Meta Platforms (META): A Leading Force in AIKey Supporting Arguments

Deploying AI tools enhances user engagement, drives up ad revenue, and strengthens Meta’s profit margins.

Meta's in-house development of AI chips is poised to lower capital outlays associated with purchasing Nvidia chips and diminish the costs involved in developing proprietary AI models.

Meta's stock has approached a support level, suggesting a potential reversal in its price trajectory.

Investment Thesis

Meta Platforms (META) stands as one of the world’s largest technology companies, specializing in social media, digital advertising, and AI development. It owns major platforms like Facebook, Instagram, WhatsApp, and Messenger, which together engage over 3.3 billion users daily. While advertising remains its primary revenue stream, the company is strategically investing in emerging areas such as generative AI and augmented reality.

Continued Commitment to AI Development as a Key Growth Driver. Meta is strategically channeling investments into AI, spearheading the development of open-source Llama models and deploying generative content across its social platforms. These advancements are anticipated to enhance targeting precision and bolster user engagement, subsequently driving a surge in advertising revenue. In 2025, the company intends to allocate up to $65 billion toward AI infrastructure, reinforcing its leadership stature in the competitive AI market.

Focus on Proprietary AI Chips to Lower Capital Costs and Enhance AI Model Development. Meta has initiated trials of its proprietary AI training chip, marking a significant move toward minimizing reliance on suppliers like Nvidia. This new chip is tailored for specific AI tasks, offering enhanced energy efficiency over conventional graphics processing units. By developing its own chips, the company stands to lower expenses and potentially capitalize on the burgeoning demand for AI processing by selling surplus capacity.

Stock May See a Rebound from Current Levels. Following the market correction triggered by concerns over a deteriorating macroeconomic landscape in the United States, the company's share price is stabilizing around the $600 mark. We anticipate that this threshold may establish itself as a significant support level, potentially serving as a springboard for the shares to rebound and continue their upward trajectory. Furthermore, the relatively modest forward P/E ratios, approximately 21-23x, underscore the oversold condition of Meta shares and suggest a possible reversal.

Our price target for META over a 2-month horizon is $685, accompanied by a "Buy" recommendation. We advise setting a stop-loss at $530.

META trade ideas

Meta UpdateI don't have much to add to my Meta analysis. I believe that the minor A wave is complete or only needs OML. However, with the sloppy price action that we have had lower, it is impossible to know for sure. Nothing has cause me to question the top I called at this time. Over the course of the next week or two we should know if the A wave is in fact complete. If it is, then we should be targeting the $670-$700 area for minor B completion. For more information check out my past posts on Meta. If anything is unclear let me know.

Meta: Further DownwardWe locate the META in a broader wave IV correction, which should unfold in a three-part - - structure. The current wave should push the price below the key support at $547.57. Once that level is broken, we anticipate a corrective rebound during wave , which should temporarily lift the price back above $547.57. The wave top should be followed by wave , which is expected to complete the overall correction with a final low inside the beige Target Zone between $491.53 and $414.50. This bottom should mark the end of wave IV. However, if the stock instead breaks out to the upside and overcomes the resistance at $740.91, we will have to expect a new high in wave alt.III before wave IV resumes its downward course (30% probability).

MetaRekt- They said " Cryptos are volatile and Dangerous ".

- was meaning like, buy Stocks they are more stable, like Facebook 😂.

- Everything is in graph

- Meta went down -75%, Elon Musk bought Twitter, what a coincidence.

- i wouldn't take the risk to touch it before it goes to 70-80$.

- Well in fact, i won't touch it at all, Facebook Golden Age is already behind them.

- Decentralization will be the major key to upgrade our future social medias in Web3.0.

- Without us, they are nothing.

Happy Tr4Ding !

