ATH Mode On => Request Your Altcoin Analysis NowThe bulls are back in action, and momentum is building fast! ⚡

To celebrate this major milestone, I’m opening the floor to YOU 👇

Request any altcoin in the comments, and I’ll personally share my technical analysis on it! 📊✅

Let’s make the most of this market together — it’s altcoin season waiting to happen! 🚀

📚 Always follow your trading plan regarding entry, risk management, and trade management.

Good luck!

All Strategies Are Good; If Managed Properly!

~Richard Nasr

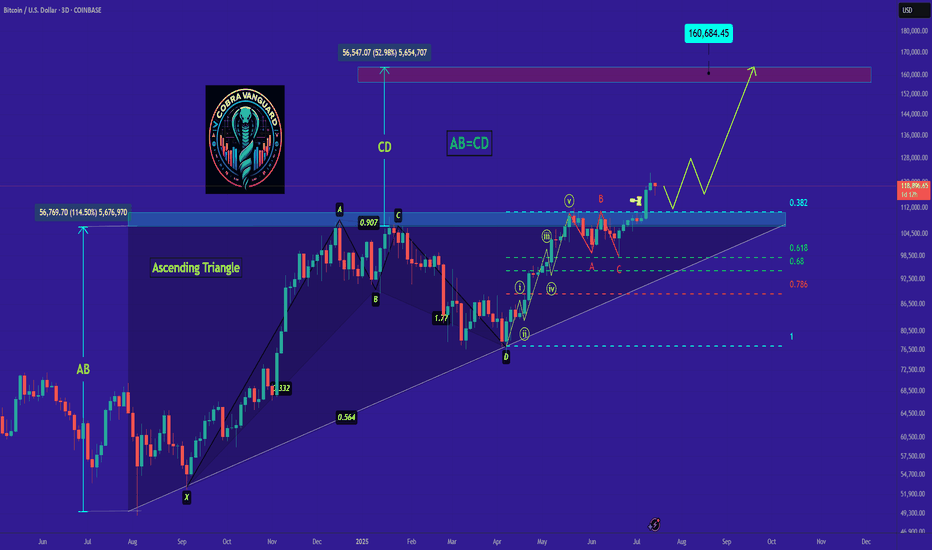

BTCUSD trade ideas

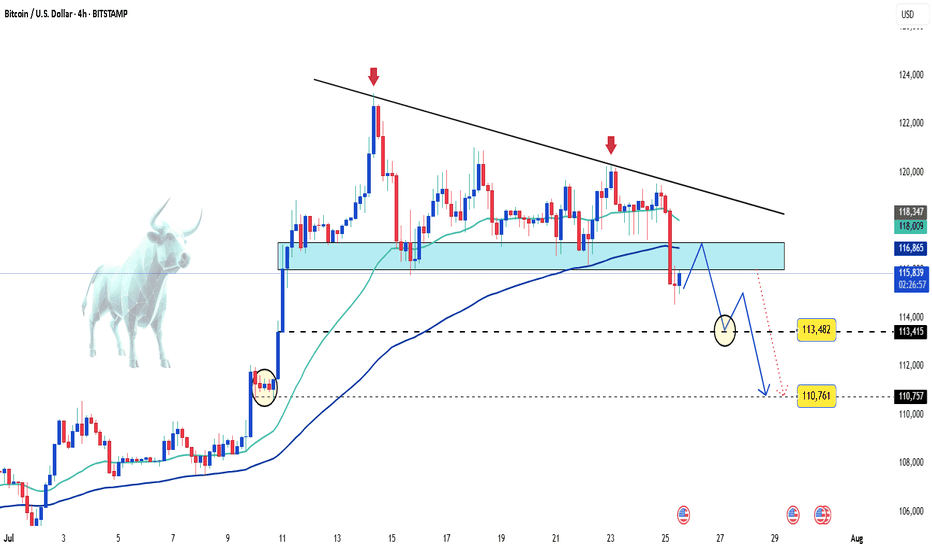

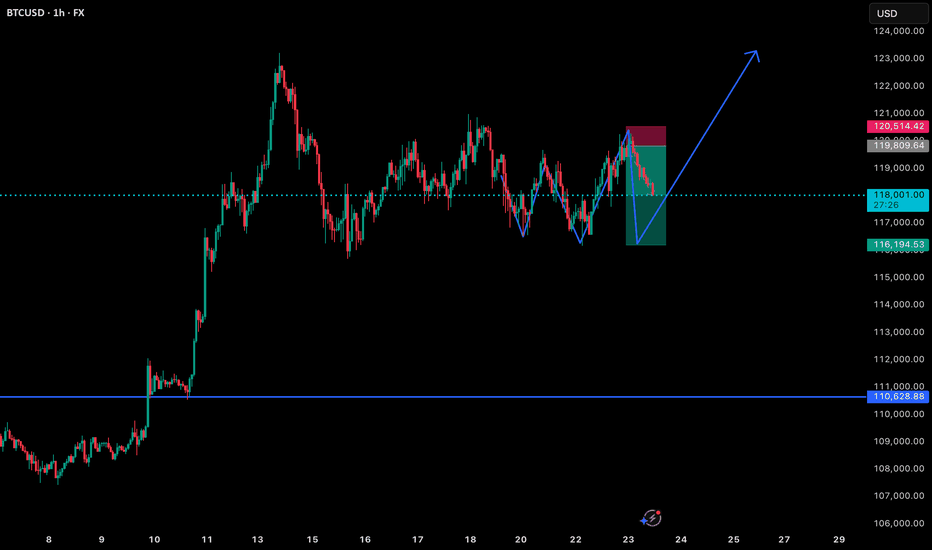

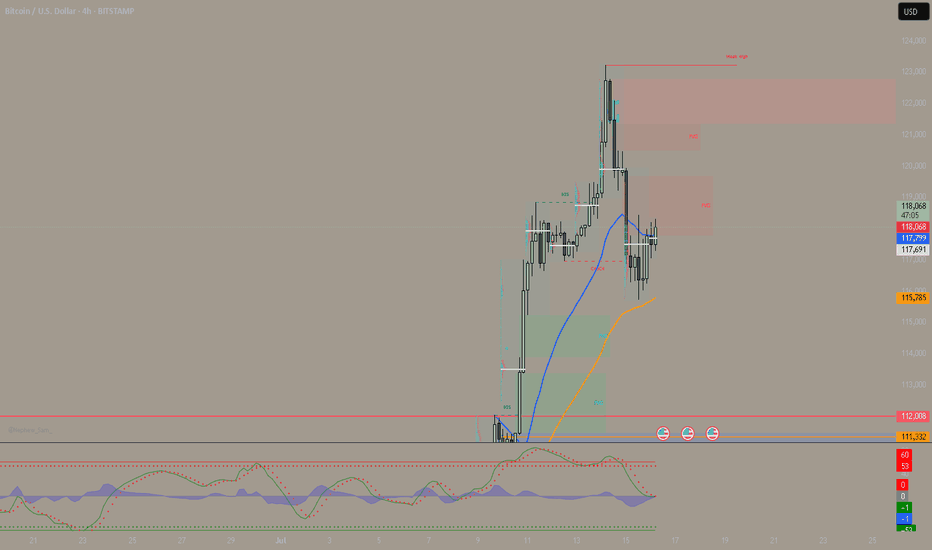

Bitcoin on the edge – Is a sharp drop coming?Bitcoin is keeping investors on edge as price action remains volatile and primed for an explosive move once news or capital flows ignite the market.

