The Curtain Falls on the Script: Why I Believe It's Time to StopHello everyone, this is EC.

From late June through July, we experienced a full-fledged primary uptrend in crypto, driven by a weakening U.S. Dollar. From the script preview to the execution of the plan, every step has been clearly documented.

However, today, I want to share a different, more cautious perspective: I believe this script may be nearing its end.

I. Reviewing the Script and the "Bubble's" Manifestation

After our call on July 4th that the "main bull wave" was starting, the market perfectly delivered on our expectations. What was more interesting was the clear internal divergence we saw, which precisely confirms our thesis about the "bubble phase" from my June 20th article, "The Restlessness Before the Storm."

When the market's sentiment "balloon" is inflated to its limit, capital flows from the leader (BTC) to assets with higher elasticity (ETH).

The data shows that from July 11th until now, ETH took the baton and rallied approximately 35%, while BTC gained only around 6% in the same period. When BTC is already showing signs of fatigue while ETH is still in a solo rally, that in itself is a major signal that the bubble is nearing its end.

II. A Shift in the Winds: The Hand Inflating the Balloon is Loosening

I've chosen to end this script at this moment based on signal changes on two levels:

The "External Factor" Shift: The Potential Strengthening of the USD

As I pointed out in my July 28th analysis, "The Market's Rebalancing," the market has entered a phase of "strength-weakness divergence." This trend is now becoming more evident: the U.S. Dollar, cushioned by the extreme weakness of currencies like the Japanese Yen, has begun to show signs of a broad strengthening. Concurrently, U.S. and European stock markets are pulling back in sync, and global risk appetite is cooling.

The external environment that fueled the bubble (a weak USD) is beginning to falter.

The "Internal Factor" Signal: The Needle Point Inside the Balloon

The crypto market itself is also showing warning signs of resistance (see attached ETH daily chart). When the leading asset, ETH, begins to show signs of stagnation and distribution at its highs, it's like the balloon meeting the needle point. The exhaustion of internal momentum is a more direct warning than changes in the external environment.

III. Conclusion: Don't Be Greedy for the Last Dessert

When the core logic driving the rally (a weak USD) begins to waver, and the market simultaneously shows internal signs of exhaustion, my choice is to end this script and take profits off the table.

This doesn't mean I think crypto will crash immediately. But "no longer suitable to hold" implies that, in my view, the risk/reward ratio at the current level is no longer attractive. A grand feast is coming to an end, and being greedy for the last dessert is not a wise move. Shifting from "buying the dip" to "cautious observation" is the rational choice.

Thank you for your attention and for following along this past month.

#Crypto #BTC #ETH #TradingView #MarketAnalysis #RiskManagement

BTCUSDT trade ideas

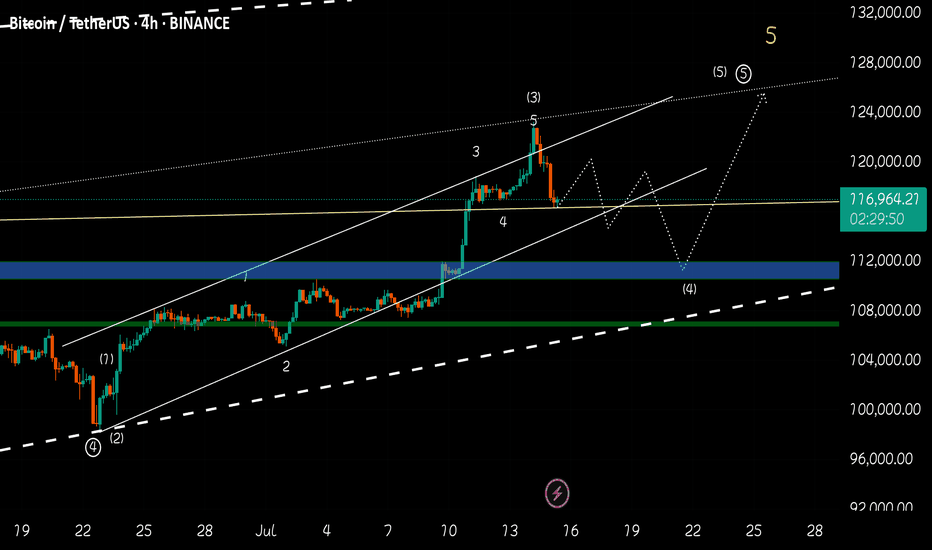

BTC CAN HIT 125K AFTER SHORT CORRECTIONHello friends, Bitcoin has made an incredible climb, carefully looking at the chart and also based on Elliott wave theory, it is clear that Bitcoin is completing submicro wave 4 of micro wave 5, wave 4 is usually an extended wave that covers a large time period with up and down fluctuations, I think the end of submicro wave 4 will be in the 110k-112k range in the four-hour timeframe. I think Bitcoin will break the 25k range in the coming days.

