BTC Efforts to break the trend to create a new ATHPlan BTC today: 30 June 2025

Related Information:!!!

As of Monday, Bitcoin (BTC) is trading around $108,500, approximately 3% below its all-time high. Ethereum (ETH) has closed above a key resistance level, indicating the potential for a sustained upward movement. Meanwhile, Ripple (XRP) is approaching a critical threshold; a confirmed breakout could strengthen bullish momentum in the near term.

Bitcoin approaches record highs

The price of Bitcoin surged by 7.32% last week, closing above the $108,000 mark. As of the latest update on Monday, it remains near $108,500.

Should the current upward trend persist, BTC may extend its rally toward the all-time high of $111,980 recorded on May 22. A decisive close above this level could pave the way for further gains, potentially establishing a new all-time high at $120,000."

personal opinion:!!!

BTC buying pressure is prevented by selling pressure according to H4 trendline, accumulating and soon surpassing ATH

Important price zone to consider :!!!

support zone : 107.000 ; 104.600

Sustainable trading to beat the market

BTCUSDT.3S trade ideas

BTCUSDT Hello traders. Wishing you a great start to the week!

This week’s first trade opportunity comes from the BTCUSDT pair. Over the weekend, the pair showed significant volatility, dropping from 108,776 to 107,565 in just a few hours. However, I see this drop as a potential buying opportunity.

In my view, the price is likely to bounce back towards the 108,930.12 level in the short term. Therefore, I’ve activated the trade and I’m sharing the details with you below:

🔍 Trade Details

✔️ Timeframe: 1-Hour (H1)

✔️ Risk-to-Reward Ratio: 1:3.20

✔️ Trade Direction: Buy

✔️ Entry Price: 107,590.73

✔️ Take Profit: 108,930.12

✔️ Stop Loss: 107,181.36

🕒 If momentum weakens or price consolidates in a tight range, I will keep this trade open only until 23:00 (UTC+4). After that, I’ll manually close it—whether in profit or loss—based on how price action evolves.

🔔 Disclaimer: This is not financial advice. I’m simply sharing a trade I’ve taken based on my personal trading system, strictly for educational and illustrative purposes.

📌 Interested in a systematic, data-driven trading approach?

💡 Follow the page and turn on notifications to stay updated on future trade setups and advanced market insights.

Trading the Impulse Rally Retracement — Price and Time Symmetry The Stop Loss Triangle is back!

This time with BITSTAMP:BTCUSD coming off its recent impulse rally. For those of you that aren’t familiar with my strategy — let me start from the beginning…

This concept involves positioning against the opposing decline in price and time as a precursor to our theoretical projection. If the underlying enters our predetermined faded cross-section, the stop loss is triggered to prevent sideways consolidation and the erosion of contract premiums or leverage decay.

This inherently ‘sclene’ triangle is constructed by drawing a straight trend line through the bottoming reversal candle and the furthest projection in price and time symmetry (78.6%) of the retracement. Once connected, draw a vertically positioned straight line from the highest or lowest point in the previously identified retracement to the bottom reversal candle area once again. To create a ‘right triangle’, now turn 90 degrees towards the final point, which is determined by the nearest projection in price and time symmetry (38.2%). This allows time after the imposed price and time date, yet not enough for premium or leverage decay to become significant.

In its entirety, this forms the stop loss triangle.

I encourage my followers to identify and explore the system on their own. As always, feel free to ask me anything related to it. We’ll follow along and you’ll be amazed at the precision of Fibonacci symmetry.

CHEERS

PSYCHOLOGY OF A CRYPTO CYCLEWe expected a pullback, and now thats behind us!😅

The market is back on track, and we are firmly in the #Belief phase of the bull cycle.

With heavy short liquidity stacked around $110K, a push into that zone could trigger a short squeeze, launching us into the #Thrill phase.

And if momentum holds, all signs point to #Euphoria by late 2025.

Favorites so far this cycle:

🥑 POLONIEX:GUACUSDT 🔗 POLONIEX:LLUSDT 🎮 KUCOIN:MYRIAUSDT

🌐 HTX:SYNTUSDT 🧪 MEXC:DEAIUSDT 🏠 OKX:PRCLUSDT

🧱 MEXC:YBRUSDT ⛏️ MEXC:KLSUSDT 🧩 $RUJIUSDT

Comment below your favorite coins!

