BTCUSDT trade ideas

BTCUSDT – 1H Chart Analysis |Critical Retest at Broken trendline

📅 \ Date:\ August 5, 2025

⏰ \ Timeframe:\ 1H

📍 \ Exchange:\ MEXC

💱 \ Pair:\ BTC/USDT Perpetual Futures

---

\ 📉 Trendline Breakdown and Retest\

BTC has broken below the ascending trendline and is now retesting it from the underside. This setup often signals a \ bearish retest\ , especially when momentum is weak and rejection wicks appear near previous support turned resistance.

Last rejection came around \ \$114,800\ , right at the underside of the broken trendline.

---

\ 🔍 Key Technical Levels\

* \ Resistance:\ \$114,800–\$115,000 (confluence of trendline + supply zone)

* \ Support:\ \$113,300 (horizontal green zone, strong historical demand)

Failure to reclaim the trendline might open the path toward \ \$113,300\ . A strong breakout above the trendline may flip bias short-term bullish.

---

\ 📊 Indicators Overview\

\ MACD\ :

• Bearish momentum is fading

• Bullish crossover is forming but not yet confirmed

• Needs clearer separation and histogram recovery for confirmation

\ RSI:\

• Currently at \ 49.43\ , struggling to cross the midline

• Facing resistance near \ 53.14\

• Neutral to slightly bearish momentum

---

\ ⚠️ What to Watch\

🔺 \ Bullish Scenario:\ Break and close above \$115,000 → continuation toward \$116,200

🔻 \ Bearish Scenario:\ Rejection at trendline → decline toward \$113,300

---

\ 🧭 Conclusion\

BTC is at a decision point. The next few candles will likely confirm whether this is a failed breakdown or a clean rejection. Watch volume and candle closes carefully.

\ Patience is key – confirmation is everything.\

---

\ #Bitcoin #BTCUSDT #TechnicalAnalysis #Trendline #MACD #RSI #SupportResistance #CryptoTrading\

BTC Analysis – The Most Likely Scenario

BTC Analysis – The Most Likely Scenario 🔥🚀

♦️ BTC ♦️

If today’s daily candle closes bullish and tomorrow we see a red engulfing candle ➡️ time to close positions.

But if we only see a rejection from the 120,000.00 level today ➡️ tomorrow the probability of breaking this zone increases.

🟡 On the monthly timeframe, it’s better to have a stronger candle with a larger body.

🟡 Lately, US traders have been 2-3 days behind Asian traders, so we could see momentum building in the US session in the next few hours.

If BTC.D rises above 60.98 ➡️ look for coins that are bullish against BTC pairs and go long.

If BTC.D keeps dropping or rejects from 60.98 ➡️ most altcoins will pump, and triggers will be easier to find on their charts.

♦️ TOTAL ♦️

Uptrend confirmed ✅ Finally broke the key 3.92 level. Look for triggers in BTC or alts.

♦️ TOTAL2 ♦️

Uptrend ✅ Broke the key 1.53 level.

Break of 1.57 = next trigger.

Break of 1.62 = last entry chance before a possible bull run.

♦️ USDT.D ♦️

After 19 days, we’re back testing 4.13.

Break above = 🔥 major bullish potential.

Rejection = should not go back above 4.20.

♦️ Most Likely Scenario ♦️

BTC stays bullish with rising dominance 📈. Then BTC needs to rest & range, at which point dominance will drop. If this happens, alts — which have been moving small and slow — could explode with huge momentum.

Best to open positions before BTC starts ranging, because once it rests and dominance starts falling, you won’t get an easy entry.

Given current market conditions, rejections and stop hits in alts are possible. But personally, I’d rather enter at these levels and take a stop-loss than miss the move entirely. 😎

🚀 Smash the rocket, follow for more setups, and stay ready for the next big move!

