BTC market update Bitcoin Market Update:

Bitcoin is currently consolidating, and the market is indecisive. It's better to watch closely for a breakout or breakdown before making any trades.

Bullish Scenario:

Breakout above resistance could lead to a strong bullish rally. Target: Next resistance level.

Pro Tip: Confirm with high volume for a valid breakout.

Bearish Scenario:

Breakdown below support could trigger strong selling. Target: Next support level.

Pro Tip: Watch for confirmation with increased selling volume to avoid fakeouts

Conclusion:

Wait for clear breakout or breakdown to trade. Avoid entering blindly.

BTCUSDT.3L trade ideas

BTC at Make-or-Break Level! Which Side Are You On?#Bitcoin #BTCUSDT #CryptoTrading #TradeWithMky

📉 Scenario 1 – Bearish Breakdown

If BTC loses the green zone (~117K), expect a heavy drop toward 113K and beyond. This is a key demand zone — break it, and bears dominate.

📈 Scenario 2 – Bullish Reversal

Watch for accumulation between the green & red zones. A breakout above the red supply zone (~119K) will signal buyers are back in charge.

🗣️ As the chart says: "بیا فیک نزن، بعد شکست این محدوده باید بخری!"

🚀 Whether you're a breakout trader or a range player — this is the zone to watch.

📊 Chart by TradeWithMky — Where Altcoins Speak Louder than Bitcoin!

👇 Share your thoughts and setups below! Let's ride this move together.

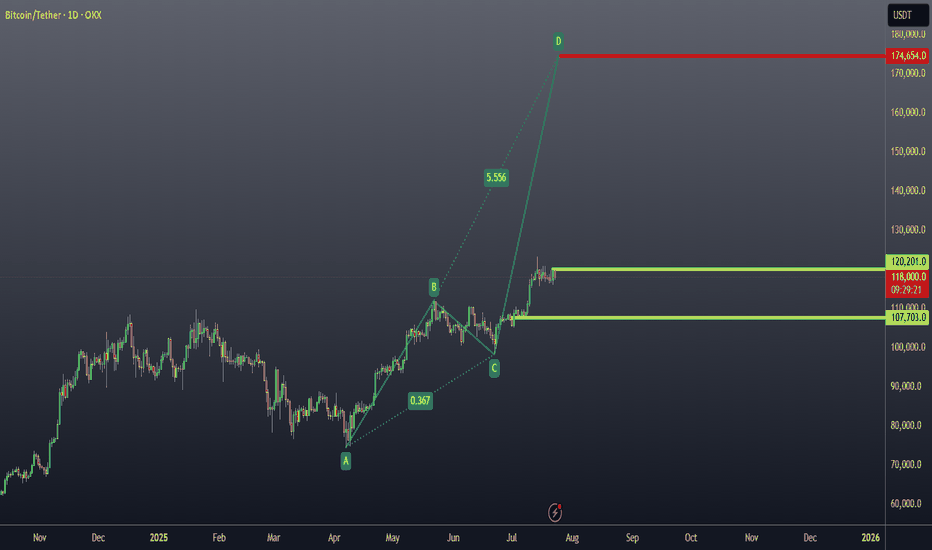

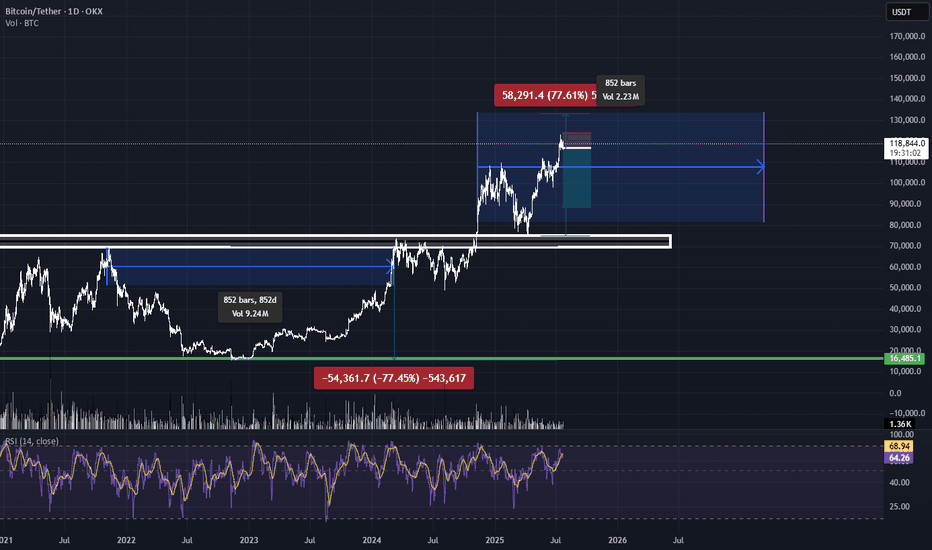

Wave Analysis: "Peak Breeds Peak, Trough Breeds Trough".This chart presents a custom technical model relying on only two points to generate a series of expected price levels, integrating multiple factors for high-precision time and price forecasting.

