QQQ trade ideas

Short term high QQQ tgt $434I had a great day with dowsing the highs & lows on QQQ today, and since hitting this high, I asked what's next & keep getting breakdown.

I did a week by week reading at the beginning of the month, and this week is supposed to take a bit of a dive & be "bottoming out". The weekly readings have been pretty helpful, so I hope this continues.

Anyway, this could be absolutely incorrect, but twice I've gotten a move to the downside on QQQ of around 5.6-.7%.

I also got some figures lower, but I'm not confident they are prices. They were 425-22. Sometimes numbers come that are something other than what I ask or expect, so it can get confusing. It's possible there's another little pop first, but It seems like a drop is imminent according to my work. Watch for a low on Wed./Thurs? I have lots of dates for this week including for a high today.

QQQ, Weekly RSI has reached oversold territory just 4 other timeIt's also came at or near a long-term bottom.

If you're a long-biased trader looking for high-probability entries, this setup deserves your attention.

The weekly RSI just hit oversold territory — something that’s only happened 4 times in the last 10 years. Each of those times? It marked a major bottom or the start of a strong bullish trend.

We’re also bouncing near long-term horizontal support (~$420) and holding above a rising trendline that’s defined the bull market since 2018.

If price continues to hold this zone and RSI starts curling back up, I’ll be looking to go long.

Stop below $420. Reward-to-risk looks solid if momentum confirms.

Not calling the exact bottom — just positioning where the risk makes sense.

$QQQ - Recap of Last Week April 14-17

Last week we had a shortened Trading week because of Good Friday.

We opened the week with a gap up and got a rejection at the 30min 200MA.

++ You typically don’t want to go long at a downward facing moving average. ++

And this did play out all week. We got rejected at the downward facing 200MA on Monday, again on Tuesday.

On Wednesday we gapped down (UHC weighed on the market). Wednesday we had a big down day - closing down almost 3%

And then on Thursday we came back up but stayed underneath the 35EMA.

Thursday was the last day of the trading week, and look tat the setup we started the day with. Red 35EMA trading under the Blue 30min 200 (That was bearish)

30min 200 pointing down - that was bearish. And bear gap at the top of the implied move.

QQQ - Intraday Setup April 16 2025QQQ Intraday Setup

April 16 2025

Decision making - 15minutes time frame

Short trade scenario -1

Market Takes resistance = 455.95

Stop loss = 456

Short trade get initiated

1st Target = 449.0 (profit booking)

2nd target = 442.58

Trade setup explained:

Market made a high of 455.95 on April 11 2025.

High has sustained above 455.95 in next 2 trading sessions

Market has opened today below 455.95. Hence this support zone is now intraday resistance zone.

Long trade scenario-1

Market Takes Support = 442.58

Long trade gets initiated

Stop loss = 441.20

1st Target 450.85 (Profit booking)

2nd Target = 455.95

Trade setup explained:

Market made a high of 442.58 on April 7 2025.

Market has sustained above 455.95 in next 6 trading sessions until today and hence becomes intraday support.

Long trade scenario-2

Market opens gap down and sustains above = 450.85

Long trade gets initiated

Stop loss = 447.19

1st Target 452.64

2nd Target = 455.95 (Profit booking)

Trade setup explained:

Market has a downward trend on April 10th and creates an intraday swing high of 450.85. The swing high of a downward trending day becomes 1st stage of resistance when markets are close to this price.

Disclaimer: I am not a registered analyst. The above information is only for educational purpose based on my years of experience. Please consult a financial advisor before investing.

QQQ Breakdown Incoming? Gamma Pressure Exploding at 452 🔮 GEX (Gamma Exposure) – Options Sentiment Overview

🔥 PUT Dominance at 452 – Market on the Edge

* QQQ is trading directly at the highest negative NET GEX level at 452.31, marking it as the PUT trigger zone.

* A breakdown below 452 opens the gates toward 450, where the 2nd PUT Wall (-13.23%) adds further downside acceleration.

* This is a high-risk gamma zone: dealers are short gamma and could fuel a liquidation flush if price stays under 452.

🧱 CALL Walls Stack from 456–463

* The nearest CALL resistance zone sits between 456–458, topped by 461–463, all stacked with hedging activity.

* Strongest net positive GEX (gamma ceiling) sits around 458–460, aligning with macro rejection zones.