BTC 140K Loading…

We nailed the LONG entry right at the golden zone 🎯

Now CRYPTOCAP:BTC is breaking out with force – bulls fully in control 🐂🔥

📊 Targets in sight:

🎯 T1 – $126,472 ✅

🎯 T2 – $132,320

🎯 T3 – $138,556 (140K psychological level next 🏆)

Weekly + Daily both showing bullish continuation 📈

Every dip = opportunity until we tag that 140K zone 💪

#BTC — TP2 Closed by Indicator SignalAs anticipated, Bitcoin continued its upward movement, and our indicator precisely identified the optimal entry point for a long position. The signal was triggered around the $114,000 level, allowing for a timely entry and guided trade management toward the target levels.

The first target was reached within three days, and yesterday the second Take Profit (TP2) level was successfully closed. Throughout the entire trade, the indicator consistently outlined holding zones and partial profit-taking points, ensuring a systematic approach free from emotional decision-making.

The current price is approaching the TP3 area; however, divergence and convergence analysis indicate an increased likelihood of a correction. Despite the absence of a clear reversal impulse, the risk-to-reward ratio has already reached an optimal level, making profit-taking at the current range a justified decision.

The long position opened on the indicator’s signal delivered strong results once again, confirming that precise entries and algorithm-based trade management enable traders to fully capitalize on market movements.

BTC 4H Ascending Support Retest, Will Supply Zone Reject Again?BTC has been respecting this ascending trendline since late June, with buyers stepping in each time price approached support. Now, price is hovering just above the trendline while the upper supply zone remains a strong ceiling. A clean bounce here could push us back toward 120K resistance, but a breakdown would likely open the door to a deeper pullback toward the June demand zone. Bulls need to defend this level decisively to avoid losing the uptrend momentum.

BTCUSDTPreferably suitable for scalping and accurate as long as you watch carefully the price action with the drawn areas.

With your likes and comments, you give me enough energy to provide the best analysis on an ongoing basis.

And if you needed any analysis that was not on the page, you can ask me with a comment or a personal message.

Enjoy Trading ;)

U.S. Pensions Enter Crypto Amid Quantum Threat to BitcoinThis week, U.S. President Donald Trump signed an executive order allowing retirement 401(k) plans to invest in cryptocurrencies, as well as private equity and real estate. The move opens the door for digital assets to tap into the $12 trillion U.S. retirement savings market.

A Watershed Moment for Institutions

Integrating cryptocurrencies into retirement plans could be a historic step toward recognizing digital assets as a legitimate asset class. Younger investors, in particular, stand to benefit from exposure to high-growth, long-term instruments. However, financial advisors caution that cryptocurrencies remain highly volatile and should be part of a diversified investment strategy.

Risks and Opportunities

While expanding crypto access through pension plans offers significant upside, it also raises questions around regulation, investor protection, and fee transparency. Past market downturns have shown that excessive exposure to volatile assets can harm savings during periods of instability.

The Quantum Threat to Bitcoin

Parallel to the pension plan news, experts are increasingly discussing the potential threat of quantum computing. According to Barron’s, by the mid-2030s, technological advances could compromise the cryptographic security of older Bitcoin addresses. While approximately 75% of BTC is already stored in more modern, secure wallets, the industry is accelerating the development of quantum-resistant protocols.

Defensive Strategies

Blockchain developers — including the Bitcoin Core and Ethereum Foundation teams — are testing post-quantum cryptography algorithms to ensure long-term security. The objective is to stay ahead of technological breakthroughs that could otherwise undermine digital asset safety.

Conclusion

The U.S. decision to allow crypto investments in pension plans is a milestone for the industry, signaling maturity — but it also presents new regulatory challenges. Meanwhile, the quantum computing threat serves as a reminder that the crypto sector must invest not only in growth, but also in securing its foundational infrastructure.