Unlike the traditional ABCD pattern, this method provides both timing and pricing predictions and is designed to detect potential explosive moves (“pumps”) early on.

The analysis is applied to Bitcoin, highlighting key support zones, targets, and stop levels derived from a neural network approach.

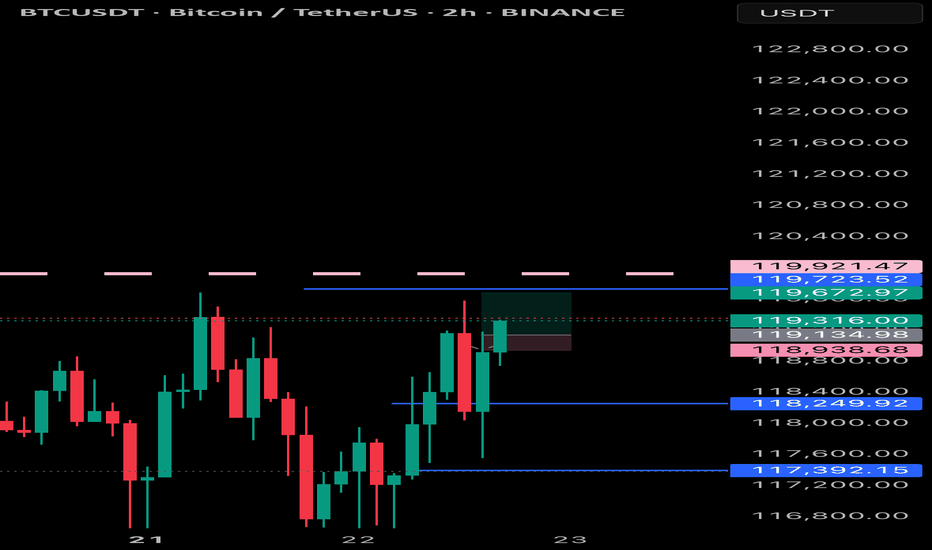

BTC/USDT Analysis: Inside the Range

Hello everyone! This is a daily analysis from a trader-analyst at CryptoRobotics.

Yesterday, Bitcoin continued moving toward the upper boundary of the sideways range. Strong market buying emerged near that level, but unfortunately, it was absorbed by sellers.

At the moment, we are testing the POC (Point of Control) of the current trading range. Buyer activity is already appearing at this level. If bulls regain initiative, we can expect a move back to the upper boundary. However, if the price drops below the current level, there is a high probability of stop-loss hunting and a liquidity grab near $115,000.

Buy Zones:

~$115,000 (zone of initiating/pushing volumes)

$110,000–$107,000 (accumulated volumes)

This publication is not financial advice.