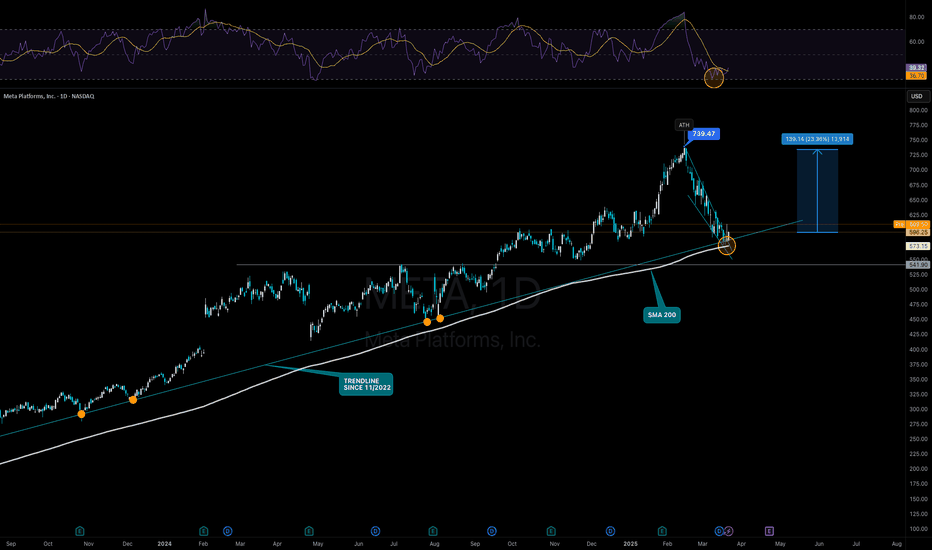

META to $740 - Chance for Strong BounceNASDAQ:META Meta has hit the trend line from November 2022 after a price loss of 20% and has shown with a first small bounce that it is still relevant. At the same time, the SMA200 is also at the same point. Last but not least, the 0.238 Fib is also located in this area (from the entire upward movement from November 2022). Technically, we can therefore definitely expect a bounce that could take us to the previous ATH at $739.

Fundamentally, Meta is also not overvalued due to its strong growth. As with many of the Mag7s, there are still problems with the AI strategy, which does not appear to be well thought out in either monetary or structural terms. However, Meta is a good candidate for actual efficiency gains due to its affiliation with the advertising market. However, the general growth is already reason enough to buy.

Support Zones

$580.00

$541.00

Target Zones

$740.00

$META The Last of UsThis is most certainly set to be a short analysis.

While everyone is talking about NASDAQ:TSLA no one is talking about NASDAQ:META at the close of the first quarter.

We are at the end of a massive rising wedge ending in a double Doji soon to be Missive blow off top. Previously when we called the 70%+ drop on NASDAQ:META in 2021 is was only the first move. The beginning.

This time when NASDAQ:META and all other stocks sell off 70% or more they will not be coming back with a thunderous vengeance. We will be back to the old market that hardly moves and all those poor retailers who are used to taking large moves will be in for a huge surprise. The buy and Hold market is coming back.

The liquidity is drying up and the Fed nor anyone else will step in to help.

They will take rich, poor, old young to the poor house. Liquidity wont be back for another 60-70 years.

Cash out that retirement now. Before it's too late.

