Meta - The breakout in question?🪓Meta ( NASDAQ:META ) is retesting major structure:

🔎Analysis summary:

After Meta perfectly retested a major previous support trendline in 2022, the trend shifted bullish. We have been witnessing an incredible rally of about +700% with a current retest of the previous all time highs. Time will tell but a bullish breakout remains quite likely.

📝Levels to watch:

$750

🙏🏻#LONGTERMVISION

Philip - Swing Trader

META trade ideas

META (Meta Platforms Inc.) – Macro Compression Before Expansion META sits at a decisive macro juncture:

A clean SMC structure combined with Fibonacci premium zones signals an imminent directional expansion.

🧠 Macro Thesis:

Price is coiled just under 0.786–0.886 Premium Zone ($729–$760)

↳ This is a known trap area for retail liquidity – institutions often engineer sweeps here.

Volatility compression and volume tapering beneath the “weak high” setup

↳ Perfect conditions for either an engineered breakout raid or a sell-side liquidity hunt.

Fibonacci Expansion Zones:

🟢 Bull case: Clean path to $796 → $870 → $990

🔻 Bear case: Reversion into EQ → discount zones → $676 or $611

🗺️ Trade Structure:

🟢 Scenario A: Expansion Breakout

Entry: $729.50+ (break above weak high)

Target Range: $740.91 → $796 → $870 → $990

Stop: $710.04 (below EQ + EMA confluence)

🔻 Scenario B: Distribution Rejection

Entry: Break below $710

Target: $676 → $647 → $611

Stop: $729.50

📊 Institutional Alignment:

SMC shows liquidity-engineered structure with BOS + CHoCH confirmed

EMA 100/200 still rising → trend remains intact unless $675 fails

🧠 Positioning around EQ and premium zones is key. META is not in a “buy or sell” zone—it's in a smart money trap. Let price decide.

This is chess, not checkers.

📍 Posted by WaverVanir International LLC – Advanced Market Intelligence & AI Governance Engine

#Meta #META NASDAQ:META #SmartMoney #InstitutionalFlow #LiquidityZones #TradingPlan #FibStrategy #MarketCycle #SwingTrading #WaverVanirResearch #AITrading #VolanX #QuantStrategy #CapitalFlow #TradingView

META: Testing Alternative Interconnection TypeResearch Notes

Given expression like this:

Fractal Corridors can be used for horizontal perspective of the same pattern manifestation. Alternative frames of reference exposes how historic swings of various magnitude in some way wire the following price dynamics. www.tradingview.com helps to seek a matching commonality in angles of trends which gives a hint how structure evolves in multi-scale perspective.

I use both when it comes to working with complex waves and making interconnections through fibonacci ratios.

To define emerging wave's limits (probable amplitude), I'll test classic rule of Support/Resistance shift in fibs. (When resistance becomes support or vice versa)

By theory it means a trendline can also shift like that.

In our case this can be applied as:

Fibocnacci Structure:

