NVIDIA: From $300B to $3T – Is the Pullback a Setup?Between October 2022 and mid-2024, Nvidia's market capitalization surged from $300 billion to over $3 trillion — a tenfold increase that outpaced the GDP of entire nations such as Russia or Canada. This meteoric rise made Nvidia the largest public company in the world at one point.

A long-term investment in NVDA has dramatically outperformed the broader market. From May 2014 to May 2024, the stock gained over 22,000%, compared to 179% for the S&P 500 and 77% for gold.

However, in 2025, Nvidia stock declined by 43%, raising the question: does this mark the end of the rally or the beginning of a new accumulation phase?

Core Drivers

AI dominance: Nvidia controls 95% of the GPU market used in machine learning applications.

Strategic clients: Tesla, Meta, Microsoft, and Alphabet continue to deepen partnerships with NVDA.

Crypto leverage: The company holds 82% of the GPU market used for mining, benefiting from the renewed crypto upcycle.

Domestic production push: Nvidia is developing over 1 million square feet of manufacturing space in Arizona and Texas, aiming to produce $500B worth of AI infrastructure over the next four years.

Policy support: The US and EU are investing more than $240B to secure domestic chip production via the CHIPS Acts.

Financial Strength

FY2024 revenue grew 114% YoY to $130.5B

Q4 net income reached $22B

Nvidia joined the Dow Jones Industrial Average in late 2024

Announced a $50B buyback program

Executed a 10-for-1 stock split in June 2024

Trading View

After peaking in 2024, NVDA retraced to the $110 area, which now acts as a potential accumulation zone. The next major resistance lies near $150, offering a 35% upside if momentum returns.

The macro backdrop remains highly favorable — AI infrastructure investment continues to accelerate, and the recent correction may reflect short-term positioning rather than fundamental weakness.

Final Thoughts

Nvidia is no longer just a semiconductor company — it is a system-level platform powering the AI economy. With robust fundamentals, strategic expansion, and institutional demand, the current price levels could represent a key medium-term opportunity for trend-followers and long-term investors alike.

#NVDA #Nvidia #Semiconductors #AI #EquityMarkets #TradingViewIdeas

NVDA trade ideas

NVDA - DECENT CONFIRMATION Good Morning,

Seeing some strength in NVDA since yesterday. Trend is showing another strong movement upwards. There is a divergent volume profile since the original YTD low on April 7th 2025.

I feel a little like this is like taking candy from a baby, lets see what happens.

Enjoy!

simple chart of what I seeAnyone who knows me know I like to make simple charts that get to the point. Nothing fancy. Just lots of lines. Anyway, I did a ghost feed so you can get an idea of where I think we go from here. I seriously doubt we see any big changes until earnings. Unless China gets their heads out of the you know what, we will trade like this for a little while. I do feel there is hoppe. If NVIDIA has strong earnings , it could be enough push it to new highs. I would use caution. You will see by my chart we started off with an ascending wedge, moved right into a descending wedge and now I feel we will rinse and repeat. All the while ultimately creating new highs and new lows. Anywhere you see horizontal lines is where I see resistance. And yes, I do still think we could drop below 100 again, so get your buy fingers ready :) Not financial advice! Just an old trader's ideas. If we break above 130 before now and earnings, consider it could be a nice ride up!!

Where is the Nvidia ball bouncing?Good afternoon, at 15:48 p.m Nvidia is looking towards the up side. A sell off took place over the weekend (great deals).A swing up at least $3 in an accumulation or quick move up is likely. Decent entries to look for adding a steady 5% to 10% in a few days in this high volatile climate.

NVDA’s Wild Crash Alert: I’m Braced for a Heart-Stopping Drop!NVDA’s like a rocket losing altitude, and I’m on edge! It’s at $95.99, but I’m seeing it tumble to $90, maybe $88.95, then $83.59 if the bears go wild. If that breaks, whoa—$77.48 could hit hard! I’m glued to $90 for the first clue—big selling there, and it’s game on for a slide.

