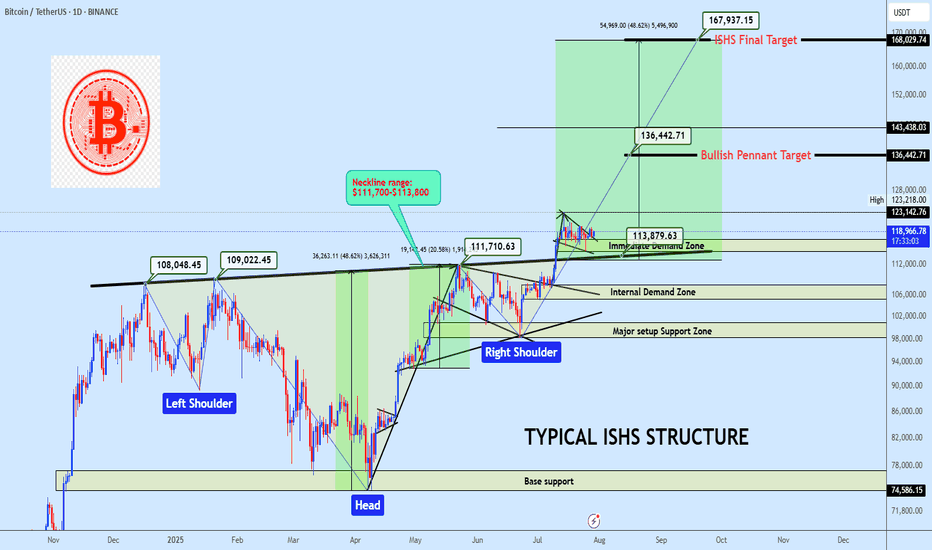

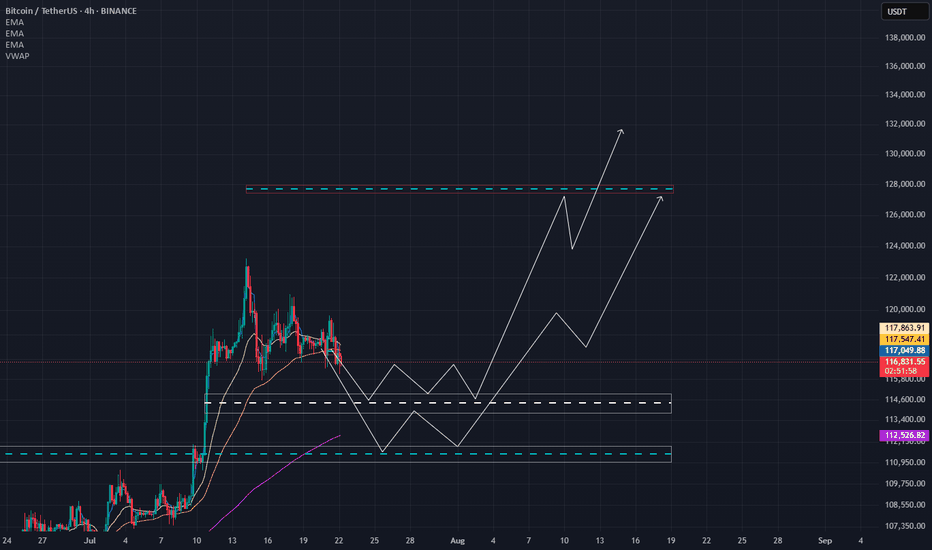

BTCUSDT ISHS Breakout with Bullish Pennant ContinuationBTC is holding above a clean neckline breakout from a inverse head and shoulders formation, currently consolidating inside a bullish pennant. A breakout from this range offers continuation potential to $136K and possibly to $168K. Bias remains bullish while price holds above the $114K region.