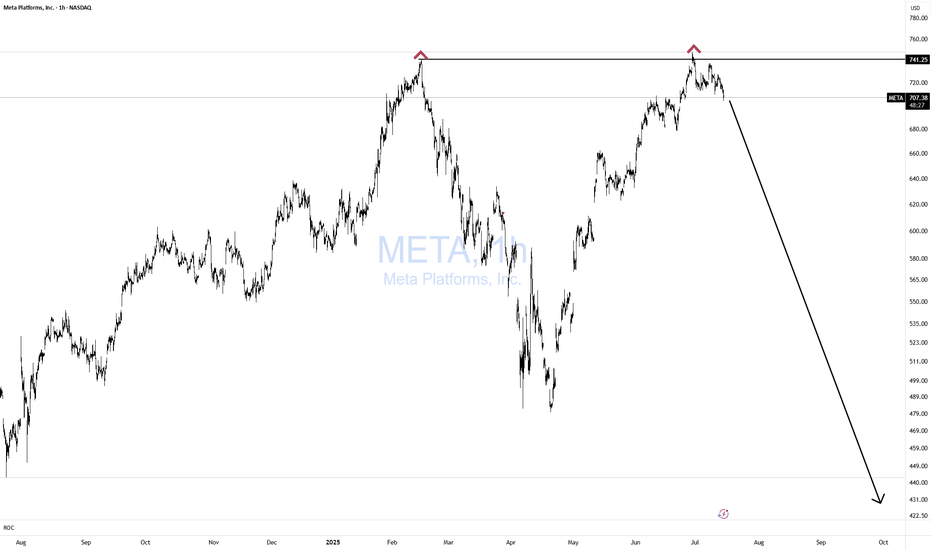

MetaSince the last post I made price has yet to make a new high. It has managed to chop in this area with a slight downward bias. If we're on the verge of the top of the indices, there is no reason to think Meta will continue higher much longer. This pattern, which is clearly corrective in nature, is way overextended. We started off with a 3-wave move higher off the April low and have risen all the way to the 2.236. Even if you could somehow say this is impulsive, it would still be over extended. So, no matter how you look at this pattern, it is in need of a correction. The question is how will that correction look. IMO, it will look like a minor C wave of intermediate (A). However, if it is somehow impulsive, then it would look like either minor A just now starting, or a smaller degree wave 2.

META | Accumulation Zone Identified — Road to $990?🧠 META | Accumulation Zone Identified — Road to $990?

📊 Ticker: META (Meta Platforms Inc.)

🕒 Timeframe: 1H

📍 Current Price: $717.36

📈 Bias: Bullish accumulation → Expansion

🔍 WaverVanir DSS Thesis

Our system has flagged a liquidity harvesting and accumulation phase between $676–$740. Institutional behavior suggests price is returning to equilibrium before a potential reaccumulation and markup.

🔑 Key SMC Zones:

🔺 Premium Zone: $729–$740 — recent rejection + liquidity engineered

🔻 Discount Zone: $676–$696 — ideal accumulation range

🔵 Equilibrium Pivot: ~$705

🟦 Volume Cluster: $716–$718 → short-term magnet and likely chop area

📐 Fibonacci Confluence:

0.786 Fib = $729.37 (converging with premium zone)

1.272–1.618 extensions → Targets = $870, $990+

0.618 retracement = $676.60 — deep discount level

🚨 VolanX Execution Logic:

Wait for sweep + displacement below $700

Watch for internal BOS + higher low formation

Confirmed entry above $729 = breakout of accumulation

Scale-out zone: $870 → $990+

🧬 Trade Strategy:

Leg Action Level Risk

A Accumulate $680–$705 Low

B Confirm Break $729+ Medium

C Profit Zone $870 / $990 High reward

⚡ Alpha Outlook: META is in a controlled markup with engineered pullbacks. This is where narratives shift, and the smart money loads. VolanX signals strong alignment with SMC zones — this may be a high-conviction multileg long.

#WaverVanir #VolanX #META #SmartMoney #TradingAlpha #SMC #Accumulation #Gamma #OptionsFlow #LSTM #DSS #AITrading #TechStocks #GrowthEquity #Fibonacci #TradingView

META (Meta Platforms) – Battle at the Premium | WaverVanir Resea🚨 META is coiling at a critical inflection zone.

We're observing textbook Smart Money Concepts (SMC) behavior on both the daily and intraday timeframes:

🧠 Key Observations:

Price is hovering below the Premium Zone (0.786–0.886 Fibonacci: ~$729–$760) – a known liquidity trap.

15M structure shift shows a CHoCH (Change of Character) and BOS (Break of Structure), signaling possible upside.

Volume is tapering near a weak high – suggesting accumulation or engineered liquidity sweep.

