Support around 115854.56-116868.0 is the key

Hello, traders.

If you "Follow", you can always get the latest information quickly.

Have a nice day today.

-------------------------------------

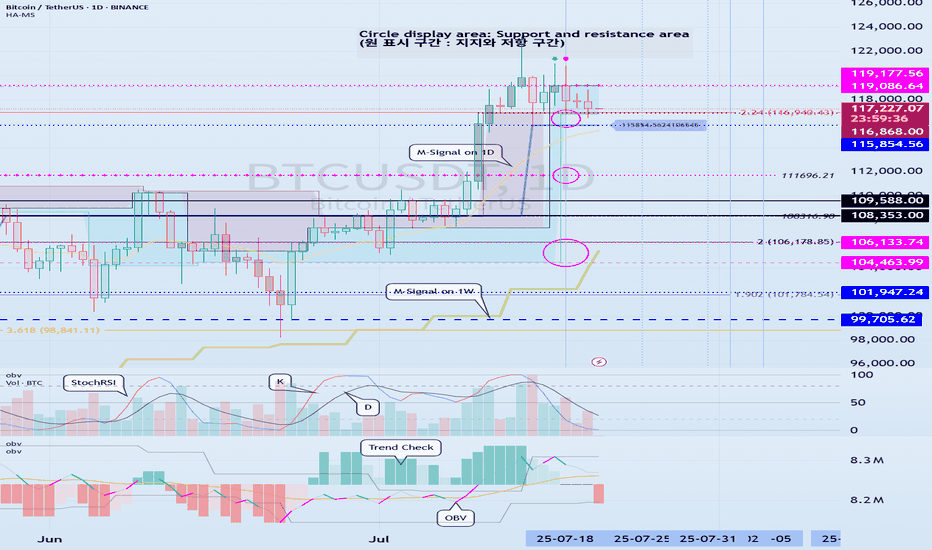

(BTCUSDT 1D chart)

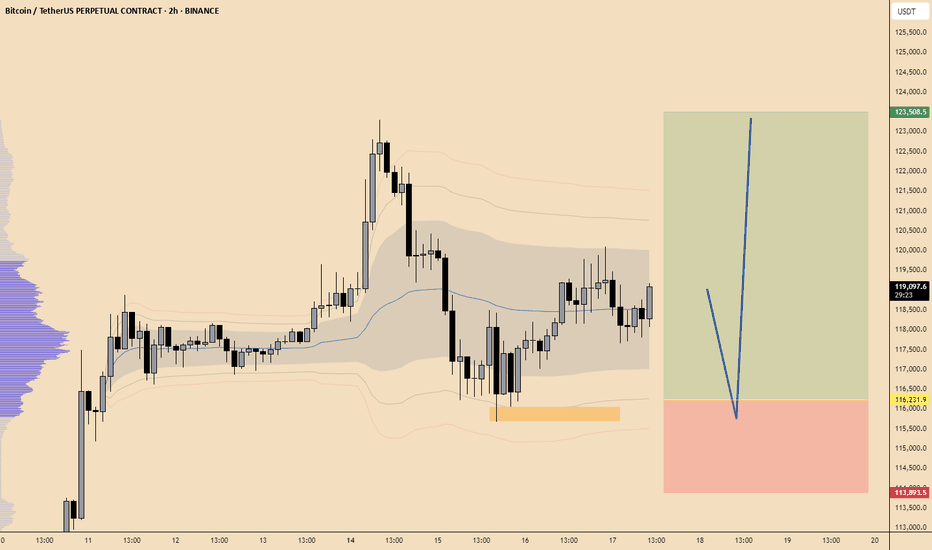

The DOM(60) indicator of the 1W chart is generated at the 119177.56 point, and the DOM(60) indicator of the 1D chart is generated at the 119086.64 point, and then shows a downward trend.

However, since the HA-High indicator is formed at the 115854.56 point, it is difficult to say that it has yet turned into a downward trend.

Accordingly, it is necessary to check whether it is supported in the HA-High ~ DOM(60) section.

The next volatility period is expected to occur around July 25 (July 24-26).

However, the important volatility period is expected to be around August 2-5 (maximum August 1-6), so we need to look at what kind of movement it shows as it passes through the volatility period that will occur in the future.

-

Since the StochRSI indicator has entered the oversold zone, there is a possibility that the decline will be restricted.

Therefore, the key is whether there is support around 115854.56-116868.0.

This is because if it falls below the HA-High indicator, there is a possibility that a downtrend will begin.

Also, since the M-Signal indicator on the 1D chart is rising around 115854.56, it can be seen as an important zone.

--------------------------------------------------

An indicator called Trend Check has been added to the OBV indicator.

This indicator is an indicator that comprehensively evaluates the StochRSI, PVT-MACD oscillator, and OBV indicators and expresses them in a column.

Accordingly, if the TC indicator rises from the 0 point, it can be interpreted that the buying force is dominant, and if it falls, the selling force is dominant.

Therefore, if it rises above 0, it is likely to show an upward trend, and if it falls below 0, it is likely to show a downward trend.

Also, if the TC indicator touches the highest point (6) or lowest point (-6), there is a high possibility that the trend will reverse, so you should think about a response plan for this.

-

Thank you for reading to the end.

I hope you have a successful trade.

--------------------------------------------------

- Here is an explanation of the big picture.

(3-year bull market, 1-year bear market pattern)

I will explain the details again when the bear market starts.

