BTC ANALYSIS🔮 #BTC Analysis 💰💰

🌟🚀As we said #BTC performed same. Now, In daily chart we can see a formation "Rising Wedge Pattern in #BTC. There is a strong resistance zone and we could see a rejection from that level but if the price breaks the resistance zone then we would see a bullish move 💲💲

🔖 Current Price: $1,18,590

⁉️ What to do?

- We have marked some crucial levels in the chart. We can trade according to the chart and make some profits in #BTC. 🚀💸

#BTC #Cryptocurrency #DYOR #PotentialBreakout

BTCUSDT trade ideas

Bitcoin (BTC): Still Above Local SupportIt's been a choppy week so far but BTC is still above the local support zone, which means we are still bullish and the bullish sentiment has not disappeared (for now, at least).

We wait for and mostly keep an eye on that middle line of BB (Bollinger Bands) for now. The order book is our friend currently as well with all those liquidity hunts taking place!

Swallow Academy

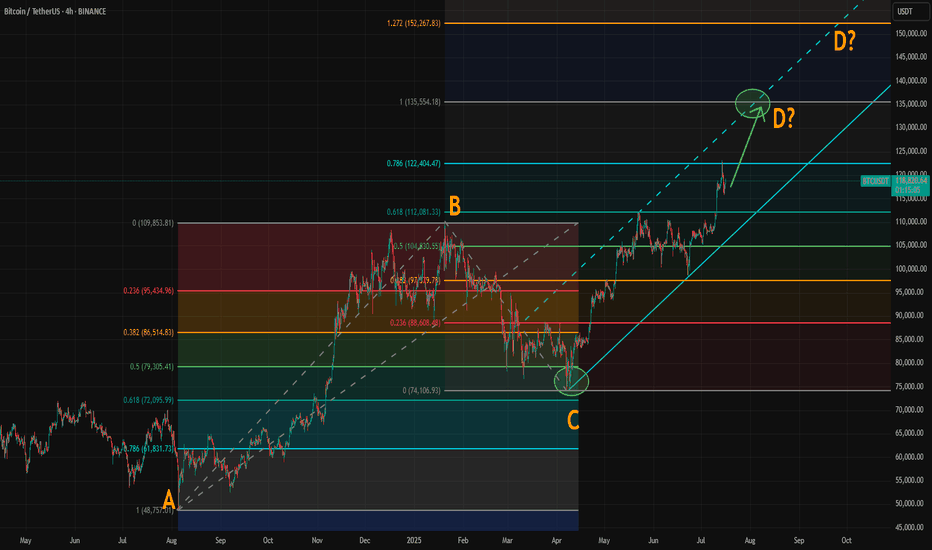

Where Could Bitcoin Make Its Cycle Top? Model and ABCD AlignedWith the breakout above resistance around 110,000, Bitcoin’s rally appears to be back on track. If you've been following our crypto analysis, either here or on our website, you’ll know our target range for this bull cycle is between 135,000 and 150,000, with the top of the range possibly extending further depending on the strength of the final wave.

Now, a possible ABCD pattern is forming, with point D potentially landing at either 135,000 or 150,000. A coincidence? Maybe, maybe not.

How Did We Arrive at the 135K–150K Target?

We based this range on historical halving cycle returns:

Halving Year - Return to Cycle Top

2012 - 9,076%

2016 - 2,122% (↓ 4.27x)

2020 - 541% (↓ 3.92x)

Two things stand out:

Each cycle has shown diminishing returns.

The rate of decline appears roughly consistent, dropping by around 4x each time—but slightly less with each cycle.

So depending on the multiplier used:

If returns fall by 4.27x again → target: 135K

If reduced by 4x → target: 140K

If reduced by 3.92x → target: 142K

If the rate of reduction itself slows (difference of 0.35 between 4.27 and 3.92) → target: 150K

While the sample size is too small, we believe the model holds reasonable logic with fundamental backing from various metrics.

The chart now shows a possible ABCD pattern:

If it becomes a classic AB = CD structure, point D could form near 135K.

If it becomes an extended ABCD (with CD = AB × 1.272), then point D could reach just above 150K.

These technical targets align closely with our halving model projections, increasing our confidence in the 135K–150K range as a likely top zone for this cycle.

Also, please check our earlier post for possible altseason start. A correlation between BTC/ETH and Gold/Silver might give some tips about possible Ether surge.