⚔️ Scenarios in Play:

🟢 Bullish Breakout:

If META breaks and closes above $729.50 with strength and volume:

Long Trigger: $729.50+

Targets: $740.91 → $796 → $870+

Stop: Below $718 (EQ/EMA cluster)

🔴 Bearish Rejection:

If price rejects premium and breaks below $710:

Short Trigger: <$710

Targets: $676 → $647 → $611

Stop: Above $723

🎯 Strategic Outlook:

META is trapped between buy-side and sell-side liquidity. We’re watching for either a bullish expansion above weak highs or a reversion into discount toward deeper demand zones.

Volume and macro catalysts (e.g., earnings, tech sector rotation) will decide the direction.

📍 Posted by WaverVanir International LLC – Institutional Market Intelligence Engine

#Meta NASDAQ:META #OptionsFlow #SmartMoneyConcepts #TradingStrategy #VolumeProfile #Fibonacci #LiquidityZones #WaverVanirResearch #VolanX #TechStocks #MarketOutlook #InstitutionalTrading #LongOrShort #TradingView #SwingTrade #BreakoutSetup

4H Chart: How Meta's Double Top Turned Into a Reversal Buy How Meta's Double Top Turned Into a Reversal Buy Signal on the 4H Chart

Meta Platforms Inc. (META) recently formed a classic double top pattern, which is often interpreted as a bearish reversal signal.

The price touched a key resistance level twice and then pulled back, triggering caution among technical traders. However, the

stochastic RSI on the 4-hour timeframe is now flashing a potential reversal buy signal that could shift market sentiment.

This hidden momentum may catch short sellers off guard. Here’s a breakdown of the setup:

Technical Breakdown

1. Double top formation

Resistance was tested two times, forming a temporary ceiling.

Typically, this signals a possible trend reversal.

However, there has been no strong bearish follow-through after the second top.

2. Stochastic RSI buy signal on the 4H chart

The %K line has crossed above the %D line in oversold territory.

This suggests a potential bullish reversal.

RSI is also recovering from a low zone, pointing to increasing buying pressure.

3. Support is holding

The neckline of the double top remains unbroken.

Price action shows higher lows forming just below resistance, a bullish sign.

Strategy Outlook: Contrarian Reversal Play

While the double top suggests weakness, the stochastic RSI indicates a rebound. Traders may be witnessing a bear trap, where the market tempts sellers before reversing higher.

If the price moves above both the 50 EMA and 200 EMA on the 4-hour chart, it could trigger what some i call a rocket booster setup —strong upside momentum backed by moving average alignment.

A bullish confirmation candle with volume could solidify the reversal case.

Conclusion

Meta’s chart pattern might look bearish at first glance, but momentum indicators tell a different story. A reversal from here could lead to a breakout if bulls step in with strong follow-through.

Disclaimer: Trading is risky. Use a simulation trading account before you trade with real money and learn risk management and profit-taking strategies.

---

META at the Pivot Zone: Big Options Energy Building Ahead of CPIGEX-Based Options Analysis:

META is currently trading at $720.70, right beneath the highest positive GEX wall at $725, which aligns with the Gamma Resistance zone. The call structure above is dense, with strong walls at 730, 735, and 740, suggesting sellers may be active on strength unless price can break through and hold above $725. This zone is the inflection.

Below, Put Support builds at 715, 710, and especially at 707.5, forming a defensive gamma floor. The net gamma delta leans slightly CALL-biased at 12.6%, and IVR at 28.6 signals a relatively low volatility environment. This favors premium-selling strategies or debit spreads with strong directional confluence.

💡 Option Trade Setup Ideas:

* Bullish: Above $725 with confirmation, long 735c or 740c dated 7/12 or 7/19. Safer via debit spreads (e.g., 725/735 call spread) if IV climbs post-CPI.

* Bearish: Rejection below $723 with failed breakout = potential short via 720p or 715p targeting $710–707 area.

* Neutral-to-Range Play: Short strangle 715p/735c if expecting chop until CPI resolution.

