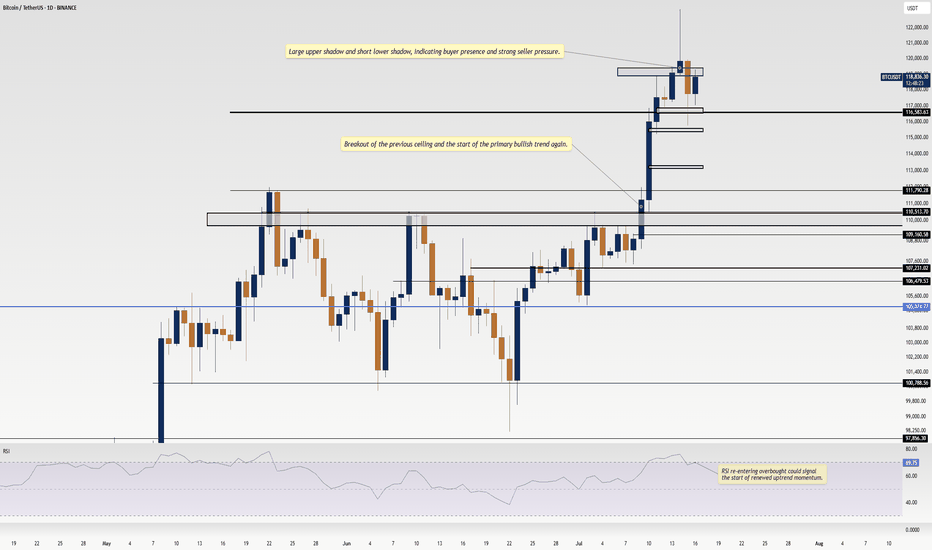

BTC Nears $120K – Pullback Risk or Breakout Launchpad?Bitcoin has rallied strongly after breaking its multi-week consolidation, now hovering just under the key psychological and historical resistance at $120K. The daily chart shows price floating above the 20EMA, with no signs of distribution—yet. However, the dense liquidity pocket between $110K–$114K remains a magnet in case of a technical pullback.

If bulls defend $118K and price cleanly breaks above $121K with strong volume, the next target lies in the $125K–$128K zone. Spot ETF inflows remain healthy, and any dovish pivot from the Fed could set off another crypto-wide bull wave.

BTCUST trade ideas

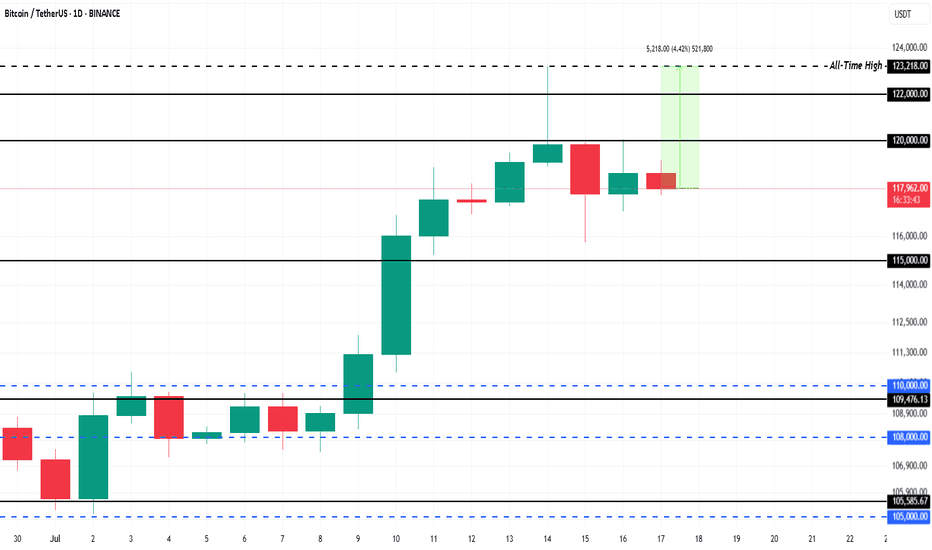

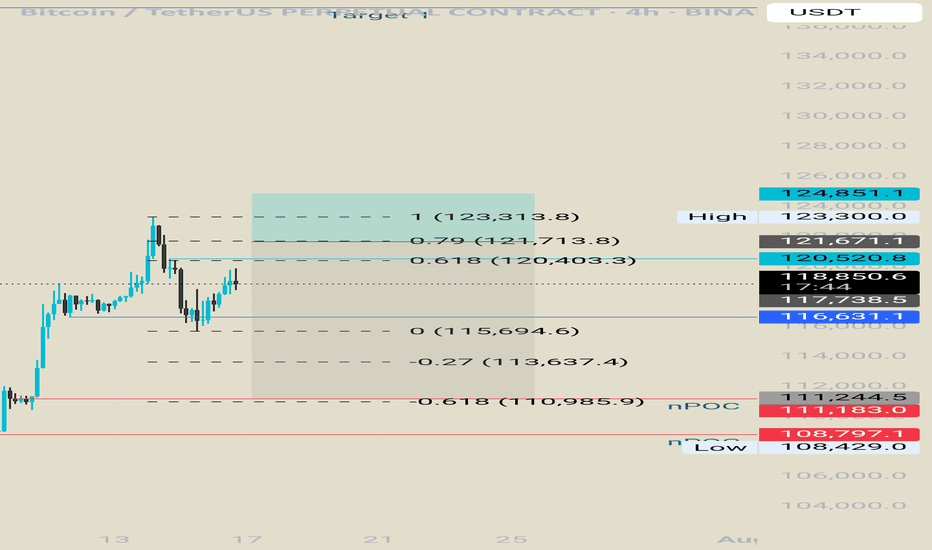

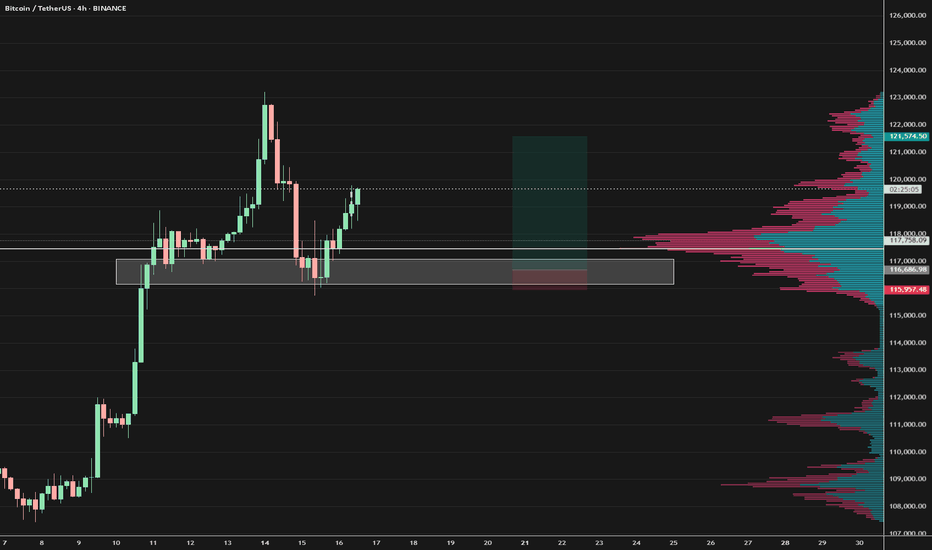

$1.5 Billion ETF Inflows Could Push Bitcoin Price 4% to New ATHBINANCE:BTCUSDT is currently trading at $118,325, facing resistance at the $120,000 level. This resistance is crucial for Bitcoin if it wants to break back to its ATH of $123,218 . The 4.4% gap to reach the ATH indicates potential for growth, but Bitcoin needs to secure support above $120,000 for this to happen.