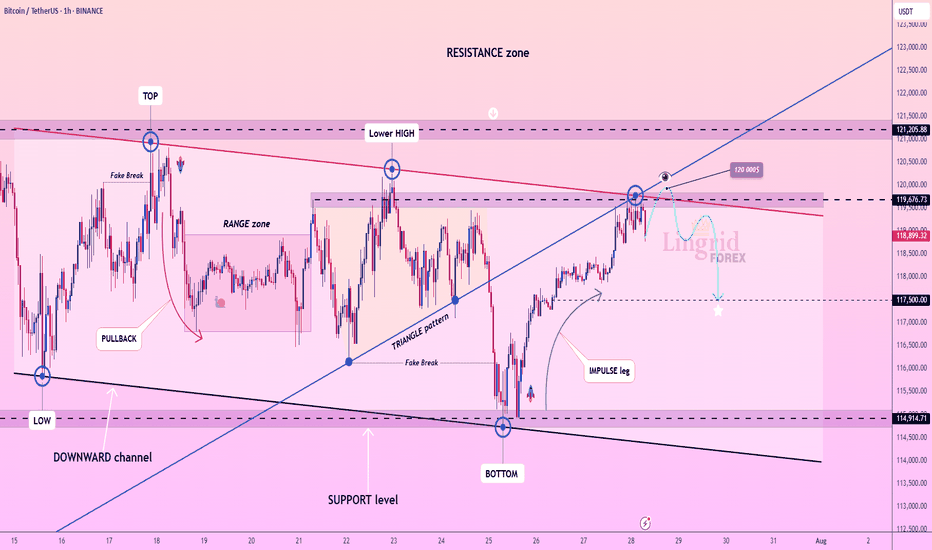

Bitcoin Retests Broken Trendline Minor Resistance in Focus!Bitcoin has recently taken support from the lower levels and moved upward, successfully breaking above a key trendline resistance. Currently, the market appears to be forming another minor trendline resistance on the short-term chart. Interestingly, the previous trendline that was broken is now acting as a support zone, indicating a potential shift in market structure.

If the price manages to break this newly developing minor trendline resistance, we may expect a possible retest of that level. Should the retest hold, it could provide a strong bullish signal, allowing Bitcoin to continue its upward movement toward higher liquidity zones or resistance levels.

BTC AI Prediction Dashboard - 6h Price Path (30.07.25)

Prediction made using Crypticorn AI Prediction Dashboard

Link in bio

BTCUSDT Forecast:

Crypticorn AI Prediction Dashboard Projects 6h Price Path (Forward-Only)

Forecast timestamp: ~10:45 UTC

Timeframe: 15m

Prediction horizon: 6 hours

Model output:

Central estimate (blue line): -118,306

Represents the AI’s best estimate of BTC’s near-term price direction.

80% confidence band (light blue): 118,086 – 118,670

The light blue zone marks the 80% confidence range — the most likely area for price to close

40% confidence band (dark blue): 117,520 – 119,603

The dark blue zone shows the narrower 40% confidence range, where price is expected to stay with higher concentration

Volume on signal bar: 80.50

This chart shows a short-term Bitcoin price forecast using AI-generated confidence zones.

Candlesticks reflect actual BTC/USDT price action in 15-minute intervals.

This helps visualize expected volatility and potential price zones in the short term.

BTC, ETH & Indexes daily analyze 🚀🔥 BTC, ETH & Indexes daily🔥🚀

💎 Daily Market Routine, Structure-Based Crypto Analysis & Watchlist Insights

💥 Like – Follow – Comment to keep this momentum alive!

👋 Hey everyone! Welcome to our daily crypto trading routine:

📅 Daily:

🔹 BTC & ETH analysis

🔹 Full market structure review (TOTAL, BTC.D, USDT.D…)

📅 Weekly (Every Sunday):

🔸 Top 10 Altcoins Analysis (excluding BTC & ETH)

🔸 🆕 Coming soon: Weekly Watchlist Picks!

💛 Your likes, follows, and comments give me the motivation to continue this journey and share deeper insights!

🟡 Methodology

💠 Long-Term Cycle (HWC): 1D timeframe

💠 Mid-Term Cycle (MWC): 4H timeframe

💠 Short-Term Cycle (LWC): 1H timeframe

💠 Market structure review:

TOTAL / TOTAL2 / TOTAL3 / BTC.D / USDT.D

💠 Technical approach: Dow Theory

💠 Fundamental events + news tracking

🔥 Today Could Be the Most Important Day of the Week!