Kris/Mindbloome Exchange

Trade Smarter Live Better

NVDA Time For Bounce?Nvidia has been in a strict downtrend for the last few months, forming a constricting price action in the form of a falling wedge.

Generally, this can be seen as a bullish reversal pattern as "pressure" builds within the wedge before ultimately an explosive move.

I will look to take long trades here with a stop below the previous low with a 1H candle close as an invalidation.

Any potential good news can be a massive catalyst for the market, majorly Nvidia who has been a large target of trumps tariffs in relation to china.

Ride Nvidia’s AI Wave: Long-Term Promise Amid Short-Term Risks

- Key Insights: Nvidia faces near-term bearish pressures due to U.S.–China trade

tensions, AI chip export restrictions, and tariff challenges. However, it

remains the undisputed leader in AI infrastructure and GPU innovation,

positioning it for long-term growth. Entry points near critical support

levels may offer opportunities for patient investors to capitalize on its

leadership in AI-driven industries. A bullish reversal requires a breakout

above $104.75.

- Price Targets:

*Next Week Targets (Long Position)*

- T1: $103.25

- T2: $108.10

*Stop Levels*

- S1: $98.50

- S2: $94.75

- Recent Performance: Nvidia's stock has struggled within a bearish channel,

underperforming tech-heavy indices such as the Nasdaq, which have been

weighed down by sector-wide semiconductor weakness. The stock’s lower highs

and lower lows reinforce its short-term downside trajectory, amplified by

regulatory uncertainties and weakened demand from China. These factors have

contributed to gamma exposure-driven speculative price movements around the

$100 zone.

- Expert Analysis: Analysts highlight Nvidia's dominant position despite export

restrictions that may cost up to $5.5 billion. Nvidia continues to drive AI

innovation through its Kyber compute architecture and Dynamo software,

targeting industries like automotive and pharmaceuticals. While bearish

sentiment persists short term, long-term growth prospects remain robust due

to strong U.S. semiconductor policy support and widespread demand for AI

applications. Nvidia’s strategic positioning makes it a desirable asset for

long-term investors despite current macroeconomic risks.

- News Impact: Geopolitical tensions, specifically the Biden administration's

restrictions on advanced AI chip exports to China, remain pivotal for

Nvidia’s stock trajectory. These restrictions are expected to impact

Nvidia’s earnings through 2024. Additionally, escalating tariffs are adding

inflationary pressures, though efforts to negotiate market access highlight

Nvidia’s proactive approach to mitigating restrictions. Meanwhile, Nvidia’s

breakthroughs in AI technology continue to drive optimism for future growth

in multiple industries. Investors should remain vigilant as any easing of

trade restrictions could act as a significant upside catalyst.

We're seeing a nice box breakout NVDA | Bullish?We're seeing a nice box breakout here, which could indicate a good opportunity for a deeper correction. Therefore, we're setting the target at $91.5 and would continue moving lower until we see another box breakout in the opposite direction. Additionally, there is a major resistance level around the $91.5 zone, which will give us insight into how far NVDA's downtrend might go—or whether this could mark the turning point.

NVIDIA Daily Chart Update (04/19/2025)What's up, traders? Let's dive into NVIDIA's chart with the SmartTrend Indicator @tradingbauhaus giving us some solid insights.

Price Action: NVIDIA's been on a downward spiral since late March, sliding from ~$148 to $104.28. It's broken below the Ichimoku Cloud, which is a big bearish flag.

Ichimoku Cloud: Price is under the cloud, and it's turned red - bears are running the show. The lagging span (Chikou) is also below the price, doubling down on the downtrend.

Key Levels: We're testing support at ~$100 right now. If it breaks, $92 might be next. Resistance is up at the cloud base around $110.

SmartTrend Indicator @tradingbauhaus: This indicator's showing a strong bearish trend with a

Trend Strength of -16.4. Volatility's high at 387.76K, and the 24 High/Low is at -5.6, confirming the downtrend. Volume sentiment is neutral, though.