------------------------------------------------------

BTCUST trade ideas

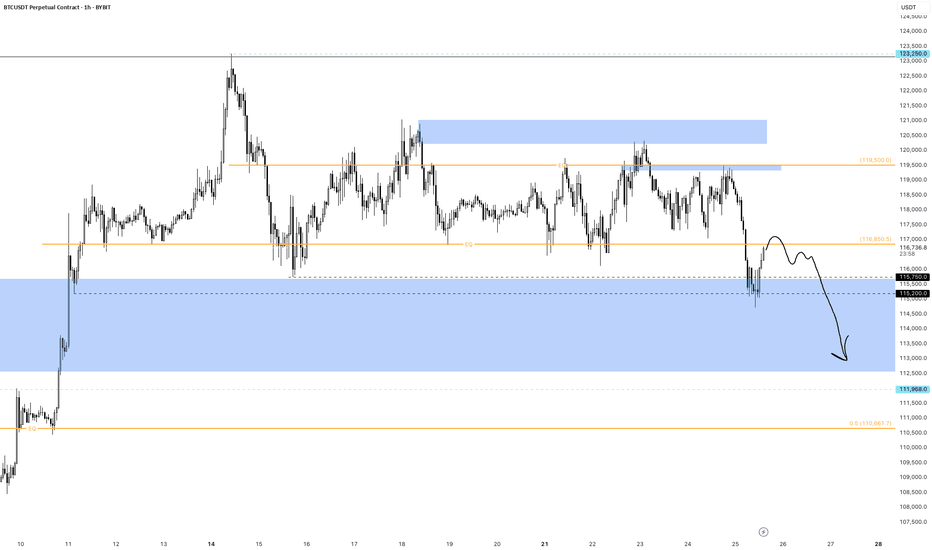

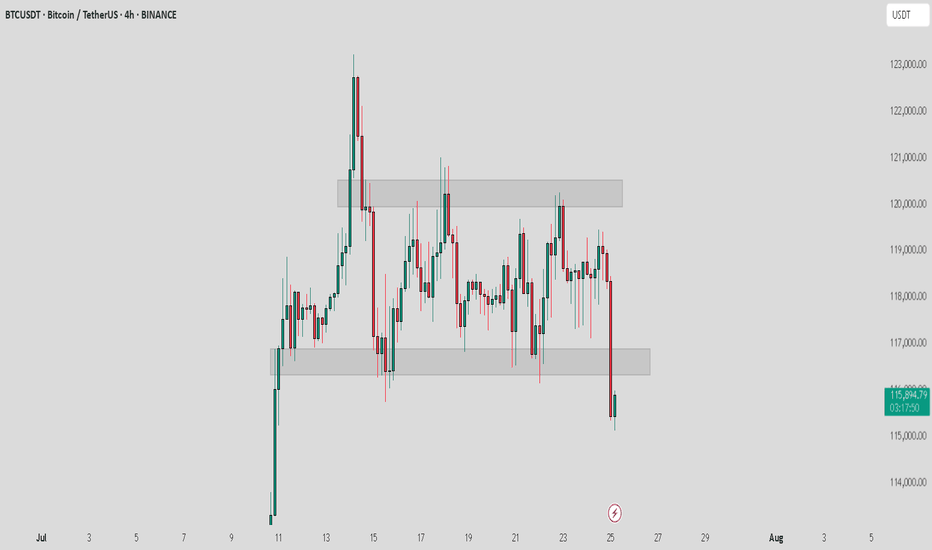

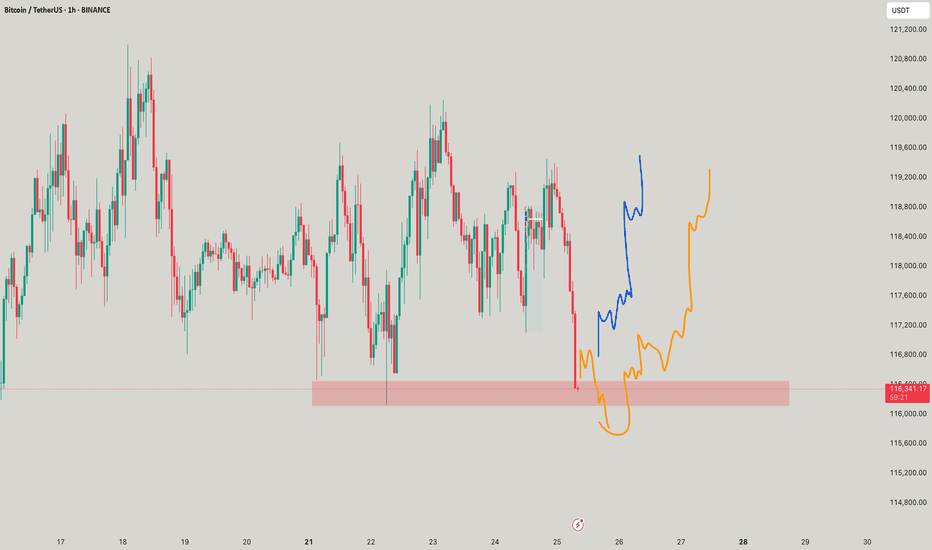

Bearish retest or deviation for Bitcoin117000 is key. it’ll decide whether this is a bearish retest or just a deviation. i believe it’s a bearish retest and we’re setting up for 110-114 next.

last drop came when price kept failing to hold above EQ. now we’re below the EQ of the ath/previous ath range. if price can’t reclaim that either, a deeper drop is likely. a 12h close above EQ could open the path toward 120-121k, but that’s the less probable case in my view.

why? nasdaq and spx are in premium zones (fib extensions), and holidays are near for big players. as profit taking hits there, pressure will echo here. simple cause, predictable effect.

