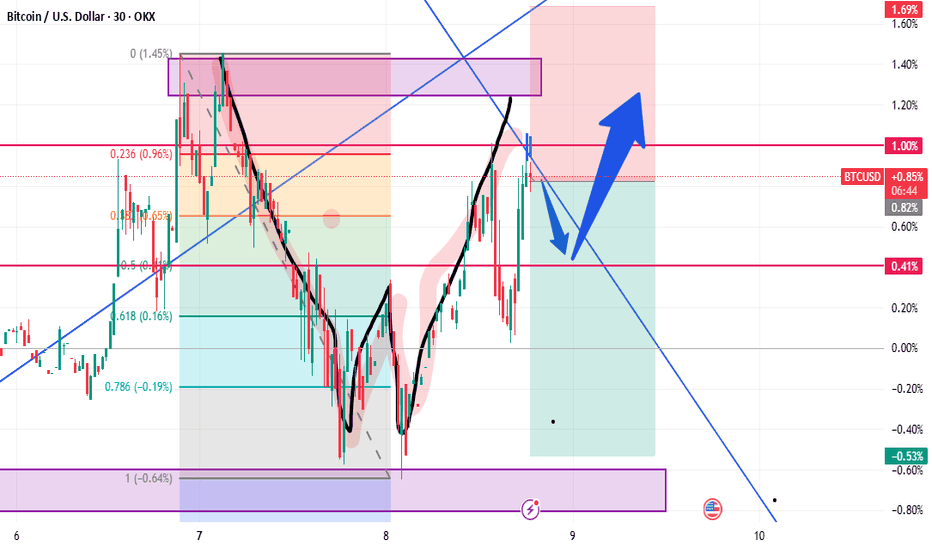

Bitcoin H1 | Potential bounce off a multi-swing-low supportBitcoin (BTC/USD) is falling towards a multi-swing-low support and could potentially bounce off this level to climb higher.

Buy entry is at 107,504.00 which is a multi-swing-low support that aligns closely with the 61.8% Fibonacci retracement.

Stop loss is at 106,700.00 which is a level that lies underneath an overlap support.

Take profit is at 109,163.00 which is a swing-high resistance that aligns with the 78.6% Fibonacci retracement.

High Risk Investment Warning

Trading Forex/CFDs on margin carries a high level of risk and may not be suitable for all investors. Leverage can work against you.

Stratos Markets Limited (tradu.com ):

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 63% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Stratos Europe Ltd (tradu.com ):

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 63% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Stratos Global LLC (tradu.com ):

Losses can exceed deposits.

Please be advised that the information presented on TradingView is provided to Tradu (‘Company’, ‘we’) by a third-party provider (‘TFA Global Pte Ltd’). Please be reminded that you are solely responsible for the trading decisions on your account. There is a very high degree of risk involved in trading. Any information and/or content is intended entirely for research, educational and informational purposes only and does not constitute investment or consultation advice or investment strategy. The information is not tailored to the investment needs of any specific person and therefore does not involve a consideration of any of the investment objectives, financial situation or needs of any viewer that may receive it. Kindly also note that past performance is not a reliable indicator of future results. Actual results may differ materially from those anticipated in forward-looking or past performance statements. We assume no liability as to the accuracy or completeness of any of the information and/or content provided herein and the Company cannot be held responsible for any omission, mistake nor for any loss or damage including without limitation to any loss of profit which may arise from reliance on any information supplied by TFA Global Pte Ltd.

The speaker(s) is neither an employee, agent nor representative of Tradu and is therefore acting independently. The opinions given are their own, constitute general market commentary, and do not constitute the opinion or advice of Tradu or any form of personal or investment advice. Tradu neither endorses nor guarantees offerings of third-party speakers, nor is Tradu responsible for the content, veracity or opinions of third-party speakers, presenters or participants.

BTCUSD trade ideas

BTCUSD Breakout Confirmed – Targeting Next Reversal ZoneBitcoin (BTC/USD) is currently trading around $108,700, showing strong bullish momentum after breaking out of a consolidation structure. Price action has shifted significantly, with clear structural developments pointing toward continued upside — but not without caution around the next reversal zone.

🔍 Key Technical Insights:

🔹 1. Volume Contraction Triangle (Bullish Breakout)

The chart initially shows a volume contraction pattern forming a symmetrical triangle.

This pattern is often associated with market compression — a setup where smart money accumulates before a breakout.

