CDNS The Quiet Killer Sitting on a $100 MoveCDNS has been building a multi-year base just under all-time highs, pressing into a supply zone that’s rejected price five times since 2021. While the market has rotated through AI hype names like NVDA and SMCI, CDNS has quietly been holding trend, consolidating, and building pressure. Now, it’s compressing with zero structural damage and sits on the verge of a potentially explosive breakout.

But this isn't just about the chart. CDNS is part of a monopoly-like layer in the semiconductor ecosystem. It powers the design infrastructure for the world’s most important chips used by TSMC, Apple, Nvidia, Intel, and anyone else trying to build AI hardware. It’s not optional software. It’s oxygen. This is the deep tech nobody watches until it rips.

Fundamental Perspective

CDNS builds EDA tools (Electronic Design Automation) Sounds boring, right? Until you realise these tools are the digital workbenches used to design and simulate advanced semiconductors.

In a world of 3nm nodes, chip let architecture, and exploding transistor counts, chipmakers can’t design or verify hardware manually anymore. They rely on tools like:

- Spectre X - Simulates analog chip behaviour

- Joules - Analyses power and timing

- Cerebrus - AI-powered design optimisation

Every AI chip, 5G modem, EV SoC, or data centre accelerator? Probably ran through Cadence.

They don’t make the chips. They make the software that makes the chips.

The Monopoly Layer - The EDA space is effectively a duopoly:

- Company Focus - Market Share

- Cadence (CDNS) - Mixed-signal, analog, power-aware AI tools (40%)

- Synopsys (SNPS) - Digital RTL and IP libraries (45%)

This isn’t a space where new players emerge. The software is too complex, the relationships too entrenched, and the switching costs too high. CDNS is the PLTR of chip design, once you're integrated, you're locked in.

CDNS in the AI Stack

If you map the AI chip lifecycle:

- PLTR = AI infrastructure & data wrangling

- CDNS = Chip design + optimisation tools

- TSMC = Manufacturing

- NVDA / AMD = Final product

- MSFT / GOOG = Deployment at scale

CDNS sits at layer 2, right in the guts. And the best part? It gets paid before the hardware is even made. Recurring SaaS-style licensing revenue and deep enterprise ties = defensive growth stock in a hyper growth sector.

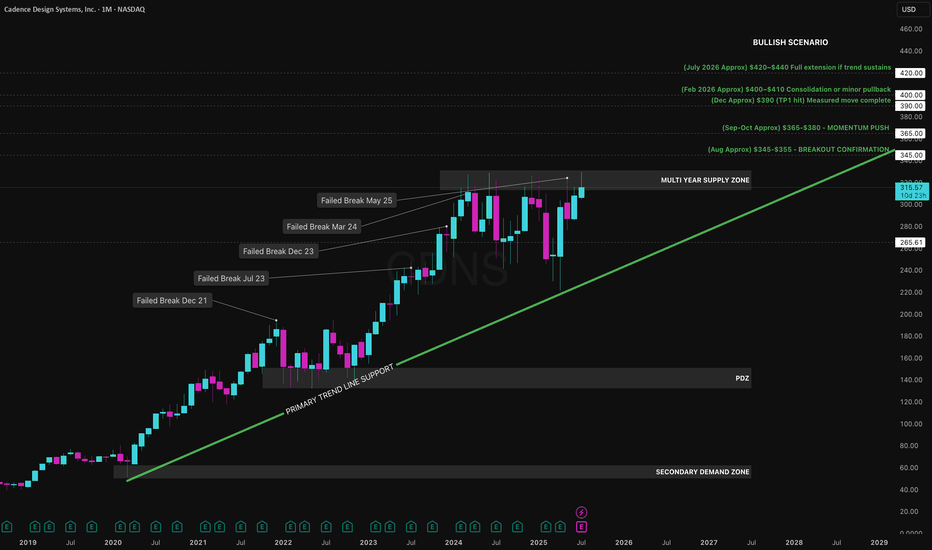

Technical Deep Dive

- Trend line from 2020 low is still perfectly intact

- Compression under resistance between $325–$345

- 5+ failed monthly breakouts — each failure with shallower downside

Current candles show tight-bodied price action and volatility is squeezing. This is textbook breakout structure: clean base, clear level, and reduced selling pressure.

Key Levels

- Supply $325–$345 Major multi-year resistance

- Demand $260–$280 Trend line and base from 2023

- Target 1 $390 Measured move of base height

- Target 2 $420–440 Full extension if momentum kicks in

Indicators (Monthly)

- RSI: > 55 and rising momentum building

- MACD: Bullish crossover forming

- Volume: No climax yet = potential energy still building

Historical Breakout Pattern Look at similar patterns in large-cap compounders:

- MSFT 2016–2017: Multi-year base, breakout - 3-year run

- PLTR 2023–2024: Compression under $18 - explosion

- NVDA 2019–2020: Sideways grind - parabolic move

CDNS fits the same mold: quiet build-up, few watching, structurally perfect.