🌍 Latest market updates:

– Whales are back in accumulation mode, with on-chain data showing large wallets growing rapidly.

– The U.S. government has just transferred a significant amount of BTC to exchanges — is a dump coming?

– U.S. spot Bitcoin ETFs are witnessing record inflows after CPI came in lower than expected, fueling hopes that the Fed will pause further rate hikes this year.

📉 Technical outlook:

– On the H4 chart, BTC formed a tightening wedge pattern, which has now broken to the downside.

– A steep drop toward the 113,000 to 110,000 USD zone is entirely possible.

This looks like a classic break-retest setup — a golden window for strategic entries. If sell volume surges, it could be the perfect moment for bears to strike.

Stay sharp — and good luck!

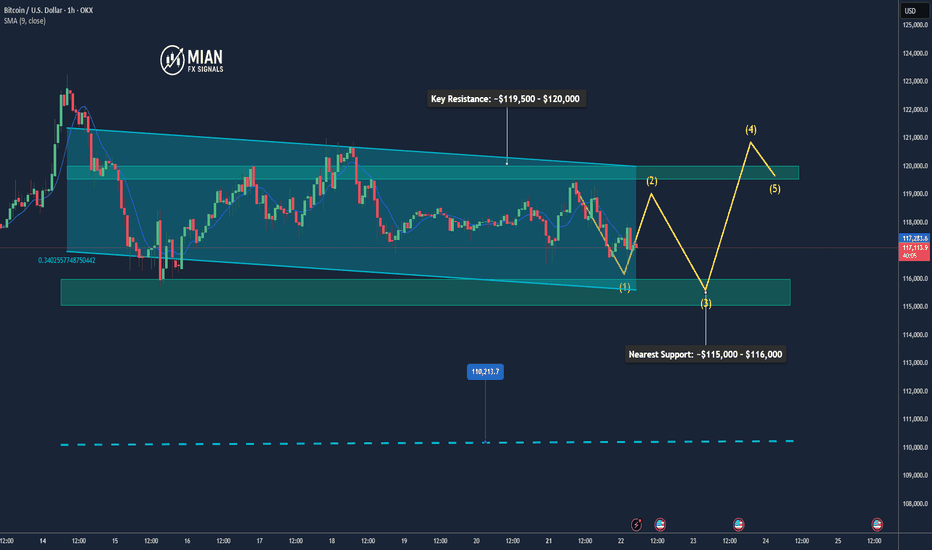

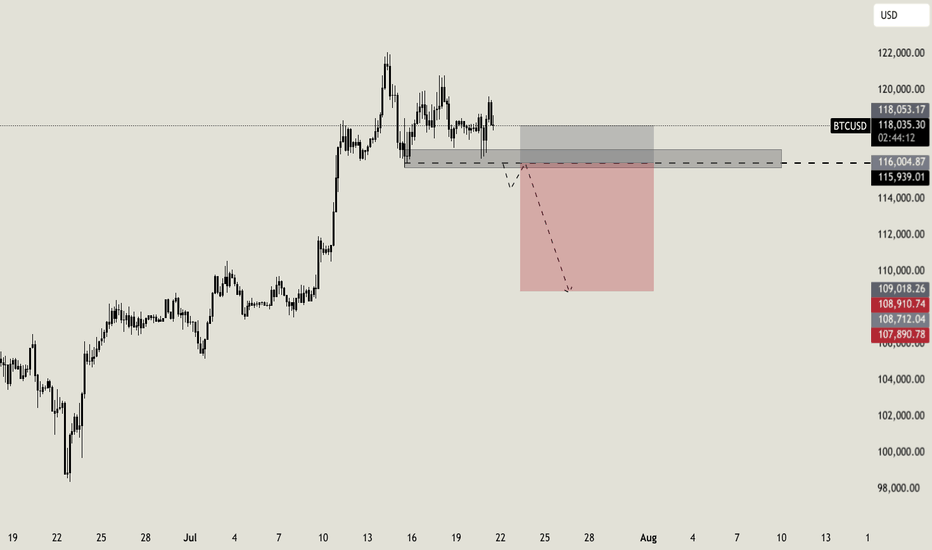

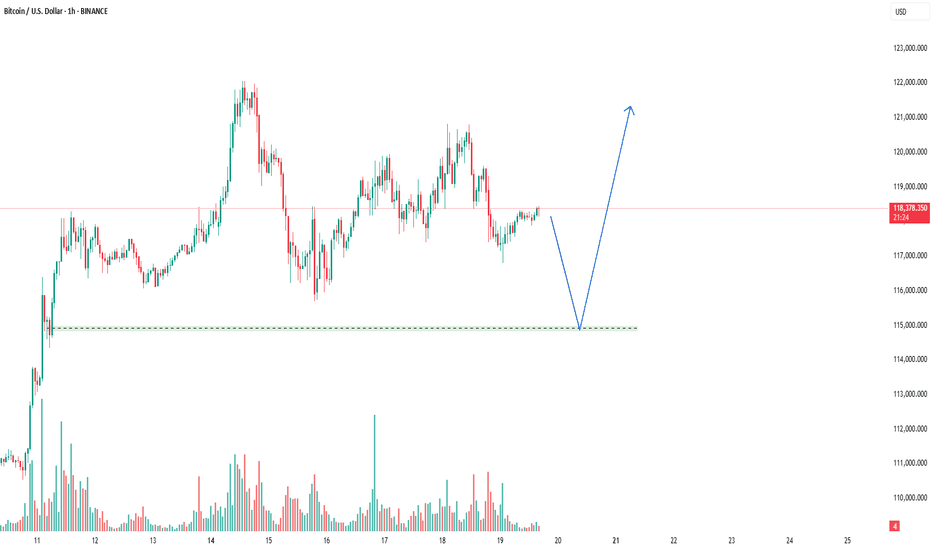

Bitcoin May Pull Back Slightly Before Resuming Uptrend📊 Market Overview

• Bitcoin is currently trading around $116,934, slightly down after hitting an intraday high of $119,524.

• The earlier rally was supported by inflows into Bitcoin ETFs, accumulation by major holders like Trump Media and MicroStrategy, and a pro-crypto regulatory stance in the U.S. (e.g., Genius Act, CLARITY Act).

• However, a surge in whale transfers to exchanges and declining BTC dominance suggests profit-taking and potential short-term volatility.

📉 Technical Analysis

• Key Resistance: ~$119,500 – $120,000 (intraday high and recent ATH)

• Nearest Support: ~$115,000 – $116,000, then $110,000

• EMA 09/20: Price is hovering around EMA 9/20 on H1–H4 timeframes, indicating a short-term uptrend but needing a pause or correction.

• Momentum / Volume: RSI is near overbought territory; falling volume hints at consolidation or a mild pullback. The overall trend remains bullish but slightly unstable.

📌 Opinion

Bitcoin is likely to pull back slightly in the short term toward the $115,000 – $116,000 zone due to profit-taking pressure, before potentially resuming the uptrend if it can break and hold above $119,500 – $120,000 with strong volume.