This week, spot BINANCE:BTCUSDT exchange-traded funds (ETFs) saw over $1.5 billion in inflows , a significant portion of which occurred in the last 48 hours during Bitcoin’s dip.

The influx of institutional money highlights that investors are confident in Bitcoin’s potential despite the market cooling. If this trend persists, it could propel BINANCE:BTCUSDT price upward, as institutional support provides stability.

If BINANCE:BTCUSDT can hold above $120,000 and push past $122,000, it could continue its ascent toward new all-time highs. The current market conditions and ETF inflows support a bullish outlook, with a significant chance of breaking the resistance.

However, the risk of profit-taking remains , which could lead to a price drop. If BINANCE:BTCUSDT faces selling pressure, it could fall back to $115,000 , erasing a portion of recent gains. This would invalidate the bullish thesis, causing Bitcoin to retest lower support levels.

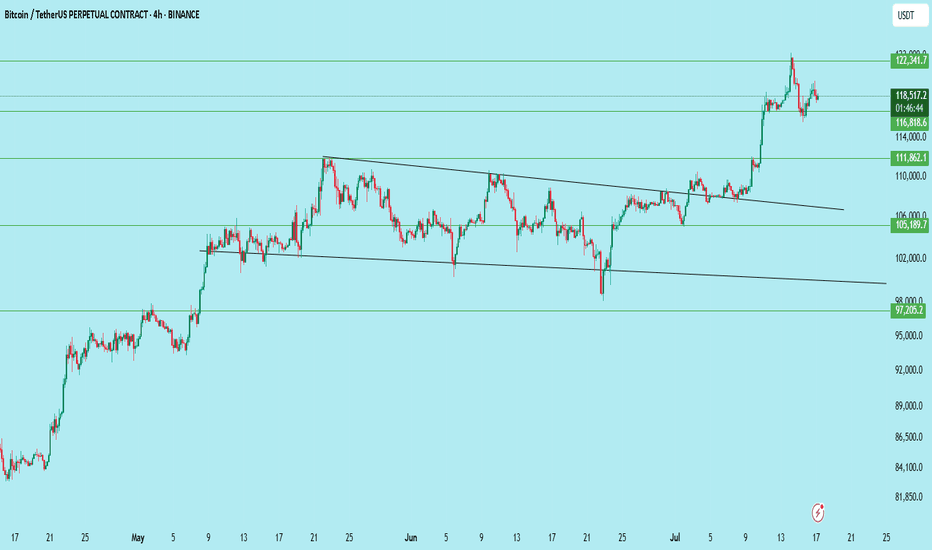

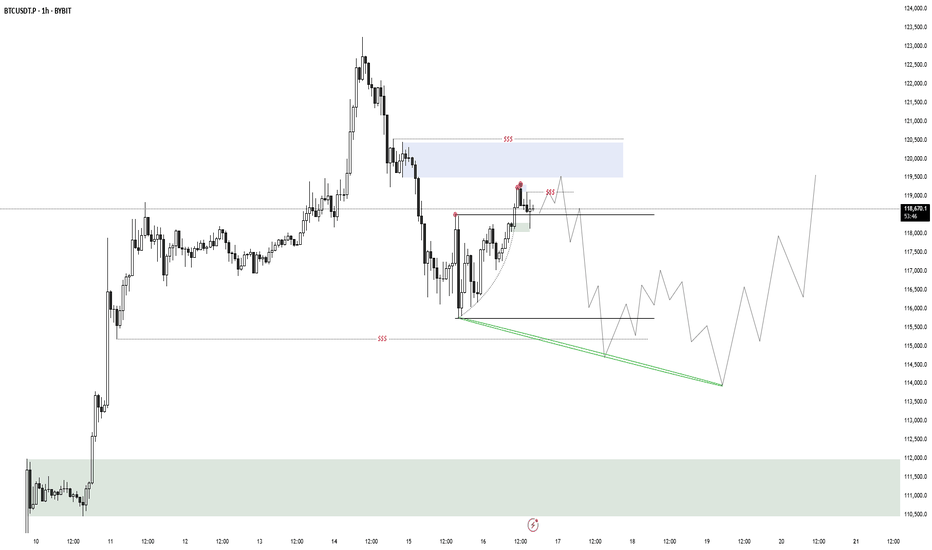

#BTCUSDT | Massive Breakout – Now What?Bitcoin has broken out of a multi-week descending wedge on the 4H chart — a classic bullish reversal pattern. Price is now consolidating just above $116,818 support, forming a base for the next leg up.

What Just Happened:

Clean breakout above the wedge resistance

Strong momentum candle above $111,862

Immediate rejection near $122,341

Currently retesting the previous breakout zone

Key Levels:

Resistance: $122,341

Support: $116,818 → key short-term level

Breakout Support: $111,862

Deeper Support: $105,189

Invalidation Level: $97,205

Bullish Outlook:

If BTC holds $116,818 and breaks above $122,341 with volume, the next leg could extend toward $128,000–$132,000.

Bearish Risk:

Losing $116,818 with volume → look for retest near $111,862 or even $105,189 for a stronger bounce.

Bias:

Bullish above $116,818 — watching for consolidation before continuation.

Trade Setup (if planning to enter):

Entry on retest of $116,818–$117,000

SL: Below $114,000

TP1: $122,341

TP2: $128,000

TP3: $132,000

DYOR | Not Financial Advice

Need a trading strategy to avoid FOMO

Hello, traders.

If you "Follow", you can always get new information quickly.

Have a nice day today.

-------------------------------------

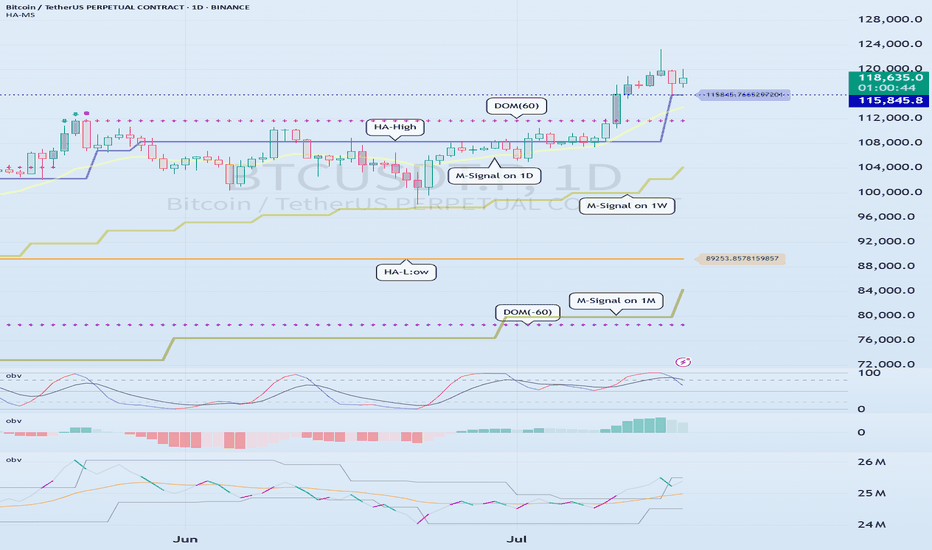

1D chart is the standard chart for all time frame charts.

