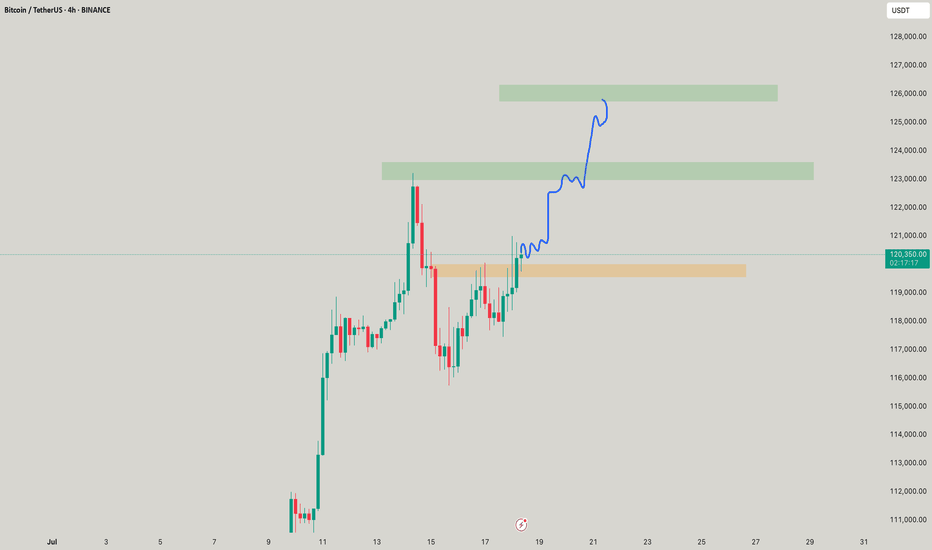

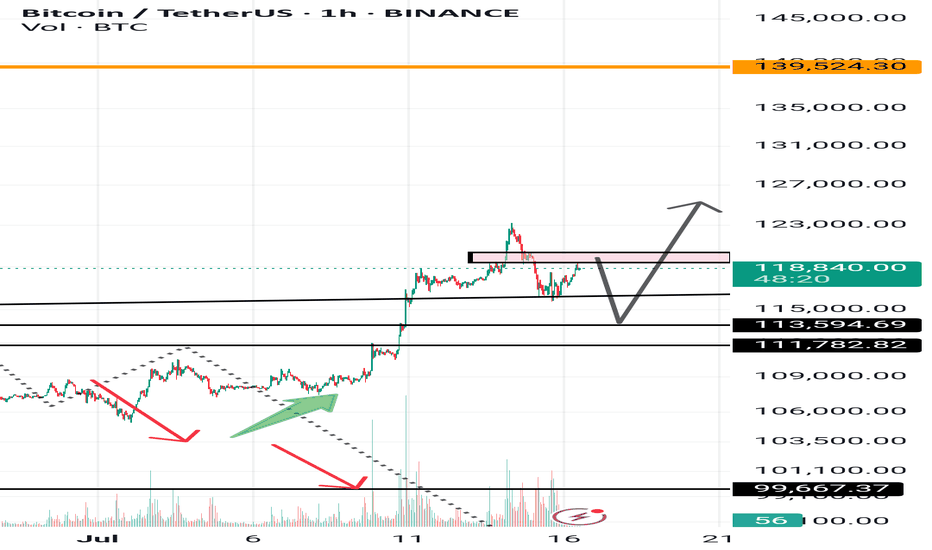

$BTC FLY TOWARDS 141K$ NEXT?CRYPTOCAP:BTC Bull Flag Target Hit – Eyes on 129K & 134.5K Next! 🔥

Bitcoin has overachieved its bull flag target and is now setting up a textbook Break & Retest of the previous All Time High (~$123K).

📌 Key Levels to Watch:

🔄 Retest Zone: $111K–$113K (previous ATH)

🎯 Next Targets:

$129K (0.12 Fib Extension)

$134.5K (Golden Extension Zone)

📉 Invalidation: Below $104K

Volume remains solid, and structure is bullish — expect a healthy dip & bounce before continuation.

This retest could be the final springboard toward $141K.

BTCUSDT.P trade ideas

Macro view of BTC - why is nobody talking about this?Looking at the weekly BTC chart, there’s a clear long-term resistance that dates back to 2017 and still hasn’t been broken convincingly. There’s plenty of talk this cycle about Bitcoin hitting 150k, just like there was hype around 100k in 2021.