💡 Trade Setup

SELL BTC/USD at: $118,500 – $119,000

🎯 TP: $116,500

❌ SL: $120,000

BUY BTC/USD at: $115,000 – $116,000

🎯 TP: $118,500 – $119,500

❌ SL: $114,000

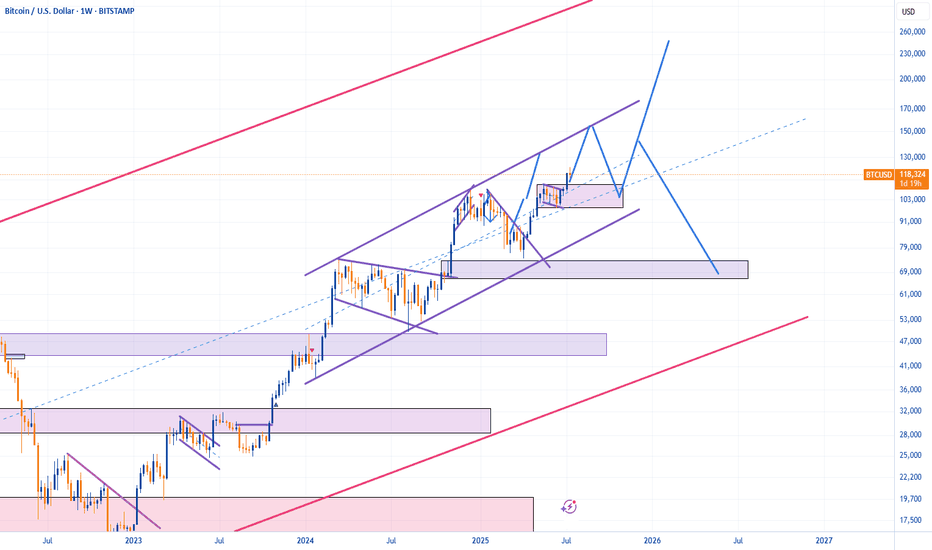

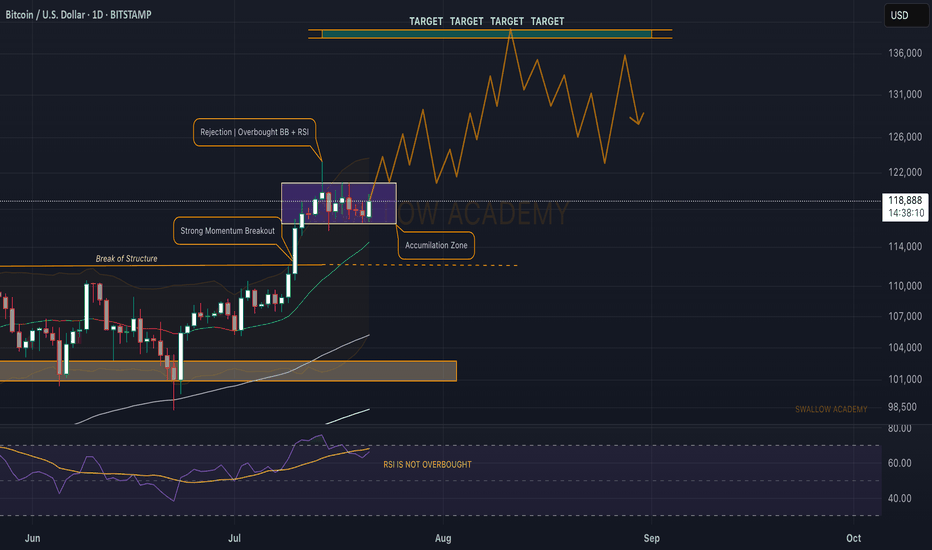

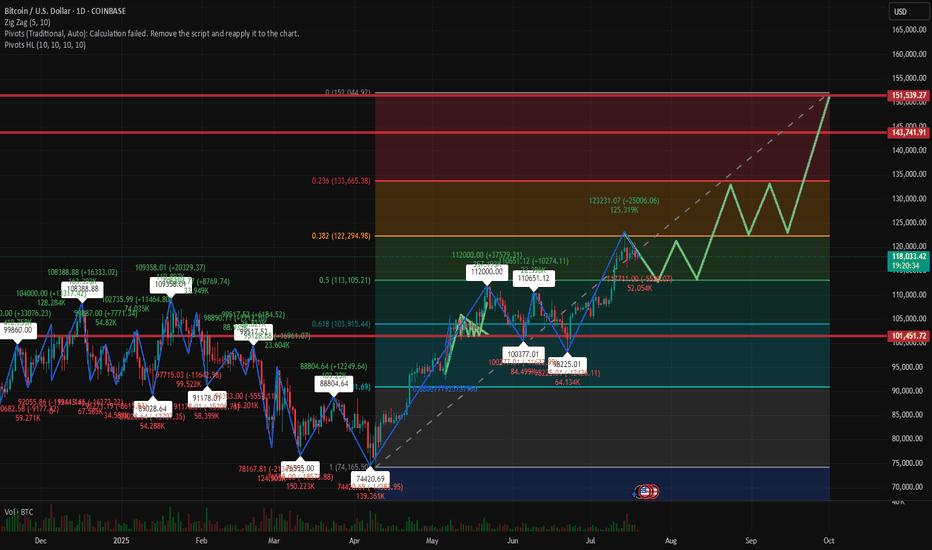

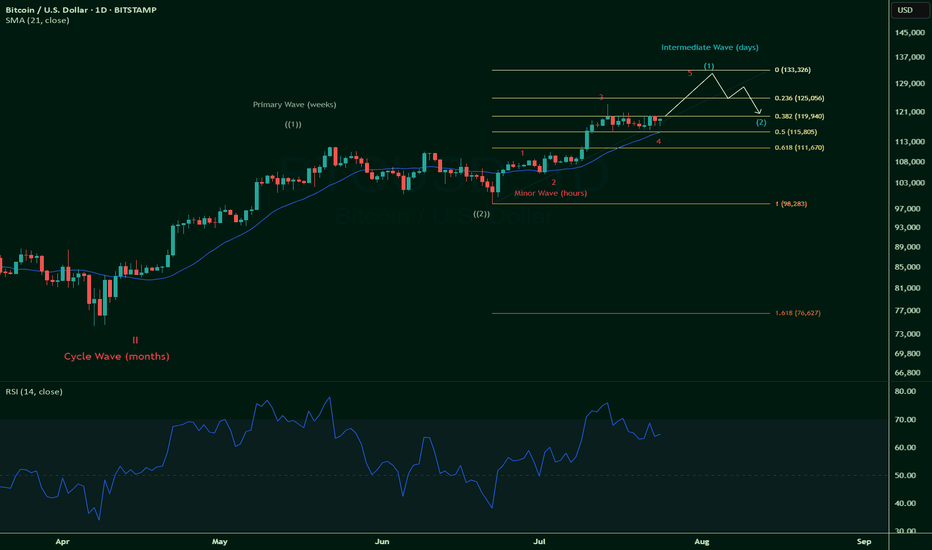

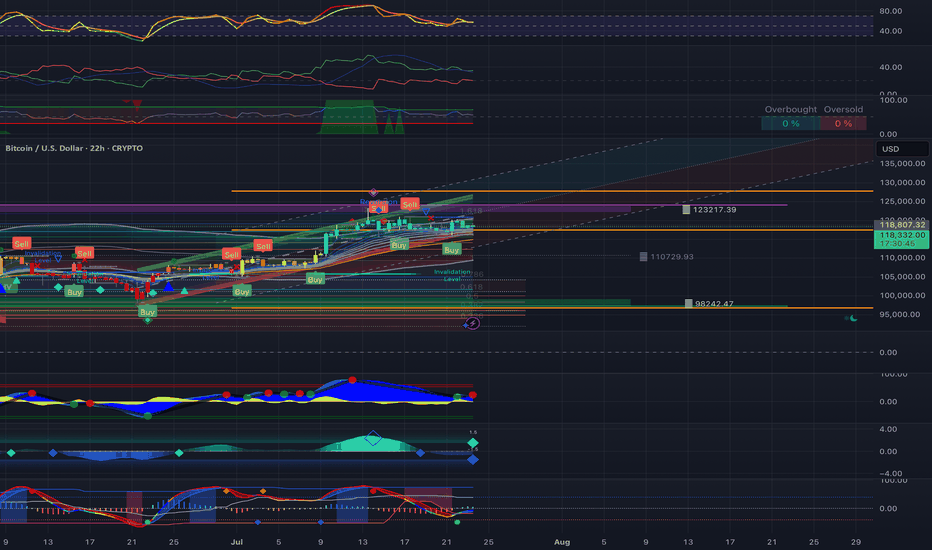

Bitcoin (BTC): Accumulation Before New All-Time-High?After the recently formed ATH near the $123K zone, we have had a decent accumulation following after that, which stabilized the Bollinger Bands and RSI, giving us a new potential for another ATH to form from here.

Now our target was $120K, which we filled quickly; now it is the $140K zone mainly so we are keeping our attention there. We are keeping the bullish game plan as long as we are above the middle line of the Bollinger Bands (which currently is in a bullish trend). (That green line is the middle line, btw).

Swallow Academy

Key Insights: Financial Markets Transformation by 2030For years, this page has been my space to share in-depth market research and personal insights into key financial trends. This post reflects my perspective — a strategic outlook on where I believe the digital finance industry is heading.

The financial world is evolving at an unprecedented pace, and it's easy to overlook subtle shifts. But the undeniable fact is that we are now standing at the intersection of three powerful industries — financial markets, blockchain, and artificial intelligence. We are positioned at the cutting edge of technology, where innovation is not a future concept but a present reality.

This post serves as a reference point for future trends and a guide to understanding the transformative forces shaping financial markets by 2030. These are not just facts, but my vision of the opportunities and challenges ahead in this rapidly converging digital ecosystem. Staying ahead today means more than following the market — it means recognizing that we are part of a technological shift redefining the core of global finance.

📈 1. Electronic Trading Evolution

Full transition from traditional trading floors to AI-driven digital platforms.

Integration of blockchain and smart contracts ensures transparency, automation, and risk reduction.

Real-time data analytics democratizes market access and enhances strategic decision-making.

🤖 2. Algorithmic Trading Growth

Accelerated by AI, machine learning, and big data analytics.

High-frequency trading (HFT) boosts efficiency but introduces new volatility factors.

Adaptive algorithms dynamically adjust strategies in real time.

Strong focus on regulatory compliance and ethical standards.

🔗 3. Tokenization of Real World Assets (RWA)

Transforming asset management with projected growth to $18.9 trillion by 2033. (now 18.85B)

Enhances liquidity, accessibility, and transparency via blockchain.

Institutional adoption is driving mainstream acceptance.

Evolving regulations (DLT Act, MiCA) support secure tokenized ecosystems.

🏦 4. Institutional Adoption & Regulatory Frameworks

Digitalization of fixed income markets and exponential growth in institutional DeFi participation.

Key drivers: compliance, custody solutions, and advanced infrastructure.