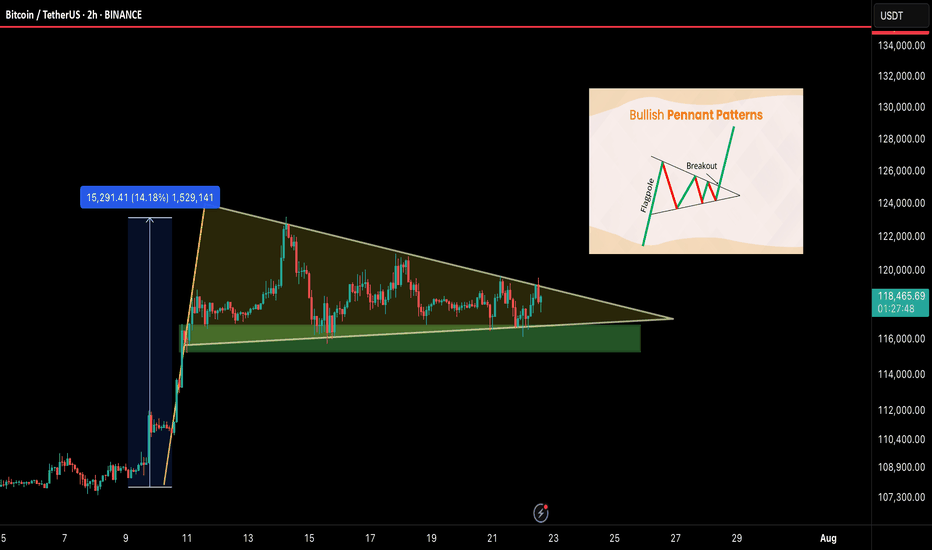

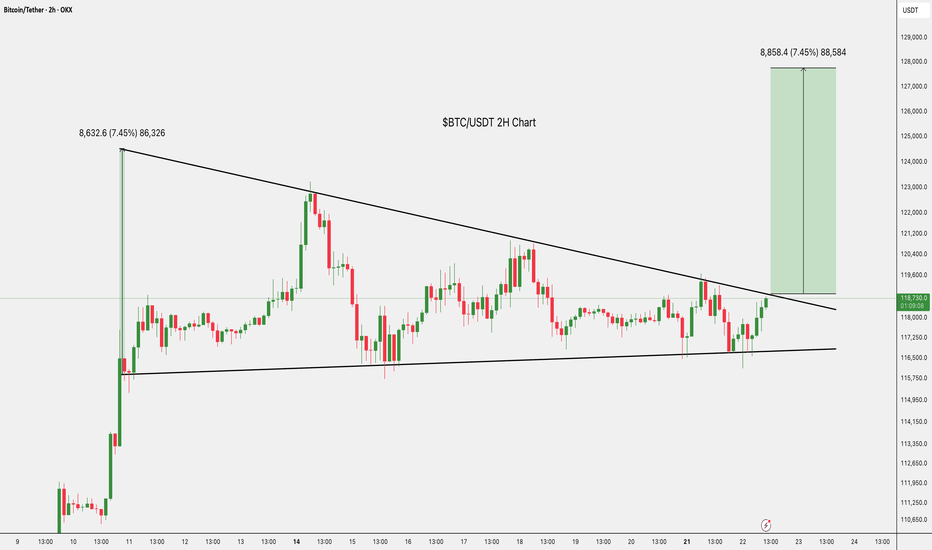

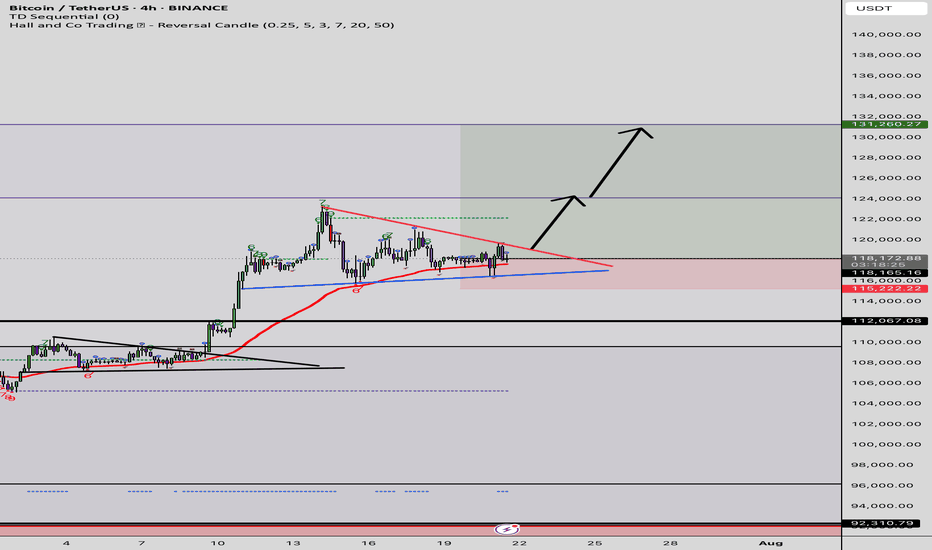

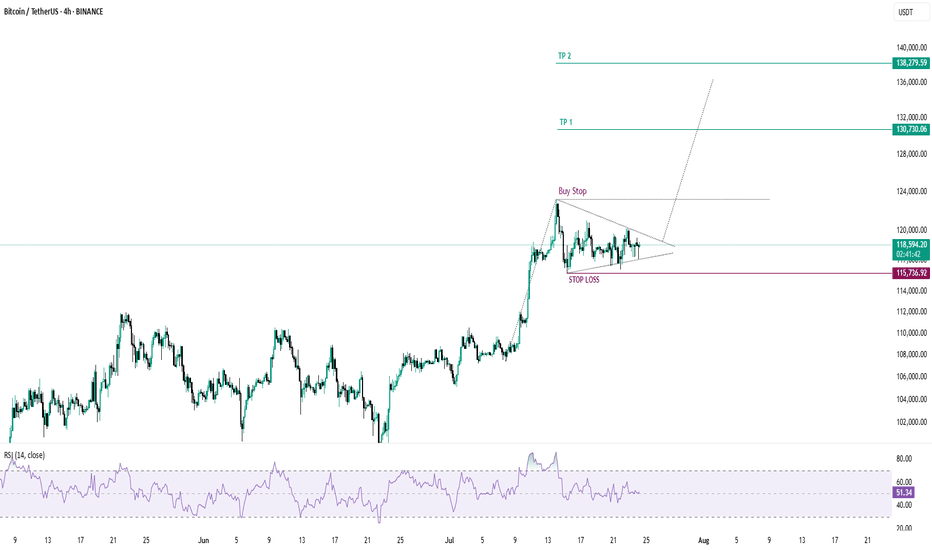

BTC/USDT – Bullish Pennant Setting Up for the Next Leg!Bitcoin is currently forming a bullish pennant — a classic continuation pattern — right after a strong 14% impulse move. This type of structure often leads to a breakout followed by another powerful rally. And it’s coiling up nicely.

🧠 Technical Breakdown:

🟢 Bullish pennant formation in progress

🔽 Support zone: $115.5K – $116.5K

📏 Flagpole projection targets $135K+ on breakout

⚠️ Currently consolidating with lower volatility — breakout could be near

🔍 What to Watch For:

Clean breakout above pennant = breakout confirmation

Daily close below $115K = invalidation zone

Volume spike will likely signal the next move

📢 Final Take:

BTC is showing healthy consolidation after a strong move, and this pennant could launch us toward $135K and beyond. Keep your eyes on the breakout and manage risk wisely.

💬 Share your thoughts below & smash that ❤️ if you’re watching this move!

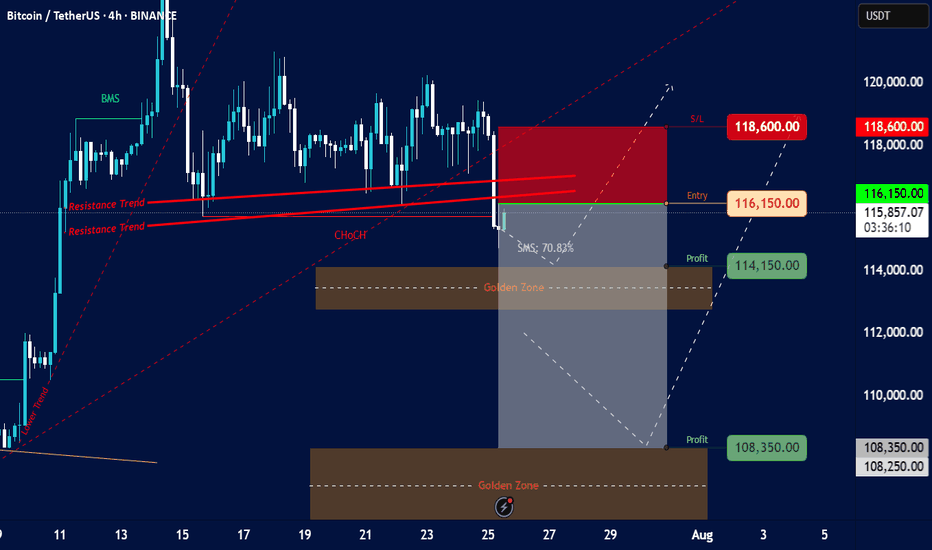

Bitcoin/TetherUS (BTC/USDT) on a 4-hour timeframeOverall Trend & Price Action:

Prior Uptrend: The chart shows a clear uptrend leading up to around July 15th, marked by an "Order Trend" line (dashed green).

Break of Market Structure (BMS): A "BMS" (Break of Market Structure) label is visible, suggesting a significant shift in market dynamics, likely indicating the end of the previous uptrend or a strong pullback.

Consolidation/Distribution: After the initial uptrend, the price appears to have entered a period of consolidation or potential distribution between approximately $115,000 and $120,000.

Resistance Trends: Several "Resistance Trend" lines (red) are drawn, indicating areas where the price has faced selling pressure. A recent breakdown below these resistance lines is evident.

Change of Character (ChoCH): A "ChoCH" label is present, which often signifies a change in the prevailing market sentiment or trend, confirming the shift away from the strong bullish momentum.

Current Price & Trading Setup:

Current Price: The current price is around $115,849.44.

Proposed Entry: The chart suggests an "Entry" point at $116,150.00. This is positioned just above the current price and within a potential retest zone of the broken resistance.

Stop Loss (S/L): The "S/L" is set at $118,600.00, indicating a risk management level if the trade goes against the intended direction.

Profit Targets (Profit):

First Profit Target: $114,150.00, located just above the first "Golden Zone."

Second Profit Target: $108,350.00, situated within the second "Golden Zone."

Golden Zones: Two "Golden Zones" (brown shaded areas) are identified, which are typically areas of significant support/demand or Fibonacci retracement levels where price is expected to react. The current setup seems to target these zones for profit-taking.

