BTCUSDT trade ideas

Three White Soldiers & Three Black CrowsHello, Traders! 😎

In technical analysis, not all candlestick patterns are created equal. While some merely hint at indecision or short-term corrections, others shout with conviction: "Trend reversal is coming…" Two of the most powerful momentum candlestick formations are the Three White Soldiers and the Three Black Crows. When they appear, traders PAY ATTENTION. In this article, we’ll dive deep into: What do these patterns look like? Why do they form? What do they tell us about market psychology? How to trade them?+ Their limitations 👇🏻

What Are Three White Soldiers and Three Black Crows?

These Are Multi-Candle Reversal Patterns That Suggest A Strong Shift In Market Sentiment:

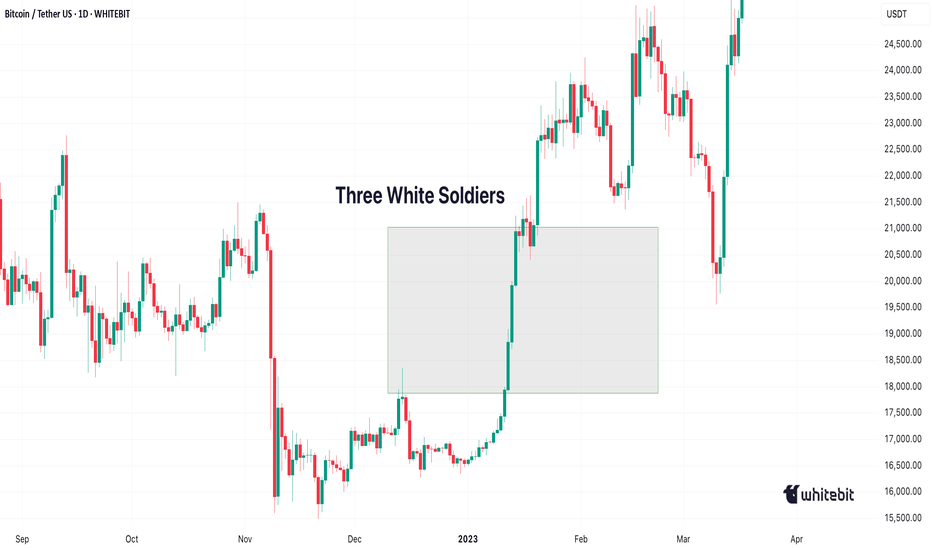

Three White Soldiers. A 🐂bullish reversal pattern that occurs after a downtrend. It consists of three consecutive long-bodied green (or white) candles, each closing higher than the last, and ideally opening within the previous candle’s real body.

Three Black Crows. A 🐻bearish reversal pattern that shows up after an uptrend. It’s made of three consecutive long-bodied red (or black) candles, each closing lower than the last and opening within the previous candle’s real body. They signal not just a change in price, but a shift in power, from sellers to buyers (or vice versa).

Candles With a Message

Unlike most one-candle signals or minor patterns, these sequences tell a real story. They show that one side has taken clear control over the market — not for an hour, not for a single day, but for multiple sessions. And that kind of shift, especially on higher timeframes like daily or weekly charts, is something seasoned traders pay close attention to.

Let’s get into the psychology for a second. Imagine you’re a trader who just watched BTC drop for two weeks. Then out of nowhere, three strong green candles appear, each more bullish than the last. You’re seeing buyers push through resistance levels like they don’t even exist. That’s not just a bounce, that’s confidence. That’s the kind of thing that makes people FOMO back in, or finally close out their shorts. Same with the Black Crows. If the price has been climbing and suddenly sellers start hammering it for three days straight? That’s not retail panic. That’s big money exiting.

Now, How do Traders Trade Them?

Well, a lot of people jump in right after the third candle closes. If you’re going long on the Three White Soldiers, you’re betting that the breakout has legs. Same for shorting the Black Crows.

But, and here’s the trap, not all of these patterns play out. Sometimes, that third candle is the climax, not the beginning. So confirmation matters. Volume should increase. The move should break a recent key level. Indicators like RSI or MACD should support the shift. Otherwise, you might just be catching the end of a move, not the start of one.

Another mistake? Ignoring context. These patterns mean nothing if they’re forming in the middle of chop or during low-volume holiday trading. They work best when they signal the end of exhaustion.

And let’s be honest. Even if the pattern is clean, you still need a plan. Stops should go below the first green candle (for bullish setups) or above the first red one (for bearish setups). If price moves against you, it means momentum never really shifted. That’s your cue to get out fast.