In 2021, BTC formed a significant resistance, which was retested and confirmed in late 2024 and early 2025. Now the common line is: “This time is different. We have institutional money.” That’s true to an extent, but market psychology doesn’t change. Profit is profit. And when sentiment turns, even institutional and ETF-driven retail investors will take it.

BTC is still considered a speculative asset, and for good reason. It doesn’t generate income or yield — it’s only worth what someone else will pay for it.

Right now, BTC appears to be forming a bull flag, but if it can’t push past the 116k to 120k range with strength, I’ll be looking to short it on the way down.

If we get a strong breakout and hold above 120k, then, and only then, do I see a path toward a 150k top.

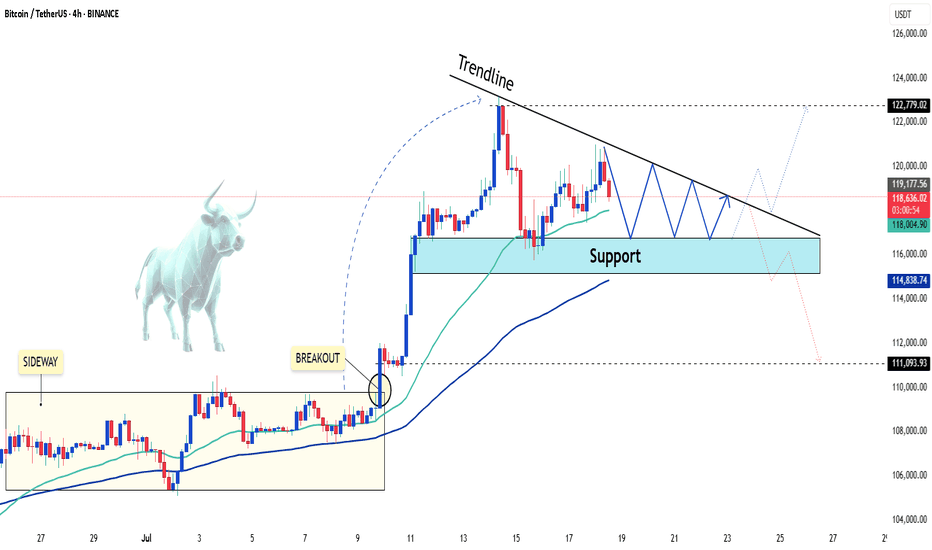

BTC TRADE PLAN 11/07/2025 - Diamond PatternDear traders,

Technical Analysis of BTCUSDT (Bitcoin/USDT) – July 11, 2025

🕐 Timeframe: 4H

Price has broken above the major resistance at $110,000 and is now trading around $118,000, forming a Diamond Top pattern — a classic reversal formation that may signal an upcoming downtrend or correction.

🔻 Key Highlights:

Major Resistance: $118,000 – current top and potential reversal point.

Key Support: $110,000 – if broken, next targets may lie around $95,000–$100,000.

Diamond Pattern: Typically a bearish reversal signal after a strong uptrend.

RSI Indicator: Currently in overbought territory (above 85), suggesting buyer exhaustion.

📉 Possible Scenario:

Price may reverse from $118,000 -120,000 and test the $110,000 support. A break below that could lead to a deeper correction in the coming weeks.

Regards,

Alireza!