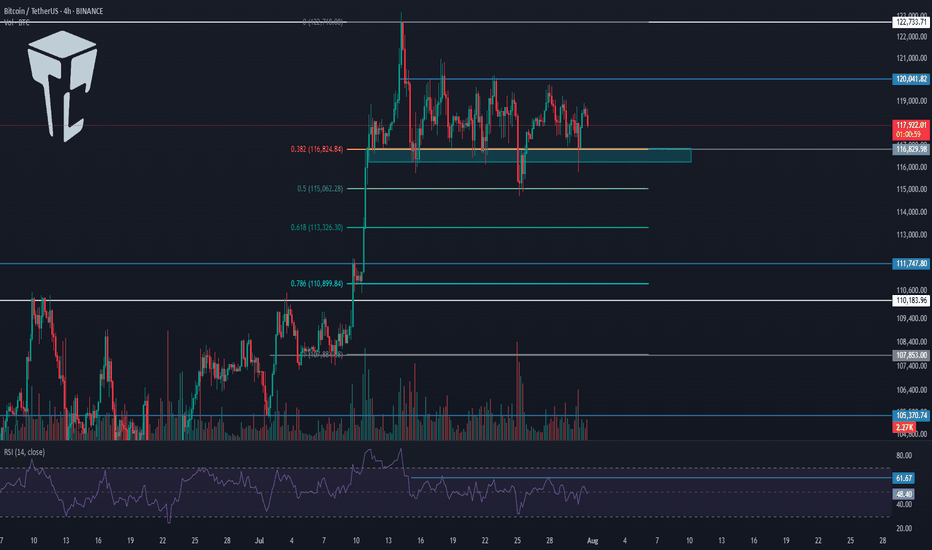

TradeCityPro | Bitcoin Daily Analysis #140👋 Welcome to TradeCity Pro!

Let’s dive into the Bitcoin analysis. Yesterday, the interest rate decision by the US Federal Reserve was announced, and once again, just like the past few months, it remained unchanged. Let’s see what impact it had on Bitcoin.

⏳ 4-Hour Timeframe

In the 4-hour timeframe, after the announcement of the unchanged interest rate and Powell’s speech, Bitcoin printed a red candle on the support zone and even wicked lower, but then recovered and the price returned back into the box.

✔️ Basically, we can say that this month’s rate decision had no real impact on the market, and Bitcoin is still moving inside its range box. The fact that the support zone wasn’t lost is a positive sign for the continuation of the trend.

⭐ But the important point is this: if the uptrend is going to continue, the price must print a higher high or at least a level equal to 120041, and in my opinion, if for any reason a lower high gets printed, the chances of breaking below 116829 significantly increase.

📊 I currently have no new position on Bitcoin, and all my entries are below 110000. But if 120041 breaks, I’ll open a long position for the next bullish wave that Bitcoin might start.

💥 A major trigger for starting a new leg is the 61.67 level on the RSI. As long as RSI remains below this level, there’s no bullish momentum in the market — and considering that the number of touches to 116829 has increased, the probability of a correction is also rising.

❌ Disclaimer ❌

Trading futures is highly risky and dangerous. If you're not an expert, these triggers may not be suitable for you. You should first learn risk and capital management. You can also use the educational content from this channel.

Finally, these triggers reflect my personal opinions on price action, and the market may move completely against this analysis. So, do your own research before opening any position.

BTC 4H – Repeating Accumulation Pattern, But Will It Hold Again?Bitcoin has shown a clear structural tendency to consolidate for ~43 days at key demand zones before breaking to new highs. This 4H chart highlights three nearly identical accumulation phases, each lasting around 260 bars with a clear base, fakeout, and bullish continuation.

We’re now sitting in the fourth demand zone, with price revisiting the same volume pocket and reclaiming key structure. If history repeats, we may be looking at another breakout leg above $124K+.

Key observations:

– Each consolidation zone lasted ~43 days

– Volume decreases into the base → demand absorption

– Reclaim of structure precedes each leg up

– Current consolidation mirrors previous 3 (in time, shape, and volume)

⚠️ A clean break below ~$112K would invalidate the pattern and suggest deeper retracement.