1-Hour Chart Technical Analysis:

The price action is forming a compression wedge between descending trendline resistance and a horizontal demand base between 711.80–713.50, which has been defended multiple times. The current structure shows lower highs, but also consistent support with multiple BOS/CHoCH flips, especially along the 715 zone.

A strong reaction candle printed off the demand block after sweeping liquidity on July 8th. Volume is declining, suggesting compression before expansion.

🔍 Key Technical Levels:

* Support: 711.80 → 707.50 (Put wall + SMC demand)

* Resistance: 725 → 730 → 735 (GEX resistance cluster)

The EMA and volume structure hint at accumulation, but buyers need a clear breakout over 725 and retest for confirmation. A break below 711 would signal bearish continuation toward 707 and potentially 700.

My Trading Outlook:

* Bullish above 725: I’ll be looking for breakout + volume confluence for short-term long toward 735–740.

* Bearish below 713: If price loses structure and VWAP shifts downward, I’ll scalp short setups toward 707.50 zone.

* Avoid chasing in mid-zone: Let CPI and market sentiment unfold.

Disclaimer:

This analysis is for educational purposes only and does not constitute financial advice. Trade based on your own risk tolerance and always use proper risk management.

3 Reasons the Meta (META) Double Top Is a Buy Signal3 Reasons the Meta (META) Double Top Is a Buy Signal – Rocket Booster Strategy Explained

Meta Platforms Inc. (META) recently printed what looks like a double top pattern on the 4-hour chart.

Many traders are expecting a reversal. But from my perspective, this setup could actually be a trap for early short-sellers. Here's why.

The overall trend remains bullish. Price is still trading above the 50 EMA and the 200 EMA, which confirms that the long-term and

short-term momentum is still upward. When a double top appears in a strong uptrend but fails to break the neckline, it often

becomes a fakeout. Instead of reversing, the price consolidates, shakes out weak hands, and then breaks higher. This is where my

strategy comes in.

I call it the Rocket Booster Strategy. It works like this:

1. First, the price must be above both the 50 EMA and 200 EMA. This confirms we’re in an active uptrend.

2. Then, if a bearish pattern like a double top appears but the neckline does not break, that’s a sign of a trap.

3. We wait for price to bounce near the neckline or break above the recent top. That’s the ignition point – the rocket is ready to fire.

In this Meta setup, if price holds above the neckline or quickly reclaims the recent high, it becomes a strong buying opportunity.

The pattern fakeout acts like fuel, giving bulls the momentum to push price even higher.

This is a high-probability setup because many traders get caught

in the trap, expecting a sell-off, and their stop-losses become buy fuel for the next rally.

Trade idea:

Entry: near neckline bounce or breakout above second top

Stop loss: below the neckline or under the 50 EMA

Target: new highs and above

Final thoughts:

Don’t fall for surface-level patterns. In strong uptrends, failed double tops are often just launchpads. The Rocket Booster

Strategy helps us spot the fakeout and ride the breakout.

How 3 Simple Conditions Turn a Double Top Into a Buy Signal

Most traders see a double top and expect a reversal. But in strong uptrends, this pattern can fail — and when it does, it often sets up

a high-probability buying opportunity. Traders who use the Rocket Booster Strategy understand how to spot these traps and trade them in the direction of the trend.

Here’s how the strategy works — and why some double tops become launchpads, not ceilings.

1. Price Above Both 50 EMA and 200 EMA

When price remains above the 50 EMA and 200 EMA, it confirms strong bullish momentum in both the short and long term. In

these conditions, many reversal patterns like the double top often fail. Instead of selling off, price consolidates and continues higher.

Traders using this strategy only look for buy setups when both EMAs are pointing up and price stays above them.

2. Bear Trap Setup

A double top often attracts sellers. These traders place their stop-losses just above the highs. If price fails to break the neckline and

instead rallies above the top, those stop-losses are triggered, creating a surge in buy orders. This becomes a trap — not a

reversal — and the breakout can be fast and aggressive. The Rocket Booster Strategy takes advantage of this liquidity burst.