Signals: The SmartTrend Indicator @tradingbauhaus has been dropping red X's (sell signals) that align perfectly with the downtrend. A blue X (buy signal) popped up on April 17, hinting at a possible short-term bounce, but the overall trend still looks bearish.

Volume: We've seen big volume spikes on down days, showing strong selling pressure, though it's eased off a bit recently.

My Take: The SmartTrend Indicator @tradingbauhaus is leaning heavily bearish unless we break above the cloud at ~$110. Keep an eye on that $100 support – a bounce could happen, but if it cracks, $92 is in sight. What's your take, fam? Drop your thoughts below!

NVDA: Buy the Dip or Miss the Run?NVDA 💥🔥

Let’s be real, the market’s been shaky. Between the spike in volatility and the new tariff chatter coming out of the Trump camp, tech stocks are getting tossed around. But here’s the thing—volatility is where the setups live. And NVDA, sitting at the center of the AI revolution, isn’t going to stay down forever.

This might be the window. We’re talking a solid entry zone between 90 and 70, right where volatility meets opportunity.

Our profit targets?

✅ 110 for a clean bounce

✅ 125 as momentum builds

✅ 145+ if the bulls take the wheel again

It’s not about chasing—this is about timing the wave before it rips. So if you’re into smart risk, layered entries, and riding volatility like a pro… NVDA just rang the bell.

Disclaimer: This is not financial advice. All trading involves risk, especially in volatile conditions. Always do your own research or speak to a licensed financial advisor before making any trading decisions.

IM BEARISH ON NVIDIA WITH A TARGET OF $55.00. HERE IS WHY:NVIDIA (NVDA) Known for their GPUs, recently has experienced a decline in asset price. Trump tariff's may have been a bearish news catalyst, but do the technicals show a bigger bearish picture?

1 Day chart: While the RSI recently signaled oversold conditions, the RSI line looks to be crossing down the RSI based moving average. Furthermore the 200 Day EMA and 65 Day EMAs appear to be forming a death cross. DMI is still indicating bearish, and the ADX is still above 20.

With recent political news, the tech company has been working on bolstering their U.S based production. But with inflation cooling (6 month low) , I believe many high performing blue chip stocks may see a dip as traders and institutions price in deflation, new news and political events.

My opinion on a target is $55.00 , and there is significant open interest on long puts for this price that are expiring in the coming months.

Will NVIDIA pull out of this downtrend? Or will it become a great value buy for investors?

Disclaimer: Not financial advice.

NVDA short trap may be set..!boost and follow for more! thanks ❤️🔥

Yesterday NVDA broke the trend support that's its held in this downtrend, but it quickly climbed back above.. was that drop the final short trap before the move higher?

it's trying to reclaim the pink support zone now, if it can and we cross 107, then the move higher to my upside targets is likely.🎯

side note: I added 110 weekly NVDA while it was in the 90s yesterday, they hit 100%+ gain this morning and I secured, but I will look to trade this again on the cross of 107 or so, for now I will put my focus elsewhere. GLTA ⚡

Nvidia: Bullish Monday?A new week is about to get started and we would like to know if the NVIDIA Corporation (NVDA) chart supports a bullish Monday.

What is the chart saying on the daily timeframe?

The chart has many positive signals and support a strong week but...

Good Sunday my fellow Cryptocurrency trader, how are you feeling in this wonderful day?

I hope you are doing great.

Let's read the chart; together, let's trade!

The chart looks really good and the short-term can always surprise, anything goes.

The chart is saying, "up, straight up," and even though the markets are unpredictable, I can easily tell you what the market is doing and is most likely to happen after the weekly close.

NVDA is super bullish and likely to continue growing based on multiple signals:

1) The falling wedge pattern is already confirmed. The action broke above it.

2) The trading volume supports a continuation of the pattern breakout.

3) The correction was really strong but the reaction to support was even stronger. Such a strong reaction indicates that traders were anxious and ready to buy. The only reason to sell was based on political bad news. With the bad news removed, up we go. NVDA is solid and with Bitcoin and mining growing, the market expanding, AI, NVDA is set to follow and also grow.