Are we seeing another accumulation leg… or distribution in disguise?

Drop your thoughts below.

#Bitcoin #BTCUSDT #Crypto #TradingView #PriceAction #MarketStructure #BTC4H #CryptoAnalysis #Accumulation #Wyckoff #SwingTrading #PatternRecognition #TechnicalAnalysis

Okay, Let's Take a Live Look Into the Market 📺⚡ Okay, Let's Take a Live Look Into the Market 💹🔥

Important levels across S&P 500, Bitcoin, and XRP are all flashing 🔴 right now. Here's what I'm seeing in real-time:

📈 S&P 500 Futures – 6,351 Is Everything

The 6,351 level marks the midpoint of the rising channel.

On Friday, I flagged 6,430 as critical resistance — price rejected perfectly.

Now we’re attempting a rebound, but we’re stuck at mid-channel.

⚠️ A confirmed breakout above 6,351 could reignite upside momentum.

👉 Yes, this is a 1-minute chart, but precision matters when watching key structural levels — especially in legacy indices.

💥 BTC – 115,700: The Grandmaster Level

Zoom out and see the massive yellow horizontal on the chart: 115,700.

It’s not just any number — this is the ultimate resistance-turned-support battleground.

We’re currently under it, which keeps pressure to the downside.

A reclaim flips the structure bullish and opens room for trend continuation.

📌 Until we’re above it, this remains the dominant resistance across the entire crypto macro framework.

🧩 XRP – Still Facing Rejection

On the 2H/3H chart, XRP continues to flirt with resistance but fails to confirm strength.

This aligns with both the S&P 500 stalling at 6,351 and Bitcoin being capped at 115.7K.

📉 When multiple assets respect key levels in sync, it signals market-wide hesitation.

🔄 Cross-Market Confluence

It’s fascinating to watch:

A TradFi index (S&P)

A macro crypto asset (BTC)

A mid-tier alt (XRP)

...all pivoting around hyper-precise structural resistance at the same time.

✅ These aren’t coincidences. They’re systemic correlations.

🔮 What’s Next?

If S&P 500 breaks above 6,351, it could act as a risk-on signal.

That momentum could help BTC flip 115,700 — a massive deal.

And if that happens, XRP could finally follow with a stronger move.

Until then? We respect resistance and wait for confirmation. 📊🔍

One Love,

The FXPROFESSOR 💙

Disclosure: I am happy to be part of the Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis. Awesome broker, where the trader really comes first! 🌟🤝📈

Deep Dive Into Relative Strength Index (RSI)The Relative Strength Index (RSI) is a momentum oscillator developed by J. Welles Wilder Jr. that measures the speed and magnitude of price changes.

Introduction

In the world of trading, timing is everything — and few indicators have stood the test of time like the Relative Strength Index (RSI). Introduced by J. Welles Wilder in 1978, the RSI is a momentum oscillator that helps traders evaluate the strength and speed of price movements. Whether you're trading stocks, forex, or crypto, understanding how RSI is calculated and how to interpret its signals can give you a critical edge.

In this article, we’ll break down exactly how the RSI works, explore its formula, and dive into practical ways you can incorporate it into your trading strategies. From spotting potential reversals to identifying overbought and oversold conditions, the RSI remains a cornerstone of technical analysis — but only if you know how to use it properly.

Let’s explore the mechanics and the mindset behind this powerful indicator.

What Is RSI and How Is It Calculated?

The Relative Strength Index (RSI) is a momentum oscillator that measures the speed and change of price movements over a defined period. It outputs a value between 0 and 100, which helps traders determine whether an asset is overbought or oversold.