#BTC Update #13 – Aug 01, 2025#BTC Update #13 – Aug 01, 2025

Bitcoin has approached the lower edge of its current channel and received a reaction from there. However, in the current timeframe, the ongoing candle seems willing to pull back again. The MA200 band held the previous candle well, which also represented the bottom of the current channel. There is high liquidity between the $113,200 and $121,000 zones. I believe Bitcoin will continue to move by sweeping through this region. Therefore, I think Bitcoin’s current target is to reach around the $118,000 level with a 3% push move.

If Bitcoin does not make this move and chooses to pull back instead, it may go as far as filling the imbalance at the $110,000 level. The last impulsive move was made around 20 days ago, and since then, the chart has been progressing with a correction of a correction. As long as there’s no close below $107,500, the uptrend will remain intact in the long term. However, if the $107,500 level is broken with a strong candle, we can say that Bitcoin has turned bearish on the 4-hour timeframe. For now, this doesn’t seem very likely. I believe Bitcoin’s next move will target the $118,000 region, continuing to clear out the liquidity accumulating in the upper ranges. However, this channel will need to break at some point.

How to Use the PCCE + False Breakout DetectorHow to Use the PCCE + False Breakout Detector to Catch Trap Zones in BTC

Chart: BTC/USDT (1H)

Tool Used: PCCE + False Breakout Detector

Type: Educational – How to identify false breakouts and anticipate trend shifts.

⸻

🧠 What the Indicator Does:

The PCCE + False Breakout Detector is designed to identify breakouts from coiling ranges and filter out trap moves that often fool traders.

🔹 Burst↑ / Burst↓: Valid breakout from a price coil with volume and trend alignment

🔻 Red X: Marks a bull trap — breakout failed and price reversed lower

🟢 Green X: Marks a bear trap — breakdown failed and price reversed higher

By flagging where breakout structure fails, the indicator helps traders avoid false entries and position early for reversals.

⸻

✅ Recent Performance Highlights (BTCUSDT 1H):

📈 From July 13–31:

• Burst↑ on July 13 led to a clean uptrend (+$1,500 gain)

• Red X on July 16 called a failed breakout — price dropped hard

• Green X on July 16 caught the bear trap — price reversed immediately

• Burst↓ on July 21 triggered a sharp decline, validating breakdown

• Red X on July 30 spotted the bull trap just before price reversed down

📉 Even in sideways ranges, Red/Green Xs signaled when the move lacked conviction, allowing traders to wait instead of chasing noise.

⸻

🔍 Current Interpretation:

• BTC is trading inside a choppy structure after a recent Burst↑ and Red X combo.

• The X mark zone (gray box) warns of instability — bulls attempted a breakout but failed.

• If price continues to stay below the Red X high → likely retracement ahead.

• If we see a Green X + rally soon → potential reversal setup in progress.

⸻

📚 How-To Use the Indicator:

1. Burst Signals (Breakouts)

🔸 Use these to enter when coil compression breaks with volume

🔸 Works best when aligned with EMA trend and breakout body

2. Red / Green X (False Breakout Detector)

❌ Red X: Price spiked above resistance but lacked follow-through → trap

✅ Green X: Price dipped below support but got bought → trap

3. Confirm with Price Context

🔄 Look for reaction candles after X marks

📏 Set tighter stops — traps often reverse fast

🔔 Combine with your S/R zones or order block theory

⸻

🧠 Final Thoughts:

The PCCE + False Breakout Detector isn’t just about spotting momentum — it’s about reading intent vs. failure in price action.

BTC’s current structure shows signs of indecision. Trust the Xs to tell you whether the move has legs — or is just another trap.

🎯 Learn to trade the trap, not fall into it.

Bitcoin held the $115k level ┆ HolderStatBINANCE:BTCUSDT is currently in a triangle formation just above key support near 112,000. The price recently dipped below short-term support, likely triggering stop-losses, but still holds inside a bullish structure. If momentum builds, a push toward 125,000+ is likely. The trend remains intact above 110,000.

