Drop Your Token – I’ll Do The AnalysisHey everyone! Hope you’re having an amazing weekend !

Want me to analyze your favorite token ? Just drop your request in the comments using this format:

Request Format

Project Name: Bitcoin

Token Symbol: BTC( BINANCE:BTCUSDT )

Important Notes:

I’ll pick and analyze only the first 10 tokens requested .

One request per person — so choose wisely!

I’ll reply directly under your comment with the analysis.

If you find this helpful, don’t forget to Like ❤️ and Share this post with your friends!

Here’s to your success — health, wealth, and great trades! 🚀

BTCUSDT trade ideas

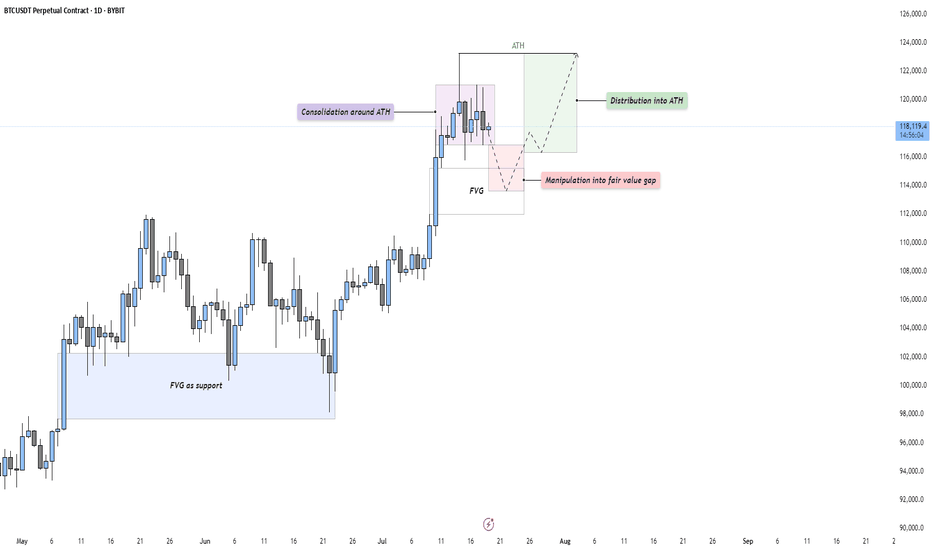

BTC - Consolidation, Manipulation & DistributionMarket Context

After a strong impulsive rally, Bitcoin is currently consolidating just beneath its All-Time High (ATH). This type of consolidation following an extended move higher often indicates indecision in the market — a pause that either leads to continuation or reversal. The current structure suggests that price is building energy for the next leg.

Consolidation and Liquidity Above ATH

The price action is tight and sideways around the ATH, which likely means liquidity is building above. Many stop-losses and breakout orders are sitting just overhead — classic conditions for a Buy Side Liquidity Sweep. This range may serve as a trap for early breakout traders, providing an opportunity for smart money to manipulate price lower before taking it higher.

Fair Value Gap Retest Scenario

Below the current range, we see a Daily Fair Value Gap that aligns with prior bullish imbalances. A move down into this Gap would represent a manipulation phase — shaking out weak longs before rebounding. The Gap also acts as a potential support level where buyers might be waiting. If price reaches into this zone and reacts strongly, it may offer a high-probability long setup.

Distribution or Reaccumulation?

While this could be interpreted as distribution beneath resistance, it’s equally valid to consider it a reaccumulation phase — a temporary markdown into demand before a fresh expansion. If the market dips into the Gap and quickly reclaims the range, it opens the door for a clean breakout above the ATH and continuation toward the 124,000–126,000 region.

Final Thoughts

Price rarely moves in a straight line. It pauses, retraces, and often tricks participants before making the real move. This type of consolidation presents opportunity — but also demands patience and clarity.

If you found this breakdown insightful, a like would be much appreciated! And I’d love to hear your thoughts in the comments — are we about to sweep down into demand, or is the rocket already on the launchpad?

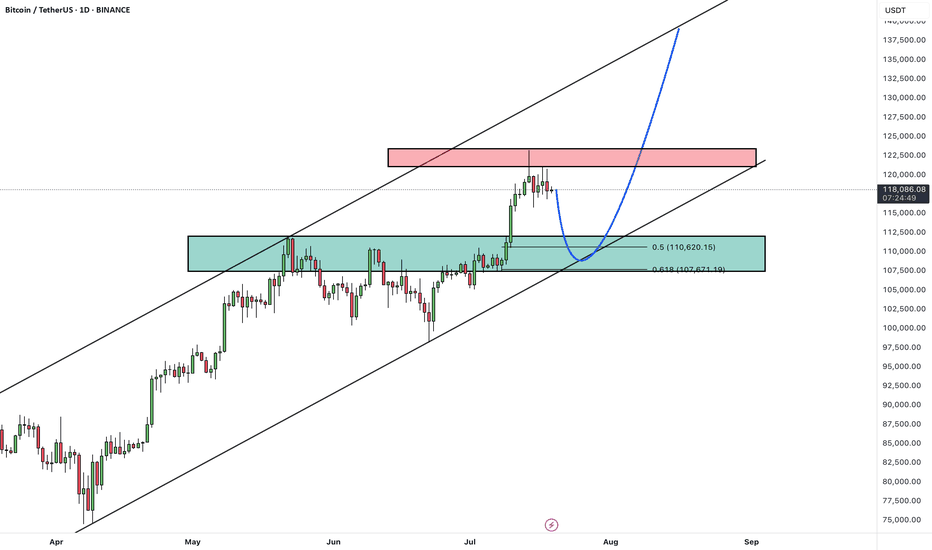

BTCUSDTHello Traders! 👋

What are your thoughts on BITCOIN?

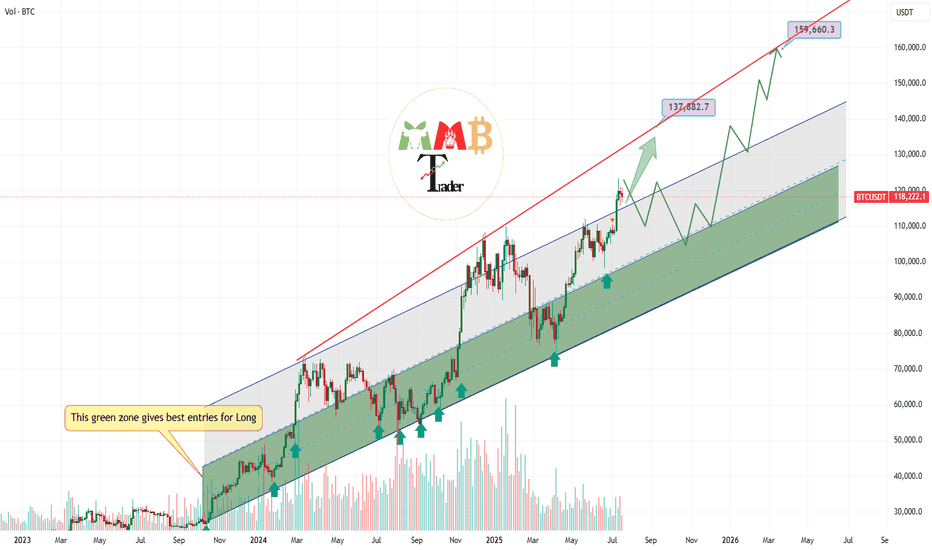

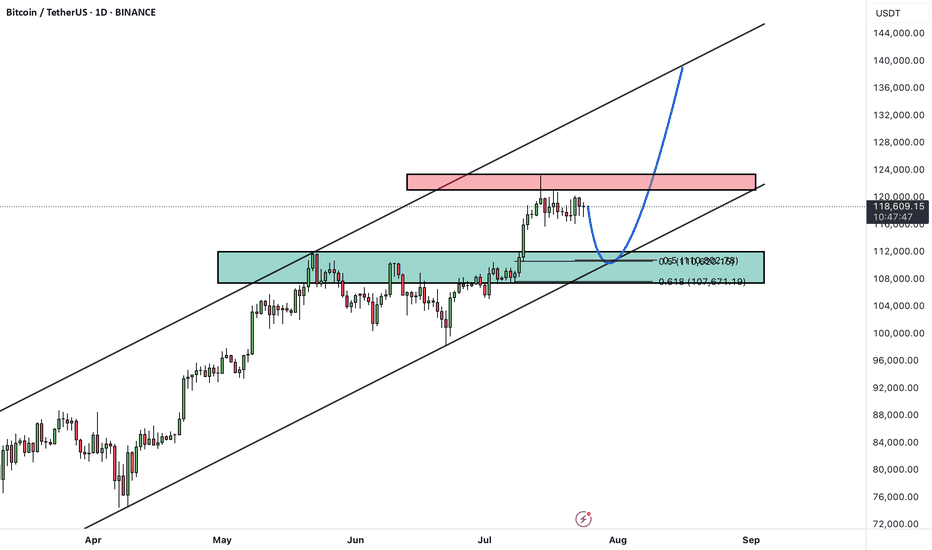

Bitcoin has recently posted a new all-time high and is now undergoing a healthy correction. This pullback is expected to extend toward a key support zone, which aligns with both the previous breakout level and the bottom of the ascending channel.