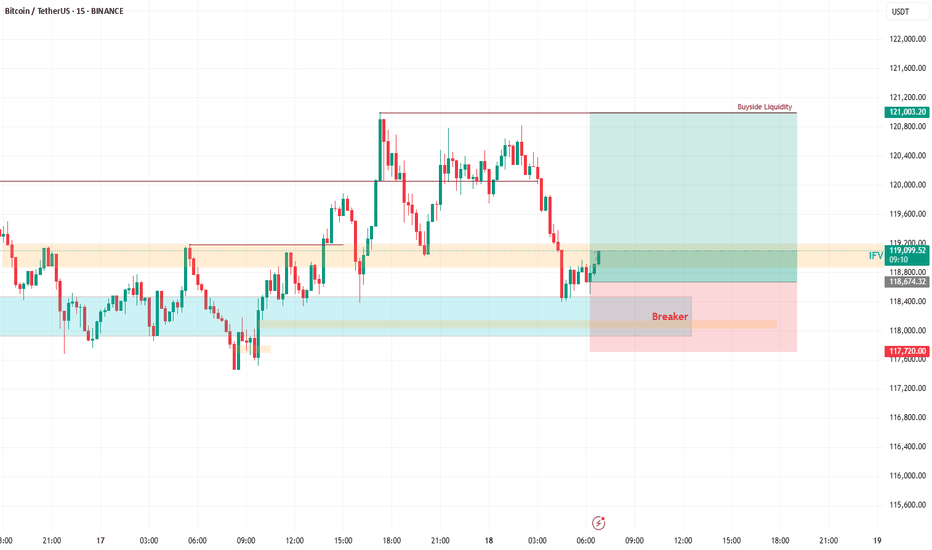

The Setup: Bullish Breaker in Play!Yesterday, BTC smashed into a strong bullish breaker and bounced like a champ. Today, it’s retracing back to this key level, setting up for what I expect to be another explosive buy reaction. Why? Because this breaker is rock-solid, and the price action is giving us all the right signals! Plus, it’s Friday—the last trading day of the week—and I’m betting BTC will stretch its legs to cover the weekly range. 🏃♂️

🎯 Trade Details: Where to Jump In

Buy Area: Right now, the price is teasing the breaker zone.

Stop Loss: Protect your capital with a stop loss at around ~117,700.

Target: We’re aiming for the Buyside Liquidity sitting pretty around 121,000. That’s a juicy move with solid risk-reward potential! 💪

🧠 Why This Trade Makes Sense

Bullish Breaker Strength: This level has proven itself as a springboard for price action.

Weekly Range Play: Fridays often see BTC push to cover its weekly range, and we’re in prime position to catch it.

Liquidity Grab: The Buyside Liquidity at 121,000 is like a magnet for price—let’s ride it there!

⚠️ Risk Management Reminder

Always trade smart! Use proper position sizing, stick to your risk management rules, and don’t go all-in like it’s a casino. Keep those stops tight to avoid getting wrecked by any sudden volatility. 😎

💬 Join the Conversation!

What do you think of this setup? Are you jumping on this BTC train or waiting for more confirmation? Drop your thoughts in the comments below! 👇 Also, if you like this idea, smash that LIKE button ❤️ and follow for more trade ideas to keep your portfolio poppin’! 🚀

Happy trading, and let’s stack those pips! 💰

#BTC #CryptoTrading #BuyTrade #Bullish #TradingView

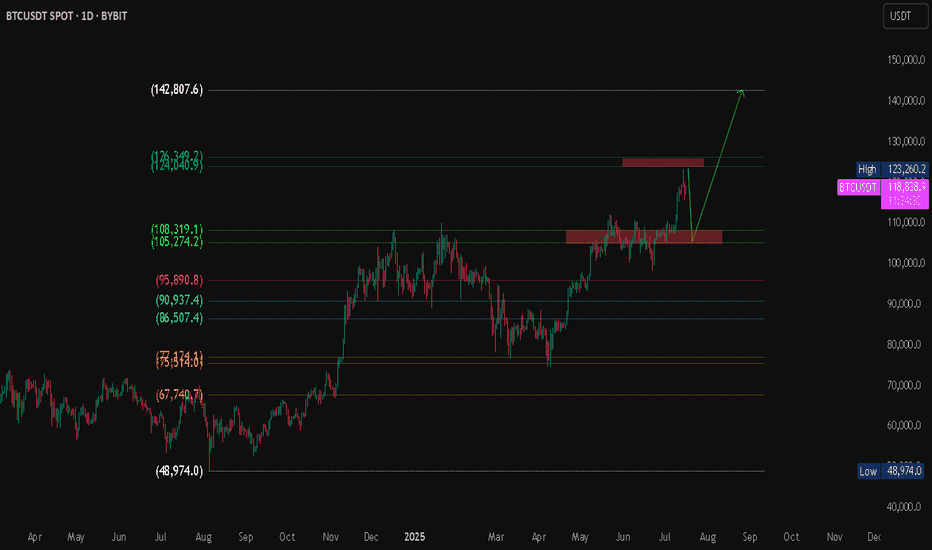

BTC/USDT Technical Analysis Market Overview

Bitcoin is currently trading at $118,788, with an intraday high of $119,311. The market has recently tested a major resistance zone and is showing signs of a potential pullback toward a key demand zone before a possible continuation to higher levels.

Projected Scenario (Bullish Bias)

Expected pullback to the support zone around $105K – $108K.

