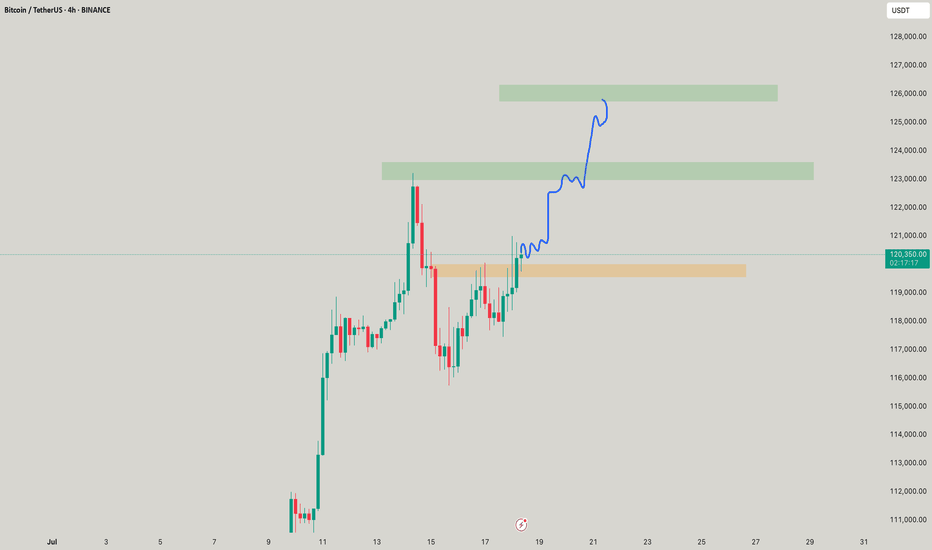

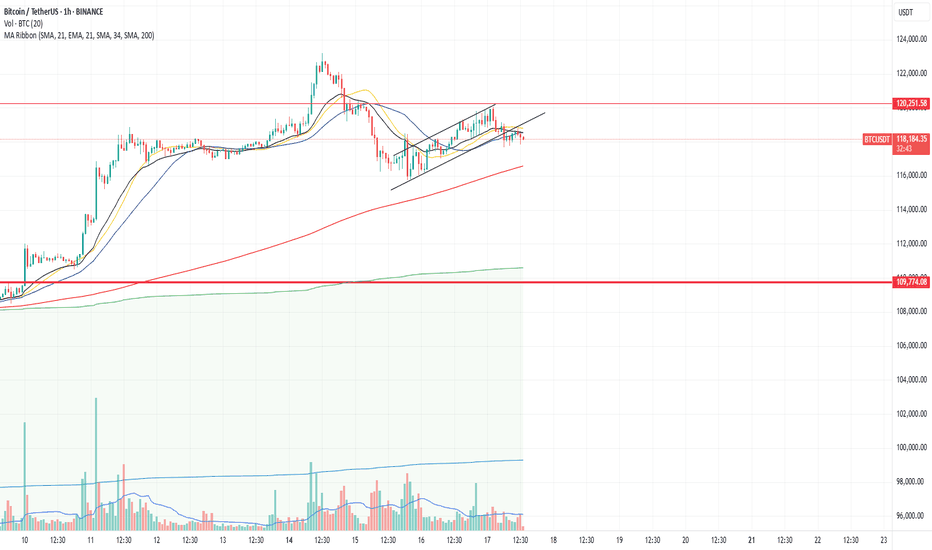

BTC 4 HR TIME FRAME ANALYSIS 4H Technical Analysis – BTCUSDT.P (Bitcoin Perpetual on Bitget)

✅ 1. Trend Overview:

Current Market Phase: Strong uptrend.

Price has broken multiple H4 BOS (Break of Structure) levels with strong bullish momentum.

The last impulse candle shows a vertical breakout, often a sign of aggressive buyers or FOMO.

🔄 2. Key Structure Zones:

🔵 Demand Zones (Highlighted in Green):

Around 113,700–114,000 → fresh demand zone after last breakout.

Around 108,000–110,000 → mid-level zone from earlier accumulation.

Deeper zone at ~96,000–98,000 → higher timeframe demand (may hold if larger correction happens).

🔴 Supply Zones (No immediate supply shown, but...)