3. Entry After Confirmation, Not Assumption

Instead of shorting the pattern, traders using the Rocket Booster Strategy wait for one of two bullish confirmations:

A bounce off the neckline without breaking below it

A breakout above the second top after the trap is set

At that point, the trend is considered intact, and momentum is ready to continue. The "rocket" is refueled, and the strategy shifts

into entry mode.

Trade Setup Example:

Entry: Near neckline bounce or breakout above second top

Stop Loss: Below neckline or under the 50 EMA

Target: New highs and above the pattern top

Final Thoughts

In strong trends, failed double tops are not warning signs — they’re opportunities. The Rocket Booster Strategy filters out weak signals by requiring clear alignment:

price above both EMAs, pattern failure, and bullish confirmation. When these conditions align, a pattern that looks bearish on the surface becomes a fuel source for the next breakout.

Disclaimer: This article is for educational purposes only and not financial advice. Always do your own research.

NVDA, AMZN, META AND NFLX 4HS CHARTNASDAQ:NVDA SUP: 157 | RES: 159.7 – Triangle forming.

NASDAQ:AMZN SUP: 220 | RES: 224 – Compression zone.

NASDAQ:META SUP: 700 | RES: 739 – Needs reclaim to recover.

NASDAQ:NFLX SUP: 1279 | RES: 1302 – Bullish dip hold.

#trading #stocks #technicalanalysis #optionsflow #NVDA #AMZN #META #NFLX

META Platforms Long Setup – Ready for the Next Move?💣 META Masterplan: Bullish Break-In Activated! 💼📈

🌟Hi! Hola! Ola! Bonjour! Hallo!🌟

Dear Money Makers & Silent Strategists, 🤑💰💸✈️

We’ve locked in on our next high-value digital vault: META Platforms Inc.

Built on our signature Thief Trading Style™ — where fundamentals meet stealth technical precision — this is your map to the bullish jackpot.

📍 ENTRY PLAN – Door’s Unlocked!

✅ Enter at any level — this heist is already in motion.

OR

🎯 Set your Buy Limit on a 15m/30m swing low or high — classic pullback infiltration.

🛑 STOP LOSS – Your Exit Route

Before breakout? Hold the line.

After breakout? Drop your SL at the recent 4H swing low – and size it to your risk appetite.

This isn’t luck — it’s calculated theft. 🔐

🎯 TARGET ZONE – Grab & Vanish

🎯 Aim: 770.00

But if the cops (aka sellers) show up early, get out with your loot — no shame in a clean getaway.

“Profit is the win. Perfection is fantasy.”

⚡ SCALPERS' TIPS – Quick In & Out

💵 Big wallet? Enter now.

💳 Tight budget? Follow the swing team.

Either way — longs only, and trailing SL is your safety rope.

📊 WHY META? – Intel Behind the Mission

🔍 This plan is reinforced by:

🔥 Strong Fundamentals

📈 Sentiment Signals

🧠 Quantitative + Macro Flow

💼 COT Data

🌐 Intermarket Correlations

It’s all aligning — the pressure’s building, and the breakout door is creaking open...

🚨 TRADING ALERT – Stay Outta Trouble

💥 Avoid placing new trades during major news drops.

🎯 Use trailing SL to protect and lock profits — your getaway vehicle must be ready.

💖 Support the Heist? Smash Boost!

Fuel the mission — every Boost empowers the crew.

This is Thief Trading Style — we don’t chase, we plan, strike, and vanish with the win. 🏆💪🐱👤

📡 Another breakout mission incoming. Stay hidden. Stay profitable. 🤑🚀

7/3/25 - $meta - Still a buy sub $1k/shr7/3/25 :: VROCKSTAR :: NASDAQ:META

Still a buy sub $1k/shr

- reality is, why would you bet against zuck

- his platforms are hitting on all strides. he is willing to internally build the best AI when he's falling behind by hiring the best talent and it is a LOT cheaper to hire for collectively $500 mm than say pay billions for a developed product and internalize it. great move Zuck!