4) Both the 0.786 and 0.618 Fib. retracement levels are major support and gauge the strength of a stock. If the action is happening below, bearish; when the action happens above bullish. The fact that the action moved below just to recover makes this a strong bullish signal. A failed signal for the bears because they failed to move prices lower. A strong bullish signals for the bulls because the action is back above long-term critical support.

5) The session 10-April closed as a hammer and this also points up.

6) Finally, NVDA managed to close daily above EMA8, EMA13 and EMA21. Short-term bullish bias is now valid, active and confirmed.

All these are bullish signals saying that the market will move higher next.

What needs to happen for all this to become invalid?

NVDA would need to close daily below the last low.

No need to worry about short-term moves and noise. We are going up long-term.

The correction here reached more than 43%. Believe it or not, a 43% drop is a very strong drop. For the market to go lower, it would need to be the end of the company or worse. What need is there for a stock like this one, with a great product in huge demand, to drop by 80%, for what reason?

We are going up.

Namaste.

Chipmaker Stocks DeclinesChipmaker Stocks Declines

According to the charts, semiconductor stocks underperformed the broader equity market yesterday. While the S&P 500 index (US SPX 500 mini on FXOpen) fell by around 2.2%, the drop was far steeper across the chip sector:

→ The bullish semiconductor ETF (SOXL) declined by 15%;

→ Nvidia (NVDA) shares fell by 6.9%;

→ Advanced Micro Devices (AMD) dropped by 7.3%.

In other words, chipmaker stocks dragged down the broader market, raising concerns ahead of the upcoming earnings season.

Why Are Chip Stocks Falling?

The decline stems from corporate assessments of how the escalating global trade war and new tariffs could impact future performance.

According to media reports:

→ AMD expects to face tariffs of up to $800 million on exports to China;

→ For Nvidia, similar levies could exceed $5 billion.

Technical Analysis – Nvidia (NVDA)

The price continues to fluctuate within a downward channel, previously identified in our analysis:

The lower boundary of the channel is acting as support, helping the price close near its opening level yesterday (forming a Doji candle on the daily chart).

Technical Analysis – AMD

A similar picture is emerging on the AMD chart:

The $96 level now appears to be a key resistance zone.

In Summary

All eyes are on today’s earnings report from chipmaker TSMC (TSM), which could significantly influence the currently bearish sentiment in the sector.

This article represents the opinion of the Companies operating under the FXOpen brand only. It is not to be construed as an offer, solicitation, or recommendation with respect to products and services provided by the Companies operating under the FXOpen brand, nor is it to be considered financial advice.