Final Thoughts

Three White Soldiers and Three Black Crows are powerful tools in the hands of a patient trader. Of course, these patterns aren’t perfect. They don’t account for time, so a 3-day move might seem powerful, but if it happens slowly over 12-hour candles, it’s not as strong as the same pattern on a daily chart with volume.

The takeaway? These are patterns worth knowing, not because they’re magic, but because they reflect a real shift in market behavior. When Three White Soldiers or Three Black Crows show up in the right place, at the right time, with the right confirmation… that’s when charts stop being random and start making sense. But remember. They are indicators, not guarantees. The best traders use them in conjunction with other tools and a clear trading plan.

Bitcoin in 15minCaption important🛑🛑🛑

Hello to all traders. 😎😎

I hope all your deals will hit their targets. 🎉🎉

I’m opening a short position on Bitcoin from the current level, targeting $118,200 as the first take-profit, and $117,600 as the second target.

⚠️ This is a high-risk trade, so make sure to apply proper risk management.

What Do You Think?

Which scenario do you think is more likely to happen? **Share your thoughts!** ⬇️

Don't forget that this is just an analysis to give you an idea and trade with your own strategy. And don't forget the stop loss🛑🛑🛑

❤️❤️❤️The only friend you have in financial markets is your stop loss❤️❤️❤️

Please support me with your ✅' like'✅ and comments to motivate me to share more analysis with you and share your opinion about the possible trend of this chart with me 🙏😊

Be Happy , Ali Jamali

"BTC Moves Down — Scenario Confirmed"As expected, the market couldn’t sustain the overheating.

Over the past few days, Bitcoin has shown clear signs of weakness. The rally from $105K to $118K happened too quickly, without proper correction, and with noticeably declining volume toward the end of the move. In such situations, the market often loses footing — and that’s exactly what we’re seeing now: BTC has corrected down to $114,000.

If you've been following my analysis, you know I pointed out signs of overheating earlier: strong deviation from moving averages, weak reaction at key resistance levels, and upward wicks without volume confirmation. My indicator gave an early warning of trend weakening around the $117–$118K zone. That’s when it became clear momentum was fading.

This isn’t a crash or panic — it’s a normal, healthy market correction. Overleveraged long positions are getting flushed out, and late entries at the top are being shaken off. In such phases, it’s crucial not to react emotionally but to follow a clear system.

The key point: markets don’t reverse “suddenly.”

Everything happening now was visible in advance — if you were looking not just at price, but at the structure of the movement.

BTC - Not the End of the DropRather the beginning. Bitcoin has fallen below this bearish intersection. Anticipating price to fall rapidly on one of these two pathways to the Uber low liquidity levels.

DXY is retesting a major bearish breakdown - this is the conduit that will justify a flash crash of this magnitude prior to a 3-5 year bull run.

Happy trading.

BTCUSDT – Key Support Holding! Next Targets if 115,827 BreaksBitcoin is currently holding above a crucial support zone around 115,220. After a recent drop to the 114,979 area, buyers stepped in strongly, preventing further downside.

📊 If price stabilizes above 115,220 and successfully breaks through the resistance at 115,827, I expect bullish continuation towards the following targets:

🎯 Target 1: 117,900

🎯 Target 2: 119,076

These zones acted as strong resistances previously, and breaking through them could open the path to further upside.

⚠️ However, if BTC closes below 114,500, we may see a bearish breakdown with potential downside towards 108,000 – 106,000 range.

📌 Personally, I hope Bitcoin holds this support as it’s a key level to maintain bullish momentum.

Let’s see how the market reacts in the next few candles! BINANCE:BTCUSDT

Bitcoin Monthly · Parabolic Rise ContinuesLast month Bitcoin produced its best numbers ever. The highest wick and close, a new all-time high at $123,226.

Bitcoin is not exhausted on the monthly timeframe but there is room for a retrace before the month ends. Think of the first part of the month being mixed, neutral or even bearish while the second half becomes full time bullish.

The levels that are relevant are $122,000 on the bullish side and $102,000 on the low. Right now the action is happening close to the middle so anything goes.

In 2020 Bitcoin produced 7 monthly candles growing and this was repeated again in 2023. In 2025 we have so far four green candles which means that Bitcoin can easily continue to grow. It has been known to produce more than four months green many times but there can be exhaustion at some point.

Bitcoin has been moving within a strong uptrend and is likely to continue rising. Bullish until the chart says otherwise. We are going up. Short-, mid- and long-term.