The default RSI setting uses a 14-period lookback window and is calculated with the following steps:

🔷Calculate the average gain and loss over the last 14 periods:

Average Gain = Sum of all gains over the past 14 periods / 14

Average Loss = Sum of all losses over the past 14 periods / 14

🔷Compute the Relative Strength (RS):

RS = Average Gain / Average Loss

🔷Apply the RSI formula:

RSI=100−(100/(1+RS))

The result is a single number between 0 and 100 that indicates the asset's momentum.

How to Use RSI in Trading Strategies

⚡️Overbought and Oversold Conditions Strategy

RSI > 70 typically signals that an asset may be overbought and due for a pullback.

RSI < 30 suggests the asset might be oversold, potentially primed for a bounce.

However, these levels aren’t absolute sell or buy signals. In strong trends, RSI can stay overbought or oversold for extended periods.

📈Long Trading Strategy Example:

1. Identify the major trend, to find the long trades it shall be uptrend. On the screen below you can see 1D time frame for BITMART:BTCUSDT.P .

2. Move to lower time frame (in our case 4h) and find the moment when RSI falls below 30. This is our oversold condition and we are going to look for long trade.

3. Find the local support zone and open long trade.

4. Take profit when price reaches resistance level next to the previous swing high

5. Don’t forget to put initial stop loss when enter position. The best stop loss which will give you 3:1 risk to reward ratio.

📉Short Trading Strategy Example

1. Identify the major trend, to find the short trades it shall be downtrend. On the screen below you can see 1D time frame for BITMART:ETHUSDT.P .

2. Move to lower time frame (in our case 4h) and find the moment when RSI grows above 70. This is our overbought condition and we are going to look for short trade.

3. Find the local resistance zone and open short trade.

4. Take profit when price reaches support level next to the previous swing low

5. Don’t forget to put initial stop loss when enter position. The best stop loss which will give you 3:1 risk to reward ratio.

⚡️RSI Breakout Strategy

RSI is breaking through 60 indicating bullish momentum shift if the long-term trend is bullish can be the potential long signal

RSI is breaking down 40 indicating bearish momentum shift if the long-term trend is bearish can be the potential short signal

This strategy works great only on the trending market, don’t use it on the range bounded market to avoid whiplashes.

📈Long trading strategy example:

1. Make sure that long-term trend is bullish. Use 200 period EMA as its approximation. If price remains above it we can look for potential long trade setup.

2. If RSI crossed above the level 60 open long trade.

3. Put the initial stop-loss under the signal candle’s low.

4. Take profit when price reached 3:1 risk-to-reward ratio.

📉Short trading strategy example

1. Make sure that long-term trend is bearish. Use 200 period EMA as it’s approximation. If price remains below it we can look for potential short trade setup.

2. If RSI crossed below the level 40 open short trade.

3. Put the initial stop-loss above the signal candle’s high.

4. Take profit when price reached 3:1 risk-to-reward ratio. In our case we received very fast and profitable trade

⚡️RSI Divergence Strategy

RSI can be used also as a trend reversal indicator if we are looking for divergences. This is very reliable sign of current trend weakness and great opportunity open trade against the trend. Usually it’s not recommended, but in case if divergence can be applicable.

Bullish divergence is the situation when price created the lower low, while RSI made the lower low. Usually, it indicates that current downtrend is weakening and we can look for long trades

Bearish divergence is the situation when price created the higher high, while RSI made the lower high. Usually, it indicates that current uptrend is weakening and we can look for short trades

😎Important hint: it’s rarely covered in textbooks about technical analysis, but in our opinion it’s better to used divergences when RSI was able to cross level 50 between two lows/highs.