Global regulatory harmonization and smart contract-based compliance automation are reshaping governance.

💳 5. Embedded Finance & Smart Connectivity

Embedded finance market to hit $7.2 trillion by 2030.

Seamless integration of financial services into everyday platforms (e-commerce, mobility, etc.).

AI, blockchain, and IoT power real-time, personalized financial ecosystems.

Smart contracts reduce operational friction and enhance user experience.

🛡 6. Financial Crime Risk Management

Market expected to reach $30.28 billion by 2030.

AI-driven threat detection and anomaly monitoring strengthen AML compliance.

Blockchain ensures data integrity and automates cross-border regulatory adherence.

Global collaboration (FATF, EU AML) fortifies defenses against evolving financial crimes.

🌍 7. Consumer Behavior & Financial Inclusion

Digital banking bridges the gap for underbanked populations, especially in emerging markets.

Mobile solutions like M-Pesa revolutionize access to financial services.

Biometrics, microfinance, and AI-powered engagement tools foster inclusive economic participation.

🚀 Conclusion

By 2030, financial markets will be defined by technology-driven efficiency, regulatory adaptability, and inclusive growth.

Success will favor those who embrace innovation, leverage automation, and engage in cross-sector collaboration.

The future belongs to agile stakeholders navigating a landscape shaped by AI, blockchain, tokenization, and smart finance connectivity.

Best regards, EXCAVO

_____________________

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

BTC #ARC FormationThe chart **15-minute Bitcoin (BTC/USD)** candlestick pattern with a clearly drawn **cup and handle** or **rounded bottom** formation. Let's identify key levels:

---

🔍 **Key Levels Identified:**

1. **Resistance Zone (Neckline of Cup)**

Level:** \~**118,400 USD**

Significance:** This is the upper gray zone where price has repeatedly been rejected. It's acting as a **resistance** and also forms the **neckline of the cup pattern**. A breakout above this level may indicate bullish continuation.

2. **Support Zone (Bottom of Cup)**

Level:** \~**115,800 – 116,000 USD**

Significance:** This is the **lowest point** in the recent pullback and serves as strong support**. The price rebounded from here to form the cup.

3. **Mid-Level / Breakout Point**

Current Price:** \~**118,067 USD**

Significance:** Price is testing the **resistance**. A candle close and confirmation above 118,400 could trigger a bullish move, possibly targeting previous highs near **121,600 USD** or more.

---

⚠️ Watch For:

Breakout confirmation above 118,400 USD** with volume for bullish continuation.

Rejection at 118,400 USD** could lead to a pullback or handle formation.

Support holding above 116,000 USD** is key to maintain bullish structure.

Let me know if you want price targets or entry/exit suggestions based on this setup.

thank u

BTC! BREAK OUT.Initially i was hesitant to call thiss bottom and I will risk my non exsistant repution. That if we break through this resistance and pump a 1-2% break through 4 hour FVG we going ballistic I dont belive in 150k this month I believe in 127-130 k and a trtacement to 113k to fill CME gap. W tradez.