Once the correction is completed near the channel support / previous high, we anticipate a bullish continuation.

The next leg higher could take Bitcoin toward the upper boundary of the current channel.

As long as price remains above the key support area, the overall structure stays bullish and this correction is likely to be a buy-the-dip opportunity within a broader uptrend.

Will Bitcoin use this pullback as a launchpad for new highs? Share your view in the comments! 🤔👇

Don’t forget to like and share your thoughts in the comments! ❤️

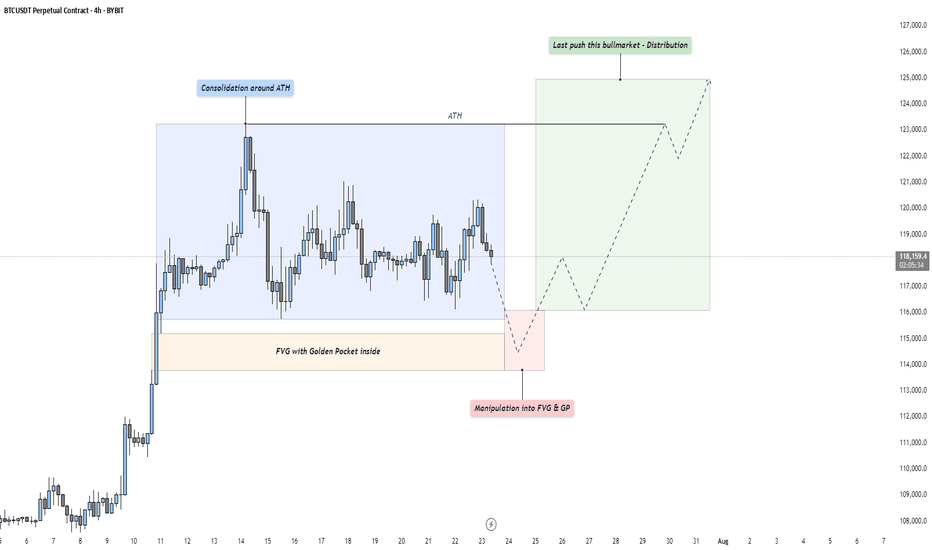

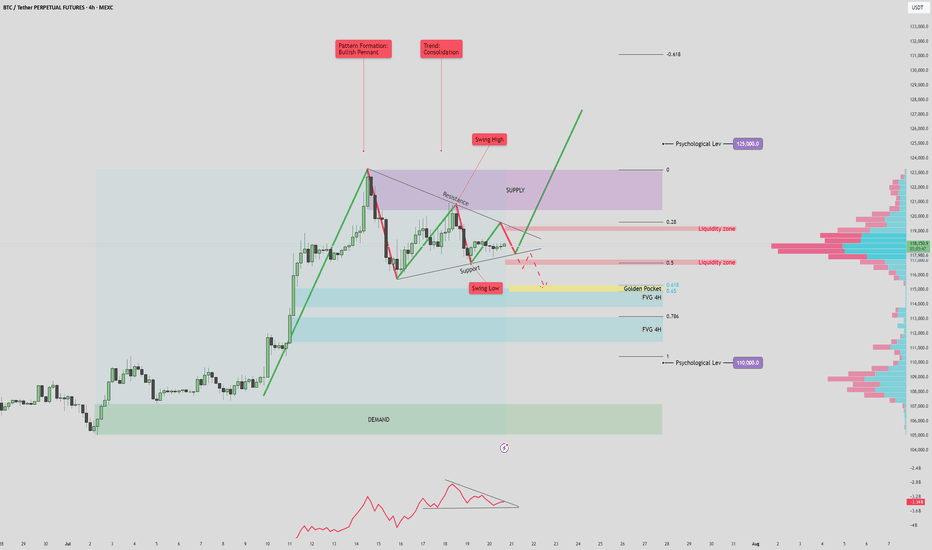

BTC - Last Push: Consolidation, Manipulation & DistributionMarket Context

After a strong upward impulse, Bitcoin has entered a mid-term consolidation phase just below its all-time high. This kind of price action is typical as the market digests recent gains and larger participants prepare for the next move. These pauses in momentum often precede either trend continuation or a reversal — and the structure here suggests we might be witnessing the former, but not without a final shakeout.

Phase 1: Consolidation Around the All-Time High

The first phase is defined by a tight range just beneath the all-time high, where price moves sideways in a balanced struggle between buyers and sellers. This is often where retail participants become overly bullish, anticipating a breakout. However, the lack of a sustained move higher indicates that smart money may be waiting for better entries — or preparing to engineer liquidity to fuel the next move.

Phase 2: Manipulation Into the Fair Value Gap and Golden Pocket

Directly below the range lies a clean Fair Value Gap, with a Golden Pocket retracement nestled inside it. This zone represents a strong area of interest. A sharp move into this area would likely sweep late long positions and trigger stop-losses from range traders — a classic manipulation pattern. This phase serves two purposes: collect liquidity and offer favorable pricing for larger players looking to position themselves before expansion. Watch for signs of absorption or reversal as price enters this zone.

Phase 3: Expansion – The Last Push of the Bull Market?

Following the liquidity sweep and reaction from the Fair Value Gap and Golden Pocket zone, we could see a renewed expansion toward higher highs. This is the phase where volume returns, sentiment shifts, and price accelerates. If this plays out, it could mark the final leg of this bull cycle — potentially driving Bitcoin to new all-time highs with strength.

Execution Thoughts

If you're looking to participate, it's wise to wait for a confirmation signal on a lower timeframe — like the 5-minute or 15-minute chart — once price enters the Fair Value Gap and Golden Pocket zone. Watch for a strong bullish reaction, break of structure, or shift in order flow to signal that buyers are stepping back in.

Final Thoughts

Let the market come to your level and don’t chase moves without context. These three phases — consolidation, manipulation, and expansion — are timeless patterns seen across all markets. Stay patient, stay objective, and react with clarity.

If this breakdown helped you see the setup more clearly, a like would mean a lot — and I’d love to hear your thoughts in the comments! Are you watching the same zone, or do you see something different?

Calling the Unthinkable: Why a Bitcoin Drop May Be ComingCOINBASE:BTCUSD BITSTAMP:BTCUSD OKX:BTCUSD BINANCE:BTCUSDT.P

Predicting a drop in Bitcoin's price during a strong uptrend is extremely difficult and calling it takes real courage. It puts my credibility at risk, but based on everything I see, I believe BTC has reached dangerously high levels.

From a psychological perspective , investor behavior is sending warning signs. There’s a rush of people buying in out of FOMO, amplified by heavy promotion on social media and mainstream claiming BTC is the safest investment out there. Many who missed earlier buying opportunities now regret betting on altcoins instead, and they see this as a last chance to profit. Even if BTC drops below their entry points, most of these “late buyers” won’t sell. They’ll convince themselves it’s just another minor correction like what happened in the previous 2 years, and that they’re in it for the long term.