BTC broke out of the triangle with strong bullish candles, confirming buyers have stepped in with conviction.

🔄 2. Structure Shift & Break of Structure (BOS)

A major BOS (Break of Structure) occurred as price broke previous swing highs, confirming a bullish market structure.

This BOS zone now acts as a potential support area if BTC pulls back.

A short-term SR interchange zone (Support becomes Resistance) was also respected and flipped again to support during the breakout — a clear sign of structural strength.

🧭 3. Next Reversal Zone – Supply in Sight

Price is approaching a major supply/reversal zone between $109,750 and $110,250.

This zone has previously shown strong selling interest.

Traders should watch for rejection or continuation patterns within this zone — such as bearish divergence, exhaustion candles, or confirmation of resistance.

🛡 4. Major Support Level

Below current price, a major support zone around $107,500–$107,800 remains intact.

This zone has provided a solid base during past consolidations and would be the first area of interest for buyers if a retracement occurs.

📌 Strategy Plan:

🔼 For Bullish Traders:

Those already in the breakout can hold with targets toward $110,000–$110,250.

If not in yet, wait for a retest of BOS/SR zone (~$109,000) for a safer re-entry.

Consider partial take-profits within the green reversal zone.

🔽 For Bearish Traders:

Watch for price exhaustion or a fake breakout in the reversal zone.

Potential short setups could form only if price fails to hold above the BOS zone and prints a lower high.

🔧 Technical Summary:

✅ Structure: Bullish Break of Structure confirmed

🔺 Momentum: Strong upside following volume contraction

📍 Next Key Resistance: $110,000–$110,250

📉 Major Support: $107,500–$107,800

⚠️ Caution Zone: Reversal area ahead – watch price action closely

Conclusion :

Bitcoin looks set to challenge the $110K psychological level as buyers remain in control. However, the reversal zone above is critical. A clean break and hold above it could open doors to further highs, while rejection here may trigger short-term pullbacks or range-bound conditions.

Quantum Computing - Why BTC isn't the biggest worryYou’ve probably heard that quantum computing could break Bitcoin’s encryption—and that’s true. But here’s the thing: Bitcoin might not even be the biggest target.

The real risks? Financial systems, national security, healthcare, and even the internet itself. These areas rely on the same encryption methods that quantum computers could crack, and the fallout could be far worse than a Bitcoin hack.

Let’s break it down.

1️⃣ Financial Systems: A Global Crisis Waiting to Happen

Imagine if hackers could:

Drain bank accounts at will.

Manipulate stock markets.

Fake trillion-dollar transactions.

This isn’t just about stolen crypto—it’s about economic chaos. Banks, stock exchanges, and payment systems all depend on encryption. If quantum computers break it, we’re looking at a meltdown way bigger than Bitcoin’s $3 trillion market.

2️⃣ National Security & Internet Privacy: A Hacker’s Dream

Governments and militaries use encryption to:

Protect classified intelligence.

Secure communications between leaders.

Guard critical infrastructure (power grids, water supplies).

If quantum computers crack these codes, entire nations could be exposed to cyberwarfare. Your private data? At risk too—email, messaging, even your online banking could be decrypted years later.

3️⃣ Healthcare, Supply Chains & IoT: The Hidden Vulnerabilities

Medical records could be leaked, exposing sensitive health data.

Smart devices (like home security systems) could be hacked.

Supply chains might collapse if logistics networks are breached.

These systems weren’t built with quantum threats in mind—and upgrading them won’t be easy.

🔴 The Bigger Picture: A "Civilizational Upgrade"

Switching to quantum-resistant encryption is like rebuilding the internet’s foundation. It’s necessary, but messy. Some experts compare it to the Y2K bug—but way harder.

🔷 So, Is Bitcoin Safe?

Not entirely—about 25% of all Bitcoin could be stolen if quantum computers advance fast enough. But compared to the risks facing banks, governments, and hospitals? Bitcoin might be the least of our worries.

🔷 What’s Next?

Governments & companies are already working on fixes (like NIST’s post-quantum cryptography standards).

The transition will take years—and hackers might exploit weak spots along the way.

Staying informed is key. If you’re in tech, finance, or security, this affects you.

ℹ️ Want to Dive Deeper?

Deloitte’s take on quantum computing & Bitcoin

Forbes on quantum risks beyond crypto

🤷♂️ Bottom line?