Watch for reaction zones around 118,000–120,000 as psychological resistance.

📍 3. Price Action & Structure:

The current move is parabolic, indicating momentum exhaustion may soon follow.

However, the last CHoCH and BOS signals are clearly bullish, and pullbacks are being aggressively bought.

Short-Term Expectation:

A correction or sideways consolidation may happen near 118,000–119,000.

Best scenario: price pulls back into the 113,700 zone, forming a bullish continuation setup.

🔍 4. Candlestick Patterns:

At the top, the last 2 candles are showing wicks, indicating possible early rejection or take-profit activity.

No confirmed reversal pattern yet (e.g., no bearish engulfing, pin bar, or evening star).

Wait for confirmation if considering a reversal trade.

📉 5. Risk Zones:

If price breaks below 113,700, then correction may deepen toward 110,000 or even 108,000.

Below 108,000 would invalidate the current short-term bullish structure and signal trend weakening.

📌 6. Key Levels to Watch:

Type Price Zone Notes

Resistance 118,500–120,000 Current high zone, psychological barrier

Demand Zone 1 113,700–114,000 Nearest fresh demand

Demand Zone 2 108,000–110,000 Mid support

HTF Demand ~96,000–98,000 Deep liquidity + structural demand

✅ Conclusion:

Market is in a strong bullish trend on the 4H chart.

Wait for a healthy pullback to demand zones before considering new longs.

Watch for bearish candlestick confirmation (like engulfing or M-structure) near highs for possible short-term reversals.

⚠️ Disclaimer:

This is not financial advice or a trading signal.

It's purely educational analysis.

Always trade based on your personal strategy and risk management. BITGET:BTCUSDT.P

BTCUSDT.3S trade ideas

BTC TRADE PLAN 11/07/2025 - Diamond PatternDear traders,

Technical Analysis of BTCUSDT (Bitcoin/USDT) – July 11, 2025

🕐 Timeframe: 4H

Price has broken above the major resistance at $110,000 and is now trading around $118,000, forming a Diamond Top pattern — a classic reversal formation that may signal an upcoming downtrend or correction.

🔻 Key Highlights:

Major Resistance: $118,000 – current top and potential reversal point.

Key Support: $110,000 – if broken, next targets may lie around $95,000–$100,000.

Diamond Pattern: Typically a bearish reversal signal after a strong uptrend.

RSI Indicator: Currently in overbought territory (above 85), suggesting buyer exhaustion.

📉 Possible Scenario:

Price may reverse from $118,000 -120,000 and test the $110,000 support. A break below that could lead to a deeper correction in the coming weeks.

Regards,

Alireza!

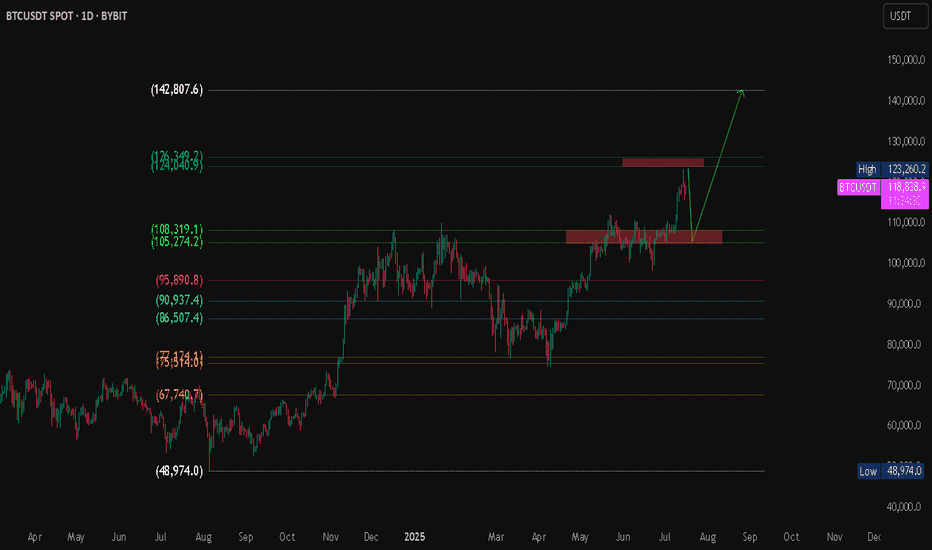

BTC/USDT Technical Analysis Market Overview

Bitcoin is currently trading at $118,788, with an intraday high of $119,311. The market has recently tested a major resistance zone and is showing signs of a potential pullback toward a key demand zone before a possible continuation to higher levels.

