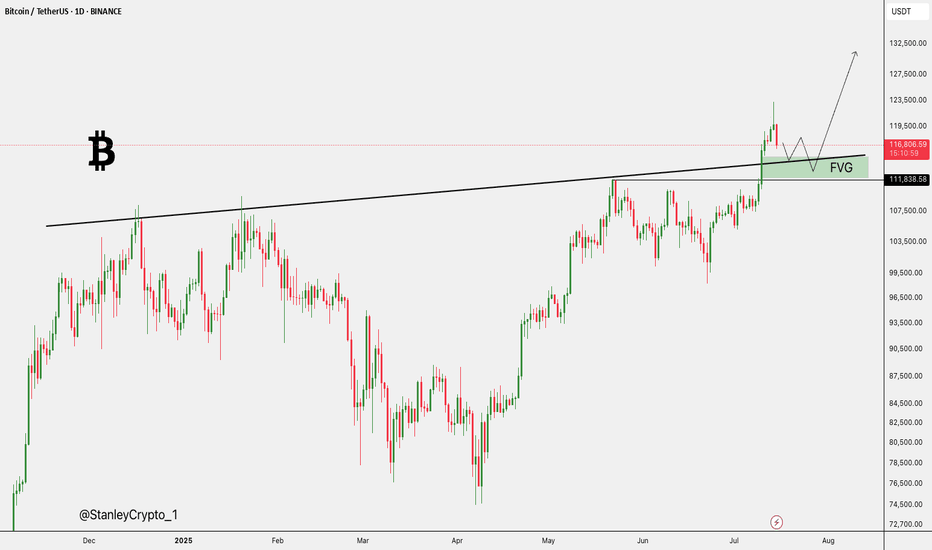

Bitcoin (BTC): Current Neckline Zone is Crucial | Bounce Coming?After a recent push to a new ATH area, the price has cooled down, which led the price back to the local neckline zone, which is our next important zone.

This correction cooled down the Bollinger Bands Channel and RSI, which would mean we are just one MSB (on smaller timeframes) away from another rally towards the upper zones.

Now if for any reason we fall more, then this might turn into a nasty movement, as our target would be then around $110K, where we would be looking for another buy entry (if we fail to get that MSB we are currently looking for).

Swallow Academy

BTCUST trade ideas

BTC HTF Distribution V3This is my new outlook for BTC if this 250 day old range is intended to be a HTF Distribution Model 1, which has neither been confirmed nor invalidated. A weekly close above 123.350$ will invalidate this model and likely lead to higher prices. Yesterday we had a perfect rejection from the deviation limit, which now probably creates a new range, that then will either reaccumulate or distribute.

Gold, Silver, and Bitcoin – A Staggered Anti-Currency Rotation?There seems to be a complex yet recurring relationship between Gold, Silver, and Bitcoin during anti-currency phases (when fiat weakens).

First Leg – Gold Leads

Gold typically leads the first leg, breaking out to new highs. Silver follows but lags—trending up without breaking major resistance. During this phase, the Gold/Silver ratio expands.

Second Leg – Silver Takes Over

Eventually, Silver breaks resistance and becomes the second leg leader. As it outperforms Gold, the Gold/Silver ratio contracts back to mean.

Bitcoin, during this time, is usually bottoming or entering Stage 2 (early uptrend). This time, it has already broken resistance but is rising slower than in past cycles.

Third Leg – Bitcoin Dominates

As Gold and Silver peak and begin to correct, Bitcoin accelerates, often making new all-time highs (ATH).

This staggered rotation played out during the 2018–2022 cycle. Let's see if history rhymes in this cycle.

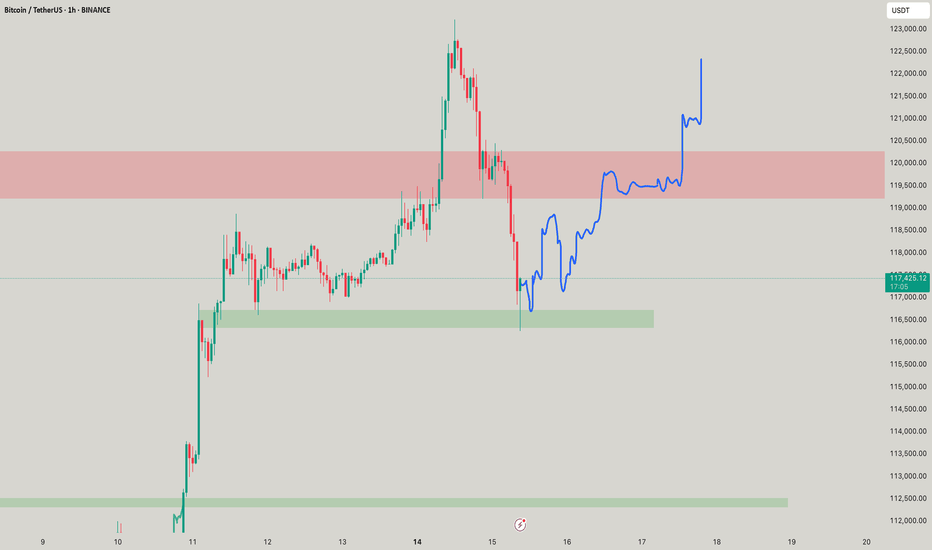

BITCOIN LONG TRADEBTC had a large flush after its ATH of 123.1k causing most late longs to get wiped out. It seems fear has been overestimated and we should see a reversal soon. We're also near major support on the 4h and have an oversold StochRSI. CPI numbers are coming out today so make sure you're managing risk accordingly and only invest what you can afford to lose.