Market Structure

• Trend: Bullish continuation

• Pattern: Inverse Head & Shoulders + Bullish Pennant

• Price Action: Clean breakout and retest of neckline support, followed by tightening consolidation

Key Zones

• Immediate Demand Zone: $114,000 – $117,000

• Internal Demand Zone: $105,000 – $108,000

• Major Setup Support Zone: $98,000 – $101,000

• Base Support (ISHS Origin): $74,500 – $77,000

• Neckline: $111,700-$113,800 (Confirmed pivot level)

Technical Confluence

• Volume: Strong candle breakout through neckline, followed by low-volume bullish flag

• Price Geometry: ISHS measured move aligns with the final target at $168K

• Momentum: Bullish structure maintained with higher lows and reactive demand

Entry Plan

• Zone: $117,500 – $119,000

• Method: Limit buy on demand retest or breakout retest of $123K

• Execution: Swing entry with invalidation below demand base

Targets

• 🎯 TP1: $136,442 — Pennant measured move

• 🎯 TP2: $168,029 — Final ISHS target

Invalidation

• ❌ SL: Below $110,000

• Reason: Break below ISHS Neckline invalidates bullish thesis in the short term

• RRR: Estimated 1:4 depending on execution

If this structure aligns with your outlook, feel free to share your thoughts in the comments.

You’re also welcome to drop your preferred altcoins for a quick technical review.

BTCUSDT trade ideas

Deep Dive Into Bollinger Bands 🗓This article explores the Bollinger Bands indicator—a powerful volatility tool used by traders worldwide. You'll learn how it works, how to calculate it, and how to use it to detect potential breakouts, trend reversals, and overbought or oversold conditions in the market.

📚 Introduction to Bollinger Bands

In the fast-paced world of trading, understanding market volatility is key to making informed decisions. Bollinger Bands, developed by John Bollinger in the 1980s, offer a visual and statistical method to measure this volatility. Unlike simple moving averages, which only tell you the trend, Bollinger Bands expand and contract based on recent price action, helping traders spot overbought, oversold, or consolidation phases.

These bands dynamically adjust to market conditions, making them one of the most popular indicators for trend-following, mean-reversion, and breakout strategies. Whether you’re trading crypto, stocks, or forex, Bollinger Bands can help you identify high-probability setups by combining trend direction with volatility.

📚 How Bollinger Bands Are Calculated

Bollinger Bands consist of three lines:

Middle Band – This is a simple moving average (SMA) of the price, typically over 20 periods.

Upper Band – The middle band plus two standard deviations.

Lower Band – The middle band minus two standard deviations.

Middle Band = SMA(n)

Upper Band = SMA(n) + (k × σₙ)

Lower Band = SMA(n) - (k × σₙ)

Where σₙ is the standard deviation of the price for n periods and k is the multiplier, typically set to 2, which captures ~95% of price action under normal distribution. The middle band shows the average price over the last 20 candles. The upper and lower bands adjust based on how volatile the price has been — expanding in high volatility and contracting in low volatility.

🤖 For those traders who want to implement Bollinger Bands into algorithmic strategy we provide formula it's calculation in Pine Script:

basis = ta.sma(src, length) // Middle Band (SMA)

dev = mult * ta.stdev(src, length) // Standard Deviation × Multiplier

upper = basis + dev // Upper Band

lower = basis - dev // Lower Band

📚 How to Use MACD in Trading Strategies

⚡️Bollinger Band Squeeze (Volatility Contraction and Expansion)

The idea is pretty simple, а squeeze indicates low volatility and often precedes a breakout. The squeeze is the situation when the Upper Band and Lower Band contract, and BB width is at a local minimum. In this case you shall be prepared for the high volatility after the period of low volatility. This strategy doesn’t predict direction — it prepares you for volatility.

Long setup:

Price is in long-term uptrend, you can use 200 EMA as a major trend approximation - price shall be above it.

Bollinger Bands is narrow in comparison to the previous period. Price usually is in sideways.

Open long trade when candle shows a breakout and closes above the Upper Band.

Set a trailing stop-loss at the Middle Band.

Short setup:

Price is in long-term downtrend, you can use 200 EMA as a major trend approximation - price shall be below it.

Bollinger Bands is narrow in comparison to the previous period. Price usually is in sideways.

Open short trade when candle shows a breakdown and closes below the Lower Band.

