Key facts today

GoPro's stock has been actively traded in the context of meme stocks, attracting significant speculation and trading interest, with traders engaging in buying and selling options related to GoPro.

Next report date

—

Report period

—

EPS estimate

—

Revenue estimate

—

−0.802 CHF

−392.62 M CHF

727.90 M CHF

125.69 M

About GoPro, Inc.

Sector

Industry

CEO

Nicholas Woodman

Website

Headquarters

San Mateo

Founded

2002

FIGI

BBG00LVDJ7X8

GoPro, Inc. engages in manufacturing and selling cameras and camera accessories. It provides mountable and wearable cameras and accessories, which it refers to as capture devices. Its product brands include HERO9 Black, HERO8 Black, Max, HERO7 Black, HERO7 Silver, GoPro Plus, and GoPro App. The company was founded by Nicholas Woodman in 2002 and is headquartered in San Mateo, CA.

Related stocks

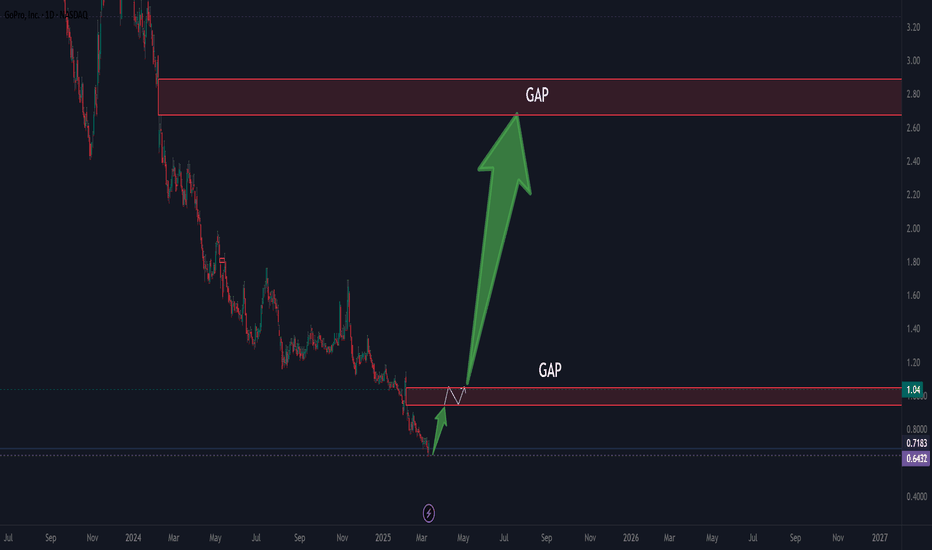

Is there an Incoming Short Squeeze on GOPRO?Is a Short Squeeze Coming?

-GoPro carries a high short interest—around 10–11% of its float, with about 3.8 days to cover.

-Such metrics suggest potential for a short squeeze—especially if a positive catalyst appears (earnings beat, new product, etc.) .

-That said, no guaranteed squeeze is imminent

GoPro | GPRO | Long at $1.35NASDAQ:GPRO is a strong brand name, but with a dying userbase / lack of growth. The company has no major turnaround planned, but the chart is interesting. The stock seems to be currently consolidating as the historical simple moving average (white line) is working its way down toward the price - wh

Meme Camera CrazeThe meme stock phenomenon has erupted several times in recent years: in the 2021 wave, the share prices of GameStop (GME), AMC Entertainment, and other small-cap companies nearly exploded almost unexpectedly due to the coordinated buying by the Reddit / r/WallStreetBets communities. A March 2025 ana

GoPro (GPRO) Long Idea – Target: $1GoPro (GPRO) Long Idea – Target: $1

GoPro CEO Nicholas Woodman has waived his salary for the remainder of 2025, reinforcing the company’s aggressive cost-cutting plan aimed at reducing operating expenses by 30% and returning to profitability by 2026. This symbolic gesture highlights leadership acc

Many will say GoPro is dead. But… Now is your chance to obtain a future meme stock before the masses.

Gen x and millennials have adored this company over the years. The extreme sports will never stop using and promoting GoPro. It’s not going anywhere!