Trade Plan (Not Financial Advice)

Scenario 1: Breakout

- Entry Trigger: Monthly close > $345

- TP1: $390

- TP2: $420–440

- Stop: Close below $310 (invalidates breakout attempt)

Scenario 2: Pullback to Trendline

- Entry: $265–$280 zone

- Target: Reclaim of highs / retest of $345

- Stop: Close below $240

What Would Invalidate This?

- Macro shock that destroys growth narratives

- Monthly close below $240 (breaks long-term trend line)

- Regulatory antitrust against EDA players (very low probability)

Until then, this chart remains one of the cleanest structures in the entire AI space.

Most people chase what’s already moved. But the real edge? Finding what’s about to. CDNS isn’t a meme stock. It’s not a high-beta flyer. It’s the infrastructure play sitting underneath every chip that powers the AI future.

It’s showing the exact kind of price behaviour that precedes major upside compression, accumulation, and rising strength. If the breakout comes, this will move faster than people expect and you’ll either be on it, or watching it.

CDS trade ideas

CDNS - Another One that Break the Previous High Hello Everyone,

Last one for this week is CDNS Cadence Design Systems

What They do?

Cadence Design Systems’ products include Industry leading EDA (electronic design automation) tools, an IP portfolio which includes predesigned and configurable blocks, automated packaging tools, PCB layout and routing technologies, verification tools and hardware, and more. Cadence products are used in a variety of market segments, including mobile, consumer, cloud datacenter, automotive, aerospace, IoT, industrial and others. The Cadence Design Systems IP portfolio includes Tensilica DSPs for AI, vision, audio, IoT, and baseband applications; Denali memory and storage IP; and controllers for the latest standard interfaces including PCI Express, USB, and Ethernet. As of December 2021, the company operates in 20 countries across the globe and employs approximately 7,600 people.

Financial Highlights:

Every year Revenue increased last 15 years

2025 (TTM) $4.87 B 5.03%

2024 $4.64 B 13.48%

2023 $4.08 B 14.83%

EPS (TTM) 3.95

On Friday it broke to previous high which was hit 4 times in the past.

Jun 24

Jan 25

May 25

Jul 25

First stop 350-353 then in this point it can play around then final target for me is 430 - 433 which is more than %30 up.

It can try to re-test 327 again. If re-test then i can directly jump in it. If not then trend is UP now and i see again big potential this one too. Maybe it can make us rich :)))

This is just my thinking and it is not invesment suggestion , please do not make any decision with my anaylsis.

Have a good start a Weekend

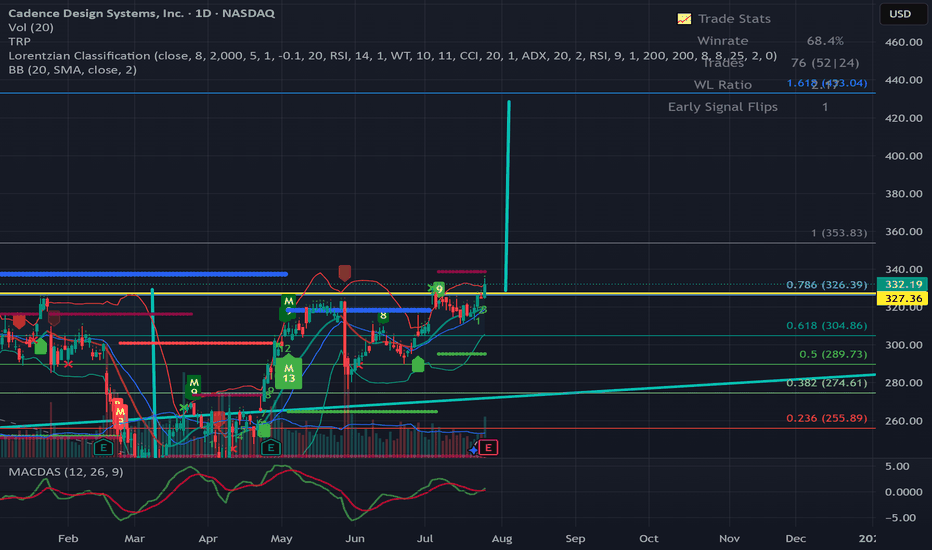

Safe Entry CNSNote: Lower TF to 1h or 4h to see better details.