📈Long trading strategy example

1. Find at the chart situation, when the price made the lower low

2. At the same time RSI shall set the higher low

3. RSI shall break level 50 between these lows indicating shift to the bullish momentum

4. If price failed to set the clean breakdown open long trade on the candle which set the lower low. Put stop loss under it’s low

5. Take profit at 3:1 RR. When you master this concept, you will be able to have much more RR trades, even 10:1. This is possible because when trend finish you have the highest potential upside

📉Short trading strategy example

1. Find at the chart situation, when the price made the higher high

2. At the same time RSI shall set the lower high

3. RSI shall break level 50 between these highs indicating shift to the bearish momentum

4. If price failed to set the clean breakout open short trade on the candle which set the higher high. Put stop loss above it’s high

5. Take profit at 3:1 RR. When you master this concept, you will be able to have much more RR trades, even 10:1. This is possible because when trend finish you have the highest potential upside

Conclusion

The Relative Strength Index (RSI) remains one of the most powerful and flexible tools in a trader’s technical arsenal — but its real value lies in how you use it.

We’ve explored three key RSI strategies:

✅ Overbought/Oversold setups offer simple entry signals in ranging markets, where price tends to revert to the mean.

✅ Breakout strategies unlock RSI’s momentum-tracking potential, helping you ride strong directional moves with confidence.

✅ Divergence detection reveals hidden shifts in market sentiment, giving you an early warning of possible reversals or trend continuations.

Each approach has its strengths — and its risks — but together, they offer a complete framework for using RSI across different market conditions

🔑 Key Takeaways:

RSI is not just a “buy low, sell high” tool — it’s a multi-dimensional indicator that adapts to trends, momentum, and market structure.

The best RSI signals come from confluence: combining RSI with price action, support/resistance, volume, or trend filters like moving averages.

Patience and discipline are essential — RSI signals are only effective when paired with proper risk management and confirmation.

By mastering RSI beyond the basics, you'll be better equipped to make timely, confident, and informed trading decisions — whether you're entering a pullback, chasing a breakout, or spotting the early signs of reversal.

NeoWave Alert: BTC G-Wave Sets Up a Brutal Drop After $116K PumpAs anticipated in our previous NeoWave analysis, the market appears to be deep within Wave G of a Contracting Diametric structure (A–G), originating from the March 2025 high.

⸻

🔻 Key Developments:

• After rejecting from $119,000–119,500 (Wave F resistance), price dipped to $112,000, breaking below the previous channel’s lower bound, and now appears to be forming a steeper descending channel.

• This new channel’s resistance has shifted lower to $116,000, becoming a potential bull trap zone.

• The bounce from $112K is likely a liquidity sweep, preparing for one final upside to $116K, followed by aggressive distribution.

⸻

💡 Trading Thesis:

We’re likely seeing a trap-style rally within Wave G, aiming to:

• Attract liquidity up to $116K

• Induce late longs before initiating a more violent selloff toward $105K or lower

⸻

🔍 Smart Money Confluence (SMC / ICT)

• 🟥 Confirmed bearish structure on 1H (Lower Highs + BOS)

• 🟨 Liquidity above $120K already swept during Wave F

• 📉 Order blocks around 119.5K rejected

• 🔻 Price currently trades above $114K, but trapped inside a sharper descending range

• 🧲 Unfilled FVGs between $113K–$110K may serve as magnets

⸻

🧠 Wave G Structure (Diametric)

• Possibly unfolding as a Zigzag or Complex Combination

• Channel boundary now capped at $116K

• Wave G likely targets a breakdown below Wave E ($113K) and toward $105K

⸻

📌 Primary Scenario:

• Final push to $116K → strong rejection expected

• Bearish continuation targeting $110K → $105K

🧯 Invalidations:

• Clean breakout & daily close above $120.5K invalidates this diametric structure

• Watch for triangle or flat morphing if structure shifts

⸻

⚠️ Risk Management:

• $116K = key distribution zone

• Watch closely for rejection and breakdown confirmation

• Shorts valid below $114K with tight invalidation above $117K

⸻

📌 Conclusion:

Bitcoin is nearing the climax of a multi-month complex correction. The current setup favors a liquidity trap toward $116K, followed by continuation of Wave G toward major demand zones. Smart money bias remains bearish below $117K.