📊 Options Sentiment Snapshot:

* IVR: 46.7 → Moderate volatility, but still supportive of fast swings.

* IVx avg: 34.8, down –11.25%, showing vol is compressing while risk increases — dangerous combo.

* PUTs 67.6% → Overwhelmingly PUT-heavy environment, a signal of dealer short gamma pressure — one move down can feed the next.

🎯 GEX Implications:

* Break below 452 → Expect momentum to ramp toward 450 → 448 → 440 range.

* Bounce off 452 → Needs strong reclaim of 456–458 to reverse gamma flow — very difficult without macro help.

🕰️ 1-Hour Technical Analysis

Structure:

* QQQ broke down from an ascending wedge and is now retesting prior support at 452.47.

* Price is below all EMAs and losing VWAP — confirms bearish control.

Indicators:

* MACD: Weak and diverging bearishly — no sign of reversal strength.

* RSI: Dipping under 40, near oversold, but no bullish divergence visible yet.

Key Levels to Watch:

* Support: 452 → 450 → 448 → 440

* Resistance: 456 → 458 → 464.98

🧠 Final Thoughts:

QQQ is sitting on the edge of a gamma trap at 452. With PUTs dominant and technicals confirming weakness, there’s a real risk of continued slide toward 450–448 or lower if bulls can’t reclaim the 456 zone quickly.

GEX suggests heavy dealer hedging is active — so expect volatility, and prepare for a momentum spike if 452 fails.

This is not financial advice. Always trade with risk management, and let price action confirm your plan before executing.

This is a good spot to start buying the market.We’ve reached the lower boundary—whether this marks the start of a prolonged sell-off or a rebound point doesn’t matter right now. In the next couple of weeks, we’ll trade higher before the true extent of the damage becomes clear. This is a good spot to start buying the market.

$QQQ - Recap of April 14 2025Today, Monday April 14th we opened with a gap UP to the 30min 200MA and slightly above that. We closed the top of the gap (always a potential resistance and in the case here, paired with the 30min 200MA that was facing down we did get pulled back down to close the morning gap and the rest of the bear gap (combined it was an island gap)

Once we closed the bear gap first from above we came back and closed the bull gap, we took another swing at the 30min 200, still facing down and got rejected back down into close. It was an easy trading range today. Rather predicable, in my opinion, with the downward facing 30min 200MA, the bear gap and the 35EMA still trading underneath the 30min 200MA. These are all things I drill in daily in the videos and even though we closed great a lot of the bearishness of this chart today played out to contain the upside.

Also let's not forget that we had a green signal line today!! It looked weak but you can see the support, weak or not, it stayed green.

How did you guys do??

Bullish Setup for QQQ: Price Targets and Key Levels for Next Wee

- Key Insights: QQQ exhibits strong bullish momentum, supported by technical

setups, including cup-and-handle formations and golden crosses. Buyer

sentiment remains robust, driven by tariff pauses on tech and chip stocks

and a broader recovery in indices. Sustaining above key support at 444 will

be critical for maintaining upward momentum, while geopolitical volatility

should be monitored closely.

- Price Targets:

- Next Week Targets: T1 = 465, T2 = 478

- Stop Levels: S1 = 436, S2 = 421

- Recent Performance: QQQ has rallied 7.5% in its latest bullish phase and is

currently trading at 446.18, outperforming major indices like SPY and ES.

Short-term activity reveals consistent gains above last week’s and

yesterday’s closing prices, underscoring the strength of buyer sentiment.

- Expert Analysis: Technical indicators such as stochastic oscillators, golden

crosses, and Fibonacci levels point toward sustained upside potential.

However, experts urge caution due to heightened geopolitical risks and

inflation concerns. Price action around the 444 support level will validate

the reliability of QQQ's bullish case.

- News Impact: Positive catalysts include a tariff pause on tech and

semiconductor stocks, which benefits QQQ’s key holdings in the technology

sector. Additionally, broad market recovery and renewed optimism have

amplified fund flows into the NASDAQ 100. However, potential downside risks

stem from trade tensions and inflationary pressures, making QQQ vulnerable

to sudden volatility despite its promising technical structure.