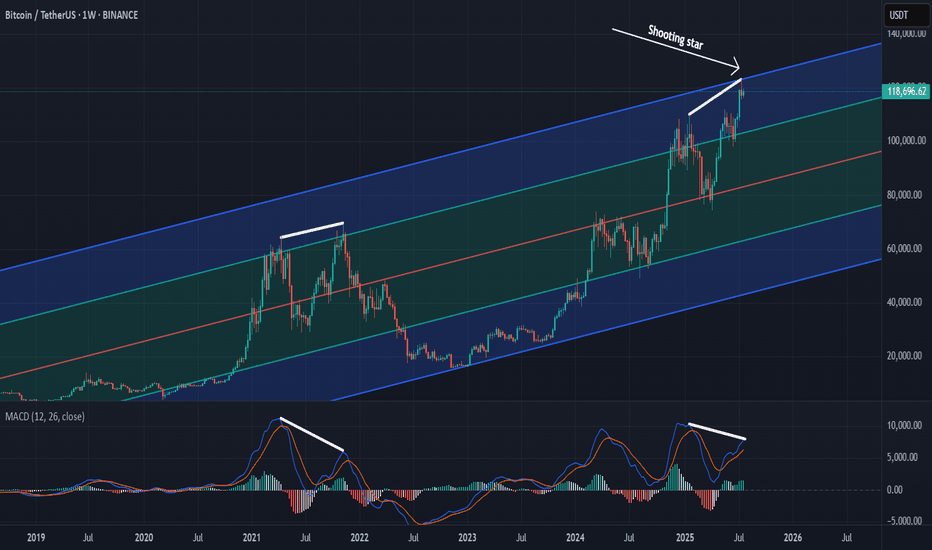

From a technical analysis point, the signs are just as concerning. A “ shooting star ” candle has formed on the weekly chart. This candle is often seen at market tops. The MACD histogram on the same timeframe is showing a potential divergence, suggesting weakening momentum. The Fear and Greed Index is approaching 70, indicating strong market greed. On top of that, traders are opening high-leverage long positions in anticipation of another big bullish candle.

These technical and psychological signals combined paint a risky picture. If this kind of setup is confirmed , it will lead to sharp corrections.

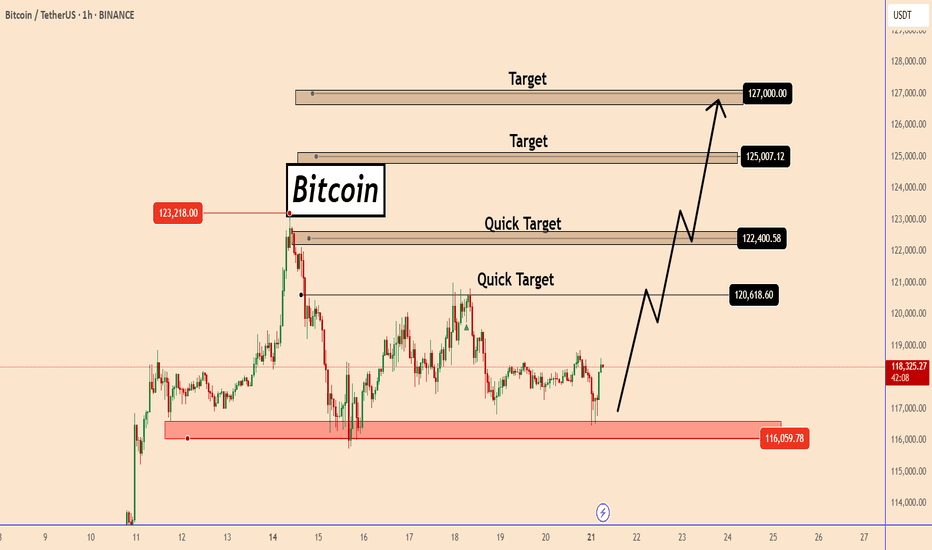

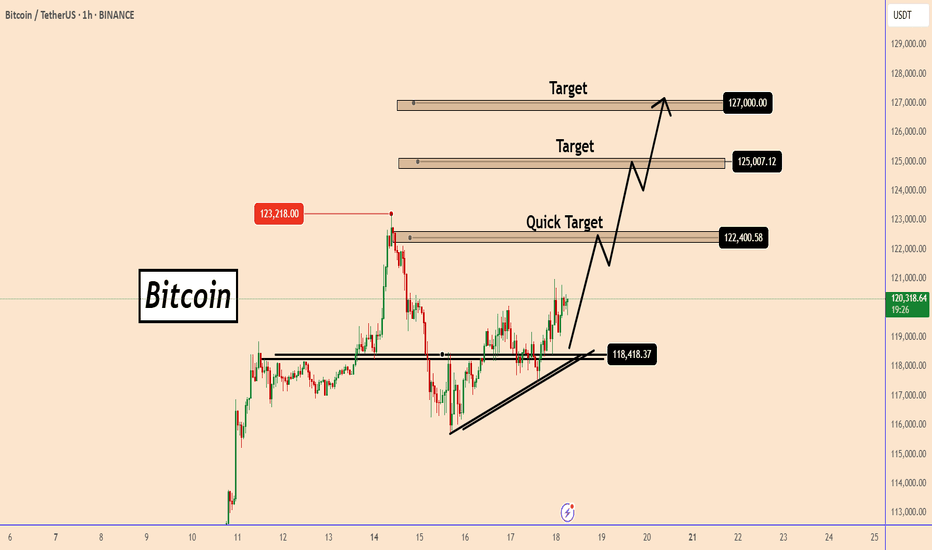

Bitcoin: Nothing Changed, Still BullishBitcoin: Nothing Changed, Still Bullish

BTC still maintains a strong upward momentum. Immediate strong support was found again near 116K.

It seems that the market has set a new low for BTC around this area for now. I think that as long as BTC stays above this area, there is a good chance that the increasing volume and buyers will increase further pushing BTC further, as shown in the chart, to 120,600; 122,400; 125,000 and 127,000.

If it moves below the red zone, we should be careful as it could undergo a major correction before taking a clear direction.

You may find more details in the chart!

Thank you and Good Luck!

PS: Please support with a like or comment if you find this analysis useful for your trading day

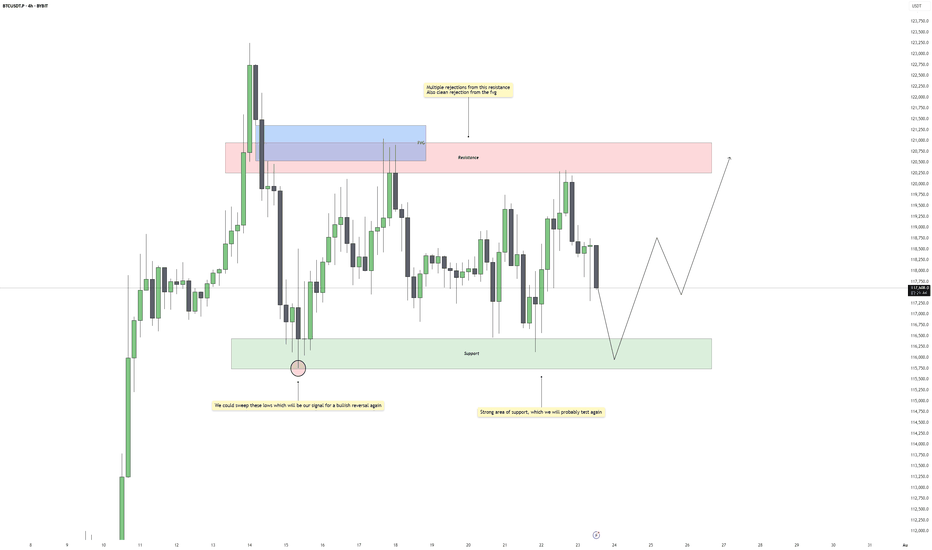

Bitcoin - Bullish Reversal PotentialBitcoin is currently consolidating within a well-defined range, with repeated rejections from the upper resistance zone and strong reactions from the support below. Price continues to respect both ends of the structure, suggesting that liquidity is being built up on both sides. Until a clear breakout occurs, we should expect more range-bound movement with sharp rejections near the boundaries.

Support Zone and Liquidity Engineering

The support zone beneath current price action has already held several times, showing clear buying interest. However, the lows around this area remain relatively clean. A sweep of those lows would not only engineer sell-side liquidity but also set the stage for a reversal if buyers step back in. This would align well with typical accumulation behavior seen during consolidation phases.

Rejections from Resistance and FVG Influence

Price has shown multiple rejections from the resistance zone, particularly inside the fair value gap that sits just above it. This confirms that the area is actively defended and will likely be the next upside target if price manages to bounce from support. The FVG itself acts as a magnet once price begins to trend again, especially if a strong displacement follows a sweep.

Expected Flow and Trade Opportunity

The anticipated scenario involves price dipping back into support, possibly sweeping the lows for inducement, and then bouncing with a shift in short-term structure. If that happens, we can expect a move back toward resistance, completing another rotation within the range. The sweep would offer an added layer of confirmation, giving a stronger reason to look for long setups.

Invalidation and Risk Perspective

If support fails to hold and price breaks beneath the range without immediate recovery, that would invalidate the bullish view and point to a potential shift in directional bias. As long as price stays inside the current consolidation, however, this remains a waiting game for either a clean reaction from support or a sweep followed by structure shift.

