This Casey does NOT strike out - Long at 448.47Step 1: Zoom out on the chart for CASY. Please. Feel free to scroll back all the way to 1984. I'll wait...

That view alone tells you all you need to know. This is one of the prettiest charts you'll find anywhere on Wall Street. Not flashy, just relentlessly and consistently profitable. If I

Next report date

—

Report period

—

EPS estimate

—

Revenue estimate

—

13.153 CHF

462.26 M CHF

13.69 B CHF

36.94 M

About Caseys General Stores, Inc.

Sector

Industry

CEO

Darren M. Rebelez

Website

Headquarters

Ankeny

Founded

1959

FIGI

BBG01K8P2QP3

Casey's General Stores, Inc. engages in the provision of management and operation of convenience stores and gasoline stations. It provides self-service gasoline, a wide selection of grocery items, and an array of freshly prepared food items. The firm offers food, beverages, tobacco products, health and beauty aids, automotive products, and other non-food items. The company was founded by Donald F. Lamberti in 1968 and is headquartered in Ankeny, IA.

Breaking: Casey's Announces Third Quarter ResultsCasey's General Stores, Inc., together with its subsidiaries, operates convenience stores under the Casey's and Casey’s General Store names announces Third Quarter Results leading to shares rising 2.35% in premarket trading on Wednesday early morning session.

Earning's Highlight:

Diluted EPS of $

CASY Casey's General Stores Options Ahead of EarningsAnalyzing the options chain and the chart patterns of CASY Casey's General Stores prior to the earnings report this week,

I would consider purchasing the 260usd strike price Calls with

an expiration date of 2023-10-20,

for a premium of approximately $2.02.

If these options prove to be profitable pri

CASY gonna grab it before earningslooks like this one could make a little in gains earnings comming out on the 8th the past 11 days have green bars on volume and we are sitting several clicks above the 50MA.the tecnical indicators are showing strong buy through the next week.

the past four earnings reports are all beats lets keep ou

CASYSystem T Performances: Annual Compound Profit 40%, Win Rate 55%, Risk/Reward Ratio 1:2, 20 Years of Backtesting Data, Over 100 Markets.

* Click Like and Follow to Support My Work!

---

Hi Traders,

I'd like to introduce the System T, a computerized trading system that analyzed and backtested the 2

CASY- Pizza join/convenience storeOverbought on RSI. Stoch looking to potentially give us the heads up on a downturn in the next day or 2. There's NO accumulation going on. Fat tail looking to give it all back. MACD Strong as can be, but the rest of the indicators lead me to believe this will be a decent short. It's only up on a gol

CASY. Double top.Double top pattern. Sell @ $125-135, TP $100-105, SL above $140. avg. volume is less than 1M, so there might be some problems if u are going to short 1000+ shares. this idea is not so perfect, cuz uptrend is still going. so I hope that the price reached it's top and will continue to stay in range $1