SMS: 70.83%: This "SMS" value (likely referring to "Smart Money Score" or a similar metric) of 70.83% suggests a strong bearish bias or conviction in the current setup.

Interpretation & Potential Strategy:

The analysis suggests a bearish trading setup for BTC/USDT.

The presence of BMS, ChoCH, and the breakdown below resistance trends indicate a potential shift from bullish to bearish sentiment or a significant correction.

The proposed short entry at $116,150.00 aims to capitalize on further downward movement.

The profit targets align with identified "Golden Zones," suggesting that these are anticipated areas of support where the bearish momentum might temporarily stall or reverse.

The significant "SMS" value reinforces the bearish outlook.

Risks & Considerations:

Reversal from Golden Zones: While profit targets are set at Golden Zones, these are also potential areas for price reversals if strong buying interest emerges.

False Breakout/Breakdown: The market can always surprise, and a re-entry above the stop-loss level would invalidate the current bearish setup.

Market Volatility: Cryptocurrency markets are highly volatile, and rapid price movements can occur.

News Events: Unforeseen news or macroeconomic events could significantly impact price action.

BTC is in a macro-uptrend but undergoing a healthy correction

Structure: BTC recently broke out from a local ascending wedge and is now pulling back toward support.

Current Price: ~$115,250 (at time of chart).

Day Support: ~117,000 (currently lost).

Next Key Support: ~109,244 (marked as WEEK RESIST, now potentially flipping to support).

Upside Target: 123,000 zone remains a key resistance, and aligns with projected measured move from wedge.

RSI: Just broke downward from overbought (divergence present). Currently ~59. A bearish signal in short-term momentum.

Williams %R: Deep in oversold, suggesting short-term bounce potential, but may be early.

200 SMA (blue): Holding well below current price — long-term uptrend remains intact.

Forecast Scenarios:

Base Case: BTC pulls back to 111K–109K, forms support, and continues the uptrend toward 123K.

Bullish Alt : If macro surprises (e.g., ETH ETF approval or FOMC dovish pivot), BTC reclaims 117K swiftly and rallies straight to 131K.

Bearish Risk: Break below 109K support, leading to retest of 98K (200 SMA area).

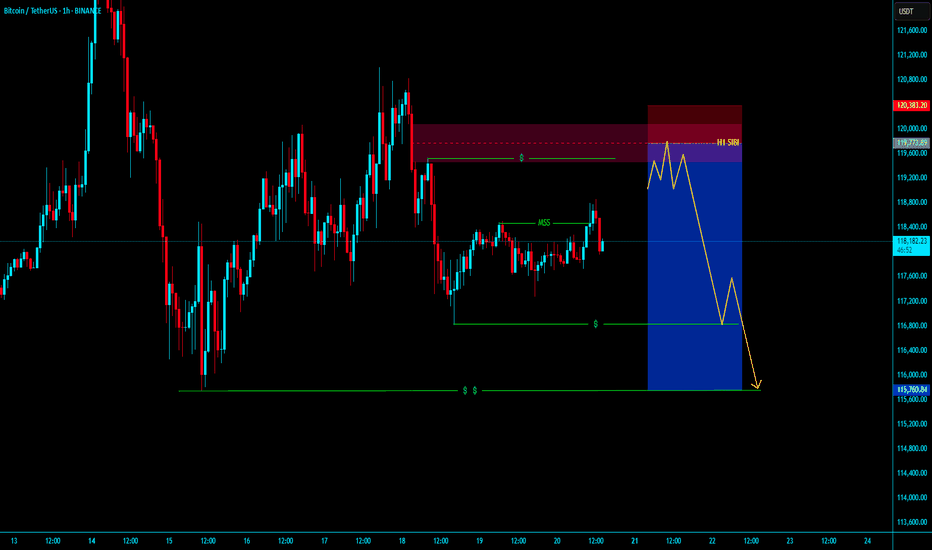

BTC / USDT : Broke down and now going for retestBitcoin Analysis:

Bitcoin has broken down and is now retesting the support zone. As mentioned earlier, a shakeout can happen at any time, and this looks like the potential retest phase.

Bullish Scenario:

Reclaims Resistance: If BTC manages to break through the resistance after the retest, it will stabilize for the short term. This could lead to a move towards higher levels.

Bearish Scenario:

Failure to Break Resistance: If the retest fails and BTC can't reclaim the resistance, further downside could be expected.

Targets: Keep an eye on the CME gap at $114,000 and 92K as key levels to watch for potential price action.

Note:

Manage your risk carefully. The market is volatile, and a shakeout could happen anytime. If BTC fails to break resistance after retest, more pain may be ahead.

