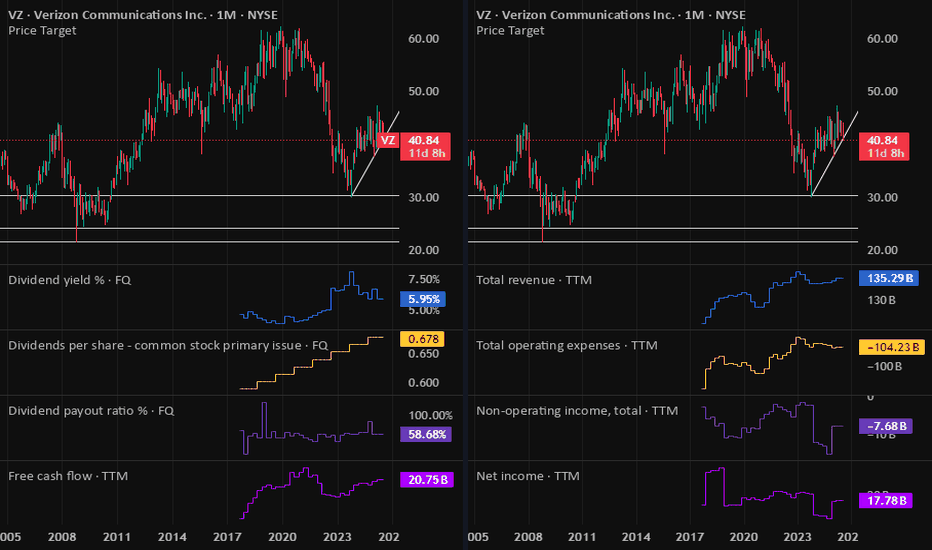

VZ: Verizon Earnings tomorrowwith 6% dividend yield and stock price at support level on the lower channel band, this draw attention to the earnings report tomorrow pre-market hours. Focused on future outlook as well.

If all good, I will buy VZ.

Disclaimer: This content is NOT a financial advise, it is for educational purpose o

Next report date

—

Report period

—

EPS estimate

—

Revenue estimate

—

3.419 CHF

15.90 B CHF

122.41 B CHF

4.21 B

About Verizon Communications Inc.

Sector

Industry

CEO

Hans Erik Vestberg

Website

Headquarters

New York

Founded

1983

FIGI

BBG006M6Z7Q6

Bank of America Corporation is a bank and financial holding company, which engages in the provision of banking and nonbank financial services. It operates through the following segments: Consumer Banking, Global Wealth and Investment Management, Global Banking, Global Markets, and All Other. The Consumer Banking segment offers credit, banking, and investment products and services to consumers and small businesses. The Global Wealth and Investment Management provides client experience through a network of financial advisors focused on to meet their needs through a full set of investment management, brokerage, banking, and retirement products. The Global Banking segment deals with lending-related products and services, integrated working capital management and treasury solutions to clients, and underwriting and advisory services. The Global Markets segment includes sales and trading services, as well as research, to institutional clients across fixed-income, credit, currency, commodity, and equity businesses. The All Other segment consists of asset and liability management activities, equity investments, non-core mortgage loans and servicing activities, the net impact of periodic revisions to the mortgage servicing rights (MSR) valuation model for both core and non-core MSRs, other liquidating businesses, residual expense allocations and other. The company was founded by Amadeo Peter Giannini in 1904 is headquartered in Charlotte, NC.

Related stocks

Verizon May Be Rolling OverVerizon Communications has been rangebound for more than a year, and now some traders could think it’s rolling over.

The first pattern on today’s chart is the May 2022 low of $45.55. VZ fell below that level in late 2022 and rebounded to it by mid-2024. The stock has been stuck below the same level

Where is Verizon headed next?Some quick points about the slight dip Verizon experienced over the past 5 trading days. Did bears step in and reject higher prices for VZ? Is the potential for a rally over?

In my opinion. No. But why you ask?

This stock trades relatively inverse to 10 year treasury yields. The 4 down days recen

The battle has begun for VZ glory.Just taking a look at the hourly chart and it looks like the bulls broke through resistance, but the bears were able to push them back, for now at least. Every time the bears push the price down, the bulls push it right back up to the edge.

This is bullish IMO. It gives bears less liquidity to slo

Verizon to the Moon? - Click my Post on the 15-minute Chart!TradingView doesn't show a link to my 15-minute chart analysis from today on the daily timeframe, but you can find a comprehensive analysis in my profile.

I just wanted to add an idea here so people would be able to find it on this time-frame.

Either switch to 15-minute, or check my profile to get

Verizon has stepped onto the launch-pad! Let's GO!I posted about this setup last week, and so far it has played out exactly as I described. I wanted to give a little update based on todays price action. I will keep this short as I have provided the key points on the chart. But this is the 5-minute chart from todays session.

The stock appears to ha

Verizon is ready to pop!This stock rallies when 10-year yields fall. Especially if tech stocks take a breather. Tech stocks are on average well into over-bought territory, and 10-year yields have been falling precipitously. Verizon is highly stable and provides a massive dividend which investors flock to when yields fall,

VZ - DO YOU SEE IT? Verizon its saying helllo!

A peaka-boo breakout on the daily chart is being observed.

This stock has coiled in a tight multi week range for a long time and is ready to explode higher if this breakout holds.