BITCOINBITCOIN wait on the close of daily candle for clear directional bias ,break and close 108k will expose 111-115 and more higher zones .break below by rejection on daily candle will call for sell and target will be around 100-94k zone .

trading is 100% probability, some people are gifted while some are not.

Bitcoin, The Next High Is The All-Time HighThe title might be a bit misleading but, the truth is that Bitcoin stays bullish short-term and this is bullish on all terms...

Good afternoon my fellow Cryptocurrency trader, how are you feeling today?

Any day, any week, any moment; every month, place or year, the market provides everything we need to know. This information is made available to us through the chart.

Bullish Bitcoin

The present signal is the fact that Bitcoin remains very high, challenging resistance, after a strong recovery and advance. This is happening with the altcoins also.

If you look at the last two peaks, as soon as resistance was hit there was an immediate crash. The next day was full red; very strong bearish action and momentum and this led to a new low. The situation is not the same today.

22-May peak. 23-May, strong bearish action.

9-June peak. 11-June, strong bearish action.

26-June lower high (not a peak). Today, neutral action. This neutral action is what I am taking as a bullish signal. Many other factors of course support this conclusion yet, this is still an early signal.

Fib support

A closer view of the daily timeframe:

4H. The grey line represents Fib. retracement. Dark blue—Fib. extension:

Conclusion

Each time there is a price peak a retrace follows, if there is no retrace then you are not witnessing a peak but rather a stop, a pause; resistance being met.

It seems that the current lower high is not the end but rather just a pause before additional growth. Market conditions can change.

It can happen that several days Bitcoin goes sideways with the bulls failing to garner enough strength. In this scenario, there would be a move lower before additional growth.

The present scenario shows a bullish chart even if prices drop, remember, the market is in no hurry.

Easy money

In September we will have lower interest rates and this is a bullish development for Bitcoin. Advanced money minds see easy money as inflationary for the currency, while Bitcoin is inflation-proof. So the dollar goes down and Bitcoin goes up.

I didn't quite develop this point, next time I'll do a better job.

Summary

The market is good even if it shakes. The market is good and isn't shaking, the recovery is already in place.

Bitcoin's price is very strong and there are many layers of support. The altcoins are in a similar situation, growing from the bottom up.

The Fed will reduce interest rates in September and then once more before the year ends, this is bullish for everything so, everything will be going up, at least everything that we are interested in, support and trade.

Thanks a lot for your continued support.

Never give up!

You are divine! You are blessed.

If you are reading this now, you will be blessed for your great timing. Hard work and dedication always pays.

Keep moving forward, keep pushing forward, never give up.

When life hits you hard, do take a break if you need it, only to comeback with new energy, a new mind and an infinite drive to achieve your goals.

You are the reason why Bitcoin exist... You are the lifeblood of the market.

Without you, nothing is possible. It is because of you that we all continue to grow.

Thanks again for taking the time to read.

I appreciate your support.

Namaste.

BTC | At the Line Between ATH Expansion or Macro FlushBINANCE:BTCUSDT Bulls need to hold the $102k–$100.8k support and 1D 50MA for a shot at new highs.

– Wick into 1D FVG ($98k) is fine, but no daily close below 50MA allowed.

– Lose $100k? Then it’s sideline season — next real support only at $93k/$87k, macro flush risk toward $75k–$58k if momentum fails.

– As long as above 1D support/MA, there’s a chance for a clean ATH breakout from the OB under the highs.

This is the zone to bet on continuation. If not, don’t fight the trend lower.

Up for BitcoinHi traders,

Last week Bitcoin made a small correction up and after that another drop just as I've said.

After it retested the Weekly FVG and broke the previous swing low it went impulsive up again.

This could be the next impulse wave to new ATH's. So wait for the correction down to finish and trade longs.

Let's see what the market does and react.

Trade idea: Wait for the correction down to finish to trade longs.

If you want to learn more about trading FVG's with wave analysis, please make sure to follow me.

This shared post is only my point of view on what could be the next move in this pair based on my analysis.

Don't be emotional, just trade your plan!

Eduwave

BTC UP OR NO📈 Bitcoin to Reach $113K, With a Breakout Path to $120K – A Professional Outlook

After analyzing the macro trend, technical structure, market sentiment, and on-chain behavior, I strongly believe that Bitcoin is on a clear trajectory toward $113,000, with a potential extension to $120,000 if key resistance is broken.

