BTCUSDT trade ideas

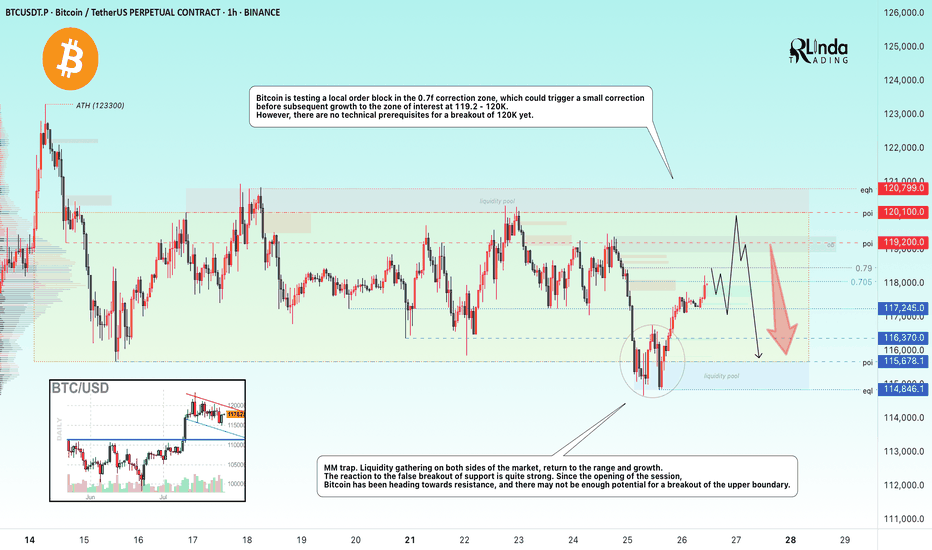

BITCOIN → Correction within a downward channel. 112K or 125K?BINANCE:BTCUSDT is consolidating. However, a local downward trading range is forming relative to the current setup. What is the probability of a correction continuing to 112K or growth to 125K?

Daily structure: a local correctional channel within a global bullish trend. We have cascading resistance at 119.2, 119.6, 120, and 120.8. It will be quite difficult to break through this zone on the first attempt, but MM can use it to form traps and collect liquidity.

At the bottom, everything is simpler — a breakdown of the local bullish structure, the formation of an intermediate minimum, below which there is a void down to 112K.

Yesterday, relative to 115-116K, mm staged a massacre (trap) on both sides of the market.

Liquidity collection, return to the range, and growth. The reaction to the false breakdown of support is quite strong. Since the opening of the session, Bitcoin has been heading towards resistance, but there may not be enough potential to break through the upper resistance conglomerate, so I expect to see a pullback or decline to 116-115-114.

Resistance levels: 119.2, 120.1, 120.85

Support levels: 116.37, 115.67, 112

Technically and fundamentally, I do not see any drivers that could support the market (I am talking about Bitcoin, since the driver for altcoins is the decline in Bitcoin's dominance). It is possible that this may appear later. In the current situation, I am considering a false breakout and correction, as the market has not yet finished consolidating or correcting, and the current downward trading range may be extended.

PS: As the price moves towards resistance, it is necessary to monitor the reaction. The market itself will show what it is preparing for...

Best regards, R. Linda!

BITCOIN BULLISH POSSIBLE VIEW🧠 Key Observations (Smart Money Concepts - SMC Style)

🔄 Market Structure:

MSS (Market Structure Shift): Price recently made a MSS after a BOS (Break of Structure), indicating a shift to bullish structure.

BOS (Break of Structure): Seen on the move up from the demand zone.

SSL (Sell-side Liquidity) taken before the recent bullish move — classic liquidity sweep behavior.

📦 Zones:

Demand Zone: Between ~$111,000 and ~$113,000

4HR Supply Zone: Around ~$115,000 to ~$116,000 — where price is currently reacting.

Golden Zone (Entry/POI): Near the origin of the move that caused the BOS.

📍 Entry & TP/SL Setup:

Buy Limit: Placed at 111,931.32, right at the edge of the demand block.

Stop Loss (SL): Set just below at 110,453.42

Take Profit (TP): Targeting 113,676.39, right before the next resistance.

📊 Volume Analysis:

Large bullish volume spike aligns with the most recent BOS.

Diminishing sell volume during retracement suggests exhaustion of bearish momentum.

✅ Trade Idea (Based on Chart Setup):

Bias: Bullish

Entry: 111,931.32 USDT

Stop Loss: 110,453.42 USDT

Take Profit: 113,676.39 USDT

Risk/Reward: ~1:1.5 to 1:2

🔍 Additional Notes:

Liquidity Sweep: SSL cleared → indicates potential for long setups.