As Bitcoin consolidates near resistance, the altcoins will continue to build strength in order to grow. Remember, we are still looking at bottom prices across thousands of altcoins. Only a few moved ahead and are trading at all-time highs, the rest will catch up. The time is now, late 2025. The best is yet to come.

Namaste.

BTC Short Update Hello ❤️

Bitcoin

Let's have an update on Bitcoin analysis

💁♂️ First Target 🔥

Near Second Target

According to the analysis I posted on the page, Bitcoin touched the first target and is now near the second target

It is a good place to save profits. The price gap is filled

Please don't forget to like, share, and boost so that I can analyze it for you with more enthusiasm. Thank you. 💖😍

Bitcoin (BTC): 200EMA is Key Are Currently | Red Monthly OpeningBTC had a really sharp start to the month, and we are back near $115K, which was a key zone for us last time (due to huge orders sitting there).

Now, we see a similar struggle like last time but not quite the same, as the 200EMA has aligned with the $115K area. We are now looking for any signs of MSB, as we think we might get a recovery from here.

Now if we do not recover right now (by the end of today), we are going to see a really deep downside movement during the weekend most likely!

Swallow Academy

BITCOIN BULLISH POSSIBLE VIEW🧠 Key Observations (Smart Money Concepts - SMC Style)

🔄 Market Structure:

MSS (Market Structure Shift): Price recently made a MSS after a BOS (Break of Structure), indicating a shift to bullish structure.

BOS (Break of Structure): Seen on the move up from the demand zone.

SSL (Sell-side Liquidity) taken before the recent bullish move — classic liquidity sweep behavior.

📦 Zones:

Demand Zone: Between ~$111,000 and ~$113,000

4HR Supply Zone: Around ~$115,000 to ~$116,000 — where price is currently reacting.

Golden Zone (Entry/POI): Near the origin of the move that caused the BOS.

📍 Entry & TP/SL Setup:

Buy Limit: Placed at 111,931.32, right at the edge of the demand block.

Stop Loss (SL): Set just below at 110,453.42

Take Profit (TP): Targeting 113,676.39, right before the next resistance.

📊 Volume Analysis:

Large bullish volume spike aligns with the most recent BOS.

Diminishing sell volume during retracement suggests exhaustion of bearish momentum.

✅ Trade Idea (Based on Chart Setup):

Bias: Bullish

Entry: 111,931.32 USDT

Stop Loss: 110,453.42 USDT

Take Profit: 113,676.39 USDT

Risk/Reward: ~1:1.5 to 1:2

🔍 Additional Notes:

Liquidity Sweep: SSL cleared → indicates potential for long setups.

BOS + MSS Confluence: Bullish intent confirmed.

BB (Break of Block): Indicates intent to move higher if resistance is broken.

ERL Target: Final target is shown far above current price, near 123,280.88, could be a longer-term swing target if price holds structure.

🔄 Next Steps (as per typical TradingView publish ideas):

Set alerts at the demand zone.

Monitor price action when it taps into the Buy Limit level.

Watch for confirmation candle or volume spike before manual execution (if not using limit orders)

Market - BTC - ETH Analysis

💎 Market - BTC - ETH Analysis💎

🟠 Current Market Status: ⚠️ / Low Risk-Reward ❗️ / Avoid Overtrading 🚫

🔷 BTC/USDT (Multi-Timeframe Analysis)

• Weekly (HWC): Last week’s red candle tapped into a buyer zone. A balance or sideways movement is likely this week.

• Daily (MWC): Minor retracement in a downtrend. No clear bullish reversal yet.

• 4H (LWC): Still in a downtrend. For a bullish reversal, we need a Higher Low (HL) followed by a break of the previous High.

• 1H: Breakout above level 116 would signal a short-term trend reversal. Breaking the upper channel confirms bullish continuation in the lower timeframe.

✅ Strategy Outlook:

• HWC: Bullish

• MWC: Bullish

• LWC: Bearish

→ We're not shorting based on LWC unless it turns bullish or MWC flips bearish.

🕒 Conclusion: Stay on the sidelines until the structure shifts clearly.

🔶 BTC Dominance (BTC.D)

• Currently rejected in the 4H chart, but not yet a confirmed bearish structure.

🧭 Two setups to watch before rotating into altcoins:

1. Clear lower highs and lower lows in 1H and 4H

2. Box formation and breakdown in lower timeframes

🚨 Key Level: A break below 60.40 may trigger sharp altcoin rallies.