In other words, if you trade according to the trend of the 1D chart, you can make profits while minimizing losses.

This can also be seen from the fact that most indicators are created based on the 1D chart.

In that sense, the M-Signal indicators of the 1M, 1W, and 1D charts are suitable indicators for confirming trends.

If the price is maintained above the M-Signal indicator of the 1M chart, it is highly likely that the upward trend will continue in the medium to long term, so it is recommended to take note of this advantage especially when trading spot.

The M-Signal indicator on the 1W, 1D chart shows the medium-term and short-term trends.

The M-Signal indicator uses the MACD indicator formula, but it can be seen as a price moving average.

You can trade with just the price moving average, but it is difficult to select support and resistance points, and it is not very useful in actual trading because it cannot cope with volatility.

However, it is a useful indicator when analyzing charts or checking general trends.

Therefore, what we can know with the M-Signal indicator (price moving average) is the interrelationship between the M-Signal indicators.

You can predict the trend by checking how far apart and close the M-Signal indicators are, and then checking the direction.

-

If you have confirmed the trend with the M-Signal indicator, you need support and resistance points for actual trading.

Support and resistance points should be drawn on the 1M, 1W, and 1D charts.

The order of the roles of support and resistance points is 1M > 1W > 1D charts.

However, the strength of the role of support and resistance points can be seen depending on how long the horizontal line is.

Usually, in order to perform the role of support and resistance points, at least 3 candles or more form a horizontal line.

Therefore, caution is required when trading when the number of candles is less than 3.

The indicators created considering this point are the HA-Low and HA-High indicators.

The HA-Low and HA-High indicators are indicators created for trading on the Heikin-Ashi chart and indicate when the Heikin-Ashi candle turns upward or downward.

Therefore, the creation of the HA-Low indicator means that there is a high possibility of an upward turn.

In other words, if it is supported by the HA-Low indicator, it is a time to buy.

However, if it falls from the HA-Low indicator, there is a possibility of a stepwise decline, so you should also consider a countermeasure for this.

The fact that the HA-High indicator was created means that there is a high possibility of a downward turn.

In other words, if there is resistance from the HA-High indicator, it is a time to sell.

However, if it rises from the HA-High indicator, there is a possibility of a stepwise upward turn, so you should also consider a countermeasure for this.

This is where a dilemma arises.

What I mean is that the fact that the HA-High indicator was created means that there is a high possibility of a downward turn, so you know that there is a high possibility of a downward turn, but if it receives support and rises, you think that you can make a large profit through a stepwise upward turn, so you fall into a dilemma.

This is caused by greed that arises from falling into FOMO due to price volatility.

The actual purchase time should have been when it showed support near the HA-Low indicator, but when it showed a downward turn, it ended up suffering a large loss due to the psychology of wanting to buy, which became the trigger for leaving the investment.

Therefore, if you failed to buy at the purchase time, you should also know how to wait until the purchase time comes.

-

It seems that you can trade depending on whether the HA-Low and HA-High indicators are supported, but the task of checking whether it is supported is quite difficult and tiring.

Therefore, to complement the shortcomings of the HA-Low and HA-High indicators, the DOM(60) and DOM(-60) indicators were added.

The DOM(-60) indicator indicates the end of the low point.

Therefore, if it shows support in the DOM(-60) ~ HA-Low section, it is the purchase time.

If it falls below the DOM(-60) indicator, it means that a stepwise downtrend is likely to begin.

The DOM(60) indicator indicates the end of the high point.

Therefore, if it is supported and rises in the HA-High ~ DOM(60) section, it means that a stepwise uptrend is likely to begin.

If it is resisted and falls in the HA-High ~ DOM(60) section, it is likely that a downtrend will begin.

With this, the basic trading strategy is complete.

This is the basic trading strategy of buying when it rises in the DOM(-60) ~ HA-Low section and selling when it falls in the HA-High ~ DOM(60) section.

For this, the trading method must adopt a split trading method.

Although not necessarily, if it falls in the DOM(-60) ~ HA-Low section, it will show a sharp decline, and if it rises in the HA-High ~ DOM(60) section, it will show a sharp rise.

Due to this volatility, psychological turmoil causes people to start trading based on the price, which increases their distrust in the investment market and eventually leads them to leave the investment market.

-

When looking at the movement of the 1D chart, it can be seen that it is not possible to proceed with trading at the moment because it is already showing a stepwise upward trend.

However, since there is a SHORT position in futures trading, trading is possible at any time.

In any case, it is difficult to select a time to buy because the 1D chart shows a stepwise upward trend.

However, looking at the time frame chart below the 1D chart can help you select a time to buy.

The basic trading strategy is always the same.

Buy when it rises in the DOM(-60) ~ HA-Low section and sell when it falls in the HA-High ~ DOM(60) section.

Currently, since the 1D chart is continuing a stepwise upward trend, the main position is to eventually proceed with a long position.

Therefore, if possible, you should focus on finding the right time to buy.

However, if it falls below the HA-High indicator of the 1D chart, the possibility of a downtrend increases, so at that time, you should focus on finding the right time to sell.

In other words, since the HA-High indicator of the current 1D chart is generated at the 115845.8 point, you should think of different response methods depending on whether the price is above or below the 115845.8 point.

Therefore, when trading futures, increase the investment ratio when trading with the main position (a position that matches the trend of the 1D chart), and decrease the investment ratio when trading with the secondary position (a position that is different from the trend of the 1D chart) and respond quickly and quickly.

When trading in the spot market, you have no choice but to trade in the direction of the 1D chart trend, so you should buy and then sell in installments whenever it shows signs of turning downward to secure profits.

In other words, buy near the HA-Low indicator on the 30m chart, and if the price rises and the HA-High indicator is created, sell in installments near that area.

-

You should determine your trading strategy, trading method, and profit realization method by considering these interrelationships, and then trade mechanically accordingly.

If you trade only with fragmentary movements, you will likely end up suffering losses.

This is because you do not cut your losses.

-

Thank you for reading to the end.

I hope you have a successful trade.

