Nike - This is the bottom!💉Nike ( NYSE:NKE ) creates the bottom now:

🔎Analysis summary:

More than four years ago, Nike created its previous all time high. We have been witnessing a downtrend ever since and a correction of about -70%. But with the recent retest of an important horizontal structure and bullish confirmation, Nike is about to create a potential bottom.

📝Levels to watch:

$65, $80

🙏🏻#LONGTERMVISION

Philip - Swing Trader

NKE trade ideas

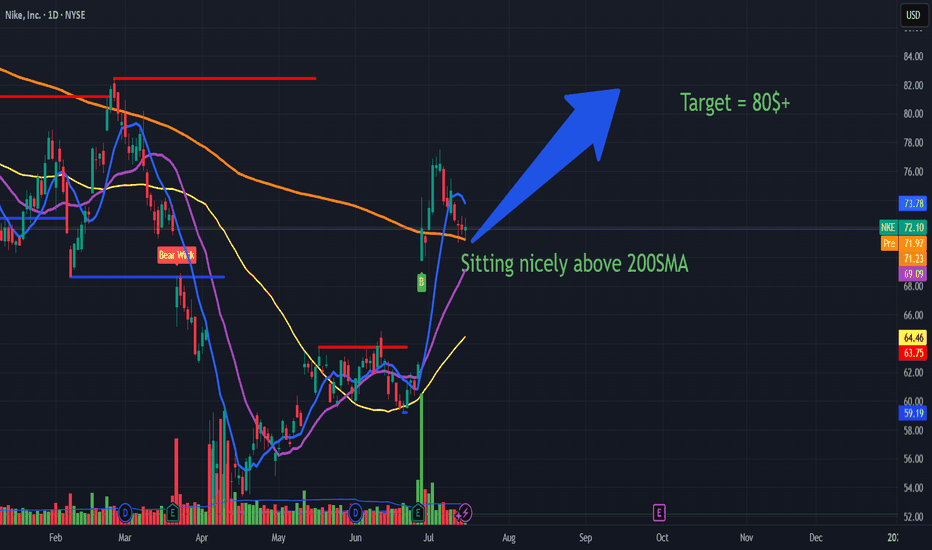

Nike is a screaming BUY with target above 80$ in the short termSummary: In short NKE is on reversal mode to the upside and 80$ is on the horizon and 100$+ by next quarter Earnings call which is an upside over 40% NYSE:NKE

Nike (NKE): Technical Strength Above the 200 SMA 🟢

Nike (NKE): Recent Earnings Overview 🏅

Above the 200-Day Simple Moving Average (SMA) 🟩

NKE’s price is currently holding above the key 200-day simple moving average (SMA).

The 200 SMA is widely followed by investors as a long-term trend indicator.

Sitting above this level signals a bullish phase, as it often marks a shift from bearish to bullish market sentiment.

Historically, when a stock breaks and sustains above its 200 SMA after a downtrend, it attracts attention from institutional buyers and can act as a strong support area for further upside .

Key Takeaways from the Earnings Call

China Recovery 🐉

Positive business trends are emerging in greater China, supporting Nike’s international momentum.

Brand Momentum 🚀

Investments in product innovation, branding, and digital transformation remain central to growth.

Shareholder Return 💰

The continuation of share buybacks and regular dividends signals Nike’s commitment to delivering value.

How This Supports the Bullish Thesis

Momentum Confirmation:

Trading above the 200 SMA supports the idea that recent gains are not just a short-term bounce, but reflect a possible trend reversal toward sustained growth.

Institutional Buying Signal:

Many long-term investors and funds use the 200 SMA as a buy trigger, increasing the likelihood of strong follow-through buying.

Risk-Reward:

Being above the 200 SMA, with support from lower moving averages, strengthens the case for manageable downside risk and a clear technical floor.

Combined with recent Earnings, the technical breakout above the 200 SMA aligns with Nike’s solid Q4 earnings results, margin improvement, and positive guidance, all reinforcing confidence in the current rally.