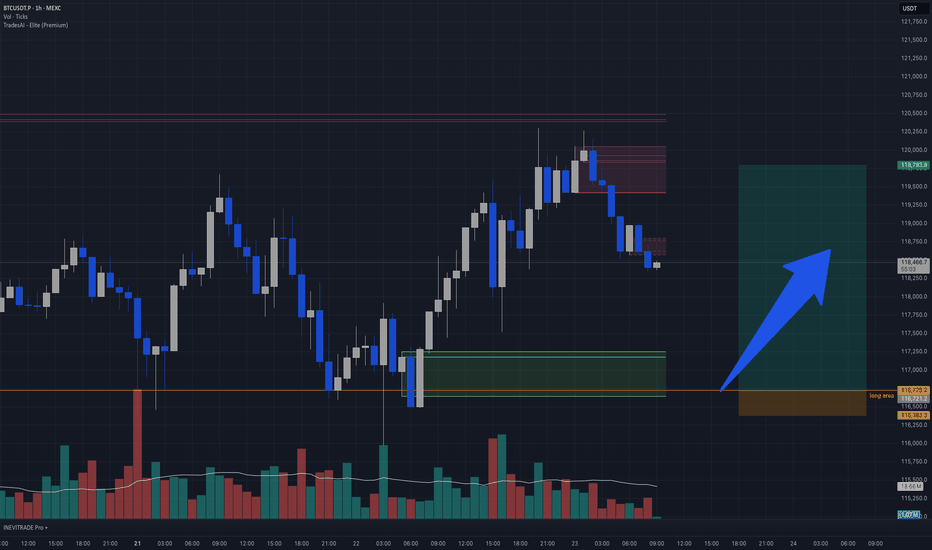

BTC intraday long idea BTCUSDT Intraday Idea | 1H Chart

Price recently pushed into a key supply zone and is now pulling back after a strong impulsive move. The highlighted green box marks a demand block or breakout origin, with confluence from high volume and previous rejection.

🟩 Long Area:

116,725 – 116,300

This area acted as a bullish breaker and low-volume node. Price previously wicked deep into this zone before a strong bullish push, suggesting unfilled orders remain. If price retests this zone, a reaction is likely.

Reason for Entry:

• Strong displacement from demand

• Price forming lower highs into potential mitigation

• Decreasing sell volume on the pullback → signs of absorption

• Clean R/R with tight invalidation

📉 Short-term Sell-off:

This retracement is likely a liquidity grab or order block mitigation, pulling into the long zone to refill institutional orders.

📈 Target Zone:

119,750+ – aligned with recent inefficiency and prior high.

BTC analysis: FOR 23 JULY 2025Bitcoin has broken out of the triangle pattern in an upward direction and is now set for a retest. If the price is able to hold above this level, we could see a continuation of the upward movement. The first resistance level is at $120,000, and a break above this could propel us toward a new all-time high.

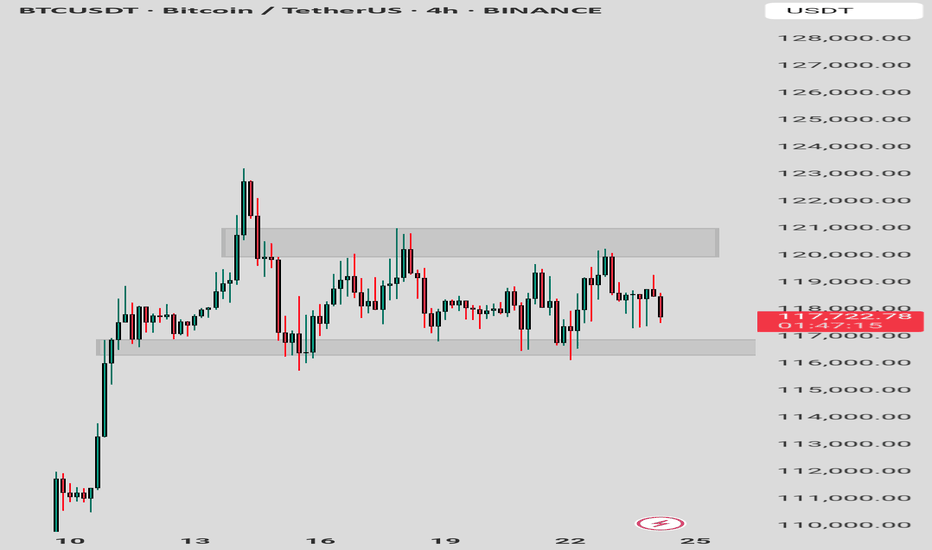

BTC/USDT – Range Formation Before Next Move?Bitcoin is currently consolidating between $117,000 support and $120,000 resistance, forming a tight sideways range after a strong breakout.

🔹 Structure Insight:

Bullish rally stalled at $120K resistance zone.

Range-bound candles with wicks on both ends = indecision.

Strong demand zone near $117K, acting as short-term floor.

🔸 Indicators Flash Neutral Bias:

RSI cooling off below overbought zone (~63) – no strong momentum.

ADX low and flattening – trend weakening.

MACD losing strength – bull momentum fading.

Volume declining during consolidation = awaiting catalyst.

🟢 Bullish Trigger: Break above $120K with strong volume could ignite next leg up → Targets: $122K–$127K

🔴 Bearish Trigger: Breakdown below $117K opens door to $114K–$112K retest.

🧭 Outlook: Sideways range – wait for breakout confirmation before positioning aggressively.

BTC - A POSSIBLE SCENARIO (MARCH 2025)BTC - A POSSIBLE SCENARIO (MARCH 2025)

BTC is still showing weakness. Overall, I remain bullish, but it may dip to $68K–$73K.

Alts are a real bargain now in March 2025. They won’t stay like this forever—soon, they’ll surprise everyone. But obviously they are extremely risky assets.