Projected Scenario (Bullish Bias)

Expected pullback to the support zone around $105K – $108K.

If price holds and shows a bullish reversal, a breakout above $124K is expected.

Primary upside target: $142,807 (Fibonacci projection / potential new high).

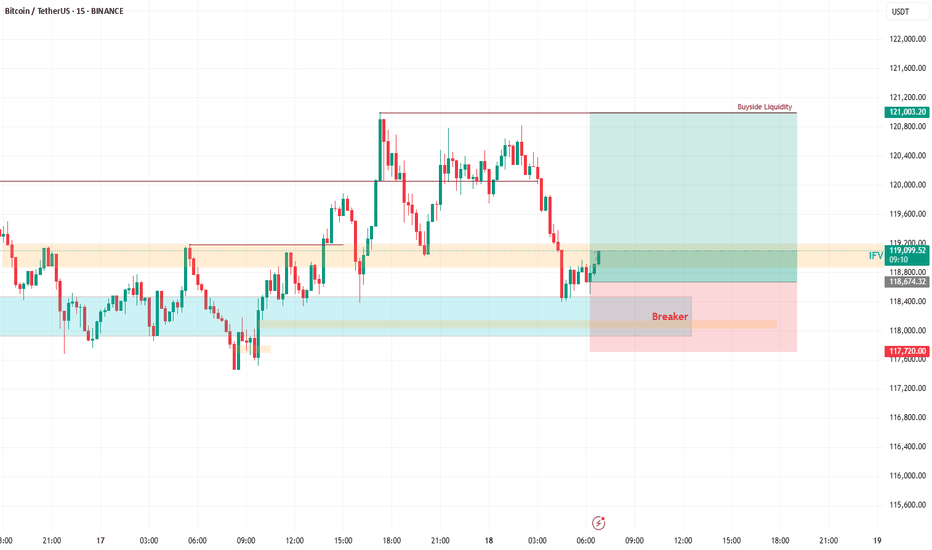

The Setup: Bullish Breaker in Play!Yesterday, BTC smashed into a strong bullish breaker and bounced like a champ. Today, it’s retracing back to this key level, setting up for what I expect to be another explosive buy reaction. Why? Because this breaker is rock-solid, and the price action is giving us all the right signals! Plus, it’s Friday—the last trading day of the week—and I’m betting BTC will stretch its legs to cover the weekly range. 🏃♂️

🎯 Trade Details: Where to Jump In

Buy Area: Right now, the price is teasing the breaker zone.

Stop Loss: Protect your capital with a stop loss at around ~117,700.

Target: We’re aiming for the Buyside Liquidity sitting pretty around 121,000. That’s a juicy move with solid risk-reward potential! 💪

🧠 Why This Trade Makes Sense

Bullish Breaker Strength: This level has proven itself as a springboard for price action.

Weekly Range Play: Fridays often see BTC push to cover its weekly range, and we’re in prime position to catch it.

Liquidity Grab: The Buyside Liquidity at 121,000 is like a magnet for price—let’s ride it there!

⚠️ Risk Management Reminder

Always trade smart! Use proper position sizing, stick to your risk management rules, and don’t go all-in like it’s a casino. Keep those stops tight to avoid getting wrecked by any sudden volatility. 😎

💬 Join the Conversation!

What do you think of this setup? Are you jumping on this BTC train or waiting for more confirmation? Drop your thoughts in the comments below! 👇 Also, if you like this idea, smash that LIKE button ❤️ and follow for more trade ideas to keep your portfolio poppin’! 🚀