📢 The Fed’s interest rate decision is expected today. Market consensus leans toward no change, but Powell’s press conference could trigger major volatility.

📈 If BTC starts a bullish trend in the coming days, ETH, BNB, and AVAX are likely to outperform – and this probability is high.

♦️ BTC/USDT – Market Still Ranging

💎 Bulls have failed to break above 120,000, but bears also haven't broken below the critical 115,000 zone.

📊 This two-week range is not surprising – it's likely a time correction, consolidation, or even distribution phase.

🚀 If 120K breaks with strong momentum and volume, price may rally to 123K → 135K → 150K.

❗ If 115K breaks, expect a drop to 110K → 100K.

⭕ Breakouts need strong candles and volume – otherwise expect fakeouts.

🟡 My strategy doesn't allow shorts at this phase. I only seek bullish confirmation – though bearish signs like buying exhaustion and profit-taking near 118K exist.

📌 I’ll re-enter long on breakout above 120K, using buy stops and proper risk control. Even if it hits my stop-loss later, I’m okay with that.

🔥 BTC must break 120K to unlock full altcoin rally potential.

♦️ BTC.D – Decision Time Nears

📉 Recent downtrend shows weakness, but not a bullish reversal yet.

🔸 Watch levels:

• 🟢 Break below 60.42 → Confirmed altcoin rally

• 🔴 Break above 62.17 → Likely altcoin crash

♦️ USDT.D – Position Before the Break!

🟡 We must take altcoin & BTC positions before USDT.D breaks 4.13.

⏳ A break there likely triggers a sharp upward move in alts.

• 🔹 Pullback to 4.64 = still bullish for alts

• 🔹 Current key zones:

• 4.44: Not tested yet

• 4.13: Likely to be retested

♦️ TOTAL Market Cap

💎 Break above 3.91T → Bullish confirmation – be in the market!

♦️ TOTAL2 (Altcoin Market Cap)

🟡 Major resistance ahead: 1.54T

♦️ TOTAL3 (Altcoin Market w/o BTC & ETH)

🟡 Important level: 1.08T

♦️ ETH/USDT – Institutions Are Accumulating!

💼 Institutional buying continues – a strong bullish signal.

💎 Buyers are trying to flip 3750 into support. Heavy order blocks detected.

📌 Key Level: 3900

• 🔹 Break & hold above = Easy ride toward 4000+

• 🔻 Bearish view: Break below 3750 = Drop to 3500–3600

🟡 Recent demand spike and fresh capital inflow = bullish sentiment

♦️ Strategic Outlook

1️⃣ Still focused on long setups

2️⃣ If BTC breaks 120K and ETH breaks 4K then ranges → and BTC.D drops = 🎉 Altcoin Party!

3️⃣ If BTC fails to break 120.3K, we won’t get a strong rally

4️⃣ If BTC keeps ranging and BTC.D keeps dropping → alts will gain, but not full bull run yet

💬 Drop your thoughts in the comments below!

🚀 Smash that ROCKET, hit LIKE, and don’t forget to FOLLOW for daily setups!

Bitcoin (BTCUSDT) - Possible Completion of a Complex CorrectionTimeframe: 4H + 1H

Methodology: NeoWave (Glen Neely) + Smart Money Concepts (ICT/SMC)

Posted by: @CryptoPilot

⸻

🧠 NeoWave Analysis: Complex Correction Ending?

From a NeoWave perspective, BTC seems to be in the final stages of a Complex Correction that started in March 2025 from ~72k. The upward move appears to form a Contracting Diametric structure (7 legs: A–B–C–D–E–F–G), with the current leg G potentially unfolding now.

• ✅ Wave A: Sharp recovery from March lows

• ✅ Waves B–F: Alternating corrective legs with varied time and complexity

• 🔄 Wave G: Could be starting now, expected to break structure to the downside

This suggests that the entire move from March till now may represent a large Wave B, setting the stage for a deeper Wave C down.