Conclusion

Bitcoin remains locked in a clear range, and until the breakout happens, the edges of that range offer the best trading opportunities. A sweep of the lows would act as a high-probability signal for a reversal back to the highs. Patience is key, wait for the sweep and confirmation before committing to the upside.

___________________________________

Thanks for your support!

If you found this idea helpful or learned something new, drop a like 👍 and leave a comment, I’d love to hear your thoughts! 🚀

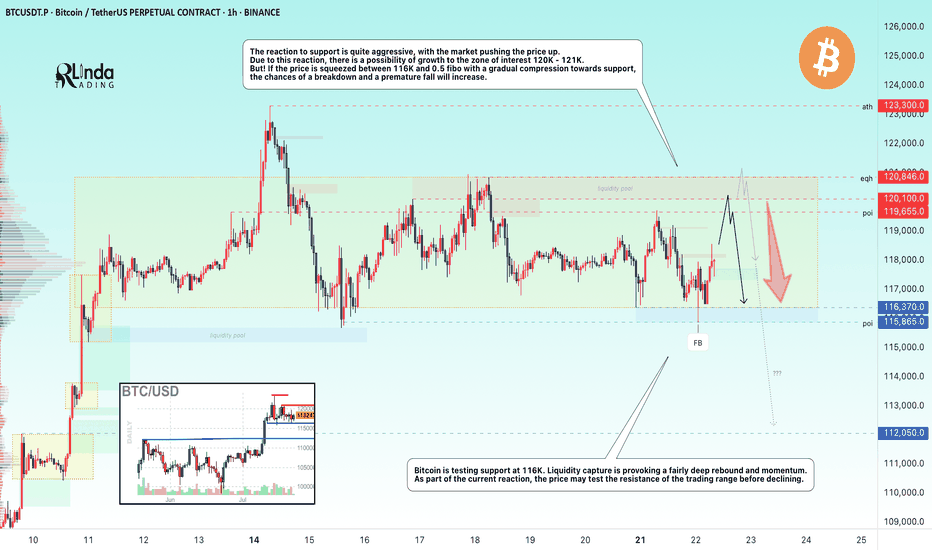

BITCOIN → Consolidation and compression to 116K. Correction?BINANCE:BTCUSDT.P continues to consolidate, with the price testing support at 116K, leaving behind the zone of interest at 120K-121K. Are there any chances for further growth?

(Alternative scenario (if growth to 120K does not occur))

Fundamentally, there is nothing particularly new, and the hype surrounding Bitcoin is stagnating. Technically, on D1, consolidation is underway with pressure from bears against the backdrop of an outflow of funds into altcoins. However, the dominance index is starting to rise, which could trigger some correction in the market. The price on the working timeframe, without updating local highs, is testing lows, and the latest retest of the liquidity zone is provoking a fairly aggressive reaction that could bring the price to retest the zone of interest at 120K-121K.

But! If the price is squeezed between 116K and 0.5 Fib with a gradual squeeze towards support, the chances of a breakdown and a premature fall will increase.

Support levels: 116370, 115860

Resistance levels: 119650, 120100

Technically, the market needs a breather or correction, which is generally a sign of health. The nuance with Bitcoin is that below 115860 there is no support until 112K, and if the market breaks the current consolidation boundary, the further correction could be quite deep. In the current situation, I do not yet see any drivers or reasons for another rally.

Best regards, R. Linda!

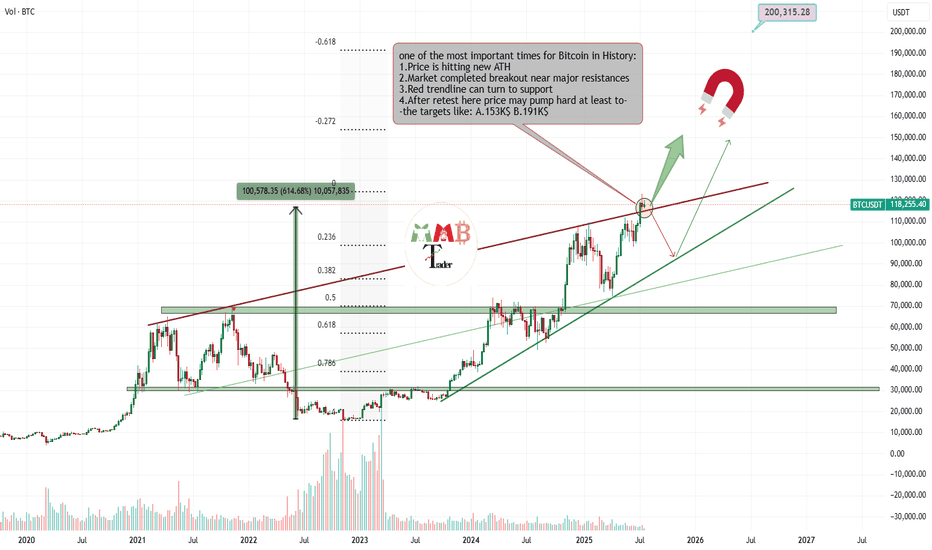

Bitcoin is retesting Critical zone for targeting almost 200K$Most traders around world now don't know what to do with their own trades or spot holdings, because some are in profit and how doubt of more pump and are still holding and some others miss this massive pump and think it can rest and fall now and it is not a good time to enter long.

And many other questions and thoughts At this time is simply check the chart and do these simple steps which are some mentioned and some not due to huge content.

Delete all of my previous drawings and start new Charting the price and see new trendlines or supports and resistances formed.

Then technically check the volume and breakouts and ... once again and here for Bitcoin i still find out chart looks extremely bullish to me and at this orange zone which is price is getting a little slow some important things may happen.

30% is expecting price fall below red trendline again and see short-term fall.

70% is expecting price complete retest of breakout here or pump more ASAP and then hitting targes like 150K$ and more for $BTCUSDT.

DISCLAIMER: ((trade based on your own decision))

<<press like👍 if you enjoy💚

BITCOIN → Consolidation, retest of 120K. Correction of dominanceBINANCE:BTCUSDT , after a rapid rally and touching 123K, rolled back and entered consolidation, giving altcoins a chance. At the same time, Trump signed new crypto laws, but will these laws open new doors?

On June 18, the GENIUS Act was signed. Information can be found in the sources, but there is no direct reference to BINANCE:BTCUSDT.P , except perhaps indirectly: increased confidence in the crypto market, increased liquidity, possible new rules, and pressure on decentralized assets. Bitcoin has not always grown on positive news; more often it has been a deep pullback and liquidation before the momentum.

Technically, Bitcoin is currently consolidating, and I would highlight several key areas: the upper range is 120K-120.9K. The zone between these levels is particularly important, as this is where buyers were previously liquidated and sellers gathered (liquidation is possible).

The bottom is 117K (confirmed) - 116.2K. There is a liquidity pool on the support side.

additional scenario if the market does not reach resistance and decides to form a long squeeze before growth

Theoretically, I am not yet expecting a breakout and growth of Bitcoin. I think that consolidation may continue for some time, especially against the backdrop of a pullback in altcoins and a deep correction in the dominance index.

Resistance levels: 120100, 120850

Support levels: 117000, 116230

Since the opening of the session, the price has been working off the liquidity capture from 117K. There is a reaction - growth, which could bring the price to the zone of interest at 120K. But the question is: will the price hold in the 120K zone? A false breakout of resistance could trigger a correction to 117-116K. Thus, I expect the market to remain in consolidation for some time or even expand the current trading range...

Best regards, R. Linda!