If price holds and shows a bullish reversal, a breakout above $124K is expected.

Primary upside target: $142,807 (Fibonacci projection / potential new high).

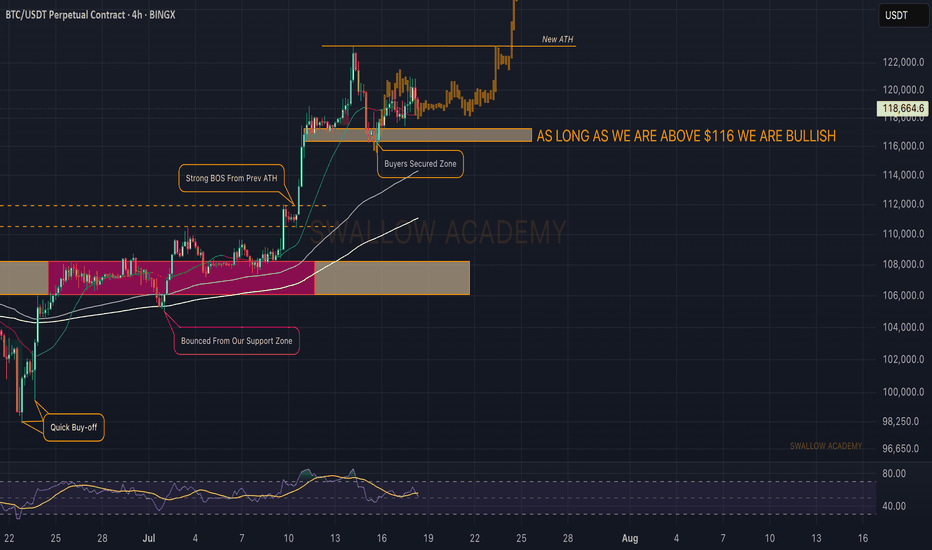

Bitcoin (BTC): Small Correction Happening | Attentions at $116KBitcoin still looks bullish, with no major signs of potential sell-side movement to happen. The least we look for here is the retest of the current ATH, which is the $123K zone, and we will keep this game plan as long as the price stays above $116K.

If we see any signs of a breakdown happening, we might be heading for a bigger correction towards $108K (only if we see a break of $116K).

Swallow Academy

Pine Screener - Powerful tool for building programmable screenerHello Everyone,

In this video, we have discussed on how to use pine screener utility of tradingview. We are making use of the indicator Divergence Screener for this demonstration and screen stocks undergoing bullish divergence.

In a nutshell, here are the steps:

🎯 Use Stock Screener to build watchlist of less than 1000 symbols

🎯 Add the indicator you want to use in the pine screener to your favorites.

🎯 Pine screener can be accessed from the tradingview screener menu or you can simply click on the link www.tradingview.com

🎯 Add the watchlist and indicator to the pine screener and adjust the timeframe and indicator settings

🎯 Select the criteria to be scanned and press scan

BITCOIN Bitcoin and the Potential Move to $136,000 based on my price action +sma+ema advanced strategy.

Current Market Context

Bitcoin (BTC) is trading near all-time highs, recently surpassing $117,000-118000

The market is characterized by strong institutional inflows, robust ETF demand, and bullish technical momentum.

Is a Move to $136,000 Possible?

Analyst and Model Forecasts

Bitwise Asset Management and several market analysts see a 30% rally possible in July, which could push Bitcoin to the $136,000 level. This projection is based on:

Historical post-crisis rallies (average 31% gains after macro/geopolitical shocks).

Institutions buying more BTC than miners can supply.

Global rate cuts increasing liquidity and risk appetite.

Quantitative models and technical forecasters also predict a range between $136,000 and $143,000 as a potential 2025 high, with some models extending targets to $151,000 and beyond.

Other major banks and analysts (e.g., Standard Chartered, Bernstein, Fundstrat) maintain even higher year-end targets ($150,000–$200,000), but $136,000 is seen as a key intermediate technical and psychological level.

Technical Analysis

Bullish momentum is confirmed across short, medium, and long-term timeframes.

Key resistance levels to watch: $120,000 (psychological), $130,000 (round number), and $136,000 (target zone highlighted by several analysts).

Sustained trading above $112,000–$118,000 would support a move toward $130,000–$136,000, especially if ETF inflows and institutional demand remain strong.