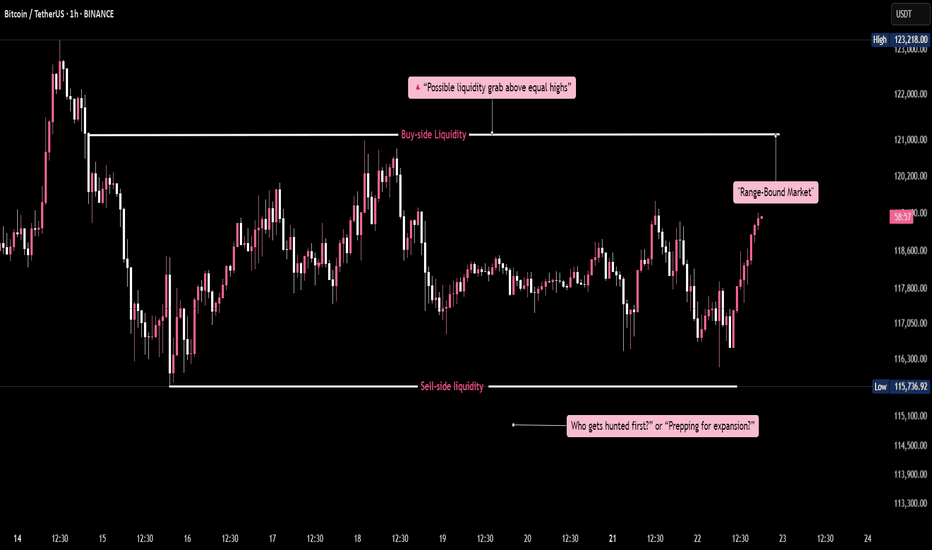

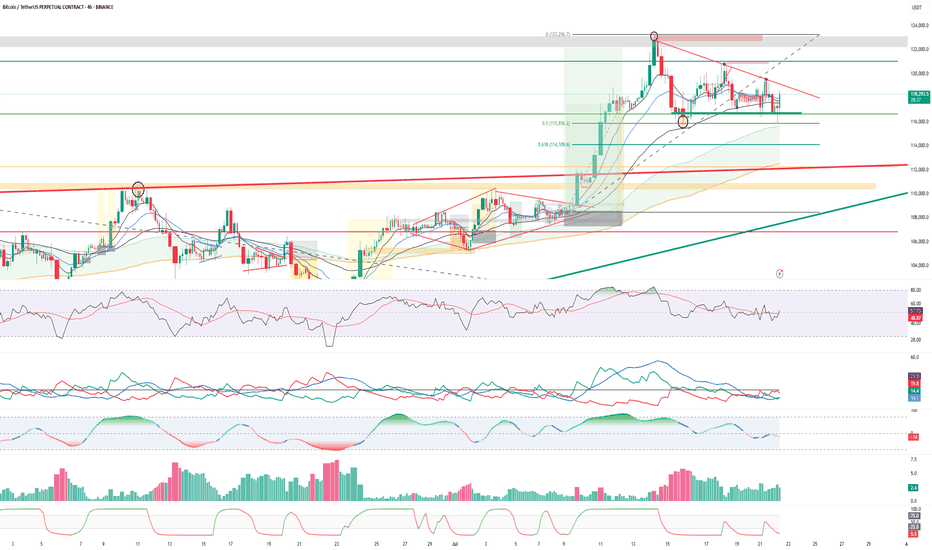

BTC/USDT - Liquidity Loading Zone

Bitcoin is trading within a well-defined range, building liquidity on both sides. Equal highs near 121K signal buy-side liquidity, while equal lows around 115.7K mark the sell-side liquidity. This setup is a classic smart money trap—engineered to gather orders before a major move. The longer the range holds, the more explosive the breakout is likely to be. Watch for a sweep of either side as a potential trigger for expansion.

Whether it’s a fakeout or breakout, liquidity will decide the next move.