QQQ Coiling for a Breakout? Critical Zone Approaching📈 Technical Analysis (1H Chart)

QQQ is riding within a clean ascending channel since the April 9th reversal. The recent candles are forming higher lows and testing upper resistance near 454.00, with bullish volume stepping in during Thursday’s session. RSI is steadily climbing toward the 60–65 zone but not overbought yet, leaving room for an upward breakout.

* Key Resistance: 468.31 (top of the channel + GEX wall)

* Support Zones: 435.00 (put wall), 420.00 (gamma gap zone)

Current consolidation around 454 suggests the market is deciding whether to push into the heavy call wall above or reject toward the lower channel boundary.

🔍 GEX (Gamma Exposure) + Options Sentiment

The options data offers a clear battleground:

* GEX Resistance: The highest positive NET GEX is at 460–469, aligning with the 2nd and 3rd CALL Walls. This creates a strong gamma magnet but also potential resistance.

* GEX Support: Strong PUT Support around 435, confirmed by -42.99% GEX Support Wall.

* Options Oscillator: Extreme PUT bias at 83%. This could be positioning for protection or fuel for a short squeeze if price breaks higher.

* IVR: 68.4 (Elevated) | IVx Avg: 46.8

This suggests high premium—buyers of options are paying up for volatility.

📊 Trade Outlooks

Bullish Scenario (Breakout Above 455–460):

* 📈 Entry: 455–456 breakout with confirmation

* 🎯 Target 1: 460

* 🎯 Target 2: 468

* ⛔️ Stop Loss: Below 448

* 💡 Suggested Option: 460C or 465C (0DTE or 4/17), tight spreads required due to elevated IVR

Bearish Scenario (Rejection at 455 and breakdown)

* 📉 Entry: Below 450 on strong red candle

* 🎯 Target 1: 445

* 🎯 Target 2: 435 (GEX support)

* ⛔️ Stop Loss: Over 456

* 💡 Suggested Option: 445P or 440P (with defined risk, preferably spreads)

📌 Conclusion

QQQ is sitting in a high-tension coil—either we break above 455–460 and see a gamma squeeze to 468, or options flows pull us back to the 445–435 support zone. With IV elevated and options heavily tilted toward PUTs, watch for a potential contrarian breakout if bulls step in.

This analysis is for educational purposes only and does not constitute financial advice. Always do your own research and manage risk before trading.

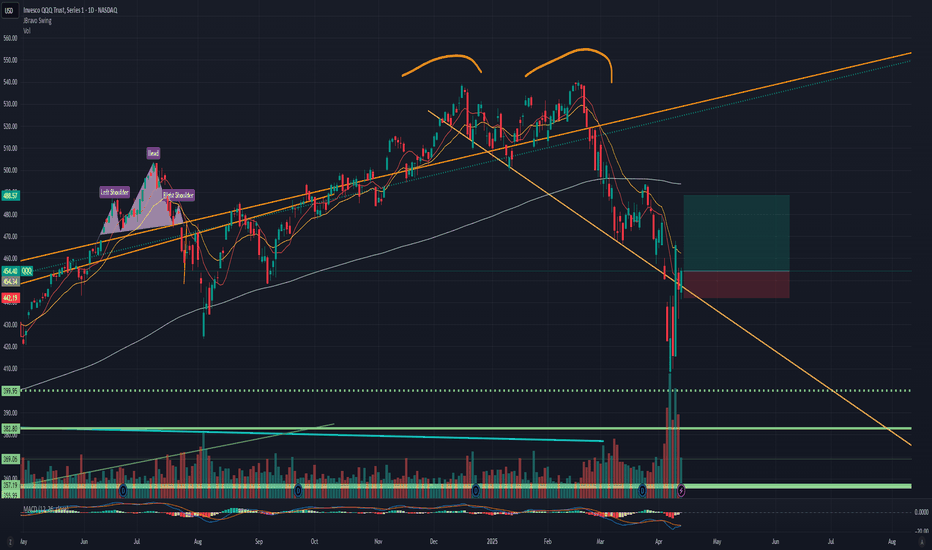

Instructional for my brother. IThis is a bad swing trade, it is under the 180 day moving average. You wouldn't enter this using a swing trading system alone, its more advanced to identify. But you can see the yellow line I drew, that is strong resistance. That means the price don't want to go below that line.

I put what a trade would look like on it. You see how in this trade there is much more green than red? That is a good risk to reward ration.