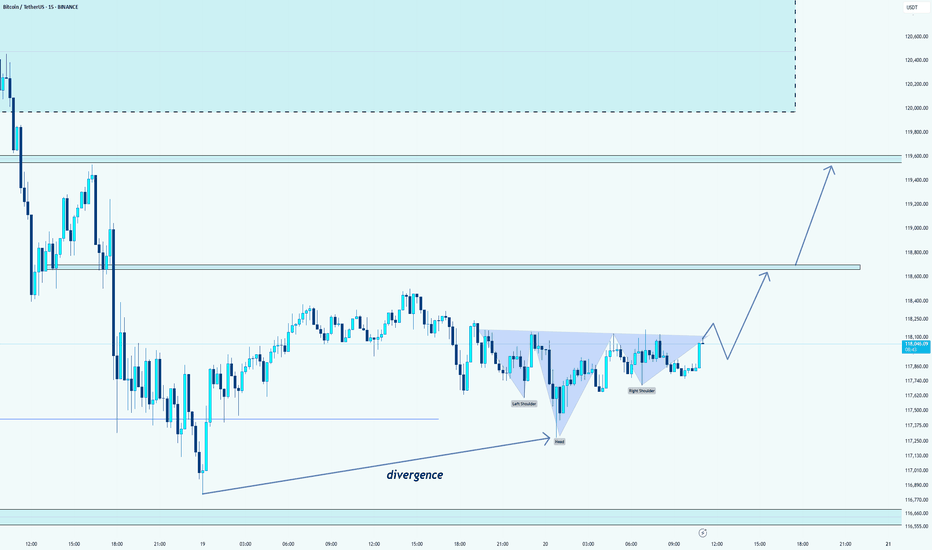

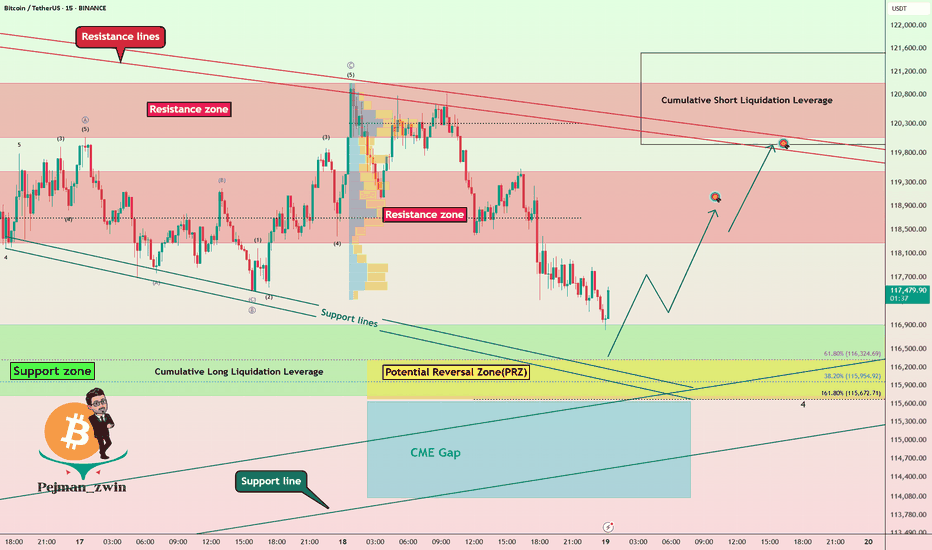

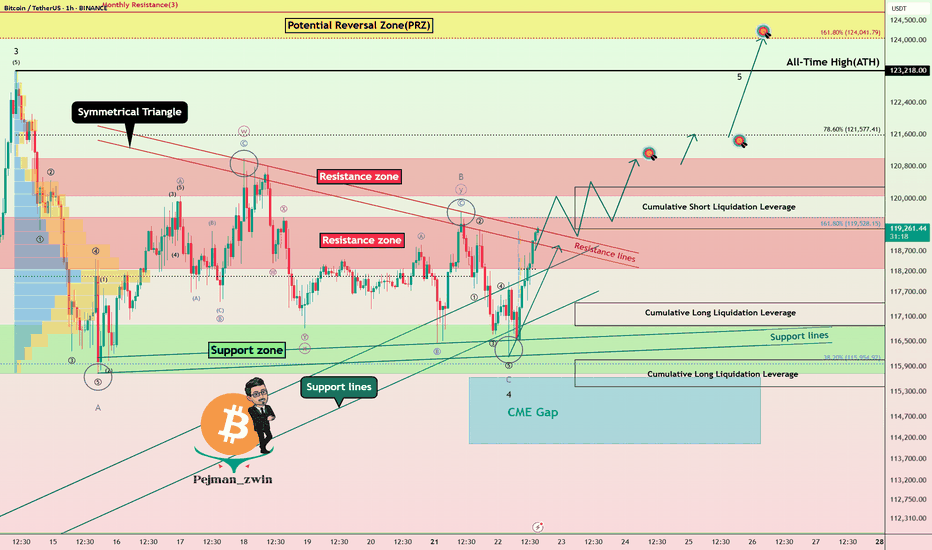

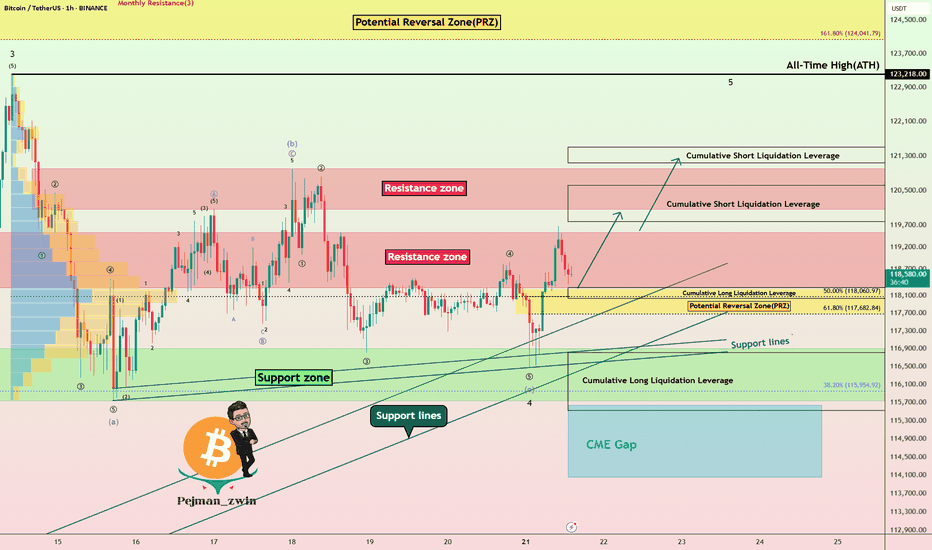

Bitcoin Technical Setup: Support Holds, Eyes on $118,600Bitcoin ( BINANCE:BTCUSDT ) moved as I expected in the previous ideas and finally completed the CME Gap($117,255-$116,675) in the last hours of the week. ( First Idea _ Second Idea )

Before starting today's analysis, it is important to note that trading volume is generally low on Saturday and Sunday , and we may not see a big move and Bitcoin will move in the range of $121,000 to $115,000 ( in the best case scenario and if no special news comes ).

Bitcoin is currently trading near the Support zone($116,900-$115,730) , Cumulative Long Liquidation Leverage($116,881-$115,468) , Potential Reversal Zone(PRZ) , and Support lines .

According to Elliott Wave theory , Bitcoin had a temporary pump after the " GENIUS stablecoin bill clears House and heads to Trump's desk " news, but then started to fall again, confirming the end of the Zigzag Correction(ABC/5-3-5) . Now we have to wait for the next 5 down waves or the corrective waves will be complicated .

I expect Bitcoin to rebound from the existing supports and rise to at least $118,600 . The second target could be the Resistance lines .

Do you think Bitcoin will fill the CME Gap($115,060-$114,947) in this price drop?

Cumulative Short Liquidation Leverage: $121,519-$119,941

Do you think Bitcoin can create a new ATH again?

Note: Stop Loss(SL)= $114,700

Please respect each other's ideas and express them politely if you agree or disagree.

Bitcoin Analyze (BTCUSDT), 15-minute time frame.

Be sure to follow the updated ideas.

Do not forget to put a Stop loss for your positions (For every position you want to open).

Please follow your strategy and updates; this is just my Idea, and I will gladly see your ideas in this post.

Please do not forget the ✅' like '✅ button 🙏😊 & Share it with your friends; thanks, and Trade safe.

Entering Green Markets or Getting Close to Liquidation?They told you it’s a green market, time to buy... but something’s off.

Most major losses begin with a green candle, not a red one!

Before jumping in, ask yourself: why does everything suddenly look so clear?

Hello✌

Spend 3 minutes ⏰ reading this educational material.