Set a trailing stop-loss at the Middle Band

📈Long Trading Strategy Example

1. Price candle shall be closed above 200-period EMA. In our example we have BITMART:BTCUSDT.P 4h time frame.

2. Bollinger Bands shall be narrow in comparison with the previous periods.

3. Open long trade when candle closes above the Upper Band.

4. Close trade when price touched the Middle Band.

📉Short trading strategy example

1. Price candle shall be closed below 200-period EMA. In our example we have BITMART:BTCUSDT.P 4h time frame.

2. Bollinger Bands shall be narrow in comparison with the previous periods.

3. Open short trade when candle closes below the Lower Band.

4. Close trade when price touched the Middle Band.

⚡️Mean Reversion (Rebound from the Bands)

This is the most common approach to use Bollinger Bands. The idea is also very simple, we just want to open long if price touches Lower Band and short if price reaches Upper Band. Price tends to revert to the mean (Middle Band), especially in range-bound markets. It's very important to trade in the direction of the major trend to reduce the probability of the large move against you.

Long setup:

Price is in long-term uptrend, you can use 200 EMA as a major trend approximation - price shall be above it.

Open long trade when price touches the Lower Band.

Set the initial stop-loss at the fixed percentage below entry price. Choose this percentage number with your personal risk/money management, you shall be comfortable to lose this amount of money in case of stop-loss hit.

If price reached Middle Band set stop-loss at breakeven.

Close trade when price reached the Upper Band.

Short setup:

Price is in long-term downtrend, you can use 200 EMA as a major trend approximation - price shall be below it.

Open short trade when price touches the Upper Band.

Set the initial stop-loss at the fixed percentage above entry price. Choose this percentage number with your personal risk/money management, you shall be comfortable to lose this amount of money in case of stop-loss hit.

If price reached Middle Band set stop-loss at breakeven.

Close trade when price reached the Lower Band.

🧪 Important: the most common approach to close trades is the Middle Band touch, this is classic mean reversion. We experimented multiple times with different approached and revealed that usually it's better to take profit at the Upper/Lower band for long/short trades and use Middle Band only for setting stop-loss at breakeven. This approach provides better risk to reward ratio.

📈Long Trading Strategy Example

1. Price candle shall be closed above 200-period EMA. In our example we have BITMART:BTCUSDT.P 4h time frame.

2. Open long trade the Lower Band.

3. Put Initial stop-loss 2% below the entry price.

4. When price reached Middle band place stop-loss at the breakeven.

5. Close long trade at the Upper Band.

📉Short trading strategy example

1. Price candle shall be closed below 200-period EMA. In our example we have BITMART:BTCUSDT.P 4h time frame.

2. Open short trade the Upper Band.

3. Put Initial stop-loss 2% above the entry price.

4. When price reached Middle band place stop-loss at the breakeven.

5. Close short trade at the Lower Band.

🧪 Important tip: notice that initial stop-loss is needed only to avoid disaster in case of price moves strongly against you. This percentage shall give enough space to avoid its reaching too often. Mean reversion strategy provides fast trades with the small average gain, so you shall maintain the high win rate (perfectly above 70%). You have to choose stop-loss based on particular asset volatility.

⚡️Combined Approach: Mean Reversion + Trend Following

Skyrexio made multiple researches about Bollinger Bands strategies and we found that we can receive better gains in combination of different approaches. Mean reversion gives you great entry with discount but you don't need to exit that early. Use the trading stop and allow to gain profit while market is moving in your direction.

This approach you can find in our advanced strategy Bollinger Bands Enhanced Strategy which we shared in 2024. Click on the link to read about it and understand how you can combine best features of this popular indicator.

📚 Conclusion

Bollinger Bands are more than just a volatility indicator — they provide a flexible framework for understanding price dynamics and market conditions. By visualizing the relationship between price and standard deviation around a moving average, traders can gain valuable insights into whether an asset is consolidating, trending, or preparing for a breakout.

