Bitcoin can continue to decline and break support levelHello traders, I want share with you my opinion about Bitcoin. Following an earlier upward trend, bitcoin entered a prolonged phase of consolidation, forming a large upward pennant where price action was tightly contested between the seller zone near 117000 and an ascending support line. This period of balance, however, has recently resolved to the downside with a significant change in market structure. A decisive breakdown has occurred, with the price breaking below the pennant's long-standing support line, signaling that sellers have ultimately gained control. Currently, after the initial drop, the asset is undergoing a minor upward correction, which appears to be a classic retest of the broken structure from below. The primary working hypothesis is a brief scenario that anticipates this corrective rally will fail upon encountering resistance from the broken trendline. A confirmed rejection from this area would validate the bearish breakdown and likely initiate the next major impulsive leg downwards. The first objective for this move is the buyer zone around the 112000 support level, but given the significance of the pattern breakdown, a continuation of the fall is expected. Therefore, the ultimate target price for this scenario is placed at the 109,000 level, representing a logical measured move target following the resolution of the large consolidation pattern. Please share this idea with your friends and click Boost 🚀

Disclaimer: As part of ThinkMarkets’ Influencer Program, I am sponsored to share and publish their charts in my analysis.

BTCUSDT trade ideas

BTC 1H Analysis – Key Triggers Ahead | Day 6💀 Hey , how's it going ? Come over here — Satoshi got something for you !

⏰ We’re analyzing BTC on the 1-hour timeframe .

👀 On the 1-hour timeframe, Bitcoin rebounded from $114,200 after heavy whale buying. It broke through the $115,530 zone and moved toward its resistance at $117,600, but was rejected twice by strong seller tickers in that area. It is now moving toward its current support levels .

🎮 Key Fibonacci zones to watch are the 0.5 and 0 levels. A breakout of these areas can trigger potential long or short entries, making them valuable as breakout triggers .

⚙️ The important RSI pivot level is 44.87; losing this level could lead to a further correction .

🕯 Trading volume and transaction count are rising, suggesting the possibility of another “Bitcoin season.” Large institutions have been buying at the lows, increasing their positions each time. ETF data has turned highly positive, indicating strong recovery potential and attracting more risk capital .

🔔 There are two alert zones: one at $117,500 and another at $116,000. Setting alerts here can help you better track price behavior .

📊 USDT.D has broken above its range box , A break of the current zone could allow Bitcoin to push higher .

🖥 Summary : After its recent pump, Bitcoin is facing resistance from seller tickers and is trying to break through this zone. As long as BTC stays above $116,000, there is potential for another attempt to set a new high .

❤️ Disclaimer : This analysis is purely based on my personal opinion and I only trade if the stated triggers are activated .

Bitcoin Price Action: Key Support & Resistance Levels to WatchKey levels are marked on the chart. These are all validated by at least three touches.

The pale blue line, that seemingly comes from out of nowhere, is the most significant one because it is the longest running. The ATH trendline for Bitcoin. The choppiness around this level is to be expected. If Bitcoin can gain the fuel to power above here, it'll almost certainly go parabolic.

Bulls need the bottom of the orange box at $116k to hold to maintain control.

How to use Order Flow / Delta Volume Indicator for IntradayWhat you’re seeing

This idea visualizes an intraday session with my Order Flow / Delta Volume study applied. The chart overlays three things that matter for short-term context:

• Cumulative delta (blue line) : running sum of delta, rescaled so it’s easy to compare to price swings.

• VWAP (grey line) : session anchor for bias and mean-reversion context.

Signal logic (kept simple & rule-based)

A bar is considered imbalanced when one side’s volume dominates the bar’s total volume.

• Imbalance: upVol / totalVol > 0.60 → buy-side imbalance; downVol / totalVol > 0.60 → sell-side imbalance.

• Trend/strength filters (optional but enabled here):

• VWAP filter → longs only when price > VWAP; shorts only when price < VWAP.

• RSI(14) filter → longs only if RSI > 50; shorts only if RSI < 50.

• Noise throttle: minimum 5 bars between signals + price must exceed the prior close by ±ATR(14) to avoid tiny wiggles.