---

🔍 1. Technical Analysis Perspective

Macro Bullish Structure: Since the 2022 bear market bottom, Bitcoin has maintained a consistent higher highs and higher lows pattern, confirming a long-term uptrend.

Fibonacci Extension: The 1.618 Fibonacci extension from the $15.5K bottom to the $69K peak gives a projected target of around $113K.

Historical Fractal Patterns: In previous cycles, Bitcoin has always broken past previous all-time highs by 1.5x to 1.75x, placing this cycle's peak in the $110K–$120K range.

Ascending Triangle Breakout: On the weekly chart, BTC is forming a bullish ascending triangle with the top resistance at ~$73K. A confirmed breakout targets $113K as the next major supply zone.

---

🧠 2. Market Psychology & Cycle Timing

Halving Effect: Historically, Bitcoin peaks occur 9–12 months post-halving. The most recent halving was in April 2024, aligning a potential peak by Q1 or Q2 of 2025.

Psychological Resistance Zones: The $100K–$113K range is not only a Fibonacci target but also a powerful psychological barrier. Once breached, FOMO and institutional momentum could push BTC rapidly to $120K.

Retail vs Institutional Flows: Data shows increased ETF inflows and long-term holder accumulation — a classic pre-peak indicator.

---

🔗 3. On-Chain and Whale Behavior

Realized Price vs Market Price: BTC market price is well above long-term holder realized price, signaling bull market phase 2 (the steep climb).

Dormant Supply: Over 70% of BTC has not moved in 6+ months, showing strong holder conviction. This reduces sell pressure as price increases.

Whale Accumulation Zones: Whales are heavily positioned around $60K–$65K, and there is minimal sell volume above $100K on major exchanges, opening the path to $113K with low resistance.

---

🚀 Conclusion:

> Based on comprehensive technical patterns, market structure, psychological phases, and on-chain behavior, Bitcoin is highly likely to reach $113,000.

If momentum continues and $113K is breached with volume confirmation, a sharp move toward $120,000 becomes not only possible — but likely.

Bitcoin Long Now ! Details chart ! 89% Accuracy VIP Signal !🟢 BTCUSDT Long Setup | 15min (BINANCE)

Entry: ~108840 zone

Stop Loss: Below 108192.82

Take Profits:

TP1: 109488.98

TP2: 110149.67

TP3: 110855.75

Reasoning:

Liquidity grab below support.

Bullish rejection and structure shift.

Potential W pattern forming.

Clean RR and price action setup.

Trade Plan:

Expecting price to break above 109488.98, retest it, and then push toward 110855.75.

📊 Classic support rejection + market structure shift play.

🔔 Not financial advice. Manage your risk!

#BTC #BTCUSDT #Crypto #TradingView #PriceAction #LongSetup #Binance #TA

BITCOIN - Price can continue grow inside flat to $107933 level#BTC

The price is moving within a descending channel on the 1-hour frame and is expected to break and continue upward.

We have a trend to stabilize above the 100 moving average once again.

We have a downtrend on the RSI indicator that supports the upward move with a breakout.

We have a support area at the lower boundary of the channel at 106500, acting as strong support from which the price can rebound.

We have a major support area in green that pushed the price upward at 106000.

Entry price: 106736

First target: 106996

Second target: 107434

Third target: 107933

To manage risk, don't forget stop loss and capital management.

When you reach the first target, save some profits and then change your stop order to an entry order.

For inquiries, please comment.

Thank you.

Let’s break down what the chart shows for BTCUSDT on the daily Chart key points

Price: Currently around $108,129

Key levels:

There are EQH (equal highs) around $111,500–$112,000 acting as liquidity.

There’s a smaller Daily FVG (Fair Value Gap) between ~$105,500–$107,000.

A larger Daily FVG lower around ~$99,000–$103,000.

Weekly Fibs mark retracement levels below.

Two projected paths: One a break above the EQH liquidity; the other shows a deeper pullback before that.

📈 Scenario 1: Bullish continuation + liquidity sweep

Idea:

BTC pushes up to sweep the EQH liquidity near $111,500–$112,000.

Breaks above, hits stops, and either:

Continues higher to the next resistance zone near $115,000–$118,000.

OR fakes out, sweeps liquidity, and retraces to the Daily FVG.

What to watch:

If price closes strongly above EQH with volume, look for continuation buys.