Nike’s position above the 200-day simple moving average—combined with recent strong fundamentals—strengthens the bullish outlook for the stock at this key juncture..

Why This Matters for the Buy Thesis

Earnings Beat: Supports the recent surge in Nike’s stock price and adds conviction to a bullish outlook.

Margin Resilience: Operational improvements reduce risk, even in a tough retail environment.

Brand and Digital Strength: Focus on innovation and digital sales provides confidence for long-term investors.

In short NKE is on reversal mode to the upsie and 80$ is on the horizon and 100$+ by next quarter Earnings call

Possible Scenarios for Nike🔺 Pattern:

An ascending triangle is forming, which is a bullish technical pattern if it breaks out with volume above the resistance level.

The TP1 (Take Profit 1) marked in the $64.72–$66.38 USD zone is logical and aligns with previous resistance levels.

🟢 Bullish Signals:

Imminent triangle breakout: if the price strongly surpasses the $59–$60 USD range, it confirms the pattern.

Increasing volume on previous green candles: a good sign of accumulation.

Slightly expanding Bollinger Band: may indicate the beginning of a stronger move.

EMAs are flattening, with a possible future crossover if a rally confirms.

🔴 Risks and Key Levels to Watch:

The macro trend remains bearish: several timeframes (15m, 1H, 4H, 1D) show "BEARISH" zones.

Strong resistances: around $64.72, and especially between $72.31 and $76.00 USD.

If the breakout fails and price drops below $57.43, the pattern is invalidated and price may seek support at lower levels ($52–$50).

Break of downward sloping channel LongNike has swept liquidity and is now showing a strong bounce to the upside.

Although I didn’t manage to enter the initial long, I am monitoring for a break above the current downward-sloping channel. A clean breakout followed by a retest would provide a more reliable entry point. I’m not aiming to catch the absolute bottom—I’d rather wait for confirmation of trend reversal.

A move above the monthly level at 79.46 would be an additional sign of strength and increase conviction in the long setup.

There is still significant overhead resistance, particularly around the point of control aligned with the anchored VWAP near 92.50. That area would be my first target. However, if momentum continues, there is potential for a move towards the 122 level.

NKE Pullback-I'm Buying the DipNike (NKE) is under pressure — post-earnings volatility, macro noise, and sentiment all weighing in. But for swing traders, this looks like a textbook accumulation setup.

📌 Entry Zones I’m Targeting:

🔹 $70.00

🔹 $65.00

🔹 $60.00

Profit Targets (Taking wins before 88):

✅ $78.80

✅ $82.50

Let the market come to you — no chasing, just precision.

💬 Drop your thoughts below — are you buying NKE here or waiting for blood?

Disclaimer: This post is for informational and educational purposes only. It does not constitute financial advice or a recommendation to buy or sell any securities. Always do your own research and consult with a licensed financial advisor before making any investment decisions. Trading involves risk, and past performance is not indicative of future results

Long NKE on pull back after break?Nke just woke investors back up with their recent forecast after earnings. This push has temporarily broken the down trend on the daily time frame and it is holding the break on the weekly. We now have a healthy-looking retest with the rsi on the daily time frame above 50 signaling a bounce is coming. I mapped out some take profits. I am still a little worried about the company itself based on my own fundamental analysis. But physiologically i believe many people don't want to miss out on a brand name like Nike at such a discount, if it bounces here, I think it will be huge. Probably a short squeeze. I will not hold this trade up to next earnings though, as i said I don't really love the fundamentals. I think NKE is losing market share rapidly. Anyways sorry for the grammar but here are my thoughts, good luck. oh, and stop loss with a clear break and hold under this bounce spot, maybe 68-69?

Nike Looks Ready — A Smart Time to Consider InvestingOn the monthly chart, NIKE has been in a downtrend since November 2021, but the signs are pointing toward a potential trend reversal. Here's why I believe the bottom may already be in:

✅ MACD Histogram shows a strong positive divergence, signaling weakening bearish momentum.