These rules try to capture moments when flow (delta) and context (VWAP/RSI) line up, while the ATR and cooldown help skip low-quality, back-to-back prints.

How to read the chart

• Rising blue cumulative-delta with price above VWAP → constructive backdrop for longs; fading/ranging delta warns to de-risk or wait.

• Green “ BUY ” labels plot when a buy-side imbalance clears the filters; red “ SELL ” labels mark sell-side imbalances with bearish context.

• Background tints briefly highlight where the raw imbalance occurred (light green/red), even when a trade filter blocks a signal.

Walk-through of the attached example

• Trend leg after a base: cumulative delta turns up first and price reclaims VWAP → several filtered BUY signals print into the push; ATR gate avoids chasing the very first small upticks.

• Mid-session chop: delta flips around the zero line and price hovers near VWAP → far fewer signals; most imbalances are filtered out by RSI/VWAP or fail the ATR move requirement.

• Late expansion: a swift VWAP reclaim with strong positive delta → clustered BUY signals that track the follow-through, while opposing sell imbalances near VWAP are rejected by filters.

Inputs used on this chart

• Imbalance threshold: 0.60

• VWAP filter: On

• RSI filter: On, threshold 50

• Cooldown: 5 bars

• ATR length: 14

Notes

• This is not a trade recommendation. Signals highlight where participation leans, not certainty of direction.

• Best paired with your execution plan (risk unit, stop location, partials near prior S/R or VWAP).

• In fast spikes, delta can be extreme—ATR and the cooldown help, but slippage and whipsaws are always possible.

• For instruments with very low volume or during illiquid hours, consider raising the imbalance threshold or disabling signals altogether.

Takeaway

Order-flow imbalance by itself fires often; layering VWAP, RSI, and an ATR-based movement check concentrates signals to moments when both flow and context align. The attached session shows that behavior clearly: fewer prints in chop, more conviction when cumulative delta trends and price holds its side of VWAP.

Educational post for discussion only. No financial advice.

BTC 1H Analysis – Key Triggers Ahead | Day 5💀 Hey , how's it going ? Come over here — Satoshi got something for you !

⏰ We’re analyzing BTC on the 1-hour timeframe .

👀 After triggering its long signals, Bitcoin moved upward and hit the seller zone at 117,500, then reversed from that level.

🎮 A Fibonacci retracement has been drawn from $ 114,200 to $ 117,560. The price entered the zone between the 0.37 and 0.61 levels, and we need to see whether it reacts to 0.61 with selling pressure or pulls back to 0.37. Understanding market behavior in this area can guide us.

✏️ A curve line has been drawn from the first touch of the maker-buyer zone to the first touch of the maker-seller zone. This line intersects well with the 0.37 Fibonacci level, which has now been broken in current conditions.

🔽 With the increase in short positions and selling volume for Bitcoin, the price experienced a decline and correction. If selling pressure continues, Bitcoin could start a short-term correction.

⚙️ Our RSI oscillator is below the 50 level, with a support zone at 41.22. If this zone is lost, market momentum will lean more towards selling and further correction.

💸 BTC.D , if it breaks 60.72 %, could drop to lower levels, making Bitcoin lighter relative to the market.

💵 USDT.D , if it breaks 4.28 %, could also drop to lower levels, reducing Tether’s share in the market and shifting more capital into Bitcoin and altcoins.

🖥 Summary: Bitcoin was rejected from the 117,560 level and, along with selling pressure, dropped below the 0.37 Fibonacci zone. There is a support level at $ 115,530 — as long as the price stays above this zone, Bitcoin can maintain its upward trend with short-term multi-timeframe corrections.

❤️ Disclaimer : This analysis is purely based on my personal opinion and I only trade if the stated triggers are activated .

BTC - 1H Elliott Wave Analysis - 06.08.25Welcome to our Elliott Wave Count for Bitcoin!

We have seen a decent reaction to the upside from our Wave 2 support area.