Recently Trump lift chips design prohibition to be sent to china. (Positive to CDNS)

Stock Obvious and clearly at major resistance with such news it expected to open Gap Up.

following the stock would be mistake unless stock open in pre-market with price level similar to close.

better to wait stock to open gap up. Re-test the major resistance.

that would be major support level and safe entry for price to go higher.

Note: 1- Potentional of Strong Buying Zone:

We have two scenarios must happen at The Mentioned Zone:

Scenarios One: strong buying volume with reversal Candle.

Scenarios Two: Fake Break-Out of The Buying Zone.

Both indicate buyers stepping in strongly. NEVER Join in unless one showed up.

2- How to Buy Stock:

On 1H TF when Marubozu/Doji Candle show up which indicate strong buyers stepping-in.

Buy on 0.5 Fibo Level of the Marubozu/Doji Candle, because price will always and always re-test the

CDNS watch $325.10: Golden Genesis Fib ceiling for over 2 yearsCDNS has topped here many times over the last 2 years.

Golden Genesis fibs are massive landmarks for any asset.

This one has marked THE TOP for over 2 years thus far.

It is PROBABLE that we "Orbit" this a few times.

It is POSSIBLE that we reject for another top.

It is PLAUSIBLE to Break and run to new ATH.

=================================================

.

China or no China, it's just a quick flip (ideally) for meThis one actually gave a signal yesterday and I bought it then. With NVDA's earnings it popped 4% and I got out after hours (thankfully). It gave another signal again today, which doesn't happen all the time so I'm going back for a double dip. The best part is that the second of 2 signals in a row usually pays off fast and well - which of course means I just jinxed myself. This is a stock in a long term uptrend, though, and that makes me worry a lot less. The market has repriced it because of the China news, but the market has a short memory.

Data is greater than superstition, anyway. The last 20 signals have produced an average return of 1.92% in an average of 10.5 days, but that's not the whole story. The median result is much better - +1.45% in 1.5 days. So with all that in mind, I got back into this one today at 284.50. I can't say for sure that this will be an FPC close - it depends on how things go.

As always - this is intended as "edutainment" and my perspective on what I am or would be doing, not a recommendation for you to buy or sell. Act accordingly and invest at your own risk. DYOR and only make investments that make good financial sense for you in your current situation.

2/24/25 - $cdns - Just too expensive, still2/24/25 :: VROCKSTAR :: NASDAQ:CDNS

Just too expensive, still

- looking at the design/ prototyping names pretty early in the AM to get a start on the week

- mainly interested in the ANSS/SNPS merger where i think all-else-equal (big statement given what's going on in this tape) it could be something to play

- my bias is to simply stay uninvolved mainly bc multiples and growth are so high, not that they aren't justified, but i can spot a number of other opportunities where growth is higher w visibility and multiples r lower

- software as a category seemed to get a second wind after everyone applied the "AI will actually improve margins" logic a few months ago.

- well.

- 1/ yes that's true

- 2/ that's probably not immediately true

- 3/ and not necessarily true of everyone

- 4/ multiples were expensive and remain expensive

- so i'd probably be more interested in these names in the mid 20s PEs or sub 10x sales. that takes cash yield (ignoring SBC) closer to mid 3's. it's still not "cheap" there, but look, you pay for quality.

- but to start necking out in this tape into non mega caps growing low DD at best at these rates/ multiples (which if earnings season has taught us anything so far... it's that the capital seems "stuck and unwilling to move until they're forced to dump the stock"...), no thanks at the moment, i have enough challenge owning stuff that i really like and think has much more limited downside and more obvious upside.

- so while i won't necessarily write on TSXV:ADK , NASDAQ:ANSS , NASDAQ:SNPS , even NASDAQ:BSY etc. just now, i just don't find the necking out compelling on an opportunity-cost basis in this tape.

- have set a look again at slightly over $200 if/when. but realistically, if got there b/c of mkt-related beta, i'd probably not buy it either.

- remains a square pass for me unless i do some deep work on inflecting growth or immediate AI benefits, perhaps someone can enlighten me in the comments to get me off the airchair view.

V

7/21/24 - $cdns - Staying on the sidelines into print7/21/24 :: VROCKSTAR :: NASDAQ:CDNS

Staying on the sidelines into print

- almost 50x PE for growing 20% this year and next. that's just too expensive for my taste.

- fcf yield (round up about 2%) growing 20% is reasonable and no dilution issue - but certainly not cheap

- suffering on it's nasdaq pair (as are all semis)

- I think the semi factor is what keeps me most concerned. good prints are getting dumped. what happens if there's a mediocre print nevermind a miss (not my base case).

- technically broke support on the 200d not good if we can't hold above it. even a beat probably retests these recent lows at some pt later in the year.

- just don't see the r/r for punting here.

have a good week my fam. i'll comment on as much as i can as EPS boots off but will be in nashville for the btc event. back at my seat next week.