Possibility to be acquired in the future. Show all good qualities of becoming

GOPRO faces a significant rise.GoPro Poised for a Strong 2025: Tariff Impact, Cost-Cutting Measures, and Market Dynamics

Summary:

GoPro (NASDAQ: GPRO) is set to emerge as the biggest beneficiary of the new U.S. tariffs on imported electronics. With key competitors such as DJI and Insta360 facing significant cost increases, GoPro’

GOPRO: $1.22 | An Opportunity for the Few HOLDERS at all time HIGHS

meet you halfway

Fresh investors

WAIT WAIT WAIT under $1.0 and place bids towaerds $0.20 cents

a humbling experience in progress

for the CEO FOUNDER to reflect

when to flip and make whole for LONG TERM INVESTORS

Adventure Gadgets are making all time highs

from Redbull

See all ideas

Summarizing what the indicators are suggesting.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

An aggregate view of professional's ratings.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Displays a symbol's price movements over previous years to identify recurring trends.

Frequently Asked Questions

The current price of 5G5 is 1.171 CHF — it has decreased by −3.70% in the past 24 hours. Watch GOPRO INC. stock price performance more closely on the chart.

Depending on the exchange, the stock ticker may vary. For instance, on BX exchange GOPRO INC. stocks are traded under the ticker 5G5.

5G5 stock has risen by 82.40% compared to the previous week, the month change is a 67.53% rise, over the last year GOPRO INC. has showed a −16.54% decrease.

We've gathered analysts' opinions on GOPRO INC. future price: according to them, 5G5 price has a max estimate of 0.41 CHF and a min estimate of 0.41 CHF. Watch 5G5 chart and read a more detailed GOPRO INC. stock forecast: see what analysts think of GOPRO INC. and suggest that you do with its stocks.

5G5 stock is 7.04% volatile and has beta coefficient of 1.81. Track GOPRO INC. stock price on the chart and check out the list of the most volatile stocks — is GOPRO INC. there?

Today GOPRO INC. has the market capitalization of 189.64 M, it has decreased by −5.04% over the last week.

Yes, you can track GOPRO INC. financials in yearly and quarterly reports right on TradingView.

GOPRO INC. is going to release the next earnings report on Aug 11, 2025. Keep track of upcoming events with our Earnings Calendar.

5G5 earnings for the last quarter are −0.11 CHF per share, whereas the estimation was −0.11 CHF resulting in a 2.09% surprise. The estimated earnings for the next quarter are −0.05 CHF per share. See more details about GOPRO INC. earnings.

GOPRO INC. revenue for the last quarter amounts to 118.90 M CHF, despite the estimated figure of 110.34 M CHF. In the next quarter, revenue is expected to reach 115.96 M CHF.

5G5 net income for the last quarter is −41.35 M CHF, while the quarter before that showed −33.78 M CHF of net income which accounts for −22.42% change. Track more GOPRO INC. financial stats to get the full picture.

No, 5G5 doesn't pay any dividends to its shareholders. But don't worry, we've prepared a list of high-dividend stocks for you.

As of Jul 26, 2025, the company has 696 employees. See our rating of the largest employees — is GOPRO INC. on this list?

EBITDA measures a company's operating performance, its growth signifies an improvement in the efficiency of a company. GOPRO INC. EBITDA is −77.05 M CHF, and current EBITDA margin is −12.70%. See more stats in GOPRO INC. financial statements.

Like other stocks, 5G5 shares are traded on stock exchanges, e.g. Nasdaq, Nyse, Euronext, and the easiest way to buy them is through an online stock broker. To do this, you need to open an account and follow a broker's procedures, then start trading. You can trade GOPRO INC. stock right from TradingView charts — choose your broker and connect to your account.

Investing in stocks requires a comprehensive research: you should carefully study all the available data, e.g. company's financials, related news, and its technical analysis. So GOPRO INC. technincal analysis shows the buy rating today, and its 1 week rating is buy. Since market conditions are prone to changes, it's worth looking a bit further into the future — according to the 1 month rating GOPRO INC. stock shows the neutral signal. See more of GOPRO INC. technicals for a more comprehensive analysis.

If you're still not sure, try looking for inspiration in our curated watchlists.

If you're still not sure, try looking for inspiration in our curated watchlists.