BAC trade ideas

$VZ can fall in the next daysContextual immersion trading strategy idea.

Verizon Communications has a strong downside trend.

This and other conditions can cause a fall in the share price in the next days.

So I opened a short position from $49,71;

Information about stop-loss and take-profits will be later.

Do not view this idea as a recommendation for trading or investing. It is published only to introduce my own vision.

Always do your own analysis before making deals. When you use any materials, do not rely on blind trust.

You should remember that isolated deals do not give systematic profit, so trade/invest using a developed strategy.

If you like my content, you can subscribe to the news and receive my fresh ideas.

Thanks for being with me!

VERIZON COMMUNICATION (VZ): Reversal Clues

hey traders,

it looks like the breakout above the previous structure high in December was false!

the market was trading about 1 week above 61.0 resistance and then dropped.

Now it looks like the market is forming a classic reversal pattern - head and shoulders pattern.

currently, the price is completing the right shoulder.

I suggest setting the alert below the neckline level.

Being broken it gives us a perfect selling opportunity.

key levels will be 55.55 / 53.0

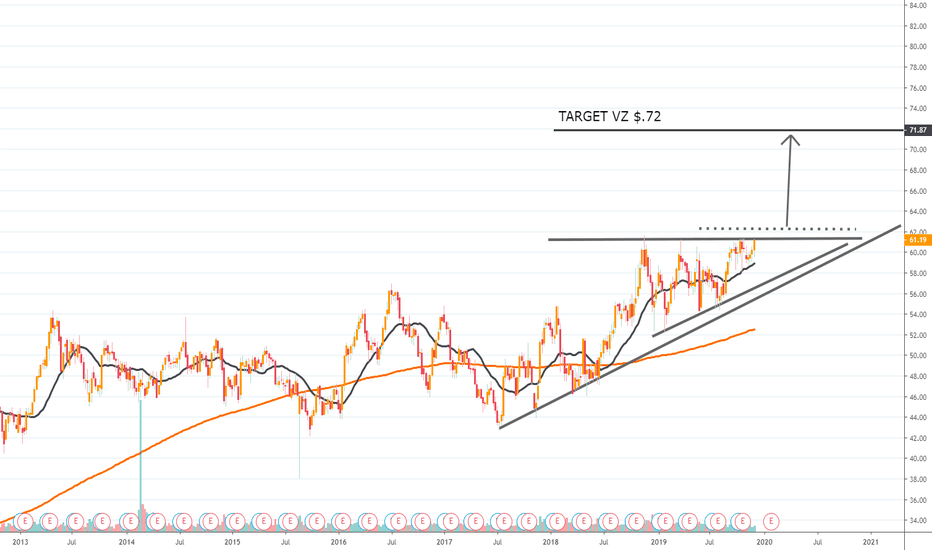

$VZ Verizon breakout tradeEntry level $62.40 = target price $70.00 = Stop loss $59.63

Bullish breakout from congestion phase underway.

Very reasonable 15 P/E ratio.

Good yield at 4%

The stock has hit the average analysts price target so expect upgrades.

Company profile

Verizon Communications, Inc. is a holding company, which engages in the provision communications, information and entertainment products and services to consumers, businesses and governmental agencies. It operates through Wireless and Wireline segments. The Wireless segment provides wireless voice and data services and equipment sales, which are provided to consumer, business, and government customers. The Wireline segment offers broadband video and data; corporate networking solutions; data center and cloud services; security and managed network services; and local and long distance voice services. It also offers voice, data and video services and solutions. The company was founded in 1983 and is headquartered in New York, NY.