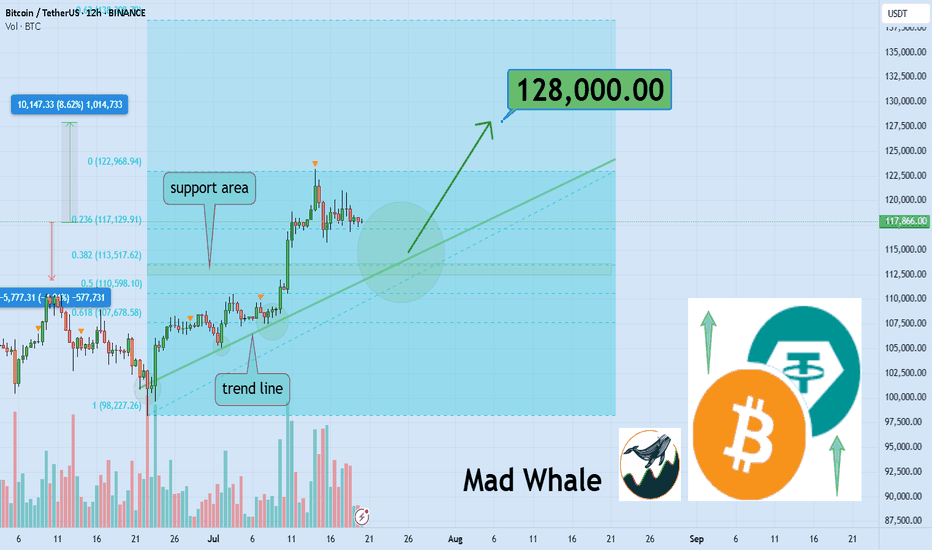

🎯 Analytical Insight on Bitcoin:

Strong volume confirming daily trendline and Fibonacci support signals a potential 8% upside, with a key target near $128,000 📈. This confluence could offer a solid entry opportunity for BINANCE:BTCUSDT traders 🧭.

Now , let's dive into the educational section,

📉 Green Doesn’t Always Mean Safe

Many traders jump into green candles, feeling they’re missing out. But most pumps end where excitement begins. The market isn’t always bullish it’s often just using collective emotion against you.

🧠 They’re Targeting Your Mind, Not Just Your Capital

Whales don’t need your money they need your mind first. The moment you think you're "too late" and must enter now, is often when they’re selling.

💡 You’re Fueling Their Profits, Not Your Trade

Those who bought early are waiting for someone like you. If you enter now, you're not beating the market you’re just helping others close in profit.

🔍 Why Most Liquidations Happen After Green Moves

Contrary to belief, major liquidations often come after green runs. That’s when confidence is high, stops are forgotten, and greed kicks in perfect timing for a rug-pull.

📊 History Doesn’t Repeat It Rhymes (Loudly)

Go back and look at Bitcoin’s chart since 2017. Nearly every major drop followed a smooth-looking pump. It’s not a warning. It’s a recurring pattern.

🎯 Hidden TradingView Tools for Spotting Green Traps

The market looks bullish. But the truth is, many pumps are just emotional traps built to bait late entries. TradingView has tools that, if used right, help you spot these traps before you step into them:

✅ Volume Profile (Fixed Range):

Use this to identify where the most trading volume occurred. If price rises on weak volume, be suspicious. It could be a fakeout or engineered pump by whales.

✅ RSI + Manual Divergence Drawing:

RSI seems simple, but traps often hide when RSI climbs while price action lags. TradingView allows manual drawing spot bearish divergence before the fall.

✅ On-Balance Volume (OBV):

If price is rising and OBV is flat or falling, warning lights should flash. A rally without money inflow is often a visual illusion.

✅ Session Volume HD (from Public Library):

See when most liquidity enters. Many fake bullish moves happen during the Asia session when volume is low and price is easier to manipulate.

✅ Multi-Timeframe Analysis:

If you're looking at the 15-min chart while the 4-hour sits in resistance, you may just be playing into a bull trap. Cross-reference your timeframes.

🧭 How to Avoid the Green Traps

Watch volume, not just candle color

Wait for level confirmations, not hype

Use TradingView’s combo indicators

Always ask: who profits if I enter right now?

✅ Final Thoughts

Not every green candle is hope sometimes it’s bait. The market is after your emotions, not your charts. Step back, zoom out, and use the right tools before you act.

✨ Need a little love!

We pour love into every post your support keeps us inspired! 💛 Don’t be shy, we’d love to hear from you on comments. Big thanks , Mad Whale 🐋

📜Please make sure to do your own research before investing, and review the disclaimer provided at the end of each post.

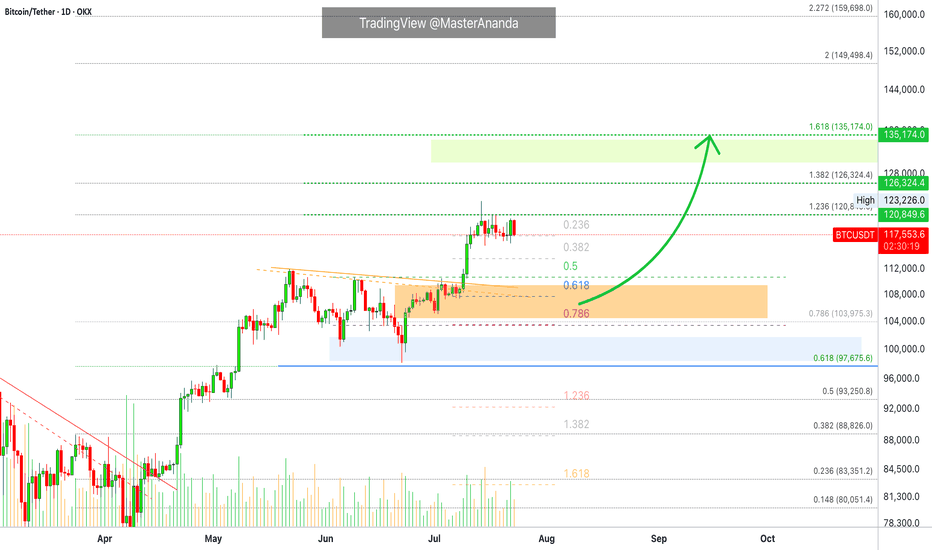

Bitcoin first target and short-term pump at least to 137K$ aheadAs we can see stop and next range zone for price can be near 135K$ to 137K$ and also major support zones now are 115K$ and 105K$ that can pump price once again if they touch.

Red trendline was strong resistance and it usually stop the pump and it is daily high detector now unless it breaks this time.

DISCLAIMER: ((trade based on your own decision))

<<press like👍 if you enjoy💚

BTC/USDT 125k? or 110k fall again?BTC/USDT 4H Analysis – July 20, 2025

The current market structure shows a bullish pennant forming after a strong impulsive move upward, with price consolidating between key support and resistance levels. This pattern, combined with volume signals and key price zones, suggests a potential for a high-volatility breakout.

🔷 Volume Profile & OBV Insights

The On-Balance Volume (OBV) indicator is forming a symmetrical triangle, indicating a volume squeeze. This suggests a potential sudden spike in volume that could confirm the next major move.

Anchored Volume Profile (VPVR) on the right shows a notable low-volume area between 112K–115K. If price breaks below this zone, it could lead to a rapid selloff toward deeper fair value areas due to reduced liquidity support.

📈 Bullish Scenario

If price breaks above the pennant resistance and 119.5K liquidity zone, it may signal bullish continuation.

A successful retest of the breakout level as support would confirm strength, opening the door to:

Short-term target: 123K (supply zone and previous swing high)

Mid-term target: 125K (key psychological level and potential ATH)

Watch for confirmation via OBV breakout and strong bullish volume. Failure to sustain above the 118K–119K area could signal a bull trap.

📉 Bearish Scenario

A breakdown below pennant support and the 115K level would likely trigger a move into the low-volume range.

First key downside target: 114.7K–115.7K, which aligns with the Golden Pocket (Fib 0.618 zone) and a 4H Fair Value Gap (FVG).

This zone may act as a support or a liquidity grab reversal area.

If this zone fails to hold, deeper downside targets become likely:

FVG 2 (~112K)

Psychological support at 110K, which aligns with strong historical demand and a major VPVR node.

This bearish move may either confirm further downside momentum or present a fakeout opportunity if price sharply reverses from one of these deeper levels.

✅ Summary

BTC is coiled within a bullish pennant, with both bullish continuation and bearish breakdown scenarios in play. Volume confirmation and breakout direction will be key. Traders should monitor how price reacts around the 115K–118K zone for directional clarity. A move beyond this range, especially with volume support, will likely define the next trend leg.