--------------------------------------------------

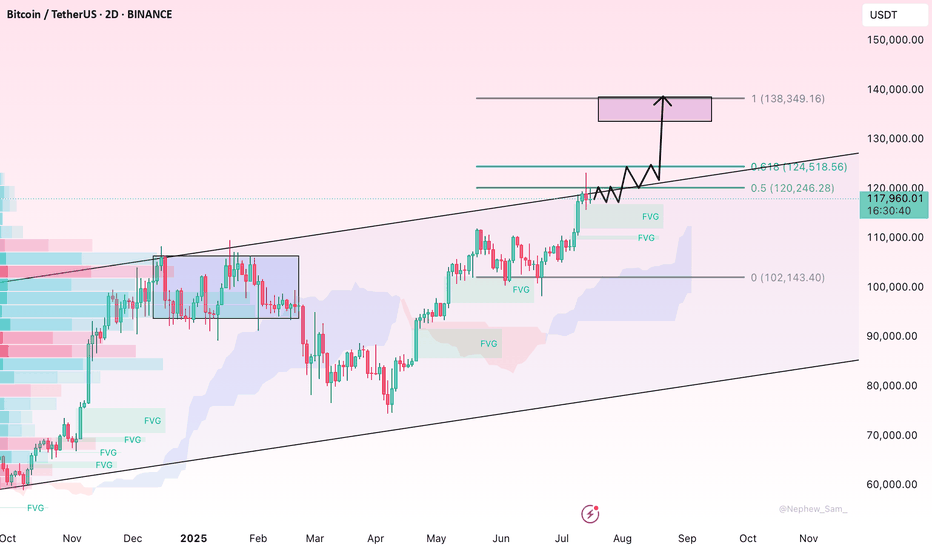

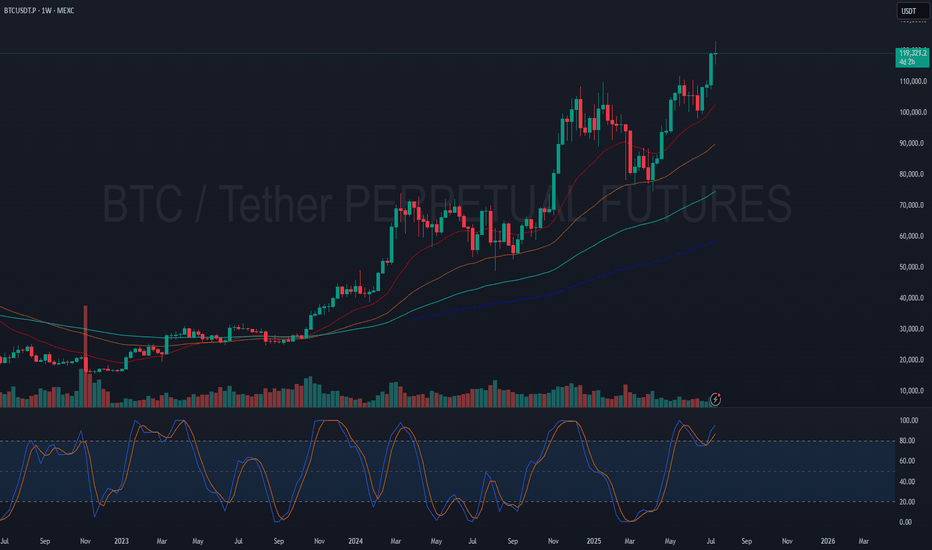

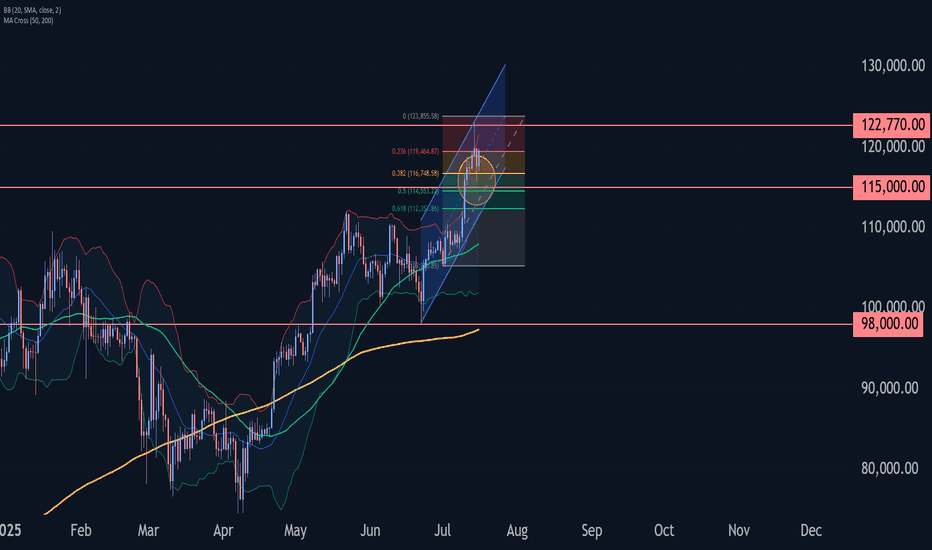

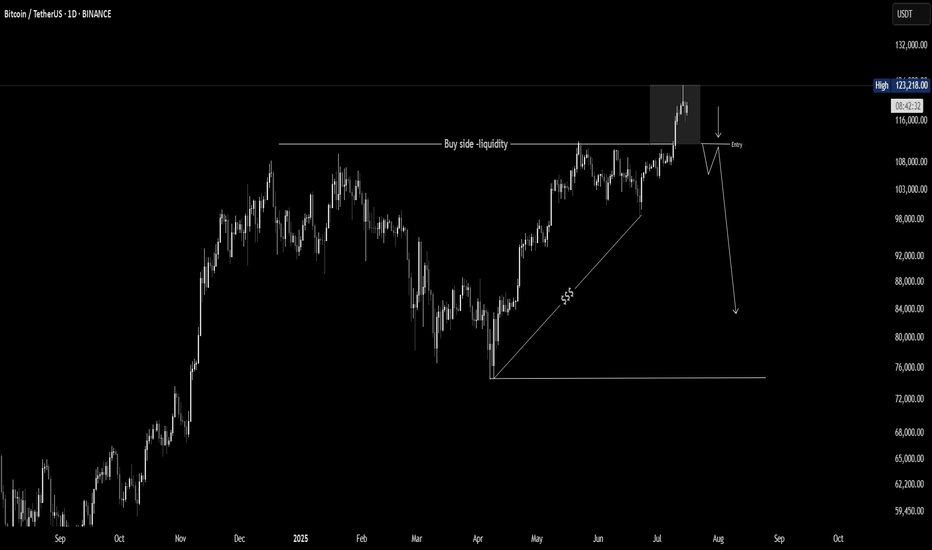

My Macro Take on BTCAfter checking BTC HTF charts, my take is that there is a resistance around $123K–$125K zone (psychological + measured move extensions). I drew a fib extension in november last year where I pointed out that 108K+ will be ATH Q1 2025 (check my TV post). It hit 110K, so pretty close. The next level was 125K, so that´s pretty close to were we are now (123K). So were are we heading now?

I might draw a new fib soon, but I see that monthly is strongly bullish. Stoch RSI is turning up from mid-range, so still has room to run. Volume hasn't spiked dramatically, so a healthy climb without blow-off. 100K looks like a resistance turned into support (also a psychological level).

Weekly is bullish with last weeks strong candle managed to breakout from that 110K level (should now be resistance level). Volume is increasing week-over-week the last weeks which confirms breakout strength. I see that if we loose 100K it could be critical (invalidation of bullish BIAS).

On daily the Stoch RSI is curling downward from overbought which might imply cooling off = short-term retrace. Price has rallied sharply and is currently pulling back slightly after tagging 123K. A pullback to 110-116K looks likely. It would be healthy and expected.