Quantum computing is coming—and while Bitcoin has risks, the real danger lies in the systems we all depend on every day.

❔What do you think? Will we be ready in time? Let me know in the comments! 🚀

BTC/USD H4 Downfall ⚠️ Disrupted Market Perspective

🟩 False Resistance Zone

The marked resistance area (~109,000) has been breached multiple times with high volatility, suggesting weak resistance strength. Instead of rejecting price, this zone acts more like a liquidity trap — luring in sellers before price spikes higher. Expect fake-outs or bullish traps near this area.

🟨 Questionable Bearish Pattern

The projected zig-zag drop is speculative. The current market structure shows higher lows forming, hinting at potential accumulation rather than breakdown. If price consolidates above 108,000, this setup might flip bullish instead of heading to the 106,000 target.

🟥 Support Area Disruption

The labeled support zone around 106,000 may not hold if broken, but it has been respected multiple times in the past. If bulls defend it again, we might see a sharp rebound rather than a continuation downward. Therefore, the “Target” area could instead become a springboard for upward reversal.

Bitcoin Ranging Below $110k – Poised for a Breakout📊 Market Overview:

Bitcoin is consolidating around $108–109k, reflecting indecision as investors await clearer signals. Institutional ETF inflows remain strong, and recent moves from 2011-era dormant wallets sparked concern but no major sell-off. Positive ETF news or supportive crypto policies could propel the next move upward.

📉 Technical Analysis:

• Major resistance: $109,500 – $110,500

• Nearest support: $108,000; secondary support at $102,000

• EMA09 (1 h): Price is above the 20 EMA and has reclaimed the 200 SMA on the 1 h chart, signaling a technical rebound

• Candlestick / Volume / Momentum: A mild bounce from $108k with low volume; Bollinger Bands show a mid-range price, hinting at sideways action .

📌 Outlook:

Bitcoin may remain range-bound between $108k and $110k. A breakout above $110.5k with strong volume could push toward $112k–115k. Conversely, a break below $108k might trigger a dip toward $102k.

Suggested Trading Strategy

SELL Bitcoin/USD at: 109,000 – 110,000

🎯 TP: 108,000 / 105,000

❌ SL: 110,800

BUY Bitcoin/USD at: 108,000 – 107,500

🎯 TP: 109,500 / 112,000

❌ SL: 107,000

BITCOIN - SELL TO $86,000 (8H VIEW)I see possible shorting opportunities right now for BTC.

⭕️LQ Swiped Above Previous Wave 3 High ($109,000).

⭕️Wave 4 Complex Correction Complete (5 Sub-Waves).

⭕️(Wave 5 Impulse Bullish Move Complete (5 Sub-Waves of 1,2,3,4,5).

❌Invalidation Zone Above Wave 5 High ($112,140).

High risk trade as BTC could still head high for Wave 5 around $120- $130,000. Use strict risk management.

BTCUSD Bullish resistance breakoutThe BTCUSD remains in a bullish trend, with recent price action showing signs of a resistance breakout within the broader uptrend.

Support Zone: 104,890 – a key level from previous consolidation. Price is currently testing or approaching this level.

A bullish rebound from 104,890 would confirm ongoing upside momentum, with potential targets at:

110.780 – initial resistance

113.140 – psychological and structural level

115,760 – extended resistance on the longer-term chart

Bearish Scenario:

A confirmed break and daily close below 104,890 would weaken the bullish outlook and suggest deeper downside risk toward:

103,500 – minor support

102,290 – stronger support and potential demand zone

Outlook:

Bullish bias remains intact while the BTCUSD holds above 104,890. A sustained break below this level could shift momentum to the downside in the short term.

This communication is for informational purposes only and should not be viewed as any form of recommendation as to a particular course of action or as investment advice. It is not intended as an offer or solicitation for the purchase or sale of any financial instrument or as an official confirmation of any transaction. Opinions, estimates and assumptions expressed herein are made as of the date of this communication and are subject to change without notice. This communication has been prepared based upon information, including market prices, data and other information, believed to be reliable; however, Trade Nation does not warrant its completeness or accuracy. All market prices and market data contained in or attached to this communication are indicative and subject to change without notice.

Bitcoin ConsolidatingBitcoin continues to hold strong just below resistance at $112K after a clean reclaim of the $105,787 support zone and the 50-day moving average. Price is consolidating in a tight range, printing higher lows and showing signs of strength as it flirts with a potential breakout.