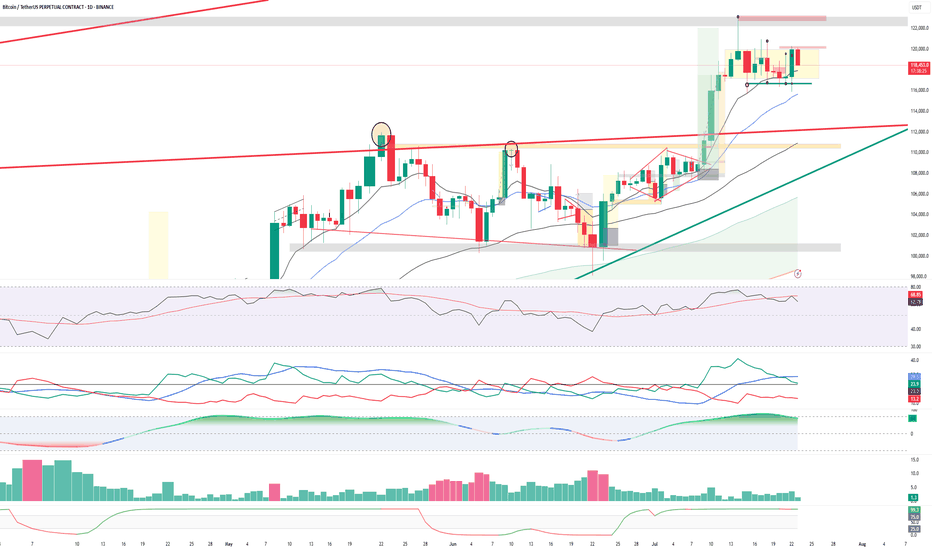

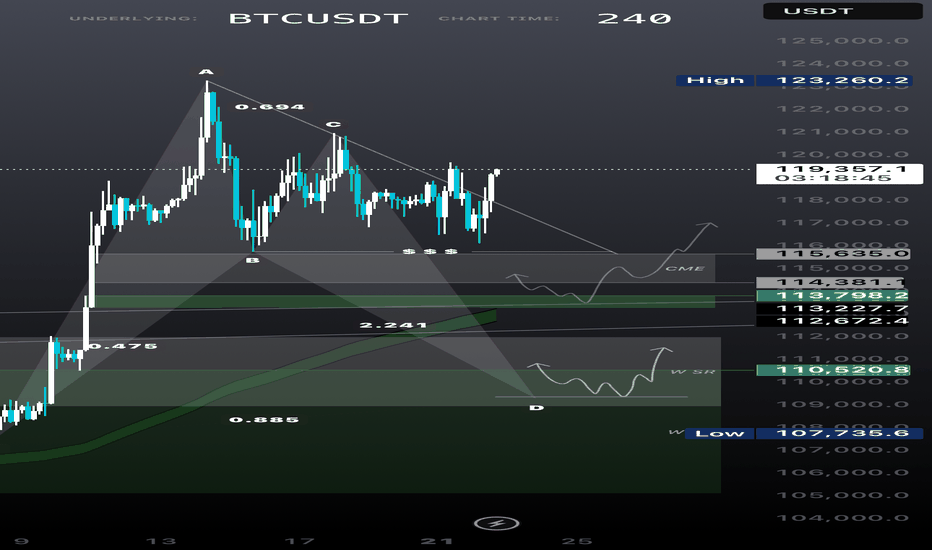

BTC Top-Down Analysis (Weekly, Daily, 4H)Weekly, Daily, and overall trend is bullish only 4H internal structure is short-term bearish with price trading inside a 4H demand zone.

From weekly timeframe:

- Inverse head & shoulders is forming showing trend continuation.

- ATH trendline (Nov 2021) has flipped from resistance to support — not retested yet.

- Major supports all align between 113K–109K including:

- CME Gap: 114380–115635

- Trendline: 113798

- Neckline: 112800

- Weekly Bullish OB: 110520

- Harmonic Bat PRZ: 109350

My Thoughts:

This 113K–109K zone is a high-confluence support area I’ll only consider buying BTC within this range.

This analysis remains valid as long as the weekly candle doesn’t close below the Bullish OB (105K) or above the ATH.

BTC #Bitcoin (BTC/USDT) 1-hour chartThis Bitcoin (BTC/USDT) 1-hour chart shows two clear consolidation phases marked by blue rectangles. Each consolidation lasted 164 bars (~6 days 20 hours). After the first range, Bitcoin broke out upwards, leading to a strong rally. The current price action is again testing the upper boundary of the second consolidation range ($119,200), indicating a possible breakout. The gray zone ($116,500) highlights a key support level. A breakout above the range could signal another bullish continuation.