The real strength of Bollinger Bands lies in their versatility. They can adapt to different trading styles — whether you’re a short-term scalper, a swing trader, or a long-term position holder. From identifying squeeze setups to riding strong trends or capturing mean reversion moves, BBs offer a strategic edge when used correctly.

However, Bollinger Bands should never be used in isolation. Like any technical tool, they work best when combined with momentum indicators like RSI or MACD, volume analysis, and price action signals. Context is key: a signal that works well in a ranging market may fail during high momentum trends.

Ultimately, Bollinger Bands help traders make more informed, disciplined decisions by clarifying where price stands relative to recent history. When paired with sound risk management and broader market awareness, they become a powerful ally in navigating market uncertainty.

Could this be the end of Bitcoin’s trend?The Current State of Bitcoin’s Trend: Has the Uptrend Come to an End...?

Based on recent analyses, Bitcoin has exited its 4-hour channel over the past few days, and there is still a possibility for further correction. However, this does not mean that the uptrend for Bitcoin is over.

My targets for Bitcoin remain the same as before: 123,700 and 129,710. It’s even possible that we might see a wick above these prices.

For those with more capital who are looking to buy Bitcoin, there are two good entry levels:

110,880

109,770

Everything else is clearly shown on the chart. Please be cautious, as there will likely be high volatility once the market opens.

Be sure to open the analysis link and boost the analysis with your likes.

BTC HUGE DROP TO 113,400$ - BIG CRASH !*Sorry for posting to late as I am between a trip in Malaysia.*

Details:

Entry: Now - 117,000 $

Target Price: 113,410 $

Stop loss: 119,460 $

Trade Ideas:

Market creating a flag pattern here. Though its not only the logic we have some secret logics here and indicators which I shared in the VIP.

What is required to Join VIP?

- Nothing just you have to share 10% of your profit with us at the end of the month which you earned from our signals. Yeah this is just the requirement, trade where ever you like your favorite broker or else you don't need to pay fees first or create account thru our link.

Trade Signal:

I provide trade signals here so follow my account and you can check my previous analysis regarding BITCOIN. So don't miss trade opportunity so follow must.

BINANCE:BTCUSDT BINANCE:BTCUSDT.P BINANCE:BTCUSD

BTC - 1H Elliott Wave AnalysisWelcome back to another Elliott Wave Analysis for Bitcoin! :)

In this analysis we want to focus on the short term. We have been in a correction displayed as pink ABC and it seems that this correction is coming or has come to an end in the pink Wave C.

It is hard to say if the pink Wave C has finished yet. The last low at 111'850 USD is the 1 to 1 ratio of the pink Wave A to the pink Wave C which is a common target for Wave C.

Looking at the sub-count in white we think another low in white Wave 5 would look cleaner but it is not given to happen.

For now we added the white Wave 4 resistance of which we touched the 0.5 FIB retracement at 115'830 USD which is a rather deep but valid Wave 4. We also added the 0.618 FIB at 116'213 USD which would be the invalidation for the white Wave 4. If we hit it the probabilities shift to the case that the low at 111'850 USD is already the end of pink Wave C.

If we get white Wave 5 the first target would be at the 1 to 1 FIB at 111'319 USD which is right below the last ATH of which we bounced recently but that seems a bit shallow.

The next target would be at around 109'700 USD where we got some confluence between the 1.38 FIB target for white Wave 5 measured with the white Wave 1 as well as the 1.618 FIB target if we measure of the white Wave 4. It is also close to the 0.5 FIB of a bigger support area.

Be aware that the bigger support area below goes down to 103'000 USD which is the 0.786 FIB of the support area.

Due it looking likely that pink Wave C is finished we also added the support area for the potential Wave 2 in the bullish scenario.

It is between the 0.5 FIB at 113'640 USD and the 0.786 FIB at 112'616 USD. From this area we would like to see a bounce if the low is already in.

Thanks for reading.

We would appreciate a follow and boost if you like the analysis! :)

NO FINANCIAL ADVICE.