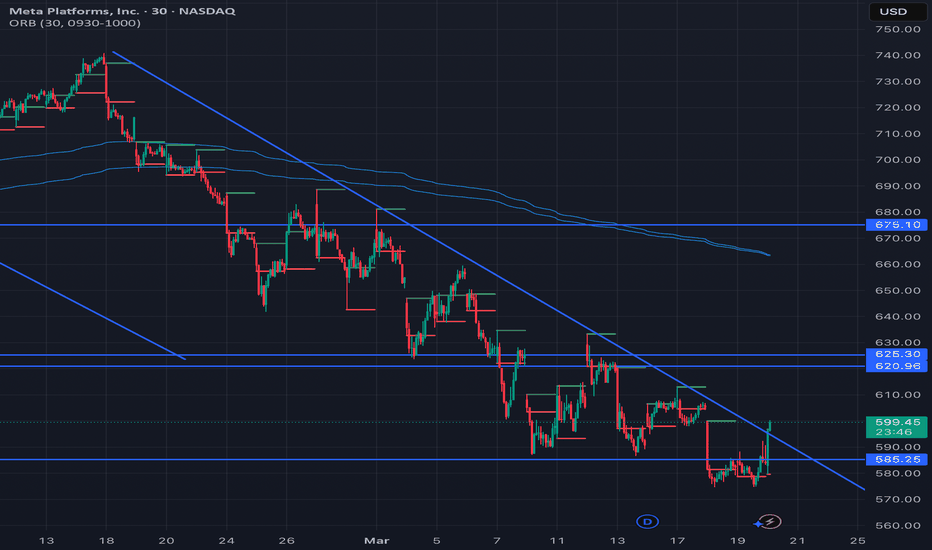

Meta bottom in?Meta has moved back above the key $600 level after holding the 200-day average test. Today the stock has broken its short-term bearish trend line, too. A close above the trend line should be a positive technical development for the stock, making it one to watch in the days ahead.

By Fawad Razaqzada, market analyst with FOREX.com

META is coming back to life!NASDAQ:META

As we discussed before a breakdown out of this Bullish Trend since 2022 would be very bearish and take META to the $400's.

Well, they said, hold my beer, and bounced hard exactly at the bottom of the channel and Anchored VWAP.

It's not over yet, as we need to follow through next week with a nice engulfing candle to make people into believers!

Not financial advice.

META) Testing Key Support – Is a Reversal on the Horizon?Technical Analysis & Options Outlook

📌 Current Price: $587.60

📌 Trend: Bullish Attempt After Key Support Hold

📌 Timeframe: 1-Hour

Price Action & Market Structure

1. Bullish Rebound from Support – META bounced off the $585–$580 demand zone, signaling buyers stepping in.

2. Breakout Setup Developing – Price is approaching trendline resistance at $595, a critical level to watch.

3. Potential Pullback Before Breakout – If META gets rejected at $595, expect a retest of $585 before another push higher.

4. MACD & Stoch RSI – Both indicate bullish momentum, but META is nearing overbought conditions, suggesting possible consolidation before continuation.

Key Levels to Watch

📍 Immediate Resistance:

🔹 $595 – Trendline Breakout Level

🔹 $605 – 2nd CALL Wall Resistance (42.52%)

🔹 $620 – 3rd CALL Wall (37.57%)

📍 Immediate Support:

🔻 $585 – Demand Zone & Breakout Retest Level

🔻 $580 – Highest Negative NETGEX / PUT Support

🔻 $574.66 – Critical Support Level for Bulls

Options Flow & GEX Sentiment

* IVR: 28.6 (Lower Volatility)

* IVx: 40.9 (-2.14%) (Declining Volatility, Favoring Breakouts)

* GEX (Gamma Exposure): Bearish Bias, But Improving

* CALL Walls: $605 & $620 (Upside targets)

* PUT Walls: $580 & $574.66 (Key demand zones)

📌 Options Insight:

* Above $595, META could see a momentum-driven rally toward $605–$620 as dealers hedge long positions.

* Below $585, risk increases for a test of $580–$574.66, where heavy liquidity is concentrated.

My Thoughts & Trade Recommendation

🚀 Bullish Case: If META holds above $585, expect a push toward $605–$620.

⚠️ Bearish Case: If META fails at $595, expect a pullback to $580 before another reversal attempt.

Trade Idea (For Educational Purposes)

📌 Bullish Play:

🔹 Entry: Break and hold above $595

🔹 Target: $605–$620

🔹 Stop Loss: Below $585

📌 Bearish Play (Hedge Idea):

🔻 Entry: Rejection at $595

🔻 Target: $580–$574.66

🔻 Stop Loss: Above $600

Disclaimer

This analysis is for educational purposes only and does not constitute financial advice. Always perform your own research and manage risk accordingly.