Confirmation: Break/retest of $111,500 as support.

📉 Scenario 2: Deeper pullback before continuation

Idea:

Price fails to break the EQH cleanly.

Pulls back into the small Daily FVG or deeper into the larger Daily FVG.

Reaccumulates around the $99,000–$104,000 zone.

From there, look for a bullish reaction for a safer long.

What to watch:

Weakness at EQH: Wicks or rejection candles.

Entry triggers: Strong bullish PA in the Daily FVG zones + confirmation.

✅ Key takeaways

Liquidity above EQH means there’s incentive for smart money to run stops.

FVGs are your high-probability reaction zones.

wait for price to trade into imbalance with signs of bullish order flow.

BTC Is Replaying a Bullish Fractal >>> Are You Watching?Hello guys!

I see a deja vu here! Let’s look at the historical daily chart (Jan–May 2025):

What happened?

Initial Drop (Yellow Oval): Bitcoin approached a key S&D zone but didn't touch it, triggering a short-lived bounce before dropping again.

Second Drop (Red Ovals): This time, price precisely touched the demand zone, triggering a clean bullish reversal.

What followed was a strong trend breakout, sustained higher lows, and an eventual surge past prior resistance levels.

Current 4H Chart Setup: A Mirror Image?

Yellow Highlight: Once again, we saw a bounce that didn't quite touch the key demand zone ($98K–$100K).

Red Zone Prediction: If this mirrors the historical move, the price is likely to return and touch this S&D area before launching a bullish leg.

Blue Path Projection: A sharp reversal is expected post-touch, aiming toward $111K–$113K as the next key resistance zone.

The descending trendline adds confluence

___________________

History Doesn’t Repeat, But It Often Rhymes

Based on this fractal analysis, Bitcoin is likely forming the same bullish base seen earlier in 2025. The setup hinges on one key event: a return to the $99K–$100K zone, where demand is likely to step in aggressively.

If the pattern repeats, the current market may offer one last high-reward long opportunity before a parabolic rally.

Bitcoin Pressing Up But This Compression Could Crack LowerBitcoin has been steadily climbing for months, respecting that long-term trendline since last year. Each dip into it brought a strong bounce, showing bulls are still in control of the bigger picture.

But right now price is pressing into a tight descending resistance line. We can see it making lower highs while struggling to break above that red trendline. At the same time, it’s sitting just above a key horizontal range, where buyers stepped in before.

This compression is risky . If BTC fails to push above the descending resistance and breaks back below the box, it could drop toward the next demand zone around the low 100K region .

As long as the major trendline from last year holds, the broader uptrend is intact . But losing this structure would open the door for a deeper correction.

This is the kind of spot where patience pays. Let the breakout or breakdown show its hand before jumping in heavy.

BTC TRrade Plan 08/06/2025Dear Traders,

📊 BTC/USDT 4H Analysis – June 8, 2025

Bitcoin is currently testing the upper boundary of a descending wedge pattern. We are monitoring two main bullish scenarios:

🔹 ALT 1: If the price breaks above the wedge resistance and holds, a continuation towards the $115,000–$120,000 zone is likely. This would confirm the breakout and a potential new bullish leg.

🔹 ALT 2: In case of a rejection from the current resistance, we expect a retracement toward the demand zone around $100,000–$101,600. If price action remains bullish in this zone, this could be a strong re-entry point for long positions.

🟥 Invalidation: A confirmed breakdown and consolidation below $100,000 would invalidate the bullish outlook and open the door to deeper corrections.

⚠️ Wait for confirmation and observe price action in key zones before entering any trades.

if you enjoyed this forecast, please show your support with a like and comment. Your feedback is what drives me to keep creating valuable content."

Regards,

Alireza!

BTC - Continuation of Bull Trap 21.06.2025Hello Friday! Never, ever, ever trade crypto on weekend, but let's hop in!

🔻 What I expect more? Continuation of Bull Trap! (Probability 70/30)

Few Reasons:

Price broke 20 EMA(daily) and is sliding just above the 50 EMA with "dead-cat" bounce attempts.

RSI is going down below 50 — momeentuum is faaadiing.

No signs of some big demand at this level (low volume on small green candles + Iran uncertainty).

Notable, that we are far from any bounce move (which would support re-accumulation).