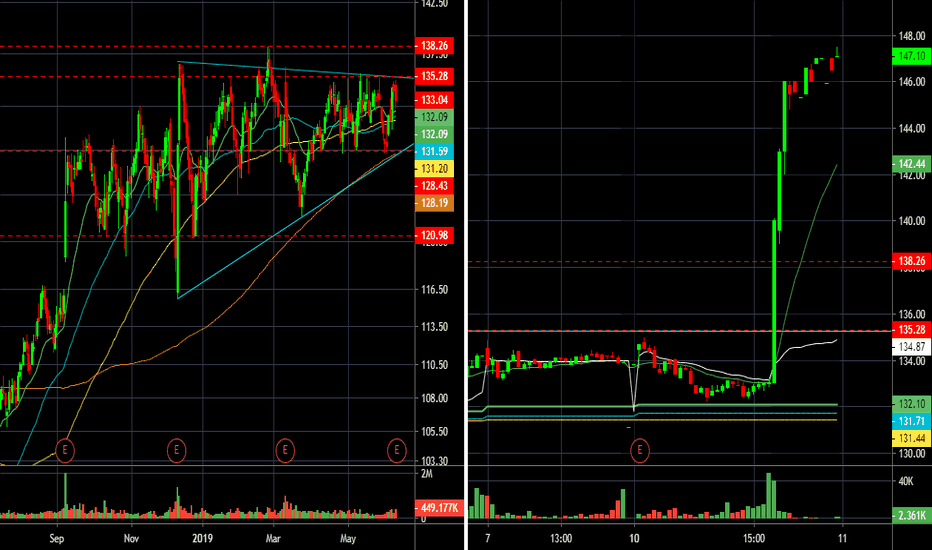

$CASY Day Trade Parabolic Potential on Good News $CASY has gone parabolic premarket on good earnings. Its at $147 premarket, the all time highs on the daily is $138. This is going be very volatile, but if it gets good volume (at least 500,000 shares in first 5 minutes on market open) then I would go Long on it after, and only after a Pullback. I w

See all ideas

An aggregate view of professional's ratings.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Related stocks

Frequently Asked Questions

Depending on the exchange, the stock ticker may vary. For instance, on BX exchange CASEYS GEN STORES stocks are traded under the ticker CS2.

CS2 stock hasn't changed in a week, the last month showed zero change in price, over the last year there was no change in CASEYS GEN STORES price.

We've gathered analysts' opinions on CASEYS GEN STORES future price: according to them, CS2 price has a max estimate of 412.86 CHF and a min estimate of 274.97 CHF. Watch CS2 chart and read a more detailed CASEYS GEN STORES stock forecast: see what analysts think of CASEYS GEN STORES and suggest that you do with its stocks.

CS2 stock is 0.00% volatile and has beta coefficient of 0.62. Track CASEYS GEN STORES stock price on the chart and check out the list of the most volatile stocks — is CASEYS GEN STORES there?

Today CASEYS GEN STORES has the market capitalization of 13.89 B, it has increased by 1.06% over the last week.

Yes, you can track CASEYS GEN STORES financials in yearly and quarterly reports right on TradingView.

CASEYS GEN STORES is going to release the next earnings report on Jun 16, 2025. Keep track of upcoming events with our Earnings Calendar.

CS2 earnings for the last quarter are 2.12 CHF per share, whereas the estimation was 1.82 CHF resulting in a 16.99% surprise. The estimated earnings for the next quarter are 1.65 CHF per share. See more details about CASEYS GEN STORES earnings.

CASEYS GEN STORES revenue for the last quarter amounts to 3.56 B CHF, despite the estimated figure of 3.40 B CHF. In the next quarter, revenue is expected to reach 3.27 B CHF.

CS2 net income for the last quarter is 79.40 M CHF, while the quarter before that showed 156.33 M CHF of net income which accounts for −49.21% change. Track more CASEYS GEN STORES financial stats to get the full picture.

Yes, CS2 dividends are paid quarterly. The last dividend per share was 0.42 CHF. As of today, Dividend Yield (TTM)% is 0.43%. Tracking CASEYS GEN STORES dividends might help you take more informed decisions.

CASEYS GEN STORES dividend yield was 0.54% in 2023, and payout ratio reached 12.80%. The year before the numbers were 0.66% and 12.77% correspondingly. See high-dividend stocks and find more opportunities for your portfolio.

As of May 10, 2025, the company has 45.36 K employees. See our rating of the largest employees — is CASEYS GEN STORES on this list?

EBITDA measures a company's operating performance, its growth signifies an improvement in the efficiency of a company. CASEYS GEN STORES EBITDA is 1.06 B CHF, and current EBITDA margin is 7.22%. See more stats in CASEYS GEN STORES financial statements.

Like other stocks, CS2 shares are traded on stock exchanges, e.g. Nasdaq, Nyse, Euronext, and the easiest way to buy them is through an online stock broker. To do this, you need to open an account and follow a broker's procedures, then start trading. You can trade CASEYS GEN STORES stock right from TradingView charts — choose your broker and connect to your account.