⸻

🔍 Price Action + Smart Money Confluence

The following observations strengthen the NeoWave scenario:

• 🟨 Liquidity Pools above 120k were swept recently, creating a potential Buy-side Liquidity Grab

• 🟥 Imbalance/FVGs below 114.5k remain unfilled

• 🔻 Market Structure Shift (MSS) evident on 1H chart — lower highs forming

• 🧠 Price rejected from a key Supply Zone, aligning with end of Wave F

• 🟩 If price re-tests the internal bearish OB (near 119.5k–120k), it may provide an ideal short trigger

⸻

📌 Key Levels to Watch:

Level

Description

120.2k

Liquidity sweep zone / MSS confirmed

118k

Current structure base (pivot)

114.5k

FVG + potential Wave G target

111–112k

Strong demand zone (accumulation support)

🧭 Scenario Outlook:

Primary:

→ Price is in Wave G of a Diametric (NeoWave)

→ Likely to unfold as a 3-leg Zigzag down or a Complex combination

→ Objective: break below Wave E low and target the unmitigated imbalances

Alternative:

→ Extended Flat or Triangle, if 120.5k is broken impulsively

→ Invalidation = clean break and hold above 121k

⸻

⚠️ Risk Note:

This analysis assumes Wave G is beginning. If bulls manage to reclaim 120.5k with momentum and close above, the bearish structure will be invalidated.

⸻

💬 Final Thought:

We are potentially nearing the end of a complex corrective rally. The confluence of NeoWave structural symmetry, Smart Money traps, and market inefficiencies suggests that BTC may be preparing for a retracement. Stay alert for confirmations before executing.

⸻

📌 Follow @CryptoPilot for advanced wave structure updates, market geometry insights, and ICT-style smart money traps.

💬 Share your views or alternate wave counts in the comments!

BITCOIN FALL TO 78K ! OR GOING TO 170K ?📊 Bitcoin Possible Scenarios (BTC/USDT Analysis)

🟢 Green Scenario (Immediate Bullish Breakout):

If the price breaks above the $120,000 resistance without any significant pullback, this would signal strong bullish continuation. It suggests buyer dominance and could lead to a fast move toward higher levels.

🟡 Yellow Scenario (Bullish Correction):

If BTC fails to break $120,000, we may see a drop toward $112,000. If this level breaks, price could head down to $100,000 to collect liquidity and attract buyers. From there, a strong rebound is likely, restoring bullish momentum (with weekly trendline support)

🔴 Red Scenario (Bearish Reversal):

If price breaks clearly below $100,000, especially with a violation of the weekly trendline, this could trigger a deeper correction toward the $78,000 – $74,000 zone. This scenario would mark a potential shift in long-term market structure.

Main Target : 170,000

$BTC/USDT – Bull Flag Breakout on 4H | Targeting $133,700Bitcoin has just broken out of a well-defined bull flag structure on the 4H chart, signaling a potential continuation of the previous uptrend.

This breakout comes after a strong impulsive move upward, followed by a textbook flag consolidation with lower highs and lows forming a descending channel. The breakout above the flag resistance suggests a bullish continuation pattern is in play.

Technical Breakdown:

Pattern: Bull Flag (Continuation)

Flagpole base: ~106,700

Breakout zone: ~117,600

Retest Support: 116,000

Immediate Resistance: 122,300

Expected Target: 133,700 (based on flagpole projection)

Invalidation: Breakdown below 115,500

Expected Move:

Measured Move Target: ~13% upside from breakout

Confluence: Target aligns with past supply zone near 133K–135K

Price has also reclaimed the 50 EMA on the 4H chart, and the volume on the breakout shows bullish interest. Watching closely for a clean retest of the breakout zone for confirmation.

Conclusion:

BTC is showing bullish continuation after breaking out of a flag. A successful retest of 117.6K–116K range could offer further upside. Traders should manage risk accordingly.

DYOR | Not Financial Advice

$BTC Daily OutlookDaily Chart

Today’s close printed a small bearish doji; visually bearish but still another inside-day that keeps BTC boxed between the High-Volume Node / v-Level cluster at $116 860-$123 300.

Holding $116 860 remains critical; lose it on a daily close and price can easily slide to the weekly breakout shelf near $111 960. We are now 16 days inside this balance. Per Auction-Market-Theory rule #5, the longer price churns at the edge, the more resting liquidity is absorbed, eventually a decisive push will follow. If buyers defend $116 860 again, the path opens toward range high $123 300 and the prior ATH; if they fail, expect a fast flush to the weekly V-Level.

Footprint Read

Value Area High and Low span the full candle, with the POC parked mid-range, classic two-sided trade. Delta finished negative and the heaviest prints sit at session lows: sellers hit the bid hard, yet could not follow through. That absorption leaves shorts vulnerable to a squeeze if new selling momentum doesn’t appear quickly.