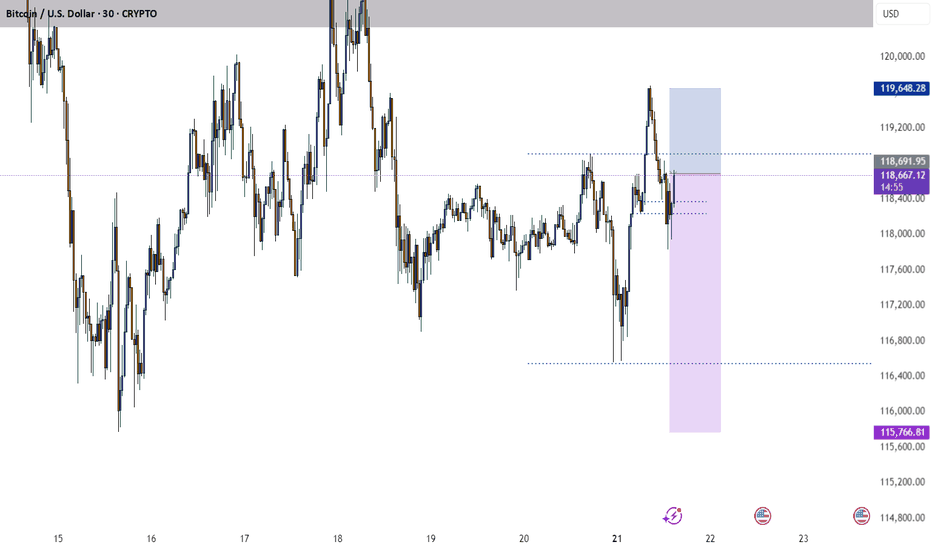

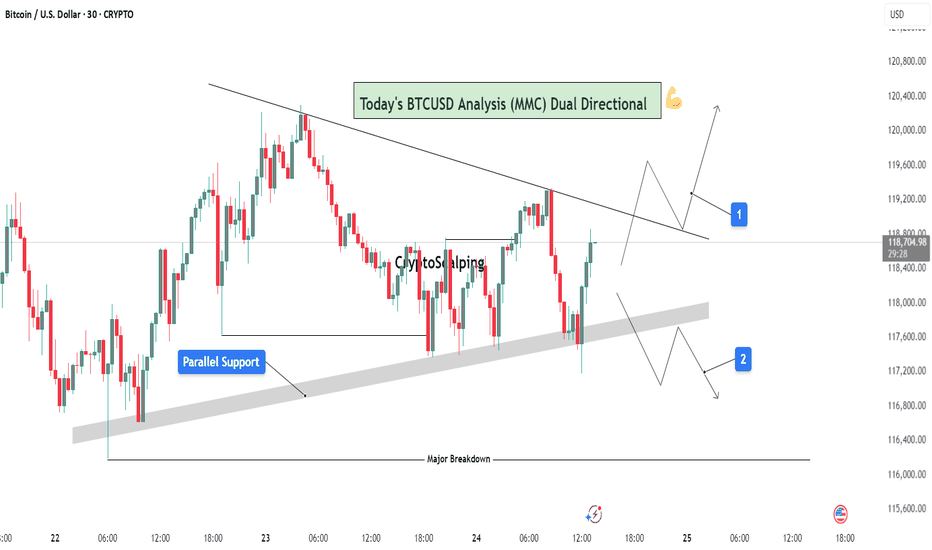

BTCUSD Analysis (MMC) : Dual Directional Outlook let's See🔍 1. Overview of Structure & Context:

On the 30-minute timeframe, BTCUSD is consolidating between two strong technical zones:

A descending trendline acting as resistance

A parallel rising support forming a compression zone

This wedge-like formation signals a potential high-impact move in either direction — a dual-directional outlook. Price is currently testing the midpoint between resistance and support, offering two reactive trade scenarios.

🟦 2. Key Zones Highlighted on Chart:

🔹 A. Parallel Support Zone (Dynamic Support):

A grey-shaded rising support has been tested multiple times.

Each bounce suggests buying strength near this diagonal zone.

This zone represents smart money accumulation potential under MMC concepts.

As price approaches this zone again, bulls are expected to step in if momentum aligns.

🔹 B. Descending Resistance Line (Supply Line):

The market is facing lower highs, a sign of bearish control at higher levels.

Each retest of this line has led to a rejection.

This line also acts as a liquidity magnet — price may spike above it to trap buyers before dropping (false breakout potential).

🧭 3. Scenarios and Trade Possibilities (Dual Directional Path):

✅ Scenario 1: Bullish Breakout – (Marked as Path 1)

If BTC breaks above the descending trendline with strong bullish volume, this confirms a structural breakout.

This setup targets:

First level: $119,600

Second level: $120,200

Once broken, the trendline can flip into support.

Ideal confirmation:

Bullish engulfing candle on breakout

Retest of broken resistance turning into support

Volume surge or momentum indicators turning bullish

⚠️ Scenario 2: Bearish Rejection & Breakdown – (Marked as Path 2)

If BTC fails to break resistance and breaks below the parallel support zone, it opens a bearish scenario.

Price may fall back to:

First level: $117,200

Final key support: $116,400 (Major Breakdown Zone)

This is a typical MMC-style mirror move: a structure break leading to liquidity run toward a previous demand zone.

Bearish confirmation:

Close below grey zone

Lower high formation near resistance

Increasing bearish volume / weak bounce

📐 4. Strategy & Trading Tips (MMC Application):

Under the Mirror Market Concepts (MMC), these zones are not just technical levels — they represent emotional price memory of both institutional and retail players.

Wait for the reaction, not prediction.

Use confluence tools (RSI divergence, volume, candle patterns).

Avoid trading inside the wedge — it's a trap zone.

Ideal entries are at breakout with retest confirmation or rejection from major zones.

📊 Risk Management Plan:

Entry Type Trigger Level SL Suggestion TP Range

Long Trade Break & retest above $118.8K Below $118.2K $119.6K → $120.2K

Short Trade Breakdown below $117.8K Above $118.2K $117.2K → $116.4K

🧠 Conclusion:

BTC is in a decision-making zone between a downward pressure line and strong support. A breakout could lead to a clean trend continuation, while a breakdown would trigger bearish momentum. The chart reflects precision MMC logic, offering a tactical map for day traders and scalpers to follow the smart money — not the noise.

Let the market decide direction. We just need to be prepared, not predictive.

BTC Bulls Defend Key Zone Eyes on $123K Breakout ExtensionBitcoin has successfully completed a breakout above the prior weekly high structure, followed by a healthy pullback which is currently unfolding into a bullish pennant formation. The key highlight is how price is retesting the neckline zone with precision, which now doubles as a strong immediate buyback zone.

The reaction from this level is already showing strong bullish momentum, with price gearing up to challenge the previous ATH. A breakout above that resistance should unlock the path toward the projected $116.5k and $123.4k targets as shown on the chart. Failure to hold the Immediate Buyback Zone opens the door toward the Strong Demand Zone, which remains a valid re-accumulation point within this bullish cycle.

Stay sharp. The structure remains intact unless the neckline fails decisively.