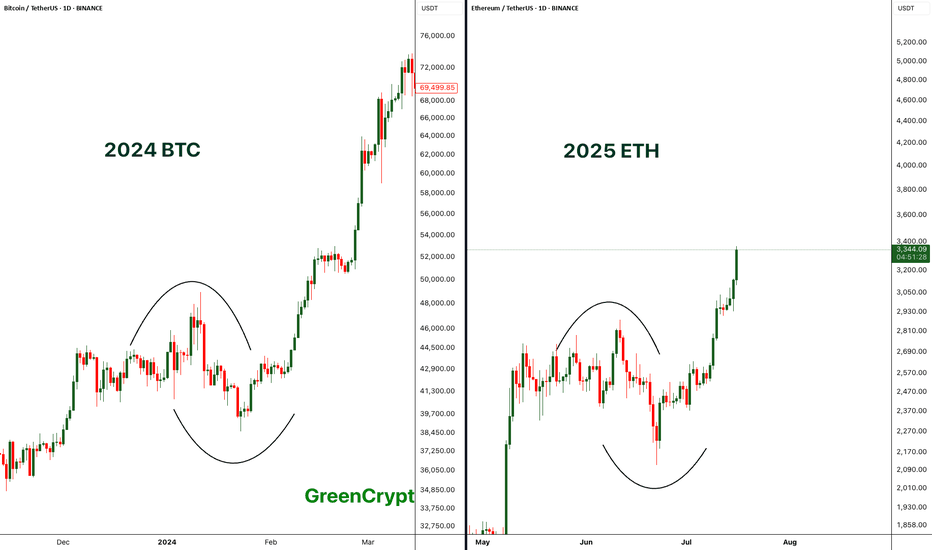

Comparing BTC 2024 with ETH 2025 - Perfect Match- If compare the chart pattern of BTC from 2024 with the current 2025 ETH pattern, wee see exactly similar chart patterns being formed here.

- Price started consolidating then it had fake breakout towards both the sides and finally the real breakout.

- BTC breakout push the price towards the new all time high above 69K, if we ETH follows similar trend then we can expect new all time high on ETH.

Let's see how it plays out.

Stay tuned for more updates.

Cheers

GreenCrypto

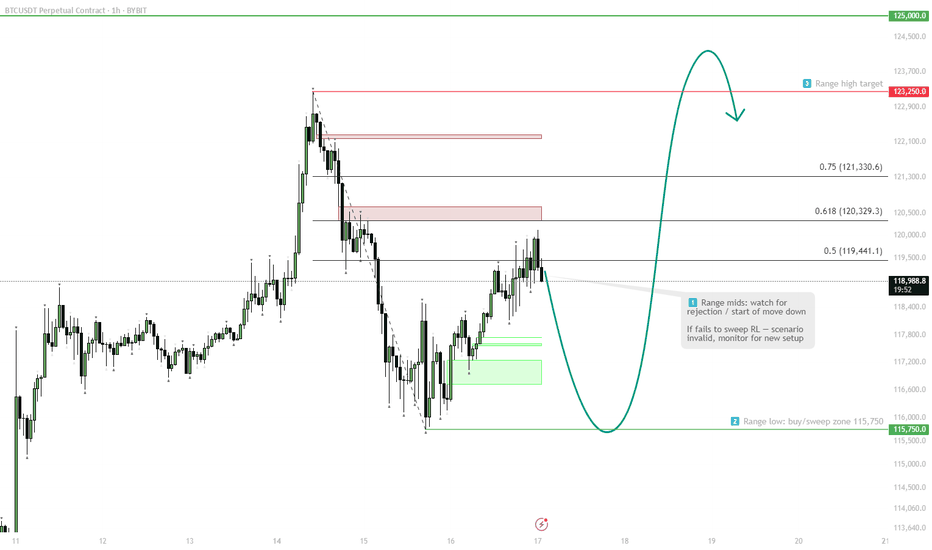

BTC Long London Low 07/16/25Next Monday between 2am-3am EST BTC will have retraced to 116-117k. This is where I will open a long, target 121500k-122k sl 115750.

BTC may sweep below this region before monday but I won't play a long until noted. The reason is based on the fact monday london sets the low range of the week and is the highest probable time to enter a swing trade. Price will most likley reach TP by Wednesday. Also The big confluence is the 1.1 B worth of longs placed at 116000.

Bitcoin Wave Analysis – 16 July 2025- Bitcoin reversed from a support area

- Likely to rise to resistance level 122770.00

Bitcoin cryptocurrency recently reversed up from the support area located between the key support level 115000.00 and the support trendline of the daily up channel from June.

This support area was further strengthened by the 38.2% Fibonacci correction of the sharp upward impulse from July.

Given the clear daily uptrend and the strongly bullish sentiment seen across cryptocurrency markets today, Bitcoin cryptocurrency can be expected to rise to the next resistance level 122770.00 (top of the previous impulse wave i).

Bitcoin - Will hit 135k in the short-term, Elliott and FIBOBitcoin is rising! That's what everyone sees at the moment, but we don't want to get drunk and establish our profit target. Where to take profit? Because we are in the price discovery mode, there is no previous price action above the current price. At this moment we really cannot use any horizontal lines, gaps, volume profiles, imbalances, previous ranges, or previous swing highs to establish our profit target. So we have to use special tools, such as Fibonacci extension or Elliott Wave.

The Fibonacci extension is a great tool - in bitcoin's case we have a 1:1 FIB extension sitting at 135,096. This level is also in confluence with a major trendline that we can see on the chart. This gives us a really good profit target in the short term for this particular trade. This is also an opportunity to short Bitcoin here, if you trade futures. From the Elliott Wave perspective, we are in wave (3), so I made a prediction on where this wave should terminate and also where wave (5) should terminate. I think my analysis definitely makes sense! Please share your analysis in the comment section, only copy your link here.

Trading tip at the end: Avoid the Obvious / Market Traps - Some obvious trading situations are kind of a trap where the chances are that everyone else has also spotted a wonderful trade situation which eventually sets you up for a disaster. Many people get trapped in some obvious good looking trades. Some obvious trades can sometimes be the market traps as they are hyped, professional traders stay away from these traps. Write a comment with your altcoin + hit the like button, and I will make an analysis for you in response. Trading is not hard if you have a good coach! This is not a trade setup, as there is no stop-loss or profit target. I share my trades privately. Thank you, and I wish you successful trades!

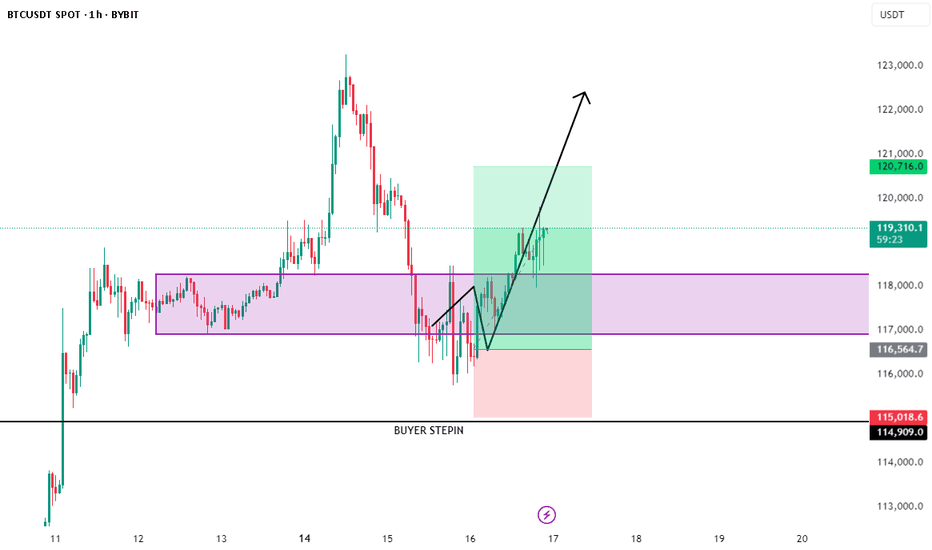

BTC/USDT Trade Update – July 16🚨 BTC/USDT Trade Update – As Planned! 🚨

Shared this setup earlier, and it’s unfolding exactly as expected. Hope you’re all locking in solid profits! 💸