Fundamental Pulse – Week Ahead

ETF Flows: Spot-Bitcoin ETFs booked three consecutive inflow days to close last week (+$180 M net). Sustained demand under the range supports the bullish case.

Macro Data: U.S. FOMC & Federal Fund Rates prints for this week; expect more volatility starting from tomorrow.

Game Plan

Primary bias stays long while daily candles close above $116 860; upside trigger is a clean for now or shorts squeeze toward $123 300.

If $116 860 breaks with volume, prepare for a quick liquidity hunt into the weekly shelf at $111 960, where we reassess for swing longs.

Intraday: I’ll monitor the Intraday Chart on tomorrow's High impact events and look for best opportunities across the board. Alt window: a fresh downtick in BTC Dominance could spark rotation; watch high-Open Interest majors if BTC ranges.

BTC Moon Phase, Dominance % and BBWP resolutionBTC, D. Moon Phase. I see bearish scenario for the next days, until 4-5th of August. After reviewing Moon Phase chart for last year+, I see same scenario is happening most of the times. During the First Quarter ( Aug. 1) of the phase, price is dropping and start to recover about 4-5 days prior Full Moon. This is exactly when energy of the Full Moon starting to amplify. Current BBWP is contracted for 8 days, making the next move very rapid, I would not set any long/short trades, untill the volume start to expand. Its the mid summer - always slow and August is the month it start to accelerate towards the Fall, with all financial/political tricks happening in September and later in Q4. We already had one bear trap fakeout, but price didnt anticipate to go higher and got rejected by falling wedge upper like ( or bull flag, in this case).I would expect that high volume green candle will be either fully recovered to $110-111K , or 75% recovery, where the CME gap is $113500 - 1-2% lower, making it $113,000. The cascade liquidation will happen very fast, I expect the whole move down and up will take around 24 hours, with the bottom time 5-15 minutes. Need to be ready, that all alts will crash as well, Im expecting BTC %dominance to bounce here , after 8.4% drop to weekly 50EMA. I would like to see BTC, D% at 70% by Christmas and new ATH, what ever it is 160K or 200K what ever it is, for bitcoin to make ATH, it must grab dominance.

Bitcoin Technical Analysis – Bullish Flag- Symmetrical Triangle📊 Bitcoin Technical Analysis – Bullish Flag or Symmetrical Triangle?

📅 Analysis Date: July 29, 2025

As shown in the chart, Bitcoin appears to be forming a bullish flag or symmetrical triangle pattern—often seen after strong upward moves.

🔹 Bullish Scenario:

If the price breaks above the triangle, the first target is around $122,480, followed by a potential second target near $129,500, based on the length of the flagpole.

🔹 Bearish Scenario:

If the triangle breaks to the downside, the first support to watch is $115,230.

🧭 These key levels act as critical zones of supply and demand, so be sure to keep them on your chart!

🔥 Follow me for real-time setups, clear signals, and expert technical analysis!

BTC/USDT Analysis — Potential Sideways Range

Hello everyone! This is the daily analysis from the CryptoRobotics trading analyst.

Yesterday, Bitcoin experienced a local reversal. At this point, two zones previously marked by us have been worked out:

Buy zone — $118,300–$117,300

Sell zone — $119,500–$119,000

We now expect continued rotation within the $117,400–$119,800 range, with potential expansion in both directions. The overall context remains positive, so a full breakout to the upside could occur in the near future.

Buy zones:

$116,200–$115,000 (volume anomalies)

$110,000–$107,000 (accumulated volume)

This publication is not financial advice.