thanking you

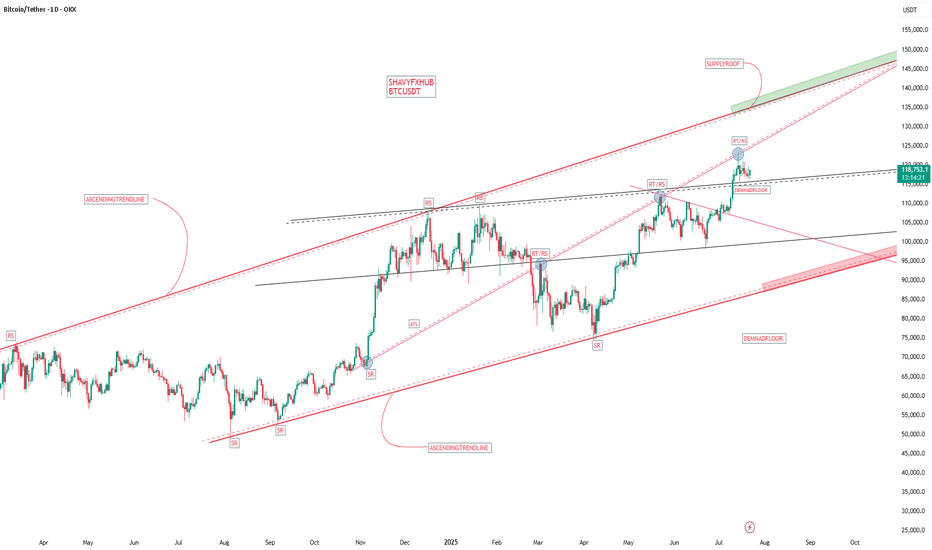

BTC BITCOIN THE BTC 135K ZONE ON the ascending trend line will like happen ,as the structure never lies.

at the moment am looking at a retest into 124k and we either get a double top structure to sell on rejection or we keep buying into 135k and sell from the supply roof of the ascending bullish trendline .

trading is 100% probability ,trade with caution.

ANY KEY LEVEL CAN FAIL .

BTC – Tightening Structure, Big Move Loading?CRYPTOCAP:BTC is currently bouncing off the lower trendline of the symmetrical triangle on the 4-hour chart 📊. The structure remains intact, with neither a breakout nor a breakdown confirmed yet.

This kind of compression often leads to expansion—either a bullish surge or a sharp dip depending on who takes control next ⚡️.

All eyes are on this zone 👀. The next few candles could decide the market’s short-term direction, so stay sharp and watch the reaction closely!