🔹 Entry: BUYER STEP‑IN zone at 116.5 K – 118 K

🔹 Confirmation: Strong bullish engulfing from demand + reclaim of 118 K

🔹 Current Price: 119 K+ and climbing

🔹 Targets Ahead: 120.7 K 🔜 122 K 📈

📌 Why it’s working:

• Demand absorption after liquidity sweep

• V‑shaped recovery forming a higher low

• Increasing momentum + follow‑through volume

🔥 Riding the wave—letting profits run!

🔔 For more real‑time setups, follow 👉 @Ali15349323

#BTC #Bitcoin #CryptoTrading #PriceAction #Profits #TradingView

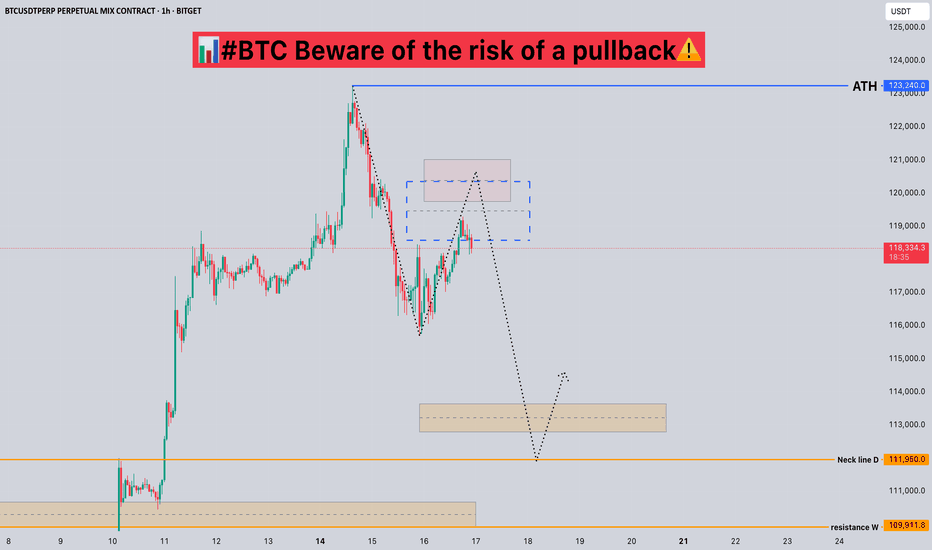

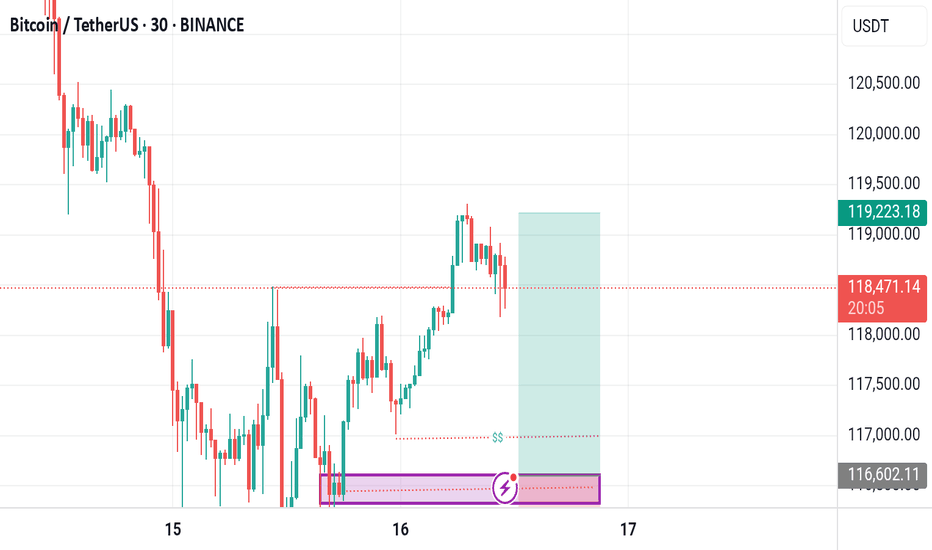

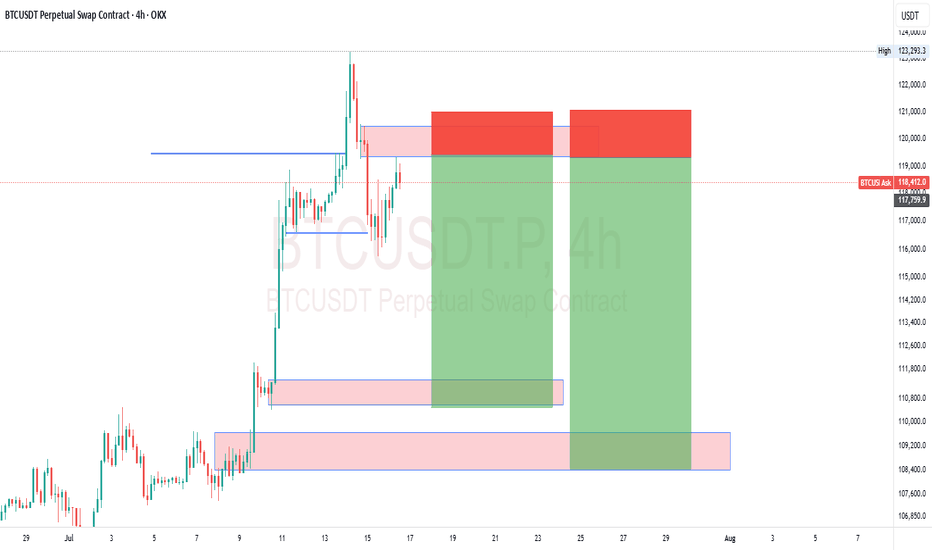

#BTC Beware of the risk of a pullback📊#BTC Beware of the risk of a pullback⚠️

🧠From a structural perspective, we are continuing the trend of the long-term bullish structure in the long cycle, but there is no bullish structure as a supporting force in the short cycle, so we need to be wary of the possible risk of a pullback!