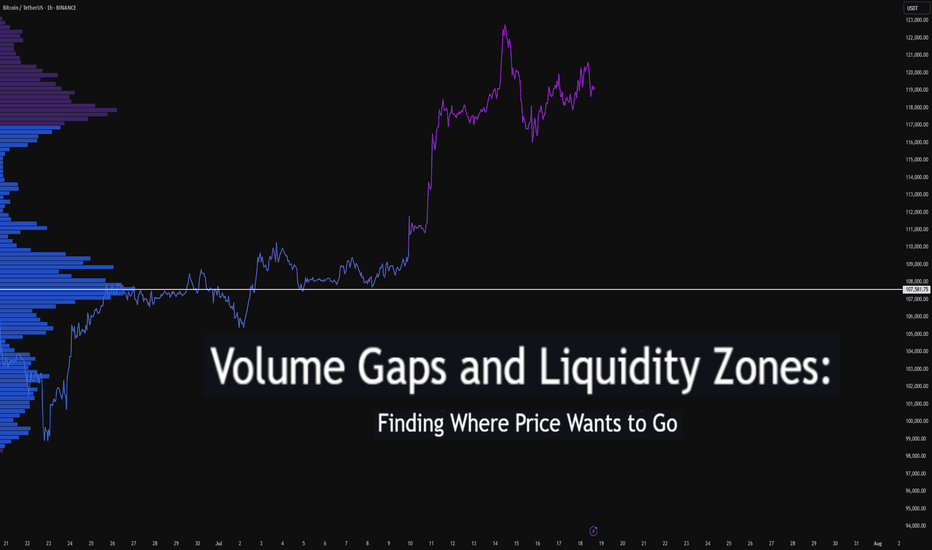

Volume Gaps and Liquidity Zones: Finding Where Price Wants to GoDifficulty: 🐳🐳🐳🐋🐋 (Intermediate+)

This article is best suited for traders familiar with volume profile, liquidity concepts, and price structure. It blends practical trading setups with deeper insights into how price seeks inefficiency and liquidity.

🔵 INTRODUCTION

Ever wonder why price suddenly accelerates toward a level — like it's being magnetized? It’s not magic. It’s liquidity . Markets move toward areas where orders are easiest to fill, and they often avoid areas with little interest.

In this article, you’ll learn how to identify volume gaps and liquidity zones using volume profiles and price action. These tools help you anticipate where price wants to go next — before it gets there.

🔵 WHAT ARE VOLUME GAPS?

A volume gap is a price region with unusually low traded volume . When price enters these areas, it often moves quickly — there’s less resistance.

Think of a volume gap as a thin patch of ice on a frozen lake. Once the market steps on it, it slides across rapidly.

Volume gaps usually show up on:

Volume Profile

Fixed Range Volume tools

Session or custom volume zones

They’re often created during impulsive moves or news events — when price skips levels without building interest.

🔵 WHAT ARE LIQUIDITY ZONES?

Liquidity zones are price areas where a large number of orders are likely to be sitting — stop losses, limit entries, or liquidation levels.

These zones often form around:

Swing highs and lows

Order blocks or fair value gaps

Consolidation breakouts

Psychological round numbers

When price approaches these areas, volume often spikes as those orders get filled — causing sharp rejections or breakouts.

🔵 WHY THIS MATTERS TO TRADERS

Markets are driven by liquidity.

Price doesn’t just move randomly — it hunts liquidity, clears inefficiencies, and fills orders.

Your edge: By combining volume gaps (low resistance) with liquidity zones (target areas), you can forecast where price wants to go .

Volume gap = acceleration path

Liquidity zone = destination / reversal point

🔵 HOW TO TRADE THIS CONCEPT

1️⃣ Identify Volume Gaps

Use a visible range volume profile or session volume. Look for tall bars (high interest) and valleys (low interest).

2️⃣ Mark Liquidity Zones

Use swing highs/lows, OBs, or EQH/EQL (equal highs/lows). These are magnet areas for price.

3️⃣ Watch for Reactions

When price enters a gap, expect speed.

When it nears a liquidity zone, watch for:

Volume spike

Wick rejections

S/R flip or OB retest

🔵 EXAMPLE SCENARIO

A strong bearish move creates a volume gap between 103 000 – 96 000

Below 96 000 sits bullish order blocks — clear liquidity

Price enters the gap and slides fast toward 96 000

A wick forms as buyers step in, volume spikes — the reversal begins

That’s price filling inefficiency and tapping liquidity .

🔵 TIPS FOR ADVANCED TRADERS

Use higher timeframes (4H/1D) to define major gaps

Look for overlapping gaps across sessions (Asia → London → NY)

Align your trades with trend: gap-fills against trend are riskier

Add OB or VWAP as confirmation near liquidity zones

🔵 CONCLUSION

Understanding volume gaps and liquidity zones is like reading the market’s intention map . Instead of reacting, you start predicting. Instead of chasing, you’re waiting for price to come to your zone — with a plan.

Price always seeks balance and liquidity . Your job is to spot where those forces are hiding.

Have you ever traded a volume gap into liquidity? Share your setup below

BTC Could Start Another Bullish WaveBTC Could Start Another Bullish Wave

Over the past two days, bitcoin has been holding strong above 118400. It seems that this small structural area could push BTC higher.

For now, ETH has performed better and BTC may follow suit.

I am looking for short-term targets near 122400, 125000 and 127000.

You may find more details in the chart!

Thank you and Good Luck!

PS: Please support with a like or comment if you find this analysis useful for your trading day

What's The Lowest Bitcoin Can Go? (Top Altcoins Choice —Comment)Bitcoin just hit a new all-time high recently and is consolidating just below resistance. I have a question: How far down can Bitcoin go on a sudden retrace?

That's a great question. Assuming that Bitcoin will continue growing mid-term and long-term, we can expect some more consolidation before higher prices. A retrace is not mandatory but is possible. A correction is almost impossible; low probability; not likely.

The worst case scenario Bitcoin does go down and the action should stop right at the previous high. Resistance turned support. That is, $112,000 to $110,000 would the first and main support range. Harder for Bitcoin to move much lower but these levels are not active yet.

If Bitcoin were to produce an extreme shakeout before additional growth, I would say the worst possible would be a touch of $104,000, but this is still a low probability setup. The chances are that Bitcoin will continue sideways while the altcoins grow. The fact that the altcoins are bullish means that Bitcoin will resume growing in due time. The next major move is another advance exceeding $130,000. It can happen within weeks or next month.

Patience is key on Bitcoin, the altcoins need to catch up.

Sometimes, Bitcoin can go sideways for months wile the altcoins grow. Prepare to wait or switch yourself to some mid-sized and small-cap altcoins. The big pairs tend to move like Bitcoin. Each chart needs to be considered individually.

Thanks a lot for your support.

Feel free to leave a comment with your favorite altcoin for an update. I will do an analysis for you in the comments section below.

Namaste.

Powell’s Comments Could Decide BTC’s Fate: New ATH or Rejection!Bitcoin ( BINANCE:BTCUSDT ) has attacked the Support zone($116,900-$115,730) several times over the past week but failed to break through, meaning that buyers are still hoping for a BTC increase or even a new All-Time High(ATH) .

Bitcoin has reached a Resistance zone($119,530-$118,270) again and is trying to break the upper lines of the Symmetrical Triangle Pattern . The Cumulative Short Liquidation Leverage($117,255-$116,675) is important and includes high sell orders , so if Bitcoin can break the Resistance zone($119,530-$118,270) and the Resistance lines with high momentum , we can hope for a continuation of the upward trend.

Whether or not the Resistance zone($119,530-$118,270) and the Resistance lines break could depend on the tone of Jerome Powell’s speech today .

Jerome Powell will speak at the opening of the “ Integrated Review of the Capital Framework for Large Banks ” — the final major appearance before the Federal Reserve enters its pre-meeting blackout period.

Market Expectations:

The speech is officially about regulatory frameworks (like Basel III), but traders are watching closely for any hints regarding interest rate policy. Even indirect comments could move risk assets like BTC.

Rate Cut Signals?

With political pressure mounting (including criticism from Trump ) and markets pricing in a potential cut later this year, Powell may adopt a cautious, data-dependent tone emphasizing flexibility in decision-making.

--------------------

In terms of Elliott Wave theory , it seems that the wave structure of the main wave 4 correction is over. The main wave 4 has a Zigzag Correction(ABC/5-3-5) , so that the microwave B of the main wave 4 has a Double Three Correction(WXY) . Of course, the breakdown of the Resistance zone($119,530-$118,270) and Resistance lines can confirm the end of the main wave 4 .

Also, there is a possibility that the 5th wave will be a truncated wave because the momentum of the main wave 3 is high , and Bitcoin may NOT create a new ATH and the main wave 5 will complete below the main wave 3.