We did remove the bearish red Wave count even if it hasn't been strictly invalided yet but we think it keeps the chart cleaner. Additionally if we take the recent high at 115'686 USD we would have an overlap of red Wave 2 and 4 which would decrease the probabilities of the bearish count.

It appears that we held the Wave 2 support and got a decent reaction to the upside.

At the moment we are continue to see the price surge to the upside.

We did add some Elliott Wave counts displayed each in 5 Waves in turquoise, white and green to help keep track of the price development.

Additionally we added a provisional support area for Wave 4 of the white count.

It sits between the 0.5 FIB at 114'469 USD and the 0.236 FIB at 115'083 USD with the invalidation at the 0.618 FIB at 114'194 USD.

Be aware that the support area moves with the price surging.

Preferable we stay above that support area.

Thanks for reading.

We would appreciate a follow and boost if you like the analysis! :)

NO FINANCIAL ADVICE.

[SeoVereign] BITCOIN BEARISH Outlook – August 12, 2025Today, I will introduce my short position outlook for Bitcoin on August 12.

There are two grounds for this idea.

First, an arbitrary wave X forms a 0.382 length ratio with another arbitrary wave.

In general, the 5th wave often has a length ratio of 0.382 compared to the 1st wave.

In this case as well, it can be counted in the same way.

Second, as a result of applying the Fibonacci in reverse to the wave that appears to be in a diagonal form,

the point where the ratio of 2 is formed almost exactly matched the recent high of around 112,360.

I often use this kind of “reverse Fibonacci.”

Normally, Fibonacci is drawn with the past point as the first point and the future point as the second point,

but I do the opposite — setting the future point as the first point and the past point as the second point.

In this case, ratios such as 1.618 / 2 / 2.24 / 2.618 / 3 / 3.618 are often used.

It is especially effective for measuring ratios between wave pairs that skip one wave,

such as between wave A and wave C, or between wave 3 and wave 1.

thank you.

08/10-10/12/25 BTC SHORT Right now will retrace however, it wont' present us with large enough move to profit from. but will soon sweep the highs listed below.

Preferred: Short BTC in $118,950–$119,200 zone after rejection.

Trigger: Wick into zone + aggressive sell reaction (fast candle back under $118,900).

Stop-loss: Above $119,300.

TPs:

TP1: $118,500

TP2: $118,300

TP3: $118,050

BTC 08/09-08/11 Levels To PlayPlay them after confirmation as many times as they are met you can enter them. They are NOT in any sequential order. Horizontal lines for easy reading. This is valid until BTC breaks below or above and those breakout levels are listed too.

LONG #1 (breakout): Break and hold above 119,500, buy the pullback 119,400–119,600 → targets 121,900 → 122–123k. Invalidate on loss of 119,000.

LONG #2 (sweep-reclaim scalp): Sweep 116,200–116,400, reclaim and hold above ~117,000 → 117,900–118,100. Invalidate on loss of the reclaim (~116,800).

SHORT #1 (rejection): Fail/sweep at 119,300–119,800 and close back inside → 118,900 → 118,000 → 117,500. Invalidate on H1 close > 119,800.

SHORT #2 (intraday fade): Reject 117,200–117,400 → 116,600 → 116,200. Invalidate on push/hold > 117,500.

Skeptic's Night Byte: How to Catch Altcoin MovesHey, welcome to the first episode of the Skeptic's Night Byte

In this quick lesson, we’ll dive into how to spot when liquidity moves from Bitcoin into altcoins .

Each video is about 60 seconds, giving you fast, no-fluff insights to help improve your trading game :)

If you find this useful, give it a boost and share it with your trading circle.

Let’s get started!

BTC - 1H Elliott Wave Analysis - 11.08.25Welcome back to our updated Elliott Wave Count for Bitcoin.

Apologizes for not publishing an update yesterday, I caught a cold over the weekend so I wasn't in a good position to do a proper analysis :( We try to post a daily BTC update and occasionally EW counts for other coins too :) Going to try to keep that style up but no promises got to see how it works out.

We have seen a strong move up from our support area as we expected.

Today we got another count on the charts which doesn't mean that the other count (diagonal) we have been discussing throughout the last week is invalid. More on that later this analysis.