Drivers Supporting the $136K Scenario

ETF and Institutional Inflows: Demand from US spot Bitcoin ETFs and corporate treasuries remains robust.

Macro Tailwinds: Expectations of US Federal Reserve rate cuts and a weakening dollar are fueling risk-on sentiment.

Supply Dynamics: The recent Bitcoin halving has reduced miner supply, amplifying the impact of new demand.

Technical Breakouts: Bull flag and breakout patterns suggest further upside, with $136,000 cited as a technical extension target.

Risks and Considerations

Volatility: Bitcoin remains highly volatile; sharp pullbacks are possible even in a strong uptrend.

Regulatory and Macro Risks: Changes in regulatory stance or a major shift in macro conditions could impact the trajectory.

Profit-Taking: Approaching major round numbers like $130,000 or $136,000 could trigger profit-taking and temporary corrections.

Summary Table: Bitcoin 2025 Price Targets

Source/Model 2025 Target Range $136K Move Outlook

Bitwise, Polymarket $136,000 (July 2025) High probability if current trends persist

Coinfomania AI Model Up to $143,440 $136K within model range

Investing Haven $80,840–$151,150 $136K within bullish scenario

Changelly, CoinDCX $100,000–$150,000 $136K is a key resistance

Standard Chartered $120,000–$200,000 $136K as a stepping stone

Conclusion

A move to $136,000 for Bitcoin is considered plausible in 2025 by my market structure advanced strategy , This scenario is supported by strong institutional demand, favorable macro conditions, and bullish technical patterns. However, volatility and macro/regulatory risks remain, so price action should be monitored closely as BTC approaches key resistance levels at 120k and 136k level

#bitcoin #btc

BTC Short Call!hort Call on BTC (Short-Term)

Entry: Sell 1 BTC Call @ $120,000 strike, August expiry (~4 weeks)

Premium Collected: ~$1.5K–$2K (~0.013 BTC)

Thesis: BTC is facing resistance in the $118.9K–$120K zone. While overall trend is bullish, short-term momentum may stall at new highs. A short call captures time decay, profiting if BTC consolidates or retraces.

Risks: Unlimited if BTC rallies strongly above $120K. Consider hedging with a long call at $125K strike.

Target: Keep the entire premium if BTC <= $120K at expiry.

BTC Analysis — Long-Term Buy Zone AheadI'm watching $111,000 as a major buy zone on Bitcoin.

If price retraces to that level, I’ll be ready to enter a long position.

This is not a prediction — it’s a scenario.

Smart traders don’t guess, they prepare.

Let price come to your level. No chasing.

📍Set your alerts and stay patient.

Analysis of the Latest Bitcoin Market。On July 14, Bitcoin's price surged sharply, with the highest level reaching $123,100. This breakthrough ended its eight-month-long consolidation phase within the $90,000 - $110,000 range.

The U.S. House of Representatives designated the week of July 14 as "Crypto Week" and plans to deliberate on a number of key bills. Among them, the Guiding and Establishing America's Stablecoin National Innovation Act aims to formulate federal regulations for stablecoins and is regarded as a "landmark legislation" in the cryptocurrency sector. The market expects the cryptocurrency industry to usher in policy dividends.

Market analysts are relatively optimistic about Bitcoin's prospects. The $125,000 level is seen as the next key psychological threshold, and a breakthrough above it would open up greater upside potential. Standard Chartered Bank predicts that Bitcoin will challenge $200,000 by the end of the year. Although the Relative Strength Index (RSI) is at a high level, there is no obvious overbought signal. The moving average system is clearly aligned, and the support level has moved up to $112,000. The market consensus holds that "any pullback represents a buying opportunity."

you are currently struggling with losses,or are unsure which of the numerous trading strategies to follow,You have the option to join our VIP program. I will assist you and provide you with accurate trading signals, enabling you to navigate the financial markets with greater confidence and potentially achieve optimal trading results.

BTC Era, continue to create new ATH💎 BTC WEEKLY PLAN UPDATE (14 July )

NOTABLE NEWS ABOUT BTC

Bitcoin (BTC) broke above a key milestone on Friday, setting a new all-time high of $119,999 with no signs of slowing down. The technical outlook supports further gains as momentum indicators remain strong and price action is solidly in price discovery mode, with the next potential target at $135.000

Bitcoin’s Next Stop: $135.000

Bitcoin entered price discovery on July 9, and since then, the king of cryptocurrencies has surged toward the $120,000 target—a key psychological level for traders. Early Monday during the Asian session, BTC climbed to a peak of $119,999, marking a new all-time high and the closest the asset has come to this milestone.