Typically a boring name that doesn't do much but when it starts to trend it can really g

VZ Weekly Trade Plan – 2025-06-08🧾 VZ Weekly Trade Plan – 2025-06-08

Bias: Moderately Bearish

Timeframe: 1 week

Catalysts: Dividend optimism vs. MACD weakness

Trade Type: Short-term directional put

🧠 Model Summary Table

Model Direction Entry Strike Option Type Target Stop Confidence

Grok Moderately Bullish $0.35 (ask) $44.00 Call

See all ideas

Summarizing what the indicators are suggesting.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

An aggregate view of professional's ratings.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Displays a symbol's price movements over previous years to identify recurring trends.

VZ5700819

Verizon Communications Inc. 3.0% 29-SEP-2060Yield to maturity

7.93%

Maturity date

Sep 29, 2060

C

VZ.HQ

Chesapeake & Potomac Telephone Co. of West Virginia 8.4% 15-OCT-2029Yield to maturity

7.40%

Maturity date

Oct 15, 2029

VZ5181143

Verizon Communications Inc. 2.987% 30-OCT-2056Yield to maturity

7.01%

Maturity date

Oct 30, 2056

VZ4779888

Verizon Communications Inc. 4.9% 15-DEC-2048Yield to maturity

6.68%

Maturity date

Dec 15, 2048

VZ5088390

Verizon Communications Inc. 1.6% 15-DEC-2030Yield to maturity

6.67%

Maturity date

Dec 15, 2030

VZ4544355

Verizon Communications Inc. 4.7% 15-SEP-2047Yield to maturity

6.65%

Maturity date

Sep 15, 2047

See all BAC bonds

Curated watchlists where BAC is featured.

Frequently Asked Questions

The current price of BAC is 34.477 CHF — it has decreased by −0.32% in the past 24 hours. Watch VERIZON COMMUN stock price performance more closely on the chart.

Depending on the exchange, the stock ticker may vary. For instance, on BX exchange VERIZON COMMUN stocks are traded under the ticker BAC.

BAC stock has risen by 1.28% compared to the previous week, the month change is a 0.55% rise, over the last year VERIZON COMMUN has showed a −2.84% decrease.

We've gathered analysts' opinions on VERIZON COMMUN future price: according to them, BAC price has a max estimate of 46.01 CHF and a min estimate of 34.11 CHF. Watch BAC chart and read a more detailed VERIZON COMMUN stock forecast: see what analysts think of VERIZON COMMUN and suggest that you do with its stocks.

BAC stock is 0.32% volatile and has beta coefficient of 0.33. Track VERIZON COMMUN stock price on the chart and check out the list of the most volatile stocks — is VERIZON COMMUN there?

Today VERIZON COMMUN has the market capitalization of 146.97 B, it has decreased by −1.52% over the last week.

Yes, you can track VERIZON COMMUN financials in yearly and quarterly reports right on TradingView.

VERIZON COMMUN is going to release the next earnings report on Oct 21, 2025. Keep track of upcoming events with our Earnings Calendar.

BAC earnings for the last quarter are 0.97 CHF per share, whereas the estimation was 0.94 CHF resulting in a 2.82% surprise. The estimated earnings for the next quarter are 0.98 CHF per share. See more details about VERIZON COMMUN earnings.

VERIZON COMMUN revenue for the last quarter amounts to 27.37 B CHF, despite the estimated figure of 26.77 B CHF. In the next quarter, revenue is expected to reach 27.80 B CHF.

BAC net income for the last quarter is 3.97 B CHF, while the quarter before that showed 4.32 B CHF of net income which accounts for −8.10% change. Track more VERIZON COMMUN financial stats to get the full picture.

Yes, BAC dividends are paid quarterly. The last dividend per share was 0.54 CHF. As of today, Dividend Yield (TTM)% is 6.34%. Tracking VERIZON COMMUN dividends might help you take more informed decisions.

VERIZON COMMUN dividend yield was 6.71% in 2024, and payout ratio reached 64.77%. The year before the numbers were 6.99% and 95.63% correspondingly. See high-dividend stocks and find more opportunities for your portfolio.

As of Aug 2, 2025, the company has 99.6 K employees. See our rating of the largest employees — is VERIZON COMMUN on this list?

EBITDA measures a company's operating performance, its growth signifies an improvement in the efficiency of a company. VERIZON COMMUN EBITDA is 39.35 B CHF, and current EBITDA margin is 35.98%. See more stats in VERIZON COMMUN financial statements.

Like other stocks, BAC shares are traded on stock exchanges, e.g. Nasdaq, Nyse, Euronext, and the easiest way to buy them is through an online stock broker. To do this, you need to open an account and follow a broker's procedures, then start trading. You can trade VERIZON COMMUN stock right from TradingView charts — choose your broker and connect to your account.

Investing in stocks requires a comprehensive research: you should carefully study all the available data, e.g. company's financials, related news, and its technical analysis. So VERIZON COMMUN technincal analysis shows the sell today, and its 1 week rating is sell. Since market conditions are prone to changes, it's worth looking a bit further into the future — according to the 1 month rating VERIZON COMMUN stock shows the sell signal. See more of VERIZON COMMUN technicals for a more comprehensive analysis.

If you're still not sure, try looking for inspiration in our curated watchlists.

If you're still not sure, try looking for inspiration in our curated watchlists.