Bitcoin in New Ascending channel wait for 160K$As we can see Price broke previous ATH & channel resistance together and is holding strong, if it continue soon new channel is path to claim for Price based on chart and targets like 160K is just easy to hit.

So get Ready for new Highs and ATH here also this breakout to upside was mentioned in previous analysis and now that it is happening don't get surprise if you see notifications like Bitcoin new ATH 150K$.

DISCLAIMER: ((trade based on your own decision))

<<press like👍 if you enjoy💚

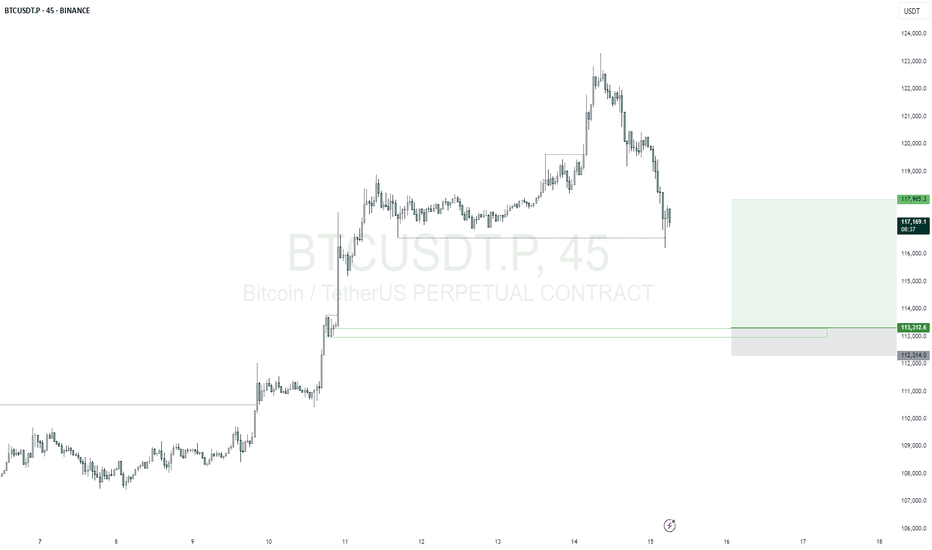

BTCUSDTmy entry on this trade idea is taken from a point of interest below an inducement (X).. I extended my stoploss area to cover for the whole swing as price can target the liquidity there before going as I anticipate.. just a trade idea, not financial advise

Entry; $113312.6

Take Profit; $117985.3

Stop Loss; $112314.0

BTC/USDT Long Position Plan🔥 BTC/USDT LONG IDEA (4H CHART)

Published by: Ali15349323

Timeframe: 4H

Exchange: Bybit Spot

Date: July 15, 2025

📊 Analysis Summary:

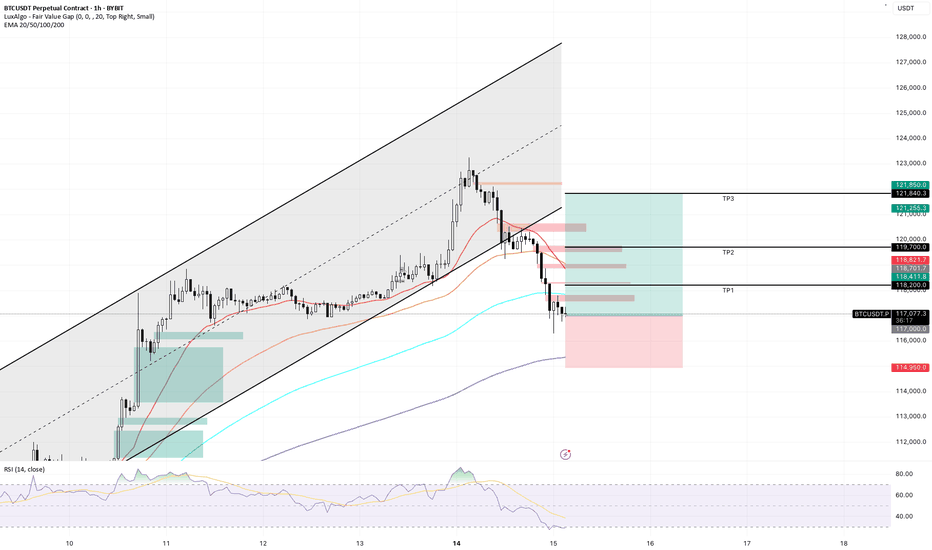

Bitcoin is pulling back after a strong impulsive move upward. Price has now entered a key 4H demand zone between 116,200 – 117,300, which previously acted as a consolidation base before the breakout.