✅ The RSI downtrend line has been broken and successfully retested, confirming bullish strength.

✅ A clear hammer candle has formed at a historical wide support zone, showing strong demand.

Now, price is facing three consecutive resistance levels — and with each breakout, the next zone becomes the new target, (87.5 → 102 → 122).

The structure suggests a step-by-step move higher if momentum holds. Keep an eye on the breakout above the descending trendline — that’s where things could accelerate.

Short Trade Idea: NKE (Nike Inc.)🧠

📅 Timeframe: 30-Minute

💼 Type: Short Position

📉 Setup: Symmetrical triangle + rejection at resistance

📍 Trade Details:

Entry: ~$73.39 (just below triangle break/retest)

Stop Loss: ~$74.35 (above upper resistance & failed breakout)

Target 1: $71.52 (minor support / red line)

Target 2: $69.77 (mid-zone)

Target 3: $68.39 (major horizontal support)

🔎 Technical Breakdown:

Symmetrical triangle formed near the top — often signals reversal.

Strong resistance around $74.35 (yellow + white lines).

Price failed to break higher → pulling back from upper wedge trendline.

Bearish setup with well-defined risk.

🎯 Risk/Reward:

Risk is tight (1 point), while potential reward is over 2–3x depending on target hit.

Clean structure, suitable for short-sellers.

NiKE annual continuation of the trendNike, a globally recognized, enduring brand, feels almost "too big to fail." I've been monitoring the $70 price level as a potential entry point for a wick fill trade in the near future, aiming for a 100% to 200%+ ROI over 6 months to 2 years. The stock shows signs of downside exhaustion and oversold conditions. Despite recent revenue declines, market cycles and Nike’s nearly 50-year brand resilience suggest a potential rebound.

Nike hit us hard… and that needs to be said too.Nike hit us hard… and that needs to be said too.

I’m not going to sugarcoat it: we entered a PUT before earnings, and we lost. We had over 20 criteria from our “Eagle Trap” system lined up — high RSI, a sharp rally with no solid fundamentals, declining sales in China and the U.S., weak forward guidance, low volume, and too much hype on social media. Everything pointed toward a disappointment.

And yes, the earnings report was weak. Revenues dropped again, guidance was soft, and there wasn’t anything particularly positive. But still, the stock went up after hours. And honestly, I still don’t get why.

My mistake? I thought I entered with 2 PUT contracts as planned, but I accidentally entered with 4. Luckily, I had my risk control in place, or the loss would’ve been even worse.

This was a tough one, but it’s a powerful lesson. Sometimes the analysis is solid, but the market does its own thing. You won’t always win — and you’ve got to accept that.

Now it’s all about keeping a cool head. No revenge trades, no emotional decisions. This loss won’t take me down — it’ll sharpen me. The system still works, and as long as I manage my risk and stay disciplined, I’ll keep growing.

The Eagle Trap isn’t perfect — but it’s smart. And the eagle always comes back to hunt.

NKE at 52-Week Lows Oversold Giant or Value Trap?Nike is a blue-chip name going through a rough patch. But this recent dip, fueled by disappointing earnings and macro uncertainty, could present a classic oversold opportunity. The stock is now in a high-probability reversal zone where risk/reward becomes extremely attractive.

🎯 Updated Entry Plan:

$58.00 – Soft support zone; start building a position

$53.00 – Close to the 52-week low; likely strong bounce area

$50.00 – 49.00 Psychological round number and historical demand zone

📈 Target Levels

Profit

TP1: $68

TP2: $77.50

TP3: $88.50

Pro Tip: Nike doesn’t stay down forever. The brand is fundamentally strong. This is not a growth story right now, it’s a value + patience play.

📢 Disclaimer: This is not financial advice. Always do your own research, manage your risk, and never risk more than you’re willing to lose.

6/26/25 - $nke - Good luck to the longs...6/26/25 :: VROCKSTAR :: NYSE:NKE

Good luck to the longs...

- keeping it small

- but let's be real

- nke still trades dayum near 30x earnings and earnings aren't growing.