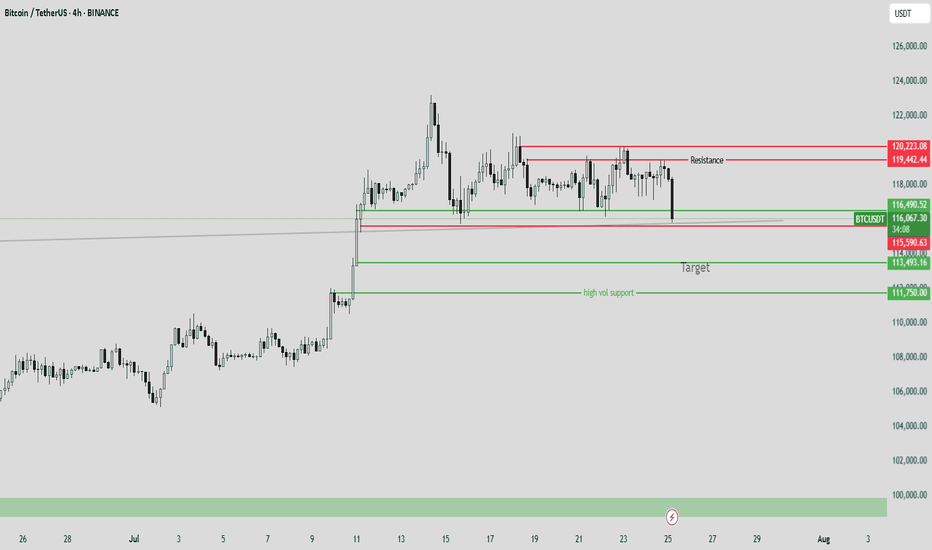

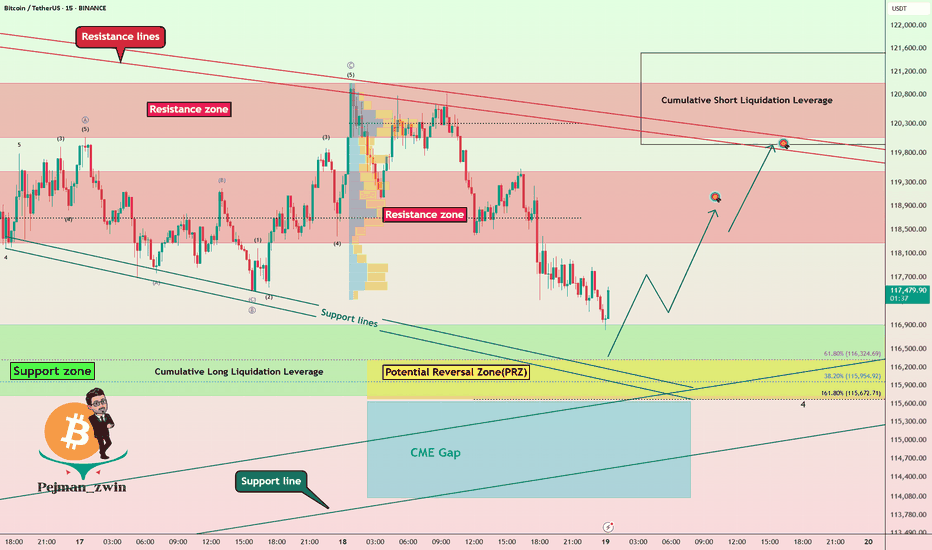

Bitcoin Technical Setup: Support Holds, Eyes on $118,600Bitcoin ( BINANCE:BTCUSDT ) moved as I expected in the previous ideas and finally completed the CME Gap($117,255-$116,675) in the last hours of the week. ( First Idea _ Second Idea )

Before starting today's analysis, it is important to note that trading volume is generally low on Saturday and Sunday , and we may not see a big move and Bitcoin will move in the range of $121,000 to $115,000 ( in the best case scenario and if no special news comes ).

Bitcoin is currently trading near the Support zone($116,900-$115,730) , Cumulative Long Liquidation Leverage($116,881-$115,468) , Potential Reversal Zone(PRZ) , and Support lines .

According to Elliott Wave theory , Bitcoin had a temporary pump after the " GENIUS stablecoin bill clears House and heads to Trump's desk " news, but then started to fall again, confirming the end of the Zigzag Correction(ABC/5-3-5) . Now we have to wait for the next 5 down waves or the corrective waves will be complicated .

I expect Bitcoin to rebound from the existing supports and rise to at least $118,600 . The second target could be the Resistance lines .

Do you think Bitcoin will fill the CME Gap($115,060-$114,947) in this price drop?

Cumulative Short Liquidation Leverage: $121,519-$119,941

Do you think Bitcoin can create a new ATH again?

Note: Stop Loss(SL)= $114,700

Please respect each other's ideas and express them politely if you agree or disagree.

Bitcoin Analyze (BTCUSDT), 15-minute time frame.

Be sure to follow the updated ideas.

Do not forget to put a Stop loss for your positions (For every position you want to open).

Please follow your strategy and updates; this is just my Idea, and I will gladly see your ideas in this post.

Please do not forget the ✅' like '✅ button 🙏😊 & Share it with your friends; thanks, and Trade safe.