Final Thoughts

META is attempting a breakout from support, but $595 is a critical level. A successful breakout could lead to $605–$620, while failure at resistance could bring a retest of $580 before the next move. Wait for confirmation before taking a trade.

META: Still My #1 Stock for 2025META is at a great spot to look for an entry.

It was my favorite stock in 2024, and as we move into 2025, it remains my top pick.

Last year, I started using META as an advertising platform, and it completely blew me away. The speed at which money goes out is unlike anything I’ve seen. Compared to Google? There’s no comparison. In the last 30 years, I haven’t dealt with any service or company that can burn through ad dollars this fast—and that’s exactly why I’m bullish and I started buying on Friday, March 7, with a sample size—now watching for the next opportunity to add.

META to the $400s?! I hope so!!!NASDAQ:META

Is the show over or will the show go on?

At the bottom of the Bullish Channel that started in October 2022.

A breakdown of this channel could lead NASDAQ:META back to a stock price in the 400's...

A Breakdown retest of the lower Anchored VWAP band could be a false breakdown and bounce area as well. If we break through that though then this name is going to the $400's area.

Not financial advice

META’s Best Correction in a Long Time – A Prime Buying Opportuni🔹 Current Price: $583.39

✅ TP1: $620 – Short-Term Rebound to Mid-Channel Resistance

✅ TP2: $720 – Retesting Previous Highs

✅ TP3: $765+ – Analyst Average Target, Aligning with Recovery Patterns

🔥 Why Are We Bullish?

1️⃣ Analyst Ratings & Price Targets

Strong Buy Consensus: Major institutions maintain bullish ratings on META.

Average Price Target: $765 → +29% upside from current levels.

Price Target Range: $580 (low) to $935 (high).

JPMorgan Calls META a Top Pick: Meta and Spotify named as two of the best investment opportunities currently.

2️⃣ Market Correction Presents a Strong Entry Point

Biggest pullback since September 2023 – The last time META corrected 23% in two months, it fully recovered within two months and resumed its uptrend.

META is now at major trendline support , historically a strong accumulation zone.

RSI indicates potential reversal , aligning with previous rebounds.

3️⃣ AI Expansion & Business Growth

Meta’s Llama AI Model Hits 1 Billion Downloads , reinforcing the company’s dominance in AI innovation.

Heavy investments in AI & machine learning strengthen long-term growth prospects.

4️⃣ Strategic Growth & Revenue Expansion

Strong Ad Revenue Growth: Despite market volatility, Meta’s ad business remains a cash machine.

Metaverse & Reality Labs: Long-term investments positioning Meta as a leader in next-gen digital experiences.

New Revenue Streams from AI & Cloud-Based Services: Expected to drive earnings in 2025 and beyond.

📌 Conclusion

META’s 23% correction is presenting a rare discounted entry opportunity in an otherwise strong bullish trend. With AI growth, ad revenue expansion, and a rebound pattern that historically favors a recovery, META remains one of the best opportunities in the tech sector right now.

Meta’s Wild Ride: Skyrocketing to $866 or Crashing to $374 Get ready, traders—Meta’s at a crossroads! If we smash past $64.70, buckle up for a thrilling climb to $866 as AI hype and Metaverse dreams fuel the fire. But if the bears take over, we could tumble hard to $442—or even skid down to $374. This isn’t just numbers; it’s a rollercoaster of hope, greed, and nail-biting suspense. Which way will it break?

Kris/Mindbloome Exchange

Trade Smarter Live Better

Reversal To The Long on Meta Platforms. METAThe previous ides on short was very profitable and I believe that we are facing a local reversal here based on price action and volatility , stochastic indicators below. This is a within one candlestick set up, so relatively risky. And yet most pivot setups are.