Scenario 1: Bearish Continuation (Most likely)

Expecting BTC to test the 99.5k zone — this is the key support level becasue of several arguments:

1) 0.886 Fib

2) Confluence with previous horizontal range support

3) 100 EMA

4) Under psychological level 100k

5) RSI needs to cool off before taking higher targets.

If 99.5k broken, next stop is near 88.5k (0.786 Fib)

I wouldn't like to analyse further possible downslide of BTC, so lets stay so far in already negative scenario within 88.5k, but let's keep in mind, that maximum pain we will see near 75k zone.

🟡 Alternative: Short-term Bounce (Probability 30/70)

BTC could attempt bounce towards 105–106.5k (retest of broken structure + 20 EMA resistance)

If this bounce has low volume and rejection near EMAs or RSI stays below 50 , it's a sell opportunity — not a bullish reversal.

✅ Final thoughts for short term: stay away from the market.

From 103.5k I would expect downward continuation toward 99.5k with possible minor bounce attempts along the way.

Wait for strong reversal signal near 100k and enter LONG with tight SL.

Don't trade during the weekend, unless there's a once in a lifetime opportunity.

Have fun!

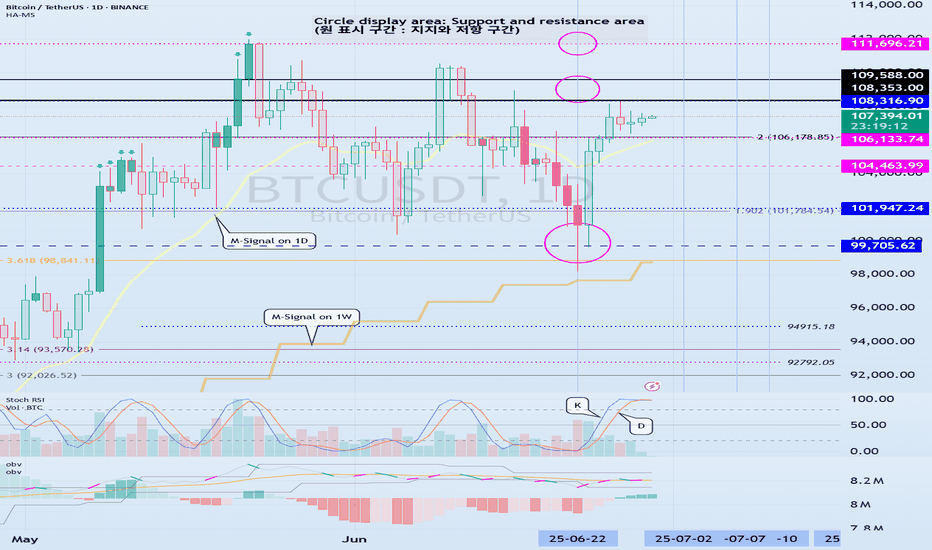

StochRSI indicator and support and resistance levels

Hello, traders.

If you "follow" me, you can always get the latest information quickly.

Have a nice day today.

-------------------------------------

The StochRSI indicator on the left chart is slightly different from the StochRSI indicator on the right.

The StochRSI indicator on the left chart is the StochRSI indicator provided by default in TradingView, and the StochRSI indicator on the right chart is an indicator with a modified formula.

The StochRSI indicator is a leading indicator that is reflected almost in real time.

Therefore, it reacts sensitively to price changes.

Although it is advantageous because it reacts sensitively, it also increases the possibility of being caught in a fake, so I thought that a slight delay(?) was necessary, and so I created the StochRSI indicator on the left chart.

If you look at the relationship between the K and D of the StochRSI indicators on the two charts, you can see that there is a big difference.

In the end, you can predict the movement by checking whether the movement of the K line has escaped the overbought or oversold section.

However, I think that you will receive information that can determine the sustainability of the trend depending on the positional relationship between K and D.

Therefore, it is important to distinguish the inflection points that occur in the StochRSI indicator.

This is because these inflection points provide important information for drawing trend lines.

Therefore, the StochRSI indicator on the left chart, which better expresses the inflection point, is being used to draw the trend line.

(Unfortunately, this indicator was not registered on TradingView because I did not explain it well.)

-

As a new candle was created, the StochRSI indicator on the left chart is showing an inflection point on the K line.

The StochRSI indicator on the right chart is showing a transition to a state where K < D.