BOS + MSS Confluence: Bullish intent confirmed.

BB (Break of Block): Indicates intent to move higher if resistance is broken.

ERL Target: Final target is shown far above current price, near 123,280.88, could be a longer-term swing target if price holds structure.

🔄 Next Steps (as per typical TradingView publish ideas):

Set alerts at the demand zone.

Monitor price action when it taps into the Buy Limit level.

Watch for confirmation candle or volume spike before manual execution (if not using limit orders)

Market - BTC - ETH Analysis

💎 Market - BTC - ETH Analysis💎

🟠 Current Market Status: ⚠️ / Low Risk-Reward ❗️ / Avoid Overtrading 🚫

🔷 BTC/USDT (Multi-Timeframe Analysis)

• Weekly (HWC): Last week’s red candle tapped into a buyer zone. A balance or sideways movement is likely this week.

• Daily (MWC): Minor retracement in a downtrend. No clear bullish reversal yet.

• 4H (LWC): Still in a downtrend. For a bullish reversal, we need a Higher Low (HL) followed by a break of the previous High.

• 1H: Breakout above level 116 would signal a short-term trend reversal. Breaking the upper channel confirms bullish continuation in the lower timeframe.

✅ Strategy Outlook:

• HWC: Bullish

• MWC: Bullish

• LWC: Bearish

→ We're not shorting based on LWC unless it turns bullish or MWC flips bearish.

🕒 Conclusion: Stay on the sidelines until the structure shifts clearly.

🔶 BTC Dominance (BTC.D)

• Currently rejected in the 4H chart, but not yet a confirmed bearish structure.

🧭 Two setups to watch before rotating into altcoins:

1. Clear lower highs and lower lows in 1H and 4H

2. Box formation and breakdown in lower timeframes

🚨 Key Level: A break below 60.40 may trigger sharp altcoin rallies.

🌐 TOTAL / TOTAL2 / TOTAL3

• All three charts share a similar structure.

• 1H TOTAL: Break of 4.72 confirms a V-pattern and may trigger upside momentum.

• TOTAL2: Watch 1.42 as a critical level.

→ Until then: No action – Wait for breakout confirmation.

💵 USDT Dominance (USDT.D)

• Ideally should not retrace beyond 4.64 – if it forms a top here, that’s a bullish sign for the market.

• Level 4.44 is less relevant for now.

• Failure to reclaim 4.53 increases the importance of 4.64.

• If it starts dropping, enter before a breakdown of 4.13 to stay ahead of bearish pressure.

🟠 ETH/BTC

• Consolidating in a 4H box.

• Break of 0.03278 is a trigger for long ETH exposure — ideally hold post-breakout.

• Wait for SMA7 on the Daily to turn upward for stronger confirmation.

• Break of 0.03288 on ETH/BTC likely aligns with $3850–$4000 breakout on ETH/USDT.

→ Position should be taken before this breakout to catch the move early.

📌 Final Note:

We are in a low momentum, low R/R environment.

Only trade confirmed breakouts and structural shifts.

Avoid overtrading, keep risk exposure limited, and rely on higher-timeframe confluences for clearer direction.

BTCUSDT: Trend in daily time frameThe color levels are very accurate levels of support and resistance in different time frames.

A strong move requires a correction to major support and we have to wait for their reaction in these areas.

So, Please pay special attention to the very accurate trend, colored levels, and you must know that SETUP is very sensitive.

BEST,

MT

its btc short according to mirrior concept A Bitcoin short position based on Fibonacci levels and market sentiment is a trading strategy to profit from a price drop.

It involves:

1. **Technical Analysis:** Using Fibonacci retracement levels (e.g., 61.8%) to identify a potential price reversal point after a bounce.

2. **Sentiment Analysis:** Confirming the reversal signal by checking for "extreme greed" in the market, which suggests overbought conditions and an impending correction.

A trader enters a short trade when both signals align, expecting the price to fall from that key resistance level.

Quick Bitcoin Analysis – 30-Minute TimeframeQuick Hey friends 👋

Bitcoin was recently moving inside a weak upward channel on the 30-minute chart. But now, it has broken below the channel with a strong bearish candle. This suggests we’re entering a short-term correction.

🔹 However, don’t forget — the overall trend is still bullish.

This drop looks more like a healthy pullback, not the start of a full downtrend.

🎯 Possible Targets for This Correction:

✅ Target 1: Around $114,500

(This comes from measuring the width of the broken channel.)

✅ Target 2: Strong support near $113,500

(This level has shown solid buyer interest in the past.)

📊 The RSI is also approaching the oversold zone, which means we might see a small bounce or slowdown in the drop soon.

📌 In short:

This is likely just a dip in a bigger uptrend. Be patient, watch key support zones, and don’t rush into trades.

Always stick to proper risk management! 💼

Bitcoin Analysis – 30-Minute Timeframe

Chart Breakdown – Smart Money Concept in ActionThis chart showcases a textbook example of a bearish setup based on Smart Money Concepts (SMC):

BOS (Break of Structure) at the left confirms a shift in momentum.

A strong engulfing candle pierces into a supply zone, setting the stage for a potential reversal.

Price forms an FVG (Fair Value Gap) and returns to fill the imbalance, offering a high-probability entry within the Bearish Order Block (OB).

A clear CHoCH (Change of Character) signals a bearish trend shift, validated by the second BOS.

The trade targets Sell Side Liquidity, resting below the recent lows—just where smart money aims.

🎯 This setup combines precision, patience, and the power of understanding institutional moves.

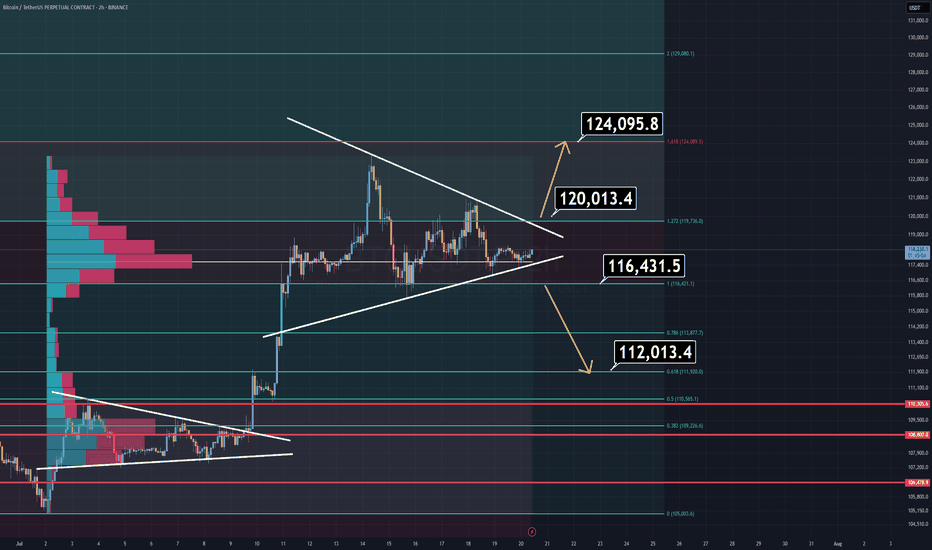

BTC Analysis (2H)Bitcoin is currently consolidating within a symmetrical triangle, suggesting indecision in the market. However, a breakout is imminent — and when it comes, it will likely be sharp.

🔹 Bullish Scenario:

A breakout above $120K would likely lead to a new All-Time High near $124K.

🔹 Bearish Scenario:

A breakdown below $116,400 opens the door for a quick drop toward the $112K–$110K zone, which should be considered a buy opportunity.

⚠️ Pro Tip:

There’s a volume imbalance just below the $116.4K level. If price breaks below it, the move down may be faster and more aggressive than expected — so plan accordingly.

Regardless of short-term volatility, the macro trend remains bullish, and Bitcoin will rise again.

Thanks for reading.

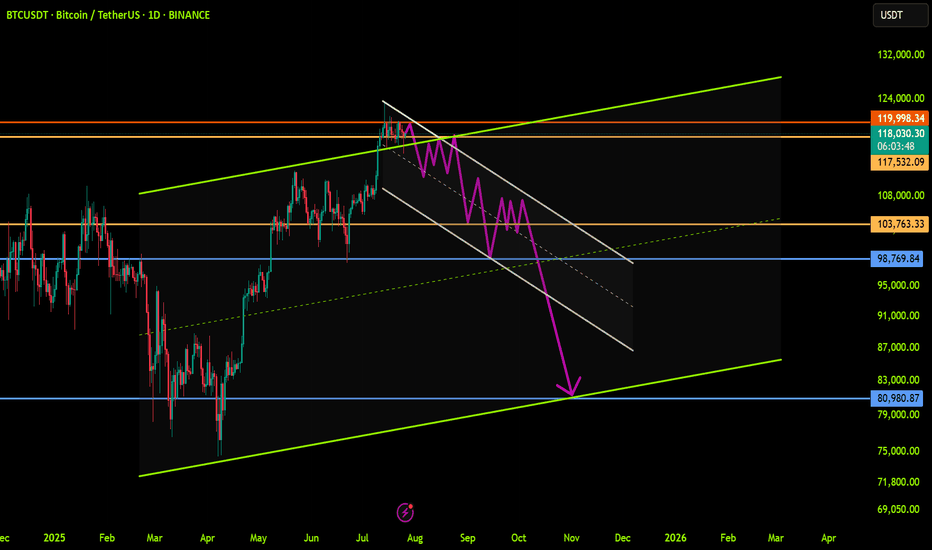

BTC Elliot Wave Double Combo CorrectionToday, I observed that Bitcoin may be unfolding within a complex double corrective wave structure—specifically a WXY pattern—potentially culminating in a contracting triangle.

Such corrective formations represent a temporal pullback, wherein the market undergoes a period of consolidation following an impulsive advance, also referred to as a pullback in time. This phase often serves as a mechanism for establishing structural support within a defined range prior to a continuation move.

A key point of uncertainty lies in whether the integrity of the triangle has been compromised by the recent, pronounced liquidity sweep. From the perspective of both the daily and 4-hour charts, this move resembles a classic deviation or "fake-out" rather than a legitimate breakout.

Nonetheless, the market may remain in a state of indecision for a few more sessions, characterized by erratic or range-bound price action, before committing to a more definitive trend.

A sustained break and successful retest above the 120K level would serve as a strong technical confirmation that Bitcoin intends to pursue higher valuations.

Low Time Frame Possible HnSThis chart illustrates a potential inverse head and shoulders pattern forming on a low time frame, signaling a possible short-term bullish reversal. The pattern is clearly marked with a Left Shoulder, Head, and Right Shoulder, suggesting a setup as shown.

The neckline area is labeled as a possible retest zone, where price may briefly revisit before either confirming the reversal or continuing the downtrend. A clean breakout and hold above this neckline would validate the pattern, with a projected upside target around 116K, as noted on the chart.

Risk management is visualized with a favorable risk-to-reward setup. However, a breakdown below the head would invalidate the pattern and imply further downside to the 110K 109K area.

This setup is ideal for traders watching for a short-term reversal, provided there is volume confirmation and alignment with broader market structure.

BTC | Short Bias — Targeting $113kPrice rejected perfectly off the 0.5 retracement and is now filling the previous imbalance.

Yesterday's daily close was decisively bearish, confirming downside momentum.

There’s a lack of convincing reversal signals at current levels.

Plan:

Main expectation is continued downside toward the $113k support.

Not interested in longs until price stabilizes at or below that level.

The Only Bitcoin Chart You NeedUnderstanding Price Action is essential for successful trading as it allows traders to interpret market dynamics and make informed decisions based on pure price movements. By focusing solely on price movements, traders can eliminate noise and distractions caused by indicators or external factors, leading to a clearer understanding of market trends and patterns.

BTC - HOOOLLDDD!!!!Looks like we got our downside first.

Short update, but important level to watch is that 112k high from May this year. I longed on a ltf low hold, looking for a bounce into the highs of this sell-off cluster, then see what's what.

Flow is still very heavy; I expect to get stopped on this but it's one of those setups I just have to take, or I kick myself tomorrow.

BITCOIN: THE PERFECT STORM - MULTIPLE BREAKOUT PATTERNS ALIGNED⚠️ CRITICAL SUPPORT LEVELS

🛡️ Support 1: $115,000 (-3%) - Triangle support

🛡️ Support 2: $110,000 (-7%) - Channel support

🔴 DANGER ZONE: $105,000 (-11%) - Multiple pattern failure

So...

Strategy: Quick profits on pattern completion 🎨

Entry: $115k (Triangle breakout confirmation) 📊

Stop Loss: $114k below (Tight risk management) ❌

Target: $125k (+10%) ✅

Time Horizon: 2-3 weeks 📅

Risk/Reward: 1:6 🎯

________________ NOTE _____________

⚠️ This is not financial advice. Bitcoin is highly volatile and risky. Only invest what you can afford to lose completely. Always do your own research and manage risk appropriately 🚨

$BTC /USDT – Breakdown from Channel, Bears Gaining ControlBitcoin has broken down from its descending channel on the 4H chart after repeated rejection from the upper trendline. Price is now hovering near key support at $111,785.

Key Technicals:

Rejection from the descending trendline resistance

Breakdown of the mini-channel structure

Current price: $113,637

Support levels:

$111,785 (Immediate)

$106,057

$101,409

$98,398

Bearish continuation is likely if $111,785 breaks with volume

If the $111.7k zone fails to hold, BTC could see further downside toward $106k and even $98k in the coming sessions.

Invalidation: Bullish only on reclaim of $117K+ with strength.

DYOR | Not Financial Advice