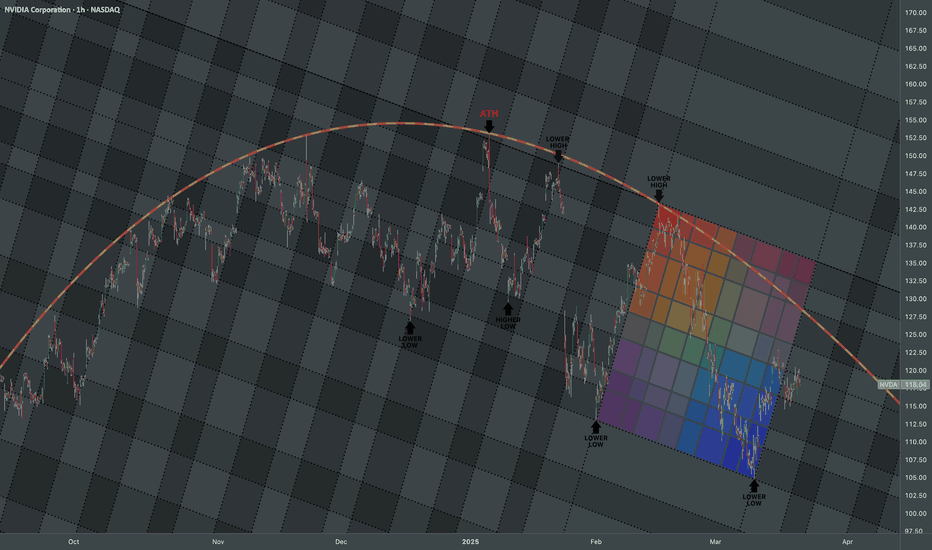

NVIDIA Rounding Top: Bearish Swings Q1 2025TA

Nvidia demonstrated strong growth throughout 2024. However, this year, it has shown rather a poor performance. When an uptrend started to weaken, it gave off subtle signals before a full reversal happened on the horizon. One of the first clues is that the highs collectively begin to appear curved compared with initial rough growth. This reflects the loss of aggressive bullish intent, showing hesitation and vulnerability to a reversal.

The price still makes higher highs, but the incremental gain between each peak shrinks. This declining magnitude in price advancement suggests that buyers are gradually losing strength with each move. These shallow bullish waves often get sold into quickly, showing early distribution behavior.

Simultaneously, it takes longer time for price to reach each successive high . When higher highs occur at reduced frequency, the rally phases become stretched out. This indicates buyers are struggling, and sellers are gaining time-based control.

Extended Rounding Top Pattern

Price crosses above the rounding top

Indicates a failed reversal and potential bullish breakout. Suggests renewed buying strength and possible trend continuation. I'd recommend using confirmation tools like volume spikes and momentum indicators which are essential to validate the breakout.

Price reaches the rounding top and stalls or reverses

Confirms the bearish reversal signal of the pattern. Acts as a strong resistance zone, often leading to a downtrend. Alongside with fibs, it can be used as a cue to take profits, exit long trades, or enter short positions.

FUNDAMENTALS

Catalysts of Bearish Swings

A transition phase characterized by a series of sharp bearish swings, marked by a sequence of Lower Highs and Lower Lows, shaping a well-defined downward channel.

Drop #1: ATH → Higher Low

(Early January 2025)

After Nvidia’s euphoric 2024 AI hype rally, it was a matter of time as some institutional Investors locked in profits, causing initial drop.

Valuation metrics (P/E; P/S) reached extremes creating grounds for a correction.

The Fed’s January meeting hinted at fewer rate cuts than the market expected. Rising Treasury yields pressured tech stocks.

The U.S. government has imposed strict export controls on advanced semiconductors, AI chips and related technology to China.

Drop #2: Lower High → Lower Low

(Late January to February 2025)

While Nvidia beat Q4 earnings expectations, its forward guidance disappointed. Management cited softening data center orders and consumer GPU inventory corrections.

Concerns about potential erosion in gross margins due to increasing costs and competitive pricing pressure from AMD and Intel.

AI infrastructure spending was plateauing faster than expected, leading to re-ratings across the sector.

Drop #3: Second Lower High → Second Lower Low

(Mid to Late February through Early March 2025)

Several investment banks downgraded semiconductor stocks, including Nvidia, amid fears of a cyclical slowdown and oversupply risks in H2 2025.

In early March, broader indices dropped due to hot inflation prints in February. Fed’s stance during testimony to Congress indicated a higher interest rate outlook.

Reports emerged about delays in next-gen chip production due to yield issues at TSMC and logistics constraints, fueling investor anxiety.

Renewed export control tightening and U.S.-China friction were again cited as major concerns earlier this year. These concerns were part of the bearish narrative during Nvidia’s downward structure, especially during Drop #1 and Drop #2 where investors began pricing in geopolitical and regulatory headwinds.

Events & Economic catalysts to monitor (before buying heavy):

Nvidia Earnings Q1 2025 Mid to Late May 2025

Why it matters: Forward guidance, Data Center/AI segment growth, margin updates, and China sales commentary will heavily impact sentiment and trend direction.

U.S. CPI (Inflation) Reports April 10, 2025 (March CPI)

Remember: Hot inflation = higher rate expectations → tech sector sell-off. Watch for YoY core CPI trends.