⸻

💬 Drop your alternate wave counts or SMC confirmations in the comments!

BTC Trade Plan 03/08/2025 - where to buy BTC?Dear Trader,

Bitcoin's price is currently moving within a double channel, with the midline of the channel around 108,000. The first scenario is that the price reaches the midline of the channel and then starts an upward movement. The second scenario involves a sharp downward move towards a stop hunt target around 97,000-100,000. In both cases, as long as the price remains above the 100822 level(Daily Close), the bullish trend will continue.

Regards,

Alireza!

BTC 1H Analysis – Key Triggers Ahead | Day 4💀 Hey , how's it going ? Come over here — Satoshi got something for you !

⏰ We’re analyzing BTC on the 1-hour timeframe .

👀 After triggering our long entry levels , Bitcoin faced increased buying volume , and the U.S . unemployment claims came in higher than expected, which was interpreted positively for the crypto market .

🔼 With rising buying volume, Bitcoin may continue moving toward higher levels and could even aim for a new local high. Our key support zones are the same trigger levels we've been watching—these are also our ideal long entry points .

⚡️ There is a strong resistance around $117,000, where taker sellers are actively selling their Bitcoin at premium prices. In order to break through this area, we’ll need solid volume inflow from both market makers and retail buyers .

⚙️ There’s no clear RSI support zone at the moment, since on the 1-hour chart RSI is already in the Overbought area and oscillating there .

📈 Long position : Be a bit patient here . Wait for Bitcoin to pull back to key Fibonacci levels , preferably around 0.236 and 0.382, and then bounce back up . Once we break above the pullback, you can consider entering a long trade .

📉 Short position : A short setup could form only if both of our marked trigger levels get stop -hunted, combined with increased selling pressure , support breakouts , and confirmation from bearish candlestick patterns.

That said — we are not looking to short right now, as there are better opportunities to catch strong long entries .

❤️ Disclaimer : This analysis is purely based on my personal opinion and I only trade if the stated triggers are activated .

BTC SHORT SETUP INTRADAY ( 02 AUG 2025 )If you have doubt on our trades you can test in demo.

Details:

Entry: 113,680 $ - 113,450 $

Target Price: 112,300 $

Stop loss: 114,370 $

Trade Ideas:

Idea is clearly shown on chart + we have some secret psychologies and tools behind this.

What is required to Join VIP?

- Nothing just you have to share 10% of your profit with us at the end of the month which you earned from our signals. Yeah this is just the requirement, trade where ever you like your favorite broker or else you don't need to pay fees first or create account thru our link.

Trade Signal:

I provide trade signals here so follow my account and you can check my previous analysis regarding BITCOIN. So don't miss trade opportunity so follow must.

BINANCE:BTCUSDT BINANCE:BTCUSDT.P BINANCE:BTCUSD

BTCUSDT | Cup & Handle Breakout Forming – Key Resistance Ahead!Bitcoin is forming a classic Cup and Handle pattern on the 4H chart, indicating potential for a bullish breakout.

🔹 Key Highlights:

Clear bullish momentum after a confirmed ChoCH (Change of Character)

Bearish trendline has been broken, shifting market structure

Price approaching the resistance area near $120,000, which aligns with a strong high

Watch for breakout above the target zone for potential continuation

MACD shows bullish divergence supporting momentum

📌 A clean break and close above the resistance zone could trigger the next leg up. However, a rejection here may retest the $112,000–$114,000 demand zone (handle support).

🧠 Not financial advice. Always do your own research before trading.

You don't know what's going on , 130K waiting for youI have shown in my previous post that Bitcoin is looking for a correction of wave 4 from wave 5 of the main wave 3 of Elliott waves, I said wait for 112k and then buy altcoins. It seems that the Elliott wave 4 micro-wave has completed its correction with the 50% Fibonacci percentage, I predict Bitcoin will touch the 128-130k levels at the end of Elliott wave 5. as I said before altcoins season is in the midway