We will have to check whether the inflection point was created only when today's candle closes, but I think that the fact that it is showing this pattern means that there is a high possibility of a change in the future trend.

Since the next volatility period is expected to start around July 2nd (July 1st-3rd), I think it has started to show meaningful movements.

-

It is true that you want to buy at the lowest price possible and sell at the highest price.

However, because of this greed, one mistake can lead to a loss that can overturn nine victories, so you should always be careful.

Therefore, if possible, it is better to check for support and respond.

In that sense, I think it is worth referring to the relationship between K and D of the StochRSI indicator on the left chart.

This is because the actual downtrend is likely to start when K < D.

-

In order to check for support, you definitely need support and resistance points drawn on the 1M, 1W, and 1D charts.

Ignoring this and checking for support at the drawn support and resistance points can result in not being able to apply the chart you drew to actual trading.

Therefore, you should draw support and resistance points first before starting a trade.

Otherwise, if you draw support and resistance points after starting a trade, you are more likely to set support and resistance points that reflect your subjective thoughts, so as I mentioned earlier, you are more likely to lose faith in the chart you drew.

If this phenomenon continues, it will eventually lead to leaving the investment market.

-

It is important to determine whether there is support by checking the correlation between the StochRSI indicator and other indicators at the support and resistance points drawn on the 1M, 1W, and 1D charts.

Even if the inflection point of the StochRSI indicator or other indicators occurs at a point other than the support and resistance points you drew, you should consider it as something that occurred beyond your ability to handle.

In other words, you should observe the price movement but not actually trade.

As I mentioned earlier, if you start to violate this, you will become less and less able to trust the chart you drew.

-

Accordingly, the basic trading strategy I suggest is to buy near the HA-Low indicator and sell near the HA-High indicator.

However, since the HA-Low and HA-High indicators are expressed as average values, they may move in the opposite direction to the basic trading strategy.

In other words, if the HA-Low indicator is resisted and falls, there is a possibility of a stepwise downward trend, and if the HA-High indicator is supported and rises, there is a possibility of a stepwise upward trend.

Therefore, the basic trading strategy mentioned above can be considered a trading strategy in the box section.

In the case of deviating from this box section, it is highly likely to occur before and after the volatility period indicated by the relationship between the trend line using the StochRSI indicator mentioned above and the support and resistance points drawn on the 1M, 1W, and 1D charts.

Therefore, special care is required when conducting new transactions during the volatility period.

This is because there is a high possibility of being caught in a fake when trading during the volatility period.

-

The DOM(60) and DOM(-60) indicators are good indicators to look at together with the HA-Low and HA-High indicators.

The DOM indicator is an indicator that comprehensively evaluates the DMI, OBV, and MOMENTUM indicators.

Therefore, the DOM(60) indicator is likely to be at the end of the high point range, and the DOM(060) indicator is likely to be at the end of the low point range.

In the explanation of the HA-Low and HA-High indicators,

- I said that if the HA-Low indicator receives resistance and falls, there is a possibility that a stepwise downtrend will begin,

- and if the HA-High indicator receives support and rises, there is a possibility that a stepwise uptrend will begin.

In order for an actual stepwise downtrend to begin, the price must fall below DOM(-60), and in order for a stepwise uptrend to begin, it must rise above DOM(60).

In other words, the DOM(-60) ~ HA-Low section and the HA-High ~ DOM(60) section can be seen as support and resistance sections.

-

If these correlations start to appear, I think you will be able to create a trading strategy that fits your investment style without being swayed by price volatility and proceed with trading.

The reason for analyzing charts is to trade.

Therefore, the shorter the time for chart analysis, the better, and you should increase the start of creating a trading strategy.

-

Thank you for reading to the end.

I hope you have a successful trade.

--------------------------------------------------

NEXT LEVELSnext move ahead for Bitcoin

Bitcoin Could Reach $140,000 in the Coming Months

Market analysts and crypto enthusiasts are increasingly confident that Bitcoin is on track to reach new highs. After strong institutional adoption, growing interest from retail investors, and the impact of recent halving events, many experts believe Bitcoin could surge to $140,000 in the coming months.

Macroeconomic factors like inflation concerns, limited BTC supply, and a weakening dollar are all contributing to the bullish momentum. If current trends continue, a breakout toward the $140K level is not just possible—it’s becoming more likely.

Stay informed, stay strategic, and get ready for what could be a historic move in the world of crypto.