TECHNICAL ANALYSIS PERSPECTIVE

Two key momentum indicators on the daily timeframe signal underlying bullish momentum in Bitcoin, suggesting a potential for further upside. The Relative Strength Index (RSI) reads 76, and the Moving Average Convergence Divergence (MACD) is flashing green histogram bars above the neutral line.

However, if BTC undergoes a correction, it may extend its pullback to find support near the lower boundary of the Fair Value Gap (FVG) around $115,222.

Derivatives market data shows that $76 million was liquidated over the past 24 hours as BTC surged toward its new high. The long/short ratio, which is considered an indicator of bullish or bearish trader sentiment, is above 1—indicating that more derivative traders are optimistic about Bitcoin and are expecting further gains in the king of cryptocurrencies.

Stay tuned to the channel for updates.

BTC & USDT.D => Bullish Correction Incoming?Hello TradingView Family / Fellow Traders. This is Richard, also known as theSignalyst.

Both BTC and USDT.D are sitting around key rejection zones.

💰 BTC is hovering near the $100,000 level — a major previous low and a psychological round number.

📊 Meanwhile, USDT.D is testing the 5% resistance — a supply zone and another critical round number.

As long as $100,000 holds as support on BTC and 5.1% holds as resistance on USDT.D, we could expect a bullish correction across the crypto market.

What do you think? Will these levels hold or break? 🤔

📚 Always follow your trading plan regarding entry, risk management, and trade management.

Good luck!

All Strategies Are Good; If Managed Properly!

~Rich

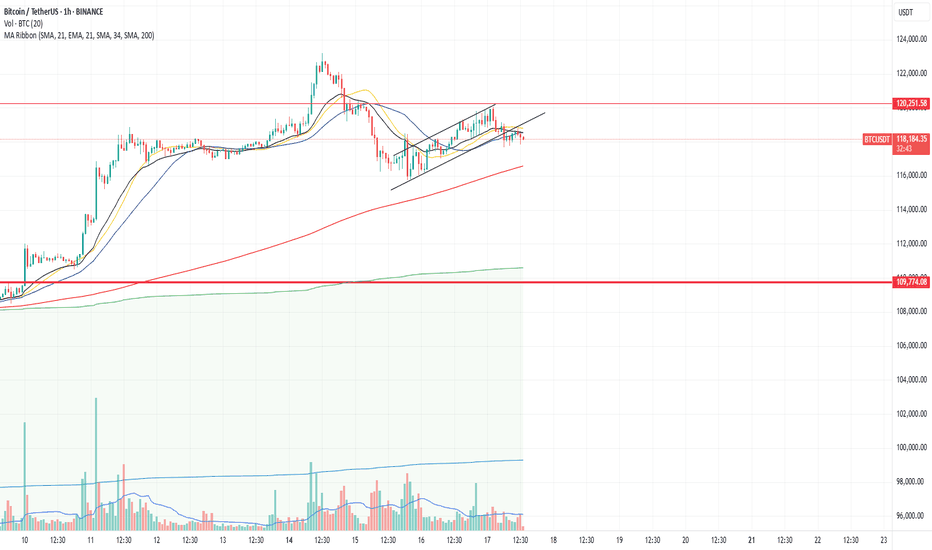

BTCUSDT: A Period of Adjustment and the Next TrendAfter a strong rally to record highs, BTCUSDT is currently entering a period of slight correction. The coin is now trading around 118,500 USD, down more than 0.57% on the day.

From a technical perspective, BTCUSD is moving within a narrowing price wedge, showing a slight downtrend. The support level at 116,500 USD is acting as a springboard for the Bulls. However, as the price approaches the tip of the wedge, a breakout may occur at any time, with two possible scenarios highlighted on the chart.

My personal outlook is that BTCUSDT will continue to decline in the short term before breaking out of the wedge in an upward direction. What do you think about BTCUSDT?

Please share your thoughts in the comments and don’t forget to like this post!

Wishing you all happy and successful trading!