Volume has tapered off slightly during this sideways action, which is typical in a coiling pattern before a move. If bulls can finally push through $112K with conviction, we’re likely headed for a fresh leg higher. On the flip side, a drop back below the 50 MA and $105K would invalidate the short-term bullish structure.

Until then, it’s just a waiting game inside this range – but the bias leans bullish.

80k BTC On The Move - WHAT It Means 80,000 BTC Wallet Movement (2011 Miner)

• Source: 8 wallets containing 10,000 BTC each — mined in 2011, dormant for 14 years

• Total Value: Over $8.6 billion USD

• Timing: Moved on July 4, 2025 — largest dormant BTC transfer in history

• New Addresses: Funds moved to modern SegWit wallets

• Probable Owner: Likely a single early miner with 200k+ BTC history

Possible Reasons for the Move

• Key Rotation: Upgrading to modern wallets for better security

• Recovered Access: Private keys may have been recently recovered

• Market Strategy: Positioning for profit-taking or major sell-off

• Yield Farming: Preparing COINBASE:BTCUSD for use in DeFi/lending platforms

• Collateral Use: Possibly for loans, stablecoin leverage, or RWAs

• Estate Planning: Legal restructuring or generational wealth setup

• OTC Transfer: Could be prepping for off-exchange institutional sale

• Psychological Warfare: Could be intended to spook or manipulate the market

• Regulatory Response: Aligning with new compliance or tax jurisdiction

Market Reaction

• COINBASE:BTCUSD Price Dip: Price briefly fell below $108,000 post-move

• ETF Context: Movement occurred despite record ETF inflows

Key Note: These wallets had not been touched since COINBASE:BTCUSD was worth ~$0.78. Their reactivation adds uncertainty and opportunity in a fragile macro environment.

• What to do????: Watch the orderbook to find these large bitcoin moves in case of exchange selling

Near term support & resistance

$106000 support

$109500 first resistance

👍 If this breakdown helped your trading, smash that Like and drop a comment below—let me know what you think will happen with the 80k COINBASE:BTCUSD . 👍

Best Reguards

MartyBoots, 17-year market trader

BTCUSD LONG TRADE PLANFollowing a classic technical view. The instrument has been trading in a global bull trend. Recently, it formed a descending expanding wedge pattern next to a key zone which I view as an accumulation.

When to buy ? In my view, I will only buy if breakout of this pattern and break above the key zone.

Please do your own analysis before placing any trades.

Cheers and Happy Trading !!!!

BITCOIN Is there enough time for another parabolic rally?Bitcoin (BTCUSD) is practically consolidating on the short-term, having just recently been rejected off its new All Time High (ATH). Despite the short-term volatility, the long-term outlook is still a very strong, structured uptrend, a Channel Up pattern that is now technically aiming for its next Higher High.

Incredibly enough, this Channel Up since the November 2022 market bottom, has been almost entirely within the Buy Zone (green) of the Fibonacci Channel Up going back all the way to April 2013!

As you can see during the previous two Cycles, every time BTC got above that Buy Zone, it started a parabolic rally. So far, we haven't got such rally on the current Cycle and with time running out (assuming the 4-year Cycle model continues to hold), do you think we will get one this time around?

Feel free to let us know in the comments section below!

-------------------------------------------------------------------------------

** Please LIKE 👍, FOLLOW ✅, SHARE 🙌 and COMMENT ✍ if you enjoy this idea! Also share your ideas and charts in the comments section below! This is best way to keep it relevant, support us, keep the content here free and allow the idea to reach as many people as possible. **

-------------------------------------------------------------------------------

💸💸💸💸💸💸

👇 👇 👇 👇 👇 👇

BTCUSD TRADES SIDEWAYS DUE TO A LACK OF DRIVING FACTORS

BTCUSD has been moving within sideways since the end of last week. This week there will be lack of news. The first significant will be FOMC minutes tomorrow, which will definitely affect the DXY index and bitcoin. So before that time I expect that the sideways dynamic of the asset will remain.

So, nothing to trade? Not really

We may consider entering long positions at a current price with a take profit nearby 0.786 Fibo and a stop loss just below the previous low:

🔼 a market buy order at 108078.50 with

❌a stop loss at 107389.50 and

🤑a take profit at 109176.65

After that I expect the price to rebound from the upper border of the triangle. Maybe will consider another long entry.