Bitcoin stop loss hunting end, entry for Long is now!!Hi on this chart that may happen with more than 70% possibility we have one of the easy setups and strategy which i call it FAKEOUT&LIQUIDTY this happen usually near trendline support or range zone support or even resistance and after a possible fakeout usually market kick sellers or Buyers and then with high volume market reverse.

I saw High volume and Fake breakout in my mind and i think it can be one of those times so we open long and lets now wait for this 1:2(Risk:Reward) signal to play.

DISCLAIMER: ((trade based on your own decision))

<<press like👍 if you enjoy💚

Bitcoin Could Accept bearish TrendBitcoin is currently testing a key resistance zone between 120,000 and 121,000. While price action is attempting to break higher, market conditions suggest the possibility of a false breakout rather than a sustained bullish continuation.

BTC has approached a significant resistance band, and early signs of exhaustion are visible. Unless the price decisively holds above 121,000, any breakout may lack conviction. Given the broader unresolved downtrend, a corrective move remains likely.

If the breakout fails to sustain, we anticipate a pullback toward the 117,000 to 115,000 range. This would align with a retest of previous support zones and continuation of the short-term bearish structure.

Ps: Support with like and comments for better analysis Thanks.

#BTCUSDT – Healthy Correction, Not the End!Bitcoin is currently experiencing a healthy pullback after an impressive run, testing the neckline of the Inverse Head & Shoulders breakout on the 1D timeframe.

🔹 Current Market View:

BTC is retesting the neckline of the IHS pattern, which now acts as a strong support zone.

Price is holding near $113K–$115K, which is crucial for maintaining bullish momentum.

This dip is a healthy correction, flushing out over-leveraged positions and preparing for the next leg up.

🔹 Key Levels:

Support Zone: $113,000 – $115,000

Immediate Resistance: $120,000 – $122,500

Breakout Target: $165,000+ on the next bullish wave

🔹 Market Sentiment:

Holding above the neckline keeps the bullish structure intact.

If the support holds, we can expect continuation to new highs once buying pressure returns.

A daily close below $112K would signal caution and delay the next rally.

💡 Tip: Don’t panic on these red candles. Healthy corrections are part of a sustainable uptrend.

Market StructureIf we look at the underlying market structure, Bitcoin's structure isn't fully formed yet. There are still unsolved puzzles around 135,000. I believe Bitcoin will finalize its final structure around 135,000, which will be its expansionary structure.

The final candle on this weekly timeframe will determine Bitcoin's direction. This August, Bitcoin will either continue its bullish structure or continue its minor retracement.

Disclamer: Any information provided is for educational and informational purposes only and does not constitute investment advice.

Important Volatility Period: August 2nd - 5th

Hello, fellow traders!

Follow us for quick updates.

Have a great day!

-------------------------------------

(BTCUSDT 1M Chart)

Let's take a moment to check the trend before the new month begins.

There have been two major declines so far, and a third major decline is expected next year.

For the reason, please refer to the "3-Year Bull Market, 1-Year Bear Market Pattern" section below.

-

My target point for 2025 is around the Fibonacci ratio of 2.618 (133889.92).

However, if the price surges further, it could touch the Fibonacci range of 3 (151018.77) to 3.14 (157296.36).

If it rises above 133K, it's expected that prices will never fall below 43823.59 again.

Since the HA-Low indicator hasn't yet been created on the 1M chart, we need to monitor whether it appears when a downtrend begins.

Based on the current trend, the HA-Low indicator is expected to form around 73499.86.

More details will likely be available once the movement begins.

-

The basic trading strategy involves buying in the DOM(-60) ~ HA-Low range and selling in the HA-High ~ DOM(60) range.

However, if the price rises above the HA-High ~ DOM(60) range, a step-up trend is likely, while if the price falls below the DOM(-60) ~ HA-Low range, a step-down trend is likely.

Therefore, the basic trading strategy should be a segmented trading approach.

The further away from the HA-High indicator, the more likely it is that the DOM(60) indicator will act as a strong resistance when it forms.

Therefore, if the current price and the HA-High indicator are trading far apart, and the DOM(60) indicator forms, it is expected to face significant resistance.