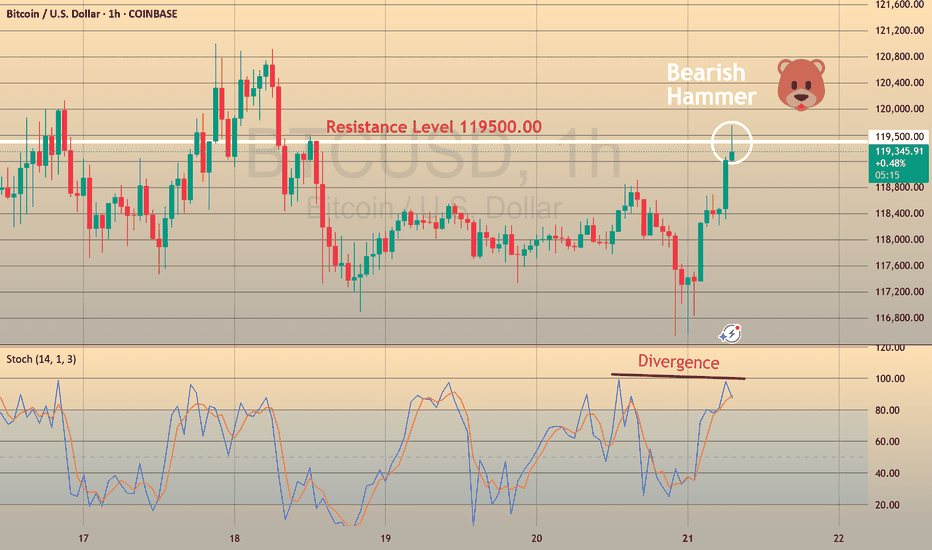

BTCUSD - BEARISH DIVERGENCE DETECTEDCAPITALCOM:BTCUSD

BTCUSD has been in a bullish trend over the past few hours and is now approaching the resistance at 119,500.00.

On the hourly chart, a bearish hammer has formed alongside a stochastic divergence, signaling potential downside.

⚡ This signal is reinforced by a strong resistance level above, adding weight to a possible pullback scenario.

📉 If BTCUSD rebounds from this level, consider Sell setups with take profit at the nearest support.

📈 If it breaks out, look for Buy opportunities on confirmation.

⚡ We use Stoch (14) to spot potential reversals when it exits overbought or oversold zones — helping you catch clear, confident entries.

BTCUSDT BUYING SETUPBTCUSDT is showing a strong bullish setup as price holds above key support. A bounce from this zone could trigger the next upward move.

Traders should wait for confirmation signals such as bullish candlestick patterns or a break above short-term resistance before entering.

Stay patient, follow the trend, and manage risk properly! 📈🔥

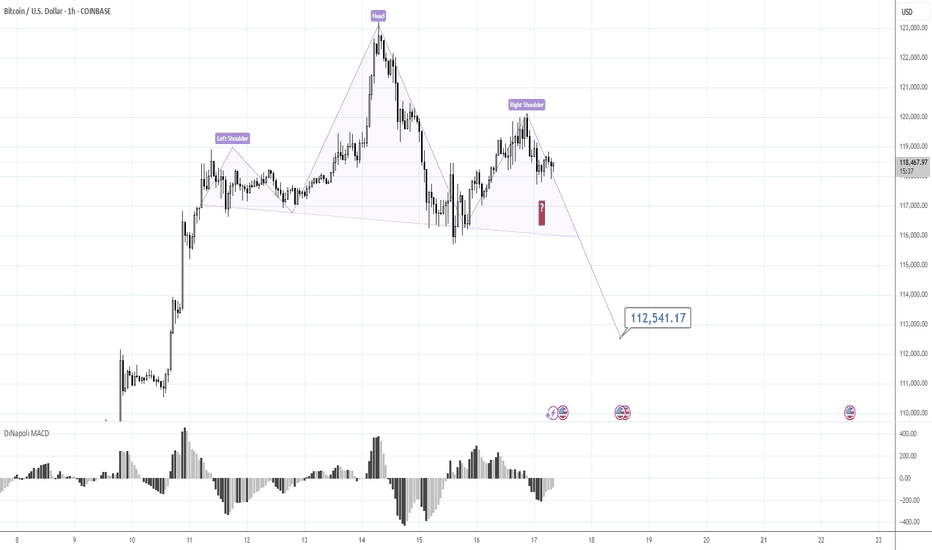

120K is the Key.Morning folks,

Our last plan worked perfect - market re-tested 117K support and jumped out. If you have longs - you could keep it.

We consider now two alternative scenarios, although we think that this one with triangle is more probable, we do not exclude the H&S shape on 1H chart that could lead BTC down to 112-113K support area.

So, if you do not know how to deal with this - keep an eye on the 120K area and top of the right arm. Upside breakout will confirm H&S failure and triangle scenario. Otherwise, until market stands under 120K - consider H&S as a basic scenario, just for safety.

Take care, S.

Bitcoin / U.S. Dollar 4-Hour Chart (BTCUSD)4-hour chart displays the recent price movement of Bitcoin (BTC) against the U.S. Dollar (USD) as of July 11, 2025. The current price is $117,979.53, reflecting a 4-hour increase of $1,938.91 (+1.67%). The chart highlights a significant upward trend, with a notable breakout above the $114,719.92 resistance level, reaching up to $121,362.93. Key price levels include support at $116,625.93 and resistance at $121,362.93, with buy and sell options marked at the current price.

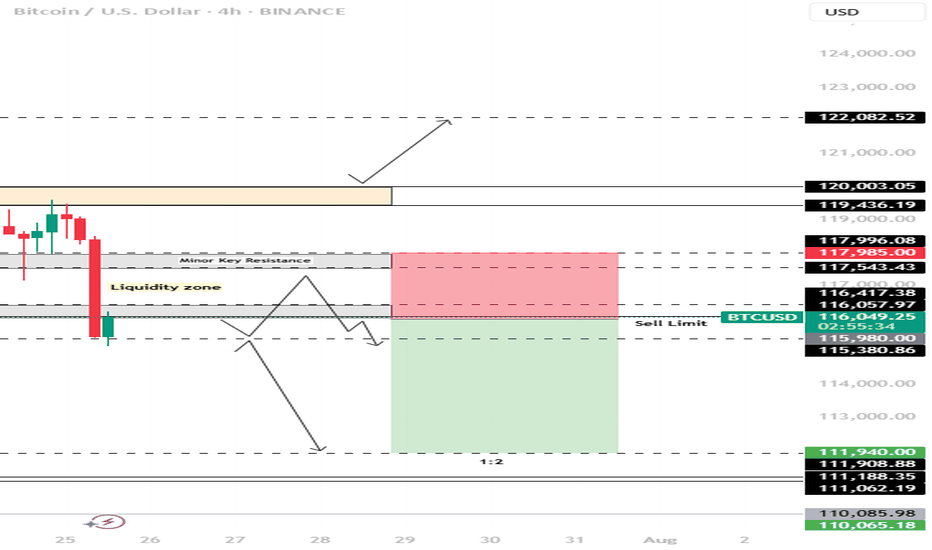

BTC/USD – 4H Technical and Fundamental AnalysisBTC/USD – 4H Technical and Fundamental Analysis

BTC/USD saw sharp downside pressure today, driven by a wave of long position liquidations—exceeding $800 million across the crypto market in the past 24 hours. The sudden shift triggered panic selling, dragging Bitcoin below its psychological and technical support near $116,000. Broader crypto market sentiment turned risk-off as large investors reduced exposure, accelerating the sell-off.