- discretionary is impossible to buy

- tariff tylk back, whaddidu think?

- they miss miss miss...

- comps not reporting good results ex. NYSE:ONON (special brand)

- so could this one be different? obviously.

- but ATM P's as a lil juice on the short side to some of my longs looks like a nice setup.

- so i'm only deploying 5 bps on this for next weeklies. it's one of those situations where if stock rips... oh well, sized appropriately. i'd say rip is 30-40% chance and likely 5-10% most and possibly a retrace

- if dips... it will be deep... and multi-day into a quarter end which could see some rebalancing flows as funds prepare for the 3Q size ups

good luck to bill ackman. smart guy. but i don't get his love of nike. better to buy NYSE:DECK , and i don't even own that one rn...

V

Will Nike’s Upcoming Earnings ‘Just Do It’ for Investors?This hasn’t been the greatest year for Nike NYSE:NKE , which will report earnings next Thursday at a time when the stock is down more than 20% year to date. What does technical and fundamental analysis say might happen to the stock from here?

Let’s take a look:

Nike’s Fundamental Analysis

NKE ended Wednesday down 21.4% year to date, and last year wasn't so hot for the athletic-gear giant, either. Shares fell 30.3% over 2024 as a whole.

In fact, it’s been a tough decade so far for Nike, a one-time Wall Street darling.

All in, the stock has fallen some 66.8% since peaking at $179.10 in November 2021. Gross.

Things got so bad that former CEO John Donahoe "retired" in October 2024 -- a retirement that the firm’s board graciously “agreed” to.

The board then pulled in Nike veteran Elliott Hill, who had retired in 2020 after 32 years with the firm, off of the bench to serve as the company’s new CEO.

While it's still early, Hill hasn’t worked much magic so far for the stock, either.

Nike shares have struggled since March, when the firm beat analyst expectations for its fiscal Q3 earnings and revenues but provided poorly received forward guidance.

As for next week’s fiscal Q4 results, the Street is looking for NKE to report just $0.11 of GAAP earning per share on roughly $10.7 billion of revenue.

That would compare badly to the $0.99 of EPS on $12.6 billion of revenues that Nike saw in the same period last year -- an 88.9% decline in earnings per share and about a 15% drop in sales.

In fact, of the 23 sell-side analysts that I’ve found that track the stock, 21 have revised their fiscal Q4 earnings estimates lower since the quarter began. Only two have moved their forecasts to the upside.

Nike’s Technical Analysis

Now let's take a look at NKE’s chart going back some four months:

Readers will see that from early April through mid-June, Nike developed a so-called “rising-wedge” pattern of bearish reversal, marked with purple shading and a red box in the chart above.

Late last week, shares broke through the wedge’s lower trend line at about $62, which is the pivot point here.

Nike also recently gave up its 21-day Exponential Average (or “EMA,” marked with a green line above). That’s likely turned some swing traders against the stock for now.

The stock will now have to look to its 50-day Simple Moving Average (or “SMA,” denoted above with a blue line) for support. That’s at $59.50 in the chart above, but NKE was trading at $59.51 on Friday afternoon as I wrote this.

Should that line crack as well, a certain percentage of portfolio managers would likely have their risk managers force them to reduce long-side exposure to the stock.

But interestingly, readers will also note that from Nike’s late-February high to its early April low, shares hit resistance at the 38.2% Fibonacci retracement level of that move twice -- first in mid-May and then again a month later. This typically implies that there are probably institutional sellers at that level.

Looking at NKE’s other technical indicators, the stock’s Relative Strength Index (the gray line at the chart’s top) is on the weak side of neutral here. It’s not awful, but it also isn’t positive.

Worse, Nike’s daily Moving Average Convergence Divergence indicator (or “MACD,” marked with blue bars and black and gold lines at the chart’s bottom) is postured quite bearishly.

Within that indicator, the 9-day EMA (the blue bars) stands below zero, while the 12-day EMA (the black line) has crossed below the 26-day EMA (the gold line). Those are all typically negative technical signals for a stock.