➡️At present, there is a relatively large resistance near 121,000, and the support reaction near 116,000 has been realized. The short-term support area we need to pay attention to next is 112,000-114,000

Let's take a look👀

🤜If you like my analysis, please like💖 and share💬

BITGET:BTCUSDT.P

BTC Just Broke the High - But Don't get Trapped!Bitcoin just swept the recent high, triggering breakout euphoria. But this could be a classic liquidity grab, not a true breakout. If price fails to hold above the level and shifts structure, we may see a sharp bearish reversal BINANCE:BTCUSDT BINANCE:ETHUSDT 👀

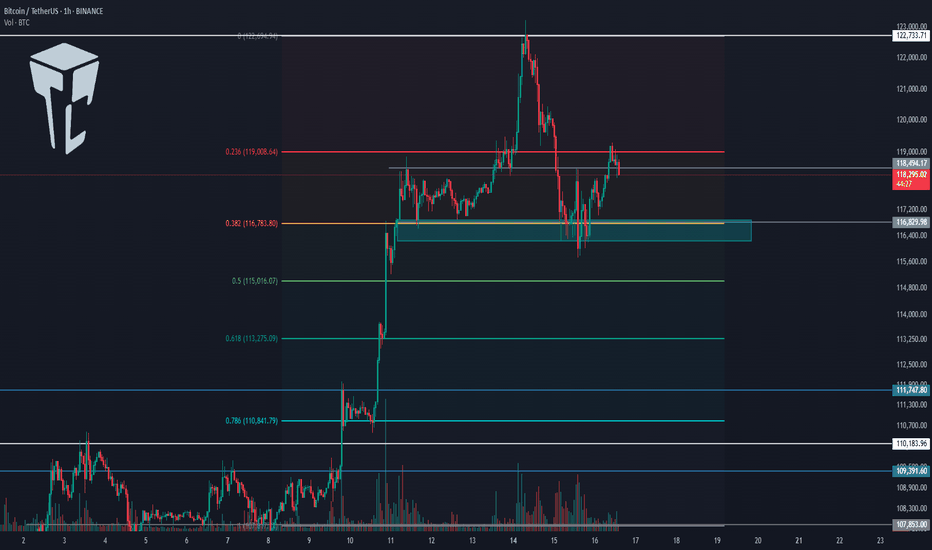

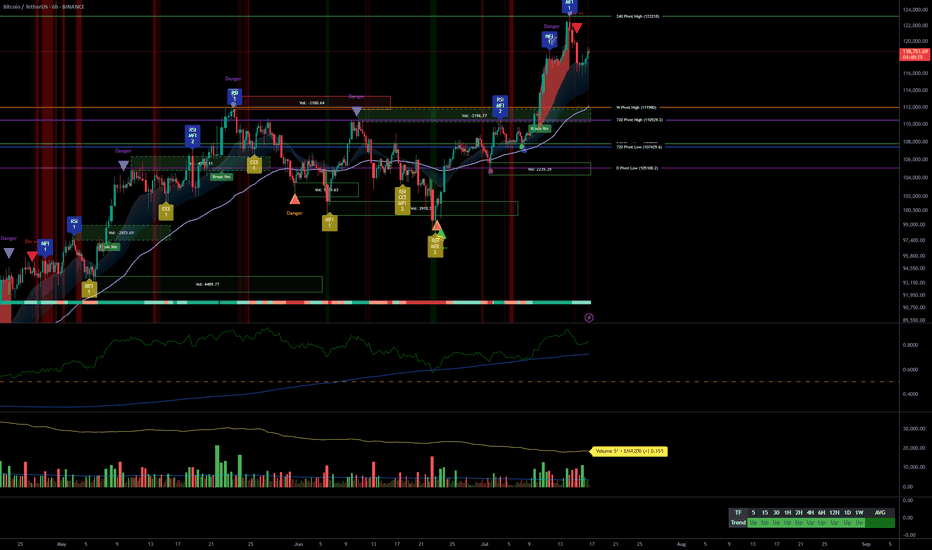

TradeCityPro | Bitcoin Daily Analysis #130👋 Welcome to TradeCity Pro!

Let’s dive into the Bitcoin analysis and key crypto indices. As usual, in this analysis, I’ll go over the futures triggers for the New York session.

⏳ 1-hour timeframe

As you can see in the 1-hour timeframe, Bitcoin was supported at the 116829 zone yesterday and is now moving upward.

📈 The long position trigger at 118494 has been activated, and the price is currently pulling back to this level.

💥 The 0.236 Fibonacci level is right above the price, and if it breaks, the price can continue moving upward.

⚡️ The current local top is 122733, which can be the first target for the long position. Breaking this level would also be our main trigger for a long entry.

👑 BTC.D Analysis

Bitcoin dominance is still falling and has now confirmed below the 63.96 zone.

🔍 Currently, the trend is fully bearish, and breaking 63.50 will confirm continuation of the downtrend.

📅 Total2 Analysis

Total2 is rising alongside the drop in Bitcoin dominance and has confirmed above 1.33.

🎲 The next resistance is at 1.41, and the current uptrend can continue toward that level.

📅 USDT.D Analysis

Tether dominance has confirmed below 4.36 and is continuing its downward move.

✔️ The next support is at 4.22, and breaking this level would initiate the next major bearish leg.

❌ Disclaimer ❌

Trading futures is highly risky and dangerous. If you're not an expert, these triggers may not be suitable for you. You should first learn risk and capital management. You can also use the educational content from this channel.

Finally, these triggers reflect my personal opinions on price action, and the market may move completely against this analysis. So, do your own research before opening any position.

Bitcoin Full analysis: Buy the dip confirmed, 123240 key__________________________________________________________________________________

Technical Overview – Summary Points

__________________________________________________________________________________

Momentum: Very bullish across all timeframes; healthy compression above previous range.

Key Supports: 115731–110481 USDT (structural, 1D to 1H).

Major Resistances: 123240 USDT (multi-frame pivot).

Volume: Normal, no climax or distribution — flows support the dominant bias.

Risk On / Risk Off Indicator: Strong bullish HLTF signal; short-term neutral intraday.

ISPD DIV: Neutral on all timeframes.

Multi-TF Behavior: Bull rally, no excess, no euphoria or capitulation; market holds above key levels.

__________________________________________________________________________________

Strategic Summary

__________________________________________________________________________________

Global Bias: Strong bullish – MT/LT “buy on dips” confirmed.

Opportunities: Progressive buying (117800, 115731 USDT), continuation on breakout >123240.

Risk Zones: Possible pullback if clear rejection below 123240, swing invalidation if close <115731-111949.

Macro Catalysts: Awaiting FOMC late July, short-term volatility limited. Watch geopolitics, extreme compression.

Action Plan: Swing entry: 118300–119000. Stop: 115500. Target: 123200 then 126000+. R/R ≥2.5. Adjust risk management before FOMC.

__________________________________________________________________________________

Multi-Timeframe Analysis

__________________________________________________________________________________

1D: Bullish momentum, supports at 105054/107939–110483. Risk On / Risk Off Indicator strong buy, healthy volume, ISPD neutral.

12H: Consolidation below 123240, aligned supports 110481/115731, healthy structure.

6H: Confirmed momentum, continuous compression, no major sell signals.

4H: Rally structure robust, corrections limited and on support.

2H: Key support band 115731–110481, volume supports rebound, possible rotation below 123240.

1H: Rally confirmed, no panic selling detected.

30min/15min: Intraday consolidation, micro-range below resistance, stable volume, Risk On / Risk Off Indicator short-term neutral.

Cross-TF summary: CLEAR momentum across all frames, no significant divergence, high-quality HTF supports. Next >123240 breakout likely fast and dynamic.