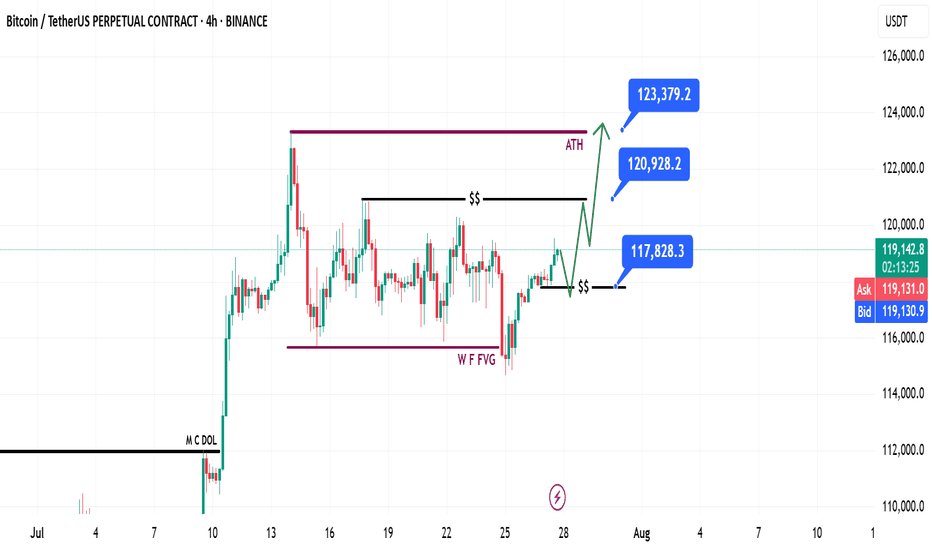

Bitcoin Weekly Recap & Gameplan | 27.07.2025📈 Market Context:

Bitcoin maintained its bullish momentum, driven by continued institutional demand and a supportive U.S. policy backdrop.

Last week’s gameplan played out well — solid profits were captured (see linked chart below).

🧾 Weekly Recap:

• Price made a bullish retracement into the Weekly FVG (purple line) exactly as projected in last week's post.

• From here, I expect continuation toward new all-time highs.

📌 Technical Outlook:

→ First, I expect a short retracement and a 4H swing liquidity grab at 117,828$.

→ Then, a strong continuation move toward ATH targets.

🎯 Setup Trigger:

Watch for:

✅ 4H liquidity sweep

✅ 15M–30M bullish break of structure (BOS)

This is the confirmation zone for potential long setups.

📋 Trade Management:

• Stoploss: Below confirmation swing low

• Targets:

– 120,938$

– 123,400$

💬 Like, follow, and drop a comment if this outlook helped — and stay tuned for more setups each week!

BITCOIN PREDICTION - MASSIVE CANDLE INCOMING!!! (WARNING) Watch this Bitcoin Prediction video now, you will love it!

Yello, Paradisers! Big warning sign: #Bitcoin is about to liquidate more traders soon if we get these confirmations that I'm sharing with you in this video. Loads of people will get wrecked again. Be careful not to get trapped into fakeouts.

In this video, I'm describing exactly what I'm seeing on Bitcoin, what patterns I'm waiting to form, and what confirmations I want to see before being able to say with 100% accuracy guaranteed that MARKETSCOM:BITCOIN is moving in that direction.

I'm sharing with you all the important targets and also how professional trading works: how risk-reward proper ratio trading works, and how high-probability trading depends a lot on how you choose to create your trades.

Watch this Bitcoin prediction to understand what I'm seeing right now on the chart and how I'm acting and making my decisions.

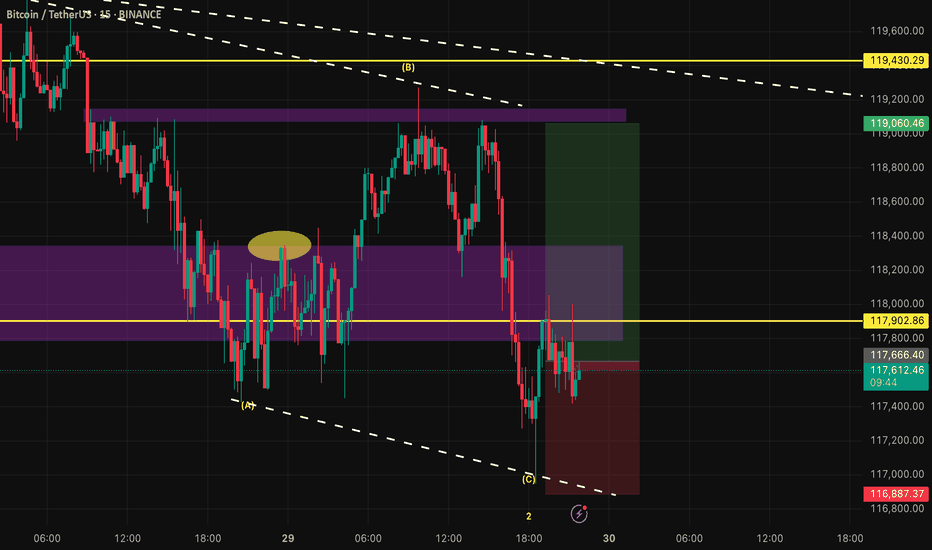

Lingrid | BTCUSDT Range-Bound Market: Short-Term Bearish MoveBINANCE:BTCUSDT has failed to break through the descending resistance near 120,000 and is now forming a lower high within the broader resistance zone. The price action follows an impulsive leg up and is currently tracing a potential reversal pattern under key structural resistance. As long as the market remains capped below 120,000, continuation toward 117,500 is likely. The downward bias is supported by weakening momentum after the bull trap and resistance rejection.