Happy trading, and let’s stack those pips! 💰

#BTC #CryptoTrading #BuyTrade #Bullish #TradingView

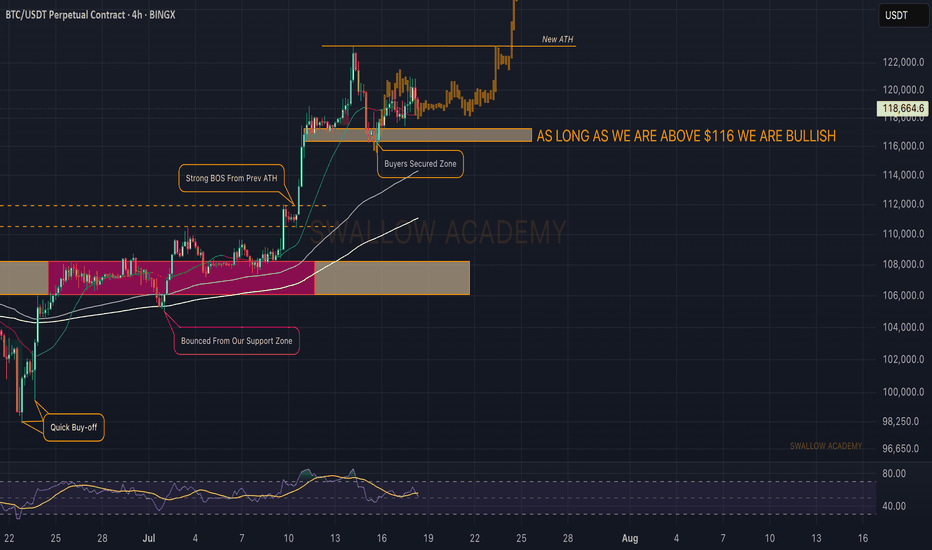

Bitcoin (BTC): Small Correction Happening | Attentions at $116KBitcoin still looks bullish, with no major signs of potential sell-side movement to happen. The least we look for here is the retest of the current ATH, which is the $123K zone, and we will keep this game plan as long as the price stays above $116K.

If we see any signs of a breakdown happening, we might be heading for a bigger correction towards $108K (only if we see a break of $116K).

Swallow Academy

BTC Short Call!hort Call on BTC (Short-Term)

Entry: Sell 1 BTC Call @ $120,000 strike, August expiry (~4 weeks)

Premium Collected: ~$1.5K–$2K (~0.013 BTC)

Thesis: BTC is facing resistance in the $118.9K–$120K zone. While overall trend is bullish, short-term momentum may stall at new highs. A short call captures time decay, profiting if BTC consolidates or retraces.

Risks: Unlimited if BTC rallies strongly above $120K. Consider hedging with a long call at $125K strike.

Target: Keep the entire premium if BTC <= $120K at expiry.

BTC Analysis — Long-Term Buy Zone AheadI'm watching $111,000 as a major buy zone on Bitcoin.

If price retraces to that level, I’ll be ready to enter a long position.

This is not a prediction — it’s a scenario.

Smart traders don’t guess, they prepare.

Let price come to your level. No chasing.

📍Set your alerts and stay patient.

Analysis of the Latest Bitcoin Market。On July 14, Bitcoin's price surged sharply, with the highest level reaching $123,100. This breakthrough ended its eight-month-long consolidation phase within the $90,000 - $110,000 range.

The U.S. House of Representatives designated the week of July 14 as "Crypto Week" and plans to deliberate on a number of key bills. Among them, the Guiding and Establishing America's Stablecoin National Innovation Act aims to formulate federal regulations for stablecoins and is regarded as a "landmark legislation" in the cryptocurrency sector. The market expects the cryptocurrency industry to usher in policy dividends.

Market analysts are relatively optimistic about Bitcoin's prospects. The $125,000 level is seen as the next key psychological threshold, and a breakthrough above it would open up greater upside potential. Standard Chartered Bank predicts that Bitcoin will challenge $200,000 by the end of the year. Although the Relative Strength Index (RSI) is at a high level, there is no obvious overbought signal. The moving average system is clearly aligned, and the support level has moved up to $112,000. The market consensus holds that "any pullback represents a buying opportunity."

you are currently struggling with losses,or are unsure which of the numerous trading strategies to follow,You have the option to join our VIP program. I will assist you and provide you with accurate trading signals, enabling you to navigate the financial markets with greater confidence and potentially achieve optimal trading results.