In this count we assume that the move up isn't a diagonal but rather multiple 1-2 set ups.

This count allows us to go higher more directly with a strong Wave 3. We got three 1-2's, a green one, a blue and a white one on the chart. We assume that the recent aggressive push was the white Wave 3 and we're now seeing a pullback in white Wave 4 which will be followed by the white Wave 5 which finishes the blue Wave 3 etc.

The support area for the white Wave 4 is between the 0.236 FIB at 120'892 USD and the 0.5 FIB at 119'150 USD. Preferably we would see a bounce from here now in this count as we have already entered it and tested the 0.5 FIB of the support area which Bitcoin seems likes to be doing recently. In case we go lower it could be that the white five move is already done but we'll see how it develops. The blue Wave 4 support area would be around 118'000 USD to 120'500 USD.

As above mentioned this doesn't invalidate the diagonal count. It is hard to distinguish between multiple 1-2's and a diagonal. We lean towards the multiple 1-2's count because the last move up was impulsive and aggressive. If you connect the Wave 1 and 3 high you get a trendline which can be overshot by the 5th Wave in a diagonal in a such called "throw-over" which usually comes with high volume which we indeed had here. The issue is we are looking for a leading diagonal and this throw-overs are more common in ending diagonals which is the main reason for the switch of the counts. :) Hope it makes it more transparent and understandable!

I just want to make aware that with this counts we got multiple support areas which are close to each other or even overlap. Essentially the whole price range of 114'000 USD to 121'000 is important, preferably we still want to bounce from the mentioned support area above but what we want to make aware of is that a break of it doesn't turn the count bearish. Just keep that in mind when trading on smaller timeframes :)

We would appreciate a follow and boost if you like the analysis! :)

Thanks for reading.

NO FINANCIAL ADVICE.

BITCOINTHE daily structure of the bitcoin shows a break out of the daily ascending trendline ,but on 4hrs we are protected by 4hr ascending trendline line ,the daily sr/rs level holds superior opinion of price action than any intraday time frame .so trade with care and know that any key level on 4r/3r can fail while contesting with daily TF and weekly structure.

#bitcoin #btc

BITCOIN THE daily structure of the bitcoin shows a break out of the daily ascending trendline ,but on 4hrs we are protected by 4hr ascending trendline line ,the daily sr/rs level holds superior opinion of price action than any intraday timie frame .so trade with care and know that any key level on 4r/3r can fail while contesting with daily TF and weekly structure.

#bitcoin #btc

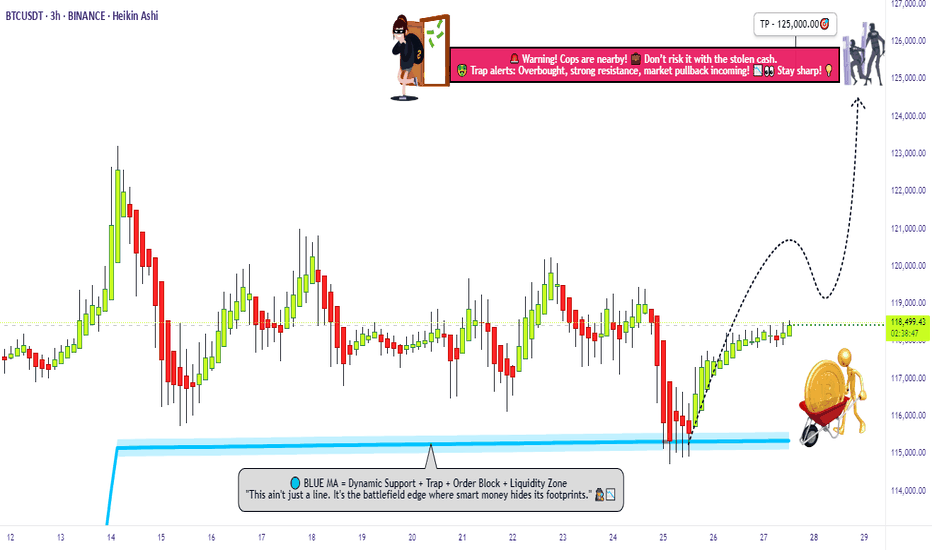

"Bitcoin’s Big Heist – Are You In or Out?"🚨 BTC/USDT HEIST MISSION – SWIPE THE BULL RUN BEFORE THE BEARS WAKE UP 💰💣