__________________________________________________________________________________

Technical & Fundamental Synthesis

__________________________________________________________________________________

Technical Synthesis: Broad bullish confirmation; buy-the-dip valid on 117800/115731, no aggressive downside signal. Swing positions above 118200 to be favored, expect acceleration after clear break of 123240.

Stops & Invalidation: Swing stops below 115731/111949. Closing below = increased risk, “off” bias.

Fundamentals: Optimal pre-FOMC swing window, US market in wait-and-see mode short term. Neutral/volatile geopolitics, no immediate shocks.

On-chain: Heavy accumulation, historic compression, ETF flows strong (but on short pause). Imminent volatility squeeze possible either way.

Recommendation: Actively monitor 123240 (breakout above), 115731 (below = increased caution). Adjust stops and sizing, remain highly responsive, especially as FOMC approaches.

__________________________________________________________________________________

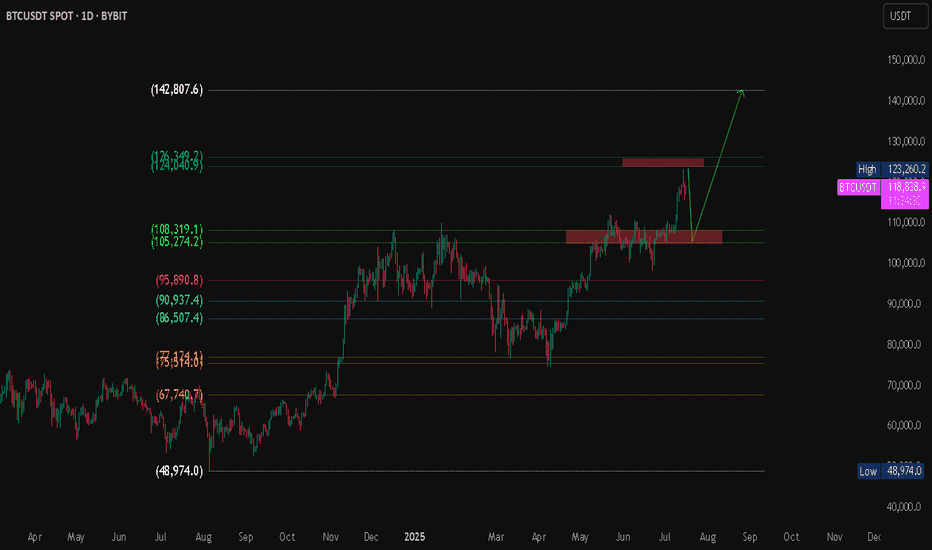

BTC/USDT Technical Analysis Market Overview

Bitcoin is currently trading at $118,788, with an intraday high of $119,311. The market has recently tested a major resistance zone and is showing signs of a potential pullback toward a key demand zone before a possible continuation to higher levels.

Projected Scenario (Bullish Bias)

Expected pullback to the support zone around $105K – $108K.

If price holds and shows a bullish reversal, a breakout above $124K is expected.

Primary upside target: $142,807 (Fibonacci projection / potential new high).

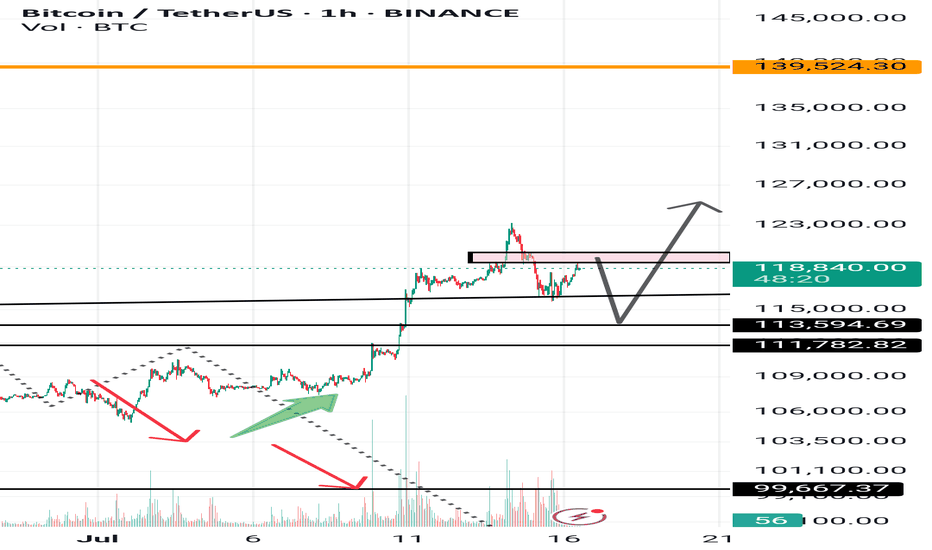

Analysis no 74 1hWelcome to king btc 3 Bitcoin is expected to decline from the range of 119,000 to 120,000 slowly to 113,500 and then rise to 125,000 in the cycle. The larger range is expected to be in the range of 115,500 to 125,000 which could be an opportunity for altcoins to rise. This is just a possibility.

Bitcoin Ranges While Altcoins Rise — Follow the Liquidity TrailHeyy traders, it’s Skeptic from Skeptic Lab! 💙 Dropping a red-hot update on Bitcoin and the crypto market to catch the next big wave. We’re diving into the Daily timeframe and market dynamics to track where the money’s flowing. here’s the play:

✔️ Daily Timeframe

As we flagged in my last Bitcoin chart, the $ 120,000 level is a liquidity magnet with heavy action. The July 14 candle tried breaking it but failed, leaving a downward shadow showing strong seller presence at this level. Plus, last week we hit the 4-week pivot point on the Weekly , and as expected, we’re now ranging around $120,000. Does this mean we ditch crypto? Big NO.

📊 Bitcoin Dominance (BTC.D)

Let’s zoom in on BTC.D —it’s gone sharply bearish, with yesterday’s candle screaming capital exiting Bitcoin. Traders who profited up to $120,000 are locking in gains and moving funds elsewhere. So, what’s the story?

Bitcoin broke its ceiling after 168 days, surging 10% to $122,000. Buyers took profits, pulling liquidity out.

Where’s the money going? Let’s test two theories:

USDT? Nope. USDT.D is also bearish.

Altcoins? Bingo! TOTAL2 (altcoin market cap) smashed its Daily resistance at 1.34 after months, signaling liquidity flooding into altcoins.

📉 Which Altcoins? Here’s the trick: check pair/BTC ratios . For example, to pick between Solana or Ethereum, compare S OL/BTC and ETH/BTC . The one with a stronger uptrend is soaking up more liquidity from Bitcoin.

🔔 Key Insight: This liquidity flow game is a game-changer for crypto traders. Want a full dominance tutorial? Let me know —it’ll show you how to track where the money moves and which coins get the most action.

🔼 Key Takeaway: Bitcoin’s ranging at $120,000, but altcoins are heating up as BTC.D drops. Hunt for altcoins with bullish pair/BTC charts to ride the liquidity wave. Risk management is your lifeline—cap risk at max 1%–2%. I’ll catch you in the next analysis—good luck, fam! <3

💬 Let’s Talk!

Which altcoin are you eyeing? Hit the comments, and let’s crush it together! 😊 If this update lit your fire, smash that boost—it fuels my mission! ✌️