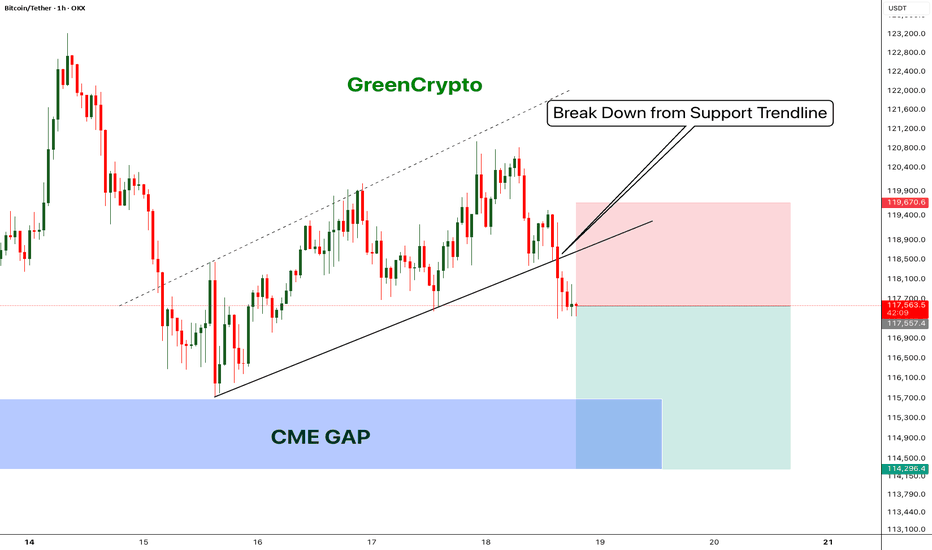

Bitcoin - Bears will push the price fill CME Gap- Bitcoin has broken down from the trending support,

- Price has been going down without any retracement on 1H candle.

- Looks like bitcoin will CME gap before going up further.

- A high risk Short Trade opportunity is here

Entry: 117,431

Stop Loss: 119,670

TP1: 116152.8

TP2: 114403.6

Move SL to Breakeven on TP1 hit

Don't forget to like and follow

Cheers

GreenCrypto

BTC Era, continue to create new ATH💎 BTC WEEKLY PLAN UPDATE (14 July )

NOTABLE NEWS ABOUT BTC

Bitcoin (BTC) broke above a key milestone on Friday, setting a new all-time high of $119,999 with no signs of slowing down. The technical outlook supports further gains as momentum indicators remain strong and price action is solidly in price discovery mode, with the next potential target at $135.000

Bitcoin’s Next Stop: $135.000

Bitcoin entered price discovery on July 9, and since then, the king of cryptocurrencies has surged toward the $120,000 target—a key psychological level for traders. Early Monday during the Asian session, BTC climbed to a peak of $119,999, marking a new all-time high and the closest the asset has come to this milestone.

TECHNICAL ANALYSIS PERSPECTIVE

Two key momentum indicators on the daily timeframe signal underlying bullish momentum in Bitcoin, suggesting a potential for further upside. The Relative Strength Index (RSI) reads 76, and the Moving Average Convergence Divergence (MACD) is flashing green histogram bars above the neutral line.

However, if BTC undergoes a correction, it may extend its pullback to find support near the lower boundary of the Fair Value Gap (FVG) around $115,222.

Derivatives market data shows that $76 million was liquidated over the past 24 hours as BTC surged toward its new high. The long/short ratio, which is considered an indicator of bullish or bearish trader sentiment, is above 1—indicating that more derivative traders are optimistic about Bitcoin and are expecting further gains in the king of cryptocurrencies.

Stay tuned to the channel for updates.

BTC & USDT.D => Bullish Correction Incoming?Hello TradingView Family / Fellow Traders. This is Richard, also known as theSignalyst.

Both BTC and USDT.D are sitting around key rejection zones.

💰 BTC is hovering near the $100,000 level — a major previous low and a psychological round number.

📊 Meanwhile, USDT.D is testing the 5% resistance — a supply zone and another critical round number.

As long as $100,000 holds as support on BTC and 5.1% holds as resistance on USDT.D, we could expect a bullish correction across the crypto market.

What do you think? Will these levels hold or break? 🤔

📚 Always follow your trading plan regarding entry, risk management, and trade management.

Good luck!

All Strategies Are Good; If Managed Properly!