(Moomoo Technologies Inc. Markets Commentator Stephen “Sarge” Guilfoyle had no position in NKE at the time of writing this column.)

This article discusses technical analysis, other approaches, including fundamental analysis, may offer very different views. The examples provided are for illustrative purposes only and are not intended to be reflective of the results you can expect to achieve. Specific security charts used are for illustrative purposes only and are not a recommendation, offer to sell, or a solicitation of an offer to buy any security. Past investment performance does not indicate or guarantee future success. Returns will vary, and all investments carry risks, including loss of principal. This content is also not a research report and is not intended to serve as the basis for any investment decision. The information contained in this article does not purport to be a complete description of the securities, markets, or developments referred to in this material. Moomoo and its affiliates make no representation or warranty as to the article's adequacy, completeness, accuracy or timeliness for any particular purpose of the above content. Furthermore, there is no guarantee that any statements, estimates, price targets, opinions or forecasts provided herein will prove to be correct.

Moomoo is a financial information and trading app offered by Moomoo Technologies Inc. In the U.S., investment products and services on Moomoo are offered by Moomoo Financial Inc., Member FINRA/SIPC.

TradingView is an independent third party not affiliated with Moomoo Financial Inc., Moomoo Technologies Inc., or its affiliates. Moomoo Financial Inc. and its affiliates do not endorse, represent or warrant the completeness and accuracy of the data and information available on the TradingView platform and are not responsible for any services provided by the third-party platform.

Nike’s Accumulation Zone Signals Bullish Reversal Potential

Current Price: $60.53

Direction: LONG

Targets:

- T1 = $63.25

- T2 = $66.00

Stop Levels:

- S1 = $55.80

- S2 = $52.40

**Wisdom of Professional Traders:**

This analysis synthesizes insights from thousands of professional traders and market experts, leveraging collective intelligence to identify high-probability trade setups. The wisdom of crowds principle suggests that aggregated market perspectives often outperform individual forecasts, reducing cognitive biases and highlighting consensus opportunities in Nike's stock.

**Key Insights:**

Nike is currently navigating bearish sentiment, but its long-term bullish potential remains intact. Institutional investors have identified the stock's accumulation zone near $54-$50, which suggests strong recovery prospects. Near-term resistance at $65-$70 will play a vital role in defining future price direction, and downside risk should be closely monitored around $52.40 support levels. Additionally, the influence of geopolitical events and economic headwinds should be factored into trading strategies.

**Recent Performance:**

In recent months, Nike's stock has struggled due to rising retail costs, supply chain challenges, and tightening discretionary spending. These factors have led to a bearish phase, but long-term resilience in Nike’s operational model allows it to weather such phases historically. Price action between $55 and $60 depicts bottoming tendencies, offering potential entry points for bullish investors.

**Expert Analysis:**

Analysts emphasize accumulation zones around $54-$50 as critical for institutional buying and long-term bullish setups. While immediate resistance close to $70 may face rejection, a breakout above this point will likely signal bullish reversals with price targets beyond $70. Nike’s brand value, evolving direct-to-consumer strategies, and market leadership position increase confidence in its mid- to long-term outlook. Technical indicators such as MACD and RSI suggest improving momentum, providing further validation for bullish positions.

**News Impact:**

Recent macroeconomic concerns, including inflation and geopolitical instability, continue to weigh on global consumer markets. Rising oil prices and constrained discretionary spending are notable challenges for retail stocks. However, Nike’s strategic focus on expanding its direct-to-consumer operations, coupled with its robust digital presence, could counterbalance some of these headwinds. Monitoring broader retail sector trends and geopolitical developments will be essential for optimizing timing and risk exposure.

**Trading Recommendation:**

Nike’s current price action suggests a slow recovery from bearish trends, with promising long-term growth potential. Investors could consider taking bullish positions at current levels with clearly defined stop-loss levels to mitigate short-term volatility risks. Success in breaking above resistance levels could spark a reversal rally exceeding $70, aligning with technical and fundamental factors supporting upward momentum.