$BTC - Swing Point RetestCRYPTOCAP:BTC | 2h

We've got a swing point retest at 115.7k after the deviation at 114.6k

For bullish continuation, holding above 117.3k-116.8k is key — any break below invalidates the setup.

A clean break above the 120k resistance, I'm expecting we could finally tag 121k–122k (untested supply zone).

Accumulate waiting for btc price increase💎 BTC PLAN UPDATE – End of July (31/07)

📊 BTC Technical Analysis (4H Timeframe – End of July)

✅ Positive Signals:

• BTC has broken out of the consolidation triangle pattern (blue diagonal line), indicating a potential strong uptrend.

• The current price is retesting the breakout support zone around 117,800–118,000 → showing a good reaction and creating upward momentum.

• MA50 and MA200 are starting to slope upwards → confirming increasing buying strength.

📈 Bullish Scenario:

• If BTC holds above 118,000, it is likely to move toward the nearest resistance zone at 119,900.

• After breaking 119,900, the next targets are:

→ 122,792 (Fibonacci 1.618)

→ Further target: 127,900 (Fibonacci 2.618)

🛑 Risk Note:

• If the price drops below 117,000, it’s important to monitor again, as it may retest a deeper support zone around 114,500.

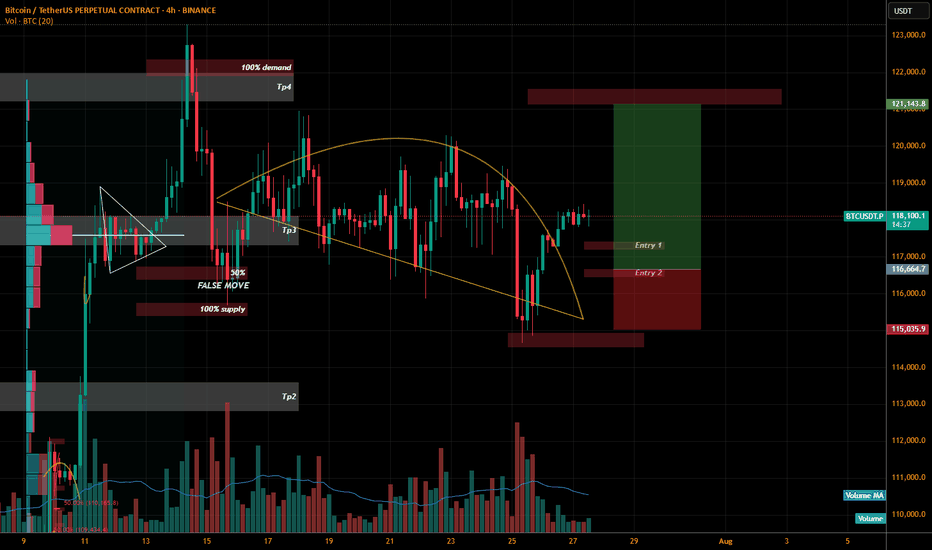

BTCUSDT.P LONGThe price is squeezed and its Sunday we might get a big move Positive Lets hope for the best and plan our trading.

I have marked 2 entries I think the more we wait the more we get.

So entry 2 in my opinion will be more beneficial to trail this trade. Anyhow if we see any bullish momentum on these level we are IN guys.

WHY? why i planned this trade as we can see the we are on sunday and price squeezed and we are already in bull run and we can see the price break the curve resistance so i hope the price will retest the level and if we see bullish candle patterns than only we will execute it.

If you like my previous ideas and analysis please don't forget to follow me. We all need encouragement. The more followers the more encouragement.

BTC Testing Resistance Within Lower Timeframe Channel

⚠️ CRYPTOCAP:BTC is setting up a key short-term play, with structure tightening on the intraday charts.

📉 4H: Trading inside a clean descending channel, with sellers still capping moves

⏱️ 1H: Price is nudging against trendline resistance — an active breakout attempt is underway

If this breakout confirms, we could see short-term bullish momentum take over 🔼

But a rejection here may push BTC back toward the channel’s lower boundary 🔽

👀 This setup is packed with potential — quick reactions are likely either way.

Are you expecting a breakout or another fade from resistance?

Not financial advice.

$BTC Retest Before Takeoff?Back on July 27, I shared a path 120K → 114K → 127K

Price has followed this playbook closely and now we’re at a critical zone again.

On daily timeframe, structure is still in an uptrend, but momentum is fading.

Price is consolidating between 119.9K–120.1K (Fib 61.8–65%) and 117.8K–116.6K (Fib 38.2–23.6%). MACD bearish crossover and histogram is still growing. RSI is neutral at 51 but definitely losing bullish energy.