🌟Hi! Hola! Ola! Bonjour! Hallo! Marhaba!🌟

Money Makers & Robbers, assemble! 🤑💰✈️💸

Here’s your decoded BTC/USDT “Bitcoin vs Tether” Crypto Market Heist Plan, fully loaded with Thief Trading Style 🔥 TA + FA combo. We’re prepping for a bullish breakout loot – eyes on the vault, ignore the noise.

🎯 PLAN OF ATTACK:

🎯 ENTRY (BUY ZONE):

💥 “The vault’s open—time to sweep!”

DCA/Layer your buy limit orders near the 15–30 min swing lows/highs for sniper pullback entries.

Use multi-entry method to stack positions (layering / DCA) as per your ammo (capital 💵).

🛑 STOP LOSS:

Set SL at the nearest swing low wick (4H TF) — around 115000.00, adjust based on your risk/load.

SL = insurance. Not optional.

🏁 TARGET:

Lock sights on 125000.00

🎉 Or… vanish with profits before the bear cops arrive.

🔎 MARKET BACKDROP & ANALYSIS:

📈 BTC/USDT currently signals bullish vibes on the swing/day horizon — fueled by:

Macro Fuel & Fundamentals

Sentiment Radar

COT Reports

On-Chain Pulse

Intermarket Clues

🚀 Connect the dots. The smart money's already prepping a breakout move.

🧲 Scalpers Note:

Stick to the long side only. No shorting the beast — unless you’re made of diamonds.

Secure your bag with trailing SLs.

⚠️ NEWS TRIGGER ZONE – TRADE WITH TACT:

📢 Upcoming high-volatility news events can spike charts.

Avoid new entries during releases and guard open trades with trailing SLs.

Protect the loot. Always.

💖 SUPPORT THE HEIST GANG: BOOST IT!

Smash that ❤️ to boost our thief squad’s momentum!

Every click powers this underground mission – making money with style, one pip at a time. 🎯💣💵

🚀 See you in the next heist drop.

Until then – Stay stealthy. Stay profitable. Stay legendary. 🐱👤💸🏆

Weekly trading plan for BitcoinBINANCE:BTCUSDT has shown strong growth since last week; the main task now is to print a new ATH. The price will likely test the 126K–130K zone we marked a couple of weeks ago, with a final monthly target at 132K .

We’re seeing some pressure and a pullback, but as long as the trendline holds, there’s a real chance to see a new ATH today/tomorrow . If the trendline breaks, I’ll look for a reversal from the moving averages or after a test of the weekly pivot.

If 115K breaks, I’ll expect further downside toward 110K .

More details are in the idea video.

BTC-CRYPTO Market - Heavy Drop !!! coming Soon !!! Dear Traders,

I believe the Bitcoin market is nearing the end of its bullish cycle, and the 127K to 131 K range will be its last bullish move. The market will then enter a deep correction and experience a significant drop.

If you are a holder, be cautious. The market could experience a sudden heavy drop from the mentioned levels.

If you found this post helpful, I would appreciate it if you share your thoughts. Support me with a like and comment.

Regards,

Alireza!

Finale is done.So many bearish patterns are there.

Before I said, finale always leads to alt bull-run. But, it is almost ended too.

However, it doesn’t mean cycle is end.

I just think CRYPTOCAP:BTC will be in big box-range. This range is too wide to say that it is just the Healthy Pullback. That’s the reason why I said “finale is end. bearish.”.

Alt finale is also end but I still think alt is better than btc at current markets because btc will be at the big range box price. I prefer low fdv or nice float of cmc/fdv alts from now. Heavy, especailly CRYPTOCAP:ETH needs time to relay the bull run .

Summary

>>Finale is ended. DCA time for $BTC. Trading time for low cap ALTs. No long-term view now.