We are now watching for a potential long entry in this zone, with a bounce confirmation and invalidation criteria clearly defined.

📌 Trade Plan (Long Setup)

Entry Zone:

🔹 116,200 – 117,300 USDT

🔹 Price is currently reacting within this support range

Stop Loss (Invalidation):

🔹 Below 114,900 USDT

🔹 A 4H candle close below this level would break structure and invalidate the setup

Take Profit Targets:

🔹 TP1: 121,000 – Local resistance

🔹 TP2: 123,000 – 124,000 – Imbalance fill zone

🔹 TP3 (Optional): 125,500+ – If momentum continues

🧠 Reasoning Behind the Trade:

✅ Strong demand zone with historical reaction

✅ Wick rejection from the lower boundary, showing early buyer interest

✅ Price structure still bullish unless 114.9k breaks

✅ Previous sell-off likely triggered liquidation — now a chance for recovery bounce

⚠️ Invalidation Criteria:

❌ A 4H candle close below 114,900 signals demand has failed

❌ In this case, the setup is no longer valid — next demand sits around 111k – 112k

🧾 Summary:

We’re looking for a bullish continuation if BTC holds above the current demand zone. A sweep-and-reclaim structure could give confirmation. If the zone fails, no trade — we step aside and wait for deeper support.

📣 Don’t forget to:

🔁 Like & Share

🧠 Follow me @Ali15349323 on X for more trades

#BTC #Bitcoin #Crypto #LongSetup #TechnicalAnalysis #TradingView

Bitcoin Rush: The Carnival and Concerns Behind $120,000Bitcoin Rush: The Carnival and Concerns Behind $120,000

The Bitcoin market is staging an epic rally - the price has broken through the $120,000 mark, setting a new record high. But behind this jubilation, the market has shown signs of overheating.

Market Status: Risks Hidden in the Frenzy

Price Performance: Hit a new high of $123,000 on July 15, up nearly 20% this year, with a total market value of $2.2 trillion (the fifth largest asset in the world)

Market Sentiment: Fear and Greed Index 72 (extreme greed), but more than 100,000 people were liquidated in 24 hours, with a loss of $510 million

Technical Signals: RSI reached 70.9 (overbought zone), and the 30-day unrealized profit and loss ratio reached the 80% percentile

Three major rising engines

Institutional entry

Spot Bitcoin ETF net inflow of $118 million in a single day (BlackRock holds more than 700,000 coins)

MicroStra Tegy's holdings value exceeds $50 billion

Trump Media Group and other listed companies join the "coin hoarding trend"

Regulatory support

The U.S. "Cryptocurrency Week" deliberates on three key bills

Hong Kong passes the "Stablecoin Ordinance" (effective on August 1)

The EU MiCA framework begins to be implemented

Macro support

The probability of the Fed's September rate cut is 72.3%

The weakening of the U.S. dollar + trade protection policies boost risk aversion demand

Bitcoin's positioning shifts from "speculative assets" to "digital gold"

Key technical signals

Breakthrough pattern: daily "three white soldiers" candle + ascending triangle breakthrough, target 128,000-132,000 U.S. dollars Yuan

Key position:

Support: $116,800 (near term), $112,000 (key)

Resistance: $121,500 (short term), $140,000 (long term)

Risk signal: H4 chart RSI reaches 77, MACD histogram shrinks

Future outlook

Short term: If the $112,000 support is maintained, it is expected to challenge $140,000

Risk: Falling below $108,500 may trigger a chain of liquidations

Cycle law: Referring to "peaking 550 days after halving", this round of bull market may peak in October

Breakout trading strategy (suitable for aggressive traders )

Entry conditions:

Price stabilizes above $123,000 with increased trading volume (at least 1.5 times the 20-day average volume)

4-hour chart closes above the previous high for three consecutive positive lines

Targets:

First target $128,000 (1.618 Fibonacci extension level)

Second target $135,000 (psychological barrier + upper channel track)

Stop loss setting:

Day trading: Falling below the $120,000 round mark

Swing trading: Falling below the $116,800 support platform

Conclusion: Bitcoin is writing a new chapter in history, but investors need to be wary of "extreme joy leads to sorrow". Remember: when others are fearful, I am greedy, and when others are greedy, I am fearful - this old saying always applies to the crypto market.

Cycle Top Theory: BTC 2025–2028 : The ₿ Line BreakoutCycle Top Theory: BTC 2025–2028" explores the probabilistic path of Bitcoin through the remainder of the current bull cycle. Combining historical market structure, halving-driven supply shocks, and volatility-based modeling, this thesis outlines potential top scenarios ranging from $xxxK to $xxxK.