Fundamentally, the market remains cautious amid a lack of positive macroeconomic catalysts for risk assets. Speculation about stricter U.S. regulatory oversight and declining inflows into crypto ETFs also dampened sentiment. Combined with hawkish remarks from Fed officials, which keep interest rates elevated, appetite for high-risk assets like Bitcoin weakened further.

From a technical perspective, BTC/USD broke below the major support level of $116,000, confirming bearish pressure. This breakdown followed a period of consolidation, with price failing to maintain bullish momentum. A liquidity hunt appears to be underway, with price revisiting the zone to trap breakout traders before resuming its move.

We are now watching for a confirmed 4H candle close below the liquidity zone. Once confirmed, a short setup is validated, with targets aligned with the next key support zone.

📍 Sell Setup

Entry: Sell Limit at 115,980.00

Stop Loss: 117,985.00

Take Profit: 111,940.00

📌 Disclaimer:

This is not financial advice. Always wait for proper confirmation before executing trades. Manage risk wisely and trade what you see—not what you feel.

Use Base-Anchored Fibonacci Retracement Formula🔹 Step 1: Base-Anchored Fibonacci Retracement Formula

🧮 Retracementₓ = Base + (Range × x)

Inputs:

• 🟢 Base = $74,458.42

• 🔴 High = $112,006.33

• 📏 Range = $112,006.33 − $74,458.42 = $37,547.91

📐 BTC Retracement Levels (Upward from Base)

1️⃣ Fib 0.236

= 74,458.42 + (37,547.91 × 0.236)

= 74,458.42 + 8,862.92

= $83,321.34

2️⃣ Fib 0.382

= 74,458.42 + (37,547.91 × 0.382)

= 74,458.42 + 14,362.66

= $88,821.08

3️⃣ Fib 0.500

= 74,458.42 + (37,547.91 × 0.500)

= 74,458.42 + 18,773.96

= $93,232.38

4️⃣ Fib 0.618

= 74,458.42 + (37,547.91 × 0.618)

= 74,458.42 + 23,285.25

= $97,643.67

5️⃣ Fib 0.786

= 74,458.42 + (37,547.91 × 0.786)

= 74,458.42 + 29,597.78

= $104,056.20

6️⃣ Fib 1.000

= 74,458.42 + 37,547.91

= $112,006.33

🚀 BTC Extension Levels (Beyond High)

📈 Extensionₓ = High + (Range × x)

1️⃣ Fib 1.618

= 112,006.33 + (37,547.91 × 0.618)

= 112,006.33 + 23,285.25

= $135,291.58

2️⃣ Fib 2.618

= 112,006.33 + (37,547.91 × 1.618)

= 112,006.33 + 60,767.17

= $172,773.50

3️⃣ Fib 3.618

= 112,006.33 + (37,547.91 × 2.618)

= 112,006.33 + 98,249.08

= $210,255.41

📊 Final BTC Levels

🎯 Target 🧭 Fib Level 💰 Price

TP1 0.236 $83,321.34

TP2 0.382 $88,821.08

TP3 0.500 $93,232.38

TP4 (High) 1.000 $112,006.33

TP5 1.618 $135,291.58

EXT2 2.618 $172,773.50

EXT3 3.618 $210,255.41

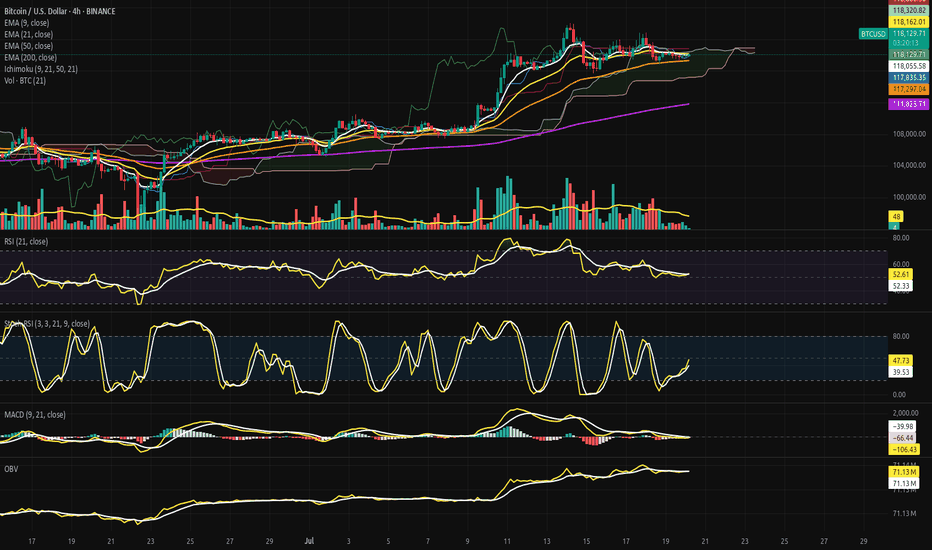

Bitcoin Suspended Beneath the Ichimoku Silence.⊢

⨀ BTC/USD - BINANCE - (CHART: 4H) - (July 20, 2025).

◇ Analysis Price: $117,919.29.

⊣

⨀ I. Temporal Axis - Strategic Interval - (4H):

▦ EMA9 - (Exponential Moving Average - 9 Close):

∴ Price is currently hovering just below the EMA9 at $118,035.43, showing weakening immediate momentum;

∴ EMA9 is now flat-to-downsloping, indicating short-term loss of control from intraday bulls;

∴ Recent candles have failed to reclaim closes above EMA9, reflecting micro-resistance and tactical fragility.

✴️ Conclusion: Logic sealed - EMA9 has lost command; tactical control has shifted to neutrality with bear undertones.

⊢

▦ EMA21 - (Exponential Moving Average - 21 Close):

∴ EMA21 currently sits at $118,164.50, acting as an overhead suppressor;

∴ The gap between EMA9 and EMA21 is compressing, signaling potential for either crossover or volatility breakout;

∴ Price action is now trapped between EMA9 and EMA50, with EMA21 forming the upper barrier of a tactical box.

✴️ Conclusion: Logic sealed - EMA21 serves as containment lid; rejection here confirms tactical indecision.

⊢

▦ EMA50 - (Exponential Moving Average - 50 Close):

∴ EMA50 rests at $117,262.74, offering foundational support within the current structure;

∴ Price has respected this level on multiple dips since mid-July, confirming its strategic function as mid-term equilibrium;

∴ The slope remains mildly upward - no sign of reversal, only compression beneath.

✴️ Conclusion: Logic sealed - EMA50 maintains its structural role as mid-range dynamic floor.

⊢

▦ EMA200 - (Exponential Moving Average - 200 Close):

∴ EMA200 remains well below at $111,765.30, untouched since early July;

∴ Its wide distance from price confirms that the broader structure remains in bullish territory;

∴ Its trajectory continues upward, anchoring the uptrend beneath all volatility.

✴️ Conclusion: Logic sealed - EMA200 secures the long-term structure; market remains elevated far above reversal threshold.

⊢

▦ Ichimoku Cloud - (9, 21, 50, 21):

∴ Price is currently within the Kumo (cloud) zone, defined between SSA and SSB - a region of ambiguity and compression;

∴ The Senkou Span A and Span B are nearly flat, signaling lack of directional command in the near term;

∴ Kijun and Tenkan lines are converged, offering no trend bias - equilibrium is dominating.