I expect Bitcoin to rise to at least the Resistance zone($121,000-$120,070) AFTER breaking the Resistance zone($119,530-$118,270) and Resistance lines .

Second Target: $121,620

Third Target: $123,820

Note: Stop Loss(SL)= $117,450

CME Gap: $115,060-$114,947

Cumulative Long Liquidation Leverage: $117,429-$116,878

Cumulative Long Liquidation Leverage: $116,053-$115,411

Please respect each other's ideas and express them politely if you agree or disagree.

Bitcoin Analyze (BTCUSDT), 1-hour time frame.

Be sure to follow the updated ideas.

Do not forget to put a Stop loss for your positions (For every position you want to open).

Please follow your strategy and updates; this is just my Idea, and I will gladly see your ideas in this post.

Please do not forget the ✅' like '✅ button 🙏😊 & Share it with your friends; thanks, and Trade safe.

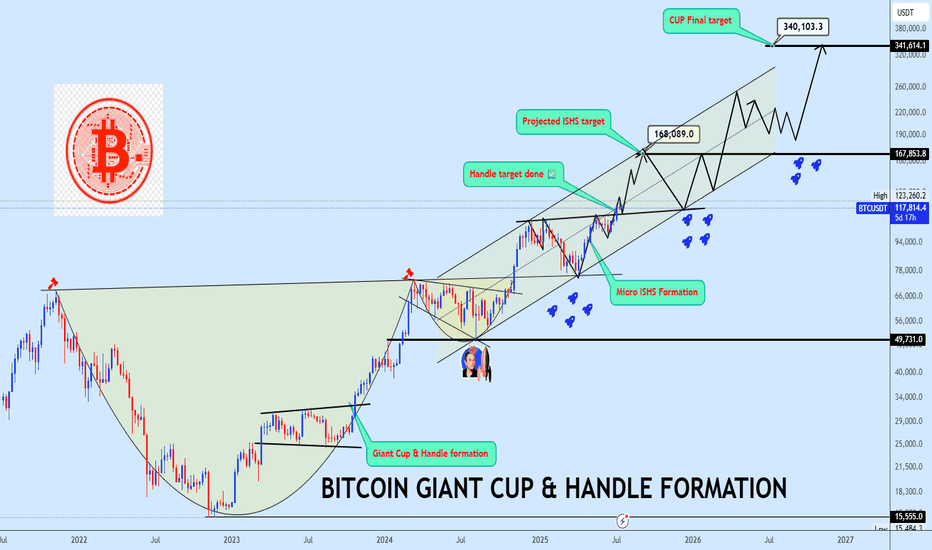

Bitcoin Bottom Three in progress targeting $340kBitcoin continues to defy the doubters, extending its dominance and triggering milestones that once seemed unreachable. A few years ago, we projected a massive rounding bottom with a target near $123K to complete the bottom two of the third halving cycle a bold forecast that has now played out in full:

📌

With bottom two now in the rearview, our focus shifts to bottom three of the fourth halving cycle, projected to mature around October 2025, barring time shifts:

📌

As shown on the chart, price has now split into a giant Cup & Handle formation and successfully broken out from the neckline. BTC is currently coiling inside a rising channel structure with trajectory toward the final projected target at $340K. A micro inverse head and shoulders (ISHS) formation has also emerged, offering a key accumulation zone near the neckline, this will be a crucial region to watch for entries.

Let price action do the talking. Share your view and let’s dissect this historic setup together.

BTCUSDTHello Traders! 👋

What are your thoughts on BITCOIN?

After setting a new all-time high, Bitcoin remains in a corrective phase, marked by sideways price action and choppy movements.

There's a notable gap around the $114,000 level, which may act as a magnet for price during this correction.

The ongoing pullback is likely to extend toward the key support zone, which aligns with the previous breakout level and the bottom of the ascending channel.

Once this support holds, we could see a bullish reversal, targeting the upper boundary of the channel once again.

As long as Bitcoin remains above the marked support zone, the overall structure stays bullish and this correction may present a buy-the-dip opportunity.

Will Bitcoin fill the gap and bounce back toward new highs? Let us know your thoughts! 🤔👇

Don’t forget to like and share your thoughts in the comments! ❤️

Bitcoin Technical Setup: Support Holds, Wave 5 in FocusBitcoin ( BINANCE:BTCUSDT ) filled the CME Gap($117,255-$116,675) and started to rise, as I expected in my previous idea .

Bitcoin is currently trying to break the Resistance zone($119,530-$118,270) . In the last week's movement, the price of $118,000 can be considered as one of the most important numbers for Bitcoin , with a lot of trading volume around this price.

In terms of Elliott Wave theory , it seems that Bitcoin has managed to complete the main wave 4 near the Support zone($116,900-$115,730) and Support lines . The structure of the main wave 4 is a Zigzag Correction(ABC/5-3-5) (so far). There is a possibility that the 5th wave will be a truncated wave because the momentum of the main wave 3 is high and Bitcoin may NOT create a new ATH and the main wave 5 will complete below the main wave 3.

I expect Bitcoin to start rising near the Potential Reversal Zone(PRZ) and Cumulative Long Liquidation Leverage($118,277-$118,033) , break the Resistance zone($119,530-$118,270) and reach the targets I have marked on the chart.

Note: Stop Loss(SL)= $116,960

CME Gap: $115,060-$114,947

Cumulative Short Liquidation Leverage: $121,502-$121,134

Cumulative Short Liquidation Leverage: $120,612-$119,783

Cumulative Long Liquidation Leverage: $116,810-$115,522

Do you think Bitcoin can create a new ATH again?

Please respect each other's ideas and express them politely if you agree or disagree.

Bitcoin Analyze (BTCUSDT), 1-hour time frame.

Be sure to follow the updated ideas.

Do not forget to put a Stop loss for your positions (For every position you want to open).

Please follow your strategy and updates; this is just my Idea, and I will gladly see your ideas in this post.

Please do not forget the ✅' like '✅ button 🙏😊 & Share it with your friends; thanks, and Trade safe.

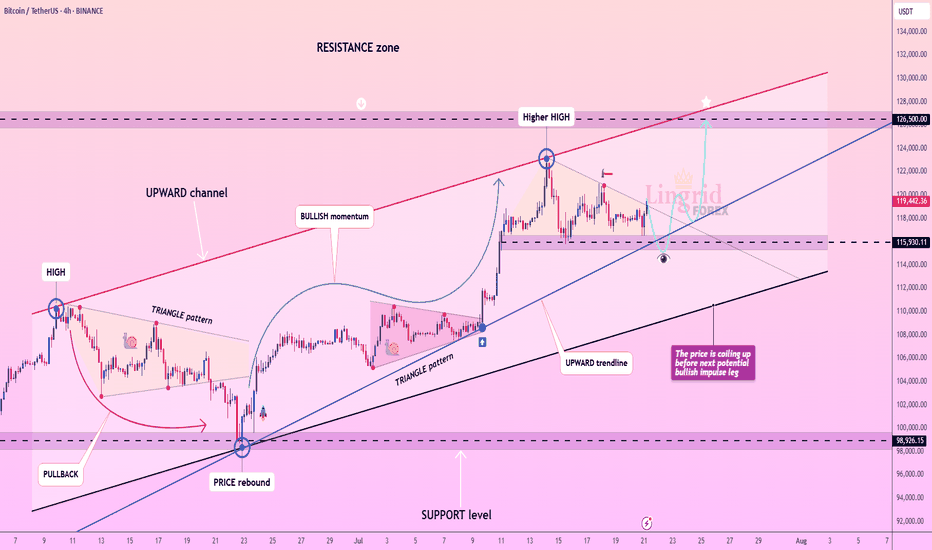

Lingrid | BTCUSDT Consolidation Expansion ScenarioBINANCE:BTCUSDT is coiling within a bullish continuation zone after rebounding strongly from the 115,930 support and holding above the blue ascending trendline. Price formed a higher high inside the rising channel, followed by sideways consolidation, suggesting preparation for another bullish leg. The triangle pattern breakout and price stability above the trendline favor upward continuation toward the resistance at 126,500. Momentum remains intact while the structure supports the next breakout push.

📉 Key Levels

Buy trigger: Break and hold above 120,000

Buy zone: 117,500–118,200

Target: 126,500

Invalidation: Close below 115,930

💡 Risks

Loss of support at the trendline

Strong rejection near red channel resistance

Weak market sentiment or macro news shocks

If this idea resonates with you or you have your own opinion, traders, hit the comments. I’m excited to read your thoughts!