Now here is CBOE. See how the green and red of this projected trade are nearly equal? Yeah, that is a bad risk to reward ration. At a 1:1 (that is for each dollar you can gain, you are risking) you are at a coin toss odds. Which is better than gambling but isn't trading.

You pretty much have the gist of Bravo simple trading, these are more advanced things. IF you are trading, you want to know where you will set your stop loss and where you will set your take profit BEFORE you buy anything. And then set those with the trade. That way you know beforehand what a worse case scenario looks like. If you do this, you will very likely succeed in the long run.

Piercing LineWe have price hovering above the 200 EMA and a key level around the 391 to 396 price area. Also, we have a possible piercing line candlestick pattern. Oscillators are in oversold regions. Chris Moody MACD is in the red zone but possibly could shift green. If price fails the 200 EMA we might have price action towards 346.68. Be careful and if the markets are too intense you can always paper trade.

$QQQ Poised for Lift-Off: Flipping Resistance, Eyeing $470-$475!🚀 NASDAQ:QQQ Poised for Lift-Off: Flipping Resistance, Eyeing $470-$475! 🚀

As mentioned in my recent post, we’ve successfully flipped the $443.14 resistance into support—a key technical shift!

🔹 Momentum Building:

- Wr% Indicator: Making higher lows and advancing steadily towards the Red Barrier.

- Volume Gap: Still in play and ready to be filled.

With a higher low now established, I believe we’re set up for a potential move to $470-$475 next week.

📈 Let’s see how this plays out—exciting times ahead!

💡 Have an amazing weekend, friends!

Not financial advice

Learning The Excess Phase Peak Pattern : How To Identify/Use ItThis new tutorial video is for all the new followers I have on TradingView who don't understand the Excess Phase Peak pattern (EPP) yet.

I received a question from a new follower yesterday about the EPP patterns. He/She could not understand what they were or how to use/identify them.

This video should help you understand what the EPP patterns are, how to identify them, how to trade with them, and how to identify/use proper expectations with them.

I hope this video is informative and clear. Remember, price only does two things...

FLAG or TREND - NOTHING ELSE

And the EPP pattern is the CORE STRUCTURE of price that happens on all charts, all intervals, and all the time.

The second pattern, the Cradle pattern, is part of the EPP pattern, but it acts as another price construct related to how to identify opportunities in price action.

Get some.

#trading #research #investing #tradingalgos #tradingsignals #cycles #fibonacci #elliotwave #modelingsystems #stocks #bitcoin #btcusd #cryptos #spy #gold #nq #investing #trading #spytrading #spymarket #tradingmarket #stockmarket #silver

SPY/QQQ Plan Your Trade For 4-11 : Break-Away in CarryoverToday's Break-away pattern suggests the SPY/QQQ will attempt to move (break) away from yesterday's Body range. I believe this trend, after the recent Ultimate Low in price, will be to the upside.

I know a lot of people are asking, "why do you think the markets are going to rally now - after you suggested the markets would trend downward?"

Things have changed now that we have a 90-day pause in the tariff wars. Yes, China is still an issue - but the rest of the world seems to have a pause on the tariff wars as negotiations continue.

I believe the removal of the tariff pressure on the markets will result in a moderate upward trend as we move into Q1:2025 earnings season.

Still, I don't believe we will see new ATHs anytime soon. But I do believe the 580+ level on the SPY is a potential high price level that can be reached before the end of April 2025.

Gold and Silver are moving into a GAP trend move today. I believe the GAP will be to the upside and I believe Gold and Silver will continue to rally.

Silver is really low in terms of comparison to Gold. Silver could make a very big move to the upside over the next 30+ days.

BTCUSD is still consolidating into the narrow range I suggested would happen before the bigger breakdown event near the end of April (into early May).

Everything is playing out just as I expected. The big change is the removal of the tariffs for 75+ nations (for now). That will give the markets some room to the upside and we need to understand how price structure is playing out into an A-B-C wave structure.

Get some.

#trading #research #investing #tradingalgos #tradingsignals #cycles #fibonacci #elliotwave #modelingsystems #stocks #bitcoin #btcusd #cryptos #spy #gold #nq #investing #trading #spytrading #spymarket #tradingmarket #stockmarket #silver

4/8/25 - $qqq - Don't fall for the meme4/8/25 :: VROCKSTAR :: NASDAQ:QQQ

Don't fall for the meme

So.