- and their ad tools are second to none and don't suffer as much from "Google search" narrative as the ecosystem is one of those that's incrementally chipping away from Google.

- at mid 20s + PE, the stock is not "cheap" but it's actually quite affordable for the environment we're in

- some market POV: I think we've seen the "garden variety" pullback already. believe it or not... when you look at the individual names from recent highs, we've seen a lil 3 to 10% shuffle and not all on the same day (take for instance the TSLA dip the other day, large, and not on a day where nasdaq or other Mag7's were red).

- i continue to see small caps failing on large cap peers

- i see more money still floating lager caps higher at the expense of small caps, even tho it might look the opposite in the immediate term (this is a story as old as time... newbs chase quick thrills, get squashed and can afford less of the assets they should be buying to begin with). so word to the wise: if you've made some nice tendies lately on slightly more degen plays... buying stuff like Mag7's or even indices at highs is not necessarily a "bad" buy.

- anyway i like NASDAQ:META at sub $1k and sub 35x PE into the print

- would like to own more, so would be buying dips

- but think this is a winner in 2H

V

$META Braces for Market HeadwindsWhile the NASDAQ is flirting with putting a double-top in, technology companies like NASDAQ:MSFT NASDAQ:GOOGL and NASDAQ:META are increasing CapEx spend for future Ai infrastructure. Margin compression is likely to result with a smaller hit from energy costs - estimated at about 1% of revenue - as energy demand for compute continues to leap forward and future executive action from the Trump administration threatens to kneecap the ITC with modified "placed-in-service" dates and onerous FEOC requirements, eliminating targeted tax subsidies on solar and redistributing the costs to energy more broadly. NASDAQ:META will not likely see the benefits of its CapEx spend anytime soon.

The ratio continues to widen between the NASDAQ:NDX and AMEX:SPY , indicating a higher probability of mean-reverting behavior. While QE and open-market operations have tended to be steepening for technology companies after the dotcom bust and beginning during the GFC, the segment is likely exhausted. We have not yet seen a larger retrace since unprecedented yield inversions starting in '22.

If we see a large market correction, a markdown in share price and any drop in advertising - META's largest revenue driver - will likely compound bearish sentiment. Tariff effects have yet to reported meaningfully in economic data and the job market is cooling. Inflation is likely to stick at 3%. Stagflation is on the table.

What a time to be alive.

~s

META - Double Top Currently Meta's double top around $750 is still in play. We wanted to watch the $710 level start to hold to climb back up but in early market we are still seeing a fall which could lead to our next lower support level around $680.

EPS data coming at the end of the month could signal if the trend will continue to be weak or if it is able to stay in line with the last few surprise prints and break through the key double top level.

The bearish divergence also shows us that currently the strength is starting to weaken in relation to price. Higher highs in price but lower highs on the RSI.

Before the Judge: Turmoil in Silicon ValleyIon Jauregui – Analyst at ActivTrades

Zuckerberg Takes the Stand

This week, Mark Zuckerberg appears as a witness in a civil lawsuit worth $8 billion, in which the governance of Meta Platforms (NASDAQ: META) is under scrutiny following the well-known Cambridge Analytica scandal. The plaintiffs — shareholders of the company — argue that decisions were made without proper board oversight, directly affecting the company’s value and corporate governance.

The trial also implicates other high-profile figures, including former executive Sheryl Sandberg, investor Marc Andreessen, Palantir Technologies (NYSE: PLTR) co-founder Peter Thiel, and former Netflix (NASDAQ: NFLX) chairman Reed Hastings. The central question is whether Meta’s board exercised independent and effective oversight in handling the crisis.

Temasek Reshapes Its Strategy in India

Singapore’s sovereign wealth fund, Temasek, has announced a shift in its investment strategy: fewer deals, but with higher concentration and larger individual commitments. Its current exposure in India exceeds $50 billion, and the fund believes the local market has matured enough to allow for easier entry and exit of capital.