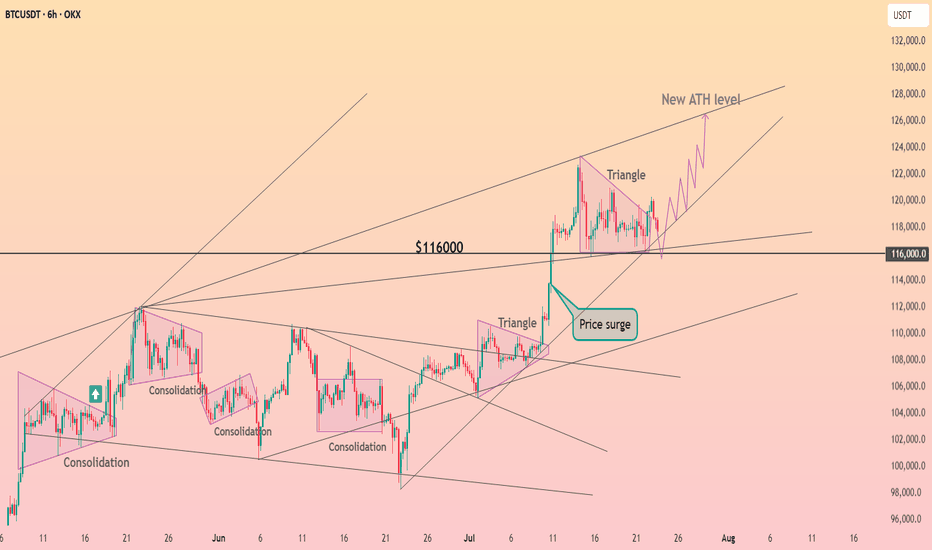

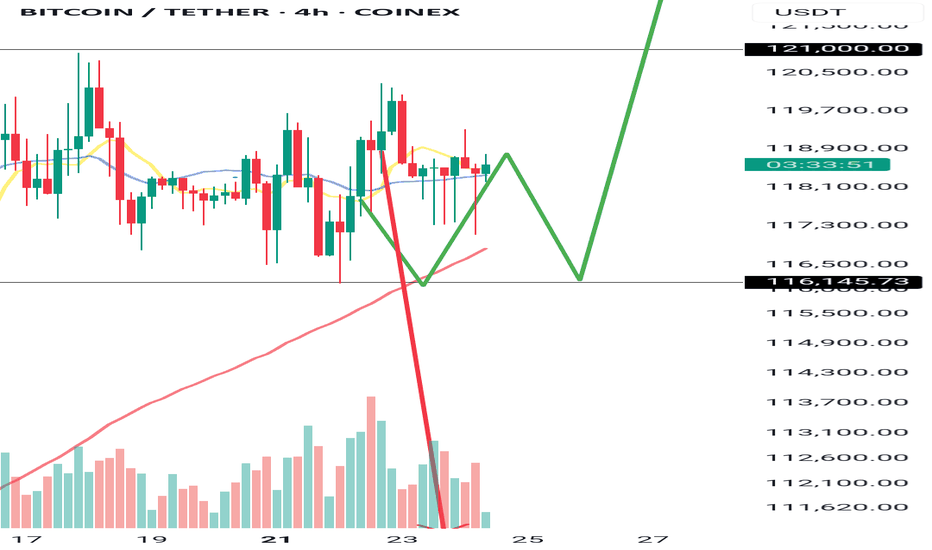

#BTC Ascending Triangle📊#BTC Ascending Triangle📊

🧠From a structural perspective, we are still in a sideways consolidation phase. We have already built a short structure. If we want to continue to rise, we need to break through the blue turning point 119240 and stabilize before we can usher in a big surge.

➡️From a morphological perspective, an ascending triangle is forming. After breaking through h, it is confirmed that the upward breakthrough will occur. The subsequent pullback is worth our participation.

⚠️If we fall below the low point near 116000, we cannot blindly go short, because the sideways consolidation time is too long. After the selling pressure is exhausted, the lows that appear are all opportunities for us to participate in long transactions.

🤜If you like my analysis, please like 💖 and share 💬 BITGET:BTCUSDT.P

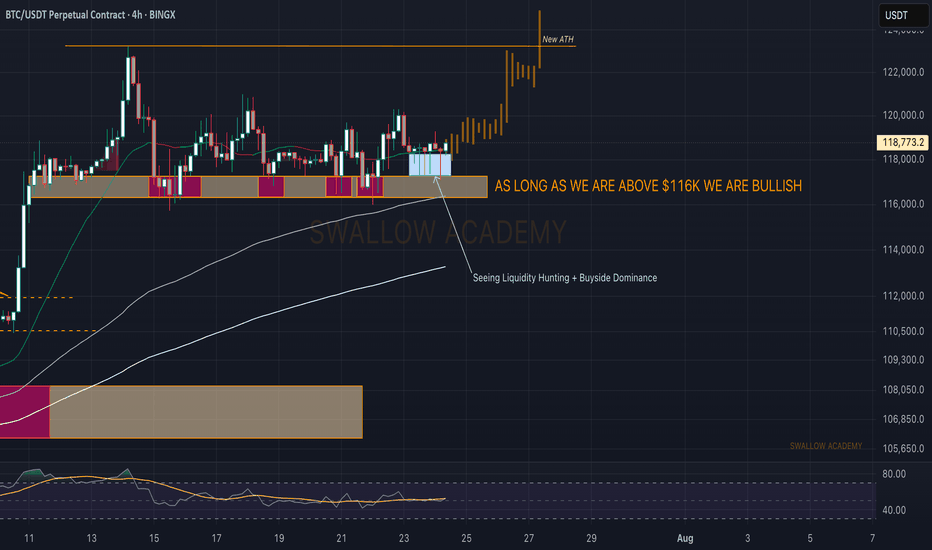

Bitcoin (BTC): Liquidity Hunting + Buyside Dominance | Bullish!What a week we have had so far; it has moved this whole week so far like one big rollercoaster, but nevertheless we are still above the $116K zone so we are bullish.

While we see slight buyside dominance,, we also see huge order limits sitting at $115K,, which means we might still see some kind of "last liquidity hunting."

That being said, we are keeping an eye on $116K and $115K zones.

Swallow Academy

Crypto Market Update & BTC & ETH Analysis

🚀 Crypto Market Update & Technical Analysis

🟢 Bullish News & Positive Signals:

• Altcoin Season Index is rising + CZ calls this the “FOMO season” → signaling emotional growth in altcoins, especially in short timeframes.

• Fear & Greed Index hits 74 → market is in a greedy phase; growth continues but a correction might be near.

• Goldman Sachs: Possible rate cuts from 2025 → expectations for a looser monetary policy, which is good for risk assets like BTC and ETH.