You are following Trump on Truth Social.

(strike 1)

You are believing Dalio about the state of geopolitics.

(strike 2)

Jim Cramer is on in the background yelling

(strike 3)

Rando on X accounts "AI is a bubble"

(strike 4)

You can taper a USD ponzi scheme

(strike 5)

... i could go on.

Here's the reality.

- The stock market is real money. "Money" being defined as "something that has productive value". It it the best money? Maybe. BTC is pretty good too. Each have their own properties. Is the USD "money"? Well. Yes, but mostly no. It's mostly a liability.

- Is the global economy melting down? No. Have you not seen what AI can do beyond one-shotting prompts? This is far from what dotcom was. Dotcom never replaced people/ labor and services. So while there are a lot of meme companies out there attaching AI to their business descriptions, the core suspects are monetizing this today, and it's only getting more impressive (not by the week), but the *day*

- Does the debt market matter more than stonks rn? Yes. Up until a few days ago, lower yields (on UST's) emboldened speech to not give a F. Well, that's changed. Back to "you can't taper a ponzi". So better own productive assets. Gold has sniffed this out. BTC usually follows 3-6 months on Gold (as a smaller asset class) unless China decides to go full retard Jerome (which they might). And historically, China stimmy is the trigger for BTC getting sent. Weird the moon bois don't track this. But put it in the back of your mental model.

- So what do we do here? Productive assets that have visibility toward growth not just this year but into the next 3-5Y and are trading where cash yields and healthy balance sheets are >5% FCF's but ideally closer to 10%.

- NASDAQ:NXT remains in a tough tide. Solar as a category has just been so scammy. And even tho US builders are sourcing mainly from Vietnam (not China) etc. etc. people don't do the work in a correlation 1 world. So do we retrace the $32/shr gap? Idk. But I sized up so hard today. And tmr I'll be updating if we gap lower. it's 33% of book today. i take to 40% if we get to sub $35. and i get to 50% (LEAPS!) if we close dat gap.

- $OBTC. bitcoin at 8-10% off spot? lol. size manage, but definitely a good way to play the beta with larger size given the discount. almost like leverage without leverage. limits only. v illiquid. hence the discount.

- I like NASDAQ:BLDE here at $2.5 the TL;DR is this. 1/ cash generative. 2/ main biz is organ transport, and consumer biz is cash generative ans mostly rich ppl Uber in the sky 3/ two-thirds of the valuation is net cash and 4/ you can sell august 15 2025 calls for 55-60c today (at $2.5/shr) locking in 20% yield with some downside production (where the stock would theoretically trade close to zero valuation and you'd honestly want to own the stock anyway). so i've sized this up to nearly 20% of book.

- I like $UBER. 6% fcf yields. not tariff exposed. but it's defn travel-punching bag. I get it. Gap in the high 50s *shouldn't* fill, but i'm prepared if/when only because we're trading like everything is the same. That's what the room-temperature "I buy ETFs" crowd deserves. Pick and choose. So if we dump, this gets dumped and we go back there, I'd consider this an absolute gift. Flows vs. fundamentals already dominant. Better beta than mkt as we re-rip toward ATHs (my view remains) this year.

- $GAMB. 15% fcf yields. not tariff exposed. normies r gonna gamble. they have founder-led beats/raises. M&A, low liquidity keeps this waffling but ultimately a winner.

- $VST. trades like NASDAQ:NVDA (so does NASDAQ:NXT ) lol. it's a f'n utility that generates piles of cash, is insulated from the hyperscaler fall out (if/does happen... which is NOT my base case), but utimately has tons of power to serve up. $1.4M/MW cheap. 6% fcf yields. no brainer.

- $NVO. honorable mention. Euro's can't seem to grow a pair and buy this obvious cash generative winner. GL.

mm..

wealth isn't measured in USD's.

<3

V

PS - i think we go higher from here. avg. stock down 30% on my calculation from peak. index doesn't tell story. could be another 5-10% on index? yeah w/e. again back to point 1. in a ponzi scheme you own real things... and the USD is the biggest shit meme coin on the planet. it has value for a small period of time, but sooner than later you gotta put it to work. don't hold the USSA bag.