Companies that could attract attention include major players such as Reliance Industries (NSE: RELIANCE) and Tata Consultancy Services (NSE: TCS)—key actors in sectors like technology, telecommunications, and financial services. Temasek values not only India’s economic growth, but also the opportunities for scalability and sector diversification.

Banking Sector Eyes Mergers

In the financial sector, Northern Trust (NASDAQ: NTRS) has drawn market attention amid speculation of a possible approach by BNY Mellon (NYSE: BK). A more flexible regulatory framework from the Federal Reserve has rekindled interest in M&A activity across the U.S. banking industry.

Major banks such as JPMorgan Chase (NYSE: JPM), Bank of America (NYSE: BAC), and Goldman Sachs (NYSE: GS) are closely monitoring the landscape, while regional players like PNC (NYSE: PNC), U.S. Bancorp (NYSE: USB), and Truist (NYSE: TFC) could also engage in strategic transactions aimed at improving efficiency and increasing market share.

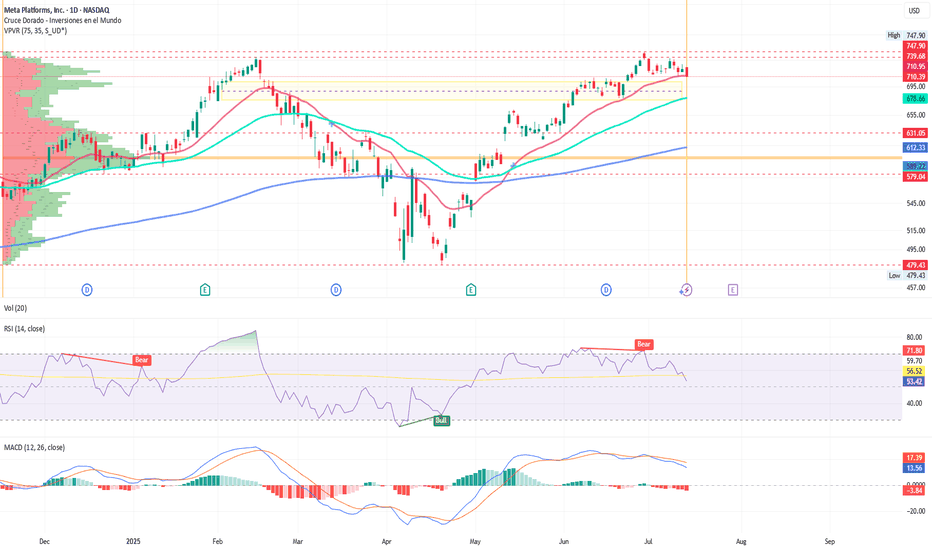

META in Focus: Technical Analysis

After reaching all-time highs in June near $747.90, Meta Platforms shares have slightly corrected, entering a consolidation phase around the 50-day moving average, which now acts as a key technical support level.

From a technical standpoint:

The price remains above the 50-day moving average since the golden cross in May, preserving the medium-term bullish structure.

The RSI stands at 53.42%, indicating a consolidation phase with no clear overbought or oversold signals.

Immediate support: $688 (100-day moving average)

Key support: $631, just above the point of control around $600

MACD: indicates short-term bearish pressure

Resistance: recent highs suggest a potential double top

A breakdown below the current support area could increase downside pressure, while a breakout above the all-time high, supported by volume, would resume the bullish trend toward new highs. The ongoing trial may bring short-term volatility, although much of the reputational risk appears to have been priced in by the market. Over the long term, investors continue to assess Meta’s strategic positioning in artificial intelligence, digital advertising, and virtual reality.

Conclusion

Silicon Valley is navigating a phase of heightened scrutiny—both in courtrooms and financial markets. As tech companies adjust their strategies and international funds recalibrate their positions, sectors like banking are preparing for potential consolidation. In this context, regulatory risk, governance, and strategic efficiency will remain key drivers in the performance of major U.S. corporations in the coming quarters.