U.S. Jobs Report (NFP) April 4, 2025

Keep in mind: Strong labor = sticky inflation = Fed hawkishness → higher discount rates on growth stocks.

Semiconductor Industry Conferences

・NVIDIA GTC (GPU Technology Conference) – usually held Spring or Fall

・Semicon West 2025 – typically July

Track the progress: Product launches, AI roadmaps, new partnerships, and forward tech strategy updates often revealed.

Nvidia Drops 9%+ Amid Export Curbs and Fed WarningNvidia Corporation (NVDA) saw its stock fall by 9.18%, trading at $101.68 as renewed fears over U.S.-China trade tensions and monetary policy signals shook investor confidence. The decline came after the company confirmed costly new restrictions on chip exports to China, intensifying market concerns about long-term demand and global supply chain disruptions.

The broader market reacted sharply to these developments. The Nasdaq Composite dropped nearly 4.3%, while the S&P 500 shed around 3.1%. The Dow Jones Industrial Average also lost more than 900 points, a drop of about 2.2%. Contributing further to the sell-off, Federal Reserve Chair Jerome Powell delivered remarks in Chicago, stating that the central bank would “wait for greater clarity” before making interest rate changes.

Powell highlighted the conflicting effects of tariffs, warning that they could bring “higher inflation and slower growth,” placing the Fed’s dual mandate of stable prices and full employment under pressure. These comments, coupled with geopolitical uncertainty, pushed stocks to session lows.

Technical Analysis

Nvidia's price action shows a notable rebound from a major support zone near $92, which has historically attracted strong buying interest. Despite Wednesday’s sharp drop, the price trades above this level, suggesting traders are still defending it.

The next key resistance lies at $153.13, a level that capped previous rallies. If Nvidia breaks above this zone, it could signal a bullish continuation, potentially leading to a move toward new all-time highs. However, rejection at this point could trigger a pullback, with a possible retest of the $92 support.

The Relative Strength Index stands at 41, indicating a close to average momentum. This positions Nvidia at a crossroads, where upcoming price action around the resistance will determine the near-term trend.

Trend Support and 18M AVWAP: Our Final Stronghold📜 Field Orders – Operation: Defensive Line

Troops, listen up.

We’re falling back to our key defenses—Trend Support and the 18M AVWAP.

Hold your ground.

Do not charge.

We wait.

🎯 Your Orders:

Stand down unless support is broken cleanly with force.

If the red army pushes through and confirms—join the short side.

Enter only with structure, never emotion.

Protect your treasures—capital is your ammunition. Don’t waste it fighting in the chop.

If this is a trap, and you’re caught in it—retreat immediately.

Take the loss. Regroup. Redeploy with strength and clarity.

If we bounce here—watch for signs of a counteroffensive near the AVWAP wall.

But again—only enter with confirmation. Not hope.

Nvidia : Should I be worried?Looking closely at Nvidia NASDAQ:NVDA , we can see that since March, the price has gravitated back to the Point of Control (POC) on the volume profile. From there, we’ve seen a solid reaction — up around 33%, after Nvidia had previously taken a sharp hit from its recent top.

In my view, it’s very possible that Wave 4 is now complete. It’s been a very complex, sideways consolidation, but that’s typical behavior for a fourth wave. Zoom out, and the bigger picture looks a lot cleaner — this whole range doesn’t seem nearly as messy on the higher timeframes.

That said, I’m not fully bullish yet. For me, $122 is the key level. Only once we break and hold above $122, I’ll shift into a more confidently bullish stance. Until then, it’s still possible we revisit the $80–$85 range, maybe even sweep the previous low. It doesn’t have to happen, but structurally, it’s still on the table.

Given the broader uncertainty — macroeconomic pressure, U.S.–China tensions, regulatory noise — I’m staying cautious. For now, I’m mainly focused on this from an 8-hour chart perspective. Until we get that confirmation above $122, I’m not rushing into any aggressive positions.