• Whales and institutions buying ETH (over 50K ETH in 48 hours) → suggests accumulation or preparation for the next Ethereum rally.

• $332M inflow into U.S. Ethereum ETFs → strong mid-term bullish fundamental for ETH.

• A whale withdrew 76,000 SOL from exchanges → usually a sign of HODLing and price growth expectations.

🔴 Warning News & Caution Signals:

• Bitcoin selling by long-term holders (high CDD) → selling pressure near historical highs could slow the rally, but not end it.

• Whale opened a 10x leveraged DOGE long ($19.82M) → could cause high volatility and liquidation risk for traders.

• TRON rings Nasdaq bell but TRX is negative → promotional event, but no strong demand reaction.

• BNB market cap surpasses Starbucks, but price is negative → long-term positive, but short-term market may be overheated.

• High Greed Index → short-term correction risk for BTC and alts.

✅ Analytical Summary (News + Charts):

• If technical signs of selling appear (especially on BTC or ETH), take them seriously as news supports selling pressure from some whales.

• Big institutional entries into ETH and SOL confirm the strength of the bigger trend.

• Market is emotional but still has a strong support base under BTC & ETH. Possible corrections = better buying opportunities, not exit signals.

📊 Technical Analysis

Strategy I use:

I analyze HWC (1D), MWC (4H), and LWC (1H).

Entry is based on breakouts in MWC (4H) and confirmation in LWC (1H).

♦️BTC/USDT♦️

• BTC is moving in the 116.2 – 120 range, keeping a bullish structure intact.

• I will not look for shorts as long as 110 holds.

• To keep the bullish scenario alive, we need high volume and sharp candles to break 121 – slow moves won’t work anymore.

• Stop-buy orders near 121 can be used to enter a long if the breakout is strong.

♦️BTC Dominance (BTC.D)♦️

• After a sharp drop last week, BTC.D is now correcting.

• Key level 61.31 was broken.

• The next resistance zones are 62.17 – 62.74 (currently being tested).

• If BTC.D holds above these levels, altcoins could see a bigger drop.

• If BTC.D rejects this zone, alts near breakout points will become our focus with better entry levels.

♦️USDT Dominance (USDT.D)♦️

• Showing signs of forming a bullish structure.

• Next resistance levels: 4.36 – 4.44.

• For a bullish continuation in coins, 4.14 must break down.

• Early but important level: 3.83 – if reached, we must rethink position management.

TOTAL / TOTAL2 / TOTAL3 /♦️ ♦️OTHERS.D

• Currently bearish, but BTC.D and USDT.D will show earlier signs of whether the correction is ending.

• Key levels to watch:

• TOTAL: 3.91

• TOTAL2: 1.55

• TOTAL3: 1.08

• OTHERS.D: 8.05 (a lower high may form if the uptrend resumes).

♦️ETH/BTC♦️

• Key level: 0.02975 (not reached yet).

♦️ETH/USDT♦️

• 3470 is the crucial level to keep the bullish structure.

• Many buyer orders (maker/taker) are stacked here, so the breakout may not be easy.

• Possible fake breakout in this area → could reset the bullish scenario again.

🎯 Conclusion:

The altcoin market correction is not over yet, but BTC & ETH are holding key support zones.

Focus remains on BTC.D and USDT.D.

If BTC breaks 121 with volume and dominance drops, it’s a green light for altcoins.

📣 If this analysis helped you, hit the 🚀, leave a comment 💬, and follow for more updates!

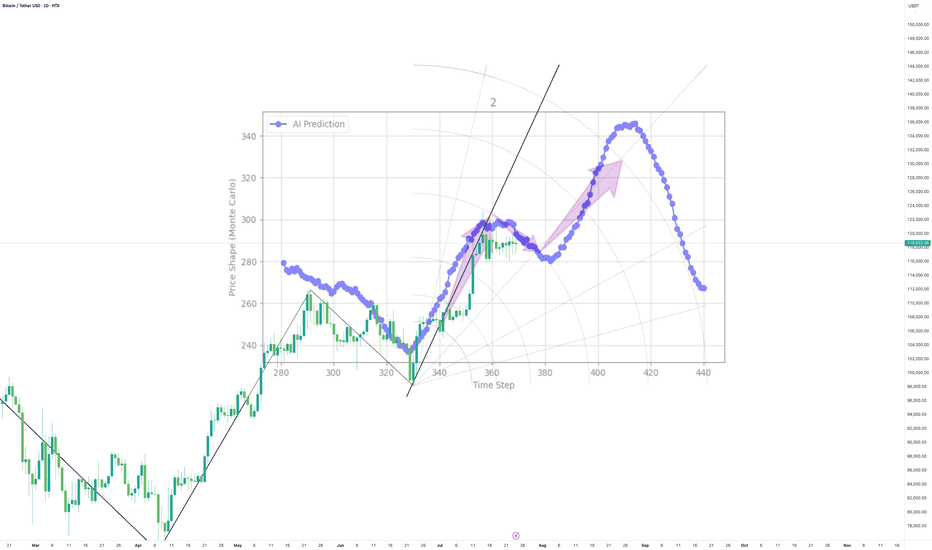

AI called it, Bitcoin listened! Now, will BTC stay the course?My AI saw Bitcoin's path weeks ago, and it's playing out PERFECTLY!

Uptrend, check.

Sideways pause? Check.

This cutting-edge tool is rewriting how we trade.

But now the stage is set for suspense...will it stay the course? Can it continue to defy the odds?

Lets see