🌐 TOTAL / TOTAL2 / TOTAL3

• All three charts share a similar structure.

• 1H TOTAL: Break of 4.72 confirms a V-pattern and may trigger upside momentum.

• TOTAL2: Watch 1.42 as a critical level.

→ Until then: No action – Wait for breakout confirmation.

💵 USDT Dominance (USDT.D)

• Ideally should not retrace beyond 4.64 – if it forms a top here, that’s a bullish sign for the market.

• Level 4.44 is less relevant for now.

• Failure to reclaim 4.53 increases the importance of 4.64.

• If it starts dropping, enter before a breakdown of 4.13 to stay ahead of bearish pressure.

🟠 ETH/BTC

• Consolidating in a 4H box.

• Break of 0.03278 is a trigger for long ETH exposure — ideally hold post-breakout.

• Wait for SMA7 on the Daily to turn upward for stronger confirmation.

• Break of 0.03288 on ETH/BTC likely aligns with $3850–$4000 breakout on ETH/USDT.

→ Position should be taken before this breakout to catch the move early.

📌 Final Note:

We are in a low momentum, low R/R environment.

Only trade confirmed breakouts and structural shifts.

Avoid overtrading, keep risk exposure limited, and rely on higher-timeframe confluences for clearer direction.

BTC Price Prediction and Elliott Wave AnalysisHello friends,

>> Thank you for joining me in my analysis. I think we need to extend the pink wave Y as wxy in purple counting => W, and then XY as orange counting. This all happened after getting the green D with not preferred closing as I mentioned yesterday.

Keep liking and supporting me to continue. See you soon!

Thanks, bros

BTCUSDT: A Bullish Foundation Meets Fibonacci FirepowerBTCUSDT: A Bullish Foundation Meets Fibonacci Firepower

BTCUSDT is currently at a critical juncture, navigating a significant upward trendline and a key Fibonacci retracement level. The chart highlights the ongoing battle between buyers and sellers following a strong multi-month rally. Price action is testing a major confluence zone, which will likely determine the immediate future direction of the market.

1. The Bullish Foundation (Late March - July):

• Long-Term Uptrend Line (White): A prominent upward-sloping trendline originating from the late March lows has defined the bullish narrative. Price has consistently found support on this line, demonstrating a strong underlying buying interest and a disciplined ascent. This trendline has been a reliable gauge of the market's health and a key area for bulls to defend.

• Fibonacci Retracement Levels: When we apply the Fibonacci retracement tool from the recent swing low to the all-time high, several potential support areas are identified. These levels are critical for understanding potential pullbacks and market structure.

2. The Current Inflection Point (Late July - August):

• Confluence Zone: The market is currently engaging with a high-stakes confluence zone. This area is defined by two key technical indicators:

o The Long-Term Uptrend Line: Price is testing this foundational support line for the first time since the July peak. A bounce from this level would reinforce the long-term bullish bias.

o The 0.236 Fibonacci Level (~$111,804): This is the first level of support in the Fibonacci sequence. The market is finding temporary footing here, and a decisive break below this level would be a bearish signal, suggesting a deeper retracement is likely.

3. Potential Scenarios:

• Bullish Continuation : The most optimistic scenario involves a successful defense of the current confluence zone. A strong bounce from the white uptrend line and the 0.236 Fibonacci level, backed by increased buying volume, would signal that the bulls are still in control. In this case, a re-test of the recent all-time highs would be the next logical target.

• Bearish Retracement : If the confluence zone fails to hold, and BTCUSDT breaks decisively below the trendline and the 0.236 Fibonacci level, it would suggest a deeper correction is underway. The next major support zone to monitor would be:

o The 0.382 Fibonacci Level (~$104,666) : This level has historically acted as both support and resistance, making it a critical psychological and technical area. A drop to this zone would likely be met with renewed buying interest.

o The 0.5 Fibonacci Level (~$98,897) : A move to this level would signal a more significant correction, potentially testing the psychological $100,000 mark.

Conclusion:

BTCUSDT is at a pivotal moment. The market's reaction to the current confluence of the long-term uptrend line and the 0.236 Fibonacci retracement level will dictate the short-to-medium-term direction. A bounce from here would confirm the strength of the uptrend, while a break lower would open the door for a deeper retracement toward the next key Fibonacci levels. Traders should closely monitor price action and volume at these critical levels for confirmation of the next directional move.