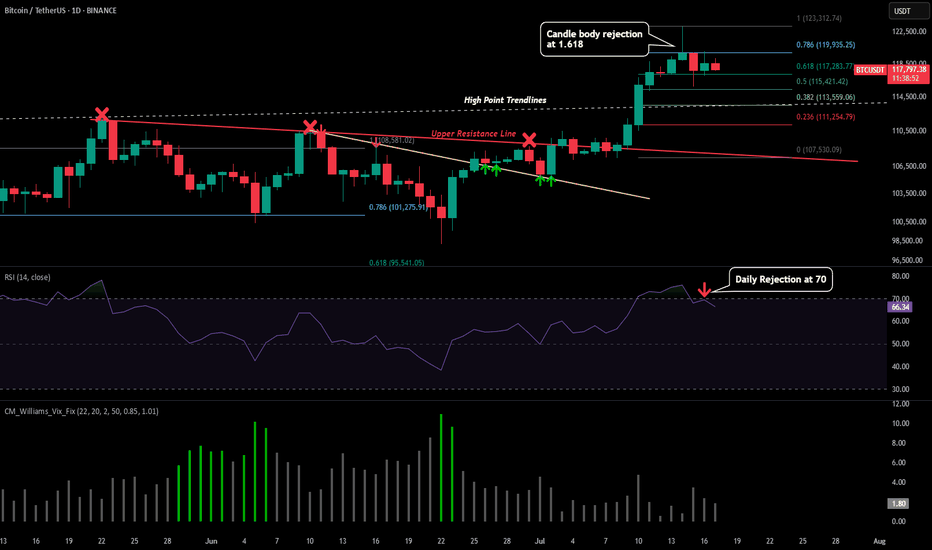

BTC - Signals of Cooloff IncomingPlease refer to our previous post:

To give additional detailed context of what to look for please look at our last post that is linked above. So far with recent price developments this idea is still intact.

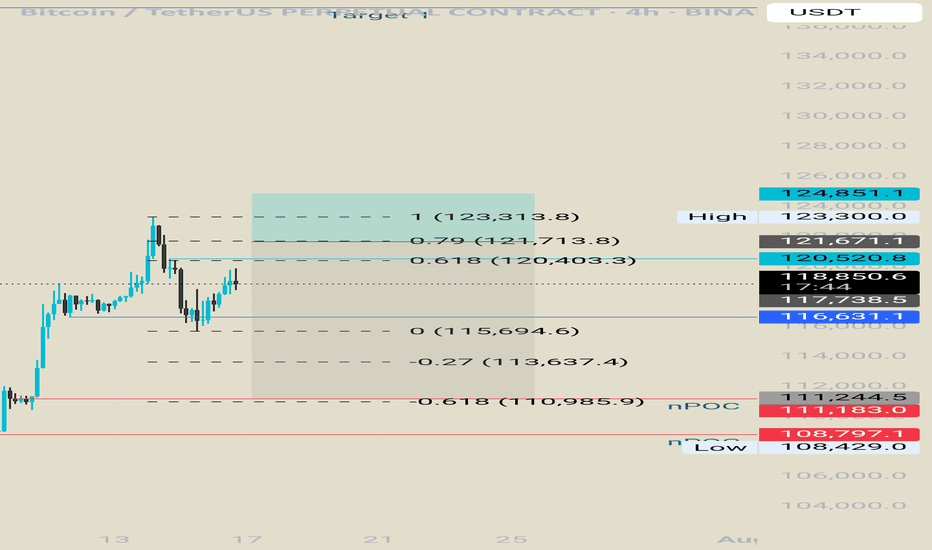

What I have also outlined in todays post are some of the reason this short term retracement is still in place.

-Market has moved up very fast

-Lots of leverage from the highs need to be flushed

-Daily candle close below our first 1.618 extension target

-Daily RSI just got rejected from the 70

If we do see a retracement then all those price levels mentioned in our last post are valid. I have also add a predictive fib model that could outline important future price levels on the LTF.

Given this model does not have much price data to go off of the accuracy cannot be for certain but pay attention the the 0.382 around $113.6k and the predicted bottom around $107.5k if price drops that low.

The way price could avoid a LTF retracement is by the daily RSI reclaiming strength above the 70 level and negating the rejection. Will make an updated post if this is to occur.

Analysis no 74 1hWelcome to king btc 3 Bitcoin is expected to decline from the range of 119,000 to 120,000 slowly to 113,500 and then rise to 125,000 in the cycle. The larger range is expected to be in the range of 115,500 to 125,000 which could be an opportunity for altcoins to rise. This is just a possibility.