-

Looking at the current trend formation, the high trend line is drawn correctly, but the low trend line is not.

This is because the StochRSI indicator failed to enter the oversold zone.

Therefore, the low trend line is marked with a dotted line, not a solid line.

Therefore, what we should pay attention to is the high trend line.

We need to see if the uptrend can continue along the high trend line.

-

(1D chart)

If we use the trend lines drawn on the 1M, 1W, and 1D charts to predict periods of volatility, the periods around August 5th and August 13th are significant periods of volatility.

By breaking this down further, the volatility periods are around July 31st, August 2nd-5th, and August 13th.

Therefore, trading strategies should be developed based on the assumption that the volatility period extends from July 30th to August 14th.

The current price is moving sideways in the 115,854.56-119,177.56 range.

This range, the HA-High ~ DOM (60), is a crucial area to consider for support.

This will determine whether the price will continue its upward trend by rising above 119,177.56, or whether it will turn downward by falling below 115,854.56.

If the price falls below 115854.56, it is expected to meet the M-Signal indicator on the 1W chart and reestablish the trend.

The HA-High indicator on the 1W chart is forming at 99705.62, and the DOM (60) indicator on the 1W chart is forming at 119086.64.

Therefore, when the price declines, it is important to check where the HA-High indicator on the 1W chart forms and determine whether there is support near that point.

-

The On-Board Value (OBV) indicator within the Low Line ~ High Line channel is showing a downward trend.

If the OBV falls below the Low Line, the price is expected to plummet.

Therefore, it is necessary to closely monitor the movements of the OBV indicator.

The Trend Check indicator is a comprehensive evaluation of the StochRSI, PVT-MACD Oscillator, and On-Board Value (OBV) indicator.

The TC (Trend Check) indicator interprets a rise from the 0 point as a buying trend, while a decline indicates a selling trend.

In other words, a rise from the 0 point is likely to indicate an uptrend, while a decline is likely to indicate a downtrend.

Currently, the TC (Trend Check) indicator is below the 0 point, suggesting a high probability of a downtrend.

However, if the TC (Trend Check) indicator touches a high or low, the trend may reverse.

In other words, touching a high increases the likelihood of a reversal from an uptrend to a downtrend, while touching a low increases the likelihood of a reversal from a downtrend to an uptrend.

When such movements occur, it's important to consider the support and resistance levels formed around the price level to determine a response.

In other words, consider the support and resistance levels formed at the current price level.

As a significant period of volatility approaches, prepare to transition from box trading to trend trading.

-

Thank you for reading to the end.

I wish you successful trading.

--------------------------------------------------

- Here's an explanation of the big picture.

(3-year bull market, 1-year bear market pattern)

I'll explain more in detail when the bear market begins.

------------------------------------------------------

This is why I firmly believe we'll witness BTC reach 150K soon.No caption needed and every reasons are kept in the chart. Zoom In and analyze every single lines in the chart and hope you will see what I tend to see as far as my capabilities allows me. Let me know your comments on the idea. I am looking forward to witness $150K in the next 3 to 4 months time. I will be updating my confluences to say this on higher timeframes too.

With Regards. And stay Tuned.

From Fakeout to Takeoff: How the V-Pattern REALLY WorksEver seen a support level break, only for the price to rocket back up in a V-shape? That’s the V-Pattern in action! In this post, Skeptic from Skeptic Lab breaks down the step-by-step mechanics of this powerful setup. From the fakeout that traps short sellers to the surge of buy orders from liquidations, you’ll learn exactly how buyers flip the script and create explosive reversals. Perfect for traders looking to spot high-probability setups. Join me to decode the markets—check out the steps and level up your trading game!

BTC – Still looking heavy below key resistanceDespite a short-term relief bounce after Monday’s drop, BTC remains below the critical 1D MSS + S/R (red box). Structure is weak until this level is reclaimed. Bears remain in control as long as price can’t close above 115.7k.

Plan:

Maintain bearish bias while below the red box — expecting new lows, targeting the green demand/OB cluster around 108.3k.