If 117.8K breaks cleanly, we may revisit 114.7K (demand zone + full Fib retracement) before bulls reclaim control.

If we look at lower timeframe (4H). It is forming a tight range, but a lower high + weakening MACD suggests a bit more downside short term. Also, RSI at 46 confirms that consolidation with mild bearish tilt.

Key levels that I am currently looking are 118.8K–117.8K for the short-term intraday range play. And 116.6K & 114.7K for the support & potential bounce zone.

The scenario is still in play

- Rejection at 120K

- Retest 114K–116K zone

🚀 Then potential launch toward 127K (measured move + channel top)

Only a daily close above 120.1K with volume invalidates this retrace idea.

TL;DR

🟥 Resistance: 119.9K–120.1K

🟧 Neutral zone: 117.8K–118.9K

🟩 Support: 116.6K - 114.7K

🟦 Target: 127K if bulls reclaim the high ground

Still playing the patient game. Let’s see if 114K gets tagged one more time. What do you guys think?

Bitcoin's Natural Correction and the $141K Target Based on Fibonhello dear trader and investors

The cryptocurrency market is always accompanied by strong fluctuations and natural corrections. Bitcoin, as the market leader, requires corrections and liquidity accumulation after each significant rally to pave the way for higher price targets. In this article, we analyze Fibonacci structures and harmonic patterns to demonstrate that Bitcoin's next target could be $141K.

1. Bitcoin Corrections: A Natural Part of an Uptrend

Price corrections in bullish trends are a normal phenomenon that helps shake out weak hands and allows major players to accumulate liquidity. Historically, Bitcoin has experienced 20-30% corrections before resuming its upward trajectory. The current correction is no different and may serve as a base for the next strong move toward higher targets.

2. The $141K Target Based on Fibonacci

Fibonacci levels are among the most reliable tools for predicting price targets. Assuming Bitcoin's recent high was around FWB:73K and the ongoing pullback is a healthy retracement, we can use harmonic AB=CD pattern to project potential upside targets. Based on these levels, Bitcoin could reach $141K in the next bullish phase.

Confirmation Through Harmonic Patterns

Harmonic patterns like Butterfly and Gartley suggest that the current correction is forming a potential reversal structure. If this correction completes within the PRZ (Potential Reversal Zone), Bitcoin could see a strong continuation of its uptrend. The Fibonacci ratios in these harmonic structures indicate that the final price target for this bullish wave could be around $141K.

Volume and Liquidity: Key Drivers for the Rally

Bitcoin needs increased volume and liquidity inflows to reach higher levels. On-chain data shows that trading volumes are rising and large investors (whales) are accumulating rather than selling. This behavior typically precedes a strong bullish move.

Bitcoin's current correction is entirely natural, and technical structures suggest that it could be laying the foundation for a new bullish wave. Based on Fibonacci and harmonic pattern analysis, Bitcoin's next major target is around $141K. Traders and investors should consider these levels in their analysis and avoid emotional decisions during market corrections

good luck

mehdi

Want to Know What Happens in Crypto? Check Silver InsteadThe Gold/Silver ratio is one of the key indicators that highlights major turning points in modern economic history. Similarly, the ETH/BTC ratio is widely followed as a gauge of strength in the crypto market and the beginning of altcoin seasons. Interestingly, these two ratios also appear to correlate well with each other.

As adoption of both Ethereum and Bitcoin has grown, the Gold/Silver and BTC/ETH ratios have started to move more closely together. They often follow similar patterns, with tops and bottoms forming one after the other. For clarity, this analysis uses the BTC/ETH ratio rather than ETH/BTC.

Historically, BTC/ETH tends to lead during market tops, followed by a similar move in the Gold/Silver ratio. This pattern has been observed repeatedly since 2020. When it comes to bottoms, the timing between the two ratios is usually tighter, as seen during the 2020, 2021, and 2024 lows.

The latest signal came from a top in the BTC/ETH ratio, and the Gold/Silver ratio now appears to be following that move. Given the cyclical nature of crypto markets, both ETH and silver could be at the early stages of new upward trends. For a potential trend reversal, it may be wise to keep a closer eye on silver in the coming weeks.

BTC/USDT Analysis — Hidden Buyer

Hello everyone! This is the daily analysis from the CryptoRobotics trading analyst.

Yesterday, Bitcoin continued its move toward the local low and formed a false breakout.