📉 Key Levels

Sell trigger: Breakdown below 119,000

Sell zone: 119,400 – 120,000

Target: 117,500

Invalidation: Break and close above 120,500

💡 Risks

Sudden bounce from the 119,000 handle could trap late sellers

Breakout above 120,000 would shift structure to bullish

Support near 117,500 may slow or reverse bearish pressure

If this idea resonates with you or you have your own opinion, traders, hit the comments. I’m excited to read your thoughts!

TradeCityPro | Bitcoin Daily Analysis #151👋 Welcome to TradeCity Pro!

Let’s dive into today’s Bitcoin analysis. Earlier today, the highly anticipated U.S. inflation data was released — let’s see how it has impacted Bitcoin.

⌛️ 4-Hour Timeframe

Bitcoin continued its correction yesterday, and remained in a corrective phase until today’s U.S. inflation news hit the market.

✔️ The news came out in Bitcoin’s favor, and we are now seeing a bullish engulfing candle on the 4-hour chart with solid volume. If this candle can close with a slightly larger body, it would be a strong signal for a potential continuation of the uptrend.

📊 As long as the price holds above the 116,829 level, I consider Bitcoin’s trend in LWC to be bullish. On the MWC, we are still ranging, and on the HWC, Bitcoin remains bullish.

🔔 Currently, there’s a resistance level at 120,041, which was previously faked out from above. We need to wait for the next tests to identify the precise resistance line.

✨ If this resistance at 120,041 breaks, a long position could be considered. The main trigger for confirming an MWC uptrend would be a breakout above 122,733. However, I recommend aiming to enter on the 120,041 breakout instead, as waiting for 122,733 might be too late — the move would likely be sharp, with no ideal entry candle.

🔽 On the other hand, if the current candle turns into a wick and closes red, Bitcoin could enter a deeper correction toward the 116,829 and 115,364 zones.

💥 If RSI closes below 50, that would give a momentum-based confirmation of bearish conditions, increasing the likelihood of a corrective scenario as selling momentum builds in the market.

❌ Disclaimer ❌

Trading futures is highly risky and dangerous. If you're not an expert, these triggers may not be suitable for you. You should first learn risk and capital management. You can also use the educational content from this channel.

Finally, these triggers reflect my personal opinions on price action, and the market may move completely against this analysis. So, do your own research before opening any position.

BTC/USDT Analysis — Buyer Weakness

Hello everyone! This is the trader-analyst from CryptoRobotics with your daily market analysis.

Yesterday, Bitcoin finally moved into a correction after forming resistance at $121,500–$122,300. There was no reaction at the nearest support around $120,000 (push volumes). Only at $119,000 did buyers attempt to step in — the delta suddenly turned positive — but for now, all buying attempts are being absorbed.

The scenario is currently highly mixed: on the one hand, wave analysis shows we are still in a strong bullish trend; on the other, volume spiked sharply at the top and is being positioned for shorts, while there was also no clear defense at support.

At this stage, we expect further correction either from current levels or after a retest of ~$120,000 (mirror zone). After that, we will watch for the buyer’s reaction at the lower support zone. This scenario will be invalidated if $120,000 is broken without any defense from sellers.

Buy Zones:

$117,500–$116,000 (accumulated volumes)

$115,300–$114,000 (accumulated volumes)

Sell Zones:

~$120,000 (mirror zone)

$121,500–$122,300 (volume zone)

This publication is not financial advice.

Bitcoin soon above 123K again enter long near 0.61% Fib support The price can pump without touching our entry because market is gonna start next phase pump ASAP but we put our short-term signal on one of the major support which is 0.61 Fib retracement level and also trade is 1:3(Risk: Reward).

for long-term view and CRYPTOCAP:BTC target which is 137K$ in my mind take a look at daily chart linked below.

DISCLAIMER: ((trade based on your own decision))

<<press like👍 if you enjoy💚