~Rich

BTCUSDT: A Period of Adjustment and the Next TrendAfter a strong rally to record highs, BTCUSDT is currently entering a period of slight correction. The coin is now trading around 118,500 USD, down more than 0.57% on the day.

From a technical perspective, BTCUSD is moving within a narrowing price wedge, showing a slight downtrend. The support level at 116,500 USD is acting as a springboard for the Bulls. However, as the price approaches the tip of the wedge, a breakout may occur at any time, with two possible scenarios highlighted on the chart.

My personal outlook is that BTCUSDT will continue to decline in the short term before breaking out of the wedge in an upward direction. What do you think about BTCUSDT?

Please share your thoughts in the comments and don’t forget to like this post!

Wishing you all happy and successful trading!

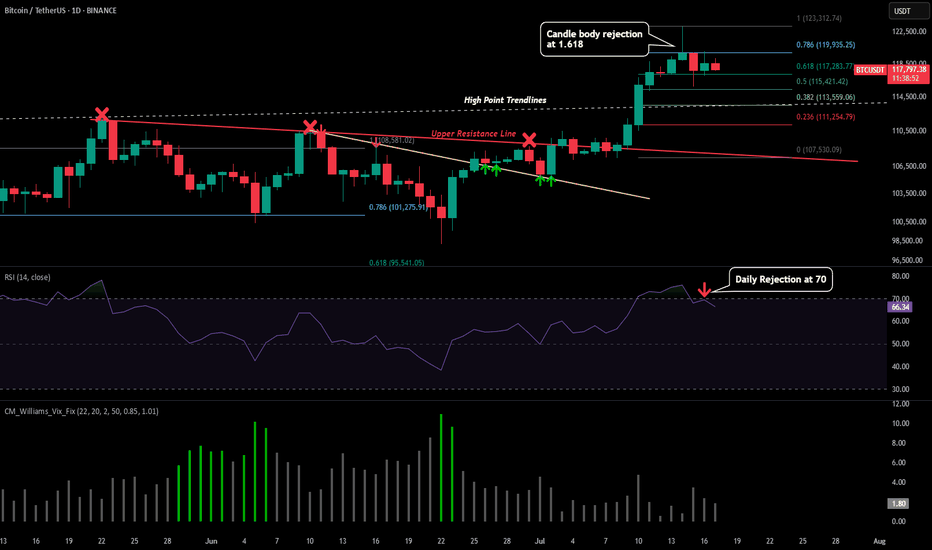

BTC - Signals of Cooloff IncomingPlease refer to our previous post:

To give additional detailed context of what to look for please look at our last post that is linked above. So far with recent price developments this idea is still intact.

What I have also outlined in todays post are some of the reason this short term retracement is still in place.

-Market has moved up very fast

-Lots of leverage from the highs need to be flushed

-Daily candle close below our first 1.618 extension target

-Daily RSI just got rejected from the 70

If we do see a retracement then all those price levels mentioned in our last post are valid. I have also add a predictive fib model that could outline important future price levels on the LTF.

Given this model does not have much price data to go off of the accuracy cannot be for certain but pay attention the the 0.382 around $113.6k and the predicted bottom around $107.5k if price drops that low.

The way price could avoid a LTF retracement is by the daily RSI reclaiming strength above the 70 level and negating the rejection. Will make an updated post if this is to occur.