✴️ Conclusion: Logic sealed - Ichimoku confirms a neutralized compression state; breakout required for trend clarity.

⊢

▦ RSI (21) + EMA9 - (Relative Strength Index with Signal Smoothing):

∴ RSI value stands at (51.48), while the EMA9-signal rests at (52.25) - confirming a soft bearish crossover;

∴ The RSI has declined from its recent peak and now oscillates around the neutral 50-line;

∴ Momentum is waning without structural damage, indicating tactical cooling.

✴️ Conclusion: Logic sealed - RSI confirms suspended momentum; structural neutrality prevails beneath fading thrust.

⊢

▦ Stochastic RSI - (3, 3, 21, 9):

∴ Current values are: (%K = 35.33), (%D = 32.68) - with %K slightly above %D, forming a mild bullish crossover;

∴ The oscillator has just risen from oversold levels, indicating potential energy buildup;

∴ Prior cycles in this zone have produced false starts, so confirmation is essential.

✴️ Conclusion: Logic sealed - Stoch RSI hints at rebounding energy, but with fragile structure and low reliability.

⊢

▦ MACD - (9, 21, 9 - EMA/EMA):

∴ MACD Line = (–105.52), Signal Line = (–129.07), Histogram = (+23.55) - confirming a bullish crossover;

∴ The crossover occurred below the zero line, indicating a possible reversal from weakness rather than strength;

∴ Slope of MACD is positive but modest - insufficient to declare dominant shift.

✴️ Conclusion: Logic sealed - MACD is in bullish transition mode, but still recovering from beneath structural base.

⊢

▦ OBV + EMA9 - (On-Balance Volume with Trend Overlay):

∴ OBV currently reads (71.13M), and is slightly above its EMA9, signaling retention of volume without strength;

∴ Volume has not left the system - but neither has it surged; this is passive accumulation at best;

∴ No divergence exists for now, but lack of buildup implies neutral positioning.

✴️ Conclusion: Logic sealed - OBV is stable and neutral; no buyer escape, but no commitment surge either.

⊢

▦ Volume + EMA21 – (Volume Profile with Trend Average):

∴ Current volume bar = (13.91), sitting below the EMA21 baseline;

∴ The volume profile across recent sessions is declining - suggesting consolidation or exhaustion;

∴ No breakout volume spike has accompanied price stabilization - trend is under silent compression.

✴️ Conclusion: Logic sealed - volume fails to validate price levels; tactical fragility remains unresolved.

⊢

🜎 Strategic Insight – Technical Oracle:

∴ The H4 structure presents a state of compression beneath a neutral cloud, suspended between tactical short-term EMA's (9, 21) and safeguarded by a rising EMA50 backbone;

∴ Momentum oscillators (RSI, Stoch RSI, MACD) converge toward reactivation, yet none have broken decisively above neutral thresholds - reflecting potential, not power;

∴ Volume participation is inconsistent and fading, offering no confirmation for breakout - the market is in silent observation mode, not assertion;

∴ Ichimoku confirms indecision: price floats within Kumo, without command or breakout - equilibrium reigns;

∴ Price positioning remains elevated above the deeper structure (EMA200), but its current zone between EMA9 and EMA50 represents a coil of indecision;

∴ The overall condition is not bearish - but it is tactically suspended, lacking conviction, awaiting external ignition.

✴️ Conclusion: The Oracle confirms - the structure is intact, but tactical initiative is lost; the field is poised, not marching.

⊢

∫ II. On-Chain Intelligence – (Source: CryptoQuant):

▦ Short-Term Holder (SOPR):

∴ SOPR currently reads (1.001), meaning short-term holders are spending coins with no significant profit or loss - a signal of economic neutrality;

∴ The chart displays persistent lateral volatility around the (1.0) threshold since early July - no emotional dominance in market behavior;

∴ This pattern historically coincides with pre-expansion compression phases, rather than breakdown events.

✴️ Conclusion: Logic sealed - SOPR confirms behavioral neutrality among short-term holders; the market remains in a state of expectation, not realization.

⊢

▦ STH-MVRV - (Short-Term Holder Market Value to Realized Value):

∴ The metric is currently oscillating around (1.30), well above the danger zone at (1.0), but far below the euphoria threshold at (1.8);

∴ The structure reflects multiple euphoria rejections, followed by a return to balance - a classic cooling-off pattern without structural failure;

∴ Convergence between market price, realized value, and short-term cost basis indicates the market is retesting foundation zones.

✴️ Conclusion: Logic sealed - STH-MVRV confirms post-euphoric cooling with structural support intact; no active trend, no breakdown.

⊢

▦ Exchange Inflow Spent Output Age Bands - (All Exchanges):

∴ Inflows to exchanges have been consistently low in recent weeks, particularly among young coins (0d–1d, 1d–1w) - showing no urgency to sell;

∴ Aged outputs (>6m) remain dormant - long-term holders are not mobilizing;

∴ The absence of inflow pressure signals no macro panic or exit event, reinforcing the diagnosis of tactical compression.

✴️ Conclusion: Logic sealed - muted inflows confirm a lack of distribution catalysts; stable structure sustains the technical silence on the 4H chart.

⊢

🜎 Strategic Insight - On-Chain Oracle:

∴ All three on-chain metrics converge into a clear state of tactical equilibrium - not bearish, not euphoric, but suspended between action and observation;

∴ Short-Term Holder SOPR stabilizes at (1.001), marking a precise psychological stasis - profit-taking and panic-selling are both absent;

∴ STH-MVRV confirms a post-euphoria cooldown with structural preservation, implying that short-term holders have recalibrated expectations without abandoning their positions;

∴ Exchange inflows remain historically depressed, with no aged coins activating - a hallmark of silent markets preparing for resolution;

∴ The chain speaks softly: no exit, no aggression, no irrationality - only latency, and the potential energy of stillness.

✴️ Conclusion: The Oracle confirms - the on-chain architecture reflects suspended initiative; nothing is broken, nothing is charged - only paused.

⊢

𓂀 Stoic-Structural Interpretation:

▦ Structurally: Bullish;

∴ Price remains well above the EMA200 and EMA50, with no breach of long-term support;

∴ All EMA's (9, 21, 50) are compressing, but retain upward trajectory - confirming structural integrity;

∴ Ichimoku Kumo holds price within a neutral band, but does not reflect a breakdown.

⊢

▦ Momentum-wise: Suspended Compression.

∴ MACD shows bullish crossover from beneath, but lacks amplitude to confirm trend reversal;

∴ RSI is parked around 50 with a bearish signal crossover - signaling stagnation, not strength;

∴ Stochastic RSI is climbing out of oversold, but with no impulsive follow-through.

⊢

✴️ Final Codex Interpretation:

∴ The H4 structure is consolidating beneath short-term resistance and within equilibrium clouds;

∴ Momentum is rebuilding, but flow remains stagnant;

∴ Buyers have not exited, but neither have they re-initiated force;

∴ The chart breathes - but does not speak.

⊢

⧉

· Cryptorvm Dominvs · MAGISTER ARCANVM · Vox Primordialis ·

⚜️ ⌬ - Silence precedes the next force. Structure is sacred - ⌬ ⚜️

⧉

⊢