Flip the red box (close above 115.7k) and the outlook shifts to neutral or bullish.

Still Losing After Backtesting? This Fixed It.Let’s get straight to it.

If you’ve gone through the "nerd arc" and the "backtesting arc" but still aren’t profitable...

What’s the fix?

In this short write-up, I’ll walk you through 3 brutal truths that made me finally see green.

Is it hard?

UH—Damn right.

But let’s go 👇

1. Market Understanding

This isn’t something you "learn" from a course.

It’s something that clicks after dozens of stop losses and live trades.

Here are a few ways I got more comfortable with it:

1. Don’t fear opening trades or hitting stop loss.

Each trade gives you data. More trades = more experience = better market feel.

What’s the requirement? Capital and risk management. Without that, you won’t even survive long enough to "get" it.

2. Journaling every single trade.

Write everything: your thoughts, screenshots, feelings — before and after.

Too lazy to do it? Left trading. Simple.

3. Be the detective.

Read the chart like a story. No, seriously.

Think of Bitcoin as a character with real moods.

Every candle tells you something.

That 5% pump? Buyers pushing up. Then bears smacked it down — candle closed red.

Now price is bleeding again.

Why?

🔍 Be the detective.

4. Analyze the market every day — even without trading.

The more you observe, the more you see. Structures. Patterns. Behavior.

Easy? Nah.

It takes discipline — like posting one story text to Insta for 1,000 days straight. Still wanna try?

2. Personal Trading Plan

Remember how I said "don’t fear opening trades"?

Well — after you’ve opened a bunch, you can start tailoring your own trading plan based on you.

This isn’t a PDF you can steal off Google.

Only after seeing how you behave in trades, you’ll know what rules make sense.

Maybe:

"I don’t trade when I’m emotionally off."

"This setup gave me the best results over 100 trades."

Just don’t copy-paste someone else’s rules.

Make a flexible structure, then let the details emerge from the market and your own experience.

Now —

Take a deep breath.

When was the last time you enjoyed your coffee?

More than a day ago?

Go make one now.

Might not get to taste it tomorrow.

Not everything in life is trading :)

3. Psychology

Ah, the final boss.

Still my weakest area, honestly.

But here are a few real things that helped:

Tip 1: WRITE.

Just write whatever you feel.

Telegram saved messages? Notebook?

Or if you're like me (🧠nerd), Notion.

Do it for 60 days straight — then feed that journal to ChatGPT and analyze yourself.

Takes time, but the patterns you'll see are... magical.

Tip 2: Money & Risk Management.

When you know your stop loss means only -0.25% of your capital…

why should you panic?

For me:

I place the SL, set a TP alert, and leave the screen.

No emotions, no fear.

Why? Because when capital is protected, so is my psychology.

Truth is, trading emotions aren’t just during the trade — they live in your head all day.

When your mental energy’s drained?

You’ll miss A+ setups.

Fall for BS ones.

Lose focus.

It’s complicated.

Because humans are complicated.

Our brains are the most tangled system known.

And somehow, out of all that noise, consciousness emerges.

A miracle.

So don’t expect to always feel calm.

Just aim to get better.

That’s it.

Thanks for sticking around.

These are just my thoughts, from one tired trader to another 🧠

I’m no expert—just sharing what’s worked (and what hasn’t).

If it helped, a boost would mean a lot.

🚫 Don’t FOMO

✅ Manage your capital

Until tomorrow —

Peace out. ✌️

Bitcoin - Will the liquidity at $122K be the next target?Bitcoin is currently trading within a defined corrective channel, which has been developing over the past few weeks. Price action within this structure has been characterized by a sequence of lower highs and lower lows, suggesting a mild downtrend. However, these movements lack strong momentum, indicating that the market is consolidating rather than entering a deeper correction. This kind of structure often precedes a significant breakout, and given the nature of the current price action, a retest of previous highs remains a realistic possibility.