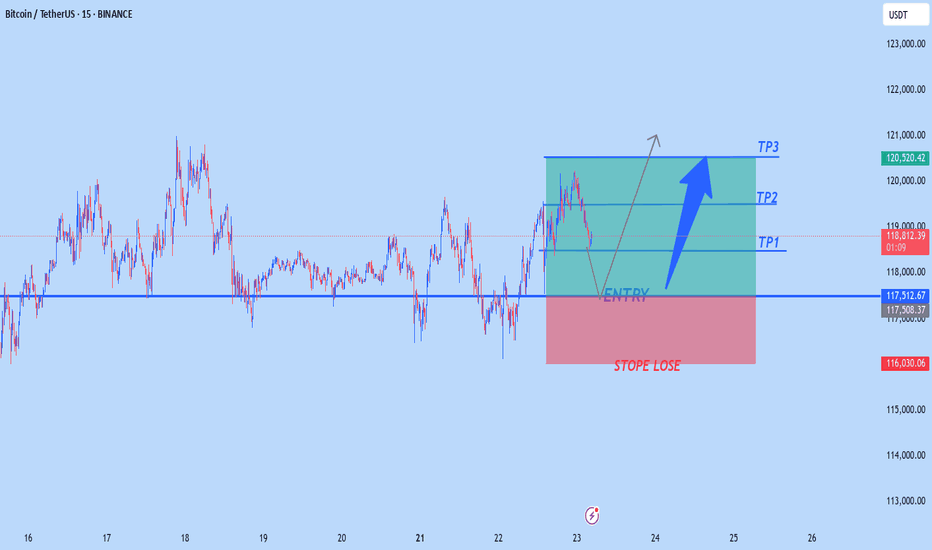

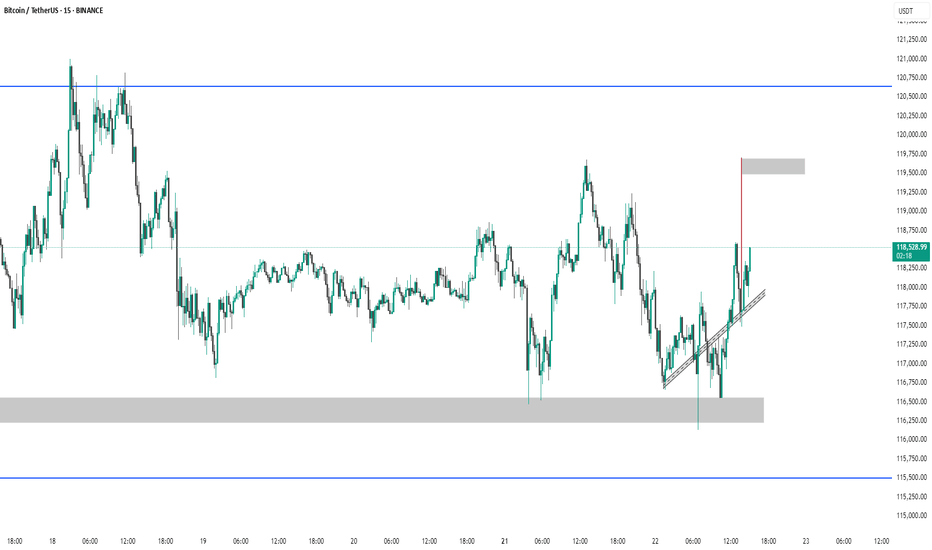

BTC #Bitcoin 15-minute BTC/USDT chart This 15-minute BTC/USDT chart (Binance) shows Bitcoin rebounding from a demand zone near 116,000–116,750 USDT and forming higher lows along a short-term ascending trendline. Price is currently around 118,446 USDT, aiming toward a marked supply zone near 119,500 USDT, suggesting a potential short-term bullish move. A rejection at this supply zone could signal a pullback, while a breakout may indicate continued upward momentum. Key support and resistance zones are clearly defined.

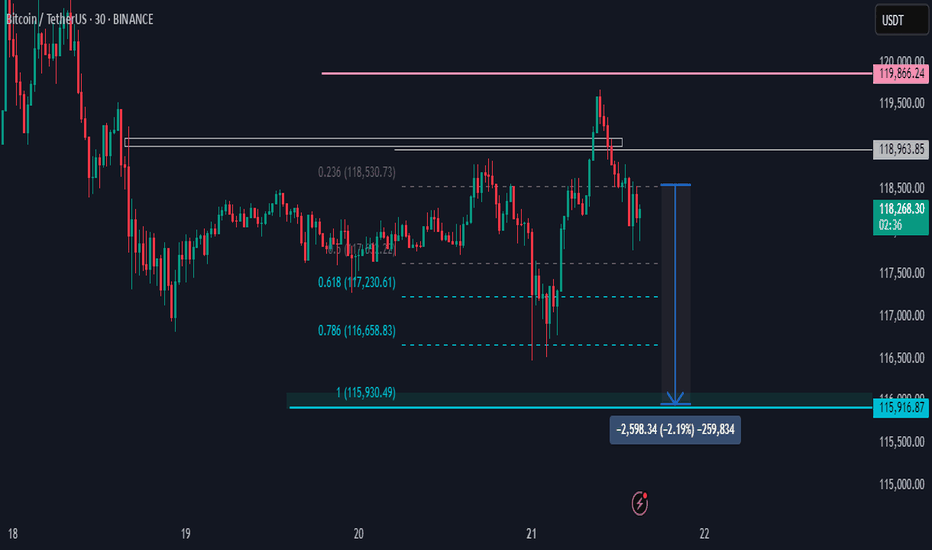

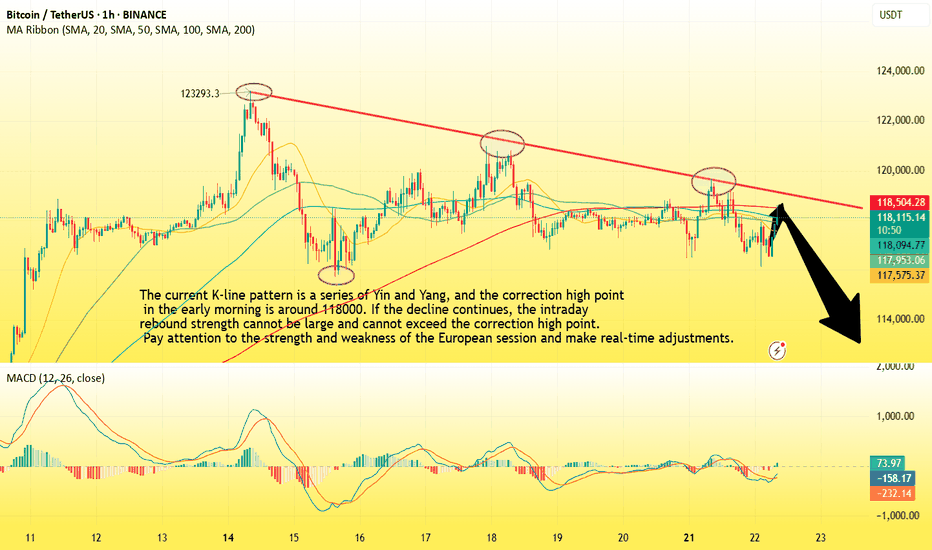

BTC-----Sell around 118100, target 116500 areaTechnical analysis of BTC contract on July 22:

Today, the large-cycle daily level closed with a small positive cross yesterday, and the price was below the moving average. The attached indicator was dead cross. The general trend is currently biased towards a downward trend. From the overall trend, we can see that the current trend is consistent and strong, but there is no room for rebound, and the continuous sluggish trend is also quite obvious, so the idea of selling down in the future market has become the main idea; the short-cycle hourly chart showed that the US market fell and rebounded yesterday, and the pressure continued to fall and broke down in the morning, and the correction high was near the 118000 area. The current K-line pattern is a single positive line. According to the trend rule, if the decline continues today, the rebound strength cannot be large, and the high point of the US market correction is resistance.

Today's BTC short-term contract trading strategy:

Sell at the current price of 118100, stop loss at 118500, and target 116500;

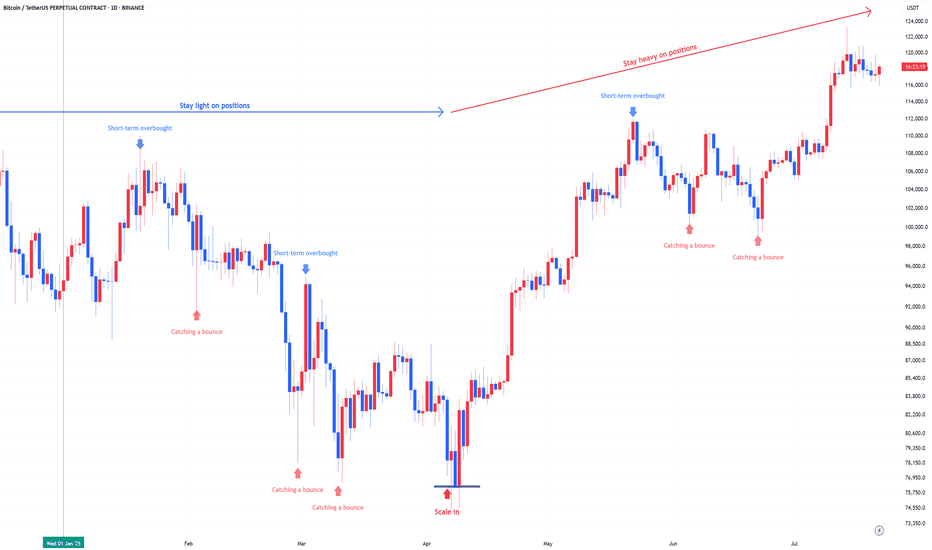

Bitcoin : Stay heavy on positionsApril was the scale-in zone:

Back in April, the US stock market flashed a split-entry buy signal—a classic zone for gradual accumulation.

That same setup applied to Bitcoin. Buying the fear worked again.

We’ve moved out of the fear zone:

Both Bitcoin and equities have left the extreme fear territory behind. Sentiment has shifted.

Short-term overbought now:

Bitcoin is currently in a short-term overbought phase. Some consolidation or cooling off is natural here, but no major trend reversal signs yet.

Stay heavy on positions:

I’m maintaining an overweight position in Bitcoin as long as the US stock market stays intact. The Nasdaq is holding up, so Bitcoin likely stays in risk-on mode.

Warning:

If US equities take a hit, expect Bitcoin to follow.

Negative moves in the stock market will likely translate directly into crypto weakness.

BTC/USDT – Breakout Watch🔹 Price rebounded strongly from key support at $116,400

🔹 Approaching breakout zone near $119,500

🔹 Descending trendline and multiple rejection wicks being tested

🔹 Bullish momentum building — RSI rising, MACD stabilizing, volume uptick visible

🔹 ADX shows trend strength picking up

📈 If breakout confirmed above $119,500:

🎯 TP1: $122,000

🎯 TP2: $127,000

🎯 TP3: $135,000

📉 Below $116,400 = invalidation

Bias: Bullish above $119,500, cautious until breakout confirms.