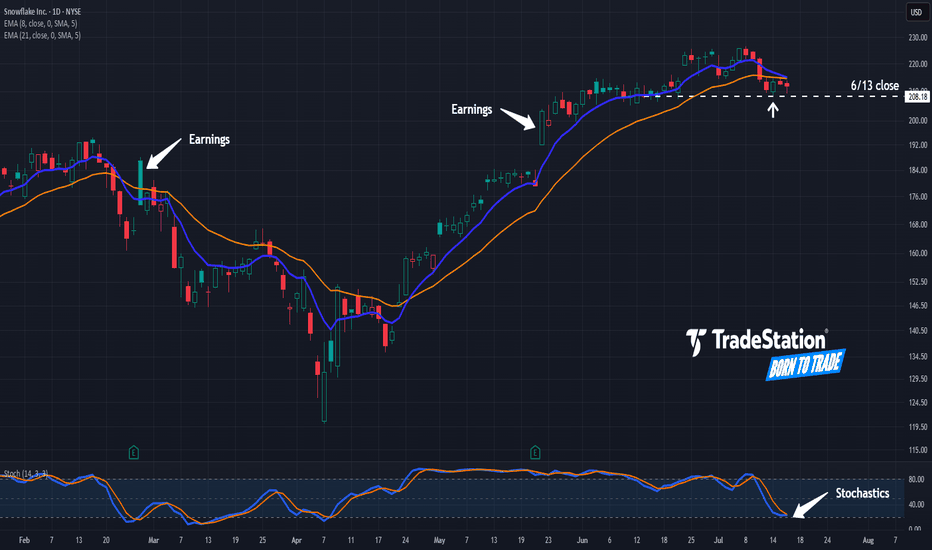

Snowflake Pulls BackSnowflake jumped to a new 52-week high last week, and now it’s pulled back.

The first pattern on today’s chart is the pair of price jumps after the last two quarterly reports. Those may reflect bullish sentiment in the software company.

Second is the June 13 weekly close of $208.18. SNOW appears t

Next report date

—

Report period

—

EPS estimate

—

Revenue estimate

—

−3.482 CHF

−1.17 B CHF

3.31 B CHF

317.20 M

About Snowflake Inc.

Sector

Industry

CEO

Sridhar Ramaswamy

Website

Headquarters

Bozeman

Founded

2012

FIGI

BBG00XGD1DL8

Snowflake, Inc. engages in the provision of cloud data warehousing software. The firm offers Data Cloud, an ecosystem where Snowflake customers, partners, data providers, and data consumers can break down data silos and derive value from data. Its platform supports a range of use cases including data warehousing, data lakes, data engineering, data science, data application development, and data sharing. The cloud-native architecture consists of layers across storage, compute, and cloud services. The storage layer ingests structured and semi-structured data to create a unified data record. The compute layer provides dedicated resources to enable users to access common data sets for many use cases without latency. The cloud services layer optimizes each use case's performance requirements with no administration. The company was founded by Marcin Zukowski, Thierry Cruanes, and Benoit Dageville on July 23, 2012 and is headquartered in Bozeman, MT.

Related stocks

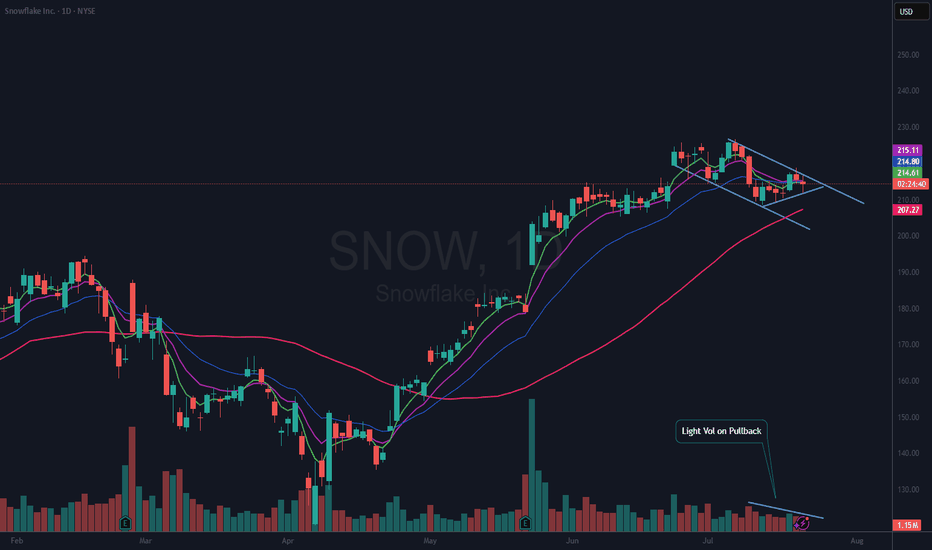

$SNOW Bull Flag?NYSE:SNOW has been and still may be one of the leaders in this market. It is forming a Bull Flag and within that flag is a nice wedging formation.

I am bullish with this name, so I have an alert set on the upper downtrend line. Should it break that, I will look for a good risk reward entry to open

[SNOW] SNOW InvestmentReally late on this investment so half size for me on this one and will not add to the downside.

I missed the reversal pattern but I have strong convictions on the fundamental part so I wanted to be part of it ... maybe I am wrong otherwise I am holding for a while ... can be a major stock for the f

Weekly SMC Macro Structure – Snowflake ($SNOW)🔹 Key Technical Observations

✅ Massive Cup & Handle Structure

Handle forming at the top of equilibrium

Clean breakout from descending macro trendline

✅ Multi-year CHoCH + BOS sequences

2023–2025: Consolidation range accumulation confirmed

✅ Final Liquidity Sweep in Discount Zone

Price reclaims

Long Overdue Breakout for $SNOW - take the leapOn the monthly chart, NYSE:SNOW just broke out of a 3 year channel. This presents a strong bullish signal. With growing demand for AI and a significant expansion in the sector, I see this moving up the scale.