*******************************************************************************************

The information provided does not constitute investment research. The material has not been prepared in accordance with the legal requirements designed to promote the independence of investment research and such should be considered a marketing communication.

All information has been prepared by ActivTrades ("AT"). The information does not contain a record of AT's prices, or an offer of or solicitation for a transaction in any financial instrument. No representation or warranty is given as to the accuracy or completeness of this information.

Any material provided does not have regard to the specific investment objective and financial situation of any person who may receive it. Past performance and forecasting are not a synonym of a reliable indicator of future performance. AT provides an execution-only service. Consequently, any person acting on the information provided does so at their own risk. Political risk is unpredictable. Central bank actions can vary. Platform tools do not guarantee success.

META Approaching Key Support – Healthy Pullback Setup?Meta (META) has been climbing within a rising wedge channel since April, recently stalling below $730. A potential short-term pullback is forming, which may offer a healthy reset for momentum indicators.

Price Action:

After tagging the top of the rising wedge, META is showing signs of weakness with a bearish candle and declining volume. Price closed at $715.81 (-1.58%), sitting just above a key support zone.

Support & Resistance:

Resistance: $726 (BB top), $740 (horizontal supply), $772.91 (upper BB 53 band)

Support: $714 (minor), $682–683 (strong horizontal + prior resistance turned support), $637 (EMA 100)

Indicators:

MACD: Still bullish but flattening, signaling slowing momentum.

RSI: 62.21 – cooling from overbought territory.

Volume: Lower on recent candles, suggesting reduced buyer strength.

Key Insight:

A pullback toward the $680 support zone would be healthy and could allow the RSI, MACD, and volume to reset from overextended levels. This would prepare META for a stronger continuation if demand steps back in.

Outlook:

META remains in a bullish structure, but short-term cooling is likely. A bounce from $682 or a breakout above $740 (with volume confirmation) could mark the next directional move. Keep an eye on the earnings date (July 28) for volatility.

META Shares Signal Major Reversal Risk Amid Potential 2B Top PatThe shares of META, the NASDAQ-listed owner of Facebook, recently reached overbought levels as the stock price rose above its upper Bollinger Band and its Relative Strength Index climbed above 70. This suggests that META is likely to enter a period of sideways consolidation or perhaps experience a sharp decline.

However, traders should also pay close attention to a potentially larger reversal pattern known as a 2B top, which may currently be forming.

A 2B top is similar to a double top pattern, but typically the second high slightly exceeds the prior high before reversing. In this case, the high on 30 June 2025 exceeded the previous high set on 14 February 2025. The stock then fell sharply on 1 July, and if it continues to decline below support at $700, this would confirm the 2B topping reversal pattern.

Additionally, a break below support at $700 would signal the end of the uptrend that began on 1 May and also push the price below the 10-day exponential moving average, further confirming a trend reversal.

A decline below $700 could see the shares fall significantly, potentially erasing much of the gains recorded following the US-China trade negotiations held in Switzerland on May 12.

Notably, a price gap exists at $593, created by the announcement following those talks.

Alternatively, if the stock holds support at $700 and continues the uptrend, the 2b top is invalidated, and traders should look for even higher prices from this AI giant. The nice thing about the 2b topping pattern is that it provides an easy-to-identify invalidation price, which in this case would be above $748.

Written by Michael J. Kramer, founder of Mott Capital Management.

Disclaimer: CMC Markets is an execution-only service provider. The material (whether or not it states any opinions) is for general information purposes only and does not take into account your personal circumstances or objectives. Nothing in this material is (or should be considered to be) financial, investment or other advice on which reliance should be placed.

No opinion given in the material constitutes a recommendation by CMC Markets or the author that any particular investment, security, transaction, or investment strategy is suitable for any specific person. The material has not been prepared in accordance with legal requirements designed to promote the independence of investment research. Although we are not specifically prevented from dealing before providing this material, we do not seek to take advantage of the material prior to its dissemination.