NKE – EMA Crossover and Bullish Continuation PotentialNIKE (NKE) has completed a clean technical gap fill and is now showing early signs of a trend reversal.

🔍 Key Technical Factors:

✅ Gap Filled: The March-April gap was filled cleanly and held.

✅ EMA Crossover: EMA 9 crossed above EMA 21 → bullish short-term signal.

✅ RSI > 50: Momentum shifting bullish; RSI reclaiming territory above neutral.

✅ Volume Confirmation: Increasing activity during the breakout attempt.

🎯 Next Target: Gap to fill around $70.50

📈 Strategy Outlook:

If price closes above $64.00, this could trigger continuation toward the next gap.

Invalidation below $61.50 (EMA cluster and recent base).

Nike's Pullback Provides a Valuable Long Opportunity

Current Price: $62.80

Direction: LONG

Targets:

- T1 = $64.50

- T2 = $68.00

Stop Levels:

- S1 = $61.00

- S2 = $59.00

**Wisdom of Professional Traders:**

This analysis synthesizes insights from thousands of professional traders and market experts, leveraging collective intelligence to identify high-probability trade setups. The wisdom of crowds principle suggests that aggregated market perspectives from experienced professionals often outperform individual forecasts, reducing cognitive biases and highlighting consensus opportunities in Nike.

**Key Insights:**

Nike’s current valuation of $62.80 reflects a steep discount from its previous highs, presenting a compelling opportunity for a long position. Despite challenges in the broader consumer discretionary sector due to inflationary pressures and slowed economic growth, Nike's global brand strength, pricing power, and robust innovation pipeline continue to underpin investor confidence. The company remains a leader in sustainability, technology-driven product offerings, and market penetration across diverse demographics. Traders are closely watching the $60 price threshold as a potential pivot point for further accumulation.

**Recent Performance:**

Nike’s stock has dropped dramatically from its all-time high of $180 to its current level of $62.80, representing sustained weakness over the past two years. This decline mirrors a challenging macroeconomic environment but highlights an oversold condition relative to its historical valuation. Recent trading activity suggests that demand is stabilizing, with strong transactional volumes around the $60 level.

**Expert Analysis:**

Analysts maintain cautious optimism for Nike's recovery, citing its dominant market position and high-margin growth potential. Nike’s ability to diversify revenue streams with direct-to-consumer strategies has helped mitigate retail pressures. Experts acknowledge macro risks but champion Nike's ability to outperform peers through its brand loyalty and financial resilience. They suggest the current price levels are an exceptional value, with the potential for strong upside as broader market conditions normalize.

**News Impact:**

Recent headlines emphasize Nike's proactive approach to economic challenges, including operational adjustments to streamline costs and boost profitability. Announcements around expanded digital engagement and innovative product rollouts have softened concerns about dampened consumer sentiment. Analysts argue that increased focus on sustainability and community-driven initiatives positions Nike favorably in a crowded marketplace.

**Trading Recommendation:**

Nike currently offers an attractive entry point for traders looking to take a long position. With strong fundamentals, a proven ability to adapt to shifts in consumer demand, and significant trading activity at current levels, the stock appears poised for recovery. For long investors, $64.50 and $68.00 represent achievable price targets, while stop levels at $61.00 and $59.00 provide prudent risk mitigation. Strategic patience and disciplined execution could yield substantial returns as Nike leverages its brand power and innovations for growth.

70% fall from the peak, is NIKE days over ?We can see from chart that NIKE has fallen from its glorious days and fallen 70% from its peak in Aug 2021. It is still on a downtrend.

Could Amazon be its saviour for the next 6 months or so, especially Christmas and Thanks Giving Day ?

Excessive inventory build up seems to be clogging the system and drag the revenues down! Not forgetting there are many other brands competing as well. It will take some months/years before we see a decent recovery.

Since I am vested, I will just park this in my garage and monitor on a monthly basis. Not adding more nor selling.