On the weekly chart, it has also formed one of my now favorite patterns - the "DOUBLE B

SNOW Based on the current 15-minute chart for SNOW (Snowflake Inc.), we are observing a clear liquidity sweep and internal CHoCH (Change of Character) following a strong bearish impulse. Price has aggressively retraced and is now approaching a key supply zone near 222.00, which also aligns with the most

SNOWFLAKE to $369Snowflake Inc. is an American cloud-based data storage company.

Headquartered in Bozeman, Montana, it operates a platform that allows for data analysis and simultaneous access of data sets with minimal latency. It operates on Amazon Web Services, Microsoft Azure, and Google Cloud Platform.

As of

Put a lid on what smells badWe are within a resistance range that is as old as 5 years. It has been confirmed impressively in February 2024 again. Perhaps we will test these high again within the next weeks. But I oubt that we may decisive exceed the 230-240 level as this resistance is very strong and even stronger due to the

Super performance candidate NYSE:SNOW , cloud-based data platform leader in its fast growing industry as its business model is expected to grow significantly, with strong customer growth and integrating with the A.I rush, positioning itself to capture significant market share.

Sitting at a RS Rating of 94,

I have reasons to be

See all ideas

Summarizing what the indicators are suggesting.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

An aggregate view of professional's ratings.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Displays a symbol's price movements over previous years to identify recurring trends.

US833445AC3

SNOWFLAKE 24/29 ZO CVYield to maturity

−8.04%

Maturity date

Oct 1, 2029

US833445AA7

SNOWFLAKE 24/27 ZO CVYield to maturity

−14.62%

Maturity date

Oct 1, 2027

See all 5Q5 bonds

Curated watchlists where 5Q5 is featured.

Software stocks: US companies at our finger tips

49 No. of Symbols

See all sparks

Frequently Asked Questions

The current price of 5Q5 is 173.574 CHF — it has increased by 1.80% in the past 24 hours. Watch SNOWFLAKE INC stock price performance more closely on the chart.

Depending on the exchange, the stock ticker may vary. For instance, on BX exchange SNOWFLAKE INC stocks are traded under the ticker 5Q5.

5Q5 stock has risen by 1.96% compared to the previous week, the month change is a −0.09% fall, over the last year SNOWFLAKE INC has showed a 48.73% increase.

We've gathered analysts' opinions on SNOWFLAKE INC future price: according to them, 5Q5 price has a max estimate of 350.74 CHF and a min estimate of 119.57 CHF. Watch 5Q5 chart and read a more detailed SNOWFLAKE INC stock forecast: see what analysts think of SNOWFLAKE INC and suggest that you do with its stocks.

5Q5 stock is 1.77% volatile and has beta coefficient of 1.40. Track SNOWFLAKE INC stock price on the chart and check out the list of the most volatile stocks — is SNOWFLAKE INC there?

Today SNOWFLAKE INC has the market capitalization of 58.38 B, it has decreased by −0.82% over the last week.

Yes, you can track SNOWFLAKE INC financials in yearly and quarterly reports right on TradingView.

SNOWFLAKE INC is going to release the next earnings report on Aug 20, 2025. Keep track of upcoming events with our Earnings Calendar.

5Q5 earnings for the last quarter are 0.20 CHF per share, whereas the estimation was 0.18 CHF resulting in a 12.97% surprise. The estimated earnings for the next quarter are 0.21 CHF per share. See more details about SNOWFLAKE INC earnings.

SNOWFLAKE INC revenue for the last quarter amounts to 862.57 M CHF, despite the estimated figure of 832.96 M CHF. In the next quarter, revenue is expected to reach 866.74 M CHF.

5Q5 net income for the last quarter is −356.01 M CHF, while the quarter before that showed −298.53 M CHF of net income which accounts for −19.25% change. Track more SNOWFLAKE INC financial stats to get the full picture.

No, 5Q5 doesn't pay any dividends to its shareholders. But don't worry, we've prepared a list of high-dividend stocks for you.

As of Jul 26, 2025, the company has 7.83 K employees. See our rating of the largest employees — is SNOWFLAKE INC on this list?

EBITDA measures a company's operating performance, its growth signifies an improvement in the efficiency of a company. SNOWFLAKE INC EBITDA is −1.04 B CHF, and current EBITDA margin is −34.41%. See more stats in SNOWFLAKE INC financial statements.

Like other stocks, 5Q5 shares are traded on stock exchanges, e.g. Nasdaq, Nyse, Euronext, and the easiest way to buy them is through an online stock broker. To do this, you need to open an account and follow a broker's procedures, then start trading. You can trade SNOWFLAKE INC stock right from TradingView charts — choose your broker and connect to your account.

Investing in stocks requires a comprehensive research: you should carefully study all the available data, e.g. company's financials, related news, and its technical analysis. So SNOWFLAKE INC technincal analysis shows the buy rating today, and its 1 week rating is strong buy. Since market conditions are prone to changes, it's worth looking a bit further into the future — according to the 1 month rating SNOWFLAKE INC stock shows the buy signal. See more of SNOWFLAKE INC technicals for a more comprehensive analysis.

If you're still not sure, try looking for inspiration in our curated watchlists.

If you're still not sure, try looking for inspiration in our curated watchlists.