V

Cadence Design Systems (CDNS) AnalysisTechnological Advancements and Market Position:

Cadence Design Systems NASDAQ:CDNS is well-positioned for growth due to recent technological advancements and its strategic market position. The launch of the Millennium M1 supercomputer, likely powered by Nvidia GPUs, is expected to enhance Cadence's stock value.

Leadership in Semiconductor Design Software:

As a leader in semiconductor design software, Cadence dominates the Electronic Design Automation (EDA) sector alongside Synopsys. Cadence's superior financial health and profit margins provide a competitive edge, allowing it to further strengthen its market dominance while Synopsys integrates recent acquisitions.

CEO Insights and Strategic Vision:

CEO Anirudh Devgan highlighted exceptional 2023 results driven by innovative solutions and the Intelligent System Design strategy, emphasizing opportunities in AI and 3D-IC technologies.

Investment Outlook:

Bullish Outlook: We maintain a bullish stance on CDNS above the $285.00-$288.00 range.

Upside Potential: With an upside target set at $400.00-$405.00, investors should consider Cadence's technological leadership, strong financial position, and strategic growth initiatives as key drivers for potential stock appreciation.

📊🖥️ Stay updated on Cadence Design Systems for promising investment opportunities! #CDNS #SemiconductorDesign 📈🔍

Cadence Design Systems Stock Slides On Weak Q2 GuidanceCadence Design Systems ( NASDAQ:CDNS ), a San Jose-based electronic design automation software manufacturer, has released its first-quarter financial results. The company reported adjusted earnings of $1.17 per share on sales of $1.01 billion, beating FactSet's estimated earnings of $1.13 per share on sales of $1 billion. However, compared to the same period last year, the company's earnings fell by 9%, while sales decreased by 1%. This marks the company's first quarterly sales decline in more than eight years and the first decline in earnings on a year-over-year basis in nine quarters.

Despite the positive first-quarter results, Cadence's ( NASDAQ:CDNS ) second-quarter guidance is below expectations. The company is forecasting adjusted earnings of $1.22 per share on sales of $1.04 billion, below analysts' predictions of $1.43 per share on sales of $1.11 billion. In the year-ago period, the company earned adjusted earnings of $1.22 per share on sales of $977 million.

Cadence's CFO, John Wall, stated that the company had achieved a record Q1 backlog of approximately $6 billion, and the company had made two major acquisitions in the first quarter. On January 8th, Cadence ( NASDAQ:CDNS ) announced its acquisition of Invecas, a provider of design engineering, embedded software and system-level solutions, while on March 5th, the company announced its plan to purchase BETA CAE Systems International, a system analysis platform provider of multi-domain, engineering simulation solutions, for $1.24 billion.

In response to Cadence's Q2 guidance, NASDAQ:CDNS stock plummeted by 9.3% to $258.60 in after-hours trading but shortly surged by 1.7% in Pre-market trading on Tuesday. The company's full-year outlook remains positive, with adjusted earnings of $5.93 per share on sales of $4.59 billion, matching FactSet's estimates. Last year, Cadence ( NASDAQ:CDNS ) earned adjusted earnings of $5.15 per share on sales of $4.09 billion.

The stock has a Relative Strength Index (RSI) of 35.30 siting weak momentum from ( NASDAQ:CDNS ) stock

CDNS a chip design software company LONGCDNS located in California is a software firm supporting computer assisted design ( ACAD) for

the semi-conductor industry. While its customer base gets the headlines, this company helps

make it happen. The 120 minute chart looks good as price is uptrending with good volume

and relative strength. Earnings have been solid and another is around the corner. Price has

appreciated 40% in six months. the trend angle of 13 degrees over the continuous uptrend

is solid. I see this as a buy now before the earnings or after a minor correction to get a bit of

a discount.

CDNS: healthy correction?A price action below 271.00 supports a bearish trend direction.

Crossing below 267.00 will trigger further support for the short-sell position.

The target price is set at 256.00 (its 38.2% Fibonacci retracement level).

The stop-loss is set at 282.00 (just above the full retracement).

A "healthy correction" in the stock market typically refers to a short-term decline in stock prices that is considered normal and even beneficial for the overall health of the market

CDNS Entry, Volume, Target, StopEntry: with price above 239.90

Volume: with volume greater than 3.32M

Target: 257.5 area

Stop: Depends on your risk tolerance; Based on an entry of 239.91, a stop of 232.84 gets you 3/1 Reward to Risk Ratio.

This swing trade idea is not trade advice and is strictly based on my ideas and technical analysis. No due diligence or fundamental analysis was performed while evaluating this trade idea. Do not take this trade based on my idea, do not follow anyone blindly, do your own analysis and due diligence. I am not a professional trader.