Throughout the decline, we observed a positive delta, which may indicate gradual accumulation of long positions. At the same time, the descending trendline has not yet been broken, and there was strong absorption of market buys around ~$118,400 and ~$118,800 — which makes entering long positions very risky at the moment.

Our main expectations are based on further rotation within the range marked in yesterday’s analysis. In the short term, we are watching for a test of two local zones to assess the reaction from sellers. If the reaction is weak, a test of the upper boundary of the new sideways range is quite possible.

Buy zones:

$116,200–$115,000 (volume anomalies)

$110,000–$107,000 (accumulated volume)

Sell zones:

~$118,400 and ~$118,800 (local resistances)

This publication is not financial advice.

BTC: Calm before the storm on market, or where we go?Sometimes the market is straightforward: there’s momentum, a trend, a clear direction. But other times—like now—there’s complete uncertainty. Over the past few days, Bitcoin has been trading in a tight range, lacking any pronounced momentum. The price moves back and forth, bouncing off local levels but not breaking out in any meaningful way.

📉 This is especially clear on the 4-hour chart: neither bulls nor bears can take control. Every move upward is quickly met with selling pressure, and attempts to drop are countered by buying. It’s like a “ping-pong” match in a sideways market.

📊 Indicators show low volatility and declining volumes, confirming that market participants are simply waiting. Likely, they’re anticipating an external trigger: news, macroeconomic events, interest rate decisions, ETF developments, or something else.

What could this mean?

Such conditions often precede a strong move. The question is—where to? Honestly, there’s no clear signal yet. Personally, I try not to rush in moments like these: if the market isn’t giving a clear direction, it’s better to take a pause.

That’s the essence of a professional approach: don’t trade just for the sake of trading, but wait until the market speaks more confidently.

What can you do now?

– Watch the range boundaries and wait for a breakout or trade bounces.

– Avoid entering positions based on emotions—pullbacks can be sharp and unexpected.

– Reduce trade sizes if you do enter, and set tight stops.

– Keep an eye on the news—sometimes even neutral news can spark a move.

Sometimes the best decision is to do nothing. This might be one of those times. In a sideways market, you’re more likely to lose than gain. But clarity almost always follows a consolidation.

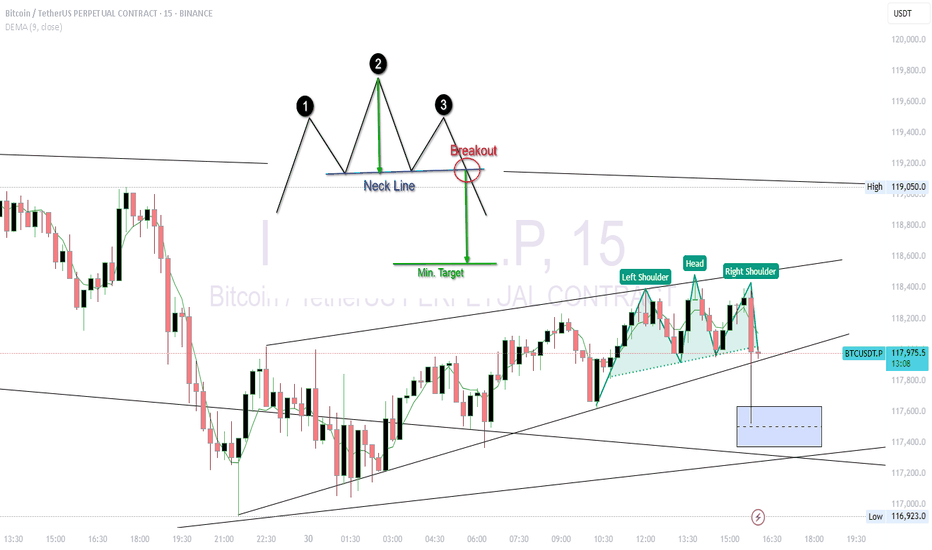

BTC USDT Forming Head and shoulder in 5 MinChart Breakdown

🟢 Pattern:

Left Shoulder: 118,450

Head: ~118,600

Right Shoulder: ~118,400

Neckline: Sloping slightly upward, around 118,050

📌 Bearish Breakdown Scenario

If BTC breaks below the neckline (~118,000) with volume, the expected drop (measured move) is:

Height of pattern:

Head (118,600) – Neckline (118,000) = 600 pts

Target on breakdown:

118,000 – 600 = ~117,400

🔻 Target: 117,400–117,300

🔒 Invalidation: Price closes above 118,300 with strong volume.