Bullish Scenario

Looking at the overall structure of the channel, a bullish breakout seems increasingly likely. For this scenario to unfold, BTC needs to hold the midline of the channel as support. If this level is respected, it could pave the way for a push towards the upper boundary of the channel and a potential break above the lower high structure near $120,000. A successful breach of that level could trigger a move toward the $122,000 liquidity zone, with the potential to challenge the all-time high (ATH) in the near future. Holding the midline and breaking above key resistance would provide confirmation of strength and continuation to the upside.

Bearish Scenario

On the flip side, if BTC fails to hold the midline as support and starts closing below it on the 4H timeframe, we could see a renewed move toward the lower boundary of the corrective channel. This could lead to a test of the unfilled 4H fair value gap (FVG) highlighted in the chart, located around the $112,000 – $113,000 area. This zone also coincides with a strong historical support level, making it a logical area where buyers might step in and provide the momentum needed for a more sustainable bullish reversal.

Final Thoughts

While both scenarios remain valid, the price structure within the corrective channel currently leans slightly more toward a bullish outcome. The lack of aggressive selling and the potential for liquidity above the previous highs support this view. However, trading is never about certainty but about preparing for various possibilities. Being aware of both bullish and bearish setups allows traders to react with flexibility and discipline depending on how the market unfolds in the coming sessions.

-------------------------

Thanks for your support. If you enjoyed this analysis, make sure to follow me so you don't miss the next one. And if you found it helpful, feel free to drop a like 👍 and leave a comment 💬, I’d love to hear your thoughts!

Bitcoin BTC price analysis by the end of 2025🕯 July is coming to an end, with 3 weeks of OKX:BTCUSDT consolidation between $117k–121k.

Tomorrow begins the last month of summer — and it promises to be "hot" as, according to our earlier published calendar Trump's administration plans to send letters with new, increased tariffs to "all countries" on 01.08.

💰 Also, take a look at Bitcoin Monthly Returns. In our view, 2025 resembles 2020 the most.

What do you think?

👉 According to this dynamic, the real "hot" may come not in summer, but late autumn.

💰 We've also tried to find a price fractal for #BTCUSD that fits the current structure — and for now, it looks plausible:

◆ In the coming days, CRYPTOCAP:BTC should not rise above $121k.

◆ A low of correction might hit mid-September around $93k.

◆ A cycle top for #BTC could arrive to the end of 2025, near $147k.

📄 Now that you've seen our version — share your forecasts on future #BTCUSDC price action in the comments 👇

BITCOIN BTCUSDT BUYING SETUPBitcoin is currently showing bullish momentum after a clear market structure (MS) shift. The price has formed a bullish reversal and is now retracing after a short-term rally.

We expect BTCUSDT to pull back into the highlighted demand zone (green area), which aligns with previous structure and volume support. If the price taps this zone and shows bullish confirmation, it could present a high-probability buy entry for the next upward leg.

📌 Trade Plan:

✅ Wait for price to enter the green zone

✅ Look for bullish price action or volume confirmation

✅ Target higher highs if support holds

Always manage your risk properly and wait for clear confirmation!

BTCUSD going to touch 116,800BITSTAMP:BTCUSD Long trade, with my back testing of this strategy, BTCUSD need to touch 116,800

This is good trade, don't overload your risk like greedy, be disciplined trader, this is good trade.

Use proper risk management

Looks like good trade.

Lets monitor.

Use proper risk management.

Disclaimer: only idea, not advice

BITCOIN CRASH PREDICTED! HERE’S WHAT HAPPENS NEXT! (scary)Yello Paradisers, Bitcoin crashed exactly as we predicted in the previous videos that it will happen with the highest probability.

In this video I am explaining to you what's gonna happen next.

Head and shoulders, neckline, is be breaking to the downside, we need a clear confirmation of a reclaim Our channel on high timeframe is getting breakout to the downside and confirmation was that a reclaim was already successful.

In this video I'm sharing with you Elliott Way theory on low timeframe and what needs to be done for confirmation perspective in order for us to continue to go to the downside or have a reversal to the upside.

Don't be a gambler. Don't try to get rich quick. Make sure that your trading is professionally based on proper strategies and trade tactics.