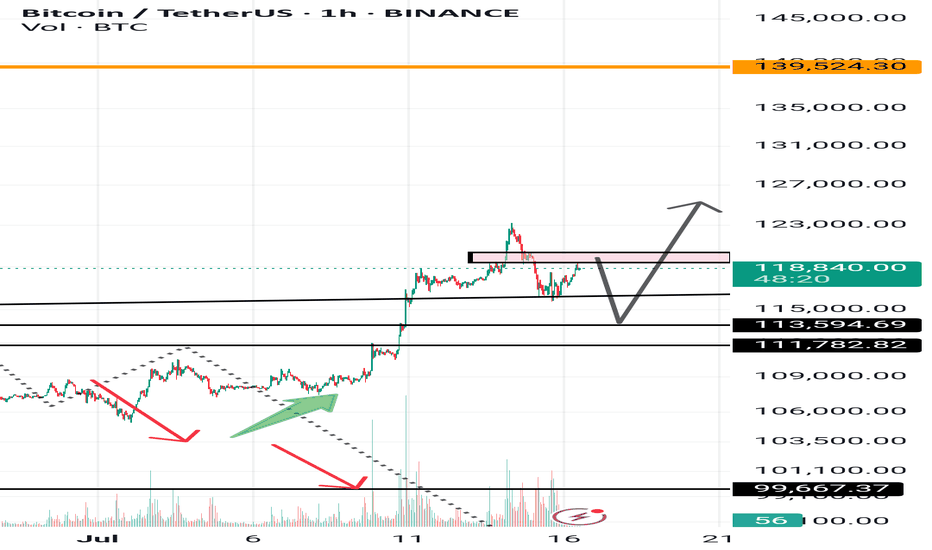

Analysis no 74 1hWelcome to king btc 3 Bitcoin is expected to decline from the range of 119,000 to 120,000 slowly to 113,500 and then rise to 125,000 in the cycle. The larger range is expected to be in the range of 115,500 to 125,000 which could be an opportunity for altcoins to rise. This is just a possibility.

BTC HTF Distribution V3This is my new outlook for BTC if this 250 day old range is intended to be a HTF Distribution Model 1, which has neither been confirmed nor invalidated. A weekly close above 123.350$ will invalidate this model and likely lead to higher prices. Yesterday we had a perfect rejection from the deviation limit, which now probably creates a new range, that then will either reaccumulate or distribute.

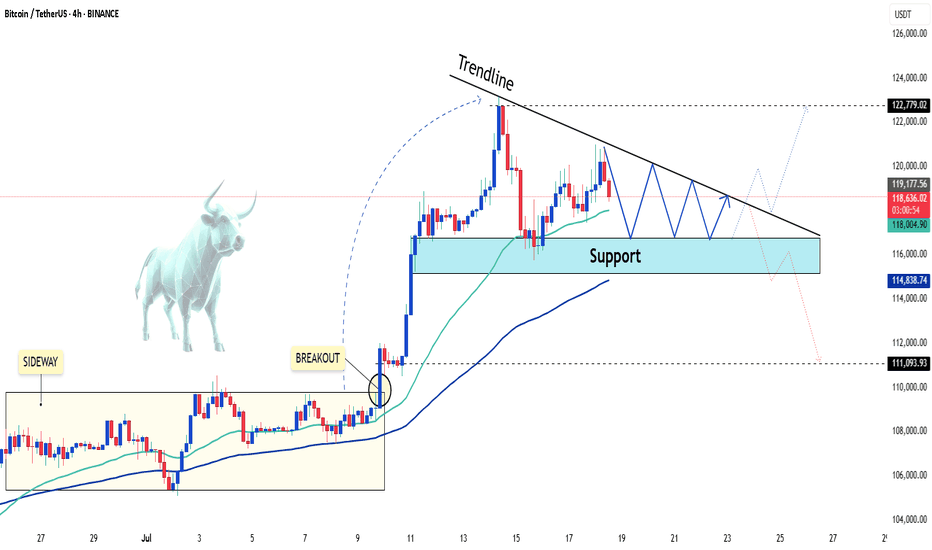

BTC - Falling Correction = Continuation?BTC has been playing by the rules lately!

Every time Bitcoin forms a falling correction, it turns out to be a bullish continuation pattern — and history might be repeating itself 👀

As shown on the chart:

Previous falling channels (flag/wedge structures) have consistently led to strong bullish impulses.

The current correction also appears to be a falling channel, hinting at another potential bullish leg soon.

As long as the structure holds and no major support is broken, the next target could be a new all-time high.

Let’s see if BTC continues to respect this textbook behavior.

📌 Remember: Falling corrections in an uptrend = healthy continuation!

📚 Always follow your trading plan regarding entry, risk management, and trade management.

Good luck!

All Strategies Are Good; If Managed Properly!

~Rich

BITCOIN PULLBACK 110.000🔹 The uptrend remains intact

After setting a new high, the price may enter a mild correction toward the $110K zone.

Key support levels in this uptrend are:

✅ $115K

✅ $110K

✅ $105K

As long as the price holds above $105K, any pullback is considered healthy and the uptrend is likely to continue.

📊 A shallow correction is part of a healthy market structure.