Disclaimer:

The information provided in this chart is for educational and informational purposes only and should not be considered as investment advice. Trading and investing involve substantial risk and are not suitable for every investor. You should carefully consider your financial situation and consult with a financial advisor before making any investment decisions. The creator of this chart does not guarantee any specific outcome or profit and is not responsible for any losses incurred as a result of using this information. Past performance is not indicative of future results. Use this information at your own risk. This chart has been created for my own improvement in Trading and Investment Analysis. Please do your own analysis before any investments.

BUY BTC 4.8.2025Confluence order: BUY at H1~M15

Type of order: Limit order

Reason:

- The current top is not touching anything, expected to rise to the H1 above.

- M15~FIBO 0,5-0,618 (same position)

Note:

- Management of money carefully at the last bottom (114,119)

Set up entry:

- Entry buy at 113,707

- SL at 113,311

- TP1: 114,119 (~1R)

- TP2: 114,906 (~3R)

- TP3: 115,963 (~5R)

Trading Method: Price action (No indicator, only trend and candles)

BTC Forecast For August & September. The Only Roadmap You Need !This is one is so obvious, its a no brainer , and would likely be very easy to trade as long as you follow this road map i have provided.

The Value Area High at 110k price range is most important upcoming battle line between bull vs bear. If bulls fail to get a strong bounce from 110k and we close at least 2 daily candles below it. Then it would mean bears have full control and the implication of that is that since we would at that point be closing back inside an established Value Area range, formed between Nov 20th to Jul 25th, then it would mean the probability of price selling all the way down to re-test the VAL (value area low) at $91.6k would instantly become very very high.

After re-testing $91.6k we'll watch and see what happens.

It'll either hold after grabbing some liquidity below and stay in the Value Area Range until further notice Or we lose it and the sell off continues. Bear market will be in full swing if that happens and you can bet a ton of weak hands will start to exit due to max pain & cascading long liquidations. Fear index will be back in the red at that point as capitulation starts to set in. Alot of new alts and meme coins will be completely obliterated.

Bullish Continuation Scenario

If bulls get a strong bounce from 110k and don't close back inside the Value Area Range below, then we could continue up to a make a new ATH for a classic trend pullback continuation trade. Once we get back above 115.4k, the dream of a new ATH will become much more realistic. There is an UFA(Unfinished Auction) at 120.8k which is only visible to traders using the market profile or footprint chart. This make poor high and needs to be taking out at some point.

For the Price target to the upside, we would be using the peak formation line of the ExoFade indicator.

BTC/USD) Bullish Analysis Read The captionSMC Trading point update

Technical analysis of Bitcoin (BTC/USDT) on the 4-hour timeframe, with a focus on smart money concepts like FVG (Fair Value Gap) and support/resistance zones.

---

Technical Breakdown:

1. Price Structure & Path Projection:

BTC is currently in a sideways range, but the drawn projection suggests a potential bullish reversal from the key support zone or the FVG level.

Two bullish paths are suggested:

One bounces from the key support zone (~114,725).

The other dips deeper into the FVG level, sweeping liquidity before heading higher.

2. Key Zones:

Key Support Level: Around 114,700–114,800, aligning with the EMA 200 and prior reaction levels.

FVG Level (Fair Value Gap): Just below the support zone — marked as a potential liquidity sweep area before bullish continuation.

Resistance Zone: 123,069.65, where partial profit could be taken.

Final Target Point: 130,312.02, projecting a strong bullish move from the base.

3. EMA 200 (Blue):

EMA sits around 114,685.97, acting as a strong dynamic support, supporting the bullish scenario.

4. RSI (14):

RSI is neutral at 51.10, providing room for bullish momentum without being overbought.

Mr SMC Trading point

---

Trade Idea Summary:

Bias: Bullish

Entry Zone:

Conservative: Near 114,725.18 (key support + EMA 200)

Aggressive: Deeper at FVG level if price sweeps that zone

Targets:

TP1: 123,069.65 (resistance zone)

TP2: 130,312.02 (main target)

Invalidation: Break and close below FVG zone would negate the setup

---

Please support boost 🚀 this analysis)

BTC 4H – Support Tapped 2x After Breakout, Will Bulls Step In?Bitcoin is retesting a major demand zone that launched the last breakout. After a sharp impulse move, price has ranged tightly and just tapped this support area for the second time.

A clear double bottom attempt is forming, but failure to hold $115K could open the door to deeper downside. Bulls want to see a quick reclaim of $117K to confirm structure still holds.

Clean levels. Clear reaction zones. Let’s see who takes control.

BTC, ETH & Market Structure Outlook – Is the Pullback Over or Ju

💎🚀 BTC, ETH & Market Structure Outlook – Is the Pullback Over or Just Beginning? 🔥♦️

🧠 Dow Theory | Multi-Cycle Technical Breakdown | Index Watch

👉 Don't forget to LIKE, FOLLOW, and COMMENT to support the content!

♦️ BTC/USDT Analysis

🔻 The key support at 115,725 was broken – but has the macro trend turned bearish? Not yet.

📉 From the HWC (1D) perspective, BTC has dropped only ~4.5%, which still looks like a pullback.

🟥 However, if price stabilizes below 109,000, we will begin shifting to a bearish macro bias.

🧠 Weakness in trend is present but not confirmed.

🔄 MWC (4H) – Sideways, Then Breakdown

📊 After a strong rally, BTC ranged for about 17 days, then broke below the range support.

🔽 The 4H trend leans bearish, but it's not a strong or confirmed downtrend.

⏱️ LWC (1H) – Clearly Bearish

📉 Lower highs and lower lows are forming. The trend is decisively downward in 1H.

🚀 Bullish Scenario:

If BTC bounces from 112,000, we need:

• A strong new high

• A healthy pullback

• A breakout of the new high → then long entries are valid

❗ Bearish Scenario:

If 109,000 breaks with volume → strong bearish continuation likely.

♦️ ETH/USDT Analysis

🔸 The 3538 level is key.

✅ If ETH shows clear reaction, followed by a breakout, a long position becomes valid.

⚠️ But only after a confirmed trend shift on the 4H timeframe.

♦️ Top Altcoins

⭕ Most alts are in an uncertain phase.

🕒 It's best to wait until new highs/lows and a valid structure are formed.

♦️ BTC Dominance (BTC.D)

💥 BTC.D broke through the critical 62.22 level.

🟡 Now we wait: Will it hold above or fake out and reverse?

🔻 If BTC is dropping while BTC.D is rising →

👉 Result: BTC drops moderately, but alts drop much harder.

♦️ USDT Dominance (USDT.D)

📉 This chart reflects market fear & greed.

Currently showing reduced greed (risk-off behavior).

🔸 Next resistance levels: 4.63 and 4.72

❗ If these break → bearish bias becomes dominant.

⭕ However, a fakeout here could create a fast early entry opportunity.

♦️ TOTAL Market Cap

📍 Market is sitting on a major support level – but BTC remains the key driver.

❗ No confirmed long setups until BTC structure shifts bullish.

♦️ Strategic Outlook

1️⃣ Not a good time to open fresh positions – wait for clear 4H structure formation

2️⃣ Bias remains bullish overall, but waiting for confirmation

3️⃣ Until BTC trend clearly reverses, we are not focused on BTC.D reversals – they remain secondary

4️⃣ On the Bitcoin chart, you can see another red zone — breaking the first one will invalidate the bullish outlook, and breaking the second one will trigger a search for short positions.

5️⃣ To return to a strong uptrend, breaking the green zone around 120,000.00 is essential.

6️⃣ I’ve drawn two green upward paths on the chart. I’ll be looking for such a path for an early long entry.

💎 Stay cautious, manage risk, and follow structure!

🚀 Smash that ROCKET, leave a LIKE, and hit FOLLOW for daily crypto insights!

BTC -MACD Triggered the Breakout Early, MACD MasteryYou didn’t need 20 indicators. Just one system that actually worked.

The MACD Liquidity Tracker Strategy flipped long on BTC just before the latest 4H breakout — catching an 11.39% move with perfect histogram and EMA alignment.

🔍 Here’s what happened:

– Histogram flipped positive on July 23

– EMA filter cleared — clean long trigger

– Histogram rose into a momentum peak

– Strategy closed just before consolidation

This is exactly what the Liquidity Tracker was built for:

✅ Spot clean trend shifts

✅ Confirm strength via momentum

✅ Filter out noise using EMAs

⚙️ Settings Used:

– MACD: 25 Fast / 60 Slow / 220 Signal

– EMA Filter: 50 / 9 / 3

– Entry Mode: Histogram + Crossover Combo

Bitcoin at Key Support - Watching for Bullish ShiftHello everybody!

Bitcoin has reached a very important demand/support zone between 110,000–112,000.

If this area holds, we could see bullish momentum building on the chart.

Currently, we are waiting for confirmations.

We're watching closely for any change in market structure or a trend shift.

If it happens, we can expect